by Calculated Risk on 11/10/2010 06:18:00 PM

Wednesday, November 10, 2010

Lawler: Early Read on October Existing Home Sales

CR Note: This is from housing economist Tom Lawler:

Based on data available so far, it would appear as if national existing home sales in October ran at a seasonally adjusted annual rate that was little changed from September [4.53 million SAAR]. Of course, October’s YOY sales decline on an unadjusted basis is significantly larger than September’s. But October sales were significantly goosed (SAAR of 5.98 million) last October by the expiring (or so folks thought!) first time home buyer tax credit. In addition, there was one fewer business day this October than last October.

The incoming listings data have on average been consistent with the realtor.com data showing a 3.2% decline in existing home sales inventory in October.

CR Note: A 3.2% decline in inventory, and sales of 4.53 million SAAR would put the months-of-supply at about 10.4 months in October. That would be the fourth straight month of double digit supply.

Based on this early forecast, YoY sales would be off 24%, and inventory would be up close to 10% YoY.

Existing home sales for October will be released on Tuesday November 23rd at 10 AM ET.

European Debt Update

by Calculated Risk on 11/10/2010 04:05:00 PM

Note: Some people have asked why I've posted so often about Ireland the last few weeks, I think these hockey stick graphs show why ...

Ireland 10-year bond yield at 8.64%.

Portugal 10-year bond yield at 7.04%.

And for Spain, the 10-year bond yield has risen to 4.5%.

And for Greece, the yield is up to 11.55%.

From the WSJ: European Debt Markets Take Hits

And from the Financial Times: Irish bond yields leap after selling wave

Last week LCH.Clearnet warned investors of higher margin requirements to trade in Ireland’s debt. That went into effect today - here is the memo:

The margin required for positions of Irish government bonds will consequently be increased by 15% of net exposure ... The additional margin will be charged on net exposure at close of business on Thursday 11 November 2010 and will be reflected in a margin call on Friday 12 November 2010.There is no immediate liquidity crisis for Ireland (unlike for Greece earlier this year), but clearly bond investors are spooked by the discussions of bond holders having to take haircuts if there is a bailout. And if yields stay above 8% that increases the likelihood of Ireland using the European Financial Stability Facility (EFSF).

Deficit Commission Draft Proposal

by Calculated Risk on 11/10/2010 01:29:00 PM

From the NY Times: Panel Weighs Deep Cuts in Tax Breaks and Spending

A draft proposal to be released Wednesday by the chairmen of President Obama’s bipartisan commission on reducing the federal debt calls for deep cuts in domestic and military spending starting in 2012, and an overhaul of the tax code to raise revenue.I doubt the mortgage interest deduction will be eliminated, but maybe it could be reduced over time. Same with the exemption for health benefits. I'd prefer if they left Social Security out of this proposal completely, and just addressed the General Fund deficit. Then, after reaching agreement on the General Fund deficit reduction, they could return to Social Security in the future.

...

The plan would reduce Social Security benefits to most future retirees ... and it would subject higher levels of income to payroll taxes to ensure Social Security’s solvency for at least the next 75 years.

But the plan would not count any savings from Social Security toward meeting the overall deficit-reduction goal set by Mr. Obama ...

The proposed simplification of the tax code would repeal or modify a number of popular tax breaks — including the deductibility of mortgage interest payments [and the exemption from taxes for employees’ health benefits] — so that income tax rates could be reduced across the board.

Oh well, this proposal will probably end up with most other commission reports - gathering dust (well, mostly digital dust these days).

Trade Deficit decreases in September

by Calculated Risk on 11/10/2010 09:20:00 AM

The Census Bureau reports:

[T]otal September exports of $154.1 billion and imports of $198.1 billion resulted in a goods and services deficit of $44.0 billion, down from $46.5 billion in August, revised.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through September 2010.

After trade bottomed in the first half of 2009, imports increased much faster than exports. Over the last five months, both exports and imports have been relatively flat.

The second graph shows the U.S. trade deficit, with and without petroleum, through September.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit decreased slightly in September, and the trade deficit with China decreased slightly (NSA).

The trade deficit will probably increase in October since oil prices increased, and China reported a higher trade surplus for October.

Weekly Initial Unemployment Claims decrease to 435,000

by Calculated Risk on 11/10/2010 08:30:00 AM

Update: due to revisions, this is the lowest level since September 2008 for the 4-week moving average.

The DOL reports on weekly unemployment insurance claims:

In the week ending Nov. 6, the advance figure for seasonally adjusted initial claims was 435,000, a decrease of 24,000 from the previous week's revised figure of 459,000. The 4-week moving average was 446,500, a decrease of 10,000 from the previous week's revised average of 456,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased this week by 10,000 to 446,500.

This is the lowest level for the 4-week moving average since

MBA: Mortgage Purchase Applications Increase slightly last week

by Calculated Risk on 11/10/2010 07:26:00 AM

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 6.0 percent from the previous week. The seasonally adjusted Purchase Index increased 5.5 percent from one week earlier. This is the third consecutive weekly increase in purchase applications.

...

“The increases in purchase applications we have seen over the past couple of weeks align with the better than expected news from October’s employment report and other data indicating some improvement in the economy’s growth prospects. Refinance applications increased as rates continued to hover near record lows.” [said Michael Fratantoni, MBA’s Vice President of Research and Economics.]

...

The average contract interest rate for 30-year fixed-rate mortgages remained unchanged at 4.28 percent, with points decreasing to 1.05 from 1.07 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The four-week moving average of the purchase index has increased slightly for three straight weeks, however the index is still about 30% below the levels of April 2010. This suggests existing home sales will remain weak through the end of the year.

Tuesday, November 09, 2010

Humor: China Rating Agency downgrades U.S.

by Calculated Risk on 11/09/2010 09:58:00 PM

From the Financial Times Alphaville: US downgraded on QE2 ... by Chinese rating agency (ht Andrew)

Dagong Global Credit Rating Co. — the Chinese rating agency which hit headlines earlier this year for its AA-view on the United States — is back. With a US downgrade.I thought this was from The Onion. The report concludes:

From the just-published, 10-page report:Dagong has downgraded the local and foreign currency long term sovereign credit rating of the United States of America (hereinafter referred to as “United States” ) from “AA” to “A+“, which reflects its deteriorating debt repayment capability and drastic decline of the government’s intention of debt repayment.

The serious defects in the United States economic development and management model will lead to the long-term recession of its national economy, fundamentally lowering the national solvency.

[G]iven the current situation, the United States may face much unpredictable risks in solvency in the coming one to two years.Uh, right. At least someone in China has a sense of humor ...

Private Label Security REO

by Calculated Risk on 11/09/2010 04:56:00 PM

Last Friday I noted that the combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased by 24% at the end of Q3 2010 compared to Q2 2010. However this is just a portion of the overall REO inventory.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the graph I posted last Friday showing the REO inventory for Fannie, Freddie and the FHA through Q3 2010.

The REO inventory for the "Fs" increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

As I noted, this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs.

The following is from housing economist Tom Lawler:

While the SF REO inventory of “the F’s” – Fannie, Freddie, and FHA – surged last quarter, the SF REO inventory for private-label RMBS continued to decline (and the overall size of the RMBS market continued to shrink. Here is an updated chart showing the SF REO inventory (EOQ) for Fannie, Freddie, FHA, and private-label RMBS combined. I got the RMBS REO data from Moody’s economy.com. I don’t yet have enough data to estimate bank and thrift REO holdings, though the limited amount of “Q’s” I’ve read suggest that bank and thrift SF REO holdings probably increased last quarter, but by a smaller % than the “F’s.”

To give one of bit of perspective: according to Moody’s economy.com data, the SF REO of private-label RMBS hit a peak of over 409,000 properties in October 2008, and the number of loans backing PL RMBS was around 9.039 million (and about 10.9 million at its peak in May 2007). This September, the combined SF REO inventory of Fannie, Freddie, and FHA, who combined own or guarantee around 37 million SF mortgages, totaled 293,171. Don’t get me wrong – the runup in overall REO over the last few quarters is very disturbing and a clear negative for near-term home prices. But ... it’s occasionally important to take things into perspective!

The above was from housing economist Tom Lawler.

We still need to add in the bank and thrift REO - and those holdings probably increased significantly in Q3.

Ireland: A Side Show

by Calculated Risk on 11/09/2010 01:44:00 PM

UPDATE: Two days after this post, I posted Ireland: Bank funding problems?

Ireland is fully funded until mid-2011, however I've heard this morning that certain European investors are no longer willing to provide Irish banks with overnight funding. This could lead to a serious liquidity problem for the Irish banks - and some investors believe that Ireland may need to borrow from the IMF or the EFSF to support the banks.Original post:

I've been posting on Ireland recently because the 10-year bond yield is approaching 8% (some analysts think Ireland will use the European Financial Stability Facility (EFSF) above 8%). The Ireland 10-year yield hit a record 7.94% today.

To be clear: Ireland is not Greece. There is no short term liquidity issue; Ireland does not need to borrow until mid-2011 and rates could fall before then.

The increase in yields is being driven by investor fears of a permanent

crisis-resolution mechanism that will include possible haircuts for private investors.

Here are some excerpts from a proposal from the think-tank Bruegel about a permanent

crisis-resolution mechanism (Via the WSJ Making Default A Real Possibility):

We propose in this paper the creation of a European Crisis Resolution Mechanism (ECRM) consisting of two pillars:This is similar to some of the recent German proposals.

A procedure to initiate and conduct negotiations between a sovereign debtor with unsustainable debt and its creditors leading to, and enforcing, an agreement on how to reduce the present value of the debtor’s future obligations in order to re-establish the sustainability of its public finances. This would require a special court to deal with such cases. The European Court of Justice is the natural institution for this purpose and a special chamber could be created within it for that purpose.

Rules for the provision of financial assistance to euro-area countries as an element in resolving the crisis. Should a euro-area country be found insolvent, the provision of financial aid should be conditional on the achievement of an agreement between the debtor and the creditors reestablishing solvency. The task of supplying financial assistance could be given to the EFSF provided that it is made permanent and an institution of the European Union. Lending by the permanent EFSF could also be provided, under appropriate conditions, to euro area countries facing temporary liquidity problems, as currently foreseen by the temporary EFSF.

Right now this is a side show (but still interesting).

BLS: Job Openings decrease slightly in September, Low Labor Turnover

by Calculated Risk on 11/09/2010 10:23:00 AM

Note: The temporary decennial Census hiring and layoffs distorted this series over the summer months.

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings in September was 2.9 million, which was little changed from August. Although the month-to-month change is small, the number of job openings in September was 25 percent higher than the number at the most recent series trough in July 2009.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. The CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

The following graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (purple) and total separations (red and blue columns stacked) are pretty close each month. When the purple line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

In September, about 4.19 million people lost (or left) their jobs, and 4.19 million were hired (this is the labor turnover in the economy) for no change in total jobs.

Note: I think this graph makes a key point: The change in net jobs each month is small compared to the overall labor turnover. Over 4 million jobs were lost in September (seasonally adjusted) and over 4 million people were hired!

Although job openings declined slightly in September, it appears job openings are still trending up. However overall labor turnover is still low.

Ceridian-UCLA: Diesel Fuel index declines in October, "Signals Weaker Holiday Season"

by Calculated Risk on 11/09/2010 09:00:00 AM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the index since January 1999.

This is a new index, and doesn't have much of a track record in real time, although the data suggests the recovery has had a "time out" since May.

Press Release: Over the Road Trucked Shipping Decline Signals Weaker Holiday Season, Reports Latest Ceridian-UCLA Pulse of Commerce Index™

The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, fell 0.6 percent in October following a decline of 0.5 percent in September and a decline of 1.0 percent in August. The three consecutive month decline is the first since January 2009, when the U.S. was still deep in recession. The negative month-over-month trajectory for October, typically a peak month for America’s trucking industry, may also prelude a disappointing holiday season, indicating retailer wariness about future sales prospects.I'm not confident in using this index to forecast GDP growth, although it does appear to track Industrial Production over time (with plenty of noise).

“The October data begins the fourth quarter on a down note. October is also an especially important siren for the holiday season,” said Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast.

...

“We have had a recovery ‘time out,’” summarized Leamer. “Since May’s peak, trucking has receded 8.3 percent. Fortunately, the full stew of economic information does not appear to foretell a double dip in the coming. Rather, the economic malaise that set-in this summer is still very much with us.”

With the three-to-one relationship between the PCI and GDP growth in recessions and recoveries, the 4.1 percent annualized growth figure translates to 1.3 percent forecasted growth for GDP. PCI results need to reach 10 to 15 percent year-over-year growth for a truly healthy job market. The declines in the PCI also suggest further slowing in the Federal Reserve's monthly Industrial Production (IP) index (to be released later this month), and anticipate a month-over-month IP decrease of 0.16 percent.

...

The Ceridian-UCLA Pulse of Commerce Index™ is based on real-time diesel fuel consumption data for over the road trucking ...

NFIB: Small Business Optimism improves slightly

by Calculated Risk on 11/09/2010 08:14:00 AM

From National Federation of Independent Business (NFIB): Small Business Optimism improves slightly

Optimism rose again in October, but the index remains stuck in the recession zone established over the past two years, not a good reading even with a 2.7 point improvement over September. This is still a recession level reading based on Index values since 1973. However, job creation plans did turn positive and job reductions ceased.Note: Small businesses have a larger percentage of real estate and retail related companies than the overall economy.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the small business optimism index since 1986. Although the index increased to 91.7 in October (highest since May), it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg.

The second graph shows the net hiring plans over the next three months.

The second graph shows the net hiring plans over the next three months.Hiring plans have turned slightly positive again. According to NFIB: "Average employment growth per firm was 0 in October, one of the best performances in years. ... Over the next three months, eight percent plan to increase employment (unchanged), and 13 percent plan to reduce their workforce (down three points), yielding a seasonally adjusted net one percent of owners planning to create new jobs, a four point gain from September."

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.

And the third graph shows the percent of small businesses saying "poor sales" is their biggest problem.Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

Monday, November 08, 2010

More Ireland

by Calculated Risk on 11/08/2010 09:58:00 PM

The WSJ has some interesting facts on the Ireland residential housing market: Ireland's Next Blow: Mortgages

More than 36,000 borrowers, representing 4.6% of Irish mortgage loans, were at least 90 days behind on their loans as of June 30, according to Ireland's financial regulator. ... nearly 200,000 Irish mortgages—about one of every four outstanding home loans—is expected to be "underwater" by the end of the year.As a comparison, the Q2 CoreLogic report showed 11 million American mortgages, or 23 percent of households with mortgages, were underwater - about the same percentage as in Ireland. In the U.S. about 4.3% of mortgages are more than 90 days delinquent, and another 3.8% are in the foreclosure process.

The Ireland 10-year bond yield hit a record 7.86% today. Ireland will not have to borrow until next year, but if the 10-year yield moves above 8% or so, then it is likely that Ireland would use the European Financial Stability Fund (EFSF).

AAR: October 2010 Rail Traffic Continues Mixed Progress

by Calculated Risk on 11/08/2010 05:06:00 PM

From the Association of American Railroads: October 2010 Rail Traffic Continues Mixed Progress. The AAR reports carload traffic in October 2010 was up 8.7% compared to October 2009, however carload traffic was still 7.9% lower than in October 2008. Intermodal traffic (using intermodal or shipping containers) is up 10.4% over October 2009 and up 1.2% over October 2008.

"Last week the government announced that GDP grew roughly two percent in the third quarter of 2010. Rail traffic in October suggests that similarly moderate growth is continuing into the fourth quarter," said AAR Senior Vice President John T. Gray.

Click on graph for larger image in new window.

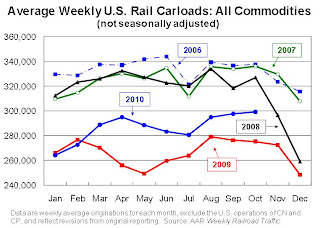

Click on graph for larger image in new window.This graph shows U.S. average weekly rail carloads (NSA). Traffic increased in 15 of 19 major commodity categories year-over-year.

From AAR:

• U.S. freight railroads originated 1,196,432 carloads in October 2010, an average of 299,108 carloads per week. That’s up 8.7% from October 2009 and down 7.9% from October 2008 on a non-seasonally adjusted basisAs the first graph shows, rail carload traffic collapsed in November 2008, and now, a year into the recovery, carload traffic has only recovered half way. However intermodal has performed better ...

• On a non-seasonally adjusted basis, October is usually the highest intermodal month of the year for U.S. railroads. That’s the case again in 2010This is consistent with a sluggish recovery.

• Well over half of U.S. intermodal traffic consists of imports or exports, and growth in international trade is a major factor behind higher intermodal traffic so far this year. In the first nine months of 2010, import TEUs (twenty-foot equivalent units) at six of the largest U.S. ports — Los Angeles, Long Beach, Savannah, New York & New Jersey, Seattle, and Norfolk — rose 19.9% in aggregate compared with the first nine months of 2009. Export TEUs at the same ports were up 15.5% in aggregate.excerpts with permission

Note: The Ceridian-UCLA diesel fuel index for October will be released tomorrow.

Fed: Banks expect tight lending standards for foreseeable future

by Calculated Risk on 11/08/2010 02:23:00 PM

In general banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans).

From the Federal Reserve The October 2010 Senior Loan Officer Opinion Survey on Bank Lending Practices

The October survey indicated that, on net, banks eased standards and terms over the previous three months on some categories of loans to households and businesses. ... However, substantial fractions of banks reported in response to a set of special questions that standards for many categories of loans would not return to their longer-run averages for the foreseeable future.Here is the full report.

...

Domestic survey respondents reported easing standards and most terms on [commercial and industrial] C&I loans to firms of all sizes. ... Demand declined, on net, for C&I loans ...

Most respondents reported no change in their bank's standards for approving [commercial real estate] CRE loans. ...

[A] special question asked banks whether their current level of lending standards remained tighter than the average level over the past decade and, if so, when they expected that standards would return to their long-run norms, assuming that economic activity progressed according to consensus forecasts. For all loan categories, substantial fractions of respondents thought that their bank's lending standards would not return to their long-run norms until after 2012 or would remain tighter than longer-run average levels for the foreseeable future.

NY Fed: Continued Decline in Consumer Debt

by Calculated Risk on 11/08/2010 11:14:00 AM

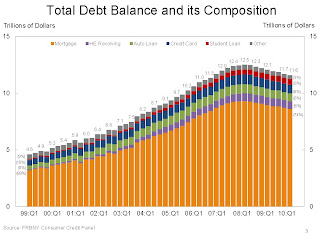

This is a new quarterly report from the NY Fed ... an interesting finding is that consumers are actively reducing their debt - the decline in debt isn't just because of defaults.

From the NY Fed: Q3 Report on Household Debt and Credit Shows Continued Decline in Consumer Debt

The Federal Reserve Bank of New York today released its Quarterly Report on Household Debt and Credit for the third quarter of 2010, which shows that consumer debt continues its downward trend of the previous seven quarters, though the pace of decline has slowed recently. Since its peak in the third quarter of 2008, nearly $1 trillion has been shaved from outstanding consumer debts.Here is the Q3 report: Quarterly Report on Household Debt and Credit

Additionally, this quarter’s supplemental report addresses for the first time the question of how this decline has been achieved and notes a sharp reversal in household cash flow from debt, indicating a decrease in available funds for consumption. According to newly available data through year end 2009, the payoff of debt by consumers reduced their cash flow by about $150 billion, whereas between 2000 and 2007, borrowing had contributed more than $300 billion annually to consumers’ cash flow.

Excluding the effects of defaults and charge-offs, available data show that non-mortgage debt fell for the first time since at least 2000. Also, net mortgage debt paydowns, which began in 2008, reached nearly $140 billion by year end 2009. These unique findings suggest that consumers have been actively reducing their debts, and not just by defaulting.

“Consumer debt is declining but only part of the reduction is attributable to defaults and charge-offs,” said Donghoon Lee, senior economist in the Research and Statistics Group at the New York Fed. “Americans are borrowing less and paying off more debt than in the recent past. This change, which we continue to study carefully, can be a result of both tightening credit standards and voluntary changes in saving behavior.”

And a supplemental report: Have Consumers Become More Frugal?

So are consumers becoming more frugal? Yes. Holding aside defaults, they are indeed reducing their debts at a pace not seen over the last ten years. A remaining issue is whether this frugality is a result of borrowers being forced to pay down debt as credit standards tightened, or a more voluntary change in saving behavior.And some data and graphs.

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the NY Fed:

Aggregate consumer debt continued to decline in the second quarter, continuing its trend of the previous six quarters. As of June 30, 2010, total consumer indebtedness was $11.7 trillion, a reduction of $812 billion (6.5%) from its peak level at the close of 2008Q3, and $178 billion (1.5%) below its March 31, 2010 level. Household mortgage indebtedness has declined 6.4%, and home equity lines of credit (HELOCs) have fallen 4.4% since their respective peaks in 2008Q3 and 2009Q1. Excluding mortgage and HELOC balances, consumer indebtedness fell 1.5% in the quarter and, after having fallen for six consecutive quarters, stands at $2.31 trillion, 8.4% below its 2008Q4 peak.There are a number of credit graphs at the NY Fed site.

Ireland Update: "Relying on the kindness of strangers"

by Calculated Risk on 11/08/2010 08:49:00 AM

The yield on the Ireland 10-year bond hit a record 7.75% this morning.

From Bloomberg: Irish Fight to End Bond `Buyers Strike' as EU Examines Budget

EU Economic and Monetary Affairs Commissioner Olli Rehn arrives in Dublin today for a two-day visit ... Ireland has the funds to avert the need for an immediate rescue, its cash may run out in the middle of next year unless it can raise money from the bond market in 2011.And a long piece from Professor Morgan Kelly (Ireland's "Doctor Doom"): If you thought the bank bailout was bad, wait until the mortgage defaults hit home. He is definitely pessimistic, and concludes:

...

Erik Nielsen, chief European economist at Goldman Sachs Group Inc., said Ireland may need help from the European Stability Fund and the IMF in Washington in early 2011.

“This is starting to feel like a tsunami of new concerns,” Nielsen said “There is a considerable probability that the alphabet soup will get involved in financing Ireland and Portugal early next year.”

Ireland faced a painful choice between imposing a resolution on banks that were too big to save or becoming insolvent, and, for whatever reason, chose the latter. Sovereign nations get to make policy choices, and we are no longer a sovereign nation in any meaningful sense of that term.

From here on, for better or worse, we can only rely on the kindness of strangers.

Sunday, November 07, 2010

NY Times on Irish Bond Yields

by Calculated Risk on 11/07/2010 10:23:00 PM

From Landon Thomas at the NY Times: Irish Debt Woes Revive Concern About Europe

The yield on Ireland’s 10-year bond climbed to 7.6 percent on Friday ... Its debt woes have stoked fear that it might even need to follow Greece and request a bailout from the European Union and the International Monetary Fund.Ireland has until next June to make progress. If Ireland does need a bailout next year, it will probably come from the European Financial Stability Facility (EFSF) - and at rates of around 8%.

...

For the moment, at least, that outcome seems improbable. Unlike Greece earlier this year, Ireland has enough cash on hand to allow it to finance government operations through June 2011.

Earlier:

NFIB: Small Business hiring "improves slightly"

by Calculated Risk on 11/07/2010 06:28:00 PM

The National Federation of Independent Business (NFIB) will release their small business confidence survey on Tuesday. They pre-released the employment results: Job Creation Plans on Main Street Improve Slightly

“[A] seasonally adjusted net 1 percent of owners [plan] to create new jobs, 4 points better than September. Although expectations for business conditions and real sales trends improved in October, it wasn’t enough to produce a surge in job creation plans which remained mired at recession levels. The NFIB labor market indicators are underperforming all recovery periods since 1973.”Small business hiring has been weak in the current recovery, and any improvement is plus - however it is important to note that a large percentage of small businesses are real estate related (compared to all businesses).

Earlier:

Schedule for Week of Nov 7th

by Calculated Risk on 11/07/2010 01:30:00 PM

A light week for economic releases. The trade report on Wednesday is probably the key release and could lead to a revision in Q3 GDP.

Association of American Railroads rail traffic indicators for October. Trucking, rail traffic and the Ceridian diesel fuel index are all measures of transportation (a coincident indicator).

AM: New York Fed: U.S. Credit Conditions for Q3. This is a new quarterly report from the New York Fed.

7:30 AM: NFIB Small Business Optimism Index for October. This index has been showing small businesses remain pessimistic and the survey shows that the major concern is the lack of customers.

9:00 AM: Ceridian-UCLA Pulse of Commerce Index™ This is the diesel fuel index for October (a measure of transportation).

10:00 AM: Monthly Wholesale Trade: Sales and Inventories for September. The consensus is 0.6% increase in inventories.

10:00 AM: Job Openings and Labor Turnover Survey for September from the BLS. This report has been showing very little turnover in the labor market and few job openings.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last couple months - suggesting reported home sales through at least November will be very weak.

8:30 AM: Trade Balance report for September from the Census Bureau. The consensus is for the U.S. trade deficit to decrease to $45 billion (from $46.3 billion in August).

8:30 AM: The initial weekly unemployment claims report will be released. Consensus is for a decline to 450,000 from 457,000 last week. (released a day early).

Veteran's Day: Stock Market Open

9:55 AM: Reuters/University of Mich Consumer Sentiment preliminary for November. The consensus is for a slight increase to 69.0 from 67.7 in October.

After 4:00 PM: Perhaps the FDIC will have another busy Friday afternoon ...