by Calculated Risk on 5/13/2010 08:33:00 AM

Thursday, May 13, 2010

Weekly Initial Unemployment Claims at 444,000

The DOL reports on weekly unemployment insurance claims:

In the week ending May 8, the advance figure for seasonally adjusted initial claims was 444,000, a decrease of 4,000 from the previous week's revised figure of 448,000 [revised up from 444,000]. The 4-week moving average was 450,500, a decrease of 9,000 from the previous week's revised average of 459,500.

The advance number for seasonally adjusted insured unemployment during the week ending May 1 was 4,627,000, an increase of 12,000 from the preceding week's revised level of 4,615,000..

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 9,000 to 450,500.

The dashed line on the graph is the current 4-week average. The current level of 444,000 (and 4-week average of 450,500) is still high, and suggests ongoing weakness in the labor market.

Although declining over the last few weeks, the 4-week average first declined to this level at the end of December 2009, and has been at this level for almost five months.

Wednesday, May 12, 2010

NY Times: The New Poor

by Calculated Risk on 5/12/2010 11:52:00 PM

Catherine Rampell at the NY Times has a story about the long term unemployed, and the skills mismatch: In a Job Market Realignment, Some Workers Left Behind

Millions of workers who have already been unemployed for months, if not years, will most likely remain that way even as the overall job market continues to improve, economists say. The occupations they worked in, and the skills they currently possess, are never coming back in style. And the demand for new types of skills moves a lot more quickly than workers — especially older and less mobile workers — are able to retrain and gain those skills.A sad story ...

There is no easy policy solution for helping the people left behind. The usual unemployment measures — like jobless benefits and food stamps — can serve as temporary palliatives, but they cannot make workers’ skills relevant again.

EU Proposes more "interdependent" economic governance

by Calculated Risk on 5/12/2010 07:52:00 PM

From Stephen Castle at the NY Times: E.U. Plans Peer Review for Member States' Budgets

[T]he European Commission on Wednesday outlined ambitious proposals to give countries that use the euro a say over each other’s budget plans.From the EU: Mastering economic interdependence: Commission proposes reinforced economic governance in the EU

...

“Member states should have the courage to say whether they want an economic union because, if they don’t want that, it is better to forget monetary union altogether,” [European Commission president, José Manuel Barroso] said at a press conference in Brussels.

Among the ideas announced Wednesday was a plan to make the huge safety net for the euro that was decided on over the weekend a permanent crisis-resolution mechanism.

I'm not sure how this will go over.

Meanwhile in Spain from the Financial Times: Tough new Spanish austerity measures

José Luis Rodríguez Zapatero, Spain’s prime minister ... announced a surprise 5 per cent cut in civil service pay to accelerate cuts to the budget deficit.The EU €750 billion announced on Sunday just buys time. As part of that agreement, both Portugal and Spain agreed to reduce their deficits.

...

The measures should help bring the deficit down from 11.2 per cent of GDP in 2009 to just over 6 per cent in 2011.

excerpt with permission

Housing Stories and Market Update

by Calculated Risk on 5/12/2010 03:55:00 PM

A couple housing stories ... the first provides analysis from Barclays analysts that suggests distressed sales will stay elevated for some time. The second is from Diana Olick about house prices and the tax credit.

From Jon Prior at HousingWire: Shadow Inventory To Peak in Summer of 2010: Barclays

Barclays defines the shadow inventory of foreclosures as loans in 90-plus day delinquency or already in the foreclosure process. ...From Diana Olick at CNBC: Home Buyer Tax Credit Takes its Toll

The shadow inventory should reach its height in the summer in 2010 before falling gradually as the market absorbs 130,000 distressed properties per month, according to the report. Over the next three years, analysts forecast 4.7m distressed sales with 1.6m in 2010, another 1.6m in 2011 and 1.5m in 2012.

From one of our own CNBC producers, Andrea Mantia:Anybody surprised that asking prices have adjusted down?"I've been househunting for a few months now...we totally got caught up in the "tax credit frenzy"....thank God we took a deep breath and relaxed...EVERY SINGLE HOME we had our eye on dropped in price this week...and this is in Bergen Co (NJ) where prices weren't budging!"

Click on graph for larger image in new window.

This graph is from Doug Short: "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Ceridian-UCLA: Diesel fuel consumption index declines in April

by Calculated Risk on 5/12/2010 01:00:00 PM

This is the new UCLA Anderson Forecast and Ceridian Corporation index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: Ceridian-UCLA Pulse of Commerce Index™ Drops 0.3 Percent in April

With the release of April’s figures, the Ceridian-UCLA Pulse of Commerce Index™ (PCI) by UCLA Anderson School of Management is showing flat, overall performance during the first four months of 2010. The PCI in April fell 0.3 percent, suggesting the economic recovery may have stalled, although an uptick in consumer spending could continue to drive a slow but steady recovery.

...

While the economy continues to climb year-over-year, the PCI indicates that expectations in the market for a robust recovery may be too optimistic. ...

“The latest PCI numbers are disappointing and cast considerable doubt on the strength of the recovery and the strength of GDP numbers for 2010,” said Ed Leamer, the PCI’s chief economist.

...

The PCI is based on an analysis of real-time diesel fuel consumption data ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the index since January 1999.

Note: This index appears to lead Industrial Production (IP), but there is a significant amount of monthly noise. This is a new index and might be interesting to follow along with the Trucking and Railroad data.

Here is a video of Leamer's comments on the report.

Rail Traffic "Recovering at moderate pace"

by Calculated Risk on 5/12/2010 10:54:00 AM

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in April 2010 was up 15.8% compared to April 2009 - although traffic was still 11.5% lower than in April 2008.

This graph shows U.S. average weekly rail carloads. Traffic increased in all 19 major commodity categories YoY.

From AAR:

• U.S. freight railroads originated 1,179,029 carloads in April 2010, up 15.8% from April 2009 on a nonseasonally adjusted basis. That could very well be the highest year-over-year percentage increase for any month ever. It’s definitely the highest since at least January 1989, which is the first month for which we have comparable data.The graph above shows that rail traffic collapsed in November 2008, and now ten months into the recovery, traffic has only recovered half way. This is clearly not a "V-shaped" recovery - there is still a long way to go.

• Part of the big percentage gain in April 2010 reflects real traffic growth, but some of it also reflects the fact that April 2009 was a lousy month for U.S. freight railroads (see chart). May 2009 was even worse, so we can probably expect a very large year-over-year percentage increase in May 2010 too.

• Is this good news? Absolutely. But some caution is in order. Total U.S. rail carloads in April 2010 were still down 11.5% from April 2008, including in 17 of the 19 commodity categories. Generally speaking, recent U.S. rail traffic gains are consistent with an economy that is recovering at a moderate but not breathtaking pace.

excerpts with permission

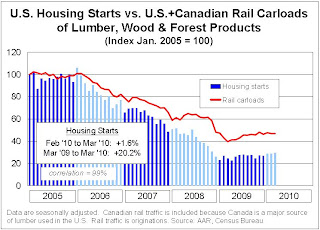

The second graph from the AAR report shows lumber rail traffic compared to U.S. housing starts.

The second graph from the AAR report shows lumber rail traffic compared to U.S. housing starts.From the AAR:

Happy days are not yet here again for homebuilders.That says it all!

Trade Deficit increases in March

by Calculated Risk on 5/12/2010 08:30:00 AM

The Census Bureau reports:

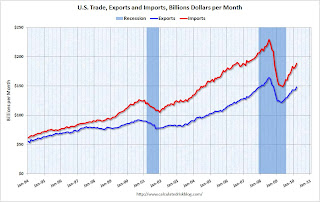

[T]otal March exports of $147.9 billion and imports of $188.3 billion resulted in a goods and services deficit of $40.4 billion, up from $39.4 billion in February, revised. March exports were $4.6 billion more than February exports of $143.3 billion. March imports were $5.6 billion more than February imports of $182.7 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through March 2010.

On a year-over-year basis, exports are up 20% and imports are up 24%. This is an easy comparison because of the collapse in trade at the end of 2008 and into early 2009.

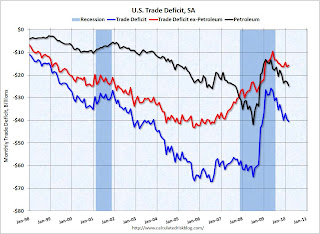

The second graph shows the U.S. trade deficit, with and without petroleum, through March.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased slightly to $73.89 in March - and are up 89% from the low of February 2009 (at $39.22). Oil import volumes increased sharply in March pushing up the value of imports.

Both imports and exports have been increasing sharply, but are still below the pre-financial crisis levels. Once again China and oil are the major contributors to the trade deficit.

MBA: Mortgage Purchase Applications Decrease

by Calculated Risk on 5/12/2010 07:21:00 AM

The MBA reports: Refinance Applications Surge, Purchase Applications Drop in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 3.9 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 14.8 percent from the previous week and the seasonally adjusted Purchase Index decreased 9.5 percent from one week earlier. ...

“The recent plunge in rates on US Treasury securities, due to a flight to quality as investors worldwide sought shelter from the Greek debt crisis, benefitted US mortgage borrowers last week. Rates on 30-year mortgages dropped to their lowest level since mid-March. As a result, refinance applications for conventional loans jumped, hitting their highest level in six weeks,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “In contrast, purchase applications fell almost 10 percent in the first week following the expiration of the homebuyer tax credit, as the tax credit likely pulled some sales into April that would otherwise have occurred in May or later.”

... The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.96 percent from 5.02 percent, with points decreasing to 0.91 from 0.92 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

We expected the Purchase Index to increase in April - and then turn down in May since the tax credit expired at the end of April (buyers need to close by June 30th). The tax credit related peak in purchase activity is probably behind us.

As Fratantoni noted, the decline in mortgage rates (below 5% again on a 30 year fixed) resulted in a surge in refinance applications last week.

Tuesday, May 11, 2010

Shanghai Composite index Off 1%

by Calculated Risk on 5/11/2010 11:59:00 PM

A follow up to a post two weeks ago ... keep an eye on the Shanghai index (in red). It appears China's economy is slowing.

A follow up to a post two weeks ago ... keep an eye on the Shanghai index (in red). It appears China's economy is slowing.

Click on graph for larger image in new window.

This graph shows the Shanghai SSE Composite Index and the S&P 500 (in blue).

The SSE Composite Index is at 2,622.67 mid-day - down about 300 points from 2 weeks ago.

Jon Stewart explains Market Disruption

by Calculated Risk on 5/11/2010 09:17:00 PM

From Jon Stewart at the Daily Show: A Nightmare on Wall Street

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c |

| A Nightmare on Wall Street | |

| www.thedailyshow.com | |

Distressed Sales: Sacramento as an Example, April Update

by Calculated Risk on 5/11/2010 05:17:00 PM

The Sacramento Association of REALTORS® is breaking out monthly resales by equity sales (conventional resales), and distressed sales (Short sales and REO sales), and I'm following this series as an example to see mix changes in a distressed area.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here is the April data.

The Sacramento Association started breaking out REO sales in 2008, but they have only broken out short sales since June 2009 - so we almost have one year of data.

In April, 63% of all resales (single family homes and condos) were distressed sales.

Note: This data is not seasonally adjusted, although the decrease in sales in April is a little surprising because of the tax credit. The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The second graph shows the percent of REO, short sales and conventional sales. The percent of short sales is near the high set in December and will probably continue to increase later this year (2010 is the year of the short sale!).

The percent of REOs has been generally declining (seasonally there are a larger percentage of REOs in the winter).

Also total sales in April were off 9.1% compared to April 2009; the eleventh month in a row with declining YoY sales - even with the tax credit buying this year!

On financing, over 58 percent were either all cash (27.2%) or FHA loans (30.9%), suggesting most of the activity in distressed former bubble areas like Sacramento is first time home buyers using government-insured FHA loans, and investors paying cash.

SEC's Shapiro on Market Disruption: "unable to point to a single event" as cause

by Calculated Risk on 5/11/2010 03:16:00 PM

Testimony from SEC Chairman Mary Schapiro before the House Subcommittee on Capital Markets, Insurance and Government Sponsored Enterprises: Severe Market Disruption on May 6, 2010

This is an overview of what happened, what didn't happen (fat finger, unusual trading in Proctor & Gamble) and possible action to be taken (single stock trading curbs). On changes:

[W]e must consider the various types of “time out” mechanisms that can help maintain a fair and orderly market, both for the broad market and for individual stocks.

For example, we must ask whether the general, market-wide circuit breaker provisions that currently are on the books (none of which were triggered on May 6) need to be revised. I note that a vitally important element of the market-wide circuit breakers is that they apply across all stock and options trading venues and all venues for trading equity security-related futures, because markets for all equity security-related products are closely linked.

I believe that we also must consider the various types of time out mechanisms that can be applied to individual stocks. Although the prices of many stocks on May 6 declined in proportion with the broader market decline that occurred in securities and futures index products, the prices of many other individual stocks declined much, much more (before snapping back largely to the prices at which they were trading prior to the precipitous decline). At this point, the root cause of the sudden disappearance of liquidity in many stocks is unclear. ...

In addition to time out mechanisms, we will consider any other steps that potentially could prevent or help minimize the harm that occurred on May 6. These include: (1) exchange-level erroneous order filters; (2) “collars” on the prices at which market orders or aggressively priced limit orders can be executed; (3) limitations on the size of market orders or aggressively priced limit orders; and (4) eliminating the practice of displaying stub quotes that were never intended to be executed.

Senate Passes One-Time Fed Audit

by Calculated Risk on 5/11/2010 01:23:00 PM

From the NY Times: Senate Backs One-Time Audit of Fed’s Bailout Role

The Senate on Tuesday voted unanimously to require a one-time audit of the Federal Reserve’s emergency actions during and after the 2008 financial crisis as part of broad legislation overhauling the nation’s financial regulatory system.This is a one time audit (as opposed to the house bill), and would also require the Fed to release a list by Dec 1, 2010 of all of the institutions that received emergency assistance during the financial crisis.

BLS: Low Labor Turnover, More Hiring in March

by Calculated Risk on 5/11/2010 10:00:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.7 million job openings on the last business day of March 2010, the U.S. Bureau of Labor Statistics reported today. The job openings rate was unchanged over the month at 2.0 percent. The hires rate (3.3 percent) was little changed, and the separations rate (3.1 percent) was unchanged in March.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. The CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

The following graph shows job openings (purple), hires (blue), Total separations (include layoffs, discharges and quits) (red) and Layoff, Discharges and other (yellow) from the JOLTS.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (blue) and separations (red) are pretty close each month. This is the level of turnover each month. Right now about 4 million people lose their jobs each month, and a little over 4 million are hired (this is the labor turnover in the economy).

When the hires (blue line) is above total separations (as in March), the economy is adding net jobs, when the blue line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.242 million hires in March (SA), and 4.016 million total separations, or 226 thousand net jobs gained. The comparable CES report showed a gain of 230 thousand jobs in March (after revision).

Layoffs and discharges have declined sharply from early 2009 - and that is a good sign.

Hiring picked up in March, although the number of job openings is still very low, as is the turnover rate.

Small Business Optimism Improves in April

by Calculated Risk on 5/11/2010 08:52:00 AM

From NFIB: Small Business Optimism Index Improves in April

The National Federation of Independent Business Index of Small Business Optimism gained 3.8 points in April, rising to 90.6 and ending seven straight quarters of under 90 readings. The persistence of Index readings below 90 is unprecedented in survey history. Nine of the 10 Index components rose, particularly the outlook for general business conditions and sales, and one was unchanged. Still, job measures barely moved and capital expenditure plans were flat.The outlook has improved, and sales and earnings have picked up some, but hiring is "bleak".

“The gains are a step in the right direction, but they are not enough to signal a solid recovery is in place,” said William Dunkelberg, NFIB chief economist. “Owners are feeling a little better about things, but not enough to turn them into concrete action.”

“What small businesses need are customers, giving them a reason to hire and make capital expenditures and borrow to support those activities,” said Dunkelberg. “Bottom line, the recovery will be sub-par in comparison to the recoveries we experienced following past severe recessions such as 1980-82."Note: although the press release doesn't mention it, there is a heavy concentration of construction related businesses in the small business sector - and obviously that is one of the weakest areas.

Monday, May 10, 2010

Small Business hiring "Bleak"

by Calculated Risk on 5/10/2010 10:43:00 PM

Note: this is the employment section of the April survey that will be released Tuesday.

From the WSJ: At Small Businesses, Hiring Still Drags

April marked the 27th consecutive month in which small businesses either shed more or the same number of jobs that they added, according to a monthly survey to be released Tuesday by the National Federation of Independent Business, a trade group in Washington, D.C. Since July 2008, employment per firm has fallen steadily each quarter, logging the largest reductions in the survey's 35-year history. Going forward, more small-business owners say they plan to eliminate jobs compared with those that expect to create new jobs over the next three months.And from the National Federation of Independent Business: Jobs Picture Still Bleak for Small Business

“The steep recession will unlikely be followed by a steep recovery, the numbers just aren’t moving in that direction. [said William C. Dunkelberg, chief economist for the National Federation of Independent Business] "April marks the 27th consecutive ‘no new jobs’ monthly reading."

“There is little enthusiasm among owners to hire more workers, primarily due to continued weak sales trends.”

60 Minutes on Walking Away

by Calculated Risk on 5/10/2010 07:11:00 PM

Here is a 60 Minutes piece on Walking Away, aka 'Strategic Defaults' and as ' Ruthless Defaults' by lenders. (ht Michael).

Just a note - anyone considering this should talk to an attorney, and they should also talk with their lender. If it can be arranged, a short sale is much better than a foreclosure for all parties ...

Fannie, Freddie, FHA REO Inventory Surges 22% in Q1 2010

by Calculated Risk on 5/10/2010 03:55:00 PM

The combined REO (Real Estate Owned) inventory for Fannie, Freddie and the FHA increased by 22% in Q1 2010 from Q4 2009. The REO inventory (foreclosed homes) increased 59% compared to Q1 2009 (year-over-year comparison). Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph (ht Tom Lawler) shows the REO inventory for Fannie, Freddie and FHA through Q1 2010.

Even with all the delays in foreclosure, the REO inventory has increased sharply over the last three quarters, from 135,868 at the end of Q2 2009, to 153,007 in Q3 2009, 172,357 at the end of Q4 2009 and now 209,500 at the end of Q4 2010.

These are new records for all three agencies.

Remember this is just a portion of the total REO inventory. Private label securities and banks and thrifts hold an even larger number of REOs. For more, see Tom Lawler's earlier post: REO: Agencies vs. Private Label and from James Hagerty at the WSJ in March writing about a Barclays Capital report: Supply of Foreclosed Homes on the Rise Again.

SEC: Exchanges agree on "structural framework" to strengthen circuit breakers

by Calculated Risk on 5/10/2010 02:16:00 PM

From the SEC: Statement on Meeting With Exchanges

"This morning, SEC Chairman Mary Schapiro had a constructive meeting with the leaders of six exchanges — the New York Stock Exchange, NASDAQ, BATS, Direct Edge, ISE and CBOE — and the Financial Industry Regulatory Authority to discuss the causes of Thursday's market events, the potential contributing factors, and possible market reforms.Why not use technology to slow down price changes on individual stocks? It is amazing that we still don't have an explanation for the weird price changes last Thursday.

"As a first step, the parties agreed on a structural framework, to be refined over the next day, for strengthening circuit breakers and handling erroneous trades."

Report: 11.2 Million U.S. Properties with Negative Equity in Q1

by Calculated Risk on 5/10/2010 11:23:00 AM

First American CoreLogic released the Q1 2010 negative equity report today.

CoreLogic reported today that more than 11.2 million, or 24 percent, of all residential properties with mortgages, were in negative equity at the end of the f irst quarter of 2010, down slightly from 11.3 million and 24 percent from the fourth quarter of 2009. An additional 2.3 million borrowers had less than five percent equity. Together, negative equity and near-negative equity mortgages accounted for over 28 percent of all residential properties with a mortgage nationwide.From the report:

Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (34 percent). Las Vegas remains the top ranked CBSA with 75% of mortgaged properties being underwater, followed by Stockton (65%), Modesto (62%), Vallejo-Fairfield (60%) and Phoenix (58%). Phoenix had more than 550,000 underwater borrowers, the most households of any metropolitan market in the country. Riverside (463,000), Los Angeles (406,000) Atlanta (399,000) and Chicago (365,000) round out the top five markets.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentage of homeowners underwater, 10 percent or more of homeowners have negative equity in 33 states and the D.C., and over 20% have negative equity or near negative equity in 23 states and D.C. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA on the graph above.

The second graph shows the distribution of homeowners with a mortgage with near or negative equity.

The second graph shows the distribution of homeowners with a mortgage with near or negative equity.The share of borrowers whose mortgage debt exceeds the property value by 25% or more fell slightly to 10.4% or 4.9 million borrowers, down from 10.6% or 5 million borrowers. The aggregate dollar value of negative equity for these deeply underwater borrowers was $656 billion dollars.Research has shown that once negative equity exceeds 25 percent "owners begin to default with the same propensity as investors", and it is these 4.9 million borrowers - with $656 billion in debt - that are most at risk for foreclosure.