by Calculated Risk on 4/26/2013 01:46:00 PM

Friday, April 26, 2013

Lawler: Selected Results (and Comments) from Large Publicly-Traded Builders for Last Quarter

From economist Tom Lawler: Selected Results (and Comments) from Large Publicly-Traded Builders for Last Quarter; Consensus is Strong Spring Selling Season, Increased Pricing Power, Though Big Differences in Net Order Growth across Builders

Below is a table showing results on net home orders, home settlements, and average closing sales price for large publicly-traded home builders who have released results for the quarter ended March 31st, 2013. (These results include “discontinued operation”.)

Net order growth varied significantly across builders, to a large extent reflecting growth/margin strategies. E.g., PulteGroup’s average community count last quarter was down 14% from a year ago, reflecting its emphasis on “price, margin realization, and effective management of land assets” rather than growth, though it did increase its planned investments in land and development (see below), while other builders increased their community counts. NVR’s “sub-par” net order growth came despite a double-digit increase in its average community count.

The combined order backlog of these six builders on March 31, 2013 was 30,082, up 42.2% from last March.

| Net Orders | Settlements | Average Closing Price | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Qtr. Ended: | 3/31/13 | 3/31/12 | % Chg | 3/31/13 | 3/31/12 | % Chg | 3/31/13 | 3/31/12 | % Chg |

| D.R. Horton | 7,879 | 5,899 | 33.6% | 5,643 | 4,240 | 33.1% | $242,548 | $219,481 | 10.5% |

| PulteGroup | 5,200 | 4,991 | 4.2% | 3,833 | 3,117 | 23.0% | $287,000 | $261,000 | 10.0% |

| NVR | 3,510 | 3,157 | 11.2% | 2,272 | 1,924 | 18.1% | $330,400 | $304,600 | 8.5% |

| The Ryland Group | 2,052 | 1,357 | 51.2% | 1,315 | 848 | 55.1% | $277,000 | $254,000 | 9.1% |

| Meritage Homes | 1,547 | 1,144 | 35.2% | 1,052 | 759 | 38.6% | $314,000 | $269,000 | 16.7% |

| M/I Homes | 1,047 | 764 | 37.0% | 627 | 507 | 23.7% | $284,000 | $249,000 | 14.1% |

| Total | 21,235 | 17,312 | 22.7% | 14,742 | 11,395 | 29.4% | $277,580 | $252,391 | 10.0% |

Here are a few select excerpts from some of the company’s press releases (NVR’s press release generally has no “color” comments.

Pulte: ‘“The stronger demand which the housing industry saw throughout 2012 has carried into the spring selling season of 2013. We experienced higher traffic in our communities with buyers feeling a greater sense of urgency given the combination of limited product inventory and rising prices found in many markets throughout the country. Within this environment, and aligned with our focus on generating higher returns, we continue to emphasize price, margin realization and effective management of land assets. Our successful execution of these strategies can be seen in the higher selling prices and improved margins achieved across each of our primary brands.

‘“Given the operational gains demonstrated by our strong first quarter results, and our expectations for an ongoing recovery in new home demand, we have again increased our authorized investment in land and development for 2013 and 2014 to $1.4 billion annually. The incremental investment, which amounts to approximately $200 million in each year, will be made using the defined and disciplined process we put in place more than 18 months ago.”

‘The higher average selling price reflects price increases implemented by the Company and a shift in the mix of closings toward move-up homes which carry higher prices.’

Ryland: For the first quarter of 2013, sales incentives and price concessions totaled 7.9 percent of housing revenues, compared to 10.9 percent for the same period in 2012.

Meritage: ‘"Housing demand is greater than the supply of homes available for sale in many of the areas where we operate, causing home prices to increase," Mr. Hilton explained. "To meet the higher demand, we opened 24 new communities during the first quarter and also grew our active community count to its highest point in almost four years. In addition, our 9.5 orders per average community for the quarter was a 27% increase over 2012 even as we raised prices in many communities. As a result, we received orders for 35% more homes for a 69% increase in total order value compared to the first quarter of 2012. We are pricing our homes and limiting the number of lots we're releasing for sale in some communities to better manage our order volumes relative to our production capacity, and to maximize our profit from those communities."’

M/I Homes: ‘With housing conditions continuing to improve, we are optimistic about our business and look for continued growth.’

D.R. Horton: ‘Donald R. Horton, Chairman of the Board, said, “The spring selling season is off to a strong start at D.R. Horton, with robust demand driving higher sales volumes and favorable pricing, which is reflected in the 14% increase in our average selling price. (LEHC note: this refers to the average net order price; the average sales price on homes closed last quarter was up 10.5% from a year ago.) We are in an excellent position to continue to meet increased sales demand and aggregate market share with 15,800 homes in inventory and 175,000 lots owned or controlled under option contracts, of which 58,000 lots are fully developed.’

Q1 GDP and Investment

by Calculated Risk on 4/26/2013 11:40:00 AM

Final demand increased in Q1 as personal consumption expenditures (PCE) increased at a 3.2% annual rate (up from 1.8% in Q4 2012), and residential investment (RI) increased at a 12.6% annual rate (down from 17.6% in Q4). This was the strongest private domestic contribution (PCE and RI) since Q4 2010, and the 2nd strongest quarter since the recession began.

Unfortunately PCE will probably slow over the next couple of quarters as the sequester budget cuts ripple through the economy.

The negative contributions came from less Federal Government spending (subtracted 0.65 percentage points), less state and local governments spending (subtracted 0.14 percentage points) and from trade (subtracted 0.50 percentage points).

Overall this was a medicore report and below expectations (mostly due to government spending and trade). The increase in PCE and RI were positives, but the ongoing government budget cuts continue to slow the economy.

The following graph shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter centered average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

For the following graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Click on graph for larger image.

Click on graph for larger image.

Residential Investment (RI) made a positive contribution to GDP in Q1 for the eight consecutive quarter. Usually residential investment leads the economy, but that didn't happen this time because of the huge overhang of existing inventory, but now RI is contributing.

Equipment and software investment was positve in Q1, however the contribution from nonresidential investment in structures was slightly negative (the three month centered average was still positive). Nonresidential investment in structures typically lags the recovery, however investment in energy and power has masked the ongoing weakness in office, mall and hotel investment (the underlying details will be released next week).

The second graph shows the contribution to percent change in GDP for residential investment and state and local governments since 2005.

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

The blue bars are for residential investment (RI), and RI was a significant drag on GDP for several years. Now RI has added to GDP growth for the last 8 quarters (through Q1 2013).

However the drag from state and local governments is ongoing. I was expecting the drag from state and local governments to end, but this unprecedented and relentless decline in state and local government spending is still a drag on the economy. The good news is the drag has to end soon - in real terms, state and local government spending is back to early 2001 levels.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

Residential Investment as a percent of GDP is up from the record lows during the housing bust. Usually RI bounces back quickly following a recession, but this time there is a wide bottom because of the excess supply of existing vacant housing units. Clearly RI has bottomed, but it still below the levels of previous recessions.

I'll break down Residential Investment (RI) into components after the GDP details are released this coming week. Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

The last graph shows non-residential investment in structures and equipment and software.

The last graph shows non-residential investment in structures and equipment and software.

I'll add details for investment in offices, malls and hotels next week.

The key story is that residential investment is continuing to increase, and I expect this to continue. Since RI is the best leading indicator for the economy, this suggests no recession this year or in 2014 (with the usual caveats about Europe and policy errors in the US).

Final April Consumer Sentiment increases to 76.4

by Calculated Risk on 4/26/2013 09:55:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for April increased to 76.4 from the preliminary reading of 72.3, but down from the March reading of 78.6.

This was above the consensus forecast of 73.0, but still fairly low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, etc).

Sentiment is mostly moving sideways over the last year at a fairly low level (with ups and downs).

Real GDP increased 2.5% Annualized in Q1

by Calculated Risk on 4/26/2013 08:38:00 AM

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.5 percent in the first quarter of 2013 (that is, from the fourth quarter to the first quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 0.4 percent.Personal consumption expenditures (PCE) increased at a 3.2% annualized rate, and residential investment increased 12.6%. However equipment and software increased only 3.0%, and non-residential investment in structures declined slightly.

The increase in real GDP in the first quarter primarily reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, residential investment, and nonresidential fixed investment that were partly offset by negative contributions from federal government spending and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

"Change in private inventories" added 1.03 percentage points to GDP in Q1 (reversing most of the decline last quarter), and the Federal government subtracted 0.65 percentage points (mostly a decrease in defense spending). State and local governments continued to decline.

This was below expectations of a 3.1% growth rate, but domestic demand was decent with PCE and private investment increasing. I'll have more on GDP later ...

Thursday, April 25, 2013

Friday: Q1 GDP

by Calculated Risk on 4/25/2013 08:47:00 PM

An interesting piece from Michelle Meyer at Merrill Lynch: Housing watch: Who are the buyers?

One of the common misconceptions is that the gain in housing demand owes primarily to investors and international buyers. In Q1, investors made up about 22% of sales, which is close to the average since mid-2010. International buyers made up about 2% of sales in Q1, which again matches the historical average over the past three years. Of course, in certain markets investors and international buyers play a bigger role. Investors buy a disproportionate share of distressed properties, making them more relevant in markets with high delinquencies. Similarly, in big cities such as New York, Miami and San Francisco, international buyers account for a much larger share of sales.Meyer argues a large percentage of the cash buyers are not investors.

Primary homebuyers are still the largest share of the market, by far. However, the constraint for primary homebuyers is tight credit conditions. This has resulted in a greater share of all-cash purchases. Over 20% of buyers who are looking to relocate (turnover) and 60% of second home buyers use only cash. First-time homebuyers are still reliant on financing as only 11% of sales are all cash among this cohort. And of course, the most extreme is investors and international buyers where about three-quarters of purchases are all-cash. All together, about a third of sales are made without financing. As credit conditions gradually ease, which we anticipate, the housing market will open to a wider range of buyers, particularly first-time owners.

emphasis added

Friday economic releases:

• At 8:30 AM ET, the BEA will release the advance Q1 GDP report. The consensus is that real GDP increased 3.1% annualized in Q1.

• At 9:55 AM, Reuter's/University of Michigan's Consumer sentiment index (final for April). The consensus is for a reading of 73.0, up from 72.3.

WSJ: "Unemployment Hits New Highs in Spain, France"

by Calculated Risk on 4/25/2013 05:59:00 PM

This is no surprise ... from the WSJ: Unemployment Hits New Highs in Spain, France

The jobless rate in Spain rose sharply to 27.2% of the workforce in the first quarter, the highest level since records began in the 1970s. In France, the number of registered job seekers who are fully unemployed rose to more than 3.2 million, topping a previous record set in 1997.Maybe, just maybe, policymakers in Europe will get the message that the almost singular focus on deficit reduction has been a policy mistake.

...

Last week, the International Monetary Fund joined the U.S. in saying the euro zone should ease up on belt-tightening, arguing it was holding back the global economic recovery and could end up being self-defeating. The head of the European Commission said Monday the policy had "reached its limits."

Zillow: Rate of Home Value Appreciation Slows Nationwide in Q1

by Calculated Risk on 4/25/2013 03:21:00 PM

From Zillow: Rate of Home Value Appreciation Slows Nationwide in Q1, But Pockets of Volatility Remain

Zillow’s first quarter Real Estate Market Reports, released today, show home values increased 0.5% from the fourth quarter of 2012 to the first quarter of 2013 to $157,600. This quarter marks five consecutive quarters of national home value appreciation. On an annual basis, the Zillow Home Value Index (ZHVI) rose 5.1% from March 2012 levels. While home values are still experiencing above normal annual home value appreciation we are seeing signs of deceleration. Monthly appreciation, albeit positive, has been continuously getting smaller, and national home values grew by only 0.1% for the past two months. This does not come as a surprise as appreciation rates have been unsustainable, especially in some of the markets harder hit by the housing recession. ...This report is through Q1, the most recent Case-Shiller release was for January.

According to the Zillow Home Value Forecast (ZHVF), we expect national home values to increase 3.2% over the next year (March 2013 to March 2014).

We are starting to see a little more inventory - probably in response to the recent price increases - and it would make sense that with more inventory, the pace of price increases would slow.

Note: Here are the Zillow Home Value Indexes by city.

Update: CoreLogic acquires Case-Shiller

by Calculated Risk on 4/25/2013 12:52:00 PM

Last night I mentioned that CoreLogic had acquired Case-Shiller house price index, and I wondered if there would be changes to how the index was released. The answer is nothing will change ...

From CoreLogic: CoreLogic Acquires Case-Shiller

CoreLogic® ... announced the acquisition of Case-Shiller® from Fiserv, Inc. ...Only the name (and ownership) has changed.

In addition to the widely recognized Case-Shiller Indexes, CoreLogic will continue to offer its CoreLogic HPI® ... The CoreLogic HPI and the Case-Shiller Indexes are complementary measures of home price trends utilizing the same baseline methodology of repeat home sales.

The Case-Shiller Indexes will be renamed the CoreLogic Case-Shiller Indexes. The S&P/Case-Shiller Home Price Indices will retain their brand name. The CoreLogic HPI, CoreLogic Case-Shiller Indexes, and S&P/Case-Shiller Home Price Indices reports will continue to be published and distributed on their customary time schedules and in their current formats.

Dr. David Stiff, chief economist for Case-Shiller, will continue to supervise the preparation of the CoreLogic Case-Shiller Indexes and comment on the findings of those indexes. Dr. Mark Fleming, chief economist for CoreLogic, will continue to supervise the preparation of the CoreLogic HPI reports and comment on the findings of those reports.

Kansas City Fed: Regional Manufacturing contracted "modestly" in April

by Calculated Risk on 4/25/2013 11:00:00 AM

So far all of the regional manufacturing surveys have indicated April was pretty weak. From the Kansas City Fed: Tenth District Manufacturing Survey Fell Modestly

The Federal Reserve Bank of Kansas City released the April Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity fell by a similar modest amount as last month, and producers' expectations moderated but remained positive overall.The last regional survey for April will be released next Monday (Dallas), and the ISM index for April will be released on Wednesday, May 1st. Based on the regional surveys, I expect a fairly weak reading for the ISM index (perhaps at or below 50).

"We saw another small decline in regional factory activity this month," said Wilkerson. "Some firms see signs of a pickup in activity later this year driven by pent up demand and new product offerings, but others have become more pessimistic recently as anticipated demand has failed to materialize."

The month-over-month composite index was -5 in April, equal to -5 in March but up from -10 in February ... The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Durable goods-producing plants reported a smaller decline in activity, but production at nondurable-goods plants fell after increasing last month, particularly for food and plastics products. Most other month-over-month indexes improved somewhat. The production index edged higher from -1 to 1, and the shipments index also increased, with both indexes moving into positive territory for the first time in 8 months. The employment index rebounded from -15 to -3, and the order backlog index also rose. The new orders and new orders for exports indexes were basically unchanged. Both inventory indexes fell further into negative territory after increasing last month.

Weekly Initial Unemployment Claims decline to 339,000

by Calculated Risk on 4/25/2013 08:35:00 AM

The DOL reports:

In the week ending April 20, the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 16,000 from the previous week's revised figure of 355,000. The 4-week moving average was 357,500, a decrease of 4,500 from the previous week's revised average of 362,000.The previous week was revised up from 352,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 357,500.

Weekly claims were the lowest in six weeks and were below the 350,000 consensus forecast.

Wednesday, April 24, 2013

Thursday: Weekly Unemployment Claims

by Calculated Risk on 4/24/2013 07:50:00 PM

Interesting ... CoreLogic acquires Case-Shiller:

On March 20, 2013, the Company acquired Case-Shiller from Fiserv, Inc. for approximately $6.0 million. Case-Shiller, one of the most widely recognized experts in home price trends and property valuation services, is a highly complementary addition to CoreLogic’s existing residential property insights platform.Currently Case-Shiller is the most followed house price index, but I also use CoreLogic, Zillow and others ... it isn't clear what CoreLogic's plans are with this acquisition (will they release both or just focus on Case-Shiller?)

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 350 thousand from 352 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

• At 11:00 AM, Kansas City Fed regional Manufacturing Survey for April. The consensus is for a reading of minus 1, up from minus 5 in March (below zero is contraction).

Lawler: How Much Has the Single Family Housing Market Shifted to Rentals (in numbers)?

by Calculated Risk on 4/24/2013 04:05:00 PM

From economist Tom Lawler:

While good, reliable, consistent, and timely government data on the housing stock and housing tenure do not exist, the limited data available suggest that over the last few years (1) there has been a sizable increase in the number of SF housing units occupied by renters; (2) a decent-sized decline in the number of SF housing units occupied by owners; and (3) this trend began several years ago, and several years before widely-publicized “institutional” investor buying emerged.

Estimates of the SHARE of SF housing units occupied by owners vs. renters are available from the American Community Survey annually from 2006 through 2011 and biennially from the American Housing Survey through 2011, and “imprecise” estimates of the owner vs. renter share of “one-unit” structures can be derived from the detailed tables of the Housing Vacancy Survey through 2012 – though rental and homeowner vacancy rates for “one-unit” structures in the HVS include not just SF detached and attached homes but also manufactured/mobile homes. All three surveys show a substantial increase in the share of SF/one-units occupied homes occupied by renters from 2007 to 2011, and the HVS data show a continued share increase in 2012. Both the AHS and the HVS, however, appear to overstated significantly overall homeownership rates (based on a comparison to decennial Census results), while the ACS homeownership rates seem more consistent with decennial Census data. As such, I believe the ACS data on the renter share of the SF housing market is superior to the AHS and HVS data.

Click on graph for larger image.

Click on graph for larger image.

Note: The estimate for 2012 is based on the 2012 vs. 2011 change in the HVS estimate of the renter share of occupied “one-unit” structures.

Translating the ACS share data to numbers, however, requires a little work. First, the numbers for households in the annual ACS results are “benchmarked” to the latest available housing stock estimate for that year, and there have been significant upward revisions in housing stock estimates. Second, the latest available “official” housing stock estimates do not incorporate post-Census analyses of the estimated “undercount” of housing units in the “official” Census numbers. And finally, the ACS appears to overstate the overall housing vacancy rate, though by less than the HVS or AHS. Unfortunately, adjusted for this last factor is difficult, since the degree of the vacancy rate “overstatement” is only available for 2010. As such, I only adjusted the ACS estimates for more reasonable estimates of the housing stock (incorporating the Census 2000 HUCS and the Census 2010 CCM).

Making this adjustment, and using estimates for the 2012 ACS data based on HVS results, it would appear that from 2007 to 2012 the number of SF detached and attached homes that were occupied by renters increased by about 2.6 million, while the number of SF detached and attached homes that were occupied by owners declined by about 1.3 million. The largest increase in both the number and the share of renter-occupied SF homes appears to have been in 2009.

Since “active” investor buying of SF homes that were then rented out has been going on for many years, why has the media only recently begun to focus intently on this “trend?

First, investor buying in earlier years occurred when for-sale inventories (and REO inventories) and the pace of foreclosure were high, the economy in general and labor markets in particular were extremely weak, and there were no signs either of a housing “recovery” or improving home prices. Second, last year a number of large institutional firms very publicly announced plans to ramp up purchases of SF homes as rental properties. Third, their ramped-up buying came when overall inventories of existing home for sale, and especially “distressed”/REO properties for sale, had fallen sharply, as well as when an improved economy and record-low mortgage rates were producing a modest increase in potential demand from folks wanting to buy a home to live in. (Folks love anecdotal stories about how investors are “out-bidding” or “crowding out” first-time home buyers!)

And finally, their (and other) aggressive buying in the face of sharply lower inventories (large institutional investors appear to have lower “hurdle rates” than “traditional” investors) has helped fuel a significant recovery in home prices in many parts of the country (oh my, more “de-stickification!”)

| All-Cash Share of Home Sales (Yearly Totals) | |||||||

|---|---|---|---|---|---|---|---|

| Phoenix | Tucson | California* | Florida SF | Florida C/TH | Knoxville | Omaha | |

| 2007 | 11.6% | 12.6% | 10.3% | N/A | N/A | 12.4% | N/A |

| 2008 | 12.6% | 18.8% | 18.7% | 25.5% | 43.6% | 15.2% | 12.1% |

| 2009 | 37.2% | 23.9% | 26.3% | 36.8% | 64.0% | 17.8% | 11.8% |

| 2010 | 41.8% | 28.3% | 28.0% | 42.3% | 73.2% | 22.1% | 16.7% |

| 2011 | 46.9% | 34.6% | 30.4% | 45.5% | 76.6% | 24.5% | 20.2% |

| 2012 | 46.0% | 34.4% | 32.6% | 45.7% | 75.6% | 26.6% | 17.6% |

| *Derived from Dataquick chart; new and resale homes based on property records, all others MLS based. | |||||||

In 2010 there were 141,722 MLS-based home sales (SF and C/TH) in Florida that were all-cash transactions, while there were 79,779 foreclosure sales and 53,780 short sales. In 2012 there were 54,607 foreclosure sales and 63,250 short sales (or 117,867 “distressed” sales, down 15,692 from 2010), but all-cash transactions increased by 28,647 to 170,369.

From 2009 to 2012 MLS-based home sales in Florida increased by 24.2%. All-cash transactions increased by 54.1%, while mortgage-financed transactions were very slightly LOWER in 2012 compared to 2009.

April Vehicle Sales forecast to be above 15 million SAAR for Sixth Consecutive Month

by Calculated Risk on 4/24/2013 01:16:00 PM

Note: The automakers will report April vehicle sales on Wednesday, May 1st. Here are a couple of forecasts:

From J.D. Power: J.D. Power and LMC Automotive Report: Solid New-Vehicle Selling Rate in April Driven by Replacement Demand

Total light-vehicle sales in April 2013 are projected to reach 1,312,100 units, a 7 percent increase from April 2012. The selling rate is expected to remain above 15 million units for the sixth consecutive month [forecast is 15.2 million Seasonally Adjusted Annual Rate, SAAR].And from Kelley Blue Book: New-Car Sales Pace Above 15 Million Seasonally Adjusted Annual Rate for Sixth Consecutive Month

...

According to J.D. Power and Associates PIN data, strong sales are being complemented by increasing prices. When comparing year-to-date data for 2013 with the same period last year, consumer-facing transaction prices are up 3.1 percent, which equates to an extra $13.2 billion spent on new vehicles through the first 4 months of the year ($113 billion in total).

Through the first three weeks of April 2013, new-car sales are on pace to remain above a 15 million unit annual selling pace for the sixth consecutive month, according to Kelley Blue Book ... Kelley Blue Book projects light vehicle sales to surpass 1.3 million units by month end, which is an 11.4 percent annual gain.Note: In 2012, there were 1.18 million light vehicle sales in April or a 14.1 million SAAR. This year sales will probably be above 1.3 million, however there is one extra selling day in this year.

Two key points: 1) sales growth will slow in 2013, and 2) it appears auto sales are still solid in April (no signs of a consumer slowdown).

Most forecasts were for auto sales growth to slow in 2013 to around 4% growth or 15.0 million units. Based on the first several months of 2013, it appears sales will be somewhat stronger than expected this year, but not double digit growth like the last few years. This suggests auto sales will contribute less to GDP growth this year than in the previous three years.

| Light Vehicle Sales | ||

|---|---|---|

| Sales (millions) | Annual Change | |

| 2005 | 16.9 | 0.5% |

| 2006 | 16.5 | -2.6% |

| 2007 | 16.1 | -2.5% |

| 2008 | 13.2 | -18.0% |

| 2009 | 10.4 | -21.2% |

| 2010 | 11.6 | 11.1% |

| 2011 | 12.7 | 10.2% |

| 2012 | 14.4 | 13.4% |

| 20131 | 15.2 | 5.3% |

| 1Current sales rate | ||

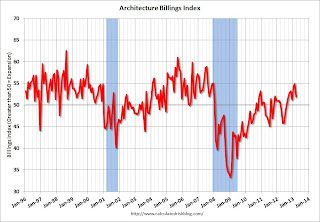

AIA: Architecture Billings Index indicates increasing demand for design services in March

by Calculated Risk on 4/24/2013 09:47:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: More Positive Momentum for Architecture Billings

The Architecture Billings Index (ABI) is reflecting a steady upturn in design activity. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 51.9, down from a mark of 54.9 in February. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.1, down from the reading of 64.8 the previous month.

“Business conditions in the construction industry have generally been improving over the last several months,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But as we have continued to report, the recovery has been uneven across the major construction sectors so it’s not a big surprise that there was some easing in the pace of growth in March compared to previous months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in February, down from 54.9 in February. Anything above 50 indicates expansion in demand for architects' services, and this was the eight consecutive month with a reading above 50.

Every building sector is now expanding and new project inquiries are strongly positive (down from February, but still at 60.1). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index suggests some increase in CRE investment in the second half of 2013.

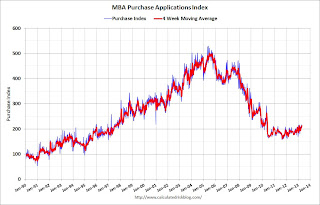

MBA: Mortgage Applications Increase, Purchase Index highest since May 2010

by Calculated Risk on 4/24/2013 08:41:00 AM

From the MBA: Mortgage Applications Increase Slightly in Latest MBA Weekly Survey

The Refinance Index increased 0.3 percent from the previous week. The seasonally adjusted Purchase Index increased 0.3 percent from one week earlier to the highest level since May 2010.

...

The HARP share of refinance applications increased from 31 percent last week to 32 percent this week, the highest level since MBA began tracking HARP applications in February 2012.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.65 percent from 3.67 percent, with points decreasing to 0.41 from 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

According to the MBA, the HARP program is contributing significant to the current level of refis.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

Tuesday, April 23, 2013

Wednesday: Durable Goods, Architecture Billings Index

by Calculated Risk on 4/23/2013 09:22:00 PM

Some more data released today ... A house price index up sharply, another regional manufacturing survey indicating weakness, and the overall economy continue to expand ... a familiar story ...

From the FHFA: House Price Index Up 0.7 Percent in February

U.S. house prices rose 0.7 percent on a seasonally adjusted basis from January to February, according to the Federal Housing Finance Agency’s monthly House Price Index (HPI). For the 12 months ending in February, U.S. house prices rose 7.1 percent.From the Richmond Fed: Manufacturing Activity Pulled Back in April; Expectations Waned

In April, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — lost nine points, settling at −6 from March's reading of 3. Among the index's components, shipments fell seventeen points to −9, the gauge for new orders moved down four points to end at−8, and the jobs index subtracted six points to end at 3.And state coincident indexes from the Philly fed:

...

Hiring activity at Fifth District plants was mixed in April. The manufacturing employment index moved down six points to 3 and the average workweek indicator lost thirteen points to end at −3. In contrast, the wage index gained eight points to finish at 12.

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2013. In the past month, the indexes increased in 47 states and remained stable in three (New Mexico, Nevada, and Wyoming), for a one-month diffusion index of 94. Over the past three months, the indexes increased in 47 states, decreased in one (Illinois), and remained stable in two (Hawaii and New Mexico), for a three-month diffusion index of 92.Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for March from the Census Bureau. The consensus is for a 2.8% decrease in durable goods orders.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

ATA Trucking Index increases in March

by Calculated Risk on 4/23/2013 04:59:00 PM

This is a minor indicator that I follow.

From ATA: ATA Truck Tonnage Index Increased 0.9% in March

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index gained 0.9% in March after decreasing 0.7% in February. (The 0.7% loss in February was revised down from a 0.6% increase ATA reported on March 19, 2013.) Tonnage has now increased in four of the last five months. Specifically, since November 2012, the index is up 7.6%. In March, the SA index equaled 123.5 (2000=100) versus 122.3 in February. The highest level on record was December 2011 at 124.3. Compared with March 2012, the SA index was up a solid 3.8%, beating February’s 3.1% year-over-year gain.Note from ATA:

“Fitting with the expectation for solid gross domestic product growth in the first quarter, tonnage was strong in March and the quarter overall,” ATA Chief Economist Bob Costello said. “At 3.9% year-over-year growth, the first quarter increase was the best since the final quarter 2011.

“Expect freight tonnage will slow in the months ahead as the federal government sequester continues and households finish spending their tax returns,” he said. “The good news for tonnage is housing starts are growing and energy production is good – both of which generates heavy freight. However, these two sectors alone won’t be enough to keep the overall index growing at a 3.9% clip in the second quarter.”

emphasis added

Trucking serves as a barometer of the U.S. economy, representing 67% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 9.2 billion tons of freight in 2011. Motor carriers collected $603.9 billion, or 80.9% of total revenue earned by all transport modes.

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is fairly noisy, but is up solidly year-over-year.

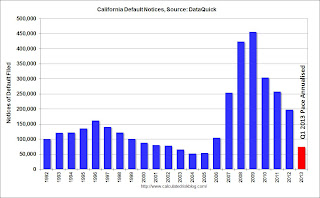

DataQuick: Q1 California Foreclosure Starts Lowest Since Late 2005

by Calculated Risk on 4/23/2013 02:14:00 PM

From DataQuick: Golden State Foreclosure Starts Lowest Since Late 2005

The number of California homeowners entering the foreclosure process plunged to the lowest level in more than seven years last quarter. The unusually sharp drop in the number of mortgage default notices filed by lenders stems mainly from rising home values, a strengthening economy and government efforts to reduce foreclosures, a real estate information service reported.

During first-quarter 2013 lenders recorded 18,567 Notices of Default (NoDs) on California houses and condos. That was down 51.4 percent from 38,212 during the prior three months, and down 67.0 percent from 56,258 in first-quarter 2012, according to San Diego-based DataQuick.

Last quarter's number was the lowest since 15,337 NoDs were recorded in fourth-quarter 2005. NoDs peaked in first-quarter 2009 at 135,431. DataQuick's NoD statistics go back to 1992.

"Foreclosure starts were already trending much lower late last year because of rising home prices, a stronger labor market and the settlement agreement between the government and some lenders. But it appears last quarter's drop was especially sharp because of a package of new state foreclosure laws - the 'Homeowner Bill of Rights' - that took effect January 1. Default notices fell off a cliff in January, then edged up. In recent years we've seen temporary lulls in foreclosure activity after new laws kick in and lenders adjust. It's certainly possible foreclosure starts will pick up at some point this year if lenders need to play a lot of catch-up," said John Walsh, DataQuick president.

...

Lenders' shift toward short sales as a foreclosure alternative has helped lower foreclosure activity in recent years. Short sales - transactions where the sale price fell short of what was owed on the property - made up an estimated 20.2 percent of the state's resale market last quarter. That was down from an estimated 24.2 percent the prior quarter and 24.8 percent a year earlier. However, the estimated number (rather than percentage) of short sales last quarter dipped just 1.5 percent from first-quarter 2012.

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of Notices of Default (NoD) filed in California each year. For 2013 (red), the bar is the Q1 rate annualized.

As John Walsh noted, the California "Homeowner Bill of Rights" slowed foreclosure activity in Q1, but the trend was already down - and this will probably be the lowest year for foreclosure starts since 2005.

A few comments on New Home Sales

by Calculated Risk on 4/23/2013 12:41:00 PM

Now that we have three months of data for 2013, one way to look at the growth rate is to use the "not seasonally adjusted" (NSA) year-to-date data.

According to the Census Bureau, there were 104 thousand new homes sold in Q1 2013, up about 19.5% from the 87 thousand sold in Q1 2012. That is a solid increase in sales, and this was the highest sales for Q1 since 2008.

Note: For 2013, estimates are sales will increase to around 450 to 460 thousand, or an increase of around 22% to 25% on an annual basis from the 369 thousand in 2012.

Although there has been a large increase in the sales rate, sales are still near the lows for previous recessions. This suggest significant upside over the next few years. Based on estimates of household formation and demographics, I expect sales to increase to 750 to 800 thousand over the next several years. Also housing is historically the best leading indicator for the economy, and this is one of the reasons I think The future's so bright, I gotta wear shades.

And here is another update to the "distressing gap" graph that I first started posting over four years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to start to close over the next few years.

Click on graph for larger image.

Click on graph for larger image.

The "distressing gap" graph shows existing home sales (left axis) and new home sales (right axis) through March 2013. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales kept existing home sales elevated, and depressed new home sales since builders weren't able to compete with the low prices of all the foreclosed properties.

I don't expect much of an increase in existing home sales (distressed sales will slowly decline and be offset by more conventional sales). But I do expect this gap to close - mostly from an increase in new home sales.

Another way to look at this is a ratio of existing to new home sales.

Another way to look at this is a ratio of existing to new home sales.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down, and I expect this ratio to trend down over the next several years as the number of distressed sales declines and new home sales increase.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales at 417,000 SAAR in March

by Calculated Risk on 4/23/2013 10:00:00 AM

The Census Bureau reports New Home Sales in March were at a seasonally adjusted annual rate (SAAR) of 417 thousand. This was up from 411 thousand SAAR in February.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

"Sales of new single-family houses in March 2013 were at a seasonally adjusted annual rate of 417,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent above the revised February rate of 411,000 and is 18.5 percent above the March 2012 estimate of 352,000."

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

The months of supply was unchanged in March at 4.4 months.

The all time record was 12.1 months of supply in January 2009.

This is now in the normal range (less than 6 months supply is normal).

This is now in the normal range (less than 6 months supply is normal)."The seasonally adjusted estimate of new houses for sale at the end of March was 153,000. This represents a supply of 4.4 months at the current sales rate."On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale is just above the record low. The combined total of completed and under construction is also just above the record low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In March 2013 (red column), 40 thousand new homes were sold (NSA). Last year 34 thousand homes were sold in March. This was the seventh weakest March since this data has been tracked. The high for March was 127 thousand in 2005, and the low for March was 28 thousand in 2011.

This was at expectations of 419,000 sales in March, and a fairly solid report. I'll have more soon ...