by Calculated Risk on 4/18/2013 04:36:00 PM

Thursday, April 18, 2013

NMHC Apartment Survey: Market Conditions Tighten in April

From the National Multi Housing Council (NMHC): Apartment Markets Resume Growth According to NMHC Survey

Apartment markets improved across all areas according to the National Multi Housing Council’s (NMHC) April Quarterly Survey of Apartment Market Conditions. All four indexes – Market Tightness (54), Sales Volume (55), Equity Financing (56) and Debt Financing (59) – came in above 50, which indicates improving conditions. This reverses last January’s findings, where Market Tightness and Sales Volume dipped below 50 for the first time since 2010.

“The apartment industry is operating on cruise control, as the expansion continues unabated,” said Mark Obrinsky, NMHC’s Vice President for Research and Chief Economist. “While concern about overbuilding has begun to crop up, demand for apartment residences remains strong. New construction may have finally recovered fully, but most units under construction won’t be delivered until 2014 or later. The dearth of recent completions has contributed to relatively low product availability. As deliveries increase, we expect to see an even greater pick-up in sales volume.”

...

Market Tightness Index rose to 54 from 45. The index has been above 50 for 12 of the past 13 quarters, with only January 2013 indicating contraction. One quarter of respondents saw markets as tighter, up from 16 percent last quarter.

emphasis added

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tightening from the previous quarter. This quarterly increase was small, but indicates tighter market conditions.

On supply: Even though multifamily starts have been increasing, completions lag starts by about a year - so the builders are still trying to catch up. There will be many more completions in 2013 and 2014, than in 2012, increasing the supply.

As I've mentioned before, this index helped me call the bottom for effective rents (and the top for the vacancy rate) early in 2010. This survey now suggests vacancy rates might be nearing a bottom, although apartment markets are still tight, so rents will probably continue to increase.

Fed's Raskin: Low- and middle-income households hit hardest by Great Recession

by Calculated Risk on 4/18/2013 03:30:00 PM

From Fed Governor Sarah Bloom Raskin: Aspects of Inequality in the Recent Business Cycle. A few excerpts:

To isolate my proper subject here, I want to be clear that I am not engaging this afternoon with the concern that many Americans have that excessive inequality undermines American ideals and values. Nor will I be investigating the social costs associated with wide distributions of income and wealth. Rather, I want to zero in on the question of whether inequality itself is undermining our country's economic strength according to available macroeconomic indicators.This is an important topic - and Raskin argues that low and middle income households suffered the most during the Great Recession (continuing a long term trend).

...

I will argue that at the start of this recession, an unusually large number of low- and middle-income households were vulnerable to exactly the types of shocks that sparked the financial crisis. These households, which had endured 30 years of very sluggish real-wage growth, held an unusually large share of their wealth in housing, much of it financed with debt. As a result, over time, their exposure to house prices had increased dramatically. Thus, as in past recessions, suffering in the Great Recession--though widespread--was most painful and most perilous for low- and middle-income households, which were also more likely to be affected by job loss and had little wealth to fall back on.

Moreover, I am persuaded that because of how hard these lower- and middle-income households were hit, the recession was worse and the recovery has been weaker. The recovery has also been hampered by a continuation of longer-term trends that have reduced employment prospects for those at the lower end of the income distribution and produced weak wage growth.

...

[I]t is also relevant to consider whether the unusual circumstances--the outsized role of housing wealth in the portfolios of low- and middle-income households, the increased use of debt during the boom, and the subsequent unprecedented shocks to the housing market--may have attenuated the effectiveness of monetary policy during the depths of the recession. Households that have been through foreclosure or have underwater mortgages or are otherwise credit constrained are less able than other households to take advantage of the lower interest rates, either for homebuying or other purposes. In my view, these effects likely clogged some of the channels through which monetary policy traditionally works. As the housing market recovers, though, I think it is possible that accommodative monetary policy could be increasingly potent. As house prices rise, more and more households have enough home equity to gain renewed access to mortgage credit and the ability to refinance their homes at lower rates. The staff at the Federal Reserve Board has estimated that house price increases of 10 percent or less from current levels would be sufficient for about 40 percent of underwater homeowners to regain positive equity.

It is my view that understanding the long-run trends in income and wealth across different households is important in understanding the dynamics of the macroeconomy and thus also may be relevant for setting monetary policy to best reach our goals of maximum employment and price stability. I believe that the accommodative policies of the FOMC and the concerted effort we have made to ease conditions in the mortgage markets will help the economy continue to gain traction. And the resulting expansion in employment will likely improve income levels at the bottom of the distribution. However, given the long-standing trends toward greater income and wealth inequalities, it is unlikely that cyclical improvements in the labor markets will do much to reverse these trends.

CoStar: Commercial Real Estate prices up 5.1% Year-over-year in February

by Calculated Risk on 4/18/2013 01:09:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Pricing Recovery for Commercial Property Continues in February Despite Seasonal Volatility

PRICING RECOVERY CONTINUES DESPITE SEASONAL VOLATILITY: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted U.S. Composite Index and the equal-weighted U.S. Composite Index—dipped by 0.7% and 1.4%, respectively, in the month of February 2013, reflecting a continuation of a seasonal pattern first observed in January, in which commercial real estate prices gave back some of the pricing gains from the surge in sales activity at the close of 2012. Despite the recent seasonal dip in activity, commercial real estate prices are still up significantly from year ago levels. The equal-weighted index increased 6.0% since February 2012, while value-weighted index expanded by 5.1% during the same period.

ABSORPTION POSTS SOLID GAINS IN THE FIRST QUARTER: The relative performance of the General Commercial and Investment Grade indices is tied to market fundamentals. Net absorption of available space for the three major property types – office, retail, and industrial – has been positive over the past three years. However, for the majority of that period, absorption has been stronger among properties in the Investment Grade segment as reflected by the faster pricing growth in this index since 2009. More recently though, the General Commercial segment has posted more robust gains in absorption as well, indicating a broader and more sustained commercial real estate recovery.

DISTRESS SALES DECLINE WITH IMPROVING FUNDAMENTALS: The percentage of commercial property selling at distressed prices dropped to 15.9% in February 2013 from over 18% for the previous month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 36.7% from the bottom (showing the demand for higher end properties) and up 5.1% year-over-year. However the Equal-Weighted index is only up 7.1% from the bottom, and up 6.0% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Philly Fed Manufacturing Survey Shows Slower Expansion in April

by Calculated Risk on 4/18/2013 10:09:00 AM

From the Philly Fed: April Manufacturing Survey

Manufacturers responding to the Business Outlook Survey reported near steady business activity in April. The indicator for overall activity remained slightly positive this month, but other broad indicators were mixed. Indicators for new orders and employment were weaker this month. The survey's broad indicators of future activity suggest that firms expect continued growth, but optimism waned compared with last month.Earlier in the week, the Empire State manufacturing survey also indicated slower expansion in April.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, was 1.3, just slightly lower than the reading of 2.0 in March ... The demand for manufactured goods remained weak, with the current new orders index declining from 0.5 to -1.0.

Labor market conditions showed continued signs of weakness, with indexes suggesting lower employment overall. The employment index decreased from 2.7 in March to -6.8 this month, its first negative reading in three months.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys decreased in April, but remained positive for the 2nd consecutive month after indicating contraction for 9 straight months. This suggests the ISM manufacturing index will show further expansion in April.

Weekly Initial Unemployment Claims increase to 352,000

by Calculated Risk on 4/18/2013 08:35:00 AM

The DOL reports:

In the week ending April 13, the advance figure for seasonally adjusted initial claims was 352,000, an increase of 4,000 from the previous week's revised figure of 348,000. The 4-week moving average was 361,250, an increase of 2,750 from the previous week's revised average of 358,500.The previous week was revised up from 346,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 361,250 - the highest level since January.

Weekly claims were above the 347,000 consensus forecast.

Wednesday, April 17, 2013

Thursday: Weekly Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 4/17/2013 09:07:00 PM

Oh my ... from the NY Times DealBook: Mortgage Relief Checks Go Out, Only to Bounce

The first round of the settlement checks were mailed last week. In recent days, problems arose at Rust Consulting, a firm chosen to distribute the checks, people briefed on the matter said. After collecting the $3.6 billion from the banks, these people said, Rust failed to move the money into a central account at Huntington National Bank in Ohio, the bank that issued the checks to homeowners.I think this fits, Stephen Colbert on smoking pot: "If kids want to grow up, break the law, and not suffer any consequences ... they should go into banking!"

...

“It’s the perfect ending for such a debacle,” said Michael Redman, a paralegal who runs 4closurefraud.org ...

Thursday economic releases:

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 347 thousand from 346 thousand last week. The "sequester" budget cuts might be starting to impact weekly claims.

• At 10:00 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of minus 3.3, up from 2.0 last month (above zero indicates expansion).

• At 1:00 PM, Speech by Fed Governor Sarah Bloom Raskin, Reflections on Inequality and the Recent Business Cycle, At the 22nd Annual Hyman P. Minsky Conference on the State of the U.S. and World Economies, New York, New York

Lawler: Early Look at Existing Home Sales in March

by Calculated Risk on 4/17/2013 04:03:00 PM

From housing economist Tom Lawler:

Based on the limited amount of local realtor reports I’ve seen, I estimate that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of about 4.89 million in March, down from February’s preliminary seasonally adjusted pace, and up 9.6% from last March’s seasonally adjusted pace. I estimated that unadjusted sales last month were up 6.3% from last March, and that the lower day count will result in a lower seasonal factor this March vs. last March.

I should note that even after getting many of the late realtor reports for February, my methodology shows a smaller YOY increase in unadjusted existing home sales than that shown in last month’s NAR report – suggesting either an “issue” with my methodology or an “issue” with the NAR’s February report.

Based on the wide sample of realtor reports I have for February, I would have estimated that unadjusted existing home sales this February were about 4.4% higher than last February’s pace. The NAR, in contrast, reported a YOY gain of 6.3% -- with existing SF home sales showing a YOY increase of 4.4% but existing condo/co-op sales showing a puzzling high YOY gain of 20.0%, with condo sales in the South showing a YOY increase of 29.4%. In addition, the NAR reported a monthly increase in the inventory of existing condos/coops for sale of 33.5%, driven by reported “months’ supply” combined with the huge jump in sales. These condo/coop sales and inventory numbers seem “off” to me, but I might be off as well.

CR Note: The NAR will report March existing home sales next Monday, April 22nd.

Fed's Beige Book: Economic activity expanded at "moderate" pace

by Calculated Risk on 4/17/2013 02:00:00 PM

Fed's Beige Book "Prepared at the Federal Reserve Bank of Dallas based on information collected on or before April 5, 2013."

Reports from the twelve Federal Reserve Districts suggest overall economic activity expanded at a moderate pace during the reporting period from late February to early April. ...And on real estate:

Most Districts noted increases in manufacturing activity since the previous report. Particular strength was seen in industries tied to residential construction and automobiles, while several Districts reported uncertainty or weakness in defense-related sectors. Consumer spending grew modestly, and firms in some Districts cited higher gasoline prices, expiration of the payroll tax cut, and winter weather as factors restraining sales growth. Retailers in several Districts expect continued sales growth in the near term.

Residential real estate activity continued to improve in most Districts, and some Districts, including Cleveland, Richmond, Chicago, Minneapolis, Kansas City, Dallas, and San Francisco, noted increased momentum since the last report. The New York District, in particular, noted especially strong improvement in residential real estate—both in for-sale housing and apartment markets.Residential real estate "continued to improve" and this was the most positive comment on commercial real estate in some time (but any "improvement" for commercial is from a very low level). This suggests moderate growth overall ...

Home sales continued to rise in most Districts. Although homebuyer demand was high in the Boston District, low home inventories were restraining sales, keeping growth modest. Home sales were reportedly strong in both the Atlanta and Dallas Districts. The Richmond District noted low inventories were pushing up contracts to well above listing prices, and the Boston and New York Districts said multiple bids on properties have become more common. Tight inventories and strong sales led to rising home prices in many Districts, including Atlanta, Minneapolis, Kansas City, Dallas, and San Francisco. Within the New York District, condo sales volumes strengthened and low inventories have begun to drive up selling prices in New York City and surrounding areas, while New Jersey home prices were rising modestly and inventories were shrinking with a marked reduction in the number of distressed properties. Contacts in the Boston District also noted a decline in the stock of distressed properties.

New home construction continued to pick up in most Districts, although the Richmond District said that a low supply of residential building materials had stalled construction. ...

Commercial real estate and construction activity improved in most Districts. Office vacancy rates declined in the Boston District and contacts said the construction of mixed-use projects was picking up. The New York District reported that office vacancy rates continued to decline and rents rose in Manhattan.

LA area Port Traffic decreases year-over-year in March

by Calculated Risk on 4/17/2013 10:12:00 AM

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for March since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic was up 2% in March, and outbound traffic down slightly, compared to the rolling 12 months ending in February.

In general, inbound traffic has been increasing slightly recently, and outbound traffic has been mostly moving sideways.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March.

Sometimes the sharp seasonal decline happens in February, sometimes in March depending on the timing of the Chinese New Year. This year the sharp seasonal decline happened in March.

My guess is this suggests a decrease in the trade deficit with Asia for March.

MBA: Mortgage Applications Increase, Purchase Index highest since May 2010

by Calculated Risk on 4/17/2013 08:44:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 5 percent from the previous week and is at its highest level since mid-January of 2013. The seasonally adjusted Purchase Index increased 4 percent from one week earlier is at its highest level since May of 2010 and the adjusted Conventional Purchase Index increased 3 percent to the highest level since October 2009.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 3.67 percent from 3.68 percent, with points increasing to 0.50 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 3.77 percent from 3.79 percent, with points decreasing to 0.27 from 0.36 (including the origination fee) for 80 percent LTV loans.

emphasis added

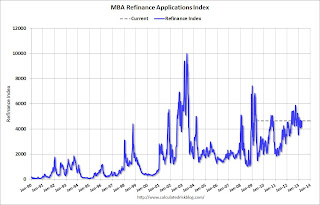

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

There has been a sustained refinance boom for over a year.

However refinance activity will probably slow in 2013.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the purchase index last week was at the highest level since May 2010.

Tuesday, April 16, 2013

Wednesday: Beige Book, Mortgage Applications

by Calculated Risk on 4/16/2013 08:23:00 PM

Another Spring slowdown?

From Tim Duy at EconomistsView Fed Watch: Another Spring Slowdown?

On net, I think the data is telling us a familiar story: The positives in the US economy are difficult to ignore. Housing starts are a very good indicator of the direction of the economy, and that direction appears to be up. But it doesn't pay to get too carried away with any one quarter's worth of data. Underlying growth has been slow and steady since the end of the recession, with positive quarters offset by negative quarters. And the impact of tighter fiscal policy looks likely to produce a similar trend this year. The light at the end of the tunnel, however, is that as the fiscal effect fades toward the end of this year and into next, activity could finally see a more of the sustained improvement we have been looking for.From Ylan Q. Mui at the WaPo: Spring is a season of growth — but not for the U.S. economy

But, at the moment, that sustained improvement looks ephemeral. That is the message of the bond market as yields plunged back to the 1.7 percent range since the beginning of the year. And the beat-down of commodity prices indicates nervousness on the global outlook as well. If I was a monetary policymaker, I would be paying attention, especially as the inflation numbers are not telling us that imminent tightening is necessary ...

For the third year in a row, the nation’s economic recovery seems to be petering out just as temperatures start to go up. Hiring has dropped off. Shoppers are putting away their wallets. Government spending cuts are looming.I think seasonal adjustments played a role in earlier slowdowns (as did the tsunami in Japan and the problems in Europe), but I think this slowdown is mostly related to fiscal tightening (mostly the payroll tax hike and the sequestration budget cuts). As Tim Duy notes, the fiscal effect should fade towards the end of this year.

That has fueled predictions of an abrupt slowdown over the next few months. Economists are forecasting tepid growth of just over 1 percent during the second quarter of the year.

...

No one seems to have a good explanation for why the recovery has taken a nosedive around the same time each year. ... At first, economists wondered whether the problem was purely technical. The 2008 financial crisis upended mathematical models for how many people are hired and fired on a normal basis, resulting, they hypothesized, in artificial boosts in the fall that evaporated by spring.

But that explanation for the swoon was almost too easy — and certainly too optimistic. It turns out the trouble lay not in the data but in the real world.

In 2011, the problem was international. A tsunami in Japan coincided with a financial crisis in Europe that pushed Greece into default and almost caused a collapse of the continent’s common currency. Last year, economists blamed the weather. The mild winter, they said, siphoned away traditional springtime jobs.

This year, all fingers are pointed at Washington.

Wednesday economic releases:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts. Analysts will look for signs of a slow down.

Lawler: Updated Table of Short Sales and Foreclosures for Selected Cities in March

by Calculated Risk on 4/16/2013 04:33:00 PM

Economist Tom Lawler sent me the updated table below of short sales and foreclosures for several selected cities in March.

Look at the right two columns in the table below (Total "Distressed" Share for March 2013 compared to March 2012). In every area that has reported distressed sales so far, the share of distressed sales is down year-over-year - and down significantly in many areas.

This is worth repeating: Imagine that the number of total existing home sales doesn't change or even declines over the next year - some people would argue that is "bad" news and the housing market isn't recovering. But also imagine that the share of distressed sales declines sharply, and conventional sales increase significantly. That would be a positive sign - and that is what is now happening.

I think the two keys for existing housing are active inventory and the number of conventional sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Mar | 12-Mar | 13-Mar | 12-Mar | 13-Mar | 12-Mar | |

| Las Vegas | 33.3% | 26.6% | 11.2% | 40.7% | 44.5% | 67.3% |

| Reno | 32.0% | 34.0% | 9.0% | 32.0% | 41.0% | 66.0% |

| Phoenix | 15.1% | 25.7% | 11.6% | 21.1% | 26.8% | 46.8% |

| Sacramento | 27.0% | 29.0% | 10.5% | 30.7% | 37.5% | 59.7% |

| Minneapolis | 9.3% | 12.4% | 28.6% | 36.5% | 37.9% | 48.9% |

| Mid-Atlantic (MRIS) | 11.4% | 13.2% | 10.7% | 14.7% | 22.1% | 27.9% |

| Orlando | 21.7% | 33.1% | 21.3% | 26.0% | 43.1% | 59.2% |

| Hampton Roads | 28.4% | 33.5% | ||||

| Northeast Florida | 40.0% | 43.2% | ||||

| Chicago | 43.0% | 46.0% | ||||

| Charlotte | 12.3% | 15.8% | ||||

| Metro Detroit | 35.4% | 46.6% | ||||

| Memphis* | 26.8% | 32.7% | ||||

| *share of existing home sales, based on property records | ||||||

A few comments on Housing Starts

by Calculated Risk on 4/16/2013 02:50:00 PM

A few comments:

• Total housing starts in March were up 46.7% from the March 2012 pace, although some of that increase was due to a surge in multi-family starts in March (Multi-family starts are volatile month-to-month). Single family starts were up 28.7%. That is a very strong year-over-year increase.

• Even with this significant increase, housing starts are still very low. Starts averaged 1.5 million per year from 1959 through 2000, and demographics and household formation suggests starts will return to close to that level over the next few years. That means starts will probably increase 50% or so from the current level (1.036 million SAAR in March).

• There is some concern that multi-family starts are now too high. That is possible, especially considering all the units currently under construction and not yet completed. However single family starts are still near record lows, and most of the future increase in starts will probably be from single family starts.

• Residential investment and housing starts are usually the best leading indicator for economy. Nothing is foolproof as a leading indicator, but this suggests the economy will continue to grow over the next couple of years.

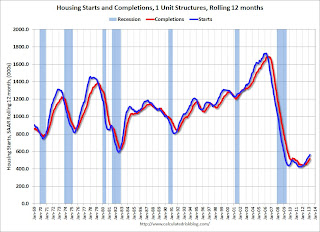

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries this year. The level of multi-family starts over the last 12 months - almost to the level in late '90s and early 00's - suggests that future growth in starts will mostly come from single family starts.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

Starts are moving up and completions are following. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units.

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Key Measures show low inflation in March

by Calculated Risk on 4/16/2013 11:18:00 AM

Note: Researchers at the Cleveland Fed recently wrote a post about the usefulness of median CPI: Forecasting Inflation? Target the Middle.

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.1% (1.1% annualized rate) in March. The 16% trimmed-mean Consumer Price Index rose 0.1% (0.7% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for March here. Motor fuel declined at a 40% annualized rate in March following the huge increase in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers fell 0.2% (-2.2% annualized rate) in March. The CPI less food and energy increased 0.1% (1.3% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.7%, and the CPI less food and energy rose 1.9%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 1.1% annualized, trimmed-mean CPI was at 0.7% annualized, and core CPI increased 1.3% annualized. Also core PCE for February increased 0.7% annualized.

With this low level of inflation and the current high level of unemployment, I expect the Fed will continue the large scale asset purchases (QE) at the current level.

Fed: Industrial Production increased 0.4% in March

by Calculated Risk on 4/16/2013 09:32:00 AM

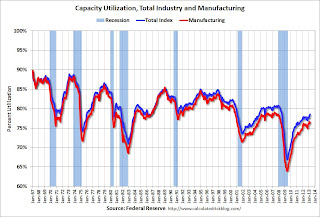

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.4 percent in March after having increased 1.1 percent in February. For the first quarter as a whole, output moved up at an annual rate of 5.0 percent, its largest gain since the first quarter of 2012. Manufacturing output edged down 0.1 percent in March after having risen 0.9 percent in February; the index advanced at an annual rate of 5.3 percent in the first quarter. Production at mines decreased 0.2 percent in March and edged down in the first quarter. In March, the output of utilities jumped 5.3 percent, as unusually cold weather drove up heating demand. At 99.5 percent of its 2007 average, total industrial production in March was 3.5 percent above its year-earlier level. The rate of capacity utilization for total industry moved up in March to 78.5 percent, a rate that is 1.2 percentage points above its level of a year earlier but 1.7 percentage points below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 11.5 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 78.5% is still 1.7 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in March to 99.5. This is 18.8% above the recession low, but still 1.3% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

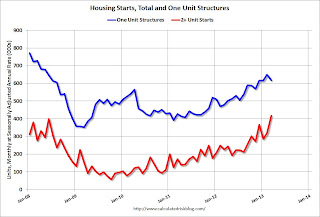

Housing Starts increase to 1.036 million SAAR in March

by Calculated Risk on 4/16/2013 08:43:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in March were at a seasonally adjusted annual rate of 1,036,000. This is 7.0 percent above the revised February estimate of 968,000 and is 46.7 percent above the March 2012 rate of 706,000.

Single-family housing starts in March were at a rate of 619,000; this is 4.8 percent below the revised February figure of 650,000. The March rate for units in buildings with five units or more was 392,000.

Building Permits:

Privately-owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 902,000. This is 3.9 percent below the revised February rate of 939,000, but is 17.3 percent above the March 2012 estimate of 769,000.

Single-family authorizations in March were at a rate of 595,000; this is 0.5 percent below the revised February figure of 598,000. Authorizations of units in buildings with five units or more were at a rate of 283,000 in March.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased sharply in March.

Single-family starts (blue) declined to 619,000 in March (Note: February was revised up sharply from 618 thousand to 650 thousand).

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that housing starts have been increasing after moving sideways for about two years and a half years. This was well above expectations of 930 thousand starts in March, mostly due to the sharp increase in multi-family starts - and the highest level since June 2008. Starts in March were up 46.7% from March 2012; single family starts were up 28.7% year-over-year. Starts in February were revised up sharply. I'll have more later, but this was a strong report.

Monday, April 15, 2013

Tuesday: Housing Starts, CPI, Industrial Production

by Calculated Risk on 4/15/2013 09:01:00 PM

From Annie Lowery at the NY Times: Europe Split Over Austerity as a Path to Growth

Economic fortunes during the recovery from the Great Recession have diverged, with new estimates of growth by the monetary fund expected on Tuesday. But they will not change the basic picture, which Ms. Lagarde has taken to describing as a “three-speed” world. Developing and emerging economies are growing apace. Some advanced economies, including the United States, are gaining strength.At least people are questioning the current policies in Europe.

But a third category of countries remains mired in stagnation or recession. Japan has struggled with a stalled-out economy, but has recently engaged in an athletic campaign of fiscal and monetary stimulus. The true laggard is Europe, suffering from rising unemployment and another bout of economic contraction — seemingly without the political consensus or economic mechanisms to tackle those problems.

...

In light of that reality, the monetary fund and its European partners, the European Commission and the European Central Bank — the so-called troika — have come under continued criticism for the austerity measures imposed on countries including Spain, Portugal and Greece, where unemployment rates extend well into the double digits. The criticism has become louder since the fund said it had determined that austerity had a far worse impact on weak economies than it once thought.

Tuesday economic releases:

• At 8:30 AM ET, Housing Starts for March from the Census Bureau. The consensus is for total housing starts to increase to 930 thousand (SAAR) in March, up from 917 thousand in February.

• Also at 8:30 AM, the BLS will release the Consumer Price Index for March. The consensus is no change in CPI in March (due to lower gasoline prices) and for core CPI to increase 0.2%.

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for March. The consensus is for a 0.2% increase in Industrial Production in March, and for Capacity Utilization to decrease to 78.3%.

Gasoline Prices Continue Decline

by Calculated Risk on 4/15/2013 05:29:00 PM

A sad day ... my thoughts are with the victims and the people of Boston.

As part of the commodity sell-off, oil prices were down again today (the price of gold is irrelevant for the economy, but oil matters). According to Bloomberg, WTI was down to $87.62 per barrel, and Brent was down to $100.39 per barrel.

According to Gasbuddy.com (see graph at bottom), gasoline prices are down to a national average of $3.50 per gallon. Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be around $3.35 per gallon. That is about 15 cents below the current level according to Gasbuddy.com, and I expect prices to fall further. The low for the year is in the $3.20s per gallon, and a year ago gasoline was at $3.90 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Existing Home Inventory is up 9.6% year-to-date on April 15th

by Calculated Risk on 4/15/2013 01:32:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly this year.

In normal times, there is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag. However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory mostly followed the normal seasonal pattern, however in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

So far - through April 15th - inventory is increasing faster than in 2011 and 2012.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

In 2010, inventory was up 15% by the end of March, and close to 20% by the end of April.

For 2011 and 2012, inventory only increased about 5% at the peak and then declined for the remainder of the year.

So far in 2013, inventory is up 9.6% (above the peak percentage increase for 2011 and 2012). It is possible that inventory could bottom this year - it will probably be close - but right now I expect inventory to bottom in early 2014.

FNC: House prices increased 6.1% year-over-year in February, At 28 Month High

by Calculated Risk on 4/15/2013 11:27:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: February Home Prices at 28-month High

The latest FNC Residential Price Index® (RPI) indicates that U.S. property values rose again in February, continuing a trend that began in the spring of 2012 which has become widely recognized as the beginning of the housing market’s recovery. In February, the FNC RPI recorded a 28-month high after rising for 12 straight months. For the 12 months through February, the index rose 6.1%−its fastest acceleration since July 2006.The year-over-year change continued to increase in February, with the 100-MSA composite up 6.1% compared to February 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

... Despite rising prices, the supply remains limited as foreclosure activities decline. Meanwhile, the supply from potential trade-up buyers remains constrained by current prices, which are still too low to allow many existing homeowners to capture equity appreciation. Inevitably, the demand by potential trade-up buyers remains constrained. The median sales-to-list price ratio in February was 95.0, up from 93.8 in January and 90.3 a year ago. Foreclosure sales were down to 20.2% from 26.5% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that February home prices rose 0.2% from the previous month and were up 6.1% year-over-year from the same period in 2012. The two narrower composite indices also show a small month-over-month price increase but greater year-over-year change at 7.1% and 7.9% respectively for the nation’s top-30 and top-10 housing markets.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

Even with the recent increase, the FNC composite 100 index is still off 29.1% from the peak.