by Calculated Risk on 2/25/2010 11:49:00 AM

Thursday, February 25, 2010

Hotel Occupancy Up Slightly Compared to Same Week 2009

From HotelNewsNow.com: Seattle tops US hotel weekly results

Overall, the industry’s occupancy ended the week with a 2.4-percent increase to 55.4 percent, ADR dropped 4.4 percent to US$95.81, and RevPAR fell 2.2 percent to US$53.04.The following graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays.

The second graph shows the year-over-year (YoY) change in occupancy (using a three week average).

The second graph shows the year-over-year (YoY) change in occupancy (using a three week average).This is a multi-year slump, and the YoY change suggests that occupancy rate may have bottomed, but at a very low level.

As Smith Travel noted, room rates are still falling (off 4.4%) because of the low occupancy rate. Business travel will be very important for the next few months, and right now it appears the weekday occupancy rate (mostly business travel) is at about the same levels as last year during the worst of the recession.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Fed's Pianalto: "May take years to get back to 2007 level of output"

by Calculated Risk on 2/25/2010 09:15:00 AM

From Cleveland Fed President Sandra Pianalto: When the Small Stuff Is Anything But Small. A few excerpts:

You know we have been through one of the most severe and longest recessions in our nation’s history. The recovery from the recession may also end up being one of the longest in our history. In fact, it may take years just to get back to the level of output we enjoyed in 2007, just before the economic crisis began.Some of these

Some of you may think I am being too pessimistic. After all, we saw a strong GDP growth estimate for the fourth quarter of last year--nearly 6 percent at an annual rate. But I think that figure overstates the underlying strength of our economy right now.

This is a case where paying attention to the small stuff--the details beneath that impressive number--reveals a more complicated story of what is shaping up to be a gradual recovery. Most of the thrust behind that impressive fourth-quarter GDP growth figure owes to a rebuilding of inventory stocks, which had been cut to the bone and could no longer support even a mild economic recovery. Over the course of this year, I expect overall growth in employment and output to be on the weak side for the early stages of an economic recovery.

For many American households and businesses, this is a recovery that just does not feel much like a recovery. Let me point to two reasons why this is so. The first is due to the large amount of excess capacity that has accumulated. As spending declined in the recession, firms of all sizes cut back, drastically in many cases.

...

Excess capacity is a dilemma for businesses of all sizes. They can maintain capacity for only so long without an uptick in sales, and they’re confronting a market where demand is only gradually recovering after having fallen off a cliff. In fact, according to the most recent survey of the National Federation of Independent Business, or NFIB (January 2010), members cited poor sales as their single most important problem. The latest American Express Open Pulse Survey also expresses a similar perspective. A very slow recovery in demand, which translates into low sales for most firms, makes it far tougher to maintain idle capacity over time. ...

One of the forces holding back demand is the continuing high level of unemployment. Indeed, poor labor market conditions pose another large challenge to the recovery. ...

The duration of unemployment is also a big concern. According to the Bureau of Labor Statistics, the share of workers who have been without jobs for 27 weeks or longer now stands at 41 percent--the highest number since this series began in 1948.

Clearly, massive layoffs contributed to these large unemployment numbers, and fortunately, layoffs slowed months ago. Our current problem is a lack of job openings. In fact, the job-finding rate now stands at a historic low. Businesses are not creating new jobs very quickly, and where labor utilization is picking up, employers are simply restoring hours that had been previously cut.

...

So, to sum up, while we are likely now in a period of recovery, it doesn't really feel much like one. All types of businesses are continuing to see weak levels of demand – in other words, they don't expect to see a bounce-back in sales for quite a while yet. This in turn creates excess capacity, which leaves businesses having to decide whether to maintain or shut idle plants and offices. In such an environment, firms are being cautious about new hiring and so unemployment persists at a high level, which in turn restrains spending. From any perspective this is not a pretty picture, but it is especially challenging for small business ...

Weekly Initial Unemployment Claims Increase to 496,000

by Calculated Risk on 2/25/2010 08:42:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 20, the advance figure for seasonally adjusted initial claims was 496,000, an increase of 22,000 from the previous week's revised figure of 474,000. The 4-week moving average was 473,750, an increase of 6,000 from the previous week's revised average of 467,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Feb. 13 was 4,617,000, an increase of 6,000 from the preceding week's revised level of 4,611,000.

Click on graph for larger image in new window.

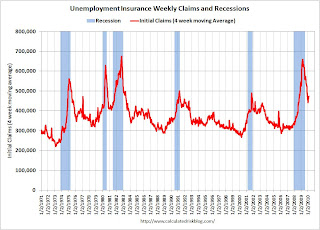

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 6,000 to 473,750.

The current level of 496,000 (and 4-week average of 473,750) are very high and suggest continuing job losses in February. This is the highest level since last November.

Wednesday, February 24, 2010

ATA Truck Tonnage Index increases in January

by Calculated Risk on 2/24/2010 11:59:00 PM

From the American Trucking Association: ATA Truck Tonnage Index Jumped 3.1 Percent in January Click on graph for slightly larger image in new window.

Click on graph for slightly larger image in new window.

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index jumped 3.1 percent in January, following a revised 1.3 percent increase in December 2009. The latest gain boosted the SA index from 107 (2000=100) in December to 110.4 in January, its highest level since September 2008.Trucking is a coincident indicator - and some of this increase is related to the inventory cycle - but this suggests growth in January.

...

For all of 2009, the tonnage index was down 8.7 percent (slightly larger than the previously reported 8.3 percent drop), which was the largest annual decrease since a 12.3 percent plunge in 1982.

...

ATA Chief Economist Bob Costello said that the latest tonnage reading, coupled with anecdotal reports from carriers, indicates that both the industry and the economy are clearly in a recovery mode. “While I don’t expect tonnage to continue growing as robustly as it did in January, the industry is finally moving in the right direction. Although there are still risks that could throw the rebound off track, the likelihood of that happening continues to diminish.”

...

Trucking serves as a barometer of the U.S. economy, representing nearly 69 percent of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Weather and the February Employment Report

by Calculated Risk on 2/24/2010 07:49:00 PM

Note: I've added a list of "Posts Today" and "Posts Yesterday" on the right sidebar so everyone can find posts on recent economic releases (this has been a busy day and week)!

On Monday I linked to an article by Floyd Norris at the NY Times: Horrid Job Number Coming. Norris wrote:

"a lot of people who had jobs may report they did not work during the week, and companies may say they had fewer people on the payroll than they would have cited a week earlier or later. If so, we may get a truly horrid job number."Since then I've spoken to a BLS representative, and although they will not comment on upcoming releases, he told me the BLS would prominently disclose any possible impact of the recent snow storms on the employment report - similar to the disclosure after Hurricane Katrina. It is possible that the response rates will be lower than usual in certain areas (like Washington D.C.) - this will be disclosed and adjustments will be made.

Other contacts - with knowledge of how the BLS conducts the surveys - have told me the snow storms will have little or no impact on the employment report (other on data collection as will be disclosed by the BLS).

Heck, maybe the snow storm boosted employment because of all the people hired temporarily to shovel snow!

97,000 Homeowners in "Loan Mod Limbo"

by Calculated Risk on 2/24/2010 05:03:00 PM

Paul Kiel at ProPublica reports: Chase and Other Servicers Leave Many in Loan Mod Limbo; Treasury Threatens Penalties

About 97,000 homeowners in the government’s mortgage modification program have been stuck in a trial period for over six months. Most of them, about 60,000, have their mortgages with a single mortgage servicer, JPMorgan Chase.Paul Kiel has much more.

Trial periods are designed to last only three months, after which mortgage servicers are supposed to either give homeowners a permanent modification or drop them from the program. According to a ProPublica analysis, about 475,000 homeowners have been in a trial modification for longer than three months.

A couple of key points on HAMP I've mentioned before:

The January guidance from Treasury addressed both of the above points.

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests that there will be fewer trial modifications per month in the future (this is already happening, see graph below) and a surge of trial cancellations in February.

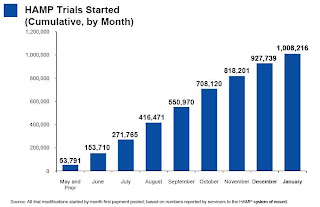

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.

This is graph is from the January Treasury report. This shows the cumulative HAMP trial programs started.Notice that the pace of new trial modifications has slowed sharply from over 150,000 in September to just over 80,000 in January 2010. This is slowest pace since May 2009 and is probably because of two factors: 1) servicers are now pre-qualifying borrowers, and 2) servicers are running out of eligible borrowers.

Housing: The Best Leading Indicator for the Economy

by Calculated Risk on 2/24/2010 02:24:00 PM

Historically the best leading indicator for the economy (and employment) has been housing. I've been writing about this for years. For a great summary paper, see Professor Leamer's presentation from the 2007 Jackson Hole Symposium: Housing and the Business Cycle

For housing as a leading indicator, I use Residential Investment (quarterly from the BEA's GDP report), and monthly data on Housing Starts and New Home sales from the Census Bureau, and builder confidence from the NAHB.

Two key points:

So here is a review of the three monthly leading indicators:

Housing Starts

Click on graph for larger image in new window.

Click on graph for larger image in new window.Total housing starts were at 591 thousand (SAAR) in January, up 2.8% from the revised December rate, and up 24% from the all time record low in April 2009 of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Total starts had rebounded to 590 thousand in June, and have moved mostly sideways for eight months.

Single-family starts were at 484 thousand (SAAR) in January, up 1.5% from the revised December rate, and 36% above the record low in January and February 2009 (357 thousand). Just like for total starts, single-family starts have been at about this level for eight months.

Housing starts are moving sideways ...

Builder Confidence

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 17 in February. This is an increase from 15 in January.

The record low was 8 set in January 2009. This is still very low - and this is what I've expected - a long period of builder depression. The HMI has been in the 15 to 19 range since May 2009.

More moving sideways ...

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

New Home Sales

The Census Bureau reports This graph shows New Home Sales vs. recessions for the last 45 years.

The Census Bureau reports This graph shows New Home Sales vs. recessions for the last 45 years.New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 309 thousand. This is a record low and a sharp decrease from the 348 thousand rate in December.

And it would be generous to even call this "moving sideways".

So these leading indicators suggest any growth will be sluggish and choppy.

Now some people might argue that housing starts and new home sales are about to increase sharply. Based on what? That seems unlikely with the large number of excess housing units (new and existing homes and rental units). See: Housing Stock and Flow

As I noted above, it might be different this time with exports and technology leading the way, but I'll stick with housing as a business cycle indicator.

Freddie Mac: "Potential Large Wave of Foreclosures"

by Calculated Risk on 2/24/2010 11:55:00 AM

"We start 2010 with some early signs of stabilization in the housing market, with house prices and home sales likely nearing the bottom sometime in 2010. We expect that low mortgage rates, relatively high affordability and the homebuyer tax credit will help continue to fuel the recovery. Still, the housing recovery remains fragile, with significant downside risk posed by high unemployment and a potential large wave of foreclosures."The quote is from the Freddie Mac Q4 earnings release:

Freddie Mac Chief Executive Officer Charles E. Haldeman, Jr.

Freddie Mac Releases Fourth Quarter and Full-Year 2009 Financial Results Fourth quarter 2009 net loss was $6.5 billion. After the dividend payment of $1.3 billion to the U.S. Department of the Treasury (Treasury) on the senior preferred stock, net loss attributable to common stockholders was $7.8 billion ... for the fourth quarter of 2009.Another $7.8 billion in losses ...

...

Full-year 2009 net loss was $21.6 billion. After dividend payments of $4.1 billion during the year to Treasury on the senior preferred stock, net loss attributable to common stockholders was $25.7 billion ... for the full-year 2009.

New Home Sales fall to Record Low in January

by Calculated Risk on 2/24/2010 10:15:00 AM

Note: See previous post for video and discussion of Bernanke's testimony.

The Census Bureau reports New Home Sales in January were at a seasonally adjusted annual rate (SAAR) of 309 thousand. This is a record low and a sharp decrease from the revised rate of 348 thousand in December. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for 2010. In January 2010, 21 thousand new homes were sold (NSA).

This is below the previous record low of 24 thousand in January 2009. The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

The second graph shows New Home Sales vs. recessions for the last 45 years. New Home sales fell off a cliff, but after increasing slightly, are now 6% below the previous record low in January 2009.

Sales of new single-family houses in January 2010 were at a seasonally adjusted annual rate of 309,000 ... This is 11.2 percent (±14.0%)* below the revised December rate of 348,000 and is 6.1 percent (±15.1%)* below the January 2009 estimate of 329,000.And another long term graph - this one for New Home Months of Supply.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.

There were 9.1 months of supply in January. Rising, but still significantly below the all time record of 12.4 months of supply set in January 2009.The seasonally adjusted estimate of new houses for sale at the end of January was 234,000. This represents a supply of 9.1 months at the current sales rate.

The final graph shows new home inventory.

The final graph shows new home inventory. Note that new home inventory does not include many condos (especially high rise condos), and areas with significant condo construction will have much higher inventory levels.

Months-of-supply and inventory have both peaked for this cycle, but sales have set a new record low. New home sales are far more important for the economy than existing home sales, and new home sales will remain under pressure until the overhang of excess housing inventory declines much further.

Obviously this is another extremely weak report.

Bernanke Humphrey-Hawkins Testimony at 10 AM ET

by Calculated Risk on 2/24/2010 09:50:00 AM

Federal Reserve Chairman Ben Bernanke is scheduled to provide the Semiannual Monetary Policy Report to the Congress before the House Committee on Financial Services at 10 AM ET.

I'll add a link to the prepared testimony, and I'll be posting the New Home sales numbers shortly after 10 AM. Commenters: Hopefully we can discuss Bernanke's testimony (especially the Q&A) on this thread, and New Home sales on the following thread).

Here is the CNBC feed.

Here is the C-Span Link

Prepared Testimony: Semiannual Monetary Policy Report to the Congress

MBA: Mortgage Purchase Applications at Lowest Level Since May 1997

by Calculated Risk on 2/24/2010 08:12:00 AM

The MBA reports: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Market Composite Index ... decreased 8.5 percent on a seasonally adjusted basis from one week earlier. ...

“As many East Coast markets were digging out from the blizzard last week, purchase applications fell, another indication that housing demand remains relatively weak,” said Michael Fratantoni, MBA's Vice President of Research and Economics. “With home prices continuing to drift amid an abundant inventory of homes on the market, potential homebuyers do not see any urgency to lock in purchases.”

The Refinance Index decreased 8.9 percent from the previous week. The seasonally adjusted Purchase Index decreased 7.3 percent from one week earlier, putting the index at its lowest level since May 1997. ...

The refinance share of mortgage activity decreased to 68.1 percent of total applications from 69.3 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages increased to 5.03 percent from 4.94 percent, with points increasing to 1.34 from 1.09 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

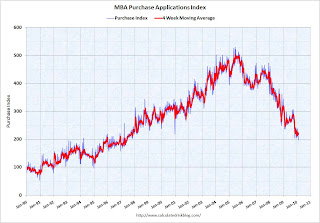

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

Once again, the decline in purchase applications since October appears significant.

Also, with mortgage rates back above 5% again, refinance activity declined too.

AIA: Architecture Billings Index Shows Contraction in January

by Calculated Risk on 2/24/2010 01:13:00 AM

Note: This index is a leading indicator for Commercial Real Estate (CRE) investment.

Reuters reports that the American Institute of Architects’ Architecture Billings Index decreased to 42.5 in January from 43.4 in December. Any reading below 50 indicates contraction.

The index has remained below 50, indicating contraction in demand for design services, since January 2008. Its lowest recent reading was in January 2009, when it reached a revised 33.9 level.The ABI press release is not online yet.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through this year, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Tuesday, February 23, 2010

Housing: Price-to-Rent Ratio

by Calculated Risk on 2/23/2010 08:27:00 PM

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph through December 2009 using the two Case-Shiller Home Price Composite Indices: Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the price to rent ratio (January 2000 = 1.0).

This suggests that house prices are still a little too high on a national basis. But it does appear that prices are much closer to the bottom than the top.

Also, OER declined again in January, and with rents still falling, the OER index will probably continue to decline - pushing up the price-to-rent ratio.

Q4 Report: 11.3 Million U.S. Properties with Negative Equity

by Calculated Risk on 2/23/2010 05:27:00 PM

First American CoreLogic released the Q4 negative equity report today.

First American CoreLogic reported today that more than 11.3 million, or 24 percent, of all residential properties with mortgages, were in negative equity at the end of the fourth quarter of 2009, up from 10.7 million and 23 percent at the end of the third quarter of 2009. An additional 2.3 million mortgages were approaching negative equity at the end of last year, meaning they had less than five percent equity. Together, negative equity and near‐negative equity mortgages accounted for nearly 29 percent of all residential properties with a mortgage nationwide.From the report:

Negative equity continues to be concentrated in five states: Nevada, which had the highest percentage negative equity with 70 percent of all of its mortgaged properties underwater, followed by Arizona (51 percent), Florida (48 percent), Michigan (39 percent) and California (35 percent). Among the top five states, the average negative equity share was 42 percent, compared to 15 percent for the remaining 45 states. In numerical terms, California (2.4 million) and Florida (2.2 million) had the largest number of negative equity mortgages accounting for 4.6million, or 41 percent, of all negative equity loans.

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the negative equity and near negative equity by state.

Although the five states mentioned above have the largest percentgage of homeowners underwater, 10 percent or more of homeowners have negative equity in 33 states, and over 20% have negative equity or near negative equity in 23 states. This is a widespread problem.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.

Note: Louisiana, Maine, Mississippi, South Dakota, Vermont, West Virginia and Wyoming are NA in the graph above.The second graph shows homeowners with severe negative equity for five states.

These homeowners are far more likely to default.

The rise in negative equity is closely tied to increases in pre‐foreclosure activity and is a major factor in changing homeowners’ default behavior. Once negative equity exceeds 25 percent, or the mortgage balance is $70,000 higher than the current property values, owners begin to default with the same propensity as investors.

Here is figure 4 from the report.

Here is figure 4 from the report. The default rate increases sharply for homeowners with more than 20% negative equity.

This graph fits with figure 2 above and suggests a large number of future defaults in Nevada, Arizona, Florida and California.

Most homeowners with negative equity will probably not default, but this does suggest there are many more foreclosures coming - and more losses.The aggregate dollar value of negative equity was $801 billion, up $55 billion from $746 billion in Q3 2009. The average negative equity for an underwater borrower in Q4 was ‐$70,700, up from ‐$69,700 in Q3 2009. The segment of borrowers that are 25 percent or more in negative equity account for over $660 billion in aggregate negative equity.

Case Shiller House Price Graphs for December

by Calculated Risk on 2/23/2010 02:42:00 PM

Finally. The S&P website has been down all morning.

S&P/Case-Shiller released the monthly Home Price Indices for December (actually a 3 month average).

The monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). This is the Seasonally Adjusted monthly data - some sites report the NSA data.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.3% from the peak, and up about 0.3% in December.

The Composite 20 index is off 29.4% from the peak, and up 0.3% in December.

The impact of the massive government effort to support house prices is obvious on the Composite graph. The question is what happens to prices as these programs end over the next few months?  The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 2.4% from December 2008.

The Composite 20 is off 3.1% from December 2008.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices. Prices decreased (SA) in 6 of the 20 Case-Shiller cities in December.

Prices decreased (SA) in 6 of the 20 Case-Shiller cities in December.

In Las Vegas, house prices have declined 55.9% from the peak. At the other end of the spectrum, prices in Dallas are only off about 3.1% from the peak. Several cities are showing price increases in 2009 - San Diego, San Francisco, Boston, Washington D.C., Denver and Dallas.

Shadow Rental Market Pushing down Rents

by Calculated Risk on 2/23/2010 12:57:00 PM

Here is an audio interview from Jon Lansner: Scott Monroe of South Coast Apartment Association visits Jon Lansner of the OC Register

"Rents are down and vacancies are up. Demand is off, and we attribute really to to the fact that here has been a pretty significant erosion of jobs in the Orange County markets. And it is having a trickle down effect. In addition to that, our members are saying that they are competing quite a bit with what historically has not been a competitor for us - that's the gray market or the shadow market - which are condominium rentals and single family home rentals and things of that nature. There is just a lot of product on the market."Monroe says they are seeing much more multi-generational housing, and he expects "doubling up" to last for another 12 months or so.

Scott Monroe, Pres. of South Coast Apartment Association

And this brings up a key point - the supply of rental units has been surging:

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the number of occupied (blue) and vacant (red) rental units in the U.S. (Source: Census Bureau).

The total number of rental units (red and blue) bottomed in Q2 2004, and started climbing again. Since Q2 2004, there have been over 4.7 million units added to the rental inventory.

Note: please see caution on using this data - this number might be a little too high, but the concepts are the same even with a lower increase.

This increase in units has more than offset the recent strong migration from ownership to renting, so the rental vacancy rate is now at 10.7% and the apartment vacancy rate is at a record high.

Where did these approximately 4.7 million rental units come from?

The Census Bureau's Housing Units Completed, by Intent and Design shows 1.1 million units completed as 'built for rent' since Q2 2004. This means that another 3.6 million or so rental units came mostly from conversions from ownership to rentals.

These could be investors buying REOs for cash flow, condo "reconversions", builders changing the intent of new construction (started as condos but became rentals), flippers becoming landlords, or homeowners renting their previous homes instead of selling.

As Scott Monroe noted, this huge surge in rental supply - what he calls the "gray or shadow market" - has pushed down rents, and pushed the rental vacancy rate to record levels. Yes, people are doubling up with friends and family during the recession, and some renters are now buying again, but the main reason for the record vacancy rate is the surge in supply. Eventually many of these "gray market" rentals will be sold as homes again - keeping the existing home supply elevated for years.

FDIC Q4 Banking Profile: 702 Problem Banks

by Calculated Risk on 2/23/2010 10:48:00 AM

The FDIC released the Q4 Quarterly Banking Profile today. The FDIC listed 702 banks with $403 billion in assets as “problem” banks in Q4, up from 552 banks with $346 billion in assets in Q3, and 252 and $159.4 billion in assets in Q4 2008.

Note: Not all problem banks will fail - and not all failures will be from the problem bank list - but this shows the problem is significant and still growing.

The Unofficial Problem Bank List shows 617 problem banks - and will continue to increase as more formal actions (or hints of pending actions) are released. Click on graph for larger image in new window.

Click on graph for larger image in new window.

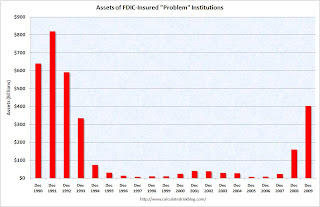

This graph shows the number of FDIC insured "problem" banks since 1990.

The 702 problem banks reported at the end of Q4 is the highest since 1992.

The second graph shows the assets of "problem" banks since 1990. The assets of problem banks are the highest since 1992.

The assets of problem banks are the highest since 1992.

On the Deposit Insurance Fund:

The Deposit Insurance Fund (DIF) decreased by $12.6 billion during the fourth quarter to a negative $20.9 billion (unaudited) primarily because of $17.8 billion in additional provisions for bank failures. ... For the year, the fund balance shrank by $38.1 billion, compared to a $35.1 billion decrease in 2008.

The DIF’s reserve ratio was negative 0.39 percent on December 31, 2009, down from negative 0.16 percent on September 30, 2009, and 0.36 percent a year ago. The December 31, 2009, reserve ratio is the lowest reserve ratio for a combined bank and thrift insurance fund on record.Note: This doesn't mean the FDIC DIF is out of money or bankrupt. The FDIC reserves against future losses, and they don't include the prepay of assessments in the DIF (although they have the cash). The FDIC has plenty of cash right now - although there will probably be hundreds of bank failures over the next couple of years, and the FDIC might have to borrow from the Treasury in the future.

Forty-five insured institutions with combined assets of $65.0 billion failed during the fourth quarter of 2009, at an estimated cost of $10.2 billion. For all of 2009, 140 FDIC-insured institutions with assets of $169.7 billion failed, at an estimated cost of $37.4 billion. This was the largest number of failures since 1990 when 168 institutions with combined assets of $16.9 billion failed (excluding thrifts resolved by the RTC).

Case-Shiller House Prices increase in December

by Calculated Risk on 2/23/2010 09:37:00 AM

Note: as usual, the S&P website crashes when they release the monthly house price data. I'll post some graphs when the data is available.

The WSJ reports:

[The composite 10 and 20] indexes dropped 0.2% from the previous month, although adjusted for seasonal factors, they increased 0.3%.More from Reuters: Home Prices Fall 2.5% as Market Recovery Still Weak (note: Reuters is reporting the NSA data).

...

Month-to-month gainers were led by Los Angeles, which rose 1%. Chicago again fared worst, falling 1.6%.

Report: State Tax Revenues decline in Q4

by Calculated Risk on 2/23/2010 08:10:00 AM

From the Rockefeller Institute: States Reported Fifth Consecutive Drop in Tax Collections in the Fourth Quarter of 2009 (ht Ann)

State tax revenues declined by 4.1 percent nationwide during the final quarter of calendar 2009, the fifth consecutive quarter of reduced collections, according to a report issued today by the Rockefeller Institute of Government.Here is the report: Final Quarter of 2009 Brought Still

The five straight quarters of year-over-year decline in overall tax collections represent a record length of such decreases, the Institute said.

...

“Calendar 2009 will be remembered as bringing historically sharp declines in tax revenue to states,” the report says. “Revenue gains toward the end of calendar 2009 were often driven by legislated tax increases rather than growth in the economy and tax base.”

Despite revenue gains in some states during the fourth quarter, the report concludes, “another negative quarter for the nation as a whole would not be unexpected. The troubling fiscal picture for states remains clearly in place.”

More Declines in State Tax Revenue

Tax revenues are still weak, and most states are still running large deficits. As a recent CNNMoney article notes:

States are looking at a total budget gap of $180 billion for fiscal 2011, which for most of them begins July 1. These cuts could lead to a loss of 900,000 jobs, according to Mark Zandi, chief economist of Moody's Economy.com.This suggests that more state and local government job cuts are coming.

Monday, February 22, 2010

Judge Accepts "Half-baked justice" in BofA-SEC Settlement

by Calculated Risk on 2/22/2010 11:36:00 PM

Louise Story at the NY Times writes: Judge Accepts S.E.C.’s Deal With Bank of America

[A] federal judge wrote on Monday that he had reluctantly approved a $150 million settlement with the Securities and Exchange Commission.And from the Judge:

"In short, the proposed settlement, while considerably improved over the vacuous proposal made last August in connection with the Undisclosed Bonuses case, is far from ideal. Its greatest virtue is that it is premised on a much better developed statement of the underlying facts and inferences drawn therefrom, which, while disputed by the Attorney General in another forum, have been carefully scrutinized by the Court here and found not to be irrational. Its greatest defect it that it advocates very modest punitive, compensatory, and remedial measures that are neither directed at the specific individuals responsible for the nondisclosures nor appear likely to have more than a very modest impact on corporate practices or victim compensation. While better than nothing, this is half-baked justice at best."I always enjoy some judicial snark.

Judge Jed S. Rakoff, Feb 22, 2010