by Calculated Risk on 11/14/2010 01:24:00 PM

Sunday, November 14, 2010

Schedule for Week of November 14th

The previous post is the Summary for Week ending November 14th

Two key housing reports will be released this week: October housing starts (Wednesday) and November homebuilder confidence (Tuesday). Also October retail sales will be released on Monday, and the Fed will release the October industrial production and capacity utilization report (Tuesday).

7:40 PM ET: Richmond Fed President Jeffrey Lacker speaks on "Unemployment and Monetary Policy: Lessons from Half a Century Ago" before the 2010 International Conference for Advanced Placement Economics teachers

8:30 AM ET: Retail Sales for October. The consensus is for a 0.7% increase from September. (0.4% increases ex-auto).

8:30 AM: Empire Manufacturing Survey for November. The consensus is for a reading of 15.0, about the same level as in October (15.7). These regional surveys have shown a slight pickup following the slowdown in Q3.

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is for a 0.8% increase in inventories.

8:30 AM: Producer Price Index for October. The consensus is for a 0.8% increase in producer prices.

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for October. The consensus is for a 0.3% increase in Industrial Production, and an increase to 74.9% (from 74.7%) for Capacity Utilization. Both Industrial Production and Capacity Utilization surprised to the downside in September.

10 AM: The November NAHB homebuilder survey. This index collapsed following the expiration of the home buyer tax credit. The consensus is for a slight increase to 17 from 16 in October (still very depressed).

Early: The AIA's Architecture Billings Index for October will be released (a leading indicator for commercial real estate). This showed slight expansion in September (50.4) for the first time since January 2008. This index usually this leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months - suggesting reported home sales will be very weak through the end of the year.

8:30 AM: Housing Starts for October. Housing starts also collapsed following the expiration of the home buyer tax credit. The consensus is for a decrease to 590,000 (SAAR) in October from 610,000 in September.

8:30 AM: Consumer Price Index for September. The consensus is for a 0.4% increase in prices. The consensus for core CPI is an increase of 0.1%.

9:15 AM: St. Louis Fed President James Bullard speaks on the "Past, Present, and Future of the Government Sponsored Enterprises (GSE's)"

8:30 AM: The initial weekly unemployment claims report will be released. Initial claims declined to 435,000 last week, and initial claims are expected to increase to 445,000 this week.

10:00 AM: Philly Fed Survey for November. This survey showed slight expansion last month after showing contraction for the previous two months. The consensus is for an increase to 5.6 from 1.0 in October.

10:00 AM: Conference Board's index of leading indicators for October. The consensus is for a 0.5% increase in this index.

5:15 AM: Fed Chairman Ben S. Bernanke speaks on Global Rebalancing at the Sixth European Central Bank Central Banking Conference, Frankfurt am Main, Germany

After 4:00 PM: Perhaps the FDIC will have another busy Friday afternoon ...

CoreLogic House Price Index for September. This release will probably show further declines in house prices. The index is a weighted 3 month average for July, August and September.

Making Home Affordable Program (HAMP) for October and the “Housing Scorecard”

Summary for Week ending November 14th

by Calculated Risk on 11/14/2010 08:55:00 AM

A summary of last week - mostly in graphs. Note: A key story all week concerned the possible bailout of Ireland.

The Census Bureau reported:

[T]otal September exports of $154.1 billion and imports of $198.1 billion resulted in a goods and services deficit of $44.0 billion, down from $46.5 billion in August, revised.

Click on graph for larger image.

Click on graph for larger image.This graph shows the monthly U.S. exports and imports in dollars through September 2010.

After trade bottomed in the first half of 2009, imports increased much faster than exports. Over the last five months, both exports and imports have been relatively flat.

The trade deficit will probably increase in October since oil prices increased, and China reported a higher trade surplus for October.

This graph shows the index since January 1999.

This graph shows the index since January 1999.Press Release: Over the Road Trucked Shipping Decline Signals Weaker Holiday Season, Reports Latest Ceridian-UCLA Pulse of Commerce Index™

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, fell 0.6 percent in October following a decline of 0.5 percent in September and a decline of 1.0 percent in August. ... “We have had a recovery ‘time out,’” summarized [Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast].

From National Federation of Independent Business (NFIB): Small Business Optimism improves slightly

From National Federation of Independent Business (NFIB): Small Business Optimism improves slightly Optimism rose again in October, but the index remains stuck in the recession zone established over the past two years, not a good reading even with a 2.7 point improvement over September. This is still a recession level reading based on Index values since 1973. However, job creation plans did turn positive and job reductions ceased.The above graph shows the small business optimism index since 1986. Although the index increased to 91.7 in October (highest since May), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

The next graph shows the net hiring plans over the next three months.

The next graph shows the net hiring plans over the next three months.Hiring plans have turned slightly positive again. According to NFIB: "Average employment growth per firm was 0 in October, one of the best performances in years. ... Over the next three months, eight percent plan to increase employment (unchanged), and 13 percent plan to reduce their workforce (down three points), yielding a seasonally adjusted net one percent of owners planning to create new jobs, a four point gain from September."

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

The preliminary Reuters / University of Michigan consumer sentiment index increased slightly in November to 69.3 from 67.7 in October.

The preliminary Reuters / University of Michigan consumer sentiment index increased slightly in November to 69.3 from 67.7 in October.This was a big story in when consumer sentiment collapsed again in July. Since then this measure of consumer sentiment has mostly moved sideways at a fairly low level.

In general consumer sentiment is a coincident indicator.

Best wishes to all.

Saturday, November 13, 2010

Labor Force Participation Trends, Over 55 Age Groups

by Calculated Risk on 11/13/2010 09:59:00 PM

On Thursday I asked: What will happen to the Labor Force Participation Rate?

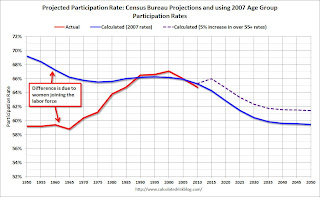

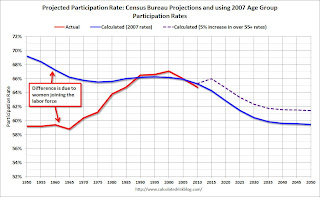

I posted a series of graphs trying to show the trends in participation - and one of the graphs I posted showed two projections for the labor force participation rate through 2050 (using population projections from the Census Bureau). Here is that graph again:

Click on graph for larger image.

Click on graph for larger image.

This graph shows the calculated participation rate (blue) through 2050, and the actual participation rate since 1950 (red). The calculated participation rate, using 2007 data, is far too high for the earlier periods. This is mostly because of women joining the labor force (see the previous post for more on women joining the labor force).

The blue line would indicate the participation rate over the next 40 years if the participation rate per age group stayed static at 2007 levels. The participation rate would be expected to decline as the population ages. This simple analysis suggests the participation rate would be at about the same level in 2015 as today.

I added the dashed purple line to show the impact of a 5 percentage point increase in the 'over 55' labor force participation rate. I pointed out that the participation rate for the 'over 55' age group has been trending up. If the trend continues for the 'over 55' group - perhaps because of necessity, perhaps because of fewer "back breaking" jobs - then the overall participation rate will not fall as quickly as the blue line indicates. With just a 5 percentage point increase in participation for the 'over 55', the participation rate will be back to 66% in 2015.

A couple of readers asked if this was possible? The answer is yes.

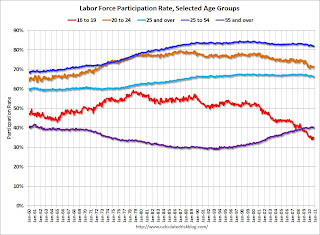

The second graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The second graph shows the participation rate for several over 55 age groups. The red line is the '55 and over' total seasonally adjusted. All of the other age groups are Not Seasonally Adjusted (NSA).

The participation rate is trending up for all age groups. And another five percentage point increase is very possible over the next 5 to 10 years. After that the 'over 55' participation rate might start to decline as the oldest baby boomers move into the 'over 75' age group.

All of this suggests to me that the participation rate will probably move back towards 66% over the next few years, even with an aging population.

Reports: Ireland bailout talks continue

by Calculated Risk on 11/13/2010 05:30:00 PM

The Financial Times "Eurozone in talks on Ireland bail out" reports that European ministers are currently deliberating whether Ireland needs a bailout before the markets open on Monday. The FT notes that the "the discussions ... are expected to intensify on Sunday".

And from Bloomberg: Ireland Urged to Take Aid by Officials Amid Debt Crisis

Irish Prime Minister Brian Cowen said he is working with fellow European leaders as his nation’s sovereign debt crisis threatens the stability of European markets.Leaders in Ireland want to avoid asking for aid from the IMF or using the EFSF, however other European leaders are apparently pushing Ireland to accept aid to contain the financial turbulence.

While reiterating that his debt-strapped country has not sought to tap an EU rescue fund, Cowen told reporters today that “there are issues affecting the wider euro area of which we are a member” and that he and his counterparts were working to “ensure that the bond markets respond positively to the euro.”

My guess is if Ireland accepts aid, then Ireland's bonds will rally (and the yield will fall sharply) - however this will probably lead to a "buyers strike" for Portugal's bonds. And then Portugal will have to ask for aid. Then Spain and / or Italy would be next in line ... and I think that is the real concern.

Apartment Rents increasing in San Francisco

by Calculated Risk on 11/13/2010 01:43:00 PM

From Robert Selna at the San Francisco Chronicle: San Francisco apartment rents expected to rise

Data from real estate research firm RealFacts show that San Francisco County's average asking rent for buildings of 50 or more units was $2,282 in the third quarter of 2010, only about $120 lower than the same quarter in 2008.This fits with other reports of falling vacancy rates and rents at least stabilizing.

...

Marcus & Millichap, which tracks rents citywide in buildings of 15 units or more, reported that since the start of the year, the average asking rent had increased 1.4 percent to $1,782.

It appears apartment rents have at least stabilized and are probably increasing in many areas - and the vacancy rates are falling. This means we will probably see a slight pickup in multi-family construction in 2011 (from record lows).

Before the housing market can recovery, a large portion of the excess vacant housing supply has to be absorbed. The excess supply includes both rental and owner occupied homes, and the falling apartment vacancy rate is an indicator the excess supply is starting to decline.

Report: Ireland in "technical" discussions on asking for aid

by Calculated Risk on 11/13/2010 09:15:00 AM

The monthly euro finance minister meeting is Tuesday in Brussels. That is probably the next key date ...

A few excerpts from the Irish Times: Government campaigns to avoid EU financial bailout

THE GOVERNMENT is campaigning to avert the threat of being forced to seek emergency fiscal aid from the EU authorities as it battles a drastic loss in investor confidence.

...

Two well-placed sources told The Irish Times, however, that Irish officials have been involved in ‘‘technical’’ discussions about the procedures to be followed in the event of any aid application being made to the European Financial Stability Facility (EFSF).

Friday, November 12, 2010

Unofficial Problem Bank list increases to 898 Institutions

by Calculated Risk on 11/12/2010 11:59:00 PM

Note: this is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Nov 12, 2010.

Changes and comments from surferdude808:

Despite failures, the Unofficial Problem Bank List continued its rise to the 900 level. This week the list count finished at 898 after six additions and two removals. Assets total $418.5 billion, up from $416.5 billion last week.

After three down trending weeks in October, some readers wondered if the list had peaked. After this pause, the Unofficial Problem Bank List has added a net 27 institutions and $16.4 billion of assets since October 22nd.

Removals are two of this week’s failures -- Darby Bank & Trust Co., Vidalia, GA ($690 million) and Copper Star Bank, Scottsdale, AZ ($204 million).

Additions include Atlantic Coast Bank, Waycross, GA ($901 million Ticker: ACFC); The Leaders Bank, Oak Brook, IL ($659 million); NewDominion Bank, Charlotte, NC ($535 million); Middlesex Federal Savings, F.A., Somerville, MA ($389 million); Community Bank of Oak Park River Forest, Oak Park, IL ($364 million); and First Federal Savings and Loan Association of Pekin, Pekin, IL ($28 million).

We applaud the Illinois State Banking Department for the timely disclosure of its enforcement actions. Next week, we anticipate the OCC will release its actions for October, which will likely push the list count over 900.

Bank Failure #146: Copper Star Bank, Scottsdale, AZ

by Calculated Risk on 11/12/2010 07:29:00 PM

Fed burnishing to return

Like a bad penny.

by Soylent Green is People

From the FDIC: Stearns Bank National Association, St. Cloud, Minnesota, Assumes All of the Deposits of Copper Star Bank, Scottsdale, Arizona

As of September 30, 2010, Copper Star Bank had approximately $204.0 million in total assets and $190.2 million in total deposits. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $43.6 million. ... Copper Star Bank is the 146th FDIC-insured institution to fail in the nation this year, and the fourth in Arizona.Three down today so far ...

Report: Ireland pressed to accept aid "within days"

by Calculated Risk on 11/12/2010 06:41:00 PM

From Bloomberg: Ireland Urged by European Officials to Accept Aid to Contain Debt Crisis

In a conference call of European Central Bank officials around noon Frankfurt time today, Ireland was pressed to seek outside help within days, the person said on condition of anonymity. Separately, a European Union official said a request for assistance was likely ...However, earlier from the Irish Times: Cowen denies reports of EU talks on emergency funding

Taoiseach Brian Cowen has denied reports that negotiations are going on behind the scenes for emergency funding for Ireland from the European Union.Conflicting news reports continue ... reminds me of when Sunday was the new Monday (with all the breaking news during the crisis).

Quoting an unnamed source, the Reuters news agency reported that Ireland was likely to become the second euro zone country, after Greece, to obtain an international rescue.

Bank Failures #144 & 145: Georgia

by Calculated Risk on 11/12/2010 06:09:00 PM

One on top of another

To the moon, Alice!

by Soylent Green is People

From the FDIC: Ameris Bank, Moultrie, Georgia, Acquires All of the Deposits of Two Georgia Institutions

As of September 30, 2010, Tifton Banking Company had total assets of $143.7 million and total deposits of $141.6 million, and Darby Bank & Trust Co. had total assets of $654.7 million and total deposits of $587.6 million.More Georgia ...

...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24.6 million for Tifton Banking Company, and $136.2 million for Darby Bank & Trust Co. ... The two closed institutions were the 144th and 145th banks to fail in the nation this year, and the 17th and 18th banks to close in Georgia.

D.R. Horton: 2011 to be a "very challenging year"

by Calculated Risk on 11/12/2010 04:11:00 PM

A few excerpts from home builder D.R. Horton's conference call:

CEO Don Tomnitz:

As we look to fiscal 2011, we ... expect another very challenging year for the homebuilding industry, as the fundamental drivers of demand, the overall economy, job growth, and consumer confidence are still very weak. In addition, we do not expect any stimulus in fiscal 2011 similar to the federal tax credits that were in effect last year.And from the Q&A:

All of these factors make it likely that our sales and closing volumes will be below our volumes in fiscal 2010.

Based on current sales demand and the fact that the tax credits were supporting sales demand last year, we expect sales in the next two quarters to be lower than last year.Until the excess housing inventory is absorbed, the home builders will be under pressure. There is still a long way to go ...

...

There are still challenges in the homebuilding industry. Rising foreclosures, significant existing home inventory, high unemployment, tight mortgage lending standards, and the weak consumer confidence ... the real key is that the traffic count in our sub-divisions is down, and I don’t think there is a lot of pricing adjustment that we can do, it’s just a function of the lack of traffic. So until there is some consumer confidence, until we start to grow jobs, I think we’re going to continue to be faced with rather flat demand just simply because buyers don’t feel confident about the future and they’re not going out there looking for a house in the numbers that they were certainly when the tax credits were there.

Ireland Update: Bonds rally on EU Statement

by Calculated Risk on 11/12/2010 12:50:00 PM

Just an update since I've been following this over the last few weeks ... the EU finance ministers issued a statement last night that pushed down the yields for Ireland and Portugal debt:

Whatever the debate within the euro area about the future permanent crisis resolution mechanism, and the potential for private sector involvement in that mechanism, we are clear that this does not apply to any outstanding debt and any programme under current instruments.The Ireland 10-year bond yield fell to 8.13% (from 8.9%).

Any new mechanism would only come into effect after mid-2013 with no impact whatsoever on the current arrangements.

The EFSF (European Financial Stability Facility) is already established and its activation does not require private sector involvement.

The Portugal 10-year bond yield fell to 6.74% from 7.2%.

Consumer Sentiment increases slightly in November

by Calculated Risk on 11/12/2010 09:55:00 AM

The preliminary Reuters / University of Michigan consumer sentiment index increased slightly in November to 69.3 from 67.7 in October.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This was a big story in when consumer sentiment collapsed again in July. Since then this measure of consumer sentiment has mostly moved sideways at a fairly low level.

In general consumer sentiment is a coincident indicator.

Las Vegas: 4,000 High Rise Condos still for sale

by Calculated Risk on 11/12/2010 09:00:00 AM

From Buck Wargo at the Las Vegas Sun: Condo sales at CityCenter a mixed bag

CityCenter projects it will have closed on 435 condominium units by the end of November out of 2,387 units it had on the market. ... even though it trimmed prices 30 percent a year agoThe CityCenter (18% sold) is even doing worse than Trump Tower (25% sold). It will take years to clear this inventory.

...

According to Las Vegas-based SalesTraq, more than 4,000 high-rise units remain unsold along the Strip.

Note: high rise condo units are not included in the new home inventory report from the Census Bureau, and they are also not included in the existing home inventory report from the NAR (unless they are list for sale). This is hidden inventory, and for certain cities like Las Vegas, this is significant.

Thursday, November 11, 2010

Report: Discussions underway to assess readiness to activate EFSF for Ireland

by Calculated Risk on 11/11/2010 08:20:00 PM

Please don't miss my earlier post: Labor Force Participation Rate: What will happen?

From the Irish Times: Merkel refuses to back down over debt burden

The Irish Times has established ... that informal contacts are under way between Brussels, Berlin and other capitals to assess their readiness to activate the €750 billion rescue fund in the event of an application from Dublin.Note: The European Financial Stability Facility (EFSF) is complicated and currently unfunded.

Also from the Irish Times (I noted the bank funding issue this morning based on information from a contact in Europe): Investor concern hits Irish banks as funding costs soar

INVESTOR CONCERN switched to the Irish banks yesterday as the cost of funding for AIB and Bank of Ireland rose to record levels and the credit-default swaps on Irish banks soared.And from the Irish Times: G20 concern over Irish debt as bond yields pass 9%

Last night the rating agency Moody’s said it was awaiting the release of Ireland’s four-year fiscal plan later this month to decide whether to downgrade the country’s credit rating.

Hotels: RevPAR up 8.2% compared to same week in 2009

by Calculated Risk on 11/11/2010 06:15:00 PM

Hotel occupancy is one of several industry specific indicators I follow ...

Important: Even though the occupancy rate is close to the weak 2008 levels, and RevPAR (revenue per available room) is up 8.2% compared to the same week in 2009 - RevPAR is still down 3% compared to the same week in 2008 - and the 2nd half of 2008 was a very difficult period for the hotel industry.

From HotelNewsNow.com: STR: Midscale with F&B reports strong weekly results

Overall, the total U.S. hotel industry’s occupancy increased 6.2% to 58.2%, average daily rate was up 1.9% to US$99.29, and RevPAR ended the week up 8.2% to US$57.75.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 8.6% compared to last year and 5.8% below the median for 2000 through 2007.

The occupancy rate is slightly above the levels of 2008, but RevPAR is still down 3% compared to the same week in 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Labor Force Participation Rate: What will happen?

by Calculated Risk on 11/11/2010 01:58:00 PM

The collapse in the labor force participation rate has been one of the key stories of the great recession. The participation rate is the percentage of the working age population in the labor force.

As the economy slowly recovers, an important question is what will happen to the participation rate over the next few years? If the participation rate increases to 66% - from the current 64.5% - then the U.S. economy will need an additional 3.3 million jobs just to hold the unemployment rate steady (not counting population growth).

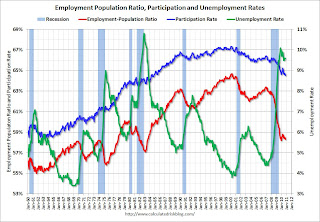

Click on graph for larger image.

Click on graph for larger image.

This graph shows the recent sharp decline in the participation rate (blue), and also the unemployment rate and the employment-population ratio. The participation rate had mostly been above 66% since the late '80s, and had been over 67% in the late '90s.

One of the key factors impacting the participation rate (other than a severe recession) is the age of the labor force. The following graph shows the participation rate by age group in 2007 (I selected 2007 because it is recent, but before the recession started).

This graph is for 2007, but the general pattern holds for all years. The participation rate is low for those in the '16 to 19' age group. The rate increases sharply for those in the '20 to 24' age group, and the rate is at its peak from 25 to 49 - and drops off a little for the '50 to 54' age group.

This graph is for 2007, but the general pattern holds for all years. The participation rate is low for those in the '16 to 19' age group. The rate increases sharply for those in the '20 to 24' age group, and the rate is at its peak from 25 to 49 - and drops off a little for the '50 to 54' age group.

After 55 workers start leaving the labor force, and the participation rate falls off with age.

Even if the participation rates per age group were static (they aren't), the overall participation rate would change with the demographics of the population.

We can use the above participation rates by age group for 2007, and historical data and age group population projections from the Census Bureau, to calculate a participation rate based on demographics.

We can use the above participation rates by age group for 2007, and historical data and age group population projections from the Census Bureau, to calculate a participation rate based on demographics.

This graph shows the calculated participation rate (blue) through 2050, and the actual participation rate since 1950 (red). The calculated participation rate, using 2007 data, is far too high for the earlier periods. This is mostly because of women joining the labor force (next graph).

Without other shifts in the labor force (last graph), the blue line would indicate the participation rate over the next 40 years. The participation rate declines as the population ages. This simple analysis suggests the participation rate will be at about the same level in 2015 as today.

Note: the dashed purple line indicates the participation rate with a 5 percentage point increase in the 'over 55' labor force participation rate.

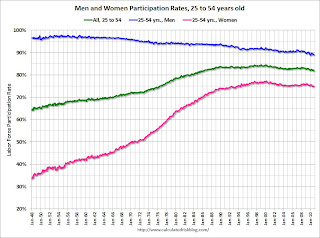

The early gap in the previous graph was due to women joining the labor force (I used 2007 data to do the projections).

The early gap in the previous graph was due to women joining the labor force (I used 2007 data to do the projections).

This graph shows the changes in the participation rates for men and women since 1960 (in the 25 to 54 age group - the prime working years).

The participation rate for women increased significantly from the mid 30s to the mid 70s. The participation rate for men has decreased from the high 90s to just about 90%.

And the final graph shows that participation rates for age groups are not static (as was assumed for the projection).

And the final graph shows that participation rates for age groups are not static (as was assumed for the projection).

There are a few key trends happening:

1) the participation rate for the '16 to 19' age group has been falling for some time (red).

2) the participation rate for the 'over 55' age group has been rising since the mid '90s (purple).

3) the participation rate for the '20 to 24' age group appears to be falling too (perhaps more education before joining the labor force). Also note the sharp decline over the last couple of years - that will probably turn around quickly as the job market improves.

This is why I added the dashed purple line to the projection graph above. If the trend continues for the 'over 55' group - perhaps because of necessity, perhaps because of fewer "back breaking" jobs - then the overall participation rate will not fall as quickly as the blue line indicates. With just a 5 percentage point increase in participation for the 'over 55', the participation rate will be back to 66% in 2015.

Ireland: Bank funding problems?

by Calculated Risk on 11/11/2010 10:19:00 AM

Ireland is fully funded until mid-2011, however I've heard this morning that certain European investors are no longer willing to provide Irish banks with overnight funding. This could lead to a serious liquidity problem for the Irish banks - and some investors believe that Ireland may need to borrow from the IMF or the EFSF to support the banks.

And some comments from officials, first from the Financial Times: Barroso reaffirms offer of help to Ireland

José Manuel Barroso, European Commission president, said ... “What is important to know is that we have all the essential instruments in place in the European Union and eurozone to act if necessary, but I am not going to make any speculation”.Both the Irish Central bank governor Patrick Honohan (See: IMF would use same fiscal policy - Honohan) and the Irish Finance Minister Brian Lenihan said today they believe Ireland will not need help (See: Irish FinMin: c.bank comments not laying ground for help).

excerpt with permission

The Ireland 10-year bond yield is at 8.9%.

For much more on the problems for Ireland (and Portugal), see: Life on the Edge of the EFSF, by Elga Bartsch & Daniele Antonucci at Morgan Stanley.

Note: I've been using the 8% cost estimate for the EFSF from Wolfgang Munchau in the Financial Times. The Morgan Stanley analysts write that they "expect such a loan to carry an interest rate of 5-6.5% per annum".

This is similar to the 6% EFSF rate calculated by University College Dublin professor Karl Whelan: Borrowing Rates from The EFSF

RealtyTrac: Foreclosure Activity Decreases slightly in October

by Calculated Risk on 11/11/2010 08:24:00 AM

From RealtyTrac: Foreclosure Activity Decreases 4 Percent in October

RealtyTrac® ... today released its U.S. Foreclosure Market Report™ for October 2010, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 332,172 properties in October, a 4 percent decrease from the previous month and almost exactly the same total reported in October 2009. ...The good news is the number of default notices is trending down, although that might pick up again as house prices decline.

“October marks the 20th consecutive month where over 300,000 U.S. homeowners received a foreclosure notice,” said James J. Saccacio, chief executive officer at RealtyTrac. “The numbers probably would have been higher except for the fallout from the recent 'robo-signing' controversy — which is the most likely reason for the 9 percent monthly drop in REOs we saw from September to October and which may result in further decreases in November."

...

A total of 100,575 U.S. properties received default notices (NOD, LIS) in October, a 2 percent decrease from the previous month and a 19 percent decrease from October 2009 — the ninth straight month where default notices have decreased on a year-over-year basis.

...

Lenders foreclosed on 93,236 U.S. properties in October, down 9 percent from the record high in the previous month but still up 21 percent from October 2009.

Wednesday, November 10, 2010

CSCO and KLIC: Weaker Outlooks

by Calculated Risk on 11/10/2010 10:15:00 PM

From Reuters: Cisco's dismal outlook stuns Street

On the conference call, CSCO guided lower and said public sector spending is slow. Management also said that Europe is seeing some declines - although it was too early to call it a trend. (ht Brian, JB)

And from the WSJ: Kulicke & Soffa 4Q Profit Soars; Shares Down On Weak 1Q View

Kulicke & Soffa Industries ... predicted revenue for the current quarter of $125 million to $135 million, far below analysts' average estimate of $214.6 million ...This might suggest a slowdown in equipment and software investment.