by Calculated Risk on 6/19/2025 08:11:00 PM

Thursday, June 19, 2025

Friday: Philly Fed Mfg

Friday:

• At 8:30 AM ET, the Philly Fed manufacturing survey for June. The consensus is for a reading of 0.0, up from -4.0 last month.

TSA: Airline Travel Down Slightly YoY

by Calculated Risk on 6/19/2025 04:03:00 PM

This data is as of June 17, 2025.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for the last 6 years.

The red line is the seven-day average for 2025. Air travel is down slightly from last year.

Realtor.com Reports Most Active "For Sale" Inventory since December 2019

by Calculated Risk on 6/19/2025 10:57:00 AM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For May, Realtor.com reported inventory was up 31.5% YoY, but still down 14.4% compared to the 2017 to 2019 same month levels.

Here is their weekly report: Weekly Housing Trends: Latest as of June 14

• Active inventory climbed 28.1% year over year

The number of homes actively for sale remains on a strong upward trajectory, now 28.1% higher than this time last year. This represents the 84th consecutive week of annual gains in inventory. There were more than 1 million homes for sale again last week, marking the seventh week in a row over the threshold and the highest inventory level since December 2019.

• New listings—a measure of sellers putting homes up for sale—rose 5.7% year over year

New listings rose again last week on an annual basis, up 5.7% compared with the same period last year, a slightly faster growth compared with the previous two weeks.

• The median list price was unchanged year over year

The median list price was flat (0% change) year over year this week and is down 0.4% year to date. The median list price per square foot—which adjusts for changes in home size—rose 0.7% year over year.

Update: The Art of the Soft Landing

by Calculated Risk on 6/19/2025 08:13:00 AM

A year ago I wrote: The Art of the Soft Landing

A few excerpts and an updated graph ...

The "Art of the Soft Landing" requires that the Fed reduce rates quick enough to keep economic growth positive, and slow enough not to reignite inflation. My view is a soft landing is achieved if growth stays positive, inflation returns to target, and the yield curve flattens or reverts to normal (long yields higher than short yields).

Inflation hasn't quite returned to target with PCE core inflation at 2.5% YoY in April. However, inflation appeared to be on the way to the Fed's 2% target until the trade war started.

And here is an updated graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED for the last 5 years.

And here is an updated graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED for the last 5 years.With the significant changes to policy, the Fed didn't completely meet my definition of a "soft landing", but it was close - and I think they deserve credit.

Wednesday, June 18, 2025

Thursday: Juneteenth Holiday

by Calculated Risk on 6/18/2025 09:09:00 PM

Thursday:

• All US markets will be closed in observance of Juneteenth National Independence Day

AIA: "Architecture firm billings continued to decline in May"

by Calculated Risk on 6/18/2025 03:26:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: ABI May 2025: Despite persistent softness, fewer firms report declining billings

The modest uptick in the AIA/Deltek Architecture Billings Index (ABI) score to 47.2 for the month means that fewer firms reported a decrease than in April. In addition, inquiries into new work increased this month for the first time since January, reflecting the modest degree of stabilization in the economy recently. However, the value of new signed design contracts continued to decline, indicating that while clients are starting to explore new projects, they remain hesitant to sign a contract committing to them.• Northeast (43.6); Midwest (43.5); South (49.2); West (44.3)

Business conditions remained soft at firms in all regions of the country in May, although firms located in the South came close to reporting growth. The pace of the decline in that region has slowed over recent months, and firms in that region may be the first to experience growth again. However, firms of all specializations reported declining billings this month, although the pace of the decline slowed at firms with a multifamily residential specialization. Firms specializing in that type of work, as well as in institutional work, look like they’ll be the first ones to turn the corner to growth when conditions start to improve.

...

The ABI score is a leading economic indicator of construction activity, providing an approximately nine-to-twelve-month glimpse into the future of nonresidential construction spending activity. The score is derived from a monthly survey of architecture firms that measures the change in the number of services provided to clients.

emphasis added

• Sector index breakdown: commercial/industrial (43.8); institutional (46.2); multifamily residential (46.1)

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 47.2 in May, down from 43.2 in April. Anything below 50 indicates a decrease in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This index usually leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment throughout 2025 and into 2026.

FOMC Projections: GDP Revised Down, Inflation Revised Up

by Calculated Risk on 6/18/2025 02:08:00 PM

Statement here.

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

Here are the projections. The projections are pretty bearish.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 1.2 to 1.5 | 1.5 to 1.8 | 1.7 to 2.0 | |

| Mar 2025 | 1.5 to 1.9 | 1.6 to 1.9 | 1.6 to 2.0 | |

The unemployment rate was at 4.2% in May after averaging 4.1% for Q1. The unemployment rate was revised up.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 4.4 to 4.5 | 4.3 to 4.6 | 4.2 to 4.6 | |

| Mar 2025 | 4.3 to 4.4 | 4.2 to 4.5 | 4.1 to 4.4 | |

As of April 2025, PCE inflation increased 2.1 percent year-over-year (YoY). There will likely be some increase in PCE inflation from trade policy.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 2.8 to 3.2 | 2.3-2.6 | 2.0 to 2.2 | |

| Mar 2025 | 2.6 to 2.9 | 2.1 to 2.3 | 2.0 to 2.1 | |

PCE core inflation increased 2.5 percent YoY in April. The projections for core PCE inflation Q4 2025 were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Jun 2025 | 2.9 to 3.4 | 2.3-2.6 | 2.0 to 2.2 | |

| Mar 2025 | 2.7 to 3.0 | 2.1 to 2.4 | 2.0 to 2.1 | |

FOMC Statement: No Change to Fed Funds Rate

by Calculated Risk on 6/18/2025 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook has diminished but remains elevated. The Committee is attentive to the risks to both sides of its dual mandate.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N. Jefferson; Adriana D. Kugler; Alberto G. Musalem; Jeffrey R. Schmid; and Christopher J. Waller.

emphasis added

Newsletter: Housing Starts Decreased to 1.256 million Annual Rate in May

by Calculated Risk on 6/18/2025 09:11:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts Decreased to 1.256 million Annual Rate in May

A brief excerpt:

Total housing starts in May were below expectations; however, starts in March and April were revised up, combined.There is much more in the article.

The third graph shows the month-to-month comparison for total starts between 2024 (blue) and 2025 (red).

Total starts were down 4.6% in May compared to May 2024. Year-to-date (YTD) starts are down 1.5% compared to the same period in 2024. Single family starts are down 7.1% YTD and multi-family up 14.5% YTD.

Housing Starts Decreased to 1.256 million Annual Rate in May

by Calculated Risk on 6/18/2025 08:32:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,256,000. This is 9.8 percent below the revised April estimate of 1,392,000 and is 4.6 percent below the May 2024 rate of 1,316,000. Single-family housing starts in May were at a rate of 924,000; this is 0.4 percent above the revised April figure of 920,000. The May rate for units in buildings with five units or more was 316,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,393,000. This is 2.0 percent below the revised April rate of 1,422,000 and is 1.0 percent below the May 2024 rate of 1,407,000. Single-family authorizations in May were at a rate of 898,000; this is 2.7 percent below the revised April figure of 923,000. Authorizations of units in buildings with five units or more were at a rate of 444,000 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) decreased sharply month-over-month in May. Multi-family starts were up 4.1% year-over-year.

Single-family starts (red) increased slightly in May and were down 7.3% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery.

Total housing starts in May were below expectations; however, starts in March and April were revised up, combined.

I'll have more later …

Weekly Initial Unemployment Claims Decrease to 245,000

by Calculated Risk on 6/18/2025 08:30:00 AM

The DOL reported:

In the week ending June 14, the advance figure for seasonally adjusted initial claims was 245,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 248,000 to 250,000. The 4-week moving average was 245,500, an increase of 4,750 from the previous week's revised average. This is the highest level for this average since August 19, 2023 when it was 246,000. The previous week's average was revised up by 500 from 240,250 to 240,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 245,500.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

by Calculated Risk on 6/18/2025 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 13, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The Refinance Index decreased 2 percent from the previous week and was 25 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 14 percent higher than the same week one year ago.

“Mortgage rates decreased last week, driven by financial market volatility caused by current geopolitical conflict and ongoing tariff uncertainties. The 30-year fixed rate decreased to 6.84 percent, its lowest level since April,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Even with lower average mortgage rates, applications declined over the week as ongoing economic uncertainty weighed on potential homebuyers’ purchase decisions.”

Added Kan, “Refinance activity declined for both conventional and government borrowers. VA applications, however, bucked the trend with a 2 percent increase in purchase applications and a slight increase in refinance applications. Additionally, the overall average loan size at $380,200, was the lowest since January 2025.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.84 percent from 6.93 percent, with points increasing to 0.66 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 14% year-over-year unadjusted.

Tuesday, June 17, 2025

Wednesday: Housing Starts, Unemployment Claims, FOMC Statement

by Calculated Risk on 6/17/2025 07:56:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for initial claims of 250 thousand, up from 248 thousand last week.

• Also at 8:30 AM ET, Housing Starts for May. The consensus is for 1.370 million SAAR, up from 1.361 million SAAR in April.

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Statement. The FOMC is expected to leave the Fed Funds rate unchanged at this meeting.

• Also at 2:00 PM, FOMC Projections This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

LA Ports: Traffic Down Sharply in May

by Calculated Risk on 6/17/2025 05:31:00 PM

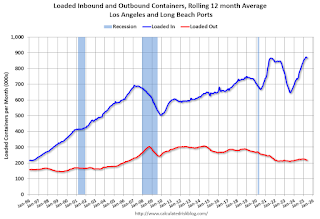

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Click on graph for larger image.

Click on graph for larger image.Usually imports peak in the July to October period as retailers import goods for the Christmas holiday and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

To remove the strong seasonal component for inbound traffic, the second graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 0.8% in May compared to the rolling 12 months ending the previous month. Outbound traffic decreased 0.9% compared to the rolling 12 months ending the previous month.

On a rolling 12-month basis, inbound traffic decreased 0.8% in May compared to the rolling 12 months ending the previous month. Outbound traffic decreased 0.9% compared to the rolling 12 months ending the previous month.Housing Market Index and Single Family Starts

by Calculated Risk on 6/17/2025 12:18:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing Market Index and Single Family Starts

A brief excerpt:

This morning, the National Association of Home Builders (NAHB) released their monthly housing market index: Builder Sentiment at Third Lowest Reading Since 2012There is much more in the article.

...

There are several negatives for new home builders now. The NAHB lists the following: rising inventory levels (this is true for both new homes and existing homes that compete with new homes), price declines for existing home sales in a “growing number of markets”, buyer hesitancy due to “elevated mortgage rates and tariff and economic uncertainty”.

In addition, margins are being squeezed by rising costs (both material and labor), and price cuts. This will be a difficult period for homebuilders.

The following graph shows the NAHB HMI and single family starts since 1985.

NAHB: "Builder Sentiment at Third Lowest Reading Since 2012" in June

by Calculated Risk on 6/17/2025 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 32, down from 34 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment at Third Lowest Reading Since 2012

In a further sign of declining builder sentiment, the use of price incentives increased sharply in June as the housing market continues to soften.

Builder confidence in the market for newly built single-family homes was 32 in June, down two points from May, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. The index has only posted a lower reading twice since 2012 – in December 2022 when it hit 31 and in April 2020 at the start of the pandemic when it plunged more than 40 points to 30.

“Buyers are increasingly moving to the sidelines due to elevated mortgage rates and tariff and economic uncertainty,” said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, N.C. “To help address affordability concerns and bring hesitant buyers off the fence, a growing number of builders are moving to cut prices.”

Indeed, the latest HMI survey also revealed that 37% of builders reported cutting prices in June, the highest percentage since NAHB began tracking this figure on a monthly basis in 2022. This compares with 34% of builders who reported cutting prices in May and 29% in April. Meanwhile, the average price reduction was 5% in June, the same as it’s been every month since last November. The use of sales incentives was 62% in June, up one percentage point from May.

“Rising inventory levels and prospective home buyers who are on hold waiting for affordability conditions to improve are resulting in weakening price growth in most markets and generating price declines for resales in a growing number of markets,” said NAHB Chief Economist Robert Dietz. “Given current market conditions, NAHB is forecasting a decline in single-family starts for 2025.”

...

All three of the major HMI indices posted losses in June. The HMI index gauging current sales conditions fell two points in June to a level of 35, the component measuring sales expectations in the next six months dropped two points lower to 40 while the gauge charting traffic of prospective buyers posted a two-point decline to 21, the lowest reading since November 2023.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 43, the Midwest moved one point higher to 41, the South dropped three points to 33 and the West declined four points to 28.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was well below the consensus forecast.

Industrial Production Decreased 0.2% in May

by Calculated Risk on 6/17/2025 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production (IP) fell 0.2 percent in May after increasing 0.1 percent in April. Manufacturing output ticked up 0.1 percent in May, driven by a gain of 4.9 percent in the index for motor vehicles and parts; the index for manufacturing excluding motor vehicles and parts fell 0.3 percent. The index for mining increased 0.1 percent, and the index for utilities decreased 2.9 percent. At 103.6 percent of its 2017 average, total IP in May was 0.6 percent above its year-earlier level. Capacity utilization moved down to 77.4 percent, a rate that is 2.2 percentage points below its long-run (1972–2024) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and close to the level in February 2020 (pre-pandemic).

Capacity utilization at 77.4% is 2.2% below the average from 1972 to 2023. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 103.6. This is above the pre-pandemic level.

Industrial production was below consensus expectations and the previous months were revised down.

Retail Sales Decreased 0.9% in May

by Calculated Risk on 6/17/2025 08:30:00 AM

On a monthly basis, retail sales decreased 0.9% from April to May (seasonally adjusted), and sales were up 3.3 percent from May 2024.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2025, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $715.4 billion, down 0.9 percent from the previous month, and up 3.3 percent rom May 2024. ... The March 2025 to April 2025 percent change was revised from up 0.1 percent to down 0.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was down 0.8% in May.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

The change in sales in May were below expectations and the previous two months were revised down.

The change in sales in May were below expectations and the previous two months were revised down.Monday, June 16, 2025

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey

by Calculated Risk on 6/16/2025 07:11:00 PM

While there's been no shortage of political and geopolitical headlines over the past 2 business days, there hasn't been much by way of inspiration for the bond market. Bonds (and, thus, rates) have moved nonetheless.Tuesday:

...

Tomorrow's Retail Sales data is capable of causing volatility in either direction, depending on the outcome. Then on Wednesday, we'll hear from the Fed. While they will not be cutting rates at this meeting, they will be updating their rate outlook--something that frequently gets the market's attention. [30 year fixed 6.91%]

emphasis added

• At 8:30 AM ET, Retail sales for May is scheduled to be released. The consensus is for a 0.5% decrease in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.7%.

• At 10:00 AM, The June NAHB homebuilder survey. The consensus is for a reading of 36, up from 34 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

3rd Look at Local Housing Markets in May

by Calculated Risk on 6/16/2025 10:49:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in May

A brief excerpt:

The NAR is scheduled to release May existing home sales on Monday, June 23rd at 10:00 AM. Housing economist Tom Lawler expects the NAR to report sales at a seasonally adjusted annual rate (SAAR) of 4.03 million for May, up slightly from April and down slightly year-over-year.There is much more in the article.

...

In May, sales in these markets were down 4.3% YoY. Last month, in April, these same markets were down 3.4% year-over-year Not Seasonally Adjusted (NSA).

Important: There were fewer working days in May 2025 (21) as in May 2024 (22). So, the year-over-year change in the headline SA data will be higher than for the NSA data.

...

More local markets to come!