by Calculated Risk on 8/02/2005 05:53:00 PM

Tuesday, August 02, 2005

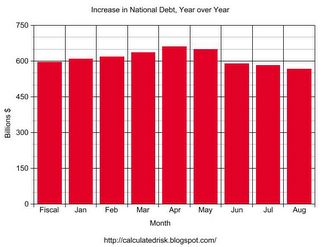

National Debt Increase: $566 Billion YoY

As of Aug 1, 2005 our National Debt is:

$7,869,521,621,947.05 (Over $7.8 Trillion)

As of Aug 1, 2004, our National Debt was:

$7,303,319,122,668.55

SOURCE: US Treasury.

Click on graph for larger image.

For comparison:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

For Aug 1, 2004 to Aug 1, 2005: $566.2 Billion

It now appears that the debt increase for fiscal '05 will be slightly less than the record set in fiscal '04. The current record annual increase in the National Debt is $596 Billion for fiscal '04.

Housing: Mortgage Rates

by Calculated Risk on 8/02/2005 11:36:00 AM

UPDATE: See graph at bottom.

Mortgage rates bottomed in May 2003.

Click on graph for larger image.

Since May 2003 the 30 year fixed rate has been steady and the 1 Year ARM starter rate has risen almost 100 bps.

A couple of points: We haven't seen a substantial increase in rates yet.

Second, in the less than two years since rates bottomed, house prices have continued to rise.

Percent Increase since Q2 2003 (through Q1 2005 according to OFHEO):

California 37%

Florida 29%

Nationwide 18%

This raises some questions:

1) Why have house prices continued to rise?

2) Have homebuyers migrated from fixed instruments to ARMs to afford homes?

3) Did transaction volumes fall when the 30 year fixed moved above 6% in late summer '03 and mid-summer '04?

To try to address the third question, here is a graph of New Home Sales, Seasonally adjusted since Jan 2002. When the 30 year fixed rate was above 6% is shaded in gray.

During the last two years, it appears that when fixed rates rose above ~6%, New Home Sales faltered. Many buyers just switched to ARMs, but there are probably some buyers that insisted on the insurance of a fixed rate loan. This might be of interest since the 30 year rate is closing in on 6% again.

Monday, August 01, 2005

Housing, Layoffs, the UK and more

by Calculated Risk on 8/01/2005 02:12:00 AM

A potpourri of stories ...

My most recent post is up on Angry Bear: A Regulatory Substitute to Burst Housing Bubble? Fed Chairman Alan Greenspan, July 11, 2005:

"Bank Regulatory policies are neither designed nor used to influence asset prices in particular sectors of the economy. Rather, there purpose is to ensure adequate bank risk management ..."

Bloomberg: Greenspan Housing View Seen Hazardous by Wall Street Economists

Worry, say Wall Street economists including David Rosenberg of Merrill Lynch & Co. and Stephen Roach of Morgan Stanley.Danielle DiMartino: Job losses might herald bigger woes

The economists say the Fed must act, for a simple reason: The U.S. has become so dependent on real estate and construction to fuel growth and jobs that an eventual, wrenching correction has the potential to sink the entire economy.

"Act now and cut off the pinky, or wait till later and risk slicing off the entire hand," Rosenberg said in an interview last week. "Either way it hurts, but you can still type with nine fingers."

...

"The Fed is in some sense caught in a box," said Rosenberg, who estimates 60 percent of the U.S. is experiencing a housing-price bubble. "Housing has been this giant locomotive driving just about everything."

...

"There's enough of a risk that the Fed should be preemptive," Maury Harris, chief economist at UBS Securities LLC in Stamford, Connecticut, said in an interview. He recommends the Fed keep pushing up its short-term rate, now at 3.25 percent, until market forces raise mortgage rates as much as 0.75 percentage points. Mortgages are linked to long-term bond yields.

...

"The Fed behaved irresponsibly" by "over-stimulating housing," Edward Leamer, director of the Anderson Forecast Center at the University of California, Los Angeles, said in an interview.

...

"The Fed is probably going to raise interest rates somewhat faster because of the housing price bubble," said Gramley, who is now a senior economic adviser at Stanford Washington Research Group in Washington. "If they can engineer a monetary policy now that brings a nice smooth end to this run-up in home prices, they're less likely to have economic instability down the road,"

"Summer is typically a time when we see a dropoff in job cuts, but this year that slowdown has not materialized," said John Challenger, chief executive of outplacement firm Challenger, Gray & Christmas. "In fact, five out of the six largest job cuts announced so far this year have occurred since May."Stephen King: America and Britain: united by debt but divided by economic performance - so far

With that in mind, while most others waited out last week on tenterhooks until Friday's July labor report, my vigil will end Wednesday with the release of Challenger's July layoff report.

After all, the government's report looks to the past, while Challenger's looks to the future, as the announced job cuts turn into real job cuts.

Announced job cuts in May and June alone were nearly 200,000. This summer's cuts could easily surpass the total for the first four months of the year, when it is much more typical to see heavy downsizing.

The number of job cuts announced between May and August is typically 20 percent lower than in the first four months of the year, according to Challenger.

This break with the typical pattern has John Challenger, whose Chicago firm has been tracking layoff announcements since 1989, looking for a deeper meaning in the numbers.

"We haven't seen mega-layoffs like this in years," Challenger said. "If the summer surge proves to be the first sign of an eventual economic slowdown, this would be the weakest expansion in recent times."

... the biggest difference, at least from a cyclical point of view, probably lies with housing and the consumer. From the Bank of England's point of view, the UK economy has delivered three major surprises over the past 18 months. The first surprise has been the slowdown in housing activity given that short-term interest rates rose only to 4.75 per cent last year, hardly a threatening level by previous standards.Bloomberg: ECB Rate Cut May Hurt More Than Help, Economists Say

Surprise No 2 has been the consumer's response: house prices are now roughly flat year-on-year, yet consumers have retrenched more rapidly than the Bank had expected. And the third surprise has been that, on the back of all these housing and consumer shenanigans, interest rates are on the verge of falling once again, suggesting that the neutral, or structural, level of interest rates is a lot lower than the Bank of England ever seriously contemplated.

"If consumers are hiding in their bolt holes, it's because of the fear of higher unemployment and unsettling European policies," said David Brown, chief European economist at Bear Stearns in London. While the ECB may lower rates as a last resort, "a quarter-point rate cut is going to make very little difference to consumer or business confidence. It's a drop in the ocean."Sorry for all the Doom and Gloom to start the week.

Sunday, July 31, 2005

Sign of the Times: Bubble T-Shirt

by Calculated Risk on 7/31/2005 01:59:00 PM

Just for fun ...

Get yours here.

Friday, July 29, 2005

Bernanke: House Prices Unlikely to Decline

by Calculated Risk on 7/29/2005 08:07:00 PM

Bernanke was on CNBC today. From Reuters:

Top White House economic adviser Ben Bernanke said on Friday strong U.S. housing prices reflect a healthy economy and he doubts there will be a national decline in prices.Is it too early to start talking about the "Bernanke Put"?

"House prices have gone up a lot," Bernanke said in an interview on CNBC television. "It seems pretty clear, though, that there are a lot of strong fundamentals underlying that.

"The economy is strong. Jobs have been strong, incomes have been strong, mortgage rates have been very low," the chairman of the White House Council of Economic Advisers said.

The pace of housing prices may slow at some point, Bernanke said, but they are unlikely to drop on a national basis.

"We've never had a decline in housing prices on a nationwide basis," he said, "What I think is more likely is that house prices will slow, maybe stabilize ... I don't think it's going to drive the economy too far from its full-employment path, though."