by Calculated Risk on 10/20/2010 07:39:00 AM

Wednesday, October 20, 2010

MBA: Mortgage Purchase Activity Declines

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 11.2 percent from the previous week. The seasonally adjusted Purchase Index decreased 6.7 percent from one week earlier.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.34 percent from 4.21 percent, with points decreasing to 0.81 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index declined to near the lows of earlier this year, but this is just one week - the decline might be related to the Columbus Day holiday or to the recent slight change in FHA lending standards.

Note that the 30 year contract rate at 4.34% is just up from the record low of 4.21%.

AIA: Architecture Billings Index shows expansion, first time since Jan 2008

by Calculated Risk on 10/20/2010 12:00:00 AM

Note: This index is a leading indicator for new Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index increased to 50.4 in September from 48.2 in August. Any reading above 50 indicates expansion.

"The strong upturn in design activity in the commercial and industrial sector certainly suggests that this upturn can possibly be sustained," said Kermit Baker, AIA's chief economist. "But we will need to see consistent improvement over the next few months in order to feel comfortable about the state of the design and construction industry."The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. This is the first time the index has been above 50 since Jan 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. So, if the index stays at 50 or above, this suggests there will probably be further declines in CRE investment for the next 9 to 12 months.

Tuesday, October 19, 2010

Foreclosure-Gate: The Investigations and some comments on other issues

by Calculated Risk on 10/19/2010 08:42:00 PM

From Zachary Goldfarb at the WaPo: Task force probing whether banks broke federal laws during home seizures

Goldfarb writes that the Financial Fraud Enforcement Task Force is looking into whether the mortgage servicers misled federal housing agencies, and also "into whether the submission of flawed paperwork during the foreclosure process violated mail or wire fraud laws". There will be a meeting tomorrow (Wednesday), followed by a briefing by "HUD Secretary Shaun Donovan and the task force executive director, Robb Adkins".

White House press secretary Robert Gibbs ... said the administration is strongly supporting a parallel probe by every state's attorney general. Foreclosure law is largely the domain of state courts.And from David Streitfeld at the NY Times: States Continue Foreclosure Inquiries

“There has been an attempt by some of the major servicers to indicate there are no problems,” said Patrick Madigan, Iowa’s assistant attorney general. “We’re not at the end of this process. We’re at the beginning.”My comment: I fully support these investigations, but I've downplayed "foreclosure-gate" because I thought the impact on housing and the economy would be minor - depending of course on the length of the foreclosure delays. Many other people disagree with my view - and please remember I'm not always right.

It is important to separate out two other issues. The first is MERS (the "Mortgage Electronic Registration System"). There are many interesting issues with MERS - and plenty of litigation - but my feeling is that the defects are curable, and these issues will have little impact on the economy. Since I think the impact will be minor, once again I've mostly been ignoring these issues.

The third issue is repurchase requests based on Reps and Warranties for mortgages. This is an important story for the banks. I've been mentioning the increasing push-backs from the GSEs (Fannie and Freddie). That isn't a new story. The important development today was that several major bond investors are pressuring BofA to repurchase defective mortgages. Although I've been following this story, I haven't mentioned it - and some people think I've been "behind the curve". Could be.

The key questions are how many loans will eventually be pushed-back and how long it will take. Usually this process takes a long time and involves analyzing numerous loan files for defects. And these weren't GSE loans for a reason - the loans had significant risk layering (stated income, option ARMs, high LTV, and high debt-to-income ratios etc.) and these risk factors were fully disclosed to the investors. I expect this to be a slow process and be a drag on bank earnings for some time, but not be another major event like the collapse of Lehman. Once again I think the impact on the economy will be minor (my focus is on housing and the economy).

Housing Starts and the Unemployment Rate

by Calculated Risk on 10/19/2010 05:50:00 PM

An update by request ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows single family housing starts and the unemployment rate (inverted) through September. Note: Of course there are many other factors too, but housing is a key sector.

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Housing starts (blue) rebounded a little last year,and then moved sideways for some time, before declining again in May.

This is what I expected when I first posted the above graph over a year ago. I wrote:

[T]here is still far too much existing home inventory, a sharp bounce back in housing starts is unlikely, so I think ... a rapid decline in unemployment is also unlikely.Usually near the end of a recession, residential investment1 (RI) picks up as the Fed lowers interest rates. This leads to job creation and also household formation - and that leads to even more demand for housing units - and more jobs, and more households - a virtuous cycle that usually helps the economy recover.

However this time, with the huge overhang of existing housing units, this key sector isn't participating. Earlier today, NY Fed President William Dudley said the NY Fed's estimate was that "there are roughly 3 million vacant housing units more than usual". If that estimate is correct (I think it is too high), then it would take several years of housing starts at the current level, combined with more normal household growth, to eliminate the excess supply.

1 RI is mostly new home sales and home improvement.

Major Bondholders seek BofA Mortgage Repurchases

by Calculated Risk on 10/19/2010 02:46:00 PM

From Bloomberg: Pimco, New York Fed Said to Seek BofA Repurchase of Mortgages

Pacific Investment Management Co., BlackRock Inc. and the Federal Reserve Bank of New York are seeking to force Bank of America Corp. to repurchase soured mortgages packaged into $47 billion of bonds by its Countrywide Financial Corp. unit, people familiar with the matter said.This will take time - and be contested - but the battle over Reps and Warranties will probably continue to grow. Fannie and Freddie have been ramping up their push backs for some time, and here come the push backs from the private investors. I think this will be a drag on bank earnings for some time.

The bondholders wrote a letter to Bank of America and Bank of New York Mellon Corp., the debt’s trustee, citing alleged failures by Countrywide to service the loans properly ...

Moody's: Commercial Real Estate Prices fall to 2002 Levels

by Calculated Risk on 10/19/2010 12:50:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 3.3% in August. This is a repeat sales measure of commercial real estate prices.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted. Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales - and that can impact prices.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

It is important to remember that the number of transactions is very low and there are a large percentage of distressed sales.

HousingWire has more:

"The commercial real estate market in the U.S. has become trifurcated with prices rising for performing trophy assets located in major markets, falling sharply for distressed assets, and remaining essentially flat for smaller healthy properties," said Nick Levidy, managing director at Moody's.

Fed's Dudley: 3 million excess vacant housing units

by Calculated Risk on 10/19/2010 10:09:00 AM

From NY Fed President William Dudley: Regional Economy and Housing Update

[L]et's consider the slow housing recovery. Housing market activity—both new construction and sales—remains depressed. On the construction side, total housing starts are running at just 600,000 units per year (seasonally-adjusted) in recent months. This is up from 530,000 units at the trough in the first quarter of 2009 but it is still extremely low by the standards of the last 50 years. In fact, the rate of new construction is so low that there is barely any net growth in the U.S. housing stock these days.For those in the New York / New Jersey area, much of Dudley speech is on the regional economy and housing market.

One reason why so little housing is being built is that many existing homes stand vacant. We estimate that there are roughly 3 million vacant housing units more than usual. And more vacancies are added daily as the foreclosure process moves homes from families to mortgage lenders. This stock of vacant homes will shrink when fewer are foreclosed upon and more of these homes are sold or rented out.

On the sales side, even though low mortgage interest rates and falling home prices have together boosted housing affordability to its highest level in 40 years, the current pace of sales is quite sluggish. Impediments to home sales include tight lending standards, a weak job market and continued uncertainty regarding the future path of home prices. The large decline in home prices that occurred between 2006 and 2008 is also important. This decline reduced the amount of equity that owners have in their homes, making it difficult for people to come up with the funds needed to "trade-up" and move into better homes.

In addition, the steep decline in home prices put many families at risk of mortgage delinquency and, ultimately, losing their homes to foreclosure. With lower home prices, many families now owe more on their mortgage than their home is worth. This means that they cannot refinance or sell their homes easily if they experience a financial crisis, such as a job loss or a serious illness. Recent developments on foreclosures have been mixed. While RealtyTrac reports that foreclosure completions in the United States exceeded 100,000 for the first time in September, it is important to remember that foreclosure is a lengthy process in most states. Our data indicate that, in recent quarters, borrowers are becoming less likely to fall behind on their mortgages, so fewer households are now entering the foreclosure process. At the same time, though, major lenders have acknowledged serious problems in the processes they have used to repossess homes and announced moratoria on new foreclosures. Taken together, these developments suggest that the situation in housing remains uncertain for the foreseeable future.

The Federal Reserve actively encourages efforts to find viable alternatives to foreclosure, like loan modifications, or deeds in lieu. We also support due process and access to legal counsel for homeowners facing foreclosure, for instance through legal aid programs. At the same time, it is important that foreclosures that properly comply with state and federal law can ultimately take place, as this is a necessary part of the adjustment that will eventually return us to more normal conditions in the housing market.

At present, the extent of the documentation problem and its wider ramifications are still uncertain. In conjunction with the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation, the Federal Reserve is therefore seeking to establish the facts through a review of the foreclosure practices, governance and documentation at the major bank mortgage servicers. We want to ensure that the housing finance business is supported by robust back-office operations—for processing of new mortgages as well as foreclosures— so that buyers of homes and investors in mortgage securities have full confidence in the process. We are monitoring developments closely in order to evaluate any potential impact on the housing market, financial institutions and the overall economy.

Housing Starts increase in September

by Calculated Risk on 10/19/2010 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 610 thousand (SAAR) in September, up 0.3% from the revised August rate of 608 thousand (revised up from 598 thousand), and up 28% from the all time record low in April 2009 of 477 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959).

There has been an increase in multi-family starts over the last two months, although single family starts are significantly below the levels of earlier this year.

Single-family starts increased 4.4% to 452 thousand in August. This is 25% above the record low in January 2009 (360 thousand).

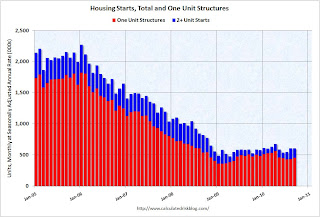

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

The second graph shows total and single unit starts since 1968. This shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for almost two years - with a slight up and down over the last six months due to the home buyer tax credit.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Housing Starts:This was above expectations of 580 thousand starts, mostly because of the volatile multi-family starts. As I've mentioned many times - this low level of starts is good news for the housing market longer term (there are too many housing units already), but bad news for the economy and employment short term.

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 610,000. This is 0.3 percent (±10.3%)* above the revised August estimate of 608,000 and is 4.1 percent (±12.0%)* above theSeptember 2009 rate of 586,000.

Single-family housing starts in September were at a rate of 452,000; this is 4.4 percent (±13.9%)* above the revised August figure of 433,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 539,000. This is 5.6 percent (±1.4%) below the revised August rate of 571,000 and is 10.9 percent (±2.3%) below the September 2009 estimate of 605,000.

Single-family authorizations in September were at a rate of 405,000; this is 0.5 percent (±1.3%)* above the revised August figure of 403,000.

Monday, October 18, 2010

Foreclosure-Gate: GMAC resumes some foreclosures

by Calculated Risk on 10/18/2010 09:48:00 PM

Statement from GMAC: GMAC Mortgage Statement on Independent Review and Foreclosure Sales

GMAC Mortgage ... has engaged several leading legal and accounting firms to conduct independent reviews of its foreclosure procedures in each of the 50 states.Earlier I posted the BofA and Citi comments (BofA is resuming foreclosures, Citi said their foreclosure process was "sound".) Several large banks report Q3 results over the next two days (BofA, Goldman Sachs, Wells Fargo and Morgan Stanley), and I expect more comments on foreclosure issues (and possibly more questions).

...

In addition to the nationwide measures, the review and remediation activities related to cases involving judicial affidavits in the 23 states continues and has been underway for approximately two months. As each of those files is reviewed, and remediated when needed, the foreclosure process resumes. GMAC Mortgage has found no evidence to date of any inappropriate foreclosures.

On the Citi conference call this morning there were no questions on foreclosure-gate and only one on securitization issues - and that didn't provide any new information.

2010 Census: Final Weekly Payroll Update

by Calculated Risk on 10/18/2010 06:59:00 PM

The Census Bureau has released the final weekly payroll report for the 2010 Census. The report shows only 2,766 temporary workers were on the payroll for the week ending Oct 2nd.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the number of Census workers paid each week. The red labels are the weeks of the BLS payroll survey.

I'm providing this update because every month there is some confusion over how to report the payroll numbers in the employment report. Starting with the October employment report (to be released on November 5th), we can go back to reporting the headline number (not ex-Census), and we can ignore the impact of the temporary Census hiring on the monthly payroll numbers - well, until the next decennial Census!

Citigroup: Foreclosure Process is 'Sound', BofA expects to submit new affidavits next week

by Calculated Risk on 10/18/2010 03:38:00 PM

From Dow Jones: Citigroup Says Its Foreclosure Processing Is 'Sound' Dow Jones is reporting that the Citigroup CFO John Gerspach said they have found no issues with the foreclosure process, and they see no reason to halt foreclosures.

"While we use external attorneys to prepare [foreclosure] documents, each package is reviewed by a Citi employee, who verifies the information and signs the foreclosure affidavit in the presence of a notary," Gerspach said ...And from the WSJ: BofA Sets Timetable for Foreclosure Review. The WSJ is reporting that BofA will resubmit new affidavits for 102,000 pending foreclosures, and that they expect to resubmit the affidavits, with the proper reviews and new signatures, by October 25th.

Fed's Lockhart: QE2 is an "insurance policy" against further disinflation

by Calculated Risk on 10/18/2010 01:03:00 PM

From Atlanta Fed President Dennis Lockhart: The Challenges of Monetary Policy in Today's Economy

To opt for more quantitative easing at this juncture is a big decision. Today I will walk you through the thicket of considerations that lead me, at this moment, to be sympathetic to more monetary stimulus in the near future.Lockhart is not currently on the FOMC.

...

With current inflation running at about 1 percent or a little higher and with official unemployment measured at 9.6 percent, it's clear that the economy is not where we want it to be. In my mind, the question is whether this situation is a call to immediate action.

...

As a starting point, I expect final measures of third quarter GDP growth to be close to that in the second quarter which came in at 1.6 percent. My current forecast sees a modest increase in the rate of growth in the fourth quarter and further, but still modest, improvement in 2011. In this forecast, inflation remains low but with no further disinflation, and unemployment comes down very gradually.

In my thinking, the range of plausible divergence from this forecast is quite wide, and the risks are more to the downside.

...

In my view, the decision is not clear cut. We policymakers have to weigh these arguments pro and con, potential costs versus benefits, and competing risks. As I said earlier, I am leaning in favor of additional monetary stimulus while acknowledging the longer-term risks the policy may present. At this juncture, and given the circumstances of sluggish growth and measured inflation that is too low, I give greater weight to the risk of further disinflation leading to deflation. In my mind, QE2 is a form of risk management—an insurance policy that is prudent to put in place at this time.

Note: Lockhart see modest improvment in both GDP growth and unemployment, but I think we will see a little more weakness in GDP growth and the unemployment rate will even tick up a little from 9.6%.

NAHB Builder Confidence increases in October

by Calculated Risk on 10/18/2010 10:00:00 AM

The National Association of Home Builders (NAHB) reports the housing market index (HMI) was at 16 in October. This is a 3 point increase from 13 in September, and is the highest level since June. The record low was 8 set in January 2009, and 16 is still very low ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph compares the NAHB HMI (left scale) with single family housing starts (right scale). This includes the October release for the HMI and the August data for starts (September starts will be released tomorrow).

This shows that the HMI and single family starts mostly move in the same direction - although there is plenty of noise month-to-month.

Press release from the NAHB: Builder Confidence Improves in October

Builder confidence in the market for newly built, single-family homes rose three points to 16 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI) for October, released today. This was the first improvement registered by the HMI in five months, and returns the index to a level last seen in June of this year.

...

All three of the HMI's component indexes registered gains in October. The index gauging current sales conditions rose three points to16, while the index gauging sales expectations in the next six months rose five points to 23 and the index gauging traffic of prospective buyers rose two points to 11.

Industrial Production, Capacity Utilization decreased in September

by Calculated Risk on 10/18/2010 09:15:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production decreased 0.2 percent in September after having increased 0.2 percent in August. ... The capacity utilization rate for total industry edged down to 74.7 percent, a rate 4.2 percentage points above the rate from a year earlier but 5.9 percentage points below its average from 1972 to 2009.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows Capacity Utilization. This series is up 9.5% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 74.7% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production declined slightly in September, and production is still 7.5% below the pre-recession levels at the end of 2007.

This is below consensus expectations of a 0.2% increase in Industrial Production, and an increase to 74.8% (from 74.7% before revision) for Capacity Utilization.

Sunday, October 17, 2010

Schedule additions: Large Bank Financial Results

by Calculated Risk on 10/17/2010 09:53:00 PM

Here is the Schedule for Week of Oct 17th

Here is the Summary for Week ending Oct 16th (with plenty of graphs).

I've updated the schedule to include financial results for several large banks (ht Tony). Usually I wouldn't include an earnings calendar, but I'll be looking for comments on Foreclosure-Gate (and other comments).

The additions are:

HUD Secretary on Foreclosure-Gate: "Will respond with full force of the law"

by Calculated Risk on 10/17/2010 07:49:00 PM

From the HuffPo: How We Can Really Help Families

The recent revelations about foreclosure processing -- that some banks may be repossessing the homes of families improperly -- has rightly outraged the American people. The notion that many of the very same institutions that helped cause this housing crisis may well be making it worse is not only frustrating -- it's shameful.I hope actions follow words.

...

[T]he Obama Administration has a comprehensive review of the situation underway and will respond with the full force of the law where problems are found. The Financial Fraud Enforcement Task Force that President Obama established last November has made this issue priority number one.

Schedule for Week of Oct 17th

by Calculated Risk on 10/17/2010 02:15:00 PM

Note: The previous post was the weekly summary for last week.

Two key housing reports will be released this week: September housing starts (Tuesday) and October homebuilder confidence (Monday). Also the Fed will release September industrial production and capacity utilization (Tuesday).

Update: Large bank earnings added for comments on Foreclosure-Gate.

CoreLogic House Price Index for August. This release will probably show further declines in house prices. The index is a weighted 3 month average for June, July and August.

Making Home Affordable Program (HAMP) for September and the “Housing Scorecard”

8:00 AM ET: Citigroup Third Quarter 2010 Earnings Review

9:15 AM ET: The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.2% increase in Industrial Production, and an increase to 74.8% (from 74.7%) for Capacity Utilization.

10 AM: The October NAHB homebuilder survey. This index collapsed following the expiration of the home buyer tax credit. The consensus is for a slight increase to 14 from 13 in September (still very depressed).

12:55 PM Atlanta Fed President Dennis Lockhart speaks at Savannah Rotary Club.

8:00 AM: Bank of America Q3 2010 Earnings

8:00 AM: Goldman Sachs earnings

8:30 AM: Housing Starts for September. Housing starts also collapsed following the expiration of the home buyer tax credit. The consensus is for a decrease to 580,000 (SAAR) in September from 598,000 in August. Note: the August increase was mostly from multi-family starts.

Morning: Moody's/REAL Commercial Property Price Index (CPPI) for August.

Various Fed Speeches scheduled: NY Fed's Dudley, Chicago Fed’s Evans at about 10 AM, Dallas Fed’s Fisher and Minneapolis Fed’s Kocherlakota at about 1:00 PM.

Early: The AIA's Architecture Billings Index for September will be released (a leading indicator for commercial real estate). This has been showing ongoing contraction, and usually this leads investment in non-residential structures (hotels, malls, office) by 9 to 12 months.

7:00 AM: The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index. This index declined sharply following the expiration of the tax credit, and the index has only recovered slightly over the last few months even with record low mortgage rates.

7:30 AM: Morgan Stanley third quarter 2010 financial results

8:00 AM: Wells Fargo earnings

2:00 PM: The Fed’s Beige Book for early October. This is anecdotal information on current economic conditions.

Fed Speeches: Philly Fed's Plosser at about 1:00 PM and Richmond Fed's Lacker at 4:00 PM.

8:30 AM: The initial weekly unemployment claims report will be released. Consensus is for about a decrease to 455,000 from 462,000 last week (still elevated).

10:00 AM: Philly Fed Survey for October. This survey showed contraction over the last two months. The consensus is for a slight increase to 1.8 from -0.7 in September.

10:00 AM: Conference Board's index of leading indicators for August. The consensus is for a 0.3% increase in this index.

Fed Speeches: St Louis Fed's Bullard at about 10:00 AM, and Kansas City Fed's Hoenig at 9:45 PM.

10:00 AM: the BLS will release the Regional and State Employment and Unemployment report for September.

After 4:00 PM: The FDIC will probably have another busy Friday afternoon ...

Summary for Week ending Oct 16th

by Calculated Risk on 10/17/2010 08:45:00 AM

A summary of last week - mostly in graphs.

Perhaps the biggest story of last week was the speech from Fed Chairman Ben Bernanke: Monetary Policy Objectives and Tools in a Low-Inflation Environment.

Although he didn't outline any specific details, he clearly stated that the unemployment rate was too high and inflation too low. Here are the key sentences:

"[I]nflation is running at rates that are too low relative to the levels that the Committee judges to be most consistent with the Federal Reserve's dual mandate in the longer run.That strongly suggests QE2 will arrive on November 3rd.

...

[U]nemployment is clearly too high relative to estimates of its sustainable rate. Moreover, with output growth over the next year expected to be only modestly above its longer-term trend, high unemployment is currently forecast to persist for some time."

On a monthly basis, retail sales increased 0.6% from August to September (seasonally adjusted, after revisions - August sales were revised up), and sales were up 7.3% from September 2009. Retail sales increased 0.4% ex-autos - about at expectations.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

Retail sales are up 9.6% from the bottom, but still off 3.2% from the pre-recession peak.

Retail sales had moved mostly moved sideways for six months, but this is now the high for the year.

Here is a graph from the NY Fed.

Here is a graph from the NY Fed."The general business conditions index rose 12 points, to 15.7. The new orders and shipments indexes were also positive and well above their September levels.

...

The index for number of employees climbed for a third consecutive month, although the average workweek index dipped slightly."

These regional surveys had been showing a slowdown in manufacturing and are being closely watched right now. This was above expectations.

Three measures of inflation: core CPI, median CPI and trimmed-mean CPI, were all below 1% in September, and also under 1% for the last 12 months.

This graph shows these three measure of inflation on a year-over-year basis.

This graph shows these three measure of inflation on a year-over-year basis.From the Cleveland Fed: "Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.2% annualized rate) in September. The CPI less food and energy was unchanged at 0.0% (0.0% annualized rate) on a seasonally adjusted basis.

Over the last 12 months, the median CPI rose 0.5%, the trimmed-mean CPI rose 0.8%, the CPI rose 1.1%, and the CPI less food and energy rose 0.8%"

They all show that inflation has been falling, and that measured inflation is up less than 1% year-over-year. Core CPI and median CPI were flat in September, and the 16% trimmed mean CPI was up 0.1%.

Here are a few graphs based on the NFIB press release: Small Business Optimism Index Remains at Recessionary Level

This graph shows the small business optimism index since 1986. Although the index increased slightly in September, it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg who said: "The downturn may be officially over, but small business owners have for the most part seen no evidence of it."

This graph shows the small business optimism index since 1986. Although the index increased slightly in September, it is still at recessionary level according to NFIB Chief Economist Bill Dunkelberg who said: "The downturn may be officially over, but small business owners have for the most part seen no evidence of it." This graph shows the net hiring plans over the next three months.

This graph shows the net hiring plans over the next three months.Hiring plans have turned negative again. According to NFIB: "Over the next three months, eight percent plan to increase employment (unchanged), and 16 percent plan to reduce their workforce (up three points), yielding a seasonally adjusted net negative three percent of owners planning to create new jobs, down four points from August."

This graph shows the percent of small businesses saying "poor sales" is their biggest problem.

This graph shows the percent of small businesses saying "poor sales" is their biggest problem.Usually small business owners complain about taxes and regulations (that usually means business is good!), but now their self reported biggest problem is lack of demand.

"The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, fell .5 percent in September after falling 1.0 percent in August ... The decline indicates four consecutive months of limited to no increases in over the road movement of produce, raw materials, goods-in-process and finished goods since the PCI peaked in May 2010."

"The Ceridian-UCLA Pulse of Commerce Index™ (PCI), a real-time measure of the flow of goods to U.S. factories, retailers, and consumers, fell .5 percent in September after falling 1.0 percent in August ... The decline indicates four consecutive months of limited to no increases in over the road movement of produce, raw materials, goods-in-process and finished goods since the PCI peaked in May 2010."This graph shows the index since January 1999.

This is a new index, and doesn't have much of a track record in real time, although the data suggests the recovery has "stalled" since May.

From MarketWatch: Consumer sentiment edges lower in October

From MarketWatch: Consumer sentiment edges lower in October The preliminary Reuters-University of Michigan consumer sentiment index edged lower in October, falling to 67.9 ... from 68.2 last month.

Consumer sentiment is a coincident indicator - and this suggests a sluggish economy.

This was a big story in July when consumer sentiment collapsed to the lowest level since late 2009.

It has moved sideways since then ...

This year’s Nobel Memorial Prize in Economic Science ... was awarded today to Peter A. Diamond, Dale T. Mortensen and Christopher A. Pissarides for their research on “markets with search frictions,” which means any setting where buyers and sellers don’t automatically find each other.

Best wishes to all.

Saturday, October 16, 2010

Foreclosure-Gate: The Lowest Bidder

by Calculated Risk on 10/16/2010 10:42:00 PM

In the previous post I asked Why did the mortgage servicers use "robo-signers"?

Note: Apparently not all servicers used "robo-signers", but several of them did.

This might be an example of the "lowest bidder", from Ariana Eunjung Cha and Zachary Goldfarb at the WaPo: For foreclosure processors hired by mortgage lenders, speed equaled money

The law firm of David J. Stern in Plantation, Fla., for instance, assigned a team of 12 to handle 12,000 foreclosure files at once ... Each time a case was processed without a challenge from the homeowner, the firm was paid $1,300. ...What a mess.

The office was so overwhelmed with work that managers kept notary stamps lying around for anyone to use. Bosses would often scream at each other in daily meetings for "files not moving fast enough," Tammie Lou Kapusta, the senior paralegal in charge of the operation, said in a deposition Sept. 22 for state law enforcement officials who are conducting a fraud investigation into the firm. ... "The girls would come out on the floor not knowing what they were doing," Kapusta said. "Mortgages would get placed in different files. They would get thrown out. There was just no real organization when it came to the original documents."

Why did the mortgage servicers use "robo-signers"?

by Calculated Risk on 10/16/2010 07:53:00 PM

This is a difficult topic to write about because of all the hysteria, emotion and misinformation, but here goes ...

One of the interesting questions with "Foreclosure-Gate" is why several (but not all) mortgage servicers used "robo-signers". This includes GMAC, JPMorganChase, and several other servicers.

First, we have to remember that every foreclosure is a personal tragedy. I support alternatives to foreclosure including modifications, cram-downs, and even short sales. And before another person claims that I support the banks, I fully support fines, sanctions, disbarment, and the investigations by the 50 future governors (the state attorney generals) into "Foreclosure-Gate".

Second, "Foreclosure-Gate" is primarily about "robo-signers". Some people are trying to conflate other sloppy procedures, cost cutting and even MERS (Mortgage Electronic Registration Systems) into "Foreclosure-Gate". This is just confusing readers. All of the servicers who have put foreclosures on hold have done so either because they had "robo-signers" or because they wanted to verify that their processes did not use "robo-signers" (or anything similar). There are valid questions about MERS and other "cost cutting" measures - although most reports I've seen are grossly misinformed - but unfortunately it takes time to get that right (I'll write about that at a later date).

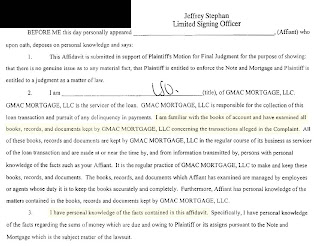

A review: "Robo-signers" are individuals who signed affidavits stating that they had "personal knowledge" of the facts in a foreclosure case, when in fact they did not.

JPM admitted as much this week: "We've identified issues relating to the mortgage foreclosure affidavits and those include signers not having personally reviewed the underlying loan files but instead having relied upon the work of others."

There were also situations of questionable notarization of the affidavits.

Here is an excerpt that I posted earlier from an affidavit signed by alleged "robo-signer" Jeffrey Stephen of GMAC:

I've highlighted a couple of sentences in yellow. Source: Stopa Law Blog

According to the affidavit the affiant claims to have "examined" the details of the transactions in the complaint, and that he has "personal knowledge of the facts contained in the affidavit". In a deposition - according to media reports - the affiant admitted to just signing the documents without verifying the details.

So back to the original question: why did some servicers use "robo-signers"?

I think there are several reasons: the flood of foreclosures, the lack of experienced staff, cost cutting - and also because several of the servicers seemed to use the same service providers to set up their processes (probably the lowest bidder).

Way back in February 2007, Tanta wrote: Mortgage Servicing for UberNerds. Tanta made it clear there are times when servicers are really hurting:

1) When rates are falling and borrowers are refinancing. The servicers get paid a slice of each monthly payment, however their fixed costs are front-loaded. So if people are refinancing too quickly, the servicer doesn't receive enough payments to recoup their fixed costs, and ...

2) When the 90+ day delinquency bucket is increasing rapidly. Although the servicer will eventually recoup the costs for foreclosure, the servicers are usually required to pay property taxes, insurance and all the expenses of foreclosure until the REO is sold.

And right now mortgage rates are falling, and many borrowers are refinancing. And at the same time the 90+ day bucket is at record levels and the servicers are swamped with foreclosure activity. So these are the worst of economic times for servicers.

So, to cut costs and control cash flow, some servicers outsourced foreclosures to the lowest bidders. Here is a possible example from Barry Meir at the NY Times: Foreclosure Mess Draws in the Lawyers Who Handled Them.

And this brings us to another key point that Tanta made in 2007:

[W]hen recovery values in a foreclosure are high (in an RE boom), servicers can noodle along and rack up expenses you didn’t know existed—i.e., shove as much of your “overhead” into FC expenses as you can get away with, since someone else will eventually pay the tab. That’s what we mean when we say that you used to be able to make money off a foreclosure. When the liquidation value starts to approach or drop under the loan amount, on the other hand, investors and insurers start going over those expense reports with a fine-toothed comb, and it can end up in [a] “war”.To no ones surprise, most liquidation values are far below the loan amounts, and investors and insurers are fighting over every servicer expense. This has pushed the servicers to do foreclosures as cheaply as possible (along with the cash flow reasons).

So my guess is a combination of getting swamped with foreclosures, lack of experienced staff, the poor economic environment for servicers, and outsourcing to the lowest bidder, all contributed to the servicers using "robo-signers". This doesn't excuse their behavior - I'm just trying to understand why this happened - and why it happened at more than one servicer.

Of course using the lowest bidders, and ending up with a flawed legal process, is going to lead to even larger battles over expenses between the investors and servicers. So instead of saving money, this is going to be far more expensive for certain servicers.