by Calculated Risk on 11/18/2024 12:47:00 PM

Monday, November 18, 2024

3rd Look at Local Housing Markets in October; First Year-over-year Sales Gain Since August 2021

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in October

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to October 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the third look at local markets in October. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in October were mostly for contracts signed in August and September when 30-year mortgage rates averaged 6.50% and 6.18%, respectively (Freddie Mac PMMS). These were the lowest mortgage rate in 2 years!

...

Here is a look at months-of-supply using NSA sales. Note the regional differences, especially in Florida and Texas (although October statistics in Florida were impacted by Hurricane Milton). This pickup in inventory is impacting prices in Florida.

...

Many more local markets to come!

NAHB: Builder Confidence Increased in November

by Calculated Risk on 11/18/2024 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 46, up from 43 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB:

Builder Confidence Moves Higher as Election Uncertainty is Lifted

Builder sentiment improved for the third straight month and builders expect market conditions will continue to improve with Republicans winning control of the White House and Congress.

Builder confidence in the market for newly built single-family homes was 46 in November, up three points from October, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“With the elections now in the rearview mirror, builders are expressing increasing confidence that Republicans gaining all the levers of power in Washington will result in significant regulatory relief for the industry that will lead to the construction of more homes and apartments,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan. “This is reflected in a huge jump in builder sales expectations over the next six months.”

“While builder confidence is improving, the industry still faces many headwinds such as an ongoing shortage of labor and buildable lots along with elevated building material prices,” said NAHB Chief Economist Robert Dietz. “Moreover, while the stock market cheered the election result, the bond market has concerns, as indicated by a rise for long-term interest rates. There is also policy uncertainty in front of the business sector and housing market as the executive branch changes hands.”

The latest HMI survey also revealed that 31% of builders cut home prices in November. This share has remained essentially unchanged since July, hovering between 31% and 33%. Meanwhile, the average price reduction was 5%, slightly below the 6% rate posted in October. The use of sales incentives was 60% in November, slightly down from 62% in October.

...

All three HMI sub-indices were up in November. The index charting current sales conditions rose two points to 49, the component measuring sales expectations in the next six months increased seven points to 64 and the gauge charting traffic of prospective buyers posted a three-point gain to 32.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased four points to 55, the Midwest moved three points higher to 44, the South edged up one point to 42 and the West held steady at 41.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was above the consensus forecast.

Housing Nov 18th Weekly Update: Inventory Up 0.1% Week-over-week, Up 26.7% Year-over-year

by Calculated Risk on 11/18/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, November 17, 2024

Sunday Night Futures

by Calculated Risk on 11/17/2024 06:57:00 PM

Weekend:

• Schedule for Week of November 17, 2024

Monday:

• At 10:00 AM ET, The November NAHB homebuilder survey. The consensus is for a reading of 42, down from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 5 and DOW futures are down 39 (fair value).

Oil prices were down over the last week with WTI futures at $66.78 per barrel and Brent at $70.91 per barrel. A year ago, WTI was at $76, and Brent was at $81 - so WTI oil prices are down about 12% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.03 per gallon. A year ago, prices were at $3.29 per gallon, so gasoline prices are down $0.26 year-over-year.

Hotels: Occupancy Rate Decreased 3.5% Year-over-year

by Calculated Risk on 11/17/2024 08:57:00 AM

As projected for election week, the U.S. hotel industry reported negative year-over-year performance comparisons, according to CoStar’s latest data through 9 November. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

3-9 November 2024 (percentage change from comparable week in 2023):

• Occupancy: 62.6% (-3.5%)

• Average daily rate (ADR): US$156.11 (-0.1%)

• Revenue per available room (RevPAR): US$97.73 (-3.5%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Saturday, November 16, 2024

Real Estate Newsletter Articles this Week: Watch Months-of-Supply!

by Calculated Risk on 11/16/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Part 1: Current State of the Housing Market; Overview for mid-November 2024

• Part 2: Current State of the Housing Market; Overview for mid-November 2024

• NY Fed: Mortgage Originations by Credit Score, Delinquencies Increase, Foreclosures Remain Low

• 2nd Look at Local Housing Markets in October

• Watch Months-of-Supply!

• Lawler: Early Read on Existing Home Sales in October

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of November 17, 2024

by Calculated Risk on 11/16/2024 08:11:00 AM

The key economic reports this week are Housing Starts and Existing Home sales.

For manufacturing, the November Philly and Kansas City Fed surveys, will be released this week.

10:00 AM: The November NAHB homebuilder survey. The consensus is for a reading of 42, down from 44. Any number below 50 indicates that more builders view sales conditions as poor than good.

8:30 AM: Housing Starts for October.

8:30 AM: Housing Starts for October. This graph shows single and total housing starts since 1968.

The consensus is for 1.338 million SAAR, down from 1.354 million SAAR.

10:00 AM: State Employment and Unemployment (Monthly) for October 2024

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for October (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 222 thousand initial claims, up from 217 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for November. The consensus is for a reading of 5.0, down from 10.3.

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.88 million SAAR, up from 3.84 million in September.

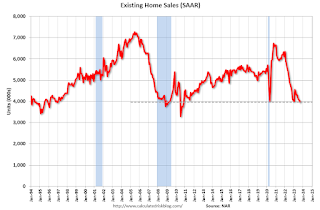

10:00 AM: Existing Home Sales for October from the National Association of Realtors (NAR). The consensus is for 3.88 million SAAR, up from 3.84 million in September.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for November.

10:00 AM: University of Michigan's Consumer sentiment index (Final for November).

Friday, November 15, 2024

November 15th COVID Update: COVID in Wastewater Continues to Decline

by Calculated Risk on 11/15/2024 07:46:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 675 | 783 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Lawler: Early Read on Existing Home Sales in October

by Calculated Risk on 11/15/2024 03:22:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Lawler: Early Read on Existing Home Sales in October

A brief excerpt:

From housing economist Tom Lawler:There is much more in the article.

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.97 million in October, up 3.4% from September’s preliminary pace and up 3.1% from last October’s seasonally adjusted pace. Unadjusted sales should show a moderately higher YOY % gain, reflecting this October’s higher business day count compared to last October’s.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 4.7% from a year earlier.

CR Note: The NAR is scheduled to release October Existing Home sales on Thursday, Nov 21st at 10:00 AM. The consensus is for 3.88 million SAAR, up from 3.84 million in September. Last year, the NAR reported sales in October 2023 at 3.85 million SAAR. This will be the first year-over-year gain since August 2021 following 37 months with a year-over-year decline.

Q4 GDP Tracking: Mid 2% Range

by Calculated Risk on 11/15/2024 02:40:00 PM

From BofA:

Next week, we will initiate our 4Q GDP tracker after the October retail sales print today and October industrial production, housing starts, existing home sales and September business inventories will impact our 3Q and 4Q tracking estimate. [Current forecast 2.0%, Nov 15th]From Goldman:

emphasis added

Following this morning’s retail sales and industrial production reports, we lowered our Q4 GDP tracking estimate by 0.1pp to +2.5% (quarter-over-quarter annualized) and left our Q4 domestic final sales forecast unchanged on a rounded basis at +2.0%. [Nov 15th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2024 is 2.5 percent on November 15, unchanged from November 7 after rounding. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Federal Reserve Board of Governors, an increase in the nowcast of fourth-quarter real personal consumption expenditures growth was offset by a decrease in the nowcast of fourth-quarter real gross private domestic investment growth. [Nov 15th estimate]

Part 2: Current State of the Housing Market; Overview for mid-November 2024

by Calculated Risk on 11/15/2024 11:40:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-November 2024

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-November 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

The Case-Shiller National Index increased 4.2% year-over-year in August and will likely slow further in the September report (based on other data).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.32% (a 4.0% annual rate), This was the nineteenth consecutive MoM increase in the seasonally adjusted index.

Industrial Production Decreased 0.3% in October

by Calculated Risk on 11/15/2024 09:15:00 AM

Earlier from the Fed: Industrial Production and Capacity Utilization

Industrial production (IP) decreased 0.3 percent in October after declining 0.5 percent in September. A strike at a major producer of civilian aircraft held down total IP growth by an estimated 0.3 percentage point in September and 0.2 percentage point in October. Hurricane Milton and the lingering effects of Hurricane Helene together reduced October IP growth 0.1 percentage point. In October, manufacturing output moved down 0.5 percent, the index for mining rose 0.3 percent, and the index for utilities gained 0.7 percent. At 102.3 percent of its 2017 average, total IP in October was 0.3 percent below its year-earlier level. Capacity utilization moved down to 77.1 percent in October, a rate that is 2.6 percentage points below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 77.1% is 2.6% below the average from 1972 to 2023. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 102.3. This is above the pre-pandemic level.

Industrial production was below consensus expectations.

Retail Sales Increased 0.4% in October

by Calculated Risk on 11/15/2024 08:30:00 AM

On a monthly basis, retail sales increased 0.4% from September to October (seasonally adjusted), and sales were up 2.8 percent from October 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for October 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $718.9 billion, an increase of 0.4 percent from the previous month, and up 2.8 percent from October 2023. ... The August 2024 to September 2024 percent change was revised from up 0.4 percen to up 0.8 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was up 0.4% in October.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.5% on a YoY basis.

The change in sales in October were above expectations, and sales in August and September were revised up, combined.

The change in sales in October were above expectations, and sales in August and September were revised up, combined.

Thursday, November 14, 2024

Friday: Retail Sales, Industrial Production

by Calculated Risk on 11/14/2024 07:40:00 PM

Friday:

• At 8:30 AM ET, Retail sales for October will be released. The consensus is for a 0.3% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 3.5, up from -11.9.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.2% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.3%.

Realtor.com Reports Active Inventory Up 26.1% YoY

by Calculated Risk on 11/14/2024 04:15:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For September, Realtor.com reported inventory was up 29.2% YoY, but still down 21.1% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending Nov. 9, 2024

• Active inventory increased, with for-sale homes 26.1% above year-ago levels

For the 53rd consecutive week, the number of listings for sale has grown year over year. This week’s growth was lower than last week’s, the seventh week of slowing growth, and the lowest annual change since late March. Slowing listing activity and stifled buyer demand have resulted in slowing inventory growth.

• New listings—a measure of sellers putting homes up for sale—climbed 1.7% this week compared with one year ago

The number of new listings on the market picked up compared with the same week last year. The recent upward trajectory of mortgage rates could largely discourage sellers from listing their homes as roughly 84% of outstanding mortgages have a rate of 6% or lower.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 53rd consecutive week.

Fed Chair Powell: No "signals that we need to be in a hurry to lower rates"

by Calculated Risk on 11/14/2024 03:00:00 PM

From Fed Chair Powell: Economic Outlook. Excerpt:

The recent performance of our economy has been remarkably good, by far the best of any major economy in the world. Economic output grew by more than 3 percent last year and is expanding at a stout 2.5 percent rate so far this year. ... The labor market remains in solid condition, having cooled off from the significantly overheated conditions of a couple of years ago, and is now by many metrics back to more normal levels that are consistent with our employment mandate.

...

We are moving policy over time to a more neutral setting. But the path for getting there is not preset. In considering additional adjustments to the target range for the federal funds rate, we will carefully assess incoming data, the evolving outlook, and the balance of risks. The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully. Ultimately, the path of the policy rate will depend on how the incoming data and the economic outlook evolve.

emphasis added

Part 1: Current State of the Housing Market; Overview for mid-November 2024

by Calculated Risk on 11/14/2024 11:18:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-November 2024

A brief excerpt:

This 2-part overview for mid-October provides a snapshot of the current housing market.There is much more in the article.

I always focus first on inventory, since inventory usually tells the tale! I’m watching months-of-supply closely.

...

New home inventory, as a percentage of total inventory, is still very high. The following graph uses Not Seasonally Adjusted (NSA) existing home inventory from the National Association of Realtors® (NAR) and new home inventory from the Census Bureau (only completed and under construction inventory).

It took a number of years following the housing bust for new home inventory to return to the pre-bubble percent of total inventory. Then, with the pandemic, existing home inventory collapsed and now the percent of new homes is 20.8% of the total for sale inventory, down from a peak of 27.2% in December 2022.

The percent of new homes of total inventory should continue to decline as existing home inventory increases. However, the percent of new home inventory will increase seasonally over the Winter as existing homes are withdrawn from the market.

Weekly Initial Unemployment Claims Decrease to 217,000

by Calculated Risk on 11/14/2024 08:30:00 AM

The DOL reported:

In the week ending November 9, the advance figure for seasonally adjusted initial claims was 217,000, a decrease of 4,000 from the previous week's unrevised level of 221,000. The 4-week moving average was 221,000, a decrease of 6,250 from the previous week's unrevised average of 227,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 221,000.

The previous week was unrevised.

Weekly claims were below the consensus forecast.

Wednesday, November 13, 2024

Thursday: Unemployment Claims, PPI, Fed Chair Powell

by Calculated Risk on 11/13/2024 07:24:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 255 thousand initial claims, up from 221 thousand last week.

• Also at 8:30 AM, The Producer Price Index for October from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.2% increase in core PPI.

• At 3:00 PM, Speech, Fed Chair Jerome Powell, Economic Outlook, At Conversation with Federal Reserve Chair Jerome Powell, Dallas, Texas

Cleveland Fed: Median CPI increased 0.3% and Trimmed-mean CPI increased 0.3% in October

by Calculated Risk on 11/13/2024 03:11:00 PM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in October. The 16% trimmed-mean Consumer Price Index increased 0.3%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details. Used cares increased at a 38% annual rate in October.