by Calculated Risk on 6/18/2024 09:15:00 AM

Tuesday, June 18, 2024

Industrial Production Increased 0.9% in May

From the Fed: Industrial Production and Capacity Utilization

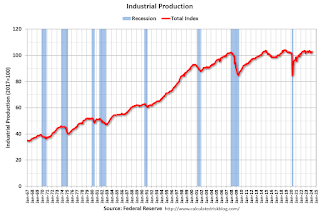

Industrial production rose 0.9 percent in May. Manufacturing output posted a similar gain of 0.9 percent after declining in the previous two months. The index for mining increased 0.3 percent in May, and the index for utilities advanced 1.6 percent. At 103.3 percent of its 2017 average, total industrial production in May was 0.4 percent higher than its year-earlier level. Capacity utilization moved up to 78.7 percent in May, a rate that is 0.9 percentage point below its long-run (1972–2023) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and above the level in February 2020 (pre-pandemic).

Capacity utilization at 78.7% is 0.9% below the average from 1972 to 2022. This was above consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased to 103.3. This is above the pre-pandemic level.

Industrial production was above consensus expectations.

Retail Sales Increased 0.1% in May

by Calculated Risk on 6/18/2024 08:30:00 AM

On a monthly basis, retail sales were "virtually unchanged" from March to April (seasonally adjusted), and sales were up 3.0 percent from April 2023.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2024, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $703.1 billion, up 0.1 percent from the previous month, and up 2.3 percent above May 2023. ... The March 2024 to April 2024 percent change was revised from virtually unchanged to down 0.2 percent.

emphasis added

Click on graph for larger image.

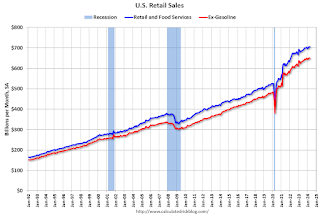

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.3% in May.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 2.6% on a YoY basis.

The change in sales in May was below expectations, and sales in March and April were revised down.

The change in sales in May was below expectations, and sales in March and April were revised down.

Monday, June 17, 2024

Tuesday: Retail Sales, Industrial Production

by Calculated Risk on 6/17/2024 07:00:00 PM

Mortgage rates moved modestly higher to start the new week. With the average top tier 30yr fixed rate just under 7% on Friday, this meant a move to just over 7% today. [30 year fixed 7.05%]Tuesday:

emphasis added

• At 8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

• At 9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.6%.

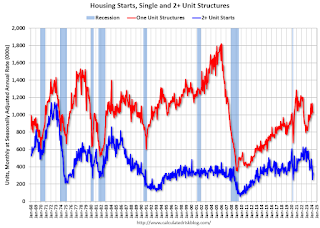

Comparing the Current Housing Market to the 1978 to 1982 period

by Calculated Risk on 6/17/2024 02:15:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Comparing the Current Housing Market to the 1978 to 1982 period

A brief excerpt:

In March 2022, I wrote: Housing: Don't Compare the Current Housing Boom to the Bubble and BustThere is much more in the article.It is natural to compare the current housing boom to the mid-00s housing bubble. The bubble and subsequent bust are part of our collective memories. And graphs of nominal house prices and price-to-rent ratios look eerily similar to the housing bubble.

However, there are significant differences. First, lending has been reasonably solid during the current boom, whereas in the mid-00s, underwriting standards were almost non-existent (“fog a mirror, get a loan”). And demographics are much more favorable today than in the mid-00s.And I suggested we compare the current situation to the 1978 to 1982 period, and I discussed a few similarities between the periods (no comparison is perfect):

1. Demographics were similar

2. House prices increased rapidly.

3. Inflation picked up

4. The Fed raised rates to bring down inflation.

5. House payments increased sharply

Here is a review and a discussion of what this means for house prices.

LA Port Traffic Decreased Year-over-year in May

by Calculated Risk on 6/17/2024 10:57:00 AM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 0.4% in May compared to the rolling 12 months ending in April. Outbound traffic decreased 0.1% compared to the rolling 12 months ending the previous month.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year. Housing June 17th Weekly Update: Inventory up 1.5% Week-over-week, Up 37.3% Year-over-year

by Calculated Risk on 6/17/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 16, 2024

Sunday Night Futures

by Calculated Risk on 6/16/2024 09:07:00 PM

Weekend:

• Schedule for Week of June 16, 2024

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -13.0, up from -15.6.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are little changed (fair value).

Oil prices were up over the last week with WTI futures at $78.45 per barrel and Brent at $82.62 per barrel. A year ago, WTI was at $72, and Brent was at $77 - so WTI oil prices are up about 8% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.43 per gallon. A year ago, prices were at $3.55 per gallon, so gasoline prices are down $0.12 year-over-year.

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 6/16/2024 08:21:00 AM

Note: I've received a number of requests lately to post this again, so here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter, George H.W. Bush and Trump only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession. And there was a pandemic related recession in 2020.

First, here is a table for private sector jobs. The previous top two private sector terms were both under President Clinton.

| Term | Private Sector Jobs Added (000s) |

|---|---|

| Biden | 14,096 |

| Clinton 1 | 10,876 |

| Clinton 2 | 10,094 |

| Obama 2 | 9,926 |

| Reagan 2 | 9,351 |

| Carter | 9,039 |

| Reagan 1 | 5,363 |

| Obama 1 | 1,907 |

| GHW Bush | 1,507 |

| GW Bush 2 | 443 |

| GW Bush 1 | -820 |

| Trump | -2,192 |

| 1After 40 months. | |

Click on graph for larger image.

Click on graph for larger image.The first graph is for private employment only.

Private sector employment increased by 9,039,000 under President Carter (dashed green), by 14,714,000 under President Reagan (dark red), 1,507,000 under President G.H.W. Bush (light purple), 20,970,000 under President Clinton (light blue), lost 377,000 under President G.W. Bush, and gained 11,833,000 under President Obama (dark dashed blue). During Trump's term (Orange), the economy lost 2,135,000 private sector jobs.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020.

A big difference between the presidencies has been public sector employment. Note: the bumps in public sector employment due to the decennial Census in 1980, 1990, 2000, 2010 and 2020. The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However, the public sector declined significantly while Mr. Obama was in office (down 263,000 jobs). During Trump's term, the economy lost 528,000 public sector jobs.

| Term | Public Sector Jobs Added (000s) |

|---|---|

| Biden | 1,5311 |

| Reagan 2 | 1,438 |

| Carter | 1,304 |

| Clinton 2 | 1,242 |

| GHW Bush | 1,127 |

| GW Bush 1 | 900 |

| GW Bush 2 | 844 |

| Clinton 1 | 692 |

| Obama 2 | 447 |

| Reagan 1 | -24 |

| Trump | -528 |

| Obama 1 | -710 |

| 1After 40 months. | |

Saturday, June 15, 2024

Real Estate Newsletter Articles this Week: Low Level of Delinquencies and Foreclosures

by Calculated Risk on 6/15/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Q1 Update: Delinquencies, Foreclosures and REO

• Part 1: Current State of the Housing Market; Overview for mid-June 2024

• Part 2: Current State of the Housing Market; Overview for mid-June 2024

• 3rd Look at Local Housing Markets in May

• 2nd Look at Local Housing Markets in May

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 16, 2024

by Calculated Risk on 6/15/2024 08:11:00 AM

The key reports this week are May Retail Sales, Housing Starts and Existing Home Sales.

For manufacturing, Industrial Production, and the NY and Philly Fed manufacturing surveys, will be released this week.

8:30 AM: The New York Fed Empire State manufacturing survey for June. The consensus is for a reading of -13.0, up from -15.6.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM: Retail sales for May is scheduled to be released. The consensus is for a 0.3% increase in retail sales.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for May.This graph shows industrial production since 1967.

The consensus is for a 0.2% increase in Industrial Production, and for Capacity Utilization to increase to 78.6%.

All US markets will be closed in observance of Juneteenth National Independence Day

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: The June NAHB homebuilder survey. The consensus is for a reading of 46, up from 45 last month. Any number above 50 indicates that more builders view sales conditions as poor than good.

8:30 AM ET: Housing Starts for May.

8:30 AM ET: Housing Starts for May. This graph shows single and total housing starts since 1968.

The consensus is for 1.380 million SAAR, up from 1.360 million SAAR in April.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 242 thousand last week.

8:30 AM: the Philly Fed manufacturing survey for June. The consensus is for a reading of 4.5, unchanged from 4.5 last month.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.14 million.

10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 4.10 million SAAR, down from 4.14 million.The graph shows existing home sales from 1994 through the report last month.

Friday, June 14, 2024

June 14th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 6/14/2024 07:23:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week✅ | 311 | 314 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Q2 GDP Tracking: 1.8% to 3.1%

by Calculated Risk on 6/14/2024 02:01:00 PM

From BofA:

Since last week,1Q GDP tracking is down from 1.6% q/q saar to 1.5% q/q saar and 2Q GDP tracking is up two-tenths to 1.8%. [June 14th estimate]From Goldman:

emphasis added

Our 2024Q2 GDP growth tracking estimate is now down to 2.1% (vs. the Atlanta Fed at 3.1%) and our 2024 Q4/Q4 GDP growth forecast is now down to 2% but still above consensus. [June 10th estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2024 is 3.1 percent on June 7, up from 2.6 percent on June 6. [June 7th estimate]

3rd Look at Local Housing Markets in May

by Calculated Risk on 6/14/2024 09:46:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in May

A brief excerpt:

The National Association of Realtors (NAR) is scheduled to release May Existing Home Sales on Friday June 21st at 10 AM ET. The early consensus is for 4.10 million SAAR, down from 4.14 million in April, and down from 4.23 million in May 2023.There is much more in the article.

...

In May, sales in these markets were down 0.6% YoY. Last month, in April, these same markets were up 7.6% year-over-year Not Seasonally Adjusted (NSA). However, there were two more working days in April 2024 than in April 2023, so seasonally adjusted, sales were down YoY last month.

Sales in all of these markets are down compared to May 2019.

...

This is a small year-over-year decrease NSA for these markets. There were the same number of working days in May 2024 compared to May 2023, so the year-over-year change in the seasonally adjusted sales will be about the same as the NSA data suggests.

...

Many more local markets to come!

Hotels: Occupancy Rate Decreased 0.1% Year-over-year

by Calculated Risk on 6/14/2024 08:11:00 AM

The U.S. hotel industry reported higher performance results from the previous week but mixed comparisons year over year, according to CoStar’s latest data through 8 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

2-8 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 69.1% (-0.1%)

• Average daily rate (ADR): US$160.90 (+1.8%)

• Revenue per available room (RevPAR): US$111.26 (+1.7%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Thursday, June 13, 2024

Realtor.com Reports Active Inventory Up 36.0% YoY

by Calculated Risk on 6/13/2024 05:55:00 PM

What this means: On a weekly basis, Realtor.com reports the year-over-year change in active inventory and new listings. On a monthly basis, they report total inventory. For April, Realtor.com reported inventory was up 35.2% YoY, but still down almost 34% compared to April 2017 to 2019 levels.

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report: Weekly Housing Trends View—Data for Week Ending June 8, 2024

• Active inventory increased, with for-sale homes 36.0% above year-ago levels

For the 31st straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options. This past week, the inventory of homes for sale grew by 36.0% compared with last year. This growth in inventory is primarily driven by housing markets in the South, which saw a 47.2% year-over-year increase in inventory in May.

• New listings—a measure of sellers putting homes up for sale—were up this week, by 8.0% from one year ago

Seller activity continued to climb annually last week, accelerating compared to the previous two weeks’ growth. With recent mortgage rates fluctuating around 7%, potential sellers are closely monitoring these changes and adjusting their listing decisions accordingly.

Here is a graph of the year-over-year change in inventory according to realtor.com.

Here is a graph of the year-over-year change in inventory according to realtor.com. Inventory was up year-over-year for the 31st consecutive week.

A Very Early Look at 2025 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 6/13/2024 02:01:00 PM

The BLS reported yesterday:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.3 percent over the last 12 months to an index level of 308.163 (1982-84=100). For the month, the index increased 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U and is not seasonally adjusted (NSA).

• In 2023, the Q3 average of CPI-W was 301.236.

The 2023 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled is for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 3.3% year-over-year in May, and although this is very early - we need the data for July, August and September - my very early guess is COLA will probably be between 2.5% and 3.0% this year, the smallest increase since 1.3% in 2021.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one-year lag. The National Average Wage Index is not available for 2023 yet, although we know wages increased solidly in 2023. If wages increased 5% in 2023, then the contribution base next year will increase to around $177,000 in 2025, from the current $168,600.

Remember - this is a very early look. What matters is average CPI-W, NSA, for all three months in Q3 (July, August and September).

Part 2: Current State of the Housing Market; Overview for mid-June 2024

by Calculated Risk on 6/13/2024 10:49:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Part 2: Current State of the Housing Market; Overview for mid-June 2024

A brief excerpt:

Yesterday, in Part 1: Current State of the Housing Market; Overview for mid-June 2024 I reviewed home inventory, housing starts and sales.There is much more in the article.

In Part 2, I will look at house prices, mortgage rates, rents and more.

...

Other measures of house prices suggest prices will be up about the same YoY in the April Case-Shiller index. The NAR reported median prices were up 5.7% YoY in April, up from 4.7% YoY in March. ICE reported prices were “cooling”, but still up 5.1% YoY in April, down from 5.7% YoY in March, and Freddie Mac reported house prices were up 6.5% YoY in April, down from 6.6% YoY in March.

Here is a comparison of year-over-year change in the FMHPI, median house prices from the NAR, and the Case-Shiller National index.

The FMHPI and the NAR median prices appear to be leading indicators for Case-Shiller. Based on recent monthly data, and the FMHPI, the YoY change in the Case-Shiller index will likely be about the same YoY in April as in March.

Weekly Initial Unemployment Claims Increase to 242,000

by Calculated Risk on 6/13/2024 08:30:00 AM

The DOL reported:

In the week ending June 8, the advance figure for seasonally adjusted initial claims was 242,000, an increase of 13,000 from the previous week's unrevised level of 229,000. The 4-week moving average was 227,000, an increase of 4,750 from the previous week's unrevised average of 222,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 227,000.

The previous week was unrevised.

Weekly claims were much higher than the consensus forecast.

Wednesday, June 12, 2024

Thursday: Unemployment Claims, PPI

by Calculated Risk on 6/12/2024 07:56:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 229 thousand last week.

• Also at 8:30 AM, The Producer Price Index for May from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

FOMC Statement and Projections: No Change to Fed Funds Rate

by Calculated Risk on 6/12/2024 03:51:00 PM

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee's 2 percent inflation objective.Here are the projections. Since the last projections were released, the economy has performed close to FOMC expectations.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 1.9 to 2.3 | 1.8 to 2.2 | 1.8 to 2.1 | |

| Mar 2024 | 2.0 to 2.4 | 1.9 to 2.3 | 1.8 to 2.1 | |

The unemployment rate was at 4.0% in April and the projections for Q4 2024 were revised up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 3.9 to 4.2 | 3.9 to 4.3 | 3.9 to 4.3 | |

| Mar 2024 | 3.9 to 4.1 | 3.9 to 4.2 | 3.9 to 4.3 | |

As of April 2024, PCE inflation increased 2.7 percent year-over-year (YoY). The projections for PCE inflation were revised up.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.5 to 2.9 | 2.2 to 2.4 | 2.0 to 2.1 | |

| Mar 2024 | 2.3 to 2.7 | 2.1 to 2.2 | 2.0 to 2.1 | |

PCE core inflation increased 2.8 percent YoY in April. The projections for core PCE inflation were revised up.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| June 2024 | 2.8 to 3.0 | 2.3 to 2.4 | 2.0 to 2.1 | |

| Mar 2024 | 2.5 to 2.8 | 2.1 to 2.3 | 2.0 to 2.1 | |