by Calculated Risk on 6/12/2024 12:16:00 PM

Wednesday, June 12, 2024

Part 1: Current State of the Housing Market; Overview for mid-June 2024

Today, in the Calculated Risk Real Estate Newsletter: Part 1: Current State of the Housing Market; Overview for mid-June 2024

A brief excerpt:

This 2-part overview for mid-May provides a snapshot of the current housing market.There is much more in the article.

I always like to start with inventory, since inventory usually tells the tale!

...

Here is a graph of new listing from Realtor.com’s May 2024 Monthly Housing Market Trends Report showing new listings were up 6.2% year-over-year in May. New listings are still well below pre-pandemic levels. From Realtor.com:

However, sellers continued to list their homes in higher numbers this May as newly listed homes were 6.2% above last year’s levels. While a notable deceleration from last month’s 12.2% growth rate, it marks the seventh month of increasing listing activity after a 17-month streak of decline.Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but still below normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be above 7%.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Cleveland Fed: Median CPI increased 0.2% and Trimmed-mean CPI increased 0.1% in May

by Calculated Risk on 6/12/2024 11:30:00 AM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% in May. The 16% trimmed-mean Consumer Price Index increased 0.1%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

Note: The Cleveland Fed released the median CPI details.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 6/12/2024 08:50:00 AM

Here are a few measures of inflation:

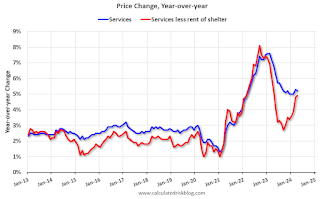

The first graph is the one Fed Chair Powell had mentioned when services less rent of shelter was up around 8% year-over-year. This declined, but has turned up recently, and is now up 5.0% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through May 2024.

Services less rent of shelter was up 5.0% YoY in May, up from 4.9% YoY in April.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were at -1.7% YoY in May, down from -1.2% YoY in April.

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April)

Here is a graph of the year-over-year change in shelter from the CPI report (through May) and housing from the PCE report (through April)Shelter was up 5.4% year-over-year in May, down from 5.5% in April. Housing (PCE) was up 5.6% YoY in April, down slightly from 5.8% in March.

Core CPI ex-shelter was up 1.9% YoY in May, down from 2.1% in April.

BLS: CPI Unchanged in May; Core CPI increased 0.2%

by Calculated Risk on 6/12/2024 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in May on a seasonally adjusted basis, after rising 0.3 percent in April, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.3 percent before seasonal adjustment.The change in both CPI and core CPI were below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

More than offsetting a decline in gasoline, the index for shelter rose in May, up 0.4 percent for the fourth consecutive month. The index for food increased 0.1 percent in May. The food away from home index rose 0.4 percent over the month, while the food at home index was unchanged. The energy index fell 2.0 percent over the month, led by a 3.6-percent decrease in the gasoline index.

The index for all items less food and energy rose 0.2 percent in May, after rising 0.3 percent the preceding month. Indexes which increased in May include shelter, medical care, used cars and trucks, and education. The indexes for airline fares, new vehicles, communication, recreation, and apparel were among those that decreased over the month.

The all items index rose 3.3 percent for the 12 months ending May, a smaller increase than the 3.4-percent increase for the 12 months ending April. The all items less food and energy index rose 3.4 percent over the last 12 months. The energy index increased 3.7 percent for the 12 months ending May. The food index increased 2.1 percent over the last year.

emphasis added

MBA: Mortgage Applications Increased in Weekly Survey

by Calculated Risk on 6/12/2024 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 15.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey for the week ending June 7, 2024.

The Market Composite Index, a measure of mortgage loan application volume, increased 15.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 26 percent compared with the previous week. The Refinance Index increased 28 percent from the previous week and was 28 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index increased 19 percent compared with the previous week and was 12 percent lower than the same week one year ago.

“Mortgage rates were trending lower over the course of last week until a stronger than anticipated employment report resulted in a bounce back, with the weekly average for the 30- year fixed mortgage rate decreasing to 7.02 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Lower rates earlier in the week meant a strong increase in refinance activity, particularly for VA borrowers, who jumped on the chance to lower their rates. Overall refinance activity was more than 27 percent above one year ago.”

Added Fratantoni, “On a seasonally adjusted basis and compared to the holiday-adjusted level from the prior week, purchase activity also increased. Multiple data sources are now indicating that home inventory levels, while still historically low, are up significantly from last year at this time. This is good news for many prospective homebuyers who have been frustrated by the lack of homes on the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased to 7.02 percent from 7.07 percent, with points unchanged at 0.65 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is down 12% year-over-year unadjusted.

Tuesday, June 11, 2024

Wednesday: CPI, FOMC Statement

by Calculated Risk on 6/11/2024 07:11:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for May from the BLS. The consensus is for 0.2% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.5% YoY).

• At 2:00 PM, FOMC Statement. The FOMC is expected to leave the Fed Funds rate unchanged at this meeting.

• Also at 2:00 PM, FOMC Projections This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

CPI Previews

by Calculated Risk on 6/11/2024 02:15:00 PM

The key economic report this week is May CPI to be released tomorrow. The consensus is for 0.2% increase in CPI (up 3.4% YoY unchanged from April), and a 0.3% increase in core CPI (up 3.5% YoY, down from 3.6% YoY in April).

From BofA:

After averaging 0.4% m/m in January through March, inflation took a small step in the right direction in April with core Consumer Price Inflation (CPI) and Personal Consumption Expenditure Inflation (PCE) both decelerating to 0.3% m/m (core PCE inflation was 0.26% rounded to two decimals).From Goldman:

We think May follows suit and our forecast is for core and headline CPI inflation rising by 0.3% (0.30% to two decimals) and 0.1% m/m. This would leave core and headline up 3.6% and 3.4% y/y, respectively, both unchanged from April levels.

We expect a 0.25% increase in May core CPI (vs. 0.3% consensus), corresponding to a year-over-year rate of 3.50% (vs. 3.5% consensus). We expect a 0.11% increase in May headline CPI (vs. 0.1% consensus), which corresponds to a year-over-year rate of 3.36% (vs. 3.4% consensus). Our forecast is consistent with a 0.20% increase in CPI core services excluding rent and owners’ equivalent rent and with a 0.19% increase in core PCE in May.

2nd Look at Local Housing Markets in May

by Calculated Risk on 6/11/2024 11:18:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in May

A brief excerpt:

NOTE: The tables for active listings, new listings and closed sales all include a comparison to May 2019 for each local market (some 2019 data is not available).There is much more in the article.

This is the second look at several early reporting local markets in May. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in May were mostly for contracts signed in March and April when 30-year mortgage rates averaged 6.82% and 6.99%, respectively (Freddie Mac PMMS). This is down from the 7%+ mortgage rates in the August through November period (although rates are now back above 7% again).

...

In May, sales in these markets were up 1.5% YoY. Last month, in April, these same markets were up 7.9% year-over-year Not Seasonally Adjusted (NSA).

Sales in all of these markets are down compared to May 2019.

...

This is a small year-over-year increase NSA for these markets. There were the same number of working days in May 2024 compared to May 2023, so the year-over-year change in the seasonally adjusted sales will be about the same as the NSA data suggests.

...

Many more local markets to come!

Hotels: Occupancy Rate Increased 0.9% Year-over-year

by Calculated Risk on 6/11/2024 08:11:00 AM

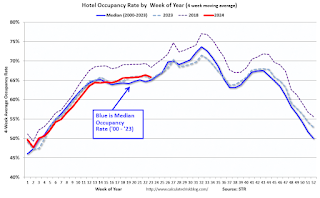

Due to Memorial Day, the U.S. hotel industry reported lower performance results from the previous week but slightly positive comparisons year over year, according to CoStar’s latest data through 1 June. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

26 May through 1 June 2024 (percentage change from comparable week in 2023):

• Occupancy: 62.0% (+0.9%)

• Average daily rate (ADR): US$150.87 (+0.1%)

• Revenue per available room (RevPAR): US$93.50 (+1.0%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2024, blue is the median, and dashed light blue is for 2023. Dashed purple is for 2018, the record year for hotel occupancy.

Monday, June 10, 2024

"Mortgage Rates Slightly Higher to Start Pivotal Week"

by Calculated Risk on 6/10/2024 06:26:00 PM

The event calendar ramps up quickly from here and Wednesday will be the most important day of the month due to the release of pivotal inflation data and an updated rate announcement and outlook from the Fed. While there's no chance of a rate cut or hike at this meeting, we should get more clarity on the Fed's interpretation of the very latest trends in inflation. [30 year fixed 7.17%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

Q1 Update: Delinquencies, Foreclosures and REO

by Calculated Risk on 6/10/2024 01:17:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Q1 Update: Delinquencies, Foreclosures and REO

A brief excerpt:

We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

...

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q4 2023 (Q1 2024 data will be released in three weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.2% of loans are under 3%, 58.1% are under 4%, and 77.0% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

AAR: Rail Carloads Down YoY in May, Intermodal Up

by Calculated Risk on 6/10/2024 11:12:00 AM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total U.S. carloads were down 6.0% in May 2024 from May 2023, their fifth straight year-over-year decline. Year-to-date total carloads through May were down 5.0%, or 247,984 carloads, from last year and were the lowest in our records that go back to 1988.

We’ve said it before and we’ll say it again: it’s coal’s fault. Coal averaged 49,239 carloads per week in May 2024, down 22.0% from last year and its fifth straight double-digit percentage decline. In our records, only May 2020 and April 2024 had fewer coal carloads. Year-to-date coal carloads in 2024 through May were down 18.3%, or 263,128 carloads, from last year. Still, coal remains the single highest volume carload commodity for U.S. railroads (25% of carloads so far this year).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six-week average of U.S. Carloads in 2022, 2023 and 2024:

Total originated carloads on U.S. railroads in May 2024 were down 6.0%, or 67,145 carloads, from May 2023. The weekly average in May 2024 was 212,160 carloads, virtually the same as in April 2024.

Year-to-date total carloads in 2024 through May were down 5.0% (247,984 carloads) from the same period last year and down 4.4% from the same period in 2022.

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):

The second graph shows the six-week average (not monthly) of U.S. intermodal in 2022, 2023 and 2024: (using intermodal or shipping containers):U.S. intermodal volume in May 2024 was up 7.6% (90,744 containers and trailers) over May 2023, its ninth straight gain. Year-to-date intermodal volume through May was 5.57 million units, up 8.7% (443,453 units) over last year but down 3.1% (180,434 units) from 2022.

Housing June 10th Weekly Update: Inventory up 1.1% Week-over-week, Up 37.8% Year-over-year

by Calculated Risk on 6/10/2024 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image.This inventory graph is courtesy of Altos Research.

Sunday, June 09, 2024

Sunday Night Futures

by Calculated Risk on 6/09/2024 06:18:00 PM

Weekend:

• Schedule for Week of June 9, 2024

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 and DOW futures are little changed (fair value).

Oil prices were down over the last week with WTI futures at $75.37 per barrel and Brent at $79.53 per barrel. A year ago, WTI was at $70, and Brent was at $75 - so WTI oil prices are up about 7% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.40 per gallon. A year ago, prices were at $3.57 per gallon, so gasoline prices are down $0.17 year-over-year.

FOMC Preview: No Change to Fed Funds Rate

by Calculated Risk on 6/09/2024 09:40:00 AM

Most analysts expect there will be no change to the federal funds rate at the meeting this week keeping the target range at 5‑1/4 to 5-1/2 percent. Currently market participants expect the next Fed move to be a 25 bp cut announced at the November FOMC meeting. The market is almost pricing in a 2nd cut in December.

From BofA:

The bottom line is that the stronger-than-expected May employment report remains consistent with our monetary policy outlook for staying on hold. This report showed solid payroll gains with positive implications for consumer spending. We expect the Fed to stay on hold for now and start a gradual cutting cycle in December which will depend on a moderation in the inflation data. The economy may be cooling, but it is not cool.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.0 to 2.4 | 1.9 to 2.3 | 1.8 to 2.1 | |

| Dec 2023 | 1.2 to 1.7 | 1.5 to 2.0 | 1.8 to 2.0 | |

The unemployment rate was at 4.0% in April, at the FOMC projections for Q4. This might be revised up slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 3.9 to 4.1 | 3.9 to 4.2 | 3.9 to 4.3 | |

| Dec 2023 | 4.0 to 4.2 | 4.0 to 4.2 | 3.9 to 4.3 | |

As of April 2024, PCE inflation increased 2.7 percent year-over-year (YoY). This is at the high end of the FOMC projections for Q4, and inflation will likely be revised down slightly.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.3 to 2.7 | 2.1 to 2.2 | 2.0 to 2.1 | |

| Dec 2023 | 2.2 to 2.5 | 2.0 to 2.2 | 2.0 | |

PCE core inflation increased 2.8 percent YoY in April. This is also at the high end of the FOMC projections for Q4 2024. However, housing is still distorting the measures of inflation, and the shelter index will continue to decline (monetary policy can't impact what happened in the past), and it is likely projections for core PCE will be revised down slightly.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2024 | 2025 | 2026 | |

| Mar 2024 | 2.5 to 2.8 | 2.1 to 2.3 | 2.0 to 2.1 | |

| Dec 2023 | 2.4 to 2.7 | 2.0 to 2.2 | 2.0 to 2.1 | |

Saturday, June 08, 2024

Real Estate Newsletter Articles this Week: "Home ATM" Mostly Closed in Q1

by Calculated Risk on 6/08/2024 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• The "Home ATM" Mostly Closed in Q1

• 1st Look at Local Housing Markets in May

• Asking Rents Mostly Unchanged Year-over-year

• Freddie Mac House Price Index Increased in April; Up 6.5% Year-over-year

• ICE Mortgage Monitor: "Home Prices Cool for Second Straight Month in April"

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of June 9, 2024

by Calculated Risk on 6/08/2024 08:11:00 AM

The key report this week is May CPI.

The FOMC meets on Tuesday and Wednesday, and rates are expected to be unchanged.

No major economic releases scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for May from the BLS. The consensus is for 0.2% increase in CPI (up 3.4% YoY), and a 0.3% increase in core CPI (up 3.5% YoY).

2:00 PM: FOMC Statement. The FOMC is expected to leave the Fed Funds rate unchanged at this meeting.

2:00 PM: FOMC Projections This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, down from 229 thousand last week.

8:30 AM: The Producer Price Index for May from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.3% increase in core PPI.

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for June).

Friday, June 07, 2024

June 7th COVID Update: Weekly Deaths at New Pandemic Low!

by Calculated Risk on 6/07/2024 07:53:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week✅ | 303 | 398 | ≤3501 | |

| 1my goals to stop weekly posts, 🚩 Increasing number weekly for Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

This appears to be a leading indicator for COVID hospitalizations and deaths.

This appears to be a leading indicator for COVID hospitalizations and deaths.Wholesale Used Car Prices Declined in May; Down 12.1% Year-over-year

by Calculated Risk on 6/07/2024 04:45:00 PM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Declined in May

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were down in May compared to April. The Manheim Used Vehicle Value Index (MUVVI) fell to 197.3, a decline of 12.1% from a year ago. The seasonal adjustment to the index reduced the impact on the month, resulting in values that declined 0.6% month over month. The non-adjusted price in May decreased by 1.2% compared to April, moving the unadjusted average price down 11.4% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

The "Home ATM" Mostly Closed in Q1

by Calculated Risk on 6/07/2024 01:15:00 PM

Today, in the Real Estate Newsletter: The "Home ATM" Mostly Closed in Q1

Excerpt:

During the housing bubble, many homeowners borrowed heavily against their perceived home equity - jokingly calling it the “Home ATM” - and this contributed to the subsequent housing bust, since so many homeowners had negative equity in their homes when house prices declined.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/.

Unlike during the housing bubble, very few homeowners have negative equity now. From CoreLogic this morning: Homeowner Equity Insights – Q1 2024CoreLogic analysis shows U.S. homeowners with mortgages (roughly 62% of all properties*) have seen their equity increase by a total of $1.5 trillion since the first quarter of 2023, a gain of 9.6% year over year.

In the first quarter of 2024, the total number of mortgaged residential properties with negative equity decreased by 2.1% from the fourth quarter of 2023, representing 1 million homes, or 1.8% of all mortgaged properties. On a year-over-year basis, negative equity declined by 16.1% from 1.2 million homes, or 2.1% of all mortgaged properties, from the first quarter of 2023.Here is the quarterly increase in mortgage debt from the Federal Reserve’s Financial Accounts of the United States - Z.1 (sometimes called the Flow of Funds report) released today. In the mid ‘00s, there was a large increase in mortgage debt associated with the housing bubble.

In Q1 2024, mortgage debt increased $38 billion, down from $91 billion in Q4, and down from the cycle peak of $467 billion in Q2 2021. Note the almost 7 years of declining mortgage debt as distressed sales (foreclosures and short sales) wiped out a significant amount of debt.

However, some of this debt is being used to increase the housing stock (purchase new homes), so this isn’t all Mortgage Equity Withdrawal (MEW).