by Calculated Risk on 2/11/2010 08:35:00 AM

Thursday, February 11, 2010

Weekly Initial Unemployment Claims Decrease to 440,000

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 6, the advance figure for seasonally adjusted initial claims was 440,000, a decrease of 43,000 from the previous week's revised figure of 483,000 [revised from 480,000]. The 4-week moving average was 468,500, a decrease of 1,000 from the previous week's revised average of 469,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 30 was 4,538,000, a decrease of 79,000 from the preceding week's revised level of 4,617,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 1,000 to 468,500.

According to MarketWatch some of recent increase was due to administrative backlogs in several states:

With today's report, the official said the backlogs had been "washed out".The current level of 440,000 (and 4-week average of 468,500) are still high and suggest continuing job losses.

RealtyTrac: Foreclosures Decline in January, Surge Expected over Next Few Months

by Calculated Risk on 2/11/2010 12:01:00 AM

Press Release: U.S. Foreclosure Activity Decreases 10 Percent in January

RealtyTrac® ... today released its January 2010 U.S. Foreclosure Market Report™, which shows foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 315,716 U.S. properties during the month, a decrease of nearly 10 percent from the previous month but still 15 percent above the level reported in January 2009. The report also shows one in every 409 U.S. housing units received a foreclosure filing in January.There probably was an increase in foreclosure activity in February, since many of the trial modifications have now ended. However I also think a key theme in 2010 will be short sales, and that might mean fewer foreclosures in 2010 than in 2009 - but still more distressed sales (just a different mix).

REO activity nationwide was down 5 percent from the previous month but still up 31 percent from January 2009; default notices were down 12 percent from the previous month but still up 4 percent from January 2009; and scheduled foreclosure auctions were down 11 percent from the previous month but still up 15 percent from January 2009.

“January foreclosure numbers are exhibiting a pattern very similar to a year ago: a double-digit percentage jump in December foreclosure activity followed by a 10 percent drop in January,” said James J. Saccacio, chief executive officer of RealtyTrac “If history repeats itself we will see a surge in the numbers over the next few months as lenders foreclose on delinquent loans where neither the existing loan modification programs or the new short sale and deed-in-lieu of foreclosure alternatives works.”

emphasis added

Wednesday, February 10, 2010

D.C. Closed Again on Thursday, California Tax Receipts Increase

by Calculated Risk on 2/10/2010 08:46:00 PM

The Federal Government office in D.C. will be closed again Thursday, from the WaPo: Federal government shutdown extends to Thursday

Federal agencies across the nation's capital will close Thursday for a fourth straight day -- taking the week-long shutdown of the government into uncharted territory.The Retail Sales (January) and Manufacturing and Trade Inventories and Sales (December) reports are still expected to be released Friday morning.

And a little good budget news from California:

State Controller John Chiang today released his monthly report covering California’s cash balance, receipts and disbursements in January. The month’s receipts rose above the Governor’s 2010-11 budget estimates by $1.28 billion, or 18.6%.At least the situation is not getting worse.

“The positive receipts are welcome news, but the State cannot be lulled into a false sense of security,” said Chiang. “Our cash position falls below safe levels this Spring, and goes into the red this Summer. Our chronic budget shortfalls require credible and sustainable fixes in order to protect taxpayers, local governments, and state funded programs.”

...

Year-to-date receipts are ahead of budget estimates by $459 million, or 1%, but state payments also went out faster than expected. Disbursements through January 31 were $586 million ahead of projections.

Greece is the Word

by Calculated Risk on 2/10/2010 04:55:00 PM

From the Financial Times: Berlin and Paris urge backing for Greece

President Nicolas Sarkozy and Chancellor Angela Merkel are expected to give a show of political support to Athens at a summit of EU leaders in Brussels [on Thursday] ... The details of a bail-out plan were “still the subject of discussion and we are not even in a position to deliver it [on Thursday]”, an official said.And from Stephen Castle and Nicholas Kulish at the NY Times: Europe Closing In on Plan to Avert Greek Debt Crisis

excerpted with permission

It is “no longer considered an option not to act,” one official in Paris said.So there will probably be some sort of statement of support for Greece tomorrow, but no firm details. Any direct bailout of Greece would be very unpopular, and it appears that some sort of loan guarantees - contingent on budget discipline in Greece - is the most likely outcome.

But officials also worried that any solution for the situation in Greece risked encouraging the markets to attack other euro zone countries that are regarded as weak links in the chain, starting with Portugal.

New Index based on Diesel Fuel Consumption data Declines in January

by Calculated Risk on 2/10/2010 01:48:00 PM

The UCLA Anderson Forecast, Ceridian Corporation and Charles River Associates have introduced a new index using real-time diesel fuel consumption data: Pulse of Commerce IndexTM

Press Release: New Ceridian-UCLA Pulse of Commerce Index(TM) Reveals Need for Economic Reality Check as January Number Declines

Results from a major new econometric report – the Ceridian-UCLA Pulse of Commerce Index™ by UCLA Anderson School of Management – show the U.S. economy fell in January after a significant increase in December, with the index falling at an annualized rate of 36.8 percent. The more reliable three-month moving average for January managed to show a 3.3 percent gain at an annualized rate following the exceptional annualized rate of 14.6 percent in the previous month.

The index is based on an analysis of real-time diesel fuel consumption data from over the road trucking tracked by Ceridian Corporation. ... It mirrors closely the Federal Reserve's Industrial Production Index but is issued days before that index is released.

"Though the January 2010 number is disappointing, the index is 3.6 percent above its January 2009 level and is similar to year-over-year pre-recession values," said Edward Leamer, director of the UCLA Anderson Forecast and chief economist for the Ceridian-UCLA Pulse of Commerce Index. "Also, the three-month moving average is 2.3 percent above the previous year's value, which is the first time that there has been a year-over-year increase since April 2008, 21 very difficult months ago."

The latest PCI numbers suggest caution about celebrating the recently announced 5.7 percent GDP growth number. Although the 7.3 percent growth rate in the fourth quarter of 2009 for the PCI was strong, at that rate the index won't exceed the 2007 second quarter peak until the third quarter of 2011. "Things are going to have to look a lot better in February and March to turn this worry into optimism about the power of the recovery," Leamer said. "Stay tuned. We expect this showing in January indicated by the PCI will also be seen in the Industrial Production number when it is released later this month."

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the index since January 1999 (monthly and 3 month average). There is significant variability month to month.

Note: As Professor Leamer noted, this index appears to lead Industrial Production (IP), but there is a significant amount of monthly noise. So the one month decline in this index does not mean IP will decline in January (to be released next week), but the three month average suggests IP growth might have slowed.

This will be an interesting index to follow along with the Trucking and Railroad data.

Freddie Mac to Buy Out Seriously Delinquent Loans

by Calculated Risk on 2/10/2010 12:26:00 PM

Press Release: Freddie Mac To Purchase Substantial Number of Seriously Delinquent Loans From PC Securities

Freddie Mac (NYSE: FRE) announced today that it will purchase substantially all 120 days or more delinquent mortgage loans from the company's related fixed-rate and adjustable-rate (ARM) mortgage Participation Certificate (PC) securities.This makes sense (since the costs are lower to buy the nonperforming loans back), and this has been in the works since Treasury increased the GSE portfolio limits in December. Back in December, Credit Suisse analysts argued this would happen (from Bloomberg):

The company's purchases of these loans from related PCs should be reflected in the PC factor report published after the close of business on March 4, 2010, and the corresponding principal payments would be passed through to fixed-rate and ARM PC holders on March 15 and April 15, respectively. The decision to effect these purchases stems from the fact that the cost of guarantee payments to security holders, including advances of interest at the security coupon rate, exceeds the cost of holding the nonperforming loans in the company's mortgage-related investments portfolio as a result of the required adoption of new accounting standards and changing economics. In addition, the delinquent loan purchases will help Freddie Mac preserve capital and reduce the amount of any additional draws from the U.S. Department of the Treasury. The purchases would not affect Freddie Mac's activities under the Making Home Affordable Program.

“This announcement increases the prospect of large-scale voluntary buyouts by removing the portfolio cap hurdle and helping funding by potentially increasing debt-investor confidence,”

Bernanke: Federal Reserve's exit strategy

by Calculated Risk on 2/10/2010 10:01:00 AM

Fed Chairman Ben Bernanke's prepared statement: Federal Reserve's exit strategy. In this testimony, Bernanke outlines the steps to unwind monetary stimulus. An excerpt:

I currently do not anticipate that the Federal Reserve will sell any of its security holdings in the near term, at least until after policy tightening has gotten under way and the economy is clearly in a sustainable recovery. However, to help reduce the size of our balance sheet and the quantity of reserves, we are allowing agency debt and MBS to run off as they mature or are prepaid. The Federal Reserve is currently rolling over all maturing Treasury securities, but in the future it may choose not to do so in all cases. In the long run, the Federal Reserve anticipates that its balance sheet will shrink toward more historically normal levels and that most or all of its security holdings will be Treasury securities. Although passively redeeming agency debt and MBS as they mature or are prepaid will move us in that direction, the Federal Reserve may also choose to sell securities in the future when the economic recovery is sufficiently advanced and the FOMC has determined that the associated financial tightening is warranted. Any such sales would be at a gradual pace, would be clearly communicated to market participants, and would entail appropriate consideration of economic conditions.A few points:

As a result of the very large volume of reserves in the banking system, the level of activity and liquidity in the federal funds market has declined considerably, raising the possibility that the federal funds rate could for a time become a less reliable indicator than usual of conditions in short-term money markets. Accordingly, the Federal Reserve is considering the utility, during the transition to a more normal policy configuration, of communicating the stance of policy in terms of another operating target, such as an alternative short-term interest rate. In particular, it is possible that the Federal Reserve could for a time use the interest rate paid on reserves, in combination with targets for reserve quantities, as a guide to its policy stance, while simultaneously monitoring a range of market rates. No decision has been made on this issue; we will be guided in part by the evolution of the federal funds market as policy accommodation is withdrawn. The Federal Reserve anticipates that it will eventually return to an operating framework with much lower reserve balances than at present and with the federal funds rate as the operating target for policy.

Trade Deficit increases to $40.2 Billion in December

by Calculated Risk on 2/10/2010 08:49:00 AM

The Census Bureau reports:

[T]otal December exports of $142.7 billion and imports of $182.9 billion resulted in a goods and services deficit of $40.2 billion, up from $36.4 billion in November, revised. December exports were $4.6 billion more than November exports of $138.1 billion. December imports were $8.4 billion more than November imports of $174.5 billion.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through December 2009.

Both imports and exports increased in December. On a year-over-year basis, exports are up 7.4% and imports are up 4.6%. This is an easy comparison because of the collapse in trade at the end of 2008.

The second graph shows the U.S. trade deficit, with and without petroleum, through December.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Import oil prices increased to $73.20 in December - up 87% from the low in February (at $39.22). Oil import volumes were up sharply in December.

Overall trade continues to increase, although both imports and exports are still below the pre-financial crisis levels.

MBA: Mortgage Purchase Applications Decline, Rates Fall below 5.0%

by Calculated Risk on 2/10/2010 07:28:00 AM

The MBA reports: Purchase Applications Decline in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index increased 1.4 percent from the previous week and the seasonally adjusted Purchase Index decreased 7.0 percent from one week earlier. ... The four week moving average is up 0.8 percent for the seasonally adjusted Purchase Index, while this average is up 4.8 percent for the Refinance Index.

The refinance share of mortgage activity increased to 69.7 percent of total applications from 69.2 percent the previous week. ...

The average contract interest rate for 30-year fixed-rate mortgages decreased to 4.94 percent from 5.01 percent, with points increasing to 1.06 from 1.04 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

The decline in mortgage applications since October appears significant.

Refinance activity picked up slightly with the decline in mortgage rates.

Tuesday, February 09, 2010

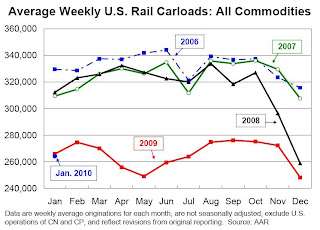

Rail Traffic Flat in January Compared to 2009

by Calculated Risk on 2/09/2010 09:17:00 PM

From the Association of American Railroads: Rail Time Indicators. The AAR reports traffic in January 2010 was down 0.7% compared to January 2009. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows U.S. average weekly rail carloads. It is important to note that excluding coal, traffic is up 11.3% from January 2009, and traffic increased in 13 of the 19 major commodity categories.

Housing: In addition to the decline in coal, two key building materials were also down YoY from January 2009: Forest products (off 27.0%) and Nonmetallic minerals & prod. (crushed stone, gravel, sand was off 16.6%). This fits with the recent data on housing starts, new home sales, and the NAHB home builder index that shows residential investment is flat and non-residential investment is declining sharply.

From AAR:

• U.S. freight railroads originated 1,056,684 carloads in January 2010, an average of 264,171 carloads per week — down 0.7% from January 2009 (265,983 average) and down 17.7% from January 2008’s 321,040 average.

• Carloads excluding coal were up 11.3% (58,467 carloads) in January 2010 from January 2009, though they were still down 19.9% from January 2008.

• In January 2010, 13 of the 19 major commodity categories tracked by the AAR saw carload gains compared with January 2009. Carloads of chemicals were up 13.2% from last year, while carloads of primary metal products (predominantly steel) were up 28.0%.

• The biggest carload percentage gain in January 2010 went to motor vehicles and parts, carloads of which were up 65.7% in January 2010 from January 2009’s severely depressed level.

emphasis added

More Greece, Revised Economic Release Schedule

by Calculated Risk on 2/09/2010 06:56:00 PM

Note: The Census Bureau will release the Trade Balance report tomorrow as scheduled, but Retail Sales (January) and the Manufacturing and Trade Inventories and Sales (December) will be delayed until Friday due to inclement weather.

On Greece from the Financial Times: Berlin looks to build Greek ‘firewall’

"We’re thinking about what we should do if the crisis spills from Greece into other euro countries. So it’s more about finding firewalls, containing the problem, than principally about helping the Greeks.” [A German government official] added there were ”no concrete plans” as yet.And from The Times: Storm over bailout of Greece, EU's most ailing economy

excerpted with permission

And from Professor Krugman, a nice explanation with charts: Anatomy of a Euromess

It's Pig'd!

by Calculated Risk on 2/09/2010 04:00:00 PM

Image and acronym from Gubbmint Cheese who writes: Tanta Vive!

Note: Tanta is my former co-blogger who created the Mortgage PigTM

| It's Pig'd ... Italy Turkey Spain Portugal Ireland Greece Dubai.. |

And a few articles ...

From the WSJ: Germany Considers Loan Guarantees for Greece

Germany is considering a plan with its European Union partners to offer Greece and other troubled euro zone members loan guarantees ...From Bloomberg: European Officials Consider Greek Bailout on Budget

The proposed plan would be done within the EU framework but led by Germany ... A final decision on the plan may not come this week

From Dow Jones: S&P: More Euro-Zone Sovereign Downgrades Possible In 2010

CBRE: Retail Cap Rates Increase Sharply in Q4

by Calculated Risk on 2/09/2010 02:31:00 PM

From CB Richard Ellis: U.S. Retail Cap Rates

Ending at 9.01%, cap rates were up again. The 35 basis point gain is slightly lower than the last few quarters (43 and 46 b.p.). Rates are now the highest recorded since the Q1 2003 start date of our series.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph from CBRE shows the retail cap rate since 2003. Note that 2009 is an average annual rate, and the cap rate in Q4 was at 9.01% - the highest since the series started.

Also on retail, Reis recently reported that the strip malls vacancy rate hit 10.6% in Q4, the highest on record (starting in 1991). And rents are falling:

Factoring in months of free rent and the landlord's portion of the cost for interiors, effective rent fell 0.8 percent to $16.75 per square foot, wiping out rent gains over the past nearly four years.Sharply higher vacancy rates, lower rents, reduced leverage and much higher cap rates - this is what Brian calls the "neutron bomb for RE equity"; destroys CRE investors (and lenders), but leaves the buildings still standing.

Cap Rate: the net operating income divided by the current value (or purchase price). Net operating income excludes depreciation and interest expenses. Say an investor paid $100 thousand in cash for a retail property, the investor would expect to clear $8,710 in cash per year after expenses with an 8.71% cap rate (the $8,710 is before paying income taxes that depend on financing and depreciation).

Report: Euro Zone Agrees to Help Greece

by Calculated Risk on 2/09/2010 12:10:00 PM

UPDATE: Reuters Headline Changed to: Report of EU Help for Greece Is Now Described as 'Unfounded'

That didn't take long ...

From Reuters: Euro Zone Agreed in Principle to Aid Greece: Report

"The decision on help for Greece has been taken in principle within the euro zone," [a senior German coalition source] said.From Bloomberg: U.S. Stocks Gain on Prospects for Bailout of Greece by EU

“You have to do the necessary measures in order for us to support you,” [Olli Rehn, who takes over as EU economic affairs commissioner tomorrow] said of Greece in an interview in Strasbourg, France today. “This will be further discussed in the coming days. We are talking about support in the broad sense of the word. I cannot specify it now.”

BLS: Few Job Openings in December

by Calculated Risk on 2/09/2010 10:04:00 AM

From the BLS: Job Openings and Labor Turnover Summary

There were 2.5 million job openings on the last business day of December 2009, the U.S. Bureau of Labor Statistics reported today. The job openings rate was little changed over the month at 1.9 percent. The job openings rate has held relatively steady since March 2009. The hires rate (3.1 percent) and the separations rate (3.2 percent) were essentially unchanged in December.Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. Remember the CES (Current Employment Statistics, payroll survey) is for positions, the CPS (Current Population Survey, commonly called the household survey) is for people.

The following graph shows job openings (yellow line), hires (purple Line), Quits (light blue bars) and Layoff, Discharges and other (red bars) from the JOLTS. Red and light blue added together equals total separations.

Unfortunately this is a new series and only started in December 2000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notice that hires (purple line) and separations (red and light blue together) are pretty close each month. When the purple line is above total separations, the economy is adding net jobs, when the purple line is below total separations, the economy is losing net jobs.

According to the JOLTS report, there were 4.073 million hires in December, and 4.238 million separations, or 165 thousand net jobs lost. The comparable CES report showed a loss of 150 thousand jobs in December (after revisions).

Separations have declined sharply from earlier in 2009, but hiring has not picked up. Quits (light blue on graph) are at a new low too. Usually "quits" are employees who have already found a new job (as opposed to layoffs and other discharges).

The low turnover rate is another indicator of a very weak labor market.

NFIB: Small Business Owners Report "shortage of customers"

by Calculated Risk on 2/09/2010 08:52:00 AM

From Reuters: Dark clouds hang over U.S. small businesses: survey

The outlook of small business owners remained bleak at the start of the new year, according to a survey released on Tuesday by the National Federation of Independent Business. ... But the group also said that seven of the index's 10 components rose, indicating conditions could soon improve. Better outlooks on jobs, inventories and capital spending have helped push the index up 1.3 points since December, the group saidAnd a few excerpts from the report:

The National Federation of Independent Business Index of Small Business Optimism improved slightly in January to 89.3, 1.3 points above December's reading. January's index is 8.3 points higher than the survey's second lowest reading reached in March 2009 (the lowest reading was 80.1 in 1980). But optimism has clearly stalled in spite of the improvements in the economy in the second half of 2009. The quarterly Index readings have been below 90 for 7 quarters, indicative of the severity and pervasiveness of this recession.And the number one problem:

"Small business owners entered 2010 the same way they left 2009, depressed," said William Dunkelberg, NFIB chief economist. "The biggest problem continues to be a shortage of customers."

...

Owners reported workforce reductions that average .52 workers per firm, basically unchanged for the past several months. Nine percent of the owners increased employment by an average of 3 workers per firm, but 19 percent reduced employment an average of 3.9 workers per firm (seasonally adjusted).

... still more firms planning to cut jobs than planning to add.

"The biggest problem continues to be a shortage of customers." ... Only 5 percent of the owners reported "finance" as their number one business problem (up one point).It appears that small business hiring has been very weak during the current "recovery", and this survey suggests the reason is weak end demand, a "shortage of customers".

Monday, February 08, 2010

D.C. Closed Again on Tuesday and Euro Perspective

by Calculated Risk on 2/08/2010 11:23:00 PM

From the WaPo: Federal government will be closed on Tuesday. More snow ...

This could mean that some of the economic releases might be delayed this week.

And from Paul Krugman: Euro perspective. Professor Krugman provides a pie chart putting the GDP of the PIGS (Portugal, Ireland, Greece and Spain) into perspective.

Greece, which is making most of the headlines, is a tiny economy. So are Portugal and Ireland. The only sizable player among the countries in the news right now is Spain. ... the group of stressed economies account for about 20 percent of the eurozone’s GDP.So muddle through might work.

Greek Finance Minister: Call for help "worst possible signal"

by Calculated Risk on 2/08/2010 07:50:00 PM

From Bloomberg: Greece Says Aid Call Would Send ‘Worst Signal’ as Bonds Slide

“The worst possible signal which we could send out is one calling for outside help,” [Greek Finance Minister George Papaconstantinou] said in an interview with Bloomberg Television in Athens yesterday. “We will tackle the deficit,” he said, adding that tax revenues in January exceeded forecasts “by some percentage points.”Maybe El Erian was right and it is a game of chicken:

"Europe has become a huge game of chicken, whereby the Greeks are waiting for help from the outside and donors are waiting for Greece to take a step forward."Or maybe Greece will just muddle through as Martin Wolfe suggested a couple weeks ago in the Financial Times: The Greek tragedy deserves a global audience . Wolfe discussed three possibilities: Greece leaves the eurozone, Greece toughs it out, or Greece defaults - and concludes:

Given the horrendous difficulty of all alternatives, I am sure the effort will be made to tough it out for as long as possible. That will also be the case elsewhere. All will be forced to accept lengthy recessions.

Party Like it's 1999

by Calculated Risk on 2/08/2010 04:00:00 PM

From March 29, 1999: A CNBC Promo ...

This graph is from Doug Short of dshort.com (financial planner). His comments:

This chart ... shifts the point of alignment ... to the bear bottom in the Oil Crisis and Tech Crash, the first major low in the 1929 Dow, and the March 9th closing low for our current Financial Crisis.

As the chart illustrates, the S&P 500 lows in 1974 and 2002 marked the beginnings of sustained recoveries. The Dow low in 1929 failed 11 months later.

The second graph shows daily closing prices for the Dow since Jan 1999. The dashed line is 10,000.

The second graph shows daily closing prices for the Dow since Jan 1999. The dashed line is 10,000. The Dow has crossed the 10,000 level many times, and my Dow 10K hat is worn out.

Of course there is nothing magical about 10K - it is just a round number.

Spanish, Portuguese CDS spreads Hit New Records

by Calculated Risk on 2/08/2010 02:20:00 PM

From MarketWatch: Portugal, Greece, Spain default worries rise

The cost of insuring Spanish and Portuguese government debt against default via credit default swaps hit new records Monday, while the cost of insurance for Greek debt also rose, according to CMA DataVision.Whether or not this concern is justified, it shows investors are nervous.