by Calculated Risk on 7/16/2025 02:00:00 PM

Wednesday, July 16, 2025

Fed's Beige Book: "Economic activity increased slightly"

Economic activity increased slightly from late May through early July. Five Districts reported slight or modest gains, five had flat activity, and the remaining two Districts noted modest declines in activity. That represented an improvement over the previous report, in which half of Districts reported at least slight declines in activity. Uncertainty remained elevated, contributing to ongoing caution by businesses. Nonauto consumer spending declined in most Districts, softening slightly overall. Auto sales receded modestly on average, after consumers had rushed to buy vehicles earlier this year to avoid tariffs. Tourism activity was mixed, manufacturing activity edged lower, and nonfinancial services activity was little changed on average but varied across Districts. Loan volume increased slightly in most Districts. Construction activity slowed somewhat, constrained by rising costs in some Districts. Home sales were flat or little changed in most Districts, and nonresidential real estate activity was also mostly steady. Activity in the agriculture sector remained weak. Energy sector activity declined slightly, and transportation activity was mixed. The outlook was neutral to slightly pessimistic, as only two Districts expected activity to increase, and others foresaw flat or slightly weaker activity.

Labor Markets

Employment increased very slightly overall, with one District noting modest increases, six reporting slight increases, three no change, and two noting slight declines. Hiring remained generally cautious, which many contacts attributed to ongoing economic and policy uncertainty. Labor availability improved for many employers, with further reductions in turnover rates and increased job applications. A growing number of Districts cited labor shortages in the skilled trades. Several Districts also mentioned reduced availability of foreign-born workers, attributed to changes in immigration policy. Employers in a few Districts ramped up investments in automation and AI aimed at reducing the need for additional hiring. Wages increased modestly overall, extending recent trends, with reports that ranged from flat wages to moderate growth. Although reports of layoffs were limited in all industries, they were somewhat more common among manufacturers. Looking ahead, many contacts expected to postpone major hiring and layoff decisions until uncertainty diminished.

Prices

Prices increased across Districts, with seven characterizing price growth as moderate and five characterizing it as modest, mostly similar to the previous report. In all twelve Districts, businesses reported experiencing modest to pronounced input cost pressures related to tariffs, especially for raw materials used in manufacturing and construction. Rising insurance costs represented another widespread source of pricing pressure. Many firms passed on at least a portion of cost increases to consumers through price hikes or surcharges, although some held off raising prices because of customers' growing price sensitivity, resulting in compressed profit margins. Contacts in a wide range of industries expected cost pressures to remain elevated in the coming months, increasing the likelihood that consumer prices will start to rise more rapidly by late summer.

emphasis added

Industrial Production Increased 0.3% in June

by Calculated Risk on 7/16/2025 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production (IP) increased 0.3 percent in June after remaining unchanged in April and May; for the second quarter as a whole, IP increased at an annual rate of 1.1 percent. In June, manufacturing output ticked up 0.1 percent, and the index for mining decreased 0.3 percent. The index for utilities rose 2.8 percent. At 104.0 percent of its 2017 average, total IP in June was 0.7 percent above its year-earlier level. Capacity utilization moved up to 77.6 percent, a rate that is 2.0 percentage points below its long-run (1972–2024) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and close to the level in February 2020 (pre-pandemic).

Capacity utilization at 77.6% is 2.0% below the average from 1972 to 2023. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 104.0. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 7/16/2025 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 10.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 11, 2025. Last week’s results included an adjustment for the Fourth of July holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 13 percent compared with the previous week. The Refinance Index decreased 7 percent from the previous week and was 25 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 12 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 13 percent higher than the same week one year ago.

“Treasury yields finished higher last week on average despite an intra-week drop, driven partly by renewed concerns of the impact of tariffs on the economy. As a result, mortgage rates rose after two weeks of declines, which contributed to slower application activity,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Jumbo rates were lower than conventional rates for the third straight week, as some depositories may be positioning themselves for growth in balance sheet lending.”

Added Kan, “Purchase applications remained sensitive to both the uncertain economic outlook and the volatility in rates and declined to the slowest pace since May. Refinance applications also dipped because of higher rates, with refinance applications falling, led by VA refinances partially reversing their previous week’s gain, dropping 22 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) increased to 6.82 percent from 6.77 percent, with points remaining unchanged at 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 13% year-over-year unadjusted.

Tuesday, July 15, 2025

Wednesday: PPI, Industrial Production, Beige Book

by Calculated Risk on 7/15/2025 07:14:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for June from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for June. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.4%.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

An Early Look at 2026 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 7/15/2025 04:06:00 PM

The BLS reported earlier today:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 2.6 percent over the last 12 months to an index level of 315.945 (1982-84=100). For the month, the index increased 0.4 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2024, the Q3 average of CPI-W was 308.729.

The 2024 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 2.6% year-over-year in June (up from 2.2% YoY in May), and although this is very early - we need the data for July, August and September - my early guess is COLA will probably be in 3% range this year, up from 2.5% in 2025.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2024 yet, although we know wages increased solidly in 2024. If wages increased 5% in 2024, then the contribution base next year will increase to around $185,000 in 2026, from the current $176,100.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

Cleveland Fed: Median CPI increased 0.2% and Trimmed-mean CPI increased 0.3% in June

by Calculated Risk on 7/15/2025 11:14:00 AM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in May. The 16% trimmed-mean Consumer Price Index increased 0.3%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 7/15/2025 08:49:00 AM

Here are a few measures of inflation:

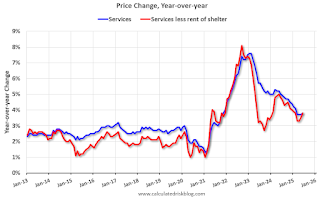

The first graph is the one Fed Chair Powell had mentioned two years ago when services less rent of shelter was up around 8% year-over-year. This declined and is now up 3.8% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through June 2025.

Services less rent of shelter was up 3.8% YoY in June, up from 3.5% YoY in April.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were at 0.6% YoY in June, up from 0.3% YoY in May.

Here is a graph of the year-over-year change in shelter from the CPI report (through June) and housing from the PCE report (through May)

Here is a graph of the year-over-year change in shelter from the CPI report (through June) and housing from the PCE report (through May)Shelter was up 3.8% year-over-year in June, down from 3.9% in May. Housing (PCE) was up 4.1% YoY in June, down from 4.2% in May.

Core CPI ex-shelter was up 2.1% YoY in June, up from 1.9% in May.

BLS: CPI Increased 0.3% in June; Core CPI increased 0.2%

by Calculated Risk on 7/15/2025 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in June, after rising 0.1 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.The change in CPI was close to expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter rose 0.2 percent in June and was the primary factor in the all items monthly increase. The energy index rose 0.9 percent in June as the gasoline index increased 1.0 percent over the month. The index for food increased 0.3 percent as the index for food at home rose 0.3 percent and the index for food away from home rose 0.4 percent in June.

The index for all items less food and energy rose 0.2 percent in June, following a 0.1-percent increase in May. Indexes that increased over the month include household furnishings and operations, medical care, recreation, apparel, and personal care. The indexes for used cars and trucks, new vehicles, and airline fares were among the major indexes that decreased in June.

The all items index rose 2.7 percent for the 12 months ending June, after rising 2.4 percent over the 12 months ending May. The all items less food and energy index rose 2.9 percent over the last 12 months. The energy index decreased 0.8 percent for the 12 months ending June. The food index increased 3.0 percent over the last year.

emphasis added

Monday, July 14, 2025

Tuesday: CPI, NY Fed Mfg

by Calculated Risk on 7/14/2025 07:43:00 PM

Today's movement in mortgage rates, in and of itself, is barely worth mentioning. The average lender remains close enough to Friday's levels but is technically just a hair higher. That fact is offset by the counterpoint that most of the past two months saw higher rates.Tuesday:

The future is far more interesting than the present--specifically, the immediate future. Tomorrow morning brings the release of the Consumer Price Index (CPI). This is one of the most important economic reports as far as interest rates are concerned and tomorrow's example is especially notable.

This CPI marks the first major opportunity for the official data to show (or not show) a meaningful impact on inflation from tariffs.[30 year fixed 6.83%]

emphasis added

• At 8:30 AM ET, The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 2.6% year-over-year and core CPI to be up 2.9% YoY.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of -10.1, up from -16.0.

CPI Preview

by Calculated Risk on 7/14/2025 02:31:00 PM

The Consumer Price Index for May is scheduled to be released tomorrow. The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 2.6% year-over-year and core CPI to be up 2.9% YoY.

From Goldman Sachs economists:

We expect a 0.23% increase in June core CPI (vs. +0.3% consensus), corresponding to a year-over-year rate of 2.93% (vs. +3.0% consensus). We expect a 0.30% increase in headline CPI (vs. +0.3% consensus), reflecting higher food prices (+0.25%) and energy prices (+1.2%).From BofA:

...

Going forward, tariffs will likely provide a somewhat larger boost to monthly inflation, and we expect monthly core CPI inflation between 0.3-0.4% over the next few months.

We forecast headline and core CPI to print at 0.3% m/m in June, which would be a notable acceleration from the recent trend. Stronger price hikes for core goods, discretionary services, and medical services should drive the pickup in core inflation. Based on our forecast, we project core PCE to print at 0.22% m/m in June, which would lower the likelihood of a September cut.Note that month-to-month inflation was soft in May and June 2024.

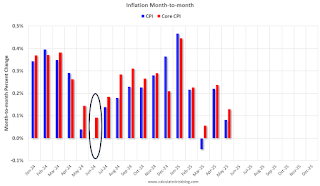

Click on graph for larger image.

Click on graph for larger image.This graph shows the month-to-month change in both headline and core inflation since January 2024.

The circled area is the change for last when inflation was soft. CPI was down fractionally in June 2024, and core CPI was up 0.09%.

Will House Prices Decline Nationally in 2025?

by Calculated Risk on 7/14/2025 11:26:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Will House Prices Decline Nationally in 2025?

A brief excerpt:

Most forecasts for 2025 were for U.S. house prices to increase modestly in the 3% to 4% range. My early view was “mostly flat prices nationally in 2025” with some areas seeing price declines. I didn’t expect either a crash in prices or a surge in prices.There is much more in the article.

With inventory increasing, year-over-year (YoY) price growth has slowed nationally, and declining in many areas. The following table shows the YoY price slowdown. Note that the median price is impacted by the mix of homes sold.

The seasonally adjusted Case-Shiller National Index is essentially unchanged year-to-date (YTD). The index was at 327.81 in December 2024 and was at 327.90 in the April report.

And the Freddie Mac HPI SA is down slightly YTD. The index was at 299.29 in December, and is now at 297.69, a decline of 0.5%.

Other measures are also indicating a slowdown in the YoY growth, but not a collapse in prices.

Housing July 14th Weekly Update: Inventory down 0.7% Week-over-week, Down 11% from 2019 Levels

by Calculated Risk on 7/14/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, July 13, 2025

Sunday Night Futures

by Calculated Risk on 7/13/2025 06:13:00 PM

Weekend:

• Schedule for Week of July 13, 2025

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 26 and DOW futures are down 185 (fair value).

Oil prices were up over the last week with WTI futures at $68.45 per barrel and Brent at $70.36 per barrel. A year ago, WTI was at $83, and Brent was at $87 - so WTI oil prices are down about 18% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.11 per gallon. A year ago, prices were at $3.50 per gallon, so gasoline prices are down $0.39 year-over-year.

Saturday, July 12, 2025

Real Estate Newsletter Articles this Week: Months-of-supply is higher than the previous 8 years!

by Calculated Risk on 7/12/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Part 1: Current State of the Housing Market; Overview for mid-July 2025

• Part 2: Current State of the Housing Market; Overview for mid-July 2025

• 2nd Look at Local Housing Markets in June

• July ICE Mortgage Monitor: Home Prices Continue to Cool, Early Signs of Homeowner Risk Emerge

• 1st Look at Local Housing Markets in June

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of July 13, 2025

by Calculated Risk on 7/12/2025 08:11:00 AM

The key reports this week are June CPI, Retail Sales and Housing Starts.

For manufacturing, the June Industrial Production report and the July New York and Philly Fed manufacturing surveys will be released.

No major economic releases scheduled.

8:30 AM: The Consumer Price Index for June from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.3% increase in core CPI. The consensus is for CPI to be up 2.6% year-over-year and core CPI to be up 2.9% YoY.

8:30 AM: The New York Fed Empire State manufacturing survey for July. The consensus is for a reading of -10.1, up from -16.0.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Producer Price Index for June from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for June.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.4%.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for initial claims to decrease to 225 thousand from 227 thousand last week.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

8:30 AM: Retail sales for June is scheduled to be released. The consensus is for a 0.2% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

8:30 AM: the Philly Fed manufacturing survey for July. The consensus is for a reading of -0.5, up from -4.0.

10:00 AM: The July NAHB homebuilder survey. The consensus is for a reading of 33, up from 32. Any number below 50 indicates that more builders view sales conditions as poor than good.

10:00 AM: Speech, Fed Governor Adriana Kugler, A View of the Housing Market and U.S. Economic Outlook, At the Housing Partnership Network Symposium, Washington, D.C.

8:30 AM ET: Housing Starts for June.

8:30 AM ET: Housing Starts for June. This graph shows single and multi-family housing starts since 2000.

The consensus is for 1.300 million SAAR, up from 1.256 million SAAR in May.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for July).

10:00 AM: State Employment and Unemployment (Monthly) for June 2025

Friday, July 11, 2025

"The Office Sector’s Double Whammy"; Record High Office Vacancy Rate

by Calculated Risk on 7/11/2025 03:55:00 PM

From Nick Villa at Moody's The Office Sector’s Double Whammy

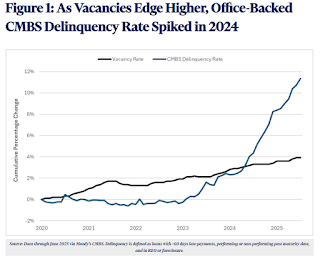

The ongoing challenges affecting the office sector have not only resulted in deteriorating space market fundamentals—evidenced by the record-high national office vacancy rate in the second quarter of 2025—but have also had a direct negative impact on capital market activities, including the performance of commercial mortgage-backed securities (CMBS). Figure 1 illustrates the office sector’s “double whammy”—in particular, record-high vacancy rates and CMBS conduit delinquency rates. Specifically, the chart benchmarks the cumulative change in each of these metrics going back to the end of 2019. While the U.S. office vacancy rate has increased by nearly four percentage points over this period, the rise in office-backed CMBS delinquency has been significantly higher at around 11 percentage points.

As one would expect, vacancy rates have slowly inched higher from weaker tenant demand and new supply entering the market, while the long-term nature of most office leases has helped delay the full impact on net operating income. Consequently, this has temporarily masked the underlying CMBS distress, which has recently become more apparent through rising loan delinquencies and declining property valuations. For example, the office-backed CMBS delinquency rate increased by approximately 600 basis points in 2024, which was the fastest annual increase on record since data collection began in 2000. In other words, 2024’s full-year delinquency spike even outpaced levels seen during the Global Financial Crisis (GFC). Concerningly, however, the first six months of 2025 reflected the fastest midyear increase on record, underscoring the unique structural challenges now facing the sector.

The second graph shows the office vacancy rate over time.

The second graph shows the office vacancy rate over time.Moody’s Analytics reported that the office vacancy rate was at 20.7% in Q2 2025, up from 20.4% in Q1 2025, and up from 20.1% in Q2 2024.

This is the highest vacancy rate on record and is above the 19.3% peak during the S&L crisis.

Realtor.com Reports Most Active "For Sale" Inventory since December 2019

by Calculated Risk on 7/11/2025 02:48:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For May, Realtor.com reported inventory was up 28.9% YoY, but still down 12.9% compared to the 2017 to 2019 same month levels.

Here is their weekly report: Weekly Housing Trends: Latest Data as of July 5

• Active inventory climbed 26.7% year-over-year

The number of homes actively for sale remains on a strong upward trajectory, virtually unchanged from last week, at 26.7% higher than this time last year. This represents the 87th consecutive week of annual gains in inventory. There were more than 1 million homes for sale again last week, marking the ninth week in a row over the threshold and the highest inventory level since December 2019.

• New listings—a measure of sellers putting homes up for sale—rose 9.3% year over year

New listings rose again last week on an annual basis, up 9.3% compared with the same period last year.

• he median list price was up 0.2% year over year

The median list price climbed again this week but is still down 0.3% year to date. The median list price per square foot—which adjusts for changes in home size—rose 0.8% year over year. With inventory on the rise and more than 1 in 5 sellers cutting prices, the market is tilting back toward balance, marked by slowing price growth and increasing buyer leverage.

Q2 GDP Tracking: Mid-to-high 2s

by Calculated Risk on 7/11/2025 11:40:00 AM

From BofA:

Since our last weekly publication, our 2Q GDP tracking is down two-tenths to 2.3% q/q saar. [July 11th estimate]From Goldman:

emphasis added

[W]e have lowered our Q2 GDP tracking estimate by 0.6pp to +3.0% (quarter-over-quarter annualized). Our Q2 domestic final sales estimate stands at +0.7%. [July 3rd estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.6 percent on July 9, unchanged from July 3 after rounding. After this morning's wholesale trade report from the US Census Bureau, the nowcast of second-quarter real residential fixed investment growth decreased from -6.4 percent to -6.5 percent, while the nowcast of the contribution of inventory investment to annualized second-quarter real GDP growth decreased from -2.13 percentage points to -2.15 percentage points. [July 9th estimate]

2nd Look at Local Housing Markets in June

by Calculated Risk on 7/11/2025 08:26:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in June

A brief excerpt:

Closed sales in June were mostly for contracts signed in April and May, and mortgage rates, according to the Freddie Mac PMMS, averaged 6.73% in April and 6.82% in May (slightly higher than for closed sales in May).There is much more in the article.

...

In June, sales in these early reporting markets were up 4.5% YoY. Last month, in May, these same markets were down 4.7% year-over-year Not Seasonally Adjusted (NSA).

Important: There were more working days in June 2025 (20) as in June 2024 (19). So, the year-over-year change in the headline SA data will be lower than for the NSA data.

...

Many more local markets to come!

Thursday, July 10, 2025

Leading Index for Commercial Real Estate Increased 7% in June

by Calculated Risk on 7/10/2025 04:47:00 PM

From Dodge Data Analytics: Dodge Momentum Index Expands 7% in June

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, grew 6.8% in June to 225.1 (2000=100) from the downwardly revised May reading of 210.9. Over the month, commercial planning grew 7.3% while institutional planning improved 5.7%.

“Nonresidential planning steadily improved in June, alongside strength in warehouse, recreational and data center planning,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Planning momentum in other key sectors – like education, hotels, and retail stores – was more subdued. Expectations for weaker consumer spending and travel demand, as well as volatility around funding, is likely contributing to weaker momentum of projects entering the planning queue for those sectors.”

Warehouse activity gained substantive momentum in June, and data center planning levels remain robust. On the institutional side, large recreational projects propped up the month-over month gain, while healthcare planning momentum continued to accelerate. In June, the DMI was up 20% when compared to year-ago levels. The commercial segment was up 11% from June 2024, and the institutional segment was up 46% after a weak June last year. If all data center projects between 2023 and 2025 are excluded, commercial planning would be up 12% from year-ago levels and the entire DMI would be up 23%.

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 225.1 in June, up from 210.9 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a pickup in mid-2025, however, uncertainty might impact these projects.