by Calculated Risk on 3/18/2013 08:43:00 AM

Monday, March 18, 2013

Cyprus Update: Delay

From the WSJ: Cyprus Postpones Debate on Deposit-Tax Proposal

The Cypriot parliament is now scheduled to meet Tuesday at 1600 GMT ... The government is also in discussion with its creditors to ease the burden on small depositors. ... The new proposal will see smaller depositors, those with up to €100,000, taxed at 3%; savers with €100,000 to €500,000 taxed at 10%; and those with over €500,000 taxed at 15%, one official said.The Russians are not happy, from the Financial Times: Russia attacks Cyprus bailout plan

Mr Putin ... was among several Russian leaders to criticise the bailout, which came without consultation with Moscow and could cost Russian depositors up to €2bn ...From Bloomberg: Euro Officials Pressing for Cyprus Bank Levy Signal Flexibility

...

“We had an agreement with our EU colleagues that we would take co-ordinated action,” Mr Siluanov pRussia’s finance minister] said. “Our role was to possibly relax the terms for [Cyprus] paying back its credit. As it turns out, the EU took action to levy a tax on deposits, without consulting Russia, and for this reason we will further consider the issue of our participation from the point of view of restructuring the earlier loan.”

excerpt with permission

While demanding that the levy raise the targeted 5.8 billion euros ($7.6 billion), finance officials said easing the cost to smaller savers was up to Cyprus. ... “If the government wants to change the structure of the solidarity levy for the banking sector, the government can decide as such,” European Central Bank Executive Board member Joerg Asmussen said today in Berlin. “What’s important is that the planned revenue of 5.8 billion euros remain.”

Sunday, March 17, 2013

Sunday Night Futures

by Calculated Risk on 3/17/2013 10:25:00 PM

Monday economic releases:

• At 10:00 AM ET, the March NAHB homebuilder survey will be released. The consensus is for a reading of 47, up from 46 in February. Although this index has increased sharply in 2012, any number below 50 still indicates that more builders view sales conditions as poor than good.

• Also at 10:00 AM, the Regional and State Employment and Unemployment report for January 2013.

Weekend:

• Summary for Week Ending March 15th

• Schedule for Week of March 17th

• FOMC Projections Preview

The Asian markets are red tonight with the Nikkei down 1.9%, and Shanghai Composite down 0.5%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 19 and Dow futures are down 130 (fair value).

Oil prices are down a little with WTI futures at $92.23 per barrel and Brent at $108.41 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are down about 8 cents over the last month after increasing more than 50 cents per gallon from the low last December.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Cyprus Update

by Calculated Risk on 3/17/2013 04:00:00 PM

Update: There is a plan to revise the deposit tax, from Matina Stevis "Exclusive: plans to revise #cyprus deposit tax on wires: under 5% for €0-100k, under 10% for €100-500k, around 13% for €500k+"

A must read account of the Cyprus negotiations by Peter Spiegel at the Financial Times: Cyprus depositors’ fate sealed in Berlin

The European Central Bank had another shock for [Cyprus’s new president Nicos Anastasiades]: the island’s second-largest bank, Laiki, was in such bad shape that it no longer qualified for the eurosystem’s emergency liquidity assistance ... The message ... meant that if no deal was reached, Laiki would collapse ... saddling Nicosia with a €30bn bill to reimburse accounts covered by the country’s deposit guarantee scheme. It was money Nicosia did not have. All of the island’s account holders would be wiped out.So basically the offer was: accept a levy on depositors or all depositors would be wiped out.

A couple of interesting posts from Pawelmorski, Cyprus: A Brutal Lesson in RealPolitik and Cyprus: What Were They Thinking? and some other notes. "Don’t need a European bailout in a German election year"

From the WSJ: Cyprus Races to Prevent Bank Crisis

Uncertain it has the votes to pass the measure, Cyprus's government postponed an emergency parliamentary session on Sunday that had been called to vote on the levy, while the cabinet petitioned the central bank to extend Monday's bank holiday by at least another day, a move that was likely. ...A final comment: This points out several problems with deposit insurance (especially since Cyprus doesn't have their own currency). First, if the largest Cyprus banks failed, all depositors would be wiped out (in effect, there really isn't any deposit insurance from Cyprus). Second, in the US, problem banks are restricted on the interest rate they can pay on insured deposits (to avoid weak banks trying to draw in deposits by offering excessively high yields). As a few people have noted, Cyprus banks have been paying very high interest rates on deposits. I found a 5 year jumbo CD yielding 11% per year. To solve these problems they really need Euro Zone wide deposit insurance and to restrict yields on insured deposits held by problem banks.

Anastasiades—sworn into office just a little over two weeks ago—directly controls 20 seats in Parliament through his center-right Democratic Rally party. He is supported by the Democratic Party with eight seats as well as the European Party with two seats and third environmental party—which has balked at the levy-with another one seat.

To pass, the measure must have at least 28 votes in Cyprus's 56-seat Parliament, with a tie vote going to the government under Cypriot parliamentary rules. But with some coalition lawmakers wavering, others demanding some sort of compensation for deposit holders, and at least one parliamentarian currently out of the country and unable to vote, passage is by no means assured.

FOMC Projections Preview

by Calculated Risk on 3/17/2013 11:34:00 AM

The FOMC meets on Tuesday and Wednesday of the coming week. I expect no policy change following the FOMC meeting, with the Fed continuing to purchase $85 billion in longer-term Treasury and agency mortgage-backed securities per month. I also expect the forward guidance thresholds will remain unchanged.

However, in recognition of recent data, I do expect a modest upgrade to the FOMC statement and quarterly economic projections, while recognizing certain downside risks (sequestration budget cuts, Cyprus bailout and depositor levy, Italian election uncertainty, and other international issues).

In the press conference, Fed Chairman Ben Bernanke will probably be asked about the Cyprus bailout, how the "sequestration budget cuts" impact the outlook, the sustainability of the recent economic pickup, what “substantial improvement” in the labor market means, and about tapering off the asset purchases later this year. I expect Bernanke's comments to be cautious, to argue we still need to see "substantial improvement" in the labor market, to note the downside risks to the economy, and to argue any pickup in inflation is transitory. He will also repeat that the benefits of QE outweigh the costs, and the Fed has the tools to exit the current highly accommodative policy.

Looking at the December FOMC statement, the first sentence will be changed:

"Information received since the Federal Open Market Committee met in December suggests that growth in economic activity paused in recent months, in large part because of weather-related disruptions and other transitory factors."This will probably be upgraded to something like "economic activity has resumed expansion at a moderate pace in recent months".

On inflation, the FOMC will probably repeat this sentence from the December meeting:

"Inflation recently picked up somewhat, reflecting higher energy prices. Longer-term inflation expectations have remained stable."On the projections, it looks like GDP might be upgraded slightly, inflation will be close to the December FOMC projections, and the projections for the unemployment rate will probably be lowered again.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2013 | 2014 | 2015 |

| Dec 2012 Meeting Projections | 2.3 to 3.0 | 3.0 to 3.5 | 3.0 to 3.7 |

I expect the FOMC will revise up slightly their 2013 and 2014 GDP forecasts. We might see a wider range for GDP in 2013 based on how each participant weighs the downside risks.

The unemployment rate was at 7.7% in February. This has already fallen to the top range of the December projections, and suggests the unemployment rate projections for 2013, 2014 and 2015 will be revised down.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2013 | 2014 | 2015 |

| Dec 2012 Meeting Projections | 7.4 to 7.7 | 6.8 to 7.3 | 6.0 to 6.6 |

Both measures of inflation will be close to the December projections, and I expect the forecasts for inflation will show the FOMC is still not concerned about inflation going forward.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2013 | 2014 | 2015 |

| Dec 2012 Meeting Projections | 1.3 to 2.0 | 1.5 to 2.0 | 1.7 to 2.0 |

Here is core inflation:

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2013 | 2014 | 2015 |

| Dec 2012 Meeting Projections | 1.6 to 1.9 | 1.6 to 2.0 | 1.8 to 2.0 |

Conclusion: I expect no change to policy at this meeting, but a slight upgrade to the economic outlook while noting the downside risks. I think it is too early for a change in the size of the monthly QE purchases. On projections, I expect GDP to be revised up slightly for 2013, and the unemployment rate to be revised lower.

Saturday, March 16, 2013

Updated Table of Short Sales and Foreclosures for Selected Cities in February

by Calculated Risk on 3/16/2013 06:23:00 PM

Note: Several people sent me links early this morning on the Cyprus bailout (thanks jb and others). This bailout was expected to eventually happen, but the surprise was forcing losses on depositors, even small depositors - and that leads to the question of possible contagion to other distressed countries (Greece, Spain, etc).

For a detailed discussion, see Joseph Cotterill piece at Alphaville: A stupid idea whose time had come

Earlier:

• Summary for Week Ending March 15th

• Schedule for Week of March 17th

Economist Tom Lawler sent me the updated table below of short sales and foreclosures for several selected cities in February.

In every area that has reported distressed sales so far (two right columns), the share of distressed sales is down year-over-year - and down significantly in many areas.

Also there has been a decline in foreclosure sales just about everywhere. Also there has been a shift from foreclosures to short sales. In most of these areas, short sales now out number foreclosures (Minneapolis and Orlando are exceptions).

Another interesting point: short sales are now declining in many areas. This might be related to sellers rushing short sales last year - before the one year extension of the Mortgage Debt Relief Act of 2007 was announced, and sales declining early in 2013. Or it might indicate that short sales activity has peaked in some areas (this will be interesting to watch).

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 13-Feb | 12-Feb | 13-Feb | 12-Feb | 13-Feb | 12-Feb | |

| Las Vegas | 37.9% | 29.3% | 10.2% | 42.0% | 48.1% | 71.3% |

| Reno | 37.0% | 28.0% | 13.0% | 42.0% | 50.0% | 70.0% |

| Phoenix | 15.0% | 28.1% | 13.8% | 23.3% | 28.8% | 51.4% |

| Sacramento | 30.3% | 31.9% | 13.5% | 33.9% | 43.8% | 65.8% |

| Minneapolis | 11.3% | 15.0% | 33.3% | 41.5% | 44.6% | 56.5% |

| Mid-Atlantic (MRIS) | 13.6% | 16.4% | 12.1% | 17.5% | 25.6% | 33.9% |

| Orlando | 22.1% | 32.8% | 23.6% | 27.2% | 45.8% | 59.9% |

| California (DQ)* | 22.5% | 26.5% | 17.5% | 33.9% | 40.0% | 60.4% |

| Bay Area CA (DQ)* | 21.4% | 27.0% | 13.6% | 26.4% | 35.0% | 53.4% |

| So. California (DQ)* | 22.0% | 26.9% | 15.8% | 32.6% | 37.8% | 59.5% |

| Hampton Roads | 34.9% | 37.2% | ||||

| Northeast Florida | 43.6% | 49.0% | ||||

| Chicago | 49.0% | 53.0% | ||||

| Charlotte | 15.9% | 18.7% | ||||

| Sarasota | 27.5% | 37.4% | ||||

| Metro Detroit | 37.1% | 46.5% | ||||

| Lehigh Valley PA | 21.7% | N/A | ||||

| Memphis* | 27.8% | 36.6% | ||||

| Birmingham AL | 29.5% | 40.0% | ||||

Schedule for Week of March 17th

by Calculated Risk on 3/16/2013 01:14:00 PM

Earlier:

• Summary for Week Ending March 15th

There are three key housing reports that will be released this week: February housing starts on Tuesday, February Existing home sales on Thursday, and the March homebuilder confidence survey on Monday.

A key event this week is the two day FOMC meeting on Tuesday and Wednesday. Note: the time has changed for the FOMC announcement and quarterly news conference.

Also, for manufacturing, the Philly Fed survey will be released on Thursday.

10:00 AM ET: The March NAHB homebuilder survey. The consensus is for a reading of 47, up from 46 in February. Although this index has increased sharply in 2012, any number below 50 still indicates that more builders view sales conditions as poor than good.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for January 2013

8:30 AM: Housing Starts for February.

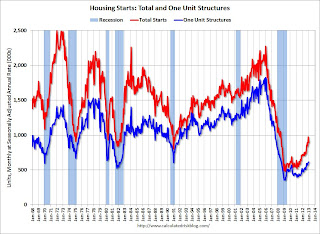

8:30 AM: Housing Starts for February. Total housing starts were at 890 thousand (SAAR) in January, 8.5% below the revised December estimate of 973 thousand (SAAR). Single-family starts increased to 613 thousand in January.

The consensus is for total housing starts to increase to 919 thousand (SAAR) in February, up from 890 thousand in January.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for February (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. No change to interest rates or QE purchases is expected at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chairman Ben Bernanke holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 340 thousand from 332 thousand last week. The "sequester" budget cuts might start impacting weekly claims this week.

9:00 AM: The Markit US PMI Manufacturing Index Flash. The consensus is for a decrease to 55.0 from 55.2 in February.

10:00 AM: FHFA House Price Index for January 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.7% increase in house prices.

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for February from the National Association of Realtors (NAR). The consensus is for sales of 5.01 million on seasonally adjusted annual rate (SAAR) basis. Sales in January were 4.92 million SAAR. Economist Tom Lawler is estimating the NAR will report a sales rate of 4.87 million.

A key will be inventory and months-of-supply.

10:00 AM: the Philly Fed manufacturing survey for March. The consensus is for a reading of minus 1.5, up from minus 12.5 last month (below zero indicates contraction).

No releases scheduled.

Summary for Week ending March 15th

by Calculated Risk on 3/16/2013 08:30:00 AM

This was another week of solid economic data. Retail sales were strong even after removing the impact of higher gasoline prices. Industrial production is at a new post-recession high and nearing the pre-recession peak. And the four-week average of initial weekly unemployment claims is at the lowest level since March 2008.

One negative was a fairly sharp decline in consumer sentiment, but that survey indicated that the decline was mostly dissatisfaction with policymakers and that buying plans were essentially unchanged.

The recent good news - even without any housing data (the key driver) - has led to some upgraded forecasts for Q1 GDP. I've excerpted a from a few research notes below. All of these analysts are upgrading their Q1 forecasts, but are still cautious about Q2 and Q3 due to fiscal policy and inventory adjustments.

From Goldman Sachs:

The US consumer has proven more resilient to the increase in payroll and income taxes than we had expected, and we are lifting our near-term GDP growth forecast slightly. Our tracking estimate for Q1 has already climbed to 2.9% and we are raising Q2 from 1.5% to 2%, primarily via stronger consumption.From Merill Lynch:

Our upgrade is modest for three reasons. First, the growth pickup in Q1 is partly due to faster inventory accumulation. Second, while consumption is holding up better than expected, it is unlikely to be strong in absolute terms. Third, we still expect the “sequester” to weigh on growth in the near term.

One of the key elements of our below-consensus forecast is that consumer spending will slow amid higher taxes and fiscal cuts. The data continue to challenge this view. February retail sales jumped 1.1% and “core control” sales, which net out the volatile components of autos, building materials and gasoline, increased 0.4%. Coupled with stronger inventory growth, this led us to revise up our forecast for 1Q GDP growth to 3.0%. We are also taking up 2Q GDP to 1.3% from 1.0% to reflect stronger momentum. This leaves full year growth at 1.8%, versus our prior forecast of 1.5%. That said, we are not entirely capitulating on our forecast – we still believe growth will slow in coming months as the sequester kicks in, but from a higher level.From Nomura:

Incoming data point to faster-than-expected growth in the first quarter. The need to replenish inventories and an apparent delay by households to adjustment to higher tax burdens at the start of the year has lifted current quarter growth tracking to an annual rate of 2.5%. However, it now appears that the 1 March spending cuts (sequester) will be in place until at least the end of September. These new cuts in spending will slow growth in Q2 and Q3 (previously we assumed that only half of these cuts would be implemented).Here is a summary of last week in graphs:

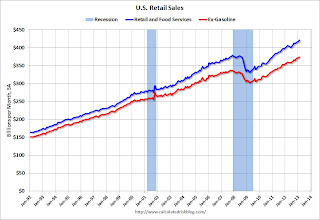

• Retail Sales increased 1.1% in February

Click on graph for larger image.

Click on graph for larger image.On a monthly basis, retail sales increased 1.1% from January to February (seasonally adjusted), and sales were up 4.6% from February 2012. Sales for December were revised up to a 0.2% gain.

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales are up 27.2% from the bottom, and now 11.2% above the pre-recession peak (not inflation adjusted)

Retail sales ex-autos increased 1.0%. Retail sales ex-gasoline increased 0.6%.

This was above the consensus forecast of a 0.5% increase. Although higher gasoline prices boosted sales, retail sales ex-gasoline increased 0.6% - suggesting some pickup in the economy in February.

• Fed: Industrial Production increased 0.7% in February

"The capacity utilization rate for total industry increased to 79.6 percent."

"The capacity utilization rate for total industry increased to 79.6 percent."This graph shows Capacity Utilization. This series is up 12.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.6% is still 0.6 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967."Industrial production increased 0.7 percent in February after having been unchanged in January". Industrial production increased in February to 99.5. This is 19.2% above the recession low, but still 1.2% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

• Weekly Initial Unemployment Claims decrease to 332,000

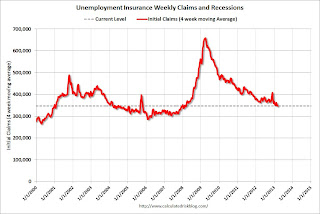

This graph shows the 4-week moving average of weekly claims since January 2000.

This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 346,750 - this is the lowest level since early March 2008.

Weekly claims were below the 350,000 consensus forecast.

Claims might increase over the next few months due to the "sequestration" budget cuts, but right now initial unemployment claims suggest an improving labor market.

• Key Measures of inflation in February

This graph shows the year-over-year change for four key measures of inflation: the median Consumer Price Index, 16% trimmed-mean Consumer Price Index, core CPI and core PCE.

This graph shows the year-over-year change for four key measures of inflation: the median Consumer Price Index, 16% trimmed-mean Consumer Price Index, core CPI and core PCE.On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 2.0%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI increased 2.1% annualized. Also core PCE for January increased 1.8% annualized.

The Fed will meet next week, and with this level of inflation and the current high level of unemployment, I expect the Fed will keep the "pedal to the metal".

• BLS: Job Openings "little changed" in January

From the BLS: Job Openings and Labor Turnover Summary

From the BLS: Job Openings and Labor Turnover Summary This graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

This series started in December 2000.

Jobs openings increased in January to 3.693 million, up from 3.612 million in December. The number of job openings (yellow) has generally been trending up, and openings are up 8% year-over-year compared to January 2012.

Quits increased in January, and quits are up 13% year-over-year and at the highest level since 2008. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Not much changes month-to-month in this report, but the trend suggests a gradually improving labor market.

• Preliminary March Consumer Sentiment declined to 71.8

The preliminary Reuters / University of Michigan consumer sentiment index for March declined to 71.8 from the February reading of 77.6.

The preliminary Reuters / University of Michigan consumer sentiment index for March declined to 71.8 from the February reading of 77.6. This was well below the consensus forecast of 77.7, and very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, default threats, etc).

In this case, the decline was probably related to both high gasoline prices and policy concerns. According to Reuters, a record 34 percent of those surveyed were negative about government economic policies (sequestration, etc.). Reuters also reports that buying plans were essentially unchanged.

Friday, March 15, 2013

Unofficial Problem Bank list declines to 801 Institutions

by Calculated Risk on 3/15/2013 09:49:00 PM

Here is the unofficial problem bank list for Mar 15, 2013.

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

As anticipated, the OCC released its recent actions this week, which contributed to several change to the Unofficial Problem Bank List. In all, there were seven removals and three additions that leave the list at 801 institutions with assets of $295.6 billion. A year ago, the list held 952 institutions with assets of $379.1 billion.CR Note: The first unofficial problem bank list was published in August 2009 with 389 institutions. The number of unofficial problem banks grew steadily and peaked at 1,002 institutions on June 10, 2011. The list has been declining since then.

Actions were terminated against Winona National Bank, Winona, MN ($258 million); Amfirst Bank, National Association, McCook, NE ($237 million); The First National Bank of Wahoo, Wahoo, NE ($206 million); The University National Bank of Lawrence, Lawrence, KS ($71 million); and The First National Bank of Germantown, Germantown, OH ($52 million). The other removals were Pacific International Bank, Seattle, WA ($182 million) and Borrego Springs Bank, National Association, La Mesa, CA ($142 million), which merged on an unassisted basis.

The additions this week were Illinois-Service Federal Savings and Loan Association, Chicago, IL ($136 million); Home Federal Savings and Loan Association of Collinsville, Collinsville, IL ($97 million); and Community Savings, Caldwell, OH ($77 million).

Next week will likely be quiet one for the list.

Lawler: Early Look at Existing Home Sales in February

by Calculated Risk on 3/15/2013 05:47:00 PM

From economist Tom Lawler:

Based on reports I’ve seen so far from various state and local realtor association/board/MLS reports (and a few reports based on property records), it seems highly likely that the YOY growth rate in unadjusted existing home sales as measured by the National Association of Realtors slowed substantially in February relative to January’s reported YOY sales gain of 11.9%. Almost all areas reporting so far showed slower YOY growth in February relative to January, and several states/areas showed YOY declines (including but not limited to California, Michigan, Iowa, Minnesota, Long Island, Phoenix, Tucson, Las Vegas, and Reno). Based on what I’ve seen so far, I estimate that February existing home sales as measured by the NAR will show a YOY increase of about 4.3%. Of course, the YOY gain in seasonally adjusted sales will be higher, reflecting the lower business day count this February vs. last February (last year was a leap year). Based on my estimated seasonal factor, I expect that the NAR will report that existing home sales in February ran at a seasonally adjusted annual rate of about 4.87 million, down about 1% from January’s pace, and up about 7.7% from last February’s pace.

On the inventory front, it’s a bit challenging of late to estimate the NAR’s existing home inventory, as it hasn’t been “tracking” various trackers of overall home listings. E.g., realtor.com said that daily residential listings on realtor.com during January averaged 1,477,266, down 16.5% from last January’s average, and during February listings averaged 1,494,218, down 16.0% from last February (December showed a YOY decline of 17.3%). Zillow said that residential listings on Zillow.com on January 23, 2013 were 17.5% lower than listings on January 23, 2012, and listings on February 24, 2013 were down 16.6% from February 24, 2012. The NAR, however, estimated that the number of existing homes for sale at the end of January was 25.3% lower than the number of existing homes for sale a year earlier! And the monthly drop in the NAR’s inventory estimate for January of 4.9% substantially exceeded that of all listings trackers, as well as what local realtor/MLS reports would have suggested.

Based on listings trackers as well as the local realtor/MLS reports I’ve seen so far, I’d expect that “actual” existing home inventories increased by a modest 1% or so in February. How that will translate in the NAR’s estimate, however, is not clear: a 1% increase in the NAR’s estimate in February, combined with no revision in the January estimate, would imply an implausibly large YOY drop of 26.7%. In looking at admittedly limited historical data, however, there has been a tendency for the NAR inventory number in February to show a bigger gain than other measure, so I’m “guessing” that the NAR inventory estimate will show a monthly gain of 3% or so.

CR Note: The NAR will report February existing home sales on Thursday, March 21st. The early consensus is the NAR will report sales of 4.99 million on a seasonally adjusted annual rate (SAAR) basis. However Lawler's analysis suggests the NAR will report sales of around 4.87 million SAAR.

Based on Lawler's estimates, the NAR will report inventory at around 1.8 million units for February, and months-of-supply around 4.4 months (up from 4.2 months in January, but still very low).

Fannie Mae Delays Annual SEC Filing due to improved results

by Calculated Risk on 3/15/2013 03:59:00 PM

From Fannie Mae: Fannie Mae Files Form 12b-25 Requesting Extension to File 2012 Q4 and Full-Year Financial Results

Fannie Mae (formally, the Federal National Mortgage Association) has determined that it is unable to file its Annual Report on Form 10‑K for the year ended December 31, 2012 by the March 18, 2013 filing deadline due to the need for additional time to analyze whether conditions existed as of December 31, 2012 that would require Fannie Mae, under generally accepted accounting principles, to release any portion of the valuation allowance on its deferred tax assets in the fourth quarter of 2012. The release of the valuation allowance would have a material impact on the company’s 2012 financial statements and result in a significant dividend payment to the U.S. Department of the Treasury under the terms of the Variable Liquidation Preference Senior Preferred Stock, Series 2008-2.Economist Tom Lawler explains:

If we conclude the valuation allowance should not be released in the fourth quarter of 2012, we will continue to evaluate the need for the valuation allowance in future periods. The valuation allowance on our deferred tax assets was $64.1 billion as of December 31, 2011 and $61.5 billion as of September 30, 2012.

Regardless of the decision to release or not release the valuation allowance, we expect to report significant net income for the three months and the year ended December 31, 2012, compared with a net loss of $2.4 billion for the three months ended December 31, 2011 and a net loss of $16.9 billion for the year ended December 31, 2011.

emphasis added

"Given negative earnings and prospects for negative earnings, in 2008 Fannie felt that ... a large portion of its deferred tax asset would never be realized, and as a result it created a "valuation allowance" for its net deferred asset, which hit earnings and net worth. As of 9/30/12, that valuation allowance was $61.5 billion."

CR Note: From Fannie's 2008 Annual SEC filing:

We recognize deferred tax assets and liabilities for the future tax consequences related to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, and for tax credits. In the third quarter of 2008, we recorded a non-cash charge of $21.4 billion to establish a partial deferred tax asset valuation allowance. In the fourth quarter of 2008, we recorded an additional deferred tax asset valuation allowance of $9.4 billion, which represented the reserve for the tax benefit associated with the pre-tax loss we incurred in the fourth quarter of 2008. The additional $9.4 billion valuation allowance increased our total deferred tax asset valuation allowance to $30.8 billion as of December 31, 2008, resulting in a reduction in our net deferred tax assets to $3.9 billion as of December 31, 2008, compared with $13.0 billion as of December 31, 2007.From Lawler:

We evaluate our deferred tax assets for recoverability using a consistent approach that considers the relative impact of negative and positive evidence, including our historical profitability and projections of future taxable income. We are required to establish a valuation allowance for deferred tax assets and record a charge to income or stockholders’ equity if we determine, based on available evidence at the time the determination is made, that it is more likely than not that some portion or all of the deferred tax assets will not be realized.

"With current earnings strong and with the projections for earnings having been upped a boatload, Fannie now is trying to figure out if it can "release" a big chunk of that valuation allowance, and apparently there are some issues about how to figure this out. If they did release a lot, net worth would jump sharply -- but, of course, be swept to the Treasury!"

Key Measures of inflation in February

by Calculated Risk on 3/15/2013 12:34:00 PM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.9% annualized rate) in February. The 16% trimmed-mean Consumer Price Index rose 0.2% (2.6% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed has the median CPI details for February here. Motor fuel increased at a 180% annualized rate in February! That was a sharp increase, but prices have fallen a little in March.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.7% (8.5% annualized rate) in February. The CPI less food and energy increased 0.2% (2.1% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.2%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 2.0%. Core PCE is for January and increased 1.3% year-over-year.

On a monthly basis, median CPI was at 2.9% annualized, trimmed-mean CPI was at 2.6% annualized, and core CPI increased 2.1% annualized. Also core PCE for January increased 1.8% annualized.

The Fed has been clear that their 2% inflation target is not a ceiling, and that they will tolerate some short term increases in inflation as long as the unemployment rate remains elevated and inflation expectations remain "well anchored". From the recent FOMC statement: "the Committee ... currently anticipates that this exceptionally low range for the federal funds rate will be appropriate at least as long as the unemployment rate remains above 6-1/2 percent, inflation between one and two years ahead is projected to be no more than a half percentage point above the Committee’s 2 percent longer-run goal, and longer-term inflation expectations continue to be well anchored".

The Fed will meet next week, and with this level of inflation and the current high level of unemployment, I expect the Fed will keep the "pedal to the metal".

Preliminary March Consumer Sentiment declines to 71.8

by Calculated Risk on 3/15/2013 09:55:00 AM

Click on graph for larger image.

The preliminary Reuters / University of Michigan consumer sentiment index for March declined to 71.8 from the February reading of 77.6.

This was well below the consensus forecast of 77.7, and very low. There are a number of factors that impact sentiment including unemployment, gasoline prices and, for 2013, the payroll tax increase and even politics (sequestration, default threats, etc).

In this case, the decline was probably related to both high gasoline prices and policy concerns. According to Reuters, a record 34 percent of those surveyed were negative about government economic policies (sequestration, etc.). Reuters also reports that buying plans were essentially unchanged.

Fed: Industrial Production increased 0.7% in February

by Calculated Risk on 3/15/2013 09:36:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production increased 0.7 percent in February after having been unchanged in January. Manufacturing output rose 0.8 percent in February, and the index revised up for the previous two months. In February, the output of utilities advanced 1.6 percent, as temperatures for the month were near their seasonal norms after two months of unseasonably warm weather. The production at mines declined 0.3 percent, its third consecutive monthly decrease. At 99.5 percent of its 2007 average, total industrial production in February was 2.5 percent above its level of a year earlier. The capacity utilization rate for total industry increased to 79.6 percent, a rate that is 0.6 percentage point below its long-run (1972--2012) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 12.8 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 79.6% is still 0.6 percentage points below its average from 1972 to 2010 and below the pre-recession level of 80.6% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in February to 99.5. This is 19.2% above the recession low, but still 1.2% below the pre-recession peak.

The monthly change for both Industrial Production and Capacity Utilization were above expectations.

CPI increases 0.7% in February, Core CPI 0.2%, NY Fed Manufacturing indicates expansion

by Calculated Risk on 3/15/2013 08:30:00 AM

• From the Bureau of Labor Statistics (BLS): Consumer Price Index - February 2013

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.7 percent in February on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.0 percent before seasonal adjustment. The gasoline index rose 9.1 percent in February to account for almost three-fourths of the seasonally adjusted all items increase.On a year-over-year basis, CPI is up 2.0 percent, and core CPI is up also up 2.0 percent. Both are at the Fed's target. This was above the consensus forecast of a 0.5% increase for CPI (due to gasoline prices), and a 0.2% increase in core CPI.

...

The index for all items less food and energy increased 0.2 percent in February.

I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

• From the NY Fed: Empire State Manufacturing Survey

The general business conditions index was positive for a second consecutive month and, at 9.2, was little changed. ... Employment indexes suggested that labor market conditions were sluggish, with little change in employment levels and the length of the average workweek. Indexes for the six-month outlook pointed to an increasing level of optimism about future conditions, with the future general business conditions index rising to its highest level in nearly a year.This is the first of the regional manufacturing surveys for March. This was at the consensus forecast of a reading of 8.5.

Thursday, March 14, 2013

Friday: Industrial Production, CPI, Consumer Sentiment

by Calculated Risk on 3/14/2013 07:57:00 PM

First, here is a price index for commercial real estate that I follow. CoStar reported that their value weighted index is up 4.8% year-over-year, and the equal weighted index is up 5.5% from January 2012. Also the volume of distressed sales is continuing to decline.

From CoStar: Commercial Real Estate Pricing Levels Off In January Following Year-End Surge

The U.S. Value-Weighted Composite Index, which weights each repeat-sale by transaction size or value (and therefore is heavily influenced by larger transactions), ticked up by 0.7% in January, and has now increased 38% from its trough in 2010. The U.S. Equal-Weighted Composite Index, which weights each repeat-sale by transaction equally (and therefore is heavily influenced by numerous smaller transactions), began 2013 with a 2.9% monthly loss, largely due to a seasonal slowdown in trading activities after the year-end sales surge. However, thanks to its steady recovery throughout 2012, the equal-weighted index has increased 5.5% since January 2012.

...

Distressed sales as a percentage of total transactions have been following a declining trend since the start of 2011. Although this percentage ticked up in January 2013 due to the seasonal slowdown in total transactions, the number of repeat sales involving distress assets was the lowest in January 2013 since the summer of 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. As CoStar noted, the Value-Weighted index is up 38.5% from the bottom (showing the demand for higher end properties) and up 4.8% year-over-year. However the Equal-Weighted index is only up 9.0% from the bottom, and up 5.5% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Friday economic releases:

• At 8:30 AM ET, the Consumer Price Index for February will be released. The consensus is for a 0.5% increase in CPI in February (due to higher gasoline prices) and for core CPI to increase 0.2%.

• Also at 8:30 AM, the NY Fed Empire Manufacturing Survey for March. The consensus is for a reading of 8.5, down from 10.0 in February (above zero is expansion).

• At 9:15 AM, the Fed will release Industrial Production and Capacity Utilization for February. The consensus is for a 0.3% increase in Industrial Production in February, and for Capacity Utilization to increase to 79.3%.

• At 9:55 AM, the preliminary March Reuter's/University of Michigan's Consumer sentiment index will be released. The consensus is for a reading of 77.5, down from 77.6.

Freddie Mac: Mortgage Rates increase in latest Survey

by Calculated Risk on 3/14/2013 04:15:00 PM

From Freddie Mac today: Mortgage Rates up on Signs of Improving Economy

The 30-year fixed averaged 3.63 percent, its highest reading since the week of August 23, 2012. The 30-year fixed hit its average all-time record low of 3.31 percent the week of November 21, 2012. ...

30-year fixed-rate mortgage (FRM) averaged 3.63 percent with an average 0.8 point for the week ending March 14, 2013, up from last week when it averaged 3.52 percent. Last year at this time, the 30-year FRM averaged 3.92 percent.

15-year FRM this week averaged 2.79 percent with an average 0.8 point, up from last week when it averaged 2.76 percent. A year ago at this time, the 15-year FRM averaged 3.16 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

This shows the recent small increase in mortgage rates. This probably means refinance activity will slow in 2013. Note: There has been an increase in refinance activity due to HARP.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates. Currently the 10 year Treasury yield is 2.02% and 30 year mortgage rates are at 3.63%. If the ten year yield stay in this range, 30 year mortgage rates might move up a little from here.

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).The recent increase in rates is pretty small on this long term graph.

Note: Mortgage rates were at or below 5% back in the 1950s.

Report: Housing Inventory declines 16% year-over-year in February

by Calculated Risk on 3/14/2013 01:54:00 PM

From Realtor.com: Spring Home Buying Season Starts Early According to realtor.com®'s February Trend Data

In February, the total number of single-family homes, condos, townhomes and co-ops for sale in the U.S. (1,494,218) increased by 1.15 percent month-over-month. On an annual basis, however, inventory was down by 15.97 percent.Note: Realtor.com reports the average number of listings in a month, whereas the NAR uses an end-of-month estimate. Since inventory usually starts to come back on the market early in the year, the NAR will probably report a larger month-to-month increase in inventory for February than Realtor.com.

The median age of inventory of for sale listings fell to 98 days in February, down 9.26 percent from January and 11.71 percent below the median age one year ago (February 2012).

Nearly all of the markets with the largest year-over-year declines in their for sale inventories in February were in California, where declines averaged 48 percent. The list includes Sacramento, Stockton, Oakland, San Jose, Orange County, Los Angeles, Seattle, San Francisco, Riverside and Ventura. These markets also experienced a dramatic decline in the median age of inventory, falling to an average of just 31 days, or 53 percent lower than it was one year ago.

Inventory decreased year-over-year in 141 of the 146 markets realtor.com tracks, and by more than 20% year-over-year in 43 markets.

The NAR is scheduled to report February existing home sales and inventory on Thursday, March 21st.

FNC: Residential Property Values increased 5.7% year-over-year in January

by Calculated Risk on 3/14/2013 10:35:00 AM

In addition to Case-Shiller, CoreLogic, FHFA and LPS, I'm also watching the FNC, Zillow and several other house price indexes.

From FNC: FNC Index: January Home Prices Rise 0.3%

The latest FNC Residential Price Index® (RPI) indicates that U.S. property values continued to recover through January—the 11th consecutive month of rising prices. Despite the uneven pace of price gains across different geographical markets, there are clear signs that the housing recovery is increasingly widespread.The year-over-year change continued to increase in January, with the 100-MSA composite up 5.7% compared to January 2012. The FNC index turned positive on a year-over-year basis in July, 2012.

A limited housing supply and declining foreclosure sales are contributing to the recovery of underlying property values. The average list-to-sale price ratio increased to 93.5 in January, compared to 90.3 during the same period a year ago; in other words, the average asking price discount dropped to 6.5% from 9.7%. Foreclosures, as a percentage of total home sales, were 20.2% in January, down from 26.9% a year ago.

Based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas, the FNC 100-MSA composite index shows that January home prices rose 0.3% from the previous month and were up 5.7% on a year-over-year basis from the same period in 2012. The 30-MSA and 10-MSA composite indices show similar trends of rising prices, with the 10-MSA composite accelerating more rapidly at 0.8% month-over-month and 7.2% year-over-year.

...

Although home prices have improved significantly in the last 12 months, a six-year price comparison shows that current prices remain well below their near-peak levels. On average, today’s home prices are about 27.5% below January 2007. In hard-hit markets such as Las Vegas, Orlando, Miami, and Riverside, Calif., home prices are only half of what they were six years ago.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for the FNC Composite 10, 20, 30 and 100 indexes. Note: The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The key is the indexes are now showing a year-over-year increase indicating prices probably bottomed early in 2012.

Weekly Initial Unemployment Claims decrease to 332,000

by Calculated Risk on 3/14/2013 08:35:00 AM

The DOL reports:

In the week ending March 9, the advance figure for seasonally adjusted initial claims was 332,000, a decrease of 10,000 from the previous week's revised figure of 342,000. The 4-week moving average was 346,750, a decrease of 2,750 from the previous week's revised average of 349,500.The previous week was revised up from 340,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 346,750 - this is the lowest level since early March 2008.

Weekly claims were below the 350,000 consensus forecast. Claims might increase over the next few months due to the "sequestration" budget cuts, but right now initial unemployment claims suggest an improving labor market.

Wednesday, March 13, 2013

Thursday: Unemployment Claims, PPI

by Calculated Risk on 3/13/2013 08:23:00 PM

On the declining deficit from MarketWatch: February budget deficit $203.5 billion: Treasury

The U.S. government ran a budget deficit of $203.5 billion in February, down 12% from the same month last year, the Treasury Department reported on Wednesday. The narrowing of the gap between spending and revenue in February is further indication that the deficit is on track to improve this fiscal year which ends Sept. 30. If lawmakers hold fiscal policy steady, the deficit for this year will total $845 billion, about $240 billion less than the fiscal 2012 deficit and the first deficit below a trillion since fiscal 2008, according to the Congressional Budget Office projections.The Congressional Budget Office (CBO) is projecting the deficit will decline to $845 billion in fiscal 2013 (the current budget year), and that the deficit will be about 5.3% of GDP.

Click on graph for larger image.

Click on graph for larger image.This graph shows the actual (purple) budget deficit each year as a percent of GDP, and an estimate for the next ten years based on estimates from the CBO.

The CBO projects the deficit will decline to 3.7% of GDP in fiscal 2014, and 2.4% of GDP in fiscal 2015. After 2015, the deficit will start to increase again according to the CBO.

Thursday economic releases:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for claims to increase to 350 thousand from 340 thousand last week.

• Also at 8:30 AM, the Producer Price Index for February. The consensus is for a 0.6% increase in producer prices (0.1% increase in core).