by Calculated Risk on 6/03/2010 03:36:00 PM

Thursday, June 03, 2010

Euro Bond and CDS Spreads Widen

Here are two graphs from the Atlanta Fed weekly Financial Highlights released today (graph as of June 2nd): Click on graph for larger image in new window.

Click on graph for larger image in new window.

From the Atlanta Fed:

Despite the latest announcement of planned austerity measures by Spain, Portugal, and Italy, uncertainty around the adjustment

challenges in peripheral Europe continues to weigh on the region’s bond prices.

Downgrading of Spanish sovereign debt by Fitch and ongoing concerns about the Spanish banking sector further added to investor worries.

Compared with two weeks ago, peripheral Europe's bond spreads to bunds have widened by 30 basis points (bps) on average.

After declining early last week, sovereign debt spreads have begun widening for peripheral euro area countries. As of June 1, the 10-year bond spread stands at 503 basis points (bps) for Greece, 219 bps for Ireland, 195 bps for Portugal, and 162 bps for Spain.

Similarly, CDS spreads have risen after the initial response to the stabilization package.After declining following the policy response, the bond and CDS spreads have resumed their steady climb - especially for Greece and Portugal.

It should be noted that the German government, through its financial services regulator BaFin, unilaterally and temporarily banned naked short selling of sovereign debt securities, naked credit default swaps on European sovereign

debt in which the buyer has no hedging demand, and naked short sales in 10 prominent German financials.

And from Reuters today: Hungary Warns of Deficit Overshoot; EU Urges Action

Hungary ... government officials reiterated the 2010 fiscal gap may reach almost twice the target agreed with lenders including the EU. ... Public finances were in much worse shape than previously expected and there was only a slim chance of avoiding a Greek-style scenario, news portal napi.hu cited [the vice chairman of the ruling Fidesz party, Lajos Kosa] as saying.The euro is down to 1.2166 dollars, the lowest level in four years.

Report: Oil Gusher impacting Gulf Coast Hotels

by Calculated Risk on 6/03/2010 02:43:00 PM

From Christine Blank at HotelNewsNow.com: Oil-spill update: Hotels report mixed results

Tourism officials and hotel operators in Gulf of Mexico coastal regions say they are struggling with occupancy and reservations, but some areas are suffering more than others.The economic impact of the oil gusher is unclear, although tourism, fishing and shipping are all being impacted.

...

“We have had some cancellations. It is hitting the beachfront properties hard and the casinos have seen some impact ... and the charter boat companies,” said Richard Forester, executive director of the Mississippi Gulf Coast Convention and Visitors Bureau in Biloxi.

...

“Our members are experiencing unprecedented cancellations heading into their peak season, and this advertising campaign is critical to our economic survival,” said Carol Dover, president and CEO of the Florida Restaurant and Lodging Association in Tallahassee ... Many hoteliers in Northwest Florida that are typically at 90 percent occupancy rates heading into the Memorial Day weekend, were reporting a drop in bookings by 30 percent, according to the FRLA.

...

Texas’s coastal hotels also are feeling an impact, but that could be due to the overall U.S. economy more than to the oil spill.

“We have yet to have any cancellations [because of the oil spill],” said Theresa Elliott, GM of Casa del Mar Beachfront Suites, Galveston, Texas. ... Galveston-area hotels are significantly discounting rooms to boost stays, such as 20-percent off Sunday through Thursday stays, according to Elliott.

Employment Report Prediction: Bad Reporting!

by Calculated Risk on 6/03/2010 12:51:00 PM

This is probably a safe prediction: There will be some really bad reporting tomorrow.

Note: The May headline payroll number will be large (consensus is for 540,000 payroll jobs added in May), but this will include around 400,000 temporary Census jobs.

I think this poor reporting will fall into two major categories:

1) Reporters who use the headline payroll number and write that this shows the recovery is picking up steam. We will probably see someone use the headline number and write something like "This is the largest monthly gain since September 1983" - well, were there 400,000+ temporary Census hires in September 1983? If not, why does this comparison matter?

2) Anyone who calls the number of temporary census workers "fake" or subtracts the birth/death adjustment from the seasonally adjusted headline number.

I've spoken with actual Census workers, and I guarantee their jobs are not "fake". Their jobs are real but temporary, and it is appropriate to subtract the Census 2010 workers from the headline payroll number to determine the underlying trend (even though it is obvious, I verified this calculation with the Census Bureau).

And no matter what anyone thinks of the birth / death model, the adjustment is added to the NSA numbers - and can't be subtracted from the SA numbers. Note: I think the birth / death model is useful although we have to aware of the weaknesses (it misses turning points - something I wrote about in 2006).

The employment report has many useful numbers. But the key payroll number is U-3 minus the number of Census 2010 temporary workers. The Census Bureau is tasked with reporting an estimate of the number of payroll jobs each month - so they include the Census 2010 jobs - but they also provide the information on the number of Census hires (the report will be released here).

It is the responsibility of anyone reporting on the numbers to do the heavy math and subtract the Census workers from the headline number. I will report both numbers.

Starting in June, the impact of the Census 2010 on the payroll report will be negative - see: Impact of Census 2010 on Payroll Report. That will require adding the temporary Census 2010 workers back to determine the underlying trend.

For some reason, print reports tend to contain the first mistake, and online reports the second error. Both are poor reporting, although the second is far more egregious (because the statements are blatantly false).

Oh well ... sorry for the rant, but I'm already seeing some really bad "analysis".

ISM Non-Manufacturing Index Shows Expansion

by Calculated Risk on 6/03/2010 10:00:00 AM

The May ISM Non-Manufacturing index was at 55.4%, unchanged from April (slightly below expectations). The employment index showed some growth after 28 consecutive months of contraction.

From the Institute for Supply Management: May 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in May for the fifth consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 55.4 percent in May, the same percentage as registered in both April and March, indicating continued growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 0.8 percentage point to 61.1 percent, reflecting growth for the sixth consecutive month. The New Orders Index decreased 1.1 percentage points to 57.1 percent, and the Employment Index increased 0.9 percentage point to 50.4 percent, reflecting growth for the first time after 28 consecutive months of contraction. The Prices Index decreased 4.1 percentage points to 60.6 percent in May, indicating that prices are still increasing but at a slower rate than in April. According to the NMI, 16 non-manufacturing industries reported growth in May. Respondents' comments remain mostly positive about current business conditions and the general direction of the economy."

emphasis added

Weekly Initial Unemployment Claims at 453,000

by Calculated Risk on 6/03/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 29, the advance figure for seasonally adjusted initial claims was 453,000, a decrease of 10,000 from the previous week's revised figure of 463,000. The 4-week moving average was 459,000, an increase of 1,750 from the previous week's revised average of 457,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 22 was 4,666,000, an increase of 31,000 from the preceding week's revised level of 4,635,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 1,750 to 459,000.

The dashed line on the graph is the current 4-week average. The current level of 453,000 (and 4-week average of 459,000) is still high, and suggests ongoing weakness in the labor market.

David Greenlaw at Morgan Stanley offered some possible reasons that claims have stayed elevated such as more ineligible filers and that "construction workers tend to file more frequently", although I'm not convinced. This is still disappointing ... the 4-week average has been moving sideways since December.

ADP: Private Employment increased 55,000 in May

by Calculated Risk on 6/03/2010 08:15:00 AM

ADP reports:

Nonfarm private employment increased 55,000 from April to May 2010 on a seasonally adjusted basis, according to the ADP National Employment Report. The estimated change in employment from March to April 2010 was revised, from an increase of 32,000 to an increase of 65,000.Note: ADP is private nonfarm employment only (no government jobs).

May’s rise in private employment was the fourth consecutive monthly gain. However, over these four months the increases have averaged a modest 39,000. The slow pace of improvement from February through May is consistent with the pause in the decline of initial unemployment claims that occurred during the winter months.

This is close to the consensus forecast of ADP showing an increase of 60,000 private sector jobs in May.

The BLS reports tomorrow, and the consensus is for an increase of 540,000 payroll jobs in May, on a seasonally adjusted (SA) basis, with over 400,000 temporary Census 2010 jobs.

Wednesday, June 02, 2010

Research: 270 Days is Optimal Time in Foreclosure

by Calculated Risk on 6/02/2010 11:54:00 PM

BofA executive Jack Schakett made some interesting comments earlier today:

"There is a huge incentive for customers to walk away because getting free rent and waiting out foreclosure can be very appealing to customers."Schakett noted that the foreclosure process is currently taking 13 to 14 months ...

For many the timeframe is apparently much longer. On Monday David Streitfeld wrote in the NY Times: Owners Stop Paying Mortgages, and Stop Fretting

The average borrower in foreclosure has been delinquent for 438 days before actually being evicted, up from 251 days in January 2008, according to LPS Applied Analytics.These long foreclosure time lines can have a significant adverse impact on housing.

...

More than 650,000 households had not paid in 18 months, LPS calculated earlier this year. With 19 percent of those homes, the lender had not even begun to take action to repossess the property ...

Housing economist Tom Lawler alerted me to a 2008 research paper by Freddie Mac economists Amy Crews Cutts and William A. Merrill: Interventions in Mortgage Default: Policies and Practices to Prevent Home Loss and Lower Costs. They studied the foreclosure time lines and costs in several states and found that 270 days is sufficient time to allow the borrower to cure, and any more time actually incentivizes the borrower to strategically default:

There are many challenges that policy makers, investors, servicers and borrowers face in minimizing the incidence of home loss through foreclosure. Among them is the tension between too little time in the foreclosure process, such that some borrowers are unable to recover from relatively mild setbacks before they lose the home but investors minimize pre-foreclosure time related costs, and too much time in the foreclosure process, such that the borrower is incented to let the home go to foreclosure sale during which no mortgage payments are made (in essence, free rent for a significant time) and investor costs rise rapidly.One of unintended consequences of the government foreclosure delaying strategy (probably aimed at limiting supply and supporting house prices), is that strategic defaults have gained fairly widespread acceptance. And that means the eventual cost to the taxpayer will be higher than if the lenders had either modified the loans, or foreclosed, or approved a short sale, within about 270 days.

...

A sweet spot for the optimal time in foreclosure likely exists around a statutory timeline of 120 days (the current national median, and equivalent to 270 days after adding in 150 days for pre-referral loss mitigation activities by servicers through workouts) in which the borrower’s incentives are aligned with both a high probability of curing out of the foreclosure and keeping the pre-foreclosure costs to the investor contained.

Housing Bust and Labor Immobility

by Calculated Risk on 6/02/2010 08:47:00 PM

Here is a theme we've been discussing for a few years - when a homeowner is underwater, it is difficult to make a career move ...

From Rana Cash at the Atlanta Journal-Constitution: Real estate market stalls recruiting, promotions (ht Ann)

When executive Wade Ledbetter leaped at the opportunity to move up in his company, the shackles of relocation snatched him back down to earth.Negative equity is impacting one of the historic strengths of the U.S. labor market - the ability of households to easily move from one region to another for a better employment opportunity.

That fabulous promotion came with a price: The $30,000 he’d invested in home improvements, the 20 percent he’d put down on his house and the extra payment every year for 7 1/2 years would be a wash, along with settling on a selling price well below what he’d paid for the home and just about all its contents. Add living away from his family in a one-bedroom apartment for eight months while his home languished on the market and his frustration accrued.

“It was horrible,” said Ledbetter, who relied in part on relocation assistance from his company. “It was constant, horrid stress. There were a number of times I said to myself, ‘What have I done?’ ”

Personal Bankruptcy Filings increase 9% compared to May 2009

by Calculated Risk on 6/02/2010 05:48:00 PM

From the American Bankruptcy Institute: May Consumer Bankruptcy Filings up 9 Percent from Last Year

The 136,142 consumer bankruptcies filed in May represented a 9 percent increase nationwide over the 124,838 filings recorded in May 2009, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). NBKRC’s data also showed that the May consumer filings represented a 6 percent decrease from the 144,490 consumer filings recorded in April 2010. ...

“While consumer filings dipped slightly from last month, housing debt and other financial burdens weighing on consumers are still a cause for concern,” said ABI Executive Director Samuel J. Gerdano. “Consumer filings this year remain on track to top 1.6 million filings.”

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Based on the comment from Gerdano, it appears the ABI has increased their forecast to over 1.6 million filings this year from their earlier forecast of just over 1.5 million filings this year.

Excluding 2005, when the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" was enacted (really a pro-lender act), the record was in 2003 when 1.62 million personal bankruptcies were filed. This year will be close to that level.

I wonder how many of these bankruptcy filings are by homeowners who lost their homes in foreclosure and are now trying to extinguish any related recourse debt (1st or 2nd)?

U.S. Light Vehicle Sales 11.6 Million SAAR in May

by Calculated Risk on 6/02/2010 03:54:00 PM

Based on an estimate from Autodata Corp, light vehicle sales were at a 11.63 million SAAR in May. This is up 18.1% from May 2009 (when sales were very low), and up 3.9% from the April sales rate. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for May (red, light vehicle sales of 11.63 million SAAR from Autodata Corp).

The second graph shows light vehicle sales since the BEA started keeping data in 1967. Note: dashed line is current month sales rate.

Note: dashed line is current month sales rate.

Auto sales have recovered from the low levels of early 2009, but are still at the lowest point of the '90/'91 recession (even with a larger number of registered drivers).

This was slightly above most forecasts of around 11.2 million SAAR.

Report: BofA acknowledges "foreclosure can be very appealing to customers"

by Calculated Risk on 6/02/2010 01:56:00 PM

From Diana Olick at CNBC: BofA: Mortgage Walkaways Have Huge Incentive

On the conference call ... this morning, BofA's credit loss mitigation executive, Jack Schakett, said the amount of strategic defaulters ... are "more than we have ever experienced before." He went on to say, "there is a huge incentive for customers to walk away because getting free rent and waiting out foreclosure can be very appealing to customers."This is just acknowledging the obvious - borrowers have "a huge incentive to walk away" and "foreclosure can be very appealing to customers".

Schakett says the foreclosure process is still taking 13 to 14 months ... and so there's over a year of free rent.

emphasis added

On the conference call, BofA announced a new "Principal Reduction Enhancement" program for certain underwater borrowers. Here is the press release via MarketWatch: Qualified Homeowners Who Are Severely Underwater May Earn Forgiveness of Some Principal Over Three or Five Years

NHRP-eligible loans include subprime, Pay-Option ARM and prime-quality two-year hybrid ARM loans originated by Countrywide on or prior to January 1, 2009, if the amount of principal owed exceeds the current property value by at least 20 percent and the loan is 60 days or more past due.This is really targeted at Option ARMs ... and I guess they are asking borrowers to stop paying so they can get a principal reduction.

General Motors: Sales up 16.6% compared to May 2009

by Calculated Risk on 6/02/2010 11:08:00 AM

From MarketWatch: GM posts 16.6% rise in May U.S. sales:

General Motors Co. on Wednesday reported a 16.6% rise in May U.S. sales from a year ago to 223,822 vehicles.This is based on an easy comparison: in May 2009 U.S. light vehicle sales fell 31% to 9.8 million (SAAR) from 14.2 million (SAAR) in May 2008. The sharp decline last year was due to the financial crisis, the recession, the Chrysler bankruptcy (Chrysler filed for bankruptcy at the end of April, 2009) and reports of the then impending bankruptcy of GM (GM filed for bankruptcy on June 1, 2009).

UPDATE: From Ford: Ford's U.S. May Sales Up 23 Percent

UPDATE2: From MarketWatch: Chrysler U.S. May sales rise 33% to 104,819 units (Chrysler was in BK last May).

UPDATE3: From MarketWatch: Toyota U.S. May sales up 6.7%

I'll add reports from the other major auto companies as updates to this post.

NOTE: Once all the reports are released, I'll post a graph of the estimated total May sales (SAAR: seasonally adjusted annual rate) - usually around 4 PM ET. Most estimates are for about the same level as April (11.2 million SAAR).

Pending Home Sales "Surge" in April

by Calculated Risk on 6/02/2010 10:00:00 AM

From the NAR: Pending Home Sales Surge Continuing

The Pending Home Sales Index, a forward-looking indicator, rose 6.0 percent to 110.9 based on contracts signed in April, from an upwardly revised 104.6 in March, and is 22.4 percent higher than April 2009 when it was 90.6. That follows gains of 7.1 percent in March and 8.3 percent in February.Once again this is no surprise - the tax credit has pulled demand forward, and existing home sales will decline after June (existing home sales are counted when the contract closes).

Pending home sales are at the highest level since last October when the index reached 112.4 and first-time buyers were rushing to beat the initial deadline for the tax credit. The data reflects contracts and not closings, which usually occur with a lag time of one or two months.

I suspect a number of these homes will never close. I've heard stories of buyers entering into two deals at the end of April, intending to cancel one. Also some short sales will probably not close on time because of the lengthy process.

Post title next month: Pending home sales collapse in May!

MBA: Mortgage Purchase Applications lowest level since April 1997

by Calculated Risk on 6/02/2010 07:06:00 AM

The MBA reports: Mortgage Refinance Applications Increase Slightly, Purchase Applications Decline Further

The Refinance Index increased 2.4 percent from the previous week. This was a smaller increase than in previous weeks, but was still the fourth consecutive weekly increase for the Refinance Index and it remains at its highest level since October 2009. The seasonally adjusted Purchase Index decreased 4.1 percent from one week earlier. The Purchase Index decreased for the fourth consecutive week and is currently at the lowest level since April 1997.

...

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.83 percent from 4.80 percent, with points decreasing to 1.05 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The purchase index has declined sharply following the tax credit related buying, suggesting home sales will fall sharply too. Pending home sales for April will be announced today and a large increase is expected, however May pending home sales will be much lower.

As the Michael Fratantoni, MBA’s Vice President of Research and Economics noted two weeks ago: "The data continue to suggest that the tax credit pulled sales into April at the expense of the remainder of the spring buying season."

Tuesday, June 01, 2010

Fannie Mae: Serious Delinquencies decline in March

by Calculated Risk on 6/01/2010 08:17:00 PM

Breaking a trend ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business decreased to 5.47% in March, down from 5.59% in February - and up from 3.13% in March 2009.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

This is the first decline since early 2006 and could be because Fannie (and Freddie and the FHA) are moving ahead with foreclosures.

As noted last month, the combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased by 22% in Q1 2010 from Q4 2009. The REO inventory (foreclosed homes) increased 59% compared to Q1 2009 (year-over-year comparison). This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2010.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q1 2010.

Even with all the delays in foreclosure, the REO inventory has increased sharply over the last three quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, 172,357 at the end of Q4 2009 and now 209,500 at the end of Q4 2010.

These are new records for all three agencies.

Market Update

by Calculated Risk on 6/01/2010 04:33:00 PM

The euro is down to 1.2238 dollars. It has been at about this level for two weeks now ...

The TED spread increased to 39.12 (a measure of credit stress). This is still fairly low, but has been increasing steadily. Note: This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is below 50 bps.Click on graph for larger image in new window.

This is a slightly different graph from Doug Short of dshort.com (financial planner).

This graph shows the ups and downs of the market since the high in 2007. The S&P 500 is now off 12.27% from the recent high.

Impact of Census 2010 on Payroll Report

by Calculated Risk on 6/01/2010 02:49:00 PM

We are starting to see articles like this from CNBC: Strong Jobs Number on Friday Could Give the Markets a Boost

Economists expect the US economy generated about 540,000 jobs in May—a large portion of which expected to come from Census hiring—and many analysts will be hoping that's enough to assuage investor fears that the European debt contagion could cause a double-dip recession.The BLS will release the May employment report on Friday. The consensus is for a gain of 540,000 payroll jobs in May, and for the unemployment rate to decline slightly to 9.8% (from 9.9%).

As the CNBC article noted, a large portion of the payroll jobs in May will be temporary hires for Census 2010 (May is the peak month). It will be important to remove the Census hiring to try to determine the underlying trend.

We can estimate the Census hiring using weekly payroll data from the Census bureau (ht Bob_in_MA). If we subtract the number of Temporary 2010 Census Workers in the 2nd week of May from the number in the second week of April, this suggests the Census boost will be around 417K in May. The Census Bureau will release the actual number with the employment report.

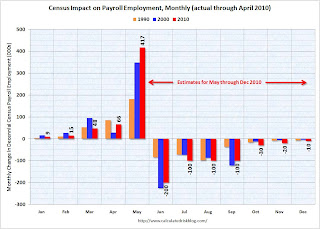

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the actual impact of Census hiring in 1990, 2000, and through April 2010. The impact of the Census hiring, from May through December 2010, are my preliminary estimates.

When the employment report is released on Friday, a key number will be payroll jobs ex-Census - since the Census will probably add over 400,000 temporary payroll jobs (these are real jobs, but they mask the underlying trend). This temporary hiring will also push down the unemployment rate in May by 0.1% or 0.2% based on previous decennial Census hiring.

Most ex-Census forecasts are in the 130,000 to 150,000 range (although most forecasts only release the headline number). This would be a decrease from the 224,000 ex-Census payroll jobs in April.

Starting in June, the Census will negatively impact the payroll report. My preliminary estimate is for a decline of 200,000 Census payroll jobs in June (see graph above). If the underlying trend is a positive 200,000 payroll jobs, the headline number will be zero! And that will understate the underlying trend, just like the 500,000+ will overstate the trend in May. So we will need to adjust for the decennial Census for most of this year.

Distressed House Sales: Movin' on up!

by Calculated Risk on 6/01/2010 12:58:00 PM

From Carolyn Said at the San Francisco Chronicle: Foreclosures shifting to affluent ZIP codes

Foreclosures are going upscale across the Bay Area. ... Even more striking is the growth of mortgage defaults - the first step in the foreclosure process - in affluent ZIP codes.Option ARMs were very popular in the mid-to-high end bubble areas.

While the high-end numbers are far shy of the massive wave of lower-priced foreclosures, the growth reflects a significant shift in the foreclosure landscape ... Mortgage distress has moved upstream in part because of economic conditions ... Also in play [are] option ARM (adjustable rate mortgage) that's just beginning to cause problems.

Previous Chronicle analyses have found that option ARMs were heavily used in the Bay Area, accounting for 20 percent of all homes bought or refinanced here from 2004 to 2008. They were used for homes averaging about $823,000 in value.Although many of these loans already recast - or were refinanced - there are still quite a few that will recast over the next couple of years. Since Option ARMs were frequently used as "affordability products", many homeowners will not be able to afford the higher payments when the loans recast.

Carolyn Said also notes that banks prefer short sales to foreclosures in the mid-to-high end areas. So just tracking foreclosures doesn't tell the entire story. I'm seeing more and more high end homes listed as short sales ... and this means there are more distressed sales coming in certain mid-to-high end bubble areas and also more price declines.

Construction Spending increases in April

by Calculated Risk on 6/01/2010 10:30:00 AM

Overall construction spending increased in April, and private construction spending, both residential and non-residential, also increased in April. From the Census Bureau: April 2010 Construction at $847.3 Billion Annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during April 2010 was estimated at a seasonally adjusted annual rate of $869.1 billion, 2.7 percent (±1.4%) above the revised March estimate of $845.9 billion. The April figure is 10.5 percent (±1.6%) below the April 2009 estimate of $971.4 billion. ... Spending on private construction was at a seasonally adjusted annual rate of $565.8 billion, 2.9 percent (±1.1%) above the revised March estimate of $549.7 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Private residential construction spending appears to have bottomed in early 2009, but has been mostly moving sideways since then. Residential spending is now 61% below the peak of early 2006.

Private non-residential construction spending is now 29% below the peak of late 2008.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.Nonresidential spending is off 24.6% on a year-over-year (YoY) basis.

Residential construction spending is now up 4.1% from a year ago (easy comparison), and will probably decline slightly later this year.

Private residential spending will probably exceed non-residential spending later this year - mostly because of continued declines in non-residential spending. Private construction will be a weak sector for some time.

ISM Manufacturing Index Shows Expansion in May

by Calculated Risk on 6/01/2010 10:00:00 AM

PMI at 59.7% in May, down from 60.4% in April.

From the Institute for Supply Management: May 2010 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in May for the 10th consecutive month, and the overall economy grew for the 13th consecutive month, say the nation's supply executives in the latest Manufacturing ISM Report On Business®.This was close to expectations of 59.5% and suggests continued growth in the manufacturing sector.

The report was issued today by Norbert J. Ore, CPSM, C.P.M., chair of the Institute for Supply Management™ Manufacturing Business Survey Committee. "The manufacturing sector grew for the 10th consecutive month during May. The rate of growth as indicated by the PMI is driven by continued strength in new orders and production. Employment continues to grow as manufacturers have added to payrolls for six consecutive months. The recovery continues to broaden as 16 of 18 industries report growth. There are a number of reports, particularly in the tech sector, of shortages of components; this is the result of excessive inventory de-stocking during the downturn."

...

ISM's Employment Index registered 59.8 percent in May, which is 1.3 percentage points higher than the 58.5 percent reported in April. This is the sixth consecutive month of growth in manufacturing employment. An Employment Index above 49.8 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

emphasis added