by Calculated Risk on 10/06/2010 11:35:00 AM

Wednesday, October 06, 2010

CoStar: Commercial Real Estate Prices decline in August

This is the new repeat sales index for commercial real estate. Previously I've only been using the Moodys/REAL Commercial Property Price Index (CPPI) for commercial real estate.

From CoStar: CoStar Commercial Repeat-Sale Indices

General commercial real estate and the broad-based CoStar composite index for all commercial real estate reversed the positive trend reported in last month’s findings and came in at -3.48% and -1.38% respectively for the month of August. ...

Repeat sales values for investment grade commercial property reversed their negative trend from July and moved positive again with a 3.73% climb in August. We continue to see a significant spread in cap rates and prices from the larger property in prime core markets to the property in second- and third-tier broader markets. Even with tighter financing, there appears to be plenty of institutional and REIT capital oriented to the lower-risk core markets.

For the past three months, all three indices are negative at -3.92% for the broad general index, -3.24% for investment grade and -3.92% for the composite. For the past 12 months, all three indices are down approximately 10% to 11%.

One reason for the volatility of these indices discussed here is the proportion of distress sales, which are continuing to climb in absolute levels, although as a percentage of sales they have leveled since June. This volume of distressed sales, while certainly not a tsunami, is still significant especially among lodging and multifamily properties.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CoStar shows the indexes for investment grade, general commercial and a composite index. The investment grade index had been increasing since the beginning of the year, but the overall index is still declining.

It is important to remember that there are very few CRE transactions (compared to residential), and that there is a high percentage of distressed sales.

On the number of transactions:

The CCRSI September report is based on sales data through the end of August. In August, 559 sales pairs were recorded.

...

Distress continues to be a significant factor in the index results. Since 2007, the ratio of distressed sales to overall sales has increased from approximately 1% to approximately 23% currently. Discounts on distressed property sales (REOs and short sales) compared to non-distressed sales are running an average of 40% for multifamily, 20% for office and industrial and 17% for retail property based on 2010 data to date.

ADP: Private Employment decreases by 39,000 in September

by Calculated Risk on 10/06/2010 08:15:00 AM

ADP reports:

Private-sector employment decreased by 39,000 from August to September on a seasonally adjusted basis, according to the latest ADP National Employment Report® released today. The estimated change of employment from July to August was revised up from the previously reported decline of 10,000 to an increase of 10,000.Note: ADP is private nonfarm employment only (no government jobs).

The decline in private employment in September confirms a pause in the economic recovery already evident in other data. A deceleration of employment occurred in all the major sectors shown in The ADP Report and for all sizes of payroll.

...

Unlike the estimate of total establishment employment to be released on Friday by the Bureau of Labor Statistics (BLS), today’s ADP National Employment Report does not include the effects of federal hiring — and now firing — for the 2010 Census.

The consensus was for ADP to show an increase of about 23,000 private sector jobs in September, so this was way below consensus.

The BLS reports on Friday, and the consensus is for no change in payroll jobs in September, on a seasonally adjusted (SA) basis, with the loss of around 78,000 temporary Census 2010 jobs (+78,000 ex-Census).

MBA: Mortgage Purchase Activity increases, FHA applications increase sharply

by Calculated Risk on 10/06/2010 07:32:00 AM

The MBA reports: Sharp Jump in Purchase Activity Led by Applications for FHA Loans in Latest MBA Weekly Survey

The Refinance Index decreased 2.5 percent from the previous week. The seasonally adjusted Purchase Index increased 9.3 percent from one week earlier and is the highest Purchase Index observed in the survey since the week ending May 7, 2010.

...

“The increase in purchase activity was led by a 17.2 percent increase in FHA applications, while conventional purchase applications also increased by 3.6 percent,” said Jay Brinkmann, MBA’s Chief Economist. “This is the second straight weekly increase in purchase applications and the highest Purchase Index level since the expiration of the homebuyer tax credit program. One possible driver of last week’s big increase in FHA applications was a desire by borrowers to get applications in before new FHA requirements took effect October 4th, which included somewhat higher credit score and down payment requirements.”

...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.25 percent from 4.38 percent, with points decreasing to 1.00 from 1.01 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The 30-year contract rate is the lowest recorded in the survey, with the previous low being the rate observed last week.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

This is the highest level of purchase activity since the end of the homebuyer tax credit, however the level is still very low - and much of the increase was driven by FHA applications that may decline next week (because of slightly tighter lending requirements).

Note that the 30 year contract rate is at another record low of 4.25%.

Tuesday, October 05, 2010

Reis: Apartment Vacancy Rates decline sharply in Q3

by Calculated Risk on 10/05/2010 11:59:00 PM

From Ilaina Jonas at Reuters: US apartment vacancy rate drops sharply in 3rd qtr

The national vacancy rate fell to 7.2 percent from 7.8 percent in the second quarter ...This is a significant decline from record vacancy rate set in Q1 at 7.9%. This decline fits with the recent survey from the NMHC that showed lower apartment vacancies.

Factoring months of free rent and other concessions landlords used to lure tenants, effective rent was up 0.6 percent to $980 per month, Reis said.

It appears the vacancy rate for large apartment buildings (and rents) bottomed early this year. This is something to watch - and indicates the excess housing inventory (that includes both vacant homes and apartments) is being absorbed.

Note: the Reis numbers are for cities. The overall vacancy rate from the Census Bureau was at a near record 10.6% in Q2 2010.

Hatzius: Two main economic scenarios "fairly bad" and "very bad"

by Calculated Risk on 10/05/2010 09:11:00 PM

This all ties together ...

Perhaps the most depressing exchange of this morning's conference -- and believe me, there were plenty to choose from -- was between Goldman Sachs's Jan Hatzius and Paul Krugman.

Hatzius, 41, said his two scenarios for the U.S. economy were “pretty bad” and “very bad.”

The economy will grow between 1 percent and 2 percent through early next year, with unemployment drifting up “to somewhere around 10 percent, maybe a little above 10 percent,” he said. ... “It’s going to take many years before you get back to anything approaching full unemployment, and 2014 is very likely too early,” said Hatzius.

We see two main scenarios for the economy over the next 6-9 months—a fairly bad one in which the economy grows at a 1½%-2% rate through the middle of next year and the unemployment rate rises moderately to 10%, and a very bad one in which the economy returns to an outright recession. There is not much probability of a significantly better outcome.

Between the two scenarios, the fairly bad one—slow growth, rising unemployment, but no outright recession—has significantly higher probability ... However, the recession scenario also has significant probability (we still think about 25%-30%).

Lawler: Trying to Make Sense of the Mortgage Foreclosure Fiasco

by Calculated Risk on 10/05/2010 06:28:00 PM

CR Note: This is from housing economist Tom Lawler.

Since the GMAC “robo-signer” issue first “broke” last month, the “issue” has catapulted from what some (but not all) industry folks characterized as a “technical” issue in judicial foreclosure states to what the media (who predictably jumped on this story like a ... well, I can’t print that!) now characterizes as a “gigantic mess.” Not too long after the GMAC story came out, both Chase and Bank of America announced that they too were suspending foreclosures in the 23 “judicial” foreclosure states, and while some other big servicers (Wells and Citi) weren’t planning to suspend foreclosures, news reports surfaced suggesting that both companies had some “robo-signers” as well. The media, of course, then searched for individual cases of “foreclosures gone wild,” and found a number of instances where there were some real mistakes made by lenders/servicers that went well beyond “robo-signing.”

Predictably, of course, politicians in many states jumped on this issue, calling for an across the board moratoria on foreclosures “until homeowners can be assured they are treated fairly.” Even California, a non-judicial state, jumped on this bandwagon, with Attorney General Brown arguing that GMAC and Chase should “stop foreclosing” on homes until they can “prove” that they are complying with a state law requiring lenders to “contact” borrowers facing foreclosure to assess their “situation” and discuss “options" before foreclosing on a home. The OCC ordered other large servicers to “review” their foreclosure processes and procedures, and Fannie and Freddie told its servicers to undertake a review of their processes and procedures on foreclosures, and reminded them of their basic duties and responsibilities (including the consequences of “non-compliance”).

Meanwhile, Old Republic National Title stopped writing title insurance on foreclosure sales by GMAC and Chase until “objectionable issues had been resolved,” creating concerns in some camps about the ability of firms to sell foreclosed properties.

I have been inundated with media (and other calls) calls asking what this “all means,” but quite frankly I don’t have enough information to give folks a credible answer – save, of course, is that foreclosure timelines in many states will lengthen yet some more.

However, the whole issue is yet another glaring indictment of the mortgage servicing industry, and its continued attempts to keep costs down during this housing/mortgage market “crisis” in fashions that have been penny-wise/pound foolish. Mega-mortgage servicers, of course, got to be really large by charging little to service loans because of the incredible economies of scale of processing mortgage payments. There are not, of course, similar economies of scales in dealing with problem loans, but servicers as a whole were incredibly slow to increase staff to deal with the surge in delinquent loans, and didn’t actually do so in a meaningful fashion until last year – with the “ramp” goosed in part by “HAMP.” Clearly, however, servicers did not ramp up their staffing sufficiently to deal with the surge in actual foreclosures, despite its predictability, to a large extent because such actions increased expenses without generating revenues!

Amazingly, before the housing bubble burst, there was immense pressure on Fannie and Freddie from large mortgage servicers to reduce their “minimum” servicing fee below 25 basis points, as these servicers didn’t like having to “manage” the “IO-like” value of their mortgage servicing fee. Countrywide even argued that it could profitably service its mortgage servicing portfolio with a ZERO servicing fee, saying that it made enough money just from float, ancillary, and other fees – AND, of course, that they were incredibly efficient mortgage servicers!!!

Below, by the way, are the largest residential mortgage servicers as of Q2/2010, according to National Mortgage News. BoA, of course, acquired Countrywide. These totals include first and second mortgages.

| Servicing | Servicing | % past due | |

|---|---|---|---|

| ($ mm) | (# of loans) | ||

| Bank of America | $2,197,662 | 14,204,957 | 14.10% |

| Wells Fargo & Company | $1,811,969 | 12,004,659 | 8.20% |

| Chase | $1,353,566 | 9,434,133 | 11.60% |

| CitiMortgage, Inc. | $677,815 | 4,859,304 | 9.30% |

| Ally Bank/Residential Capital, LLC (GMAC) | $398,355 | 2,618,872 | |

| U.S. Bank Home Mortgage | $199,575 | 1,338,154 | |

| SunTrust Bank | $175,970 | 994,025 | 11.40% |

| PHH Mortgage | $155,967 | 968,669 | 6.30% |

| PNC Mortgage/National City | $149,945 | 989,228 | 9.90% |

| OneWest Bank/IndyMac | $110,000 | 517,504 |

The current mess, of course, suggests that (1) either loans should be priced differently based on a state’s foreclosure law; or (2) the government should push states to accept a national foreclosure law, with crystal clear rules and adequate borrower and lender safeguards. It also suggests that the “timeline” to reduce the government’s role in the US mortgage market has now been extended even further into the future!

CR Note: This is from housing economist Tom Lawler.

Foreclosure Mess: Little impact on California

by Calculated Risk on 10/05/2010 03:21:00 PM

From Eric Wolff at the North County Times: Lender woes unlikely to halt California foreclosures

The pace of foreclosures in California will continue unabated, despite paperwork improprieties that drove three of the nation's biggest mortgage lenders to suspend foreclosures in 23 states last week, real estate attorneys said Monday.Most foreclosures in California are non-judicial, so there will probably be little impact on the pace of foreclosures.

...

Last week, GMAC Mortgage LLC, JPMorgan Chase & Co. and Bank of America said they needed to review thousands of crucial legal documents that they may have signed without reading. But the documents only matter in states that require a judge's order for a foreclosure. The three lenders suspended foreclosures in these states, but announced no changes to their activities in California.

And - all else being equal - the housing market in states that require judicial foreclosures will probably be under pressure for a longer period than states with non-judicial foreclosures. Just more bad news for Florida and other judicial states.

And another point - there is a national mortgage market, but each state has their own foreclosure laws. Mortgages should probably be priced based on the local foreclosure laws (higher rates for judicial states), and on whether the mortgage is recourse or non-recourse. Different mortgage rates would probably push the states to more uniform foreclosure laws.

Fed's Evans: Favors "much more [monetary] accommodation"

by Calculated Risk on 10/05/2010 12:59:00 PM

From a WSJ interview with Chicago Fed President Charles Evans, Jon Hilsenrath writes: Fed Official Calls for Aggressive Action

"In the last several months I've stared at our unemployment forecast and come to the conclusion that it's just not coming down nearly as quickly as it should," [Chicago Fed President Charles] Evans said in an interview with The Wall Street Journal Monday. "This is a far grimmer forecast than we ought to have," he added. As result, he said, he favors "much more [monetary] accommodation than we've put in place."Although Evans is not a voting member of the FOMC this year, he will be next year.

...

[Evans] has grown frustrated with a lack of progress in bringing down unemployment and is now forecasting inflation of 1% in 2012 and below 1.5% in 2013, well below his own 2% goal.

According to the article, Evans is forecasting inflation to be below target for the next three years - and for the unemployment rate to remain very high. This month the Fed Presidents will present their revised forecasts, and I think the tone will be generally grim.

ISM non-Manufacturing Index increases in September

by Calculated Risk on 10/05/2010 10:00:00 AM

The September ISM Non-manufacturing index was at 53.2%, up from 51.5% in August - and above expectations of 52.0%. The employment index showed slight expansion in September at 50.2%, up from 48.2% in August. Note: Above 50 indicates expansion, below 50 contraction.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

From the Institute for Supply Management: September 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in September for the ninth consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 53.2 percent in September, 1.7 percentage points higher than the 51.5 percent registered in August, indicating continued growth in the non-manufacturing sector at a faster rate. The Non-Manufacturing Business Activity Index decreased 1.6 percentage points to 52.8 percent, reflecting growth for the 10th consecutive month, but at a slower rate than in August. The New Orders Index increased 2.5 percentage points to 54.9 percent, and the Employment Index increased 2 percentage points to 50.2 percent, indicating growth in employment for the third time in the last five months. The Prices Index decreased 0.2 percentage point to 60.1 percent, indicating that prices increased in September at a slightly slower rate. According to the NMI, 11 non-manufacturing industries reported growth in September. Respondents' comments continue to be mixed about business conditions, with a slight majority reflecting optimism."

emphasis added

Bank of Japan eases monetary policy

by Calculated Risk on 10/05/2010 09:02:00 AM

From the WSJ: Bank of Japan Cuts Key Rate

The Bank of Japan [announced] a 35 trillion yen ($418 billion) monetary easing program ... while cutting interest rates to virtually zero. It also launched a 5 trillion yen program to buy private- and public-sector assets.The Japan central bank will be buying corporate debt in addition to government debt.

... the BOJ said the new program was designed to "encourage the decline in longer-term interest rates and various risk premiums to further enhance monetary easing."

The central bank acknowledged its move was "an extraordinary measure for a central bank." Bank of Japan Gov. Masaaki Shirakawa said Tuesday that the central bank's [decision] was based on a worse-than-expected outlook for the domestic economy.

Monday, October 04, 2010

Reis: Office Vacancy Rate at 17 Year High

by Calculated Risk on 10/04/2010 11:59:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate starting in 1991.

Reis is reporting the vacancy rate rose to 17.5% in Q3 2010, up from 17.4% in Q2 2010, and up from 16.6% in Q3 2009. The peak following the previous recession was 16.9%.

From the WSJ Signs of Recovery For Office Market

[O]ffice buildings in 79 metropolitan areas tracked by Reis lost 1.9 million square feet of occupied space in the third quarter, pushing the national office vacancy rate to 17.5%, the highest level since 1993.It appears the rate of increase in the vacancy rate has slowed - and rents may be stabilizing.

...

Average effective rents ... fell by just a penny in the last three months, the smallest quarterly decline since 2008.

Reis should release the Mall and Apartment vacancy rates over the next few days, and those will probably be at record levels.

More Cities turn to State Distressed Cities Programs

by Calculated Risk on 10/04/2010 09:34:00 PM

From Mary Williams Walsh at the NY Times: Cities in Debt Turn to States, Adding Strain

Across the country, a growing number of towns, cities and other local governments are seeking refuge in [distressed-cities programs] that many states provide as alternatives to federal bankruptcy court. Pennsylvania will have 20 cities in its distressed-cities program if Harrisburg receives approval. Michigan has 37 in its program; New Jersey has seven; Illinois, Rhode Island and California each have at least one. ...The concern with the distressed-cities programs is that the cities become almost permanent wards of the state - and the states already have their own budget problems. And the list of distressed-cities keeps growing ...

The programs, which vary by state, generally allow troubled communities to tap emergency credit lines while restructuring their finances with some form of state oversight.

Bernanke breaks promise, discusses fiscal issues

by Calculated Risk on 10/04/2010 08:01:00 PM

This speech isn't worth reading for substance (Ben Bernanke is clueless on budget issues), but it reveals something about Bernanke.

From Fed Chairman Ben Bernanke speaking at the Rhode Island Public Expenditure Council meeting tonight: Fiscal Sustainability and Fiscal Rules

Bernanke never mentioned "PAYGO" when he was head of the Council of Economic Advisors in 2005. In fact Bernanke barely mentioned the deficit in 2005 - except in postive terms - even though the structural deficit was in place and the cyclical deficit was coming (because of the housing bubble). I wonder why? Well, he missed the housing bubble completely - but what about the structural deficit?

Today he said:

Our fiscal challenges are especially daunting because they are mostly the product of powerful underlying trends, not short-term or temporary factors. Two of the most important driving forces are the aging of the U.S. population, the pace of which will intensify over the next couple of decades as the baby-boom generation retires, and rapidly rising health-care costs.Weren't the baby boomers going to get older in 2005? Oh my ...

This is an issue that 1) is outside of Bernanke's area of responsibility, 2) he has promised not to discuss, and 3) he has zero credibility on. Enough said.

Yellen Sworn in as Fed's Vice Chairman, Goldman says some of QE2 Priced into Bonds

by Calculated Risk on 10/04/2010 03:59:00 PM

Francesco Garzarelli, chief interest-rate strategist at Goldman Sachs in London, said that the benchmark 10-year note's yield has seen its bottom in the 2.45%-to-2.50% area, breaking ranks with other bulls. ... Mr. Garzarelli said some of the quantitative easing measures have been priced into the Treasury market.Note that this forecast is not from the Goldman Sachs economics group in New York (that correctly forecast the bond market rally this year).

Consumer Bankruptcy Filings increase in September

by Calculated Risk on 10/04/2010 01:13:00 PM

Via MarketWatch: Consumer bankruptcy filings climb 11%

The American Bankruptcy Institute reported that there were 130,329 consumer bankruptcies filings in September, up 3.3% from August. Filings were up 11% over the first 9 months of the year compared to the first 9 months of 2009.

"We expect that there will be nearly 1.6 million new bankruptcy filings by year end," ABI Executive Director Samuel Gerdano said.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

In 2005 the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted. Since then the number of bankruptcy filings has increased steadily.

Fed's Sack: Managing the Federal Reserve’s Balance Sheet

by Calculated Risk on 10/04/2010 11:30:00 AM

This speech suggests to me that the Fed is prepared to embark on QE2 (subject to incoming data), and the program will be incremental - and persistent - and the amount of QE announced at each FOMC meeting. This is a long excerpt, but the speech has a number of key points.

From New York Fed EVP Brian Sack: Managing the Federal Reserve’s Balance Sheet

The sluggish outlook for the economy and the risks that surround that outlook have raised the possibility of further monetary policy accommodation.

...

The FOMC has several policy tools that it could use to achieve more accommodative financial conditions, as Chairman Bernanke discussed in his speech at the Jackson Hole symposium in August. My remarks today will focus on one of those options—changing the size of the Federal Reserve's holdings of securities. In particular, I will review the FOMC’s recent decision to keep the size of those security holdings at their current level, and I will discuss some of the issues to be considered in any decision on whether to expand them further.

...

In terms of the benefits, balance sheet expansion appears to push financial conditions in the right direction, in that it puts downward pressure on longer-term real interest rates and makes broader financial conditions more accommodative. One can reach that judgment based on the empirical evidence from the earlier round of asset purchases, as mentioned before. In addition, the market responses to more recent news about the balance sheet also lean in this direction. The market response to the reinvestment decision at the August FOMC meeting seemed largely in line with the estimated effects from the earlier round of asset purchases, once we account for the size of the surprise and the anticipatory pricing that occurred ahead of its announcement. And the increased expectations for balance sheet expansion in response to the September FOMC statement also generated a sizable market response.

To be sure, I think it is fair to say that this is an imperfect policy tool. Even under the estimates noted earlier, the Federal Reserve had to increase its securities holdings considerably to induce the estimated 50 basis point response of longer-term rates. In addition, there is a large degree of uncertainty surrounding the estimates of these effects, given our limited experience with this instrument. Lastly, it is reasonable to assume that the effects of balance sheet expansion would diminish at some point, especially if yields were to move to extremely low levels. Nevertheless, the tool appears to be working, and it is not clear that we have yet reached a point of diminishing effects.

Some observers have argued that balance sheet changes, even if they influence longer-term interest rates, will not affect the economy because the transmission mechanism is broken. This point is overstated in my view. It is true that certain aspects of the transmission mechanism are clogged because of the credit constraints facing some households and businesses, and it is true that monetary policy cannot directly target those parties that are the most constrained. Nevertheless, balance sheet policy can still lower longer-term borrowing costs for many households and businesses, and it adds to household wealth by keeping asset prices higher than they otherwise would be. It seems highly unlikely that the economy is completely insensitive to borrowing costs and wealth, or to other changes in broad financial conditions.

...

Designing a Purchase Program

...

First, should the balance sheet be adjusted in relatively continuous but smaller steps, or in infrequent but large increments? The earlier round of asset purchases involved the latter approach, which caused the market response to be concentrated in several days on which significant announcements were made. That might have been appropriate in circumstances when substantial and front-loaded policy surprises had benefits, but different approaches may be warranted in other circumstances. Indeed, it contrasts with the manner in which the FOMC has historically adjusted the federal funds rate, which has typically involved incremental changes to the policy instrument.

Second, how responsive should the balance sheet be to economic conditions? Historically, the FOMC has determined the federal funds target rate based on the Committee’s assessment of the outlook for economic growth and inflation. If changes in the balance sheet are now acting as a substitute for changes in the federal funds rate, then one might expect balance sheet decisions to also be governed to a large extent by the evolution of the FOMC’s economic forecasts. The earlier purchase program, in contrast, did not demonstrate much responsiveness to changes in economic or financial conditions. Indeed, the execution of the program largely involved confirming the expectations that were put in place by the two early announcements.

Third, how persistent should movements in the balance sheet be? An important feature of traditional monetary policy is that movements in the federal funds rate are not quickly reversed, which makes them more influential on broader financial conditions. A change that was expected to be transitory would instead move conditions very little. For similar reasons, one could argue that movements in the balance sheet should have some persistence in order to be more effective.

Fourth, to what extent should the FOMC communicate about the likely path of the balance sheet? The FOMC often communicates about the path of the federal funds rate or provides other forward-looking information that allows market participants to anticipate that path. This anticipation of policy actions is beneficial, as it brings forward their effects and thus helps to stabilize the economy. For the same reason, providing information about the likely course of the balance sheet could be desirable. In fact, such communication might be particularly important in the current circumstances, because financial market participants have no history from which to judge the FOMC’s approach and anticipate its actions.

Fifth, how much flexibility should the FOMC retain to change its policy approach? The original asset purchase programs specified the amount and distribution of purchases well in advance. However, the FOMC would be learning about the costs and benefits of its balance sheet changes as it implemented a new program. This might call for some flexibility to be incorporated into the program, providing some discretion to change course as market conditions evolve and as more is learned about the instrument.

Pending Home Sales increase 4.3% in August

by Calculated Risk on 10/04/2010 10:06:00 AM

From the NAR: Pending Home Sales Show Another Gain

The Pending Home Sales Index ... rose 4.3 percent to 82.3 based on contracts signed in August from a downwardly revised 78.9 in July, but is 20.1 percent below August 2009 when it was 103.0. The data reflects contracts and not closings, which normally occur with a lag time of one or two months.July was revised down from 79.4. Tom Lawler forecast an increase of about 4% - right on again.

This suggests some bounce back in existing home sales in September and October, but months-of-supply will probably still be in double digits - putting downward pressure on house prices.

Rates keep falling: 2-Year Treasury Yield Hits Record Low

by Calculated Risk on 10/04/2010 09:00:00 AM

Just a look at falling treasury yields and mortgage rates ...

From Reuters: US 2-Year Treasury Yield Hits Record Low

The two-year U.S. Treasury note yield fell to a record low of 0.403 percent on Monday ... the 30-year T-bond rose almost a full point in price to yield 3.676 percent, down 4 bps.The 10-year yield is down to 2.49% and, according to Freddie Mac (for the week ending Sept 30th): "The 30-year fixed-rate mortgage rate [4.32 percent] dropped to tie the survey’s all-time low and the 15-year fixed-rate [3.75 percent] set another record low." And mortgage rates have probably fallen further over the last week.

Lots of records ...

Sunday, October 03, 2010

Nightly Mortgage Mess

by Calculated Risk on 10/03/2010 11:32:00 PM

Note: Here is the weekly schedule for Oct 3rd, and the summary for last week.

A few articles ...

From Gretchen Morgenson at the NY Times: Flawed Paperwork Aggravates a Foreclosure Crisis

The implications are not yet clear for borrowers who have been evicted from their homes as a result of improper filings. But legal experts say that courts may impose sanctions on lenders or their representatives or may force banks to pay borrowers’ legal costs in these cases.Sanctions and awarding the defendants legal costs are likely - and it will be costly to fix these errors, but it is very unlikely in a foreclosure case that a judge will dismiss the bank's complaint with prejudice.

Judges may dismiss the foreclosures altogether, barring lenders from refiling and awarding the home to the borrower. That would create a loss for the lender or investor holding the note underlying the property. Almost certainly, lawyers say, lawsuits on behalf of borrowers will multiply.

The facts of these cases are 1) the borrower had a mortgage, and 2) the borrower is seriously delinquent (with the exception of a few cases with outright errors). Those facts are not in dispute. Just something to remember when reading these stories.

From Robbie Whelan at the WSJ: Foreclosure? Not So Fast

Israel Machado's foreclosure started out as a routine affair. In the summer of 2008, as the economy began to soften, Mr. Machado's pool-cleaning business suffered and like millions of other Americans, he fell behind on his $400,000 mortgage.That explains why Machado (and I suppose others) are hiring attorneys - they are trying to get the banks to do a principal reduction.

But Mr. Machado's response was unlike most other Americans'. Instead of handing his home over to the lender, IndyMac Bank FSB, he hired Ice Legal LP in nearby Royal Palm Beach to fight the foreclosure. ...

Mr. Machado and his lawyer, Tom Ice, say they now want to convince the owners of the mortgage to cut Mr. Machado's loan balance to between $150,000 and $200,000—the current selling price for comparable homes in his community near West Palm Beach. "The whole intent was to get them to come to the negotiating table, to get me in a fixed-rate mortgage that worked," Mr. Machado said.

And from the NY Times editorial: On the Foreclosure Front

It is hard to be shocked. During the bubble, banks and other lenders ignored loan standards and stuffed the mortgage pipeline with toxic loans and related securities. Since the bubble burst, efforts to rework bad loans have been slowed by the lenders’ resistance, and by their incompetence.

...

The robo-signing scandal is yet another reminder that it is folly to rely on banks that got us into this mess to get us out.

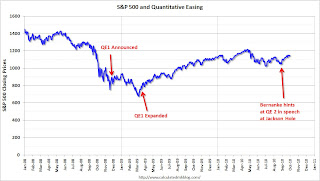

A QE1 Timeline

by Calculated Risk on 10/03/2010 05:21:00 PM

Note: Here is the weekly schedule for Oct 3rd, and the summary for last week.

QE2 will probably arrive on November 3rd. By request here is a look back at the QE1 announcements (phased in over a few months):

S&P 500: 851.81

The Federal Reserve announced

the purchase of the direct obligations of housing-related government-sponsored enterprises (GSEs)--Fannie Mae, Freddie Mac, and the Federal Home Loan Banks--and mortgage-backed securities (MBS) backed by Fannie Mae, Freddie Mac, and Ginnie Mae.

...

Purchases of up to $100 billion in GSE direct obligations under the program will be conducted with the Federal Reserve's primary dealers through a series of competitive auctions and will begin next week. Purchases of up to $500 billion in MBS will be conducted by asset managers selected via a competitive process with a goal of beginning these purchases before year-end. Purchases of both direct obligations and MBS are expected to take place over several quarters.

S&P 500: 913.18

As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities.

S&P 500: 874.09

The Federal Reserve continues to purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand the quantity of such purchases and the duration of the purchase program as conditions warrant. The Committee also is prepared to purchase longer-term Treasury securities if evolving circumstances indicate that such transactions would be particularly effective in improving conditions in private credit markets.

S&P 500: 794.35

To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months.

Click on graph for larger image in new window.

Click on graph for larger image in new window.S&P 500: 1064.79

This is not investment advice!