by Calculated Risk on 11/03/2014 09:00:00 PM

Monday, November 03, 2014

Tuesday: Trade Deficit

Two weeks ago, Professor James Hamilton wrote: How will Saudi Arabia respond to lower oil prices? (read entire piece!). Hamilton wrote:

it’s primarily a question of responding to surging output of U.S. tight oil. My guess is that Saudi Arabia would lower prices rather than cut production ...And today from the WSJ: Oil Skids as Saudis Adjust Prices

U.S. oil prices tumbled to a fresh two-year low Monday on news that Saudi Arabia cut its selling price for oil to the U.S., suggesting that the kingdom is trying to compete with U.S. shale oil.Bloomberg shows WTI down to $78.24 a barrel, and Brent down to $84.78. So gasoline prices should continue to decline (currently $2.96 per gallon national average).

Tuesday:

• At 8:30 AM ET, the Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to be at $40.7 billion in September from $40.1 billion in August.

• At 10:00 AM, the Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is for a 0.7 decrease in September orders.

Fed Survey: Banks "eased standards for construction and land development loans"

by Calculated Risk on 11/03/2014 05:12:00 PM

From the Federal Reserve: The October 2014 Senior Loan Officer Opinion Survey on Bank Lending Practices

Regarding loans to businesses, the October survey results indicated that only a modest net fraction of banks eased their standards for commercial and industrial (C&I) loans to firms of all sizes, but generally larger net fractions of banks eased each of the pricing terms listed in the survey and some non-price terms. Banks also reported having eased standards for construction and land development loans, a category of commercial real estate (CRE) loans included in the survey. On the demand side, modest net fractions of banks reported stronger demand for C&I loans to larger firms; similar net fractions experienced stronger demand for all three categories of CRE loans covered in the survey.

...

Regarding loans to households, some large banks reported having eased standards on closed-end mortgage loans, but respondents generally indicated little change in standards and terms for other types of loans to households. Reported changes in loan demand were mixed. Moderate net fractions of banks reported stronger demand for auto loans and weaker demand for nontraditional closed-end mortgage loans. Demand for other types of loans to households was about unchanged at most banks.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are some charts from the Fed.

This graph shows the change in lending standards and for CRE (commercial real estate) loans.

Banks are loosening their standards for CRE loans, and for various categories of CRE (right half of graph). Multifamily is seeing slightly tighter standards for the second consecutive quarter.

The second graph shows the change in demand for CRE loans.

Banks are seeing a pickup in demand for all categories of CRE.

Banks are seeing a pickup in demand for all categories of CRE.This suggests (along with the Architecture Billing Index) that we will see a further increase in commercial real estate development.

U.S. Light Vehicle Sales unchanged at 16.35 million annual rate in October

by Calculated Risk on 11/03/2014 02:30:00 PM

Based on an WardsAuto estimate, light vehicle sales were at a 16.35 million SAAR in October. That is up 7% from October 2013, and unchanged from the 16.34 million annual sales rate last month.

This graph shows the historical light vehicle sales from the BEA (blue) and an estimate for October (red, light vehicle sales of 16.35 million SAAR from WardsAuto).

This was below the consensus forecast of 16.6 million SAAR (seasonally adjusted annual rate).

Note: dashed line is current estimated sales rate.

This was the sixth consecutive month with a sales rate over 16 million.

Construction Spending decreased 0.4% in September

by Calculated Risk on 11/03/2014 11:29:00 AM

Earlier the Census Bureau reported that overall construction spending decreased in September:

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2014 was estimated at a seasonally adjusted annual rate of $950.9 billion, 0.4 percent below the revised August estimate of $955.2 billion.. The September figure is 2.9 percent (±2.1%) above the September 2013 estimate of $924.2 billion.Both private and public spending decreased in September:

Spending on private construction was at a seasonally adjusted annual rate of $680.0 billion, 0.1 percent below the revised August estimate of $680.8 billion. Residential construction was at a seasonally adjusted annual rate of $349.1 billion in September, 0.4 percent above the revised August estimate of $347.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $331.0 billion in September, 0.6 percent below the revised August estimate of $333.0 billion. ...Note: Non-residential for offices and hotels is increasing, but spending for oil and gas is declining. Early in the recovery, there was a surge in non-residential spending for oil and gas (because prices increased), but now, with falling prices, oil and gas is a drag on overall construction spending.

In September, the estimated seasonally adjusted annual rate of public construction spending was $270.9 billion, 1.3 percent below the revised August estimate of $274.4 billion.

emphasis added

As an example, construction spending for lodging is up 15% year-over-year, whereas spending for power (includes oil and gas) construction is down 11% since peaking in May.

Click on graph for larger image.

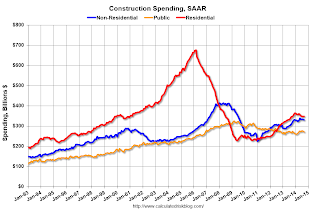

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Private residential spending has declined recently and is 48% below the peak in early 2006 - but up 53% from the post-bubble low.

Non-residential spending is 20% below the peak in January 2008, and up about 47% from the recent low.

Public construction spending is now 17% below the peak in March 2009 and about 4% above the post-recession low.

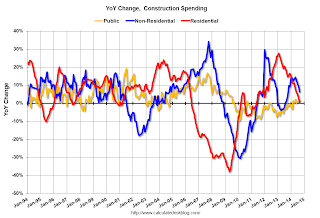

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is now up 1%. Non-residential spending is up 6% year-over-year. Public spending is up 2% year-over-year.

Looking forward, all categories of construction spending should increase in 2015. Residential spending is still very low, non-residential is starting to pickup, and public spending has probably hit bottom after several years of austerity.

This was a weak report - well below the consensus forecast of a 0.6% increase - and there were also downward revisions to spending in July and August.

ISM Manufacturing index increases to 59.0 in October

by Calculated Risk on 11/03/2014 10:04:00 AM

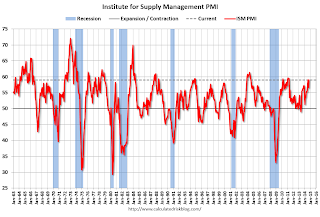

The ISM manufacturing index suggests faster expansion in October than in September. The PMI was at 59.0% in October, up from 56.6% in September. The employment index was at 55.5%, up from 54.6% in September, and the new orders index was at 65.8%, up from 60.0%.

From the Institute for Supply Management: October 2014 Manufacturing ISM® Report On Business®

Economic activity in the manufacturing sector expanded in October for the 17th consecutive month, and the overall economy grew for the 65th consecutive month, say the nation’s supply executives in the latest Manufacturing ISM® Report On Business®.

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee. "The October PMI® registered 59 percent, an increase of 2.4 percentage points from September’s reading of 56.6 percent, indicating continued expansion in manufacturing. The New Orders Index registered 65.8 percent, an increase of 5.8 percentage points from the 60 percent reading in September, indicating growth in new orders for the 17th consecutive month. The Production Index registered 64.8 percent, 0.2 percentage point above the September reading of 64.6 percent. The Employment Index grew for the 16th consecutive month, registering 55.5 percent, an increase of 0.9 percentage point above the September reading of 54.6 percent. Inventories of raw materials registered 52.5 percent, an increase of 1 percentage point from the September reading of 51.5 percent, indicating growth in inventories for the third consecutive month. Comments from the panel generally cite positive business conditions, with growth in demand and production volumes."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph of the ISM manufacturing index.

This was above expectations of 56.0%, and indicates solid expansion in October.

Black Knight releases Mortgage Monitor for September

by Calculated Risk on 11/03/2014 08:01:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for September today. According to BKFS, 5.67% of mortgages were delinquent in September, down from 5.90% in August. BKFS reported that 1.76% of mortgages were in the foreclosure process, down from 2.63% in September 2013.

This gives a total of 7.43% delinquent or in foreclosure. It breaks down as:

• 1,760,000 properties that are 30 or more days, and less than 90 days past due, but not in foreclosure.

• 1,118,000 properties that are 90 or more days delinquent, but not in foreclosure.

• 893,000 loans in foreclosure process.

For a total of 3,711,000 loans delinquent or in foreclosure in September. This is down from 4,593,000 in September 2013.

Click on graph for larger image.

This graph shows the percent of borrowers and the amount of equity. Black Knight notes: "Only 8 percent of borrowers remain “underwater” on their mortgages, down from a level of 33 percent at the end of 2011, and to the lowest point since 2007"

More from Black Knight:

“Before the most recent reductions in the average 30-year mortgage interest rate, approximately six million borrowers met broad-based ‘refinancibility’ criteria,” said Barnes. “These criteria assume loan-to-value ratios of 80 percent or below, good credit, non-delinquent loan status and current interest rates high enough that borrowers have an incentive to refinance. In light of where rates are today, and looking at borrowers with current notes at 4.5 percent and above, that population has now swelled to 7.4 million – almost a 25 percent increase. This is a relatively conservative assessment though, as those with current rates of 4.25 to 4.5 percent could arguably benefit from refinancing as well. That group adds another 1.7 million borrowers to the population.There is much more in the mortgage monitor.

“On a related note, we also examined how the equity situation in America has changed since we last looked. Due in no small part to 28 consecutive months of home price appreciation since 2012, we’ve seen the share of borrowers with negative equity drop down to just below eight percent as of July, down from a level of 33 percent at the end of 2011, and to its lowest point since 2007. An additional 8.5 percent of borrowers are in ‘near-negative equity’ positions, with less than 10 percent equity in their homes. However, more than half of all borrowers have 30 percent or more equity, a level not seen in nearly eight years.”

Sunday, November 02, 2014

Monday: ISM Mfg, Auto Sales, Construction Spending

by Calculated Risk on 11/02/2014 08:30:00 PM

From the SacBee: Sacramento gas prices under $3 per gallon are part of nationwide trend

AAA reported that the average gas price nationally dropped by 33 cents in October, reaching $2.99 on Saturday. That was the first time in four years that the national average dropped below $3.Nice!

Monday:

• Early, Black Knight Mortgage Monitor report for September.

• All day, Light vehicle sales for October. The consensus is for light vehicle sales to increase to 16.6 million SAAR in October from 16.3 million in September (Seasonally Adjusted Annual Rate).

• At 10:00 AM ET, the ISM Manufacturing Index for October. The consensus is for a decrease to 56.0 from 56.6 in September. The ISM manufacturing index indicated expansion in September at 56.6%. The employment index was at 54.6%, and the new orders index was at 60.0%.

• Also at 10:00 AM, Construction Spending for September. The consensus is for a 0.6% increase in construction spending.

Weekend:

• Schedule for Week of November 2nd

• Retail: October Seasonal Hiring vs. Holiday Retail Sales

From CNBC: Pre-Market Data and Bloomberg futures: currently the S&P futures are down slightly and DOW futures are also down slightly (fair value).

Oil prices were down over the last week with WTI futures at $80.54 per barrel and Brent at $85.86 per barrel. A year ago, WTI was at $96, and Brent was at $107 - so prices are down close to 20% year-over-year.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are around $2.98 per gallon (down almost 30 cents from a year ago). If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Retail: October Seasonal Hiring vs. Holiday Retail Sales

by Calculated Risk on 11/02/2014 11:17:00 AM

Every year I track seasonal retail hiring for hints about holiday retail sales.

At the bottom of this post is a graph showing the correlation between October seasonal hiring and holiday retail sales.

First, here is the NRF forecast for this year: Optimism Shines as National Retail Federation Forecasts Holiday Sales to Increase 4.1

[T]he National Retail Federation ... expects sales in November and December (excluding autos, gas and restaurant sales) to increase a healthy 4.1 percent to $616.9 billion, higher than 2013’s actual 3.1 percent increase during that same time frame.Note: NRF defines retail sales as including discounters, department stores, grocery stores, and specialty stores, and exclude sales at automotive dealers, gas stations, and restaurants.

According to NRF, retailers are expected to hire between 725,000 and 800,000 seasonal workers this holiday season, potentially more than they actually hired during the 2013 holiday season (768,000). Seasonal employment in 2013 increased 14 percent over the previous holiday season.

Here is a graph of retail hiring for previous years based on the BLS employment report:

Click on graph for larger image.

Click on graph for larger image.This graph shows the historical net retail jobs added for October, November and December by year.

Retailers hired about 786 thousand seasonal workers last year (using BLS data, Not Seasonally Adjusted), and 160 thousand seasonal workers last October.

The following scatter graph is for the years 1993 through 2013 and compares October retail hiring with the real increase (inflation adjusted) for retail sales (Q4 over previous Q4).

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.70 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.

In general October hiring is a pretty good indicator of seasonal sales. R-square is 0.70 for this small sample. Note: This uses retail sales in Q4, and excludes autos, gasoline and restaurants. Note: The NRF is just looking at November and December.When the October employment report is released this coming Friday, I'll be looking at seasonal retail hiring for hints if retailers expect a strong holiday season.

Saturday, November 01, 2014

Fannie Mae: Mortgage Serious Delinquency rate declined in September, Lowest since October 2008

by Calculated Risk on 11/01/2014 06:46:00 PM

Fannie Mae reported yesterday that the Single-Family Serious Delinquency rate declined in September to 1.96% from 1.99% in August. The serious delinquency rate is down from 2.55% in September 2013, and this is the lowest level since October 2008.

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Earlier this week, Freddie Mac reported that the Single-Family serious delinquency rate declined in September to 1.96% from 1.98% in August. Freddie's rate is down from 2.58% in September 2013, and is at the lowest level since December 2008. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

Note: These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate has fallen 0.59 percentage points over the last year, and at that pace the serious delinquency rate will be under 1% in 2016 - although the rate of decline has slowed recently.

Note: The "normal" serious delinquency rate is under 1%.

Maybe serious delinquencies will be close to normal in late 2016.

Schedule for Week of November 2nd

by Calculated Risk on 11/01/2014 01:01:00 PM

The key report this week is the October employment report on Friday.

Other key reports include the October ISM manufacturing index and October vehicle sales, both on Monday, the September Trade Deficit on Tuesday, and September ISM non-manufacturing index on Wednesday.

Early: Black Knight Mortgage Monitor report for September.

All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 16.6 million SAAR in October from 16.3 million in September (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for October. The consensus is for light vehicle sales to increase to 16.6 million SAAR in October from 16.3 million in September (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the September sales rate.

10:00 AM: ISM Manufacturing Index for October. The consensus is for a decrease to 56.0 from 56.6 in September

10:00 AM: ISM Manufacturing Index for October. The consensus is for a decrease to 56.0 from 56.6 in SeptemberHere is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in September at 56.6%. The employment index was at 54.6%, and the new orders index was at 60.0%.

10:00 AM: Construction Spending for September. The consensus is for a 0.6% increase in construction spending.

8:30 AM: Trade Balance report for September from the Census Bureau.

8:30 AM: Trade Balance report for September from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through August. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is for the U.S. trade deficit to be at $40.7 billion in September from $40.1 billion in August.

10:00 AM: Manufacturers' Shipments, Inventories and Orders (Factory Orders) for September. The consensus is for a 0.7 decrease in September orders.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for October. This report is for private payrolls only (no government). The consensus is for 212,000 payroll jobs added in October, down from 213,000 in September.

10:00 AM: ISM non-Manufacturing Index for October. The consensus is for a reading of 58.0, down from 58.6 in September. Note: Above 50 indicates expansion.

Early: Trulia Price Rent Monitors for October. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 283 thousand from 287 thousand.

8:30 AM: Employment Report for October. The consensus is for an increase of 240,000 non-farm payroll jobs added in October, down from the 248,000 non-farm payroll jobs added in September.

The consensus is for the unemployment rate to be unchanged at 5.9% in October.

This graph shows the year-over-year change in total non-farm employment since 1968.

This graph shows the year-over-year change in total non-farm employment since 1968.In September, the year-over-year change was 2.635 million jobs, and it appears the pace of hiring is increasing. Right now it looks like 2014 will be the best year since 1999 for both total nonfarm and private sector employment growth.

As always, a key will be the change in real wages - and as the unemployment rate falls, wage growth should eventually start to pickup.

3:00 PM: Consumer Credit for September from the Federal Reserve. The consensus is for credit to increase $16.0 billion.

Unofficial Problem Bank list declines to 422 Institutions

by Calculated Risk on 11/01/2014 08:11:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Oct 31, 2014.

Changes and comments from surferdude808:

As expected, the FDIC provided an update on its enforcement action activities. Their disclosure has to be the shortest list of new actions and terminations since the on-set of the Great Recession. In all, there were three removals and two additions to the Unofficial Problem Bank List this week. After the changes, the list holds 422 institutions with assets of $133.5 billion. For the month of October, the list declined by a net 10 institutions after eight action terminations, three mergers, two failures, and three additions.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The list peaked at 1,002 institutions on June 10, 2011, and is now down to 422.

The FDIC terminated actions against Decatur State Bank, Decatur, AR ($144 million); Lone Star Bank, Houston, TX ($106 million); and The Bank of Kaukauna, Kaukauna, WI ($84 million).

New to the list is Polonia Bank, Huntingdon Valley, PA ($300 million Ticker PBCP) and Proficio Bank, Cottonwood Heights, UT ($199 million).

Friday, October 31, 2014

Friday Night: Kudlow makes me laugh ... again!

by Calculated Risk on 10/31/2014 09:08:00 PM

Larry Kudlow wrote an absurd piece at CNBC today.

Of course Kudlow is usually wrong and frequently absurd ... as an example, in June 2005 Kudlow wrote "The Housing Bears are Wrong Again" and called me (or people like me) "bubbleheads".

Homebuilders led the stock parade this week with a fantastic 11 percent gain. This is a group that hedge funds and bubbleheads love to hate. All the bond bears have been dead wrong in predicting sky-high mortgage rates. So have all the bubbleheads who expect housing-price crashes in Las Vegas or Naples, Florida, to bring down the consumer, the rest of the economy, and the entire stock market.In the piece today, Kudlow claimed: "I've always believed the 1990s were Ronald Reagan's third term."

Kudlow is rewriting his own history. Near the beginning of Clinton's first term, Kudlow was arguing Clinton's policies would take the economy into a deep recession or even depression. Kudlow was wrong then (I remember because I was on the other side of that debate), so he can't claim he "always believed" now. Nonsense.

Further down, Kudlow dismisses gains in the stock market as unrelated to the economy:

"Over the last eight quarters ... the S&P 500 climbed 43 percent. But that's mostly from record profits and expanding multiples."Weird, because in 2007, Kudlow wrote:

"I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."

Q3 GDP: Investment Contributions

by Calculated Risk on 10/31/2014 05:31:00 PM

This is one of my favorite GDP graphs. The graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Note: This can't be used blindly. Residential investment is so low as a percent of the economy that the small decline earlier this year was not a concern.

Residential investment (RI) increased at a 1.8% annual rate in Q3 - and RI only contributed 0.06 percentage points to GDP growth. For the rate of economic growth to increase, RI will probably have to make larger positive contributions to economic growth.

Equipment investment increased at a 7.2% annual rate, and investment in non-residential structures increased at a 3.9% annual rate. Equipment and software added 0.41 percentage points to growth in Q3 and the three quarter average moved down slightly (green).

The contribution from nonresidential investment in structures was also positive in Q3. Nonresidential investment in structures typically lags the recovery, however investment in energy and power provided a boost early in this recovery.

I expect to see all areas of private investment increase over the next few quarters - and that is key for stronger GDP growth.

Q3 2014 GDP Details on Residential and Commercial Real Estate

by Calculated Risk on 10/31/2014 02:30:00 PM

The BEA has released the underlying details for the Q3 advance GDP report today.

Investment in single family structures is now back to being the top category for residential investment (see first graph). Home improvement was the top category for twenty one consecutive quarters following the housing bust ... but now investment in single family structures is the top category once again.

However - even though investment in single family structures has increased from the bottom - single family investment is still very low, and still below the bottom for previous recessions. I expect further increases over the next few years.

The first graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

Investment in single family structures was $190 billion (SAAR) (almost 1.1% of GDP).

Investment in home improvement was at a $180 billion Seasonally Adjusted Annual Rate (SAAR) in Q3 (just over 1.0% of GDP).

Investment in offices is down about 47% from the recent peak (as a percent of GDP) and increasing slowly.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and is down about 59% from the peak. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment peaked at 0.31% of GDP in Q3 2008 and is down about 66%. With the hotel occupancy rate at the highest level since 2000, it is likely that hotel investment will probably continue to increase.

These graphs show investment is generally increasing, but from a very low level.

Preliminary: 2015 Housing Forecasts

by Calculated Risk on 10/31/2014 11:32:00 AM

The NAHB released their 2015 housing forecast today. Towards the end of each year I collect some housing forecasts for the following year, and it looks like most analysts are optimistic for 2015.

Here is a summary of forecasts for 2014. In 2014, new home sales will be around 440 thousand, and total housing starts will be close to 1 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high).

In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Note: Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays were the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows a few forecasts for 2015 (I'll update these in December).

From Fannie Mae: Housing Forecast: October 2014

From NAHB: Single-Family Production Poised to Take Off in 2015

I don't have Moody's Analytics' forecast, but Mark Zandi, chief economist at Moody's Analytics said today "that single-family starts could be closing in on 1 million units by the end of 2015 and multifamily production could go as high as 500,000 units." That seems too high.

I haven't worked up a forecast yet for 2015.

| Housing Forecasts for 2015 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| NAHB | 802 | 1,158 | ||

| Fannie Mae | 523 | 783 | 1,170 | 4.9%2 |

| Merrill Lynch | 557 | 1,200 | 3.6% | |

| Wells Fargo | 535 | 760 | 1,110 | 3.2% |

| Zillow | 3.0%3 | |||

| 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3Zillow Home Value Index, Sept 2014 to Sept 2015 | ||||

Final October Consumer Sentiment at 86.9, Chicago PMI increases to 66.2

by Calculated Risk on 10/31/2014 09:03:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for October was at 86.9, up from the preliminary reading of 86.4, and up from 84.6 in September.

This was slightly above the consensus forecast of 86.4. Sentiment has generally been improving following the recession - with plenty of ups and downs - and a big spike down when Congress threatened to "not pay the bills" in 2011.

This was the highest level since 2007.

Chicago PMI October 2014: Chicago Business Barometer Up 5.7 Points to 66.2 in October, New Orders Rise Sharply to the Highest Since October 2013

The Chicago Business Barometer rose 5.7 points to a one year high of 66.2 in October, fuelled by a double digit gain in New Orders. ...This was well above the consensus forecast of 60.0.

New Orders was the strongest component of the Barometer and increased sharply to 73.6, the highest level since October 2013. ... Employment increased to the highest level since November 2013, a potential sign that the recovery is becoming more entrenched.

emphasis added

BEA: Personal Income increased 0.2% in September, Core PCE prices up 1.5% year-over-year

by Calculated Risk on 10/31/2014 08:36:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $22.7 billion, or 0.2 percent ... in September, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) decreased $19.0 billion, or 0.2 percent.A key point is that the PCE price index was only up 1.4% year-over-year (1.5% for core PCE). This is still below the Fed's target.

...

Real PCE -- PCE adjusted to remove price changes -- decreased 0.2 percent in September, in contrast to an increase of 0.5 percent in August. ... The price index for PCE increased 0.1 percent in September, in contrast to a decrease of 0.1 percent in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

...

Personal saving -- DPI less personal outlays -- was $732.2 billion in September, compared with $702.0 billion in August. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 5.6 percent in September, compared with 5.4 percent in August.

Thursday, October 30, 2014

Friday: Personal Income and Outlays, Chicago PMI, Consumer Sentiment

by Calculated Risk on 10/30/2014 06:52:00 PM

From Freddie Mac: Mortgage Rates Rebound, Remain Below Four Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher across the board this week and rebounding from the lowest rates of the year.Mortgage News Daily shows rates today were at 4.01%.

30-year fixed-rate mortgage (FRM) averaged 3.98 percent with an average 0.5 point for the week ending October 30, 2014, up from last week when it averaged 3.92 percent. A year ago at this time, the 30-year FRM averaged 4.10 percent.

Friday:

• At 8:30 AM ET, Personal Income and Outlays for September. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, the Chicago Purchasing Managers Index for October. The consensus is for a reading of 60.0, down from 60.5 in September.

• At 9:55 AM, the Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 86.4, unchanged from the preliminary reading of 86.4, and up from the September reading of 84.6.

Hotels: Occupancy up 5.4%, RevPAR up 10.8% Year-over-Year

by Calculated Risk on 10/30/2014 02:54:00 PM

From HotelNewsNow.com: STR: US results for week ending 25 October

The U.S. hotel industry recorded positive results in the three key performance measurements during the week of 19-25 October 2014, according to data from STR, Inc.Note: ADR: Average Daily Rate, RevPAR: Revenue per Available Room.

In year-over-year measurements, the industry’s occupancy rose 5.4 percent to 69.4 percent. Average daily rate increased 5.1 percent to finish the week at US$119.52. Revenue per available room for the week was up 10.8 percent to finish at US$82.89

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Business travel has probably peaked for the Fall season, and now hotels are heading into the slow period.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2014, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels. Purple is for 2000.

The 4-week average of the occupancy rate is solidly above the median for 2000-2007, and is a little above the level for the same week in 2000 (the previous high).

Right now it looks like 2014 will be the best year since 2000 for hotels.

And since it takes some time to plan and build hotels, I expect 2015 will be a record year for hotel occupancy.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Lawler: MDC Results and Homebuilder Summary Table

by Calculated Risk on 10/30/2014 11:36:00 AM

From housing economist Tom Lawler: M.D.C. Holdings: Net Orders Up, Orders per Community Down; Margins Fall on Higher Incentives

M.D.C. Holdings reported that net home orders in the quarter ended September 30, 2014 totaled 1,081, up 17.0% from the comparable quarter of 2013. Net orders per active community were down 2.3% from a year ago. Home deliveries totaled 1,093 last quarter, down 13.0% from the comparable quarter of 2013, at an average sales price of $370,600, up 7.4% from a year ago. The company’s order backlog at the end of September was 1,874, up 6.4% from last September, at an average order price of $422,700, up 10.0% from a year ago.

Here are some excerpts from the company’s press release.

‘Larry A. Mizel, MDC's Chairman and Chief Executive Officer, stated, "Against the backdrop of an uneven recovery for housing and overall economic conditions, we are pleased that we have consistently produced profitable results since the beginning of 2012. However, the volatility of the housing market recovery was evident in our third quarter results, as elevated land and construction costs, combined with our use of additional incentives to stimulate demand for new homes, have pressured our homebuilding gross margins."M.D.C.’s results were below “consensus.”

‘Mr. Mizel continued, "While we believe that the housing recovery remains on solid footing, it is evident that certain obstacles, such as Qualified Mortgage Standards and reduced Federal Housing Authority loan limits, have taken their toll on housing demand, especially for the first time buyer segment. Additionally, on the production side of our business, we have seen a negative impact from tighter subcontractor availability and adverse weather conditions in certain markets, as well as an elongated mortgage approval process. We believe the impact of many of these factors will diminish over time, allowing us to return to more robust levels of demand as overall economic conditions continue to improve."’

Here are some summary results for large publicly-traded builders who have reported results for last quarter. For these six builders combined, net orders per active community last quarter were up 1.8% YOY. Excluding the impact of acquisitions of other builders, net orders last quarter were up about 8.3% YOY.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 9/30/14 | 9/30/13 | % Chg | 9/30/14 | 9/30/13 | % Chg | 9/30/14 | 9/30/13 | % Chg |

| Pulte Group | 3,779 | 3,781 | -0.1% | 4,646 | 4,817 | -3.5% | $334,000 | 310,000 | 7.7% |

| NVR | 2,936 | 2,381 | 23.3% | 3,236 | 3,342 | -3.2% | $366,200 | 349,200 | 4.9% |

| The Ryland Group | 1,707 | 1,592 | 7.2% | 2,018 | 1,883 | 7.2% | $331,000 | 298,000 | 11.1% |

| Meritage Homes | 1,500 | 1,300 | 15.4% | 1,522 | 1,418 | 7.3% | $358,000 | 341,000 | 5.0% |

| MDC Holdings | 1,081 | 924 | 17.0% | 1,093 | 1,257 | -13.0% | $370,600 | 345,000 | 7.4% |

| M/I Homes | 892 | 869 | 2.6% | 985 | 937 | 5.1% | $320,000 | 284,000 | 12.7% |

| Total | 11,895 | 10,847 | 9.7% | 13,500 | 13,654 | -1.1% | $345,918 | $322,597 | 7.2% |