by Calculated Risk on 5/28/2010 11:55:00 PM

Friday, May 28, 2010

Friday Night Summary

From Bloomberg: Spain Loses AAA Rating at Fitch as Europe Battles Debt Crisis

The euro declined to 1.2274 dollars on the news. The TED spread increased to 38.11. This is still fairly low, but has been increasing ... Note: This is the difference between the interbank rate for three month loans and the three month Treasury and is considered a measure of credit stress. The peak was 463 on Oct 10th and a normal spread is below 50 bps.

The BEA reported April Personal Income up 0.4%, Spending up slightly.

The Institute for Supply Management – Chicago reported the "CHICAGO BUSINESS BAROMETER eased" and "EMPLOYMENT slipped below neutral". New orders were softer, and it appears the inventory adjustment is over.

The National Restaurant Association index decreased slightly, but still showed some expansion. Same store sales and customer traffic both showed declines in April.

And a few interesting articles:

Best to all.

Bank Failure #78: Sun West Bank, Las Vegas, Nevada

by Calculated Risk on 5/28/2010 09:09:00 PM

Crepuscular Sun West Bank

Radiant, now dark

by Soylent Green is People

From the FDIC: City National Bank, Los Angeles, California, Assumes All of the Deposits of Sun West Bank, Las Vegas, Nevada

Sun West Bank, Las Vegas, Nevada, was closed today by the Nevada Financial Institutions Division, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes five today ...

As of March 31, 2010, Sun West Bank had approximately $360.7 million in total assets and $353.9 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $96.7 million. ... Sun West Bank is the 78th FDIC-insured institution to fail in the nation this year, and the second in Nevada. The last FDIC-insured institution closed in the state was Carson River Community Bank, Carson City, on February 26, 2010.

Bank Failure #77: Granite Community Bank, N.A., Granite Bay, California

by Calculated Risk on 5/28/2010 08:13:00 PM

Reinflating Granite Bank

Too much crushing debt.

by Soylent Green is People

From the FDIC:

Granite Community Bank, N.A., Granite Bay, California, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Financed too many granite countertops?

As of March 31, 2010, Granite Community Bank, N.A. had approximately $102.9 million in total assets and $94.2 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $17.3 million. ... Granite Community Bank, N.A. is the 77th FDIC-insured institution to fail in the nation this year, and the sixth in California. The last FDIC-insured institution closed in the state was 1st Pacific Bank of California, San Diego, on May 7, 2010.

Bank Failures #74 to #76: Florida

by Calculated Risk on 5/28/2010 05:38:00 PM

Reckless lending aftermath

Condo kingdom crash

by Soylent Green is People

From the FDIC: Everbank, Jacksonville, Florida, Acquires All the Deposits of Three Affiliated Florida Institutions

Bank of Florida – Southeast, Fort Lauderdale, Florida; Bank of Florida – Southwest, Naples, Florida; and Bank of Florida – Tampa Bay, Tampa, Florida, were all closed today by the Florida Office of Financial Regulation, which appointed the FDIC as receiver. The three failed banks were owned by the same holding company, Bank of Florida Corporation, which was not part of this transaction.A quick three-fer ...

...

As of March 31, 2010, Bank of Florida - Southeast had total assets of $595.3 million and total deposits of $531.7 million; Bank of Florida - Southwest had total assets of $640.9 million and total deposits of $559.9 million; and Bank of Florida – Tampa Bay had total assets of $245.2 million and total deposits of $224.0 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Bank of Florida - Southeast will be $71.4 million; for Bank of Florida - Southwest, $91.3 million; and for Bank of Florida – Tampa Bay, $40.3 million. ...The three closings bring the total number of failed banks in the nation so far this year to 76 and the total in Florida to 13. Prior to today, the last bank closed in the state was Bank of Bonifay, Bonifay, on May 7, 2010.

Decline in Small Business Lending: Supply or Demand problem?

by Calculated Risk on 5/28/2010 05:20:00 PM

There have been numerous reports of less small business lending. But it is unclear if this is because a lack of credit, or if the lower level of lending is because of less demand. A survey by the Atlanta Fed suggests that it is mostly a demand problem (especially excluding construction and real estate industries).

From Atlanta Fed senior economist Paula Tkac: How "discouraged" are small businesses? Insights from an Atlanta Fed small business lending survey

We at the Federal Reserve Bank of Atlanta have ... begun a series of small business credit surveys. Leveraging the contacts in our Regional Economic Information Network (REIN), we polled 311 small businesses in the states of the Sixth District (Alabama, Florida, Georgia, Louisiana, Mississippi and Tennessee) on their credit experiences and future plans. While the survey is not a stratified random sample and so should not be viewed as a statistical representation of small business firms in the Sixth District, we believe the results are informative.This fits with comments from the National Federation of Independent Businesses that cited "poor sales" as the number one problem for small businesses.

Indeed, the results of our April 2010 survey suggest that demand-side factors may be the driving force behind lower levels of small business credit. To be sure, when asked about the recent obstacles to accessing credit, some firms (34 firms, or 11 percent of our sample) cited banks' unwillingness to lend, but many more firms cited factors that may reflect low credit quality on the part of prospective borrowers. For example, 32 percent of firms cited a decline in sales over the past two years as an obstacle, 19 percent cited a high level of outstanding business or personal debt, 10 percent cited a less than stellar credit score, and 112 firms (32 percent) report no recent obstacles to credit. Perhaps not surprisingly, outside of the troubled construction and real estate industries, close to half the firms polled (46 percent) do not believe there are any obstacles while only 9 percent report unwillingness on the part of banks.

Sales halted on Condo Project, None Sold

by Calculated Risk on 5/28/2010 03:32:00 PM

This sounds so 2007 ... but it is today.

From David Bracken at the Newobserver.com: Sales stop for Raleigh condo project (ht dshort)

Hue, the multicolor building that is the largest condo project ever attempted in downtown Raleigh, closed its sales office without ever selling a unit.So much for the "revitalization". This is part of the shadow inventory ...

Signs posted on the building's doors, as well as a message left on the sales office's answering machine, say Hue will be closed until further notice.

...

With its royal blue and mustard exterior, the 208-unit ... seven-story building across from the city administration building downtown replaced a parking lot and was considered a bold symbol of downtown Raleigh's revitalization.

Restaurant Index: Same store sales and customer traffic off in April

by Calculated Risk on 5/28/2010 12:41:00 PM

This is one of several industry specific indexes I track each month.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Same store sales and customer traffic both showed declines in April. This was more than offset by a postive outlook in the "expectations index" and the overall index showed expansion in April.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading above 100 shows expansion for this index.

From the National Restaurant Association (NRA): Restaurant Industry Outlook Remained Positive as the Restaurant Performance Index Stood Above 100 in April

[T]the National Restaurant Association’s Restaurant Performance Index (RPI) ... was essentially unchanged from its previous month’s level; the RPI stood at 100.4 in April, down slightly from its March level of 100.5. RPI levels above 100 indicate expansion of key industry indicators.Restaurants are a discretionary expense, and they tend to be 'first in, last out' of a recession for consumer spending (as opposed to housing that is usually first in and first out). So far the recovery for restaurants has been sluggish, and operators will only stay optimistic if sales and traffic picks up.

“Although the sales and traffic indicators softened somewhat from their March performance, restaurant operators remain optimistic that business conditions will improve in the months ahead,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the Association. “In addition, restaurant operators reported a positive outlook for staffing gains, as well as continued plans for capital expenditures in the coming months.”

...

After reporting net positive same-store sales in March for the first time in 22 months, restaurant operators reported softer sales results in April.

...

Similarly, restaurant operators reported a net decline in customer traffic levels in April, after posting positive traffic results in March.

emphasis added

Chicago PMI shows expansion, Employment declines

by Calculated Risk on 5/28/2010 09:51:00 AM

From the Institute for Supply Management – Chicago:

The Chicago Purchasing Managers reported the CHICAGO BUSINESS BAROMETER eased again, tempering the pace of its expansion while marking its eighth month of growth. All Business Activity indexes except EMPLOYMENT signaled expansion. ... EMPLOYMENT slipped below neutral for the first time in 2010.The new orders index declined from April (65.2 to 62.7), and inventories increased sharply. Note: any number above 50 shows expansion.

This is similar to other regional reports: continued expansion, but at a slower pace. New orders are softer, and the inventory adjustment is over.

Especially concerning is the sharp decline in the employment index (from 57.2 to 49.2). The national ISM manufacturing index will be released next Tuesday.

April Personal Income up 0.4%, Spending Increases Slightly

by Calculated Risk on 5/28/2010 08:30:00 AM

From the BEA: Personal Income and Outlays, April 2010

Personal income increased $54.4 billion, or 0.4 percent ... Personal consumption expenditures (PCE) increased $4.0 billion, or less than 0.1 percent.The following graph shows real Personal Consumption Expenditures (PCE) through April (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased less than 0.1 percent in April

...

Personal saving as a percentage of disposable personal income was 3.6 percent in April, compared with 3.1 percent in March.

Click on graph for large image.

Click on graph for large image.The quarterly change in PCE is based on the change from the average in one quarter, compared to the average of the preceding quarter.

The colored rectangles show the quarters, and the blue bars are the real monthly PCE.

Spending only increased slightly in April compared to March.

The National Bureau of Economic Research (NBER) uses several measures to determine if the economy is in recession. One of the measures is real personal income less transfer payments (see NBER memo). This increased in April to $9,059 billion (SAAR) and is barely above the low of October 2009 ($8,987 billion).

This graph shows real personal income less transfer payments since 1969.

This graph shows real personal income less transfer payments since 1969.This measure of economic activity is moving sideways - similar to what happened following the 2001 recession.

This month income increased faster than spending ... meaning the saving rate increased.

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the April Personal Income report. The saving rate increased to 3.6% in April (decreased slightly using a three month average).

This graph shows the saving rate starting in 1959 (using a three month trailing average for smoothing) through the April Personal Income report. The saving rate increased to 3.6% in April (decreased slightly using a three month average). I still expect the saving rate to rise over the next couple of years slowing the growth in PCE.

The increase in income was good news, but personal income less transfer payments are still barely above the low of last year.

Thursday, May 27, 2010

Late Night Thread

by Calculated Risk on 5/27/2010 11:59:00 PM

I was out for some time ... the euro is back under 1.23 dollars again ... futures are off slightly (Dow off about 45).

On Friday the BEA will release the Personal Income and Outlay report for April - and that will provide some hints for PCE for Q2. Also the Chicago Purchasing Managers Index for May will be released. Another fun day!

Best to all

"Housing Production Credit Crisis"?

by Calculated Risk on 5/27/2010 06:49:00 PM

I thought this was from The Onion ... unfortunately it is not.

From the NAHB: Legislation Addresses Housing Production Credit Crisis

Legislation introduced yesterday by Reps. Brad Miller (D-N.C.) and original co-sponsors Carolyn Maloney (D-N.Y.) and Joe Baca (D-Calif.) would help alleviate the severe lack of credit for acquisition, development and construction (AD&C) financing that threatens to end the budding housing recovery before it has time to take root, according to the National Association of Home Builders (NAHB).There is still a large overhang of existing housing units (at the current price). The last thing we need is more production - and then sticking the U.S. taxpayers with more bad loans.

“We applaud these lawmakers for taking the lead to address the housing production credit crisis that is jeopardizing the housing and economic recovery now under way,” said NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Mich.

H.R. 5409, the Residential Construction Lending Act, would create a new residential construction loan guarantee program within the Department of Treasury to provide loans to builders with viable construction projects. Designed to unfreeze credit for small home building firms, the measure would expand the flow of credit to residential builders on competitive terms.

Under intense pressure from their bank examiners to reduce their exposure to development and construction loans to builders and curtail their outstanding portfolios of real estate loans, many lenders are refusing to make loans for viable new housing projects and cutting off the funding for performing loans, or calling them. This is causing unnecessary foreclosures and losses on these loans. Performing loans are also being reappraised, reducing the value of the collateral and forcing borrowers to come up with large amounts of cash to keep their loans current.

“H.R. 5409 will help restore the flow of credit to housing, provide jobs and give a meaningful lift to the economy,” said Jones. “We urge Congress to act quickly on this bill.”

Gross Domestic Income shows more sluggish recovery

by Calculated Risk on 5/27/2010 03:49:00 PM

Most of the revisions in the "Second Estimate" GDP report this morning were small; the headline GDP number was revised down to 3.0% from 3.2% (annualized real growth rate).

There are really two measures of GDP: 1) real GDP, and 2) real Gross Domestic Income (GDI). The BEA also released GDI today. Recent research suggests that GDI is often more accurate than GDP.

For a discussion on GDI, see from Fed economist Jeremy Nalewaik, “Income and Product Side Estimates of US Output Growth,” Brookings Papers on Economic Activity. An excerpt:

The U.S. produces two conceptually identical official measures of its economic output, currently called Gross Domestic Product (GDP) and Gross Domestic Income (GDI). These two measures have shown markedly different business cycle fluctuations over the past twenty five years, with GDI showing a more-pronounced cycle than GDP. These differences have become particularly glaring over the latest cyclical downturn, which appears considerably worse along several dimensions when looking at GDI. ...The NBER uses both real GDP and real GDI to date recessions.

In discussing the information content of these two sets of estimates, the confusion often starts with the nomenclature. GDP can mean either the true output variable of interest, or an estimate of that output variable based on the expenditure approach. Since these are two very different things, using “GDP” for both is confusing. Furthermore, since GDI has a different name than GDP, it may not be initially clear that GDI measures the same concept as GDP, using the equally valid income approach.

The following graph is constructed as a percent of the previous peak in both GDP and GDI. This shows when the indicator has bottomed - and when the indicator has returned to the level of the previous peak. If the indicator is at a new peak, the value is 100%. The recent recession is marked as ending in Q3 2009 - this is preliminary and NOT an NBER determination.

Click on graph for larger image in new window.

Click on graph for larger image in new window.It appears that GDP bottomed in Q2 2009 and GDI in Q3 2009. Real GDP is only 1.2% below the pre-recession peak - but real GDI is still 2.3% below the previous peak.

GDI suggests the recovery has been more sluggish than the headline GDP report and better explains the weakness in the labor market.

Also "Personal income excluding current transfer receipts (billions of chained 2005 dollars)" was revised down for the last two quarters, and now shows essentially no growth in real personal income since the bottom of the recession.

Hotel Occupancy increases 4% compared to same week in 2009

by Calculated Risk on 5/27/2010 01:46:00 PM

From HotelNewsNow.com: STR: Urban hotels top weekly performance

Overall, the industry’s occupancy increased 4.0 percent to 61.6 percent, ADR ended the week virtually flat with a 0.3-percent decrease to US$98.15, and RevPAR rose 3.7 percent to US$60.49.The occupancy rate has been running about 3% to 4% above 2009 for the last three months. The following graph shows the occupancy rate by week and the 52 week rolling average since 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The occupancy rate is running above 2009 - the worst year since the Depression - but still well below the normal level of close to 67% for this week.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Next Stimulus Package Scaled Back

by Calculated Risk on 5/27/2010 11:21:00 AM

From Lori Montgomery at the WaPo: Bill on jobless benefits, state financial help scaled back

[C]ongressional leaders reached a tentative agreement Wednesday to scale back a package that would have devoted nearly $200 billion to jobless benefits and other economic provisions ...The "extension" of the unemployment benefits doesn't add more weeks; it extends the eligibility for the previously expanded benefits.

Under Wednesday's agreement, the overall cost of the package would drop from more than $190 billion to about $145 billion ... Unemployment benefits would be extended through the end of November, instead of through the end of the year ... $32 billion in expiring tax credits and deductions for businesses and individuals and $24 billion to help cash-strapped state governments.

The spending from the American Recovery and Reinvestment Act (ARRA) starts to decline in Q3, and that will be a drag on GDP growth. However the additional spending (including this proposed package) will probably keep the overall contribution to GDP growth slightly positive in Q3, but will be a drag on GDP growth starting in Q4 as spending declines.

Weekly Initial Unemployment Claims at 460,000

by Calculated Risk on 5/27/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending May 22, the advance figure for seasonally adjusted initial claims was 460,000, a decrease of 14,000 from the previous week's revised figure of 474,000. The 4-week moving average was 456,500, an increase of 2,250 from the previous week's revised average of 454,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending May 15 was 4,607,000, a decrease of 49,000 from the preceding week's revised level of 4,656,000.

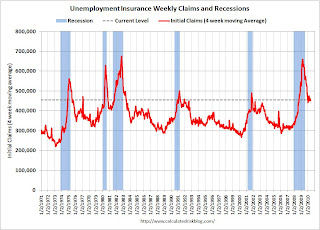

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 2,250 to 456,500.

The dashed line on the graph is the current 4-week average. The current level of 460,000 (and 4-week average of 456,500) is still high, and suggests ongoing weakness in the labor market.

Still disappointing ... the 4-week average has been moving sideways for almost five months.

Wednesday, May 26, 2010

Mortgage Refinance Activity

by Calculated Risk on 5/26/2010 11:33:00 PM

With the recent decline in mortgage rates, the Mortgage Bankers Association (MBA) has reported an increase in refinance activity. But so far the activity is far below the levels of early 2009 even though mortgage rates are at about the same level.

This is because most people who could refinance already did last year ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield (Note: Using the 10 year to approximate moves in mortgage rates).

Every time the 10 year yield drops sharply, refinance activity picks up. But notice what happened at the end of 1995. The Ten Year yield dropped, but the increase in refinance activity was muted. This was because mortgage rates didn't fall below the rates of a couple years earlier - and many people had already refinanced at those lower rates.

The same thing is happening now, and although activity has increased, there will only be a huge surge in refinance activity if mortgage rates fall below the rates of 2009.

Toll Brothers: Orders Up, Cancellation Rates Way Down, Toll buying Lots Again (Uh, Oh!)

by Calculated Risk on 5/26/2010 06:28:00 PM

This post is from housing economist Tom Lawler:

Toll Brothers, the self-proclaimed “leading builder of luxury homes,” reported that net home contracts totaled 866 in the quarter ended April 30th, up 40.9% from the comparable quarter of 2009. Gross orders were up 16.6% from a year ago, while sales cancellations were down 71.4%. The company’s sales cancellation rate expressed as a % of gross orders was 5.3%, the lowest rate since the third quarter of FY 2005, and close to the time that Toll CEO Robert Toll made his infamous comment in the summer of 2005 that “(w)e’ve got the supply, and the market has got the demand; it’s a match made in heaven” right before housing demand started to fall. Home deliveries last quarter totaled 543, down 16.2% from the comparable quarter of last year, while the company’s order backlog as of 4/30/10 was 1,738, up 9.9% from a year ago. The company’s increase in orders came despite a 21% drop in Toll’s community count from last year.

In its press release, new Toll CEO-designate Doug Yearley, Jr. noted that “with demand increasing in many areas, we are now focused on growth,” and said the company increased its lot count for the first time in four years – scaring more than a few folks.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

[This graph], by the way, is some history of Toll’s land/lot position from one of its presentations, with one of the most misleading headlines known to man.

This chart, as well as Bob Toll’s statements, highlights how Toll completely and totally misread the housing markets during the middle of last decade, accelerating land/lot acquisitions right near the peak – a move that eviscerated shareholders, though the company’s relative low leverage saved it from extinction.

What scared folks is that the company’s new push to growth was based on an assessment, echoed by Bob Toll in the press release, that the rebound in orders/demand was not simply the result of the home buyer tax credit, but was also driven “by an increase in confidence among our buyers in their job security, their ability to sell their existing homes, and general trends in home prices." He based this assessment in part on the fact that “(i)n the three weeks since the start of our third quarter on May 1st, which coincided with the expiration of the homebuyer tax credit, our per community deposits and traffic were up 23% and 11%, respectively, over last year's comparable period.”

Note, though that (1) he referenced activity per community, and the company’s community count was down 21% from a year ago, and last quarter’s YOY increase in gross orders per community were up 47.2% YOY (and net orders 78%!); and (2) a year ago wasn’t exactly a strong housing market!!!! But…you know Bob!!!!

An amusing thing in today’s press release that actually suggests the company is highly uncertain about housing demand for the rest of this year was CFO’s Joel Rassman’s “limited” guidance he offered for the company’s home deliveries in FY 2010 (which is half over). He said the company estimates that it will deliver “between 2,200 and 2,275” homes in FY2010. Given the 1,139 homes already delivered in the first half of FY 2010, that means the company’s “guidance” is that it expects to deliver between 1,061 and 1,611 homes from May 1st through October 31st !!!! Now THAT’S a huge range, and one consistent with a view that “well, I think demand may have rebounded, but BOY, maybe it really WAS the tax credit!!!”

Of course, the tax credit probably was NOT as much of a factor for buyer’s of Toll’s homes relative to other builders – after all, Toll’s average price is in the $560,000 - $570,000, and the federal tax credit was capped at $8,000. And, in fact, there IS some anecdotal evidence that in some markets the demand for “Toll-like” homes has improved a bit. However, given Bob Toll’s track record of reading the housing market since the turn of the millennium ...

Bob Toll, by the way, will step down as Toll’s CEO effective June 16th, though he will “remain active” as Executive Chairman of the Board.

CR Note: this was from economist Tom Lawler.

Market Update: More Euro

by Calculated Risk on 5/26/2010 03:40:00 PM

The euro was down under 1.22 dollars as investors apparently reacted to a story in the Financial Times: China reviews eurozone bond holdings

China ... is reviewing its holdings of eurozone debt ...And this brought out the Dow 10K hats with the Dow closing at 9.974. Party likes it's 1998!

Representatives of China’s State Administration of Foreign Exchange, or Safe ... has been meeting with foreign bankers in Beijing in recent days to discuss the issue.

Safe, which holds an estimated $630bn of eurozone bonds in its reserves ...

excerpts with permission

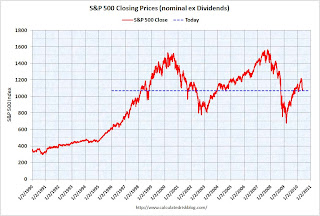

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows the S&P 500 since 1990.

The dashed line is the close today. The first time the S&P 500 was at this level was March 11, 1998 - over 12 years ago.

For investors this has already been a "lost decade" and more ...

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

New Home Prices: Median Lowest since 2003

by Calculated Risk on 5/26/2010 12:40:00 PM

As part of the new home sales report, the Census Bureau reported that the median price for new homes fell to the lowest level since 2003. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the median and average new home price. It appears the builders sold at a lower price point in April, and that helped boost sales.

This makes sense since many of the buyers were trying to take advantage of the housing tax credit (and probably using FHA insurance). Since the modification programs and the delays in foreclosure limited the number of distressed sales - many buyers at the low end found buying a new home easier than buying an existing home. The second graph shows the percent of new home sales by price.

The second graph shows the percent of new home sales by price.

Half of all home sales were under $200K in April - tying Jan 2009 as the highest level since 2003 (there was panic selling in Jan 2009).

And excluding Jan 2009, this is the highest percentage under $300K since May 2003 - and the highest under 400K since April 2003.

To summarize: the homebuilders sold 16,000 more units in April 2010 than in April 2009 - probably because of the tax credit, and at lower prices - and now sales will decline sharply in May probably close to the 34,000 units sold in May 2009.

New Home Sales increase to 504K Annual Rate in April

by Calculated Risk on 5/26/2010 10:00:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 504 thousand. This is an increase from the revised rate of 439 thousand in March (revised from 411 thousand). Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red columns for 2010. In April 2010, 48 thousand new homes were sold (NSA).

The record low for the month of April was 32 thousand in 1982 and 2009; the record high was 116 thousand in 2005. The second graph shows New Home Sales vs. recessions for the last 45 years.

The second graph shows New Home Sales vs. recessions for the last 45 years.

Sales of new one-family houses in April 2010 were at a seasonally adjusted annual rate of 504,000 ... This is 14.8 percent (±19.5%)* above the revised March rate of 439,000 and is 47.8 percent (±26.0%) above the April 2009 estimate of 341,000.And another long term graph - this one for New Home Months of Supply.

Months of supply declined to 5.0 in April from 6.2 in March. This is significantly below the all time record of 12.4 months of supply set in January 2009. This would be about normal, except the months of supply will increase next month when sales decline.

Months of supply declined to 5.0 in April from 6.2 in March. This is significantly below the all time record of 12.4 months of supply set in January 2009. This would be about normal, except the months of supply will increase next month when sales decline.The seasonally adjusted estimate of new houses for sale at the end of April was 211,000. This represents a supply of 5.0 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. New home sales are counted when the contract is signed, so this pickup in activity is related to the tax credit.

For new home sales, the tax credit selling ended in April and sales will probably decline sharply in May.