by Calculated Risk on 9/16/2005 03:10:00 PM

Friday, September 16, 2005

Port of Long Beach: Record Imports for August

Import traffic at the Port of Long Beach increased 6% compared to July, breaking the record traffic of last fall's heavy shipping season. A total of 306 thousand loaded cargo containers came into the Port of Long Beach, compared to 289.5 thousand in July and breaking the previous record of 296 thousand last November.

The Port of Los Angeles import traffic showed a 3% decline in August. However imports of 343 thousand containers were still near the all time high.

For Long Beach, outbound traffic was up 3.5% at 110.7 thousand containers - also a record. At Los Angeles, outbound traffic was down 3% to 95 thousand containers.

The quantity of containers says nothing about the content value, but provides a rough guide on imports from China and the rest of Asia. With these numbers, I expect record imports from China for August.

Thursday, September 15, 2005

IMF Warns on Household Finances and Imbalances

by Calculated Risk on 9/15/2005 08:53:00 PM

The Independent reports:

Record levels of mortgage and credit card debt have left families "potentially vulnerable" to a sudden economic shock, the International Monetary Fund warned yesterday.The Sydney Morning Herald reports on the IMF warnings on global imbalances:

The world's chief financial watchdog said households in countries such as the UK and US were exposed to asset prices such as housing that were being used as collateral for their debts.

"These developments increasingly expose the household sector to the performance of asset markets," it said in its biannual review of financial stability. "Most likely, substantial asset price declines would undermine consumer confidence and reduce personal consumption."

Imbalances between the US and the rest of the world were "clearly unsustainable" and the "issue is not whether but how they adjust", the fund said in its September 2005 World Economic Outlook.The warnings just keep coming and no action is taken. Are people growing numb to all the debt warnings? This reminds me of a new movie coming out (I haven't seen it, just the Ads) "Cry Wolf".

It expects the US current account deficit to remain stuck at an unprecedented 6 per cent of GDP, matched by large surpluses in Japan, emerging-Asian and oil-exporting countries.

"Hence the United States' net external position would continue to deteriorate, reaching a record 50 per cent of GDP by 2010, matched by rising net creditor positions in the rest of the world," it said.

The IMF report canvasses a scenario where investors lose confidence as a result of these imbalances and dump US assets, causing a rapid fall in the value of the US dollar and a surge in protectionist economic policies across the world.

The IMF report said the combinations of protectionist pressures and falling demand for US assets could trigger volatile exchange rate adjustments and heighten the risk of a global economic slump.

Prediction August Trade Deficit: Petroleum

by Calculated Risk on 9/15/2005 07:24:00 PM

Here are the forecasted August oil numbers using the same model (described here). The ERPP (Energy Related Petroleum Products) trade numbers for August are forecast to be:

Forecast: Total NSA ERRP Imports: $24.2 Billion

Total SA ERPP FORECAST:

Imports SA: $23.5 Billion (seasonal factor estimated at 0.972 for Aug)

Exports SA: $2.4 Billion

Balance ERPP: $21.1 Billion

I am forecasting a record average price per barrel of $52.94 compared to July's record of $49.03.

Imports SA and NSA will set records in August (again). The $21.1 Billion Petroleum deficit compares to the SA July deficit of $18.48 Billion. It appears oil imports will add approximately $2.6 Billion to the SA August trade deficit.

It is highly probable that the SA August Trade deficit will break the record deficit set in February of $60.4 Billion.

UK: Construction Industry Suffers Job Losses

by Calculated Risk on 9/15/2005 01:02:00 AM

The Independent reports: Construction industry suffers biggest fall in jobs since 1993

The number of construction workers has suffered its steepest fall for more than 11 years, according to figures yesterday that were the latest to highlight a slowdown in the property market.Back in May I asked on Angry Bear: When will Housing Slowdown?

About 38,000 jobs were lost in the sector over the three months to July, the biggest fall since a cull of 56,000 in December 1993 when the housing market was suffering the hangover of the crash, the Office for National Statistics said.

Construction firms slashed their demand for new workers, with a 4,700 cut in vacancies, the largest for any sector measured by the ONS. The figures follow a series of downbeat statements from housebuilders such as Bovis, Taylor Woodrow and Berkeley.

The Construction Confederation said the slowdown in growth was driven entirely by a fall-off in private-sector demand.

Perhaps we can look at the UK for guidance on timing. ... The housing boom has apparently ended, and the retailers are already feeling the impact.And now the next step: job losses in the UK construction industry.

Back in May I guessed that the US was "about 6 to 8 months behind the UK". That would put our housing slowdown (and retail slowdown) in the 2nd half of this year. Unfortunately the US economy is probably more dependent on housing and the construction industry than the UK. When housing slows in the US, I expect employment growth to take a significant hit - probably following the UK pattern - with layoffs starting about 6 months after housing clearly slows down.

Wednesday, September 14, 2005

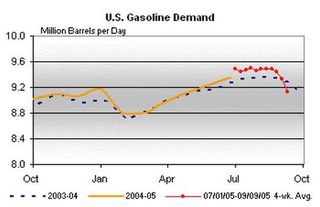

Gasoline Demand Continues to Fall

by Calculated Risk on 9/14/2005 01:16:00 PM

The DOE reports that gasoline demand fell to 8.636 million barrels per day for the week ending September 9, 2005, down from 9.027 m bbls/day for the pervious week.

UPDATE: Dr. Hamilton provides an excellent discussion and a weekly graph (as opposed to 4 wk average from DOE).

Click on graph for larger image.

Demand for gasoline usually falls after labor day, but this still represents a 6% drop in demand for the comparable week from 2004. Prices for "Retail Average Regular Gasoline" dropped about 3% to $2.96 from the record $3.06 the previous week. Based on futures prices for unleaded gasoline, it appears prices will drop further this week.