by Calculated Risk on 4/04/2010 06:42:00 PM

Sunday, April 04, 2010

Weekly Summary and a Look Ahead

by Calculated Risk on 4/04/2010 12:25:00 PM

The economic news will be a little lighter in the up coming week, although there will be a number of Fed speeches.

Early in the week, I expect REIS to release the Q1 vacancy data for offices, malls and apartments. This is key data for commercial real estate, and the vacancy rates have been steadily rising and setting new records.

Later in the week, we will probably get the March National Federation of Independent Business (NFIB) small business survey and the rail traffic report for March from the Association of American Railroads (AAR).

On Monday, the ISM non-manufacturing (service) index for March will be released at 10 AM ET, and February pending home sales from the National Association of Realtors (also at 10 AM). The consensus is for an increase in the ISM index to 54.0 from 53.0 in February, and a slight decline in pending home sales.

On Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for February will be released at 10 AM by the BLS. This report has been showing very little hiring and turnover in the labor market. Also on Tuesday the FOMC minutes for the March meeting will be released at 2 PM. Minnesota Fed President Narayana Kocherlakota speaks at 1 PM.

On Wednesday consumer credit will be released by the Federal Reserve at 2 PM. Fed Chairman Ben Bernanke is speaking at a luncheon, and also on Wednesday Kansas City Fed President (and inflation hawk) Tom Hoenig speaks at 2PM.

On Thursday the closely watched initial weekly unemployment claims will be released. The consensus is for some slight improvement from the 439K last week. Fed Vice Chairman Donald Kohn speaks on the U.S. economic outlook at 4 PM, and Chairman Bernanke speaks on economic policy at 8:30 PM.

And on Friday, Wholesale inventories for February will be released at 10 AM. Also on Friday the FDIC will probably close several more banks. Puerto Rico is still on the clock ...

And a (long) summary of last week:

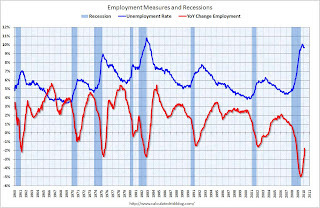

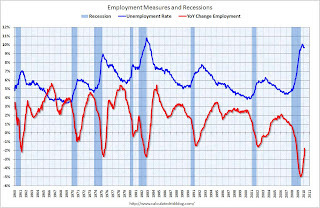

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 162,000 in March. The economy has lost 2.3 million jobs over the last year, and 8.2 million jobs since the beginning of the current employment recession.

The unemployment rate was steady at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 48,000 (NSA) in March. So payrolls increased 114,000 ex-Census.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.The Employment-Population ratio ticked up slightly to 58.6% in March, after plunging since the start of the recession. This is about the same level as in 1983.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate increased slightly to 64.9% (the percentage of the working age population in the labor force). This is at the level of the early 80s. Many of these people will return to the labor force when the employment picture improves - and that will keep the unemployment rate elevated unless net hiring picks up dramatically.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 9.1 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 9.1 million. The all time record of 9.2 million was set in October. This suggests the increase last month was not weather related - and is not a good sign.

The next graph shows long term unemployment.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.55 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.3% of the civilian workforce. (note: records started in 1948)

Although the headline number of 162,000 payroll jobs was a positive (this is 114,000 after adjusting for Census 2010 hires), the underlying details were mixed. The positives: the unemployment rate was steady, the employment-population ratio ticked up slightly (after plunging sharply), the diffusion index showed more industries hiring, and average hours increased (might have been impacted by the snow in February).

But a near record number of part time workers (for economic reasons), a record number of unemployed for more than 26 weeks, and a decline in average hourly wages are all negatives.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Private residential construction spending is now 62.9% below the peak of early 2006.

Private non-residential construction spending is 29.0% below the peak of late 2008.

Residential spending will probably exceed non-residential spending later this year - mostly because of continued declines in non-residential spending as major projects are completed.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).This is a 13.9% increase from the February sales rate.

Excluding August '09 (Cash-for-clunkers), this is the highest level since September 2008. The current level of sales are very low, and are at about the low point for the '90/'91 recession (even with a larger population now).

Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.52% in January, up from 5.38% in December - and up from 2.77% in January 2009.

Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.52% in January, up from 5.38% in December - and up from 2.77% in January 2009."Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

IMPORTANT: These graphs are Not Seasonally Adjusted (NSA).

IMPORTANT: These graphs are Not Seasonally Adjusted (NSA).This graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.2% from the peak, and down about 0.2% in January NSA (up 0.4% SA, but the data wasn't available when the charts were created).

The Composite 20 index is off 29.6% from the peak, and down about 0.4% in January (NSA) (up 0.3% SA)

Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA.

Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA. On a SA basis from the NY Times: U.S. Home Prices Prices Inch Up, but Troubles Remain

Twelve of the cities in the index went up in January from December. Los Angeles was the biggest gainer, up 1.7 percent. Chicago was the biggest loser, dropping 0.8 percent.

Here is a map of the three month change in the Philly Fed state coincident indicators. Twenty five states are showing declining three month activity. The index increased in 18 states, and was unchanged in 7.

Here is a map of the three month change in the Philly Fed state coincident indicators. Twenty five states are showing declining three month activity. The index increased in 18 states, and was unchanged in 7.Here is the Philadelphia Fed state coincident index release for February.

In the past month, the indexes increased in 21 states, decreased in 22, and remained unchanged in seven for a one-month diffusion index of -2. Over the past three months, the indexes increased in 18 states, decreased in 25, and remained unchanged in seven for a three-month diffusion index of -14.

Best wishes to all.

Texas and the Housing Bubble

by Calculated Risk on 4/04/2010 09:02:00 AM

From Alyssa Katz at the WaPo: How Texas escaped the real estate crisis

Only a dozen states have lower mortgage foreclosure and default rates [than Texas], and all of them are rural places such as Montana and South Dakota, where they couldn't have a real estate boom if they tried.Here is a graph based on the Q4 2009 MBA delinquency survey:

Texas's 3.1 million mortgage borrowers are a breed of their own among big states with big cities. Fewer than 6 percent of them are in or near foreclosure, according to the Mortgage Bankers Association; the national average is nearly 10 percent.

...

[T]here is a ... secret to Texas's success ... Across the nation, cash-outs became ubiquitous during the mortgage boom, as skyrocketing house prices made it possible for homeowners, even those with bad credit, to use their home equity like an ATM. But not in Texas. There, cash-outs and home-equity loans cannot total more than 80 percent of a home's appraised value. There's a 12-day cooling-off period after an application, during which the borrower can pull out. And when a borrower refinances a mortgage, it's illegal to get even a dollar back. Texas really means it: All these protections, and more, are in the state constitution. The Texas restrictions on mortgage borrowing date from the first days of statehood in 1845, when the constitution banned home loans.

"Delinquency and foreclosure rates are significantly lower in Texas," says Scott Norman of the Texas Mortgage Bankers Association. "The 80 percent loan-to-value limit -- that's the catalyst for a lot of this."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Sure enough the seriously delinquent rate in Texas is only higher than 12 other states. However the total delinquency rate is right in the middle.

The limits on home equity borrowing might have helped because fewer homeowners could get into situations with negative equity.

This graph is based on the First American CoreLogic Q4 negative equity report.

This graph is based on the First American CoreLogic Q4 negative equity report.This graph shows the negative equity and near negative equity by state.

Once again Texas is in the bottom half, but the negative equity rate doesn't seem extremely low.

I think there are other factors too. Texas is part of Krugman's Flatland, and most areas with abundant land saw smaller price increases during the bubble. And there is a direct correlation between price increase and eventual price decrease - and therefore negative equity (all those people who bought near the top) - and the delinquency rate. I think Texas saw a minimal price increase because it is easy to build there.

Although I think limits on home equity borrowing make sense, and might have helped at the margin, I'm not convinced it is a "secret" to the lower rate in Texas.

Note: Nevada and Arizona have building limitations, and they also saw significant investor buying from Californians - many using their home equity to buy investment property.

Saturday, April 03, 2010

India: 30% Mall Vacancy Rate in Cities, Falling Rents

by Calculated Risk on 4/03/2010 11:14:00 PM

We rarely discuss India ...

From Praveen Singh at the Indian Express: Sprawling Malls, empty spaces

According to reports, the average vacancy across malls in major cities rose to over 30 per cent last year. ...It appears there was a commercial real estate bubble in India too.

Jones Lang LaSalle Meghraj (JLLM), a global property consultant, says that out of 17.3 million sq ft supply of retail space across the country in 2010, only 9.3 million sq ft is expected to be absorbed. ...

[T]here has been a continuous fall in retail rentals. A Cushman & Wakefield (C&W) survey revealed that certain pockets of Delhi, Gurgaon, Chandigarh, Kolkata, Hyderabad, Mumbai, Pune and Bangalore are witnessing severe decline in rentals. The NCR, which received the highest quantum of mall space last year, saw a rental correction of approximately 30 to 60 per cent in locations such as Noida and Gurgaon. Likewise, high streets like Linking Road and Kemps Corner in Mumbai, Cathedral Road and R K Salai in Chennai, and Ganesh Khind Road in Pune witnessed a 13 to 20 per cent drop in rentals.

Housing Starts and the Unemployment Rate

by Calculated Risk on 4/03/2010 07:43:00 PM

Returning to a theme ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows single family housing starts through February and the unemployment rate through March (inverted).

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Usually housing starts and residential construction employment lead the economy out of a recession, but not this time because of the huge overhang of existing housing units. Housing starts (blue) are moving sideways. The second graph shows construction payroll employment. Unfortunately the BLS didn't start breaking out residential specialty trade construction employment until 2001 - so this graph shows total construction.

The second graph shows construction payroll employment. Unfortunately the BLS didn't start breaking out residential specialty trade construction employment until 2001 - so this graph shows total construction.

Usually residential leads both into and out of a recession, and non-residential lags a recession. But we can't see that here.

But this graph does show that there are 2.13 million fewer construction payroll jobs than at the peak. About 1.3 million of these are residential construction. Since non-residential construction is still declining - and residential is flat - this is a key area of employment that will see little recovery this year.

Of course this is only about 14% of the total unemployed and other sectors will probably do better, but this is usually a leading sector for the economy. Since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010.

Geithner: U.S. to Delay Currency Report

by Calculated Risk on 4/03/2010 04:10:00 PM

From Reuters: US Delays Decision on China Yuan Manipulation

U.S. Treasury Secretary Timothy Geithner said on Saturday he was delaying an April 15 report on whether China manipulates its currency but pledged to press for a more flexible Chinese currency policy.This sure sounds like currency manipulation: "China's continued maintenance of a currency peg has required increasingly large volumes of currency intervention."

...

Delaying the report -- something that happened regularly in prior administrations -- will push the decision to well after [Chinese President Hu Jintao]'s visit [to the U.S.].

Treasury Secretary Timothy Geithner, April 3, 2010

Unofficial Problem Bank List at 683

by Calculated Risk on 4/03/2010 01:10:00 PM

This is an unofficial list of Problem Banks compiled only from public sources. Changes and comments from surferdude808:

With no failures this week and the OCC and FDIC not releasing any actions until the second half of the month, the Unofficial Problem Bank List did not undergo many changes this week.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

There are 683 institutions on the list with aggregate assets of $361 billion. Four institutions were added this week including First Bank, Creve Coeur, MO ($10.5 billion); and Preferred Bank, Los Angeles, CA ($1.3 billion Ticker: PFBC).

Prompt Corrective Action Orders were issued this week against two institutions on the list -- Midwest Bank and Trust Company ($3.4 billion) and TierOne Bank ($2.9 billion).

Removals include New Resource Bank ($159 million) as its enforcement action was terminated according to a company press release and the Bank of Tacoma ($39 million), which was acquired by Northwest Bank via an unassisted acquisition back in February.

We also had two institutions that were listed twice; thanks to reader MS for noting this error.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Unemployment Rates and Duration of Unemployment

by Calculated Risk on 4/03/2010 08:57:00 AM

Here is a graph of the unemployment rate seasonally adjusted and not seasonally adjusted - plus, by request, two more graphs of the duration of unemployment. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the calculated unemployment rate - both seasonally adjusted (SA) and not seasonally adjusted (NSA).

Some sites noted the NSA rate was "only" 9.5% when the SA moved above 10% last October. Other sites noted that the NSA rate had hit 10.6% in January. Both sites were correct - but there is a clear seasonal pattern for employment, so the SA unemployment rate is the one to use. Note: the SA rate will be above the NSA rate in April.

ALSO - the graph above uses the calculated unemployment rate (unrounded). For March, the calculated unemployment rate was 9.749% up from 9.687% in February. Both were rounded to 9.7% ...

And on duration of unemployment, by request: This graph shows the duration of unemployment as a percent of the civilian labor force (line graph unstacked). The graph shows the number of unemployed in four categories as provided by the BLS: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

This graph shows the duration of unemployment as a percent of the civilian labor force (line graph unstacked). The graph shows the number of unemployed in four categories as provided by the BLS: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

This really shows the change in turnover - there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII. The last graph is a repeat, but the information is stacked in reverse order.

The last graph is a repeat, but the information is stacked in reverse order.

In March 2010, there were a record 6.55 million people unemployed for 27 weeks or more, or 4.3% of the labor force.

For more on duration (and possible causes) see my post yesterday: Duration of Unemployment

Earlier employment posts yesterday:

Daily Show: 2010 Census

by Calculated Risk on 4/03/2010 12:18:00 AM

From the Daily Show: "If you don't return the Census forms, an army of Census thugs will come to your door up to 6 times ..."

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| 2010 Census | ||||

| www.thedailyshow.com | ||||

| ||||

Friday, April 02, 2010

Financial Times Interview with Larry Summers

by Calculated Risk on 4/02/2010 07:48:00 PM

Martin Wolf and Chris Giles at the Financial Times interviewed Larry Summers yesterday. Here is the transcript.

Summers was asked about China, the U.S. economy, the deficit, taxes, financial regulation and more. A brief excerpt (with permission):

Chris Giles: Do you see the economy, the growth being self sustaining now? Or are we on a process whereby the time the fiscal money runs out, are you confident that we’re then in a self sustaining growth?I think the concern for a double dip (something I think the economy will avoid) are mostly for the 2nd half of 2010 as the fiscal stimulus subsides.

Larry Summers: I think the economy appears to be moving towards escape, quite clearly moving towards escape velocity. You hear a lot less talk of W-shaped recoveries and double-dips than you did six months ago. And there are obviously uncertainties, there obviously can be new shocks, but I think one has to see the performance of the economy against the backdrop of a major economic downturn associated not with the sharp tightening of monetary policy but with the collapse in asset prices.

And if you use as a standard for judging the US economy the aftermath of financial crises of the kind summarised in the Rogoff and Reinhart book, what I think you have to be impressed by is that the timetable to major action was much shorter than is historically normal and that the process of recovery seems to be more sustained. It seems to have started earlier and more vigorously than was common in that category of problems.

On China, Summers reiterated the G20 commitment for a more balanced global economy and he argued that exchange rates play a crucial role. I expect China to allow their currency to appreciate this year (I've seen estimates in the 5% to 10% range).

Diffusion Index and Temporary Help

by Calculated Risk on 4/02/2010 05:08:00 PM

First, I asked on the BLS live chat today about adjusting for the temporary 2010 Census hiring. The Census hiring is reported not seasonally adjusted (NSA), and usually we don't want to mix NSA and SA numbers. The BLS experts explained they don't include the 48K Census hiring in the NSA numbers, and they add the Census numbers in after making the seasonal adjustment. So it is correct to report the headline payroll number was 162K, and 114k (ex-Census). This will really be important in May when the 2010 Census is expected to boost employment by as much at 500k! These are real payroll jobs, but all of these are temporary jobs and will be lost over the 2nd half of 2010.

Here are a couple more graphs based on data in the employment report ...

Diffusion Index The BLS diffusion index for total private employment increased to 60.0 from 50.0 in February. This is the highest level since 2006. For manufacturing, the diffusion index is at 54.9.

The BLS diffusion index for total private employment increased to 60.0 from 50.0 in February. This is the highest level since 2006. For manufacturing, the diffusion index is at 54.9.

Think of this as a measure of how widespread job gains are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.This fits with the headline payroll report and is a positive.

Temporary Workers

From the BLS report:

Temporary help services added 40,000 jobs in March. Since September 2009, temporary help services employment has risen by 313,000.

This graph is a little complicated (note: explanation same as last month - repeated for clarity).

This graph is a little complicated (note: explanation same as last month - repeated for clarity).The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

The blue line (right axis) is the three month average change in total employment (excluding temporary help services).

Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months. When we discussed this graph last year, temporary help suggested positive job growth in December 2009. But with revisions - the graph has been shifted a few months.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees (hours worked declined in March) and also hire temporary employees. Since the number of temporary workers increased sharply recently, some people think this might be signaling the beginning of an employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution.

Also the temporary hiring for the Census should be excluded from this graph in the future - and I will exclude the Census numbers starting next month.

I doubt we will see the 300K per month net payroll jobs (ex-Census) over the next few months that this graph seems to suggest.

Earlier employment posts today:

Personal Bankruptcy Filings Surge in March

by Calculated Risk on 4/02/2010 01:59:00 PM

From the American Bankruptcy Institute: March Consumer Bankruptcy Filings Reach Highest Monthly Total Since 2005 Bankruptcy Overhaul

The 149,268 consumer bankruptcies filed in March represented the highest monthly consumer filing total since Congress overhauled the Bankruptcy Code in 2005, according to the American Bankruptcy Institute (ABI) relying on data from the National Bankruptcy Research Center (NBKRC). The March filing total represented a 34 percent increase from the February filing total of 111,693 and a 23 percent increase from March 2009 total of 121,413. Chapter 13 filings constituted 25 percent of all consumer cases in March, representing a 2 percent decrease from February.

“The sustained economic pressures of unemployment coupled with high pre-existing debt burdens are a formula for consumer filings to surpass 1.5 million filings,” said ABI Executive Director Samuel J. Gerdano. “As consumers continue to look to bankruptcy for financial shelter, annual filings will likely equal those averaged in the years leading up to the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005.”

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter using monthly data from the ABI and previous quarterly data from USCourts.gov.

Note: The NY Times uses a different source that puts the March bankruptcy filings at 158,141.

The ABI's forecast for over 1.5 million filings is at about the same level as prior to when the banker friendly "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005" (BAPCPA) took effect - and an increase from the just over 1.4 million filings in 2004. I think the ABI forecast is low ...

Duration of Unemployment

by Calculated Risk on 4/02/2010 12:53:00 PM

In the previous post I noted that according to the BLS there are a record 6.55 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.3% of the civilian workforce.

Here are two graphs that show the level of long term unemployed by duration. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the number of unemployed in four categories as provided by the BLS: less than 5 week, 6 to 14 weeks, 15 to 26 weeks, and 27 weeks or more.

Note: The BLS reports 15+ weeks, so the 15 to 26 weeks number was calculated.

The second graph shows the same information as a percent of the civilian labor force. It appears there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII.

It appears there was more turnover in the '70s and '80s, since the 'less than 5 weeks' category was much higher as a percent of the civilian labor force than in recent years. This changed in the early '90s - perhaps as a result of more careful hiring practices or changes in demographics or maybe other reasons - but if the level of normal turnover was the same as in the '80s, the current unemployment rate would probably be the highest since WWII.

What really makes the current period stand out is the number of people (and percent) that have been unemployed for 27 weeks or more. In the early '80s, the 27 weeks or more unemployed peaked at 2.9 million or 2.6% of the civilian labor force.

In March 2010, there were 6.55 million people unemployed for 27 weeks or more, or 4.3% of the labor force. This is significantly higher than during other periods.

Atlanta Fed President Dennis Lockhart made a couple of key points on Wednesday:

There are two key types of match inefficiency. One is geographic mismatch. In 2008, the percentage of individuals living in a county or state different than the previous year was the lowest recorded in more than 50 years of data. People may be reluctant to relocate for a new job if the value of their house has declined. In addition, many who would like to move are under water in their mortgage or can't sell their homes.Both of these mismatches are contributing to the long term unemployment problem - and the housing bubble was a direct cause of both. Usually people can move freely in the U.S. to pursue employment (geographic mobility), but many people are tied to an anchor (their home). And many workers went into the construction trades and acquired skills that are not easily transferable. Both of these issues make the long term unemployment problem a difficult challenge.

The second inefficiency is skills mismatch. In simple terms, the skills people have don't match the jobs available. Coming out of this recession there may be a more or less permanent change in the composition of jobs.

Employment-Population Ratio, Part Time Workers, Unemployed over 26 Weeks

by Calculated Risk on 4/02/2010 10:12:00 AM

Here are a few more graphs based on the employment report ...

Employment-Population Ratio

The Employment-Population ratio ticked up slightly to 58.6% in March, after plunging since the start of the recession. This is about the same level as in 1983. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

The Labor Force Participation Rate increased slightly to 64.9% (the percentage of the working age population in the labor force). This is at the level of the early 80s. Many of these people will return to the labor force when the employment picture improves - and that will keep the unemployment rate elevated unless net hiring picks up dramatically.

Part Time for Economic Reasons  From the BLS report:

From the BLS report:

The number of persons working part time for economic reasons (sometimes re-The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 9.1 million.

ferred to as involuntary part-time workers) increased to 9.1 million in March.

These individuals were working part time because their hours had been cut back

or because they were unable to find a full-time job.

The all time record of 9.2 million was set in October. This suggests the increase last month was not weather related - and is not a good sign.

Unemployed over 26 Weeks

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.55 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.3% of the civilian workforce. (note: records started in 1948)

The number of long term unemployed is one of the key stories of this recession.

Although the headline number of 162,000 payroll jobs was a positive (this is 114,000 after adjusting for Census 2010 hires), the underlying details were mixed. The positives: the unemployment rate was steady, the employment-population ratio ticked up slightly (after plunging sharply), and average hours increased (might have been impacted by the snow in February).

But a near record number of part time workers (for economic reasons), a record number of unemployed for more than 26 weeks, and a decline in average hourly wages are all negatives.

I'll have even more later ...

Earlier employment post today:

Live Chat with BLS at 9:30 AM ET

by Calculated Risk on 4/02/2010 09:18:00 AM

Note: See March Employment Report: 162K Jobs Added, 9.7% Unemployment Rate for graphs. I'll post more graphs after the chat.

The BLS will host a live chat starting at 9:30 AM ET. You can follow the chat below (and ask questions).

After the discussion, the chat will be available for replay.

March Employment Report: 162K Jobs Added, 9.7% Unemployment Rate

by Calculated Risk on 4/02/2010 08:43:00 AM

From the BLS:

Nonfarm payroll employment increased by 162,000 in March, and the unemployment rate held at 9.7 percent, the U.S. Bureau of Labor Statistics reported today.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 162,000 in March. The economy has lost 2.3 million jobs over the last year, and 8.2 million jobs since the beginning of the current employment recession.

The unemployment rate was steady at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 48,000 (NSA) in March.

This was about at expectations given the level of Census 2010 hiring and some bounce back from the snow storms in February. I'll have much more soon ...

Note: I'll post a live chat with the BLS (starts at 9:30 AM ET), and more graphs around 10:30 AM ET.

Thursday, April 01, 2010

NY Times on Wage Garnishment

by Calculated Risk on 4/01/2010 11:54:00 PM

From John Collins Rudolf at the NY Times: Moves to Garnish Pay Rise as More Debtors Fall Behind (ht Ann)

One of the worst economic downturns of modern history has produced a big increase in the number of delinquent borrowers, and creditors are suing them by the millions.I'm surprised there isn't a move to rework the Orwellian-named "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". We definitely need a consumer financial protection agency. Look at this example from the Times story:

...

Bankruptcy can clear away most debts. Yet sweeping changes to federal law in 2005 — pushed by the banking lobby — complicated that process and more than doubled the average cost of filing, to more than $2,000. Many low-income debtors must save for months before they can afford to go broke.

Ruth M. Owens, a disabled Cleveland woman, was sued by Discover Bank in 2004 for an unpaid credit card. Ms. Owens offered a defense, sending a handwritten note to the court.

“After paying my monthly utilities, there is no money left except a little food money and sometimes it isn’t enough,” she wrote.

Robert Triozzi, a judge at the time, heard the case. He found that over a period of several years, Ms. Owens had paid nearly $3,500 on an original balance of $1,900. But Discover was suing her for $5,564, mostly for late fees, compound interest, penalties and other charges. He called Discover’s actions “unconscionable” and threw the case out.

NY Times: Hu Coming to D.C. suggests possible currency deal

by Calculated Risk on 4/01/2010 10:18:00 PM

From Vikas Bajaj at the NY Times: Coming Visit May Signal Easing by China on Currency

[T]he announcement by Chinese authorities on Thursday that President Hu Jintao will be visiting Washington in two weeks is being seen as the beginning of a possible easing of the friction over the renminbi.There is much more in the article, but I think it is unlikely that China will be named a currency manipulator on April 15th - and likely that China will allow their currency to appreciate.

China experts said it was unlikely that China would have agreed to the visit unless there was at least an informal assurance by the Treasury Department that it would not be named a currency manipulator either on or around April 15 — the deadline for the Obama administration to submit one of its twice-a-year reports on foreign exchange to Congress.

At the same time, economists say the visit, and other Chinese moves, suggest China is finally willing to let the renminbi increase in value.

Countdown: Fed MBS Purchase Program Complete

by Calculated Risk on 4/01/2010 06:14:00 PM

Just to complete the countdown, the NY Fed purchased an additional net $6.074 billion in MBS for the week ending March 31st. That puts the total purchases at $1.25 trillion ... and completes the program right on schedule.

The Fed's balance sheet today shows $1.074 trillion in MBS. As mentioned before, the difference is the NY Fed announces the purchases when they contract to buy; the Federal Reserve places the MBS on the balance sheet when the contract settles. The Fed's balance sheet will probably expand by $150+ billion over the next two months as the remaining contracts settle.

The spread between mortgage rates and treasuries widened slightly, from Bloomberg: Mortgage-Bond Yields That Guide Loan Rates Rise to 3-Month High.

Fannie Mae’s current-coupon 30-year fixed-rate mortgage bonds climbed 0.05 percentage point to 4.56 percent as of 5 p.m. in New York, the highest since Dec. 28, according to data compiled by Bloomberg.Oh boy, a 10 bps widening from the low! I expect the spread to widen slowly and push up mortgage rates a little (at least the spread between the Ten Year and the 30 Year fixed rate).

...

The difference between yields on Washington-based Fannie Mae’s securities and 10-year Treasuries widened for a third day, rising about 0.01 percentage point to 0.69 percentage point, Bloomberg data show.

That spread reached 0.59 percentage point on March 10, the lowest since at least 1984, as the Fed’s purchases of agency mortgage bonds approached their scheduled conclusion. The gap averaged 1.32 percentage points from 2000 through 2009.

On mortgage rates, Freddie Mac reported today:

Freddie Mac (NYSE:FRE) today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 5.08 percent with an average 0.7 point for the week ending April 1, 2010, up from last week when it averaged 4.99 percent. Last year at this time, the 30-year FRM averaged 4.78 percent.

U.S. Light Vehicle Sales 11.8 Million SAAR in March

by Calculated Risk on 4/01/2010 04:00:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).

This is a 13.9% increase from the February sales rate. The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Excluding August '09 (Cash-for-clunkers), this is the highest level since September 2008. The current level of sales are very low, and are at about the low point for the '90/'91 recession (even with a larger population now).

Most forecasts were for sales over 12 million (SAAR), so the sales rate is a little disappointing given all the incentive programs in March.