by Calculated Risk on 1/29/2010 10:29:00 PM

Friday, January 29, 2010

Unofficial Problem Bank List increases to 599

This is an unofficial list of Problem Banks compiled only from public sources.

Changes and comments from surferdude808:

The Unofficial Problem Bank List underwent significant changes since last as a net 15 institutions were added. Twenty-six institutions were added while 11 institutions were removed because of failure. Please note that the six failures were removed along with the five last Friday. Usually, failures are removed with a one-week lag.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

After these changes, the list stands at 599 institutions with aggregate assets of $322.5 billion, up from 584 institutions with assets of $305.3 billion last week.

Among the eleven failures are First Regional Bank ($2.2 billion); Charter Bank ($1.25 billion); Community Bank & Trust ($1.2 billion); Columbia River Bank ($1.1 billion); Florida Community Bank ($875 million); and First National Bank of Georgia ($833 million).

The 26 institutions added this week have aggregate assets of $25.9 billion. Notable among the additions are Flagstar Bank, FSB, Troy, MI ($14.8 billion); The Stillwater National Bank and Trust Company, Stillwater, OK ($2.7 billion); Guaranty Bank and Trust Company, Denver, CO ($2.1 billion); Fireside Bank, Pleasanton, CA ($1.0 billion); Darby Bank & Trust Co., Vidalia, GA ($909 million); and LibertyBank, Eugene, OR ($856 million).

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #15: American Marine Bank, Bainbridge Island, Washington

by Calculated Risk on 1/29/2010 09:04:00 PM

The first month of twenty ten

Not a record....yet.

by Soylent Green is People

From the FDIC: Columbia State Bank, Tacoma, Washington, Assumes All of the Deposits of American Marine Bank, Bainbridge Island, Washington

American Marine Bank, Bainbridge Island, Washington, was closed today by the Washington Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...That makes six.

As of September 30, 2009, American Marine Bank had approximately $373.2 million in total assets and $308.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $58.9 million. ... American Marine Bank is the 15th FDIC-insured institution to fail in the nation this year, and the third in Washington. The last FDIC-insured institution closed in the state was Evergreen Bank, Seattle, on January 22, 2010.

Bank Failure #14: First Regional Bank, Los Angeles, California

by Calculated Risk on 1/29/2010 07:51:00 PM

Gobbled up by East coast bank.

Zero near partners?

by Soylent Green is People

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina, Assumes All of the Deposits of First Regional Bank, Los Angeles, California

First Regional Bank, Los Angeles, California, was closed today by the California Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Five down, at almost a $2 billion cost to DIF.

As of September 30, 2009, First Regional Bank had approximately $2.18 billion in total assets and $1.87 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $825.5 million. ... First Regional Bank is the 14th FDIC-insured institution to fail in the nation this year, and the first in California. The last FDIC-insured institution closed in the state was Imperial Capital Bank, La Jolla, on December 18, 2009.

Bank Failure #13 in 2010: Community Bank and Trust, Cornelia, Georgia

by Calculated Risk on 1/29/2010 07:03:00 PM

"Community" is spot on.

Loss, absorbed by all.

by Soylent Green is People

From the FDIC: SCBT, N.A., Orangeburg, South Carolina, Assumes All of the Deposits of Community Bank and Trust, Cornelia, Georgia

Community Bank and Trust, Cornelia, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Four down and about $1 billion in losses today ...

As of September 30, 2009, Community Bank and Trust had approximately $1.21 billion in total assets and $1.11 billion in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $354.5 million. .... Community Bank and Trust is the 13th FDIC-insured institution to fail in the nation this year, and the second in Georgia. The last FDIC-insured institution closed in the state was First National Bank of Georgia, Carrollton, earlier today.

Bank Failures #10 to #12: Georgia, Florida, and Minnesota

by Calculated Risk on 1/29/2010 06:23:00 PM

Frail green shoots die each weeks end

Three more banks are hushed

by Soylent Green is People

From the FDIC: Community & Southern Bank, Carrollton, Georgia, Assumes All of the Deposits of First National Bank of Georgia, Carrollton, Georgia

First National Bank of Georgia, Carrollton, Georgia, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: Premier American Bank, National Association, Miami Florida, Assumes All of the Deposits of Florida Community Bank, Immokalee, Florida

As of September 30, 2009, First National Bank of Georgia had approximately $832.6 million in total assets and $757.9 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $260.4 million. ... First National Bank of Georgia is the tenth FDIC-insured institution to fail in the nation this year, and the first in Georgia. The last FDIC-insured institution closed in the state was Rockbridge Commercial Bank, Atlanta, on December 18, 2009.

Florida Community Bank, Immokalee, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: United Valley Bank, Cavalier, North Dakota, Assumes All of the Deposits of Marshall Bank, National Association, Hallock, Minnesota

As of September 30, 2009, Florida Community Bank had approximately $875.5 million in total assets and $795.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $352.6 million. .... Florida Community Bank is the 11th FDIC-insured institution to fail in the nation this year, and the second in Florida. The last FDIC-insured institution closed in the state was Premier American Bank, Miami, on January 22, 2010.

Marshall Bank, National Association, Hallock, Minnesota, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...

As of September 30, 2009, Marshall Bank, N.A. had approximately $59.9 million in total assets and $54.7 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $4.1 million. ... Marshall Bank, National Association is the 12th FDIC-insured institution to fail in the nation this year, and the second in Minnesota. The last FDIC-insured institution closed in the state was St. Stephen State Bank, St. Stephen, on January 15, 2010.

Market Update

by Calculated Risk on 1/29/2010 04:15:00 PM

Since it is the end of January ... here is a market update: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today. The S&P 500 was first at this level in March 1998; almost 12 years ago.

The market is off 6.6% from the recent peak - not even a correction yet, but keep your Dow 10K hats at the ready (the Dow is down to 10,067)!

The S&P 500 is up 59% from the bottom in 2009 (397 points), and still off 31% from the peak (491 points below the max).

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Real GDP: Declines from Prior Peak

by Calculated Risk on 1/29/2010 03:21:00 PM

This is an update to a graph I posted in early 2009 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the real GDP declines from the prior peak for post WWII recessions.

The recent recession was the worst since WWII (the peak decline was 3.83% in Q2 2009).

Even after the strong GDP growth in Q4 (due to inventory changes), current GDP is still 1.9% below the prior peak in real terms. If the recovery is sluggish - as I expect - it will take several more quarters to return to the pre-recession peak in real GDP.

Restaurant Index Improves in December

by Calculated Risk on 1/29/2010 01:24:00 PM

Note: This index is based on year-over-year performance, and the headline index might be slow to recognize a pickup in business.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index.

This is the highest level in almost two years, but the current situation index still suggests contraction in the restaurant industry.

From the National Restaurant Association (NRA): December Restaurant Performance Index Rose to Highest Level in Nearly Two Years

[T]he Association’s Restaurant Performance Index (RPI) ... stood at 98.7 in December, up 0.9 percent from November and its strongest level in nearly two years.

“The RPI’s strong gain in December was the result of broad-based improvements among several index components,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “Although restaurant operators continued to report a net decline in same-store sales and customer traffic, both registered their strongest performances since the summer of 2008.”

“Along with a solid improvement among the current situation indicators, restaurant operators are increasingly optimistic about industry growth in the months ahead,” Riehle added. “More than a third of restaurant operators expect to their sales to improve in six months, the highest level in more than two years.”

... The full report is available online. ...

... Index values above 100 indicate that key industry indicators are in a period of expansion, and index values below 100 represent a period of contraction for key industry indicators. Despite the solid improvement in December, the RPI remained below 100 for the 26th consecutive month.

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 97.3 in December – up a strong 1.4 percent from November and its highest level since August 2008. However, December still represented the 28th consecutive month below 100, which signifies contraction in the current situation indicators.

...

Restaurant operators also reported an improving customer traffic performance in December. Thirty percent of restaurant operators reported an increase in customer traffic between December 2008 and December 2009, up from just 21 percent who reported higher customer traffic in November. Forty-seven percent of operators reported a traffic decline in December, down from 62 percent who reported lower traffic in November.

Although restaurant operators reported stronger sales and traffic results in December, capital spending activity continued to drop off. ...

emphasis added

A Few Comments on Q4 GDP Report

by Calculated Risk on 1/29/2010 10:57:00 AM

Any analysis of the Q4 GDP report has to start with the change in private inventories. This change contributed a majority of the increase in GDP, and annualized Q4 GDP growth would have been 2.3% without the transitory increase from inventory changes.

Unfortunately - although expected - the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), both slowed in Q4.

Note: for more on leading and lagging sectors, see Business Cycle: Temporal Order and Q1 GDP Report: The Good News.

It is not a surprise that both key leading sectors are struggling. The personal saving rate increased slightly to 4.6% in Q4, and I expect the saving rate to increase over the next year or two to around 8% - as households repair their balance sheets - and that will be a constant drag on PCE.

And there is no reason to expect a sustained increase in RI until the excess housing inventory is absorbed. In fact, based on recent reports of housing starts and new home sales, there is a good chance that residential investment will be a slight drag on GDP in Q1 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graphs shows Residential investment (RI) as a percent of GDP since 1947.

RI had declined for 14 consecutive quarters before the increase in Q3 2009. The Q4 report puts RI as a percent of GDP at just over 2.5%, barely above the record low - since WWII - set in Q2 2009.

Notice that RI usually recovers very quickly coming out of a recession. This time RI is moving sideways - not a good sign for a robust recovery in 2010.

The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.Business investment in equipment and software increased 13.3% (annualized). This is a good sign, but continued investment probably depends on increases in underlying demand.

Investment in non-residential structures was only off 15.4% (annualized) and will probably be revised down (this has happened for the last few quarters). I expect non-residential investment in structures to continue to decline sharply over the next several quarters. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

When the supplemental data is released, I'll post graphs of investment in retail, offices, and hotels, and a breakdown of residential investment.

The transitory boost from inventory changes is frequently a great kick start to the economy at the beginning of a recovery - as long as the leading sectors (PCE and RI) are also picking up. This report has to be viewed as concerning ... and is reminiscent of Q1 1981 and Q1 2002 ... both examples of inventory changes making large contributions to GDP, but underlying growth remained weak.

BEA: GDP Increases at 5.7% Annual Rate in Q4

by Calculated Risk on 1/29/2010 08:30:00 AM

As expected, GDP growth in Q4 was driven by changes in private inventories, adding 3.39% to GDP.

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.This is very close to my expectations and shows a fairly weak economy (real PCE increase 2.0%). The question is: what happens in 2010?

...

The increase in real GDP in the fourth quarter primarily reflected positive contributions from private inventory investment, exports, and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP in the fourth quarter primarily reflected an acceleration in private inventory investment, a deceleration in imports, and an upturn in nonresidential fixed investment that were partly offset by decelerations in federal government spending and in PCE.

...

Real personal consumption expenditures increased 2.0 percent in the fourth quarter, compared with an increase of 2.8 percent in the third.

...

Real nonresidential fixed investment increased 2.9 percent in the fourth quarter, in contrast to a decrease of 5.9 percent in the third. Nonresidential structures decreased 15.4 percent, compared with a decrease of 18.4 percent. Equipment and software increased 13.3 percent, compared with an increase of 1.5 percent. Real residential fixed investment increased 5.7 percent, compared with an increase of 18.9 percent.

I'll have some more on GDP and investment later ...

Thursday, January 28, 2010

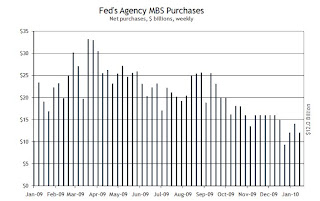

Fed MBS Purchases by Week

by Calculated Risk on 1/28/2010 10:41:00 PM

This graph from the Atlanta Fed weekly Financial Highlights shows the Fed MBS purchases by week:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

The Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to $1.164 trillion or just over 93% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of January 20. This purchase brings its total purchases up to $1.152 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 92% complete).

This shows that the Fed has slowed down purchases significantly from earlier this year, but so has the issuance of Fannie and Freddie MBS - so I don't think the slowdown has impacted mortgage rates yet.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.It sounds like the refinance boom is ending, from the MBA this week:

“Refinance activity fell substantially last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today’s rates.”With 9 weeks to go, the Fed needs to average just under $10 billion in net purchases per week.

Recourse: One of the Dangers of "Walking Away"

by Calculated Risk on 1/28/2010 07:31:00 PM

From Bloomberg: Lenders Pursue Mortgage Payoffs Long After Homeowners Default

[L]enders are exercising their rights to pursue unpaid mortgage balances. To get their money, they can seize wages, tap bank accounts and put liens on other assets held by debtors.As we've discussed before, the recourse laws vary by state. As an example Florida is a recourse state, however in California purchase money is non-recourse. If the borrower walks away in California, the lender is stuck with the collateral. However, if the borrower in California refinanced their home, then the lender usually has recourse, and can pursue a judicial foreclosure (as opposed to a trustee's sale), and seek a deficiency judgment. Usually 2nd liens have recourse too.

...

While there are no statistics on the number of deficiency judgments approved by courts, the Federal Deposit Insurance Corp. tracks the amount banks collect after defaulted loans were written off.

These mortgage recoveries rose 48 percent to a record $1.01 billion in the first nine months of last year compared with the year-earlier period, according to the Washington-based regulator. Recoveries on defaulted home-equity loans almost doubled to $392 million, the FDIC data shows.

Historically lenders rarely pursued a deficiency judgment in California because the trustee's sale was much cheaper and quicker than a judicial foreclosure - and the borrowers rarely had any resources anyway. However in Florida, all foreclosures are judicial, so the lender might as well obtain a deficiency judgment too.

This is important for short sales too. All sellers should obtain the advice of a lawyer and make sure the lender waives their rights for a deficiency judgment if possible.

Update: For a few examples in California, see Greg Weston's blog on jingle mail.

Fannie Mae: Delinquencies Increase Sharply in November

by Calculated Risk on 1/28/2010 04:41:00 PM

Earlier I posted the Freddie Mac delinquency graph.

And here is the monthly Fannie Mae hockey stick graph ... (note that Fannie releases delinquency data with a one month lag to Freddie). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

Once again it is important to note these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.

Treasury Releases new Guidance for HAMP

by Calculated Risk on 1/28/2010 02:11:00 PM

There are two key components:

1) New Requirements that Documentation be Provided Before Trial Modification Begins.

2) and guidance on Converting Borrowers in the Temporary Review Period to Permanent Modifications

From Treasury: Administration Updates Documentation Collection Process and Releases Guidance to Expedite Permanent Modifications. And the Special Directive.

1) On beginning trial modifications: The original plan allowed servicer discretion on when to place borrowers in HAMP trial modification programs. Some servicers required documentation and a first payment before putting the borrower in a trial program, others just accepted a verbal agreement over the phone. The new rules include:

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The Treasury was initially trumpeting the number of trial modifications, but that was a poor metric of success since some servicers were just putting anyone who answered the phone in a trial modification.

2) The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests a surge of trial cancellations in February.

Hotel RevPAR off 10.3%

by Calculated Risk on 1/28/2010 01:16:00 PM

The good news for hotels is it appears the occupancy rate might be near the bottom. This week Smith Travel Research reported the occupancy rate was "virtually flat with an 0.9-percent decrease" compared to the same week in 2009.

The bad news for hotels is the average daily rate (ADR) is still falling because the occupancy rate is so low. Therefore RevPAR (revenue per available room) is still falling.

From HotelNewsNow.com: Boston leads occ., RevPAR increases in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy ended the week virtually flat with an 0.9-percent decrease to 46.8 percent, average daily rate dropped 9.4 percent to US$93.87, and RevPAR for the week fell 10.3 percent to finish at US$43.89.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays. Business travel is the key over the next few months.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Freddie Mac: Delinquencies Increase Sharply in December

by Calculated Risk on 1/28/2010 11:04:00 AM

Here is the monthly Freddie Mac hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 3.87% in December 2009, up from 3.72% in November - and up from 1.72% in December 2008.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

Just more evidence of the growing delinquency problem, although some of these loans may be in the trial modification programs and are still included as delinquent until they become permanent.

Fannie Mae should report soon ...

Chicago Fed: Economic Activity Moved Lower in December

by Calculated Risk on 1/28/2010 08:55:00 AM

From the Chicago Fed: Index shows economic activity moved lower in December

Led by declines in employment-related indicators, the Chicago Fed National Activity Index decreased to –0.61 in December, down from –0.39 in November. Three of the four broad categories of indicators that make up the index moved lower, although both the production and income category and the sales, orders, and inventories category made positive contributions.

...

In contrast to the monthly index, the index’s three-month moving average, CFNAI-MA3, increased slightly to –0.61 in December from –0.68 in November. December’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend; but the level of activity remained in a range historically consistent with the early stages of a recovery following a recession.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures. ... The critical question is: how early does the CFNAI-MA3 reveal this turning point? For four of the last five recessions, this happened within five months of the business cycle trough."Although the CFNAI-MA3 improved slightly in December, the index is still negative. According to Chicago Fed, it is still early to call the official recession over.

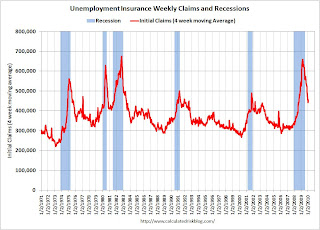

Weekly Initial Unemployment Claims: 470,000

by Calculated Risk on 1/28/2010 08:31:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Jan. 23, the advance figure for seasonally adjusted initial claims was 470,000, a decrease of 8,000 from the previous week's revised figure of 478,000. The 4-week moving average was 456,250, an increase of 9,500 from the previous week's revised average of 446,750.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 16 was 4,602,000, a decrease of 57,000 from the preceding week's revised level of 4,659,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims increased this week by 9,500 to 456,250.

The level of the 4-week average is still relatively high and suggests continued job losses in January.

Wednesday, January 27, 2010

Jon Stewart: Obama takes on Bankers

by Calculated Risk on 1/27/2010 10:45:00 PM

NOTE: here is the New Home sales post from early this morning.

Now for a little fun ... this was last night (link here)

ALSO another great segment with Elizabeth Warren.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Obama Takes On Bankers | ||||

| www.thedailyshow.com | ||||

| ||||

President Obama: SOTU Address at 9 PM ET

by Calculated Risk on 1/27/2010 08:36:00 PM

NOTE: here is the New Home sales post from early this morning.

Here is the WhiteHouse.gov live feed.

Here is the CNBC feed.

And a live feed from C-SPAN.

From the NY Times: Text: Obama’s State of the Union Address