by Calculated Risk on 9/12/2005 06:48:00 PM

Monday, September 12, 2005

Oil and Gasoline Confusion

A Reuters article, "Oil sinks back near $63", quotes Gary Ross, chief executive of U.S. energy consultancy PIRA Energy, saying:

"U.S. gasoline data over the next few weeks will show the effect of high oil prices on demand."His statement is inaccurate. Gasoline data will show the effect of high gasoline prices on demand. Even with spot oil prices over $60, gasoline demand was still robust until Hurricane Katrina shut down several major refineries causing a supply shock for refined products.

The Financial Times makes a similar mistake:

"One factor driving up [crude oil] prices has been the inability of consuming countries to increase refinement capacity."It is very possible that limitations on refining heavy and/or sour crude have increased the spread between different grades of crude (see Sweet and Sour Crude). However, a general constraint on refining capacity would lead to lower crude prices, not "drive" up the price of crude oil.

This confusion seems to be widespread in the financial media.

Gasoline Update

by Calculated Risk on 9/12/2005 01:11:00 AM

My latest post on Angry Bear is up: Gasoline: A Time for Caution.

And here is an interesting follow on article: Could Katrina kill the SUV?

Even before Hurricane Katrina tore through the southern United States, hampering a big chunk of the US oil industry, consumers were having second thoughts about gas-guzzling sport utility vehicles.The headline is an exaggeration, but the automobile industry was in trouble before the hurricane and it is very possible that consumer preferences will change in response to higher gas prices (just like in the early '80s). The consequences for the automobile manufacturers and the US economy might be significant.

Katrina could now hasten the demise of the SUV, at least in its current guise, after years in which it has ruled the roost over the world's biggest auto market, analysts believe.

...

"Potentially, Katrina could signal the death knell of the SUV in as much as consumers are going to find themselves once burned, twice shy to buy such vehicles," Wachovia economist Jason Schenker said.

"High gas prices and the perceived fragility of the US energy sector are all likely to weigh on consumers' choices for years," he said.

Sales of big SUVs dropped dramatically in August, hurting both American and Japanese manufacturers, which have been trying to edge into the segment over the past five years

Best to all.

Saturday, September 10, 2005

Return from Paradise

by Calculated Risk on 9/10/2005 12:25:00 PM

After a week without news, hopefully I return with a clear head and a fresh look at the world. But first a few photos of Yellowstone ...

Click on photos for larger image.

The Yellowstone river winds its way through the Hayden valley in early September.

The wildlife viewing was excellent. Herds of bison were ubiquitous. We encountered several bull elk herding their harems through the forest. We saw wolves in the Lamar Valley, Pronghorn antelope, moose, coyote, trumpeter swan, mule deer and more. Did I mention the Bison were everywhere? Examining a large petrified Redwood tree stump on Specimen Ridge.

Examining a large petrified Redwood tree stump on Specimen Ridge.

This tree was buried some 50 million years ago by volcanic deposits and mudflows during a volcanic eruption. There are two smaller petrified Redwood trees just below the large Redwood (one in the bright sun, one in the shade). The view and the numerous specimens on the ridge (hence the name) made the steep climb worth the effort.

This Great Gray Owl greeted us on a short walk to the Natural Bridge (a small natural arch near Lake Yellowstone).

The park is incredible. The burn areas from the '88 fire are filling in with new growth and many of the young Lodgepole Pines, in the better growing areas, are 10 to 15 feet tall. I heartily recommend a September visit to Yellowstone.

Best to all and its great to be home!

Friday, September 02, 2005

Some Good News on Oil and Gas

by Calculated Risk on 9/02/2005 04:28:00 PM

NOTE: I will be out of town over the next week (leaving tonight). I hope everyone has a good week ... and my thoughts are with the victims of Hurricane Katrina.

The AP reports: Nations to Release 60M Barrels of Oil, Gas

Twenty-six countries in an international energy consortium will release more than 60 million barrels of crude oil and gasoline to relieve the energy crunch caused by Hurricane Katrina in the United States.This is a short term (30 day) fix since these countries are drawing down reserves to help the US. OCT Crude Oil was down to $67.57 per barrel and unleaded gasoline (OCT) down to $2.18 per gallon on the news.

...

[Energy Secretary Samuel Bodman] said he had received indications from other IEA members that a significant part of their portion would be refined products, mostly gasoline, which will be released onto global markets.

"We have made it known that we are facing shortfalls in available supplies of refined products in our country as a consequence of this storm," Bodman said, expressing confidence the gasoline will find its way to the United States where prices are expected to remain high.

Already there are 20 ships carrying gasoline from commercial foreign stocks to the United States, he said. The supplies from government stocks would be in addition.

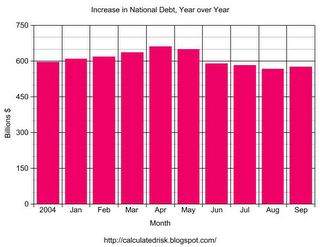

National Debt Increase: $575 Billion YoY

by Calculated Risk on 9/02/2005 03:06:00 PM

As of Sep 1, 2005 our National Debt is:

$7,929,658,283,890.28 (almost $8 Trillion)

As of Aug 1, 2004, our National Debt was:

$7,354,611,427,274.47

SOURCE: US Treasury.

Click on graph for larger image.

For comparison Year over Year Increase:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

For Aug 1, 2004 to Aug 1, 2005: $566.2 Billion

For Sep 1, 2004 to Sep 1, 2005: $575.0 Billion

The debt situtation worsened slightly in August and fiscal 2005 has a chance to see the worst annual increase in National Debt ever. The current record annual increase in the National Debt is $596 Billion for fiscal '04.

So far, despite the much ballyhooed "budget improvement", the US keeps accumulating debt at about the same pace as last year.