by Calculated Risk on 4/24/2013 09:47:00 AM

Wednesday, April 24, 2013

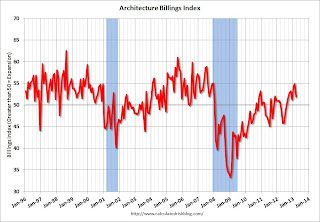

AIA: Architecture Billings Index indicates increasing demand for design services in March

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: More Positive Momentum for Architecture Billings

The Architecture Billings Index (ABI) is reflecting a steady upturn in design activity. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the March ABI score was 51.9, down from a mark of 54.9 in February. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.1, down from the reading of 64.8 the previous month.

“Business conditions in the construction industry have generally been improving over the last several months,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “But as we have continued to report, the recovery has been uneven across the major construction sectors so it’s not a big surprise that there was some easing in the pace of growth in March compared to previous months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.9 in February, down from 54.9 in February. Anything above 50 indicates expansion in demand for architects' services, and this was the eight consecutive month with a reading above 50.

Every building sector is now expanding and new project inquiries are strongly positive (down from February, but still at 60.1). Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index suggests some increase in CRE investment in the second half of 2013.