by Calculated Risk on 9/24/2024 01:12:00 PM

Tuesday, September 24, 2024

A few comments on the Seasonal Pattern for House Prices

Two key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through March 2024). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the pandemic price surge changed the month-over-month pattern.

The swings in the seasonal factors were decreasing following the bust but have increased again recently - this time without a surge in distressed sales.

Case-Shiller: National House Price Index Up 5.0% year-over-year in July; Over last 3 months, FHFA Index has increased at a 0.7% Annual Rate

by Calculated Risk on 9/24/2024 09:58:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Case-Shiller: National House Price Index Up 5.0% year-over-year in July

Excerpt:

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3-month average of May, June and July closing prices). July closing prices include some contracts signed in March, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

For the second consecutive month, the MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.18% (a 2.2% annual rate), This was the eighteenth consecutive MoM increase, but this tied the previous as the smallest MoM increase in the last 18 months.

On a seasonally adjusted basis, prices increased month-to-month in 18 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 7.1% from the recent peak, Phoenix is down 4.2% from the peak, Portland down 3.1%, and Seattle and Denver are both down 2.9%.

Case-Shiller: National House Price Index Up 5.0% year-over-year in July

by Calculated Risk on 9/24/2024 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3-month average of May, June and July closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P S&P CoreLogic Case-Shiller Index All-Time Highs Continue in July 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.0% annual gain for July, down from a 5.5% annual gain in the previous month. The 10-City Composite saw an annual increase of 6.8%, down from a 7.4% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 5.9%, dropping from a 6.5% increase in the previous month. New York again reported the highest annual gain among the 20 cities with an 8.8% increase in July, followed by Las Vegas and Los Angeles with annual increases of 8.2% and 7.2%, respectively. Portland held the lowest rank for the smallest year-over-year growth, notching the same 0.8% annual increase in July as last month.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends continued to decelerate from last month, with pre-seasonality adjustment increases of 0.1% for the national index, and both the 20-City and 10-City Composites remained unchanged on the month.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.2%, while both the 20-City and 10-City Composite reported a monthly rise of 0.3%.

“Accounting for seasonality of home purchases, we have witnessed 14 consecutive record highs in our National Index,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets. “While the S&P 500 has achieved 39 record highs and the S&P GSCI Gold TR hit 35 record highs, housing is following a similar trajectory. The growth has come at a cost, with all but two markets decelerating last month, eight markets seeing monthly declines, and the slowest annual growth nationally in 2024. Overall, the indices continue to grow at a rate that exceeds long-run averages after accounting for inflation.

“We continue to observe outperformance in most low-price tiers in the market on a three- and five-year horizon,” Luke continued. “The low-price tier of Tampa was the best performing market nationally with five-year performance of 88%. The New York market was the best market annually, posting a gain of 8.9%. New York’s low-tier index, which include home values up to $533,000, helped drive that growth with 10.8% annual gains. Over five years, markets such as New York and Atlanta saw low-price-tiered indices outperforming their market by as much as 20% and 18%, respectively. The relative outperformance of low-price-tiered indices has both benefited first-time homebuyers as well as made it more difficult for those looking for a starter home. The opposite is happening in California, which has the most expensive high-price tiers in the nation, all well over $1 million. The rich are getting richer in San Diego, Los Angeles, and San Francisco where their high-price-tiered indices outperformed on a one- and three-year basis. ”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.3% in July (SA). The Composite 20 index was up 0.3% (SA) in July.

The National index was up 0.2% (SA) in July.

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA was up 6.8% year-over-year. The Composite 20 SA was up 5.9% year-over-year.

The National index SA was up 5.0% year-over-year.

Annual price changes were close to expectations. I'll have more later.

Monday, September 23, 2024

Tuesday: Case-Shiller House Prices, Richmond Fed Mfg

by Calculated Risk on 9/23/2024 06:59:00 PM

Mortgage rates rose modestly last week after hitting long term lows before the Fed announced its 0.50% rate cut. In not so many words, mortgage rates had already gotten in position for that cut and were thus left to undergo a mild correction. [30 year fixed 6.20%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for July. The consensus is for a 5.9% year-over-year increase in the Composite 20 index for July.

• At 9:00 AM, FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, the Richmond Fed manufacturing survey for September.

MBA Survey: Share of Mortgage Loans in Forbearance Increases to 0.31% in August

by Calculated Risk on 9/23/2024 04:10:00 PM

From the MBA: Share of Mortgage Loans in Forbearance Increases to 0.31% in August

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance increased to 0.31% as of August 31, 2024. According to MBA’s estimate, 155,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 8.2 million borrowers since March 2020.At the end of August, there were about 155,000 homeowners in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance increased 1 basis point to 0.13% in August 2024. Ginnie Mae loans in forbearance increased by 10 basis points to 0.66%, and the forbearance share for portfolio loans and private-label securities (PLS) increased 2 basis points to 0.35%.

“For the third consecutive month, the percentage of loans in forbearance increased across all loan types,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “By investor type, Ginnie Mae loans in forbearance have increased the most – up 27 basis points since May 2024.”

Added Walsh, “Forbearance levels are much lower than they were during the first two years of the pandemic. However, a weakening in the performance of servicing portfolios and an increase in forbearance requests are both likely given the softening observed in the labor market.”

emphasis added

LA Ports: Inbound Traffic Increased Sharply Year-over-year in August

by Calculated Risk on 9/23/2024 02:05:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic increased 2.2% in August compared to the rolling 12 months ending in July. Outbound traffic increased 0.3% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year. Watch Months-of-Supply!

by Calculated Risk on 9/23/2024 11:01:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Watch Months-of-Supply!

A brief excerpt:

Both inventory and sales are well below pre-pandemic levels, and I think we need to keep an eye on months-of-supply to forecast price changes. Historically nominal prices declined when months-of-supply approached 6 months - and that is unlikely any time soon - however, as expected, months-of-supply is back to 2019 levels.There is much more in the article.

Months-of-supply was at 4.2 months in August compared to 4.0 months in August 2019. Even though inventory has declined significantly compared to 2019, sales have fallen even more - pushing up months-of-supply.

The following graph shows months-of-supply since 2017. Note that months-of-supply is higher than the last 3 years (2021 - 2023), and above August 2019. Months-of-supply was at 4.2 in August 2017 and 4.3 in August 2018. In 2020 (black), months-of-supply increased at the beginning of the pandemic and then declined sharply.

...

What would it take to get months-of-supply above 5 months? If sales stay depressed at 2023 and 2024 levels, how much would inventory have to increase to put months-of-supply at 5 months by, say, June 2024?

Housing Sept 23rd Weekly Update: Inventory up 1.6% Week-over-week, Up 37.2% Year-over-year

by Calculated Risk on 9/23/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, September 22, 2024

Sunday Night Futures

by Calculated Risk on 9/22/2024 07:55:00 PM

Weekend:

• Schedule for Week of September 22, 2024

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are mostly unchanged (fair value).

Oil prices were up over the last week with WTI futures at $71.01 per barrel and Brent at $74.50 per barrel. A year ago, WTI was at $90, and Brent was at $94 - so WTI oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.16 per gallon. A year ago, prices were at $3.84 per gallon, so gasoline prices are down $0.68 year-over-year.

The Top Ten Job Streaks: Current Streak is in 5th Place

by Calculated Risk on 9/22/2024 08:22:00 AM

For fun:

| Headline Jobs, Top 10 Streaks | ||

|---|---|---|

| Year Ended | Streak, Months | |

| 1 | 2019 | 100 |

| 2 | 1990 | 48 |

| 3 | 2007 | 46 |

| 4 | 1979 | 45 |

| 5 | 20241 | 44 |

| 6 tie | 1943 | 33 |

| 6 tie | 1986 | 33 |

| 6 tie | 2000 | 33 |

| 9 | 1967 | 29 |

| 10 | 1995 | 25 |

| 1Currrent Streak | ||

Saturday, September 21, 2024

Real Estate Newsletter Articles this Week: Existing-Home Sales Decreased to 3.86 million SAAR in August

by Calculated Risk on 9/21/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August

• Housing Starts Increased to 1.356 million Annual Rate in August

• Part 2: Current State of the Housing Market; Overview for mid-September 2024

• Q2 Update: Delinquencies, Foreclosures and REO

• Lawler: Early Read on Existing Home Sales in August

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of September 22, 2024

by Calculated Risk on 9/21/2024 08:11:00 AM

The key reports this week are August New Home sales, the third estimate of Q2 GDP, Personal Income and Outlays for August, and Case-Shiller house prices for July.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

9:00 AM: S&P/Case-Shiller House Price Index for July.

9:00 AM: S&P/Case-Shiller House Price Index for July.This graph shows the year-over-year change in the seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 5.9% year-over-year increase in the Composite 20 index for July.

9:00 AM: FHFA House Price Index for July. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: the Richmond Fed manufacturing survey for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 700 thousand SAAR, down from 739 thousand in July.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, up from 219 thousand last week.

8:30 AM: Gross Domestic Product, 2nd Quarter 2024 (Third Estimate), and Corporate Profits (Revised) The consensus is that real GDP increased 3.0% annualized in Q2, unchanged from the second estimate of 3.0%.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.8% decrease in durable goods orders.

9:20 AM: Speech, Fed Chair Jerome Powell, Opening Remarks (via pre-recorded video), At the 2024 U.S. Treasury Market Conference, Federal Reserve Bank of New York, New York, N.Y.

10:00 AM: Pending Home Sales Index for August. The consensus is 3.1% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for September.

8:30 AM: Personal Income and Outlays, August 2024. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.2%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 67.7.

Friday, September 20, 2024

September 20th COVID Update: Wastewater Measure Declining

by Calculated Risk on 9/20/2024 06:44:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week🚩 | 1,139 | 1,022 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q3 GDP Tracking: Close to 3%

by Calculated Risk on 9/20/2024 11:26:00 AM

From Goldman:

We left our Q3 GDP tracking estimate unchanged at +3.0% (quarter-over-quarter annualized) and our domestic final sales forecast unchanged at +2.9%.And from the Atlanta Fed: GDPNow

emphasis added [Sept 19th estimate]

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2024 is 2.9 percent on September 18, down from 3.0 percent on September 17. [Sept 18th estimate]

Hotels: Occupancy Rate Decreased 1.7% Year-over-year

by Calculated Risk on 9/20/2024 09:01:00 AM

The U.S. hotel industry reported mostly negative year-over-year comparisons, according to CoStar’s latest data through 14 September. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

8-14 September 2024 (percentage change from comparable week in 2023):

• Occupancy: 66.6% (-1.7%)

• Average daily rate (ADR): US$162.05 (+0.2%)

• Revenue per available room (RevPAR): US$107.86 (-1.4%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Thursday, September 19, 2024

Friday: Misc

by Calculated Risk on 9/19/2024 07:15:00 PM

Friday:

• At 10:00 AM ET, State Employment and Unemployment (Monthly) for August 2024

Realtor.com Reports Active Inventory Up 33.0% YoY

by Calculated Risk on 9/19/2024 02:48:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For August, Realtor.com reported inventory was up 5.8% YoY, but still down 26.4% compared to the 2017 to 2019 same month levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending Sept. 14, 2024

• Active inventory increased, with for-sale homes 33.0% above year-ago levels

For the 45th consecutive week dating to November 2023, the number of listings for sale has grown year over year, and this week continues a string of growth rates in the mid-30% range that started in April. This is a slight decrease from last week’s gain of 33.4%. As we discussed above and below, it’s important to note that much of the increase in inventory is due to listings accumulating on a slow market rather than a surge in new listings.

• New listings—a measure of sellers putting homes up for sale—ticked up by 6.6% from one year ago

As the recent easing of mortgage rates kept encouraging many sellers to return to the market, the year-over-year growth in new listings continued this week. With mortgage rates nearly 1 percentage point lower than last year and the announcement of a rate cut, we expect sellers’ motivation to sell could continue to rise this fall. In addition, as rates are likely to be even lower in 2025, a larger increase in listing activity is expected next spring.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 45th consecutive week.

NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August; Median House Prices Increased 3.1% Year-over-Year

by Calculated Risk on 9/19/2024 11:15:00 AM

Today, in the CalculatedRisk Real Estate Newsletter: NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August

Excerpt:

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2023 and 2024.

Sales declined 4.2% year-over-year compared to August 2023. This was the thirty-sixth consecutive month with sales down year-over-year.

NAR: Existing-Home Sales Decreased to 3.86 million SAAR in August

by Calculated Risk on 9/19/2024 10:00:00 AM

From the NAR: Existing-Home Sales Declined 2.5% in August

In August 2024, existing-home sales fell in the South, West, and Northeast, while the Midwest registered no change. Year-over-year, sales slipped in three regions but remained stable in the Northeast.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1994.

Sales in August (3.86 million SAAR) were down 2.5% from the previous month and were 4.2% below the August 2023 sales rate.

According to the NAR, inventory increased to 1.35 million in August from 1.34 million the previous month.

According to the NAR, inventory increased to 1.35 million in August from 1.34 million the previous month.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 22.7% year-over-year (blue) in August compared to August 2023.

Inventory was up 22.7% year-over-year (blue) in August compared to August 2023. Months of supply (red) increased to 4.2 months in August from 4.1 months the previous month.

The sales rate was at the consensus forecast. I'll have more later.

Weekly Initial Unemployment Claims Decrease to 219,000

by Calculated Risk on 9/19/2024 08:30:00 AM

The DOL reported:

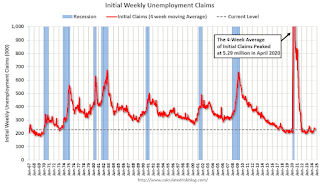

In the week ending September 14, the advance figure for seasonally adjusted initial claims was 219,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 230,000 to 231,000. The 4-week moving average was 227,500, a decrease of 3,500 from the previous week's revised average. The previous week's average was revised up by 250 from 230,750 to 231,000.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 230,750.

The previous week was revised up.

Weekly claims were below the consensus forecast.