by Calculated Risk on 12/08/2009 08:23:00 PM

Tuesday, December 08, 2009

Book Review: "American Apocalypse"

Meredith Whitney's comments this morning sounded like something right out of "American Apocalypse I":

The government is running out of ways to help the economy as the US faces major issues regarding credit and employment ahead, banking analyst Meredith Whitney told CNBC.In American Apocalypse, Nova imagines the economic recovery stalling, leading to the collapse of another major financial firm, the unemployment rate rising to 14% and the fabric of society starting to unravel.

"I think they're out of bullets," Whitney said in an interview during which she reinforced remarks she made last month indicating she is strongly pessimistic about the prospects for recovery.

Primary among her concerns is the lack of credit access for consumers who she said are "getting kicked out of the financial system."

Nova's protagonist, Gardener, loses his job, and is forced to face the challenges of the street. Almost vacant strip malls, "car people", "tree people" and tent cities are all part the scenery.

I am sure that someday a history will be written of our times, I am just not sure from whose perspective it will be written. Eventually there will be a Gibbons to write the Decline and Fall, but I am positive it will not be Europe or America that produces the author.Oh no, watch out for the ICA!

The fragmentation of information sources was accelerating. Print had failed as a business model, at least of the daily news; digital broadcast news was homogeneous for the most part. The only difference in the networks was what shade of the official color you wanted. Online news was the least regulated and most interesting; the only problem was the amount of noise one had to sift through to find a reliable source. I was still reading Calculated Risk then, this was before the 'Information Consolidation Act' shut him down.

Nova has a website where he is currently posting chapters from Part II.

The book is fast paced and gripping; a terrifying portrait of what seems a little too possible.

Disclosure: Nova sent me an unsolicited proof copy of his book. I’ve received no compensation for this review.

JPMorgan: 200,000 HAMP Mods Offered, Only 2% Permanent

by Calculated Risk on 12/08/2009 05:38:00 PM

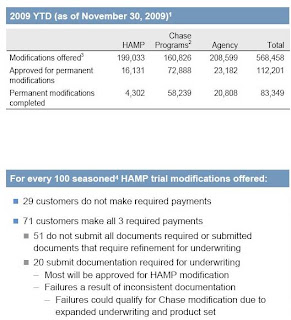

The following information is from the JPMorgan Chase presentation today at the Goldman Sachs Financial Services Conference. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first slide (page 18 in the presentation) shows the progress of the various modification programs at JPM Chase. Only 2% of all trial modification have become permanent (4,302 or 199,033 trial mods).

29% fail to make all their payments during the trial modification program. Another 51% fail to submit all documentation.

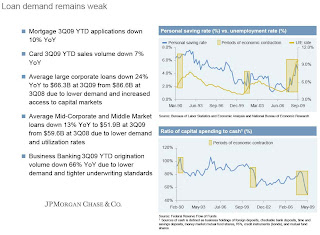

The other modification programs are having more success. The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The second slide is even more important (slide 15 in the presentation). This shows the weak demand for loans in all categories.

The presentation isn't all gloomy (see page 14):

Overall CommentarySome initial signs of stability in consumer delinquency trends, but we are not certain if this trend will continue Prime and subprime mortgage delinquencies impacted by foreclosure moratorium, extended REO timelines and trial modifications

Survey: Companies More Upbeat on Sales, Negative on Jobs

by Calculated Risk on 12/08/2009 04:06:00 PM

From Bloomberg: Companies in U.S. More Upbeat on Sales Than Jobs, Surveys Show

Chief executive officers, supply managers and small business leaders in the U.S. said a pickup in sales next year will not lead to a surge in hiring, surveys showed.Here is the Business Roundtable CEO survey. Of the CEOs surveyed, 68% percent sales to increase over the next 6 months, but only 19% thought their U.S. employment would increase (compared to 31% who thought their employment would decrease).

Three times as many company chiefs anticipate sales will grow over the next six months than project payrolls will climb, according to a survey by the Washington-based Business Roundtable. A poll by the Institute for Supply Management found service companies, which account for almost 90 percent of the economy, forecast additional job cuts in 2010.

Here is the ISM survey: Economic Recovery Continues in 2010. On service employment:

For 2010, 15 percent of respondents expect higher levels of employment, 27 percent anticipate lower levels, and 58 percent expect their employment levels to be unchanged.This shows that hiring plans are still weak, although the recent Manpower survey showed some improvement in hiring plans.

Morgan Stanley: Fed to Raise Rates in 2nd Half of 2010

by Calculated Risk on 12/08/2009 01:47:00 PM

In a research note titled: "The Fed Will Exit in 2010", Morgan Stanley's Richard Berner and David Greenlaw forecast that the Fed will raise the Fed Funds rate in the 2nd half of 2010 to 1.5%.

They are forecasting GDP to increase 2.8% in both 2010 and 2011, and for unemployment to peak in Q1 2010 at 10.3%, and decline to 9.5% in 2011.

The GDP and unemployment rate forecasts are consistent with each other (see my post: Employment and Real GDP), but the real question is why do they expect the Fed to raise rates in the 2nd half of 2010 with a sluggish recovery?

The reason is they expect inflation expectations to pickup, and the Fed to react by raising rates (to 1.5% by the end of 2010, and 2.0% by the end of 2011). That would be unusually since the Fed historically waits until sometime well after the unemployment rate peaks.

The following graph is from I post I wrote in September: Fed Funds and Unemployment Rate Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the effective Fed Funds rate (Source: Federal Reserve) and the unemployment rate (source: BLS)

In the early '90s, the Fed waited more than a 1 1/2 years after the unemployment rate peaked before raising rates. The unemployment rate had fallen from 7.8% to 6.6% before the Fed raised rates.

Following the peak unemployment rate in 2003 of 6.3%, the Fed waited a year to raise rates. The unemployment rate had fallen to 5.6% in June 2004 before the Fed raised rates.

Here is more from Paul Krugman: When should the Fed raise rates? (even more wonkish)

Goldman Sachs recently forecast that the Fed will be on hold through 2011:

The key features of our 2011 outlook: (1) a strengthening in growth from 2.1% on average in 2010 to 2.4% in 2011, with real GDP rising at an above-potential 3½% pace in late 2011; (2) a peaking in unemployment in mid-2011 at about 10¾%; (3) extremely low inflation – close to zero on a core basis during 2011; and (4) a continuation of the Fed’s (near) zero interest rate policy (ZIRP) throughout 2011.Although there are other considerations - such as inflation expectations, I don't expect the Fed to raise rates until late in 2010 at the earliest - and more likely sometime in 2011 or even later.

Treasury: "Thousands of Borrowers" have received Permanent Modifications

by Calculated Risk on 12/08/2009 10:53:00 AM

From Bloomberg: Most Targeted for Mortgage Relief Don’t Qualify, Official Says

A majority of the 3.2 million borrowers targeted by the U.S. Treasury Department for mortgage relief under the administration’s foreclosure prevention program are unlikely to qualify, an agency official said.Testimony from Treasury Assistant Secretary for Financial Stability Herbert Allison: “The Private Sector and Government Response to the Mortgage Foreclosure Crisis”

...

Although we know that not every borrower will qualify for a permanent modification, we are disappointed in the permanent modification results so far,” said Allison, who is the former chief executive officer for federally controlled mortgage- finance giant Fannie Mae.

The Home Affordable Modification Program (HAMP), which provides eligible homeowners the opportunity to significantly reduce their monthly mortgage payment, is a key part of this effort, designed to help millions of homeowners remain in their homes and prevent avoidable foreclosures. As of November 17, over 680,000 borrowers are in active modifications, saving an average of over $550 a month on their monthly mortgage payments. Servicers report that over 900,000 borrowers have received offers to begin trial modifications.Only "thousands" of borrowers? Ouch. The actual data should be released this week.

...

Our most immediate and critical challenge is converting trial modifications to permanent modifications. All mortgage modifications begin with a trial phase to allow borrowers to submit the necessary documentation and determine whether the modified monthly payment is sustainable for them.

...

Currently servicers report that about 375,000 trial modifications will have finished a three month trial period with timely payments before 12/31/2009. Informal survey data from servicers indicate receipt of complete documents in about 30% of active trial modifications – these modifications where borrowers have returned all required documents need to be decisioned by servicers as quickly as possible. For other borrowers, servicers report that the large majority are current on their payments, but have some of the required documentation missing from applications. Housing counselors and homeowners report that servicers are losing documents, while servicers report that homeowners are not providing documents despite repeated outreach. Thousands of borrowers have successfully converted trial modifications to permanent modifications – but this is a low number compared to the total number of trial modifications.

Meredith Whitney: Consumers in Trouble

by Calculated Risk on 12/08/2009 09:48:00 AM

From CNBC: Government 'Out of Bullets,' Consumers in Trouble: Whitney

Primary among her concerns is the lack of credit access for consumers who she said are "getting kicked out of the financial system." She said that will be the prevailing trend in 2010.Ms. Whitney makes me look like an optimist!

...

"You're going to get a situation where you revert from a consumer standpoint," she added, "where those that had bank accounts for the first time, credit cards for the first time, homes for the first time get kicked out of the system and then fall prey to real predatory lenders."

...

"I have 100 percent conviction that the consumer is not getting any better and there's not more liquidity," Whitney said. ... "For a 2010 prediction, which is so disturbing on so many levels to have so many Americans be kicked out of the financial system and the consequences both political and economic of that, it's a real issue. You can't get around it. This has never happened before in this country."

Obama to Announce New Stimulus Package

by Calculated Risk on 12/08/2009 08:39:00 AM

From Jeff Zeleny at the NY Times: Obama Announces New Jobs Programs

President Obama on Tuesday will announce three proposals intended to turn around the nation’s beleaguered job market ...So there are three parts: 1) apparentaly a tax credit for businesses to hire new employees, 2) more infrastructure investment, 3) and a cash-for-caulkers program.

The speech, according to a senior administration official, will outline a series of steps to help small businesses grow and hire new staff. The president also will call for increasing the investment in infrastructure through building and modernizing highways, railways, bridges and tunnels. He also will propose a new program that provides rebates for consumers who retrofit their homes to become more energy efficient.

...

The president also will call for using some of the $200 billion in Troubled Asset Relief Program to help pay down the $1.4 trillion budget deficit.

Monday, December 07, 2009

Zombie Buildings

by Calculated Risk on 12/07/2009 09:26:00 PM

From Thomas Corfman at Crain's Chicago Business: Zombie fears stalk Tishman in the Loop (ht David)

Corfman describes properties where the owners owe far more than the buildings are worth, and can't refinance, as "zombie buildings". The owners "can't compete for new tenants because they lack the money to cover brokers' commissions and interior office reconstruction."

"Virtually all the assets bought between '05 and '07 cannot be refinanced today without a significant capital infusion," says Shawn Mobley, executive vice-president at real estate firm Grubb & Ellis Co. "These buildings need to be recapitalized to get back in the business of being active real estate."An "extend and pretend" loan modification will just let the zombie building live longer with deferred maintenance and few tenant improvements.

...

The number of zombie buildings in the Chicago area is likely to grow in 2010 ... For landlords, the trend means even top-quality office properties are likely to divide themselves into "haves" and "have-nots," with the latter seeing their vacancy rates worsen because of the lack of financing.

...

Many tenants won't consider zombie buildings because they need landlords' cash [for tenant improvements].

Although Corfman is discussing commercial office buildings, the same idea applies to residential real estate and loan modifications. Homeowners with significant negative equity own zombie houses - the "owners" are really renters and will defer maintenance as long as possible.

NY Fed President Dudley: Still More Lessons from the Crisis

by Calculated Risk on 12/07/2009 06:35:00 PM

From NY Fed President William Dudley: Still More Lessons from the Crisis

The entire speech is worth reading. Dudley discusses a number of topics including his economic outlook, how the Fed should respond to bubbles, and why he believes the Fed should retain supervisory authority.

Dudley offers a mea culpa for the Fed:

With the benefit of hindsight, it is clear that the Fed and other regulators, both here and abroad, did not sufficiently understand some of the critical vulnerabilities in the financial system, including the consequences of inappropriate incentives, and the opacity and the large number of self-amplifying mechanisms that were embedded within the system. Likewise, we did not appreciate all the ramifications of the growth of the shadow banking system and its linkage back to regulated financial institutions until after the crisis began.It didn't take "hindsight" to see that the Fed was failing to properly regulate the financial system - many people were pointing out the problems in real time, and the Fed simply chose to ignore the warnings.

On bubbles:

[I]dentifying asset bubbles in real time is difficult. However, identifying variables that often are associated with asset bubbles—especially credit asset bubbles—may be less daunting. To take one recent example, there was a tremendous increase in financial leverage in the U.S. financial system over the period from 2003 to 2007, particularly in the nonbank financial sector. This sharp rise in leverage was observable. Presumably, this rise in leverage also raised the risks of a financial asset bubble and the impact of this bubble on housing certainly raised the stakes for the real economy if such a bubble were to burst. This suggests that limiting the overall increase in leverage throughout the system could have reduced the risk of a bubble and the consequences if the bubble were to burst.We are making progress on bubbles.

Turning to ... how to limit and/or deflate bubbles in an orderly fashion, the fact that increases in leverage are often associated with financial asset bubbles suggests that limiting increases in leverage may help to prevent bubbles from being created in the first place. This again suggests that there is a role for supervision and regulation in the bubble prevention process. ...

Whether there is a role for monetary policy to limit asset bubbles is a more difficult question. On the one hand, monetary policy is a blunt tool for use in preventing bubbles because monetary policy actions also have important consequences for real economic activity, employment and inflation. On the other hand, however, there is evidence that monetary policy does have an impact on desired leverage through its impact on the shape of the yield curve. A tighter monetary policy, by flattening the yield curve, may limit the buildup in leverage.

emphasis added

And on the economic outlook:

My views about the outlook have not changed much recently and do not differ much from the consensus. The situation is slowly improving. We are having a recovery in terms of output and the pace of job losses has slowed substantially. In the second half of this year, real GDP growth will likely fall in a 3 percent to 3.5 percent annualized range. 2010 will probably be slightly weaker than that, mostly because some of the current sources of strength are temporary. The inventory cycle is providing lots of support right now and the fiscal stimulus—which is very powerful right now — will abate as we go through 2010.It is very unlikely that the Fed will raise the Fed funds rate in 2010.

2010 is also likely to be a more moderate growth period because we still face quite a few headwinds generated by the hangover of the financial crisis. ...

If growth is subdued, this implies that the unemployment rate will stay high and inflation will stay low. If this outlook is broadly correct, this suggests that it will be appropriate to keep the federal funds rate target exceptionally low for an extended period.

BofA on Modifications: Two thirds of Borrowers have not Submitted Full Docs

by Calculated Risk on 12/07/2009 05:02:00 PM

From Diana Olick at CNBC: Bank of America: 2/3 of Borrowers May Lose Mods (ht montas ankle)

[Jack Schakett, credit loss mitigation strategies executive at B of A.] told me that of the 65 thousand trial modifications set to expire Dec. 31st with B of A, a full two thirds of the borrowers, while current on their payments, have not submitted the full documentation required to turn a trial mod permanent under the HAMP guidelines.Borrowers are complaining that the banks are losing documentation and that they have to submit it multiple times. Ms. Olick also suggests the possibility that some borrowers can't document their income.

"We don't really know the major reason why the customers are not returning the documentation," Schakett claims.

BofA's Mr. Schakett said it was too soon to know why the documentation is incomplete, but this suggests that the number of permanent modifications announced this week will be very low (in the 10s of thousands).

Consumer Credit Declines for 9th Straight Month

by Calculated Risk on 12/07/2009 03:00:00 PM

The Federal Reserve reports:

Consumer credit decreased at an annual rate of 3-1/4 percent in the third quarter of 2009. Revolving credit decreased at an annual rate of 7-1/4 percent, and nonrevolving credit decreased at an annual rate of 1 percent. In October, consumer credit decreased at an annual rate of 1-3/4 percent.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the year-over-year (YoY) change in consumer credit. Consumer credit is off 3.6% over the last 12 months - and falling fast. The previous record YoY decline was 1.9% in 1991.

Consumer credit has declined for a record 9 straight months - and declined for 12 of the last 13 months. It is difficult to get a robust recovery without an expansion of consumer credit - unless the recovery is built on business spending and exports (seems unlikely).

Note: The Fed reports a simple annual rate (multiplies change in month by 12) as opposed to a compounded annual rate. Consumer credit does not include real estate debt.

Fed Chairman Bernanke: Frequently Asked Questions

by Calculated Risk on 12/07/2009 12:45:00 PM

From Fed Chairman Ben Bernanke: Frequently Asked Questions. Dr. Bernanke discusses four questions:

1. Where is the economy headed?On inflation, Bernanke says he expects "inflation to remain subdued for some time." On the economy:

2. What has the Federal Reserve been doing to support the economy and the financial system?

3. Will the Federal Reserve's actions lead to higher inflation down the road?

4. How can we avoid a similar crisis in the future?

Where Is the Economy Headed?

... Recently we have seen some pickup in economic activity, reflecting, in part, the waning of some forces that had been restraining the economy during the preceding several quarters. The collapse of final demand that accelerated in the latter part of 2008 left many firms with excessive inventories of unsold goods, which in turn led them to cut production and employment aggressively. This phenomenon was especially evident in the motor vehicle industry, where automakers, a number of whom were facing severe financial pressures, temporarily suspended production at many plants. By the middle of this year, however, inventories had been sufficiently reduced to encourage firms in a wide range of industries to begin increasing output again, contributing to the recent upturn in the nation's gross domestic product (GDP).

Although the working down of inventories has encouraged production, a sustainable recovery requires renewed growth in final sales. It is encouraging that we have begun to see some evidence of stronger demand for homes and consumer goods and services. In the housing sector, sales of new and existing homes have moved up appreciably over the course of this year, and prices have firmed a bit. Meanwhile, the inventory of unsold new homes has been shrinking. Reflecting these developments, homebuilders have somewhat increased the rate of new construction--a marked change from the steep declines that have characterized the past few years.

Consumer spending also has been rising since midyear. Part of this increase reflected a temporary surge in auto purchases that resulted from the "cash for clunkers" program, but spending in categories other than motor vehicles has increased as well. In the business sector, outlays for new equipment and software are showing tentative signs of stabilizing, and improving economic conditions abroad have buoyed the demand for U.S. exports.

Though we have begun to see some improvement in economic activity, we still have some way to go before we can be assured that the recovery will be self-sustaining. Also at issue is whether the recovery will be strong enough to create the large number of jobs that will be needed to materially bring down the unemployment rate. Economic forecasts are subject to great uncertainty, but my best guess at this point is that we will continue to see modest economic growth next year--sufficient to bring down the unemployment rate, but at a pace slower than we would like.

A number of factors support the view that the recovery will continue next year. Importantly, financial conditions continue to improve: Corporations are having relatively little difficulty raising funds in the bond and stock markets, stock prices and other asset values have recovered significantly from their lows, and a variety of indicators suggest that fears of systemic collapse have receded substantially. Monetary and fiscal policies are supportive. And I have already mentioned what appear to be improving conditions in housing, consumer expenditure, business investment, and global economic activity.

On the other hand, the economy confronts some formidable headwinds that seem likely to keep the pace of expansion moderate. Despite the general improvement in financial conditions, credit remains tight for many borrowers, particularly bank-dependent borrowers such as households and small businesses. And the job market, though no longer contracting at the pace we saw in 2008 and earlier this year, remains weak. Household spending is unlikely to grow rapidly when people remain worried about job security and have limited access to credit.

Inflation is affected by a number of crosscurrents. High rates of resource slack are contributing to a slowing in underlying wage and price trends, and longer-run inflation expectations are stable. Commodities prices have risen lately, likely reflecting the pickup in global economic activity and the depreciation of the dollar. Although we will continue to monitor inflation closely, on net it appears likely to remain subdued for some time.

Tim Duy's Fed Watch: Structural and Cyclical

by Calculated Risk on 12/07/2009 11:55:00 AM

From Professor Duy: Structural and Cyclical

For several months, I have been telling stories that decompose US economic activity into what I think of as cyclical and structural dynamics. I believe the distinction is very important to firms, markets, and policymakers who need to be aware when one dynamic is clouding their view of the other.A nice summary of the differences between those who expect a "V-shaped" recovery, and those that believe the recovery will be sluggish. I think growth will be sluggish primarily because of the overhang of excess housing inventory (slowing any recovery in residential investment), and because consumers will increase their saving rate to repair their household balance sheets. There is much more in Dr. Duy's post.

The cyclical dynamics, in my opinion, are the most spectacular, the most visible. The real cyclical fireworks began in the second half of [2008], as the energy price shock decimated household budgets, quickly followed by a financial shock that triggered an additional pullback in demand. Firms unexpectedly found they had far too much excess capacity in this environment, and began the process of "rightsizing." [Job] losses mounted even as falling energy costs and lower interest rates for those not credit constrained began to put a floor under spending.

Eventually, firms would realign capacity with the new level of demand, and job losses would taper off. That would mark the early stages of the cyclical bottom, the point at which growths returns. The initial growth spurt could be very rapid, as firms restock inventory and pent-up demand comes into play. The additional of government stimulus will add additional fuel to the fire.

Once the early stages of recovery are complete, the story shifts from cyclical to structural. The boost from inventory correction, pent-up demand, and government stimulus fade, and the underlying growth rate, the fundamental rates of activity, becomes evident. Now your expectations about the nation's economic direction depend on the weight you place on the structural factors. If you place nearly zero weight on those factors, then growth remains fairly high as the economy rapidly returns to potential. In effect, cyclical dynamics dominate your story; the Fed is simply flipping a switch that shifts the economy from high to low states and back again, a traditional post-WWII business cycle. If you place heavy weight on structural stories, you talk about the inability to revert to past patterns of consumer spending growth due to excessive household debt, a reversion to global imbalances that supports outsized import growth, lack of an asset bubble to compensate for these structural problems, etc. With these stories in your toolkit, you expect a low underlying growth rate - barely at potential growth - in which case the gap between actual and potential output remains distressingly high for possibly years to come.

Trapped under TARP: Regional Banks and Real Estate Loans

by Calculated Risk on 12/07/2009 08:57:00 AM

From Bloomberg: No Escape From TARP for U.S. Banks Choking on Real Estate Loans

... mounting defaults on commercial property may keep regional lenders from repaying bailout funds until at least 2011.Basically small and regional banks were over concentrated in C&D (Construction and Development) and CRE (Commercial Real Estate) loans - and those areas are still under severe stress (CRE will get worse). This is why the FDIC is busy every Friday, and also why many of these small and regional banks will be stuck with TARP for some time (or even fail owing money to the Treasury).

... regional banks ... are almost four times more concentrated in commercial property loans than the nation’s biggest lenders, according to data compiled by Bloomberg on bailout recipients.

The concentration makes regulators less likely to let regional lenders ... leave the Troubled Asset Relief Program, analysts said.

...

The stakes for taxpayers include whether they’ll get back $36.6 billion held by 35 of the largest regional lenders that received TARP money.

...

Among 35 of the biggest regional lenders that retain TARP funds, commercial real estate and construction loans average 37 percent of total loans, compared with 9.5 percent at Citigroup Inc. and Wells Fargo & Co., the two biggest U.S. banks that haven’t announced plans to repay the government, according to data compiled by Bloomberg....

Treasury Forecasts Smaller Loss from TARP

by Calculated Risk on 12/07/2009 12:16:00 AM

From the NY Times: U.S. Forecasts Smaller Loss From Bailout of Banks

The Treasury Department expects to recover all but $42 billion of the $370 billion it has lent to ailing companies since the financial crisis began last year, with the portion lent to banks actually showing a slight profit, according to a new Treasury report.And from the WSJ: Estimated TARP Cost Is Cut by $200 Billion

The new assessment of the $700 billion bailout program, provided by two Treasury officials on Sunday ahead of a report to Congress on Monday, is vastly improved from the Obama administration’s estimates last summer of $341 billion in potential losses from the Troubled Asset Relief Program. ...

The officials said the government could ultimately lose $100 billion more from the bailout program in new loans to banks, aid to troubled homeowners and credit to small businesses.

The article notes that this will reduce the deficit significantly this year.

Sunday, December 06, 2009

Financial Times: Bear Stearns and Lehman Executives Cashed in before Collapse

by Calculated Risk on 12/06/2009 09:18:00 PM

From Lucian Bebchuk, Alma Cohen, and Holger Spamann in the Financial Times: Bankers had cashed in before the music stopped

According to the standard narrative, the meltdown of Bear Stearns and Lehman Brothers largely wiped out the wealth of their top executives. ... That standard narrative, however, turns out to be incorrect. ... our analysis ... shows the banks’ top five executives had cashed out such large amounts since the beginning of this decade that, even after the losses, their net pay-offs during this period were substantially positive.It appears these executives were incentivized to gamble.

excerpted with permission

Mark Thoma has more excerpts Did Bank Executives Lose Enough to Learn their Lesson?

Employment and Real GDP

by Calculated Risk on 12/06/2009 04:52:00 PM

Based on the recent trend in the employment report, the U.S. economy might start adding net payroll jobs soon. This post looks at payroll employment vs. the change in real GDP, and estimates the unemployment rate in 12 months for several growth scenarios.

Credit: This idea is from a recent research note by Jan Hatzius.

Note: This is similar to Okun's relationship between GDP and unemployment. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the four quarter change in real GDP and the four quarter change in employment, as a percent of payroll employment (to normalize for changes in payroll over time).

The second graph shows the same data in a scatter graph. There is a clear relationship - the higher the change in the real GDP, the larger the increase in payroll employment.

There is a clear relationship - the higher the change in the real GDP, the larger the increase in payroll employment.

This shows that real GDP has to grow at a sustained rate of about 1% just to keep the net change in payroll jobs at zero.

A 3% increase in real GDP (over a year) would lead to about a 1.5% increase in payroll employment. With approximately 131 million payroll jobs, a 1.5% increase in payroll employment would be just under 2 million jobs over the next year - and the unemployment rate would probably remain close to 10%.

The following table summarizes several growth scenarios. The unemployment rate is from the household survey and depends on the number of people in the work force - so it cannot be calculated directly. The table uses a range of unemployment rates based on 1.6 to 2.1 million people entering the workforce over the next 12 months (a combination of population growth and discouraged workers reentering the work force).

| Real GDP Growth | Percent Payroll Growth | Annual Payroll Growth (000s) | Monthly Payroll Growth (000s) | Approximate Unemployment Rate in One Year |

|---|---|---|---|---|

| 6.0% | 3.5% | 4,563 | 380 | 8.0% to 8.3% |

| 5.0% | 2.8% | 3,684 | 307 | 8.6% to 8.9% |

| 4.0% | 2.1% | 2,806 | 234 | 9.1% to 9.4% |

| 3.0% | 1.5% | 1,928 | 161 | 9.7% to 10.0% |

| 2.0% | 0.8% | 1,049 | 87 | 10.3% to 10.6% |

| 1.0% | 0.1% | 171 | 14 | 10.8% to 11.1% |

I expect a sluggish recovery in 2010, and I think the unemployment rate will stay near 10% for the next year. Those expecting a sharp drop in the unemployment rate are clearly expecting real GDP growth of 5% or more.

Obviously higher growth rates would mean an even quicker decline in the unemployment rate, and a decline in real GDP would mean much higher unemployment rates.

Summary and a Look Ahead

by Calculated Risk on 12/06/2009 12:00:00 PM

Scheduled data for the coming week include the trade report (Thursday) and retail sales (Friday). Also the Treasury is expect to release the Making Home Affordable Program data for November this week and include additional metrics such as the number of permanent modifications and the number of failed trial modifications.

The number of permanent modifications is expected to be in the 10s of thousand.

Also, the Federal Reserve will release the Q3 Flow of Funds report on Thursday.

And a summary ...

The employment report showed a decline of 11,000 payroll jobs in November and a decline in the unemployment rate to 10.0% (from 10.2%). The smaller number of payroll jobs lost was surprising because other indicators (like the ADP report, weekly initial unemployment claims, ISM reports) suggested a larger number of job losses.

From Employment Report: 11K Jobs Lost, 10% Unemployment Rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession is the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Note: The total number of jobs lost does not include the preliminary benchmark payroll revision of minus 824,000 jobs. (This is the preliminary estimate of the annual revision that will be announced early in 2010).

From Seasonal Retail Hiring, Employment-Population Ratio, Part Time Workers

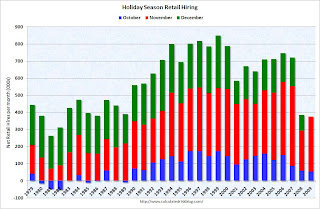

Retailers are hiring seasonal workers at slightly above the pace of last year ...

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. Here is a graph that shows the historical net retail jobs added for October, November and December by year.Retailers only hired 54.2 thousand workers (NSA) net in October. This was essentially the same as in 2008 (59.1 thousand NSA). However retailers hired 321.3 thousand workers in November (NSA), an increase from the 233.7 thousand last year. This suggests retailers are a little more optimistic than last year.

From Unemployment: Record number Unemployed over 26 Weeks, Diffusion Index

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 5.887 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 3.8% of the civilian workforce. (note: records started in 1948)

Other Employment posts:

If the Economy lost Jobs, why did the Unemployment Rate decline?

Temporary Help

Manufacturing showed slower expansion: From the Institute for Supply Management: November 2009 Manufacturing ISM Report On Business®

Economic activity in the manufacturing sector expanded in November for the fourth consecutive month ...Services showed contraction: From the Institute for Supply Management: November 2009 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector contracted in November after two consecutive months of expansion ...

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Residential construction spending increased in October, and nonresidential spending continued to decline.

Private residential construction spending is now 63% below the peak of early 2006.

Private non-residential construction spending is 20.6% below the peak of last October.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 10.93 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for November (red, light vehicle sales of 10.93 million SAAR from AutoData Corp).Obviously sales were boosted significantly by the "Cash-for-clunkers" program in August and some in July.

Excluding July and August, this was the strongest month since October 2008 (12.5 million SAAR) before sales fell off the final cliff.

The current level of sales are still very low, and are below the lowest point for the '90/'91 recession (even with a larger population).

Best wishes to all.From the American Bankruptcy Institute: November Consumer Bankruptcy Filings Drop 18 Percent from Previous Month HUD's Donovan: "Next Steps" for FHA Fed's Beige Book: Economy "improved modestly" Restaurant Index Shows Contraction in October Hotel RevPAR off 8.4 Percent Unofficial Problem Bank List, Dec 4, 2009

Temporary Help

by Calculated Risk on 12/06/2009 09:12:00 AM

Tom Abate writes in the San Francisco Chronicle: In economic woes, firms count on temp workers

A surge in temporary employment was one of the encouraging aspects of a Labor Department report issued Friday.

Click on graph for larger image.

Click on graph for larger image.This graph shows temporary help services (seasonally adjusted) and the unemployment rate. Unfortunately the data on temporary help services only goes back to 1990, but it does appear temporary help and the unemployment rate have been inversely correlated.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees and also hire temporary employees. Since the number of temporary workers increased sharply, some people think this might be signaling the beginning of an employment recovery.

Tom Abate adds some caution:

BLS economist Amar Mann said an analysis by the San Francisco office suggests that employers are getting more sophisticated about using temp hiring as a clutch to downshift into recessions and upshift into recoveries.So use the increase in temporary help with caution.

Mann said temp jobs started down a month after overall employment dropped during the 1990-91 recession. But by the 2001 downturn, employers started cutting temps about five months before they started issuing pink slips to the general workforce.

In the current recession, he said, companies began shedding temps 12 months before they started cutting permanent payrolls.

A similar pattern prevailed in the two prior recoveries, Mann said. Temp jobs came back at the same time as overall employment after the 1991 recovery. Temporary employment rebounded five months before the general job market turned positive following the 2001 dip.

If that pattern holds, it could be next summer before general payrolls start to grow.

Mann refused to speculate about the timing, but said temps are playing an increasing role in the job cycle.

"Employers are getting more savvy about using just-in-time labor on the way down and on the way up," he said.

Is Dubai Holding the next Dubai World?

by Calculated Risk on 12/06/2009 01:22:00 AM

From The Times: Banks face fresh Dubai debt fears

FEARS are growing among western banks that Dubai Holding, the personal investment vehicle of the emirate’s ruler, Sheikh Mohammed bin Rashid al-Maktoum, will be the next state-owned Dubai company to default.Just more potential losses for the Royal Bank of Scotland and HSBC.

The conglomerate went on a debt-fuelled spending spree in the past decade, borrowing $12 billion (£7.3 billion) to fund ambitious projects ...

Together, Dubai World and Dubai Holding are thought to account for 60% to 70% of Dubai’s total debt. Research from Bank of America Merrill Lynch indicates that Dubai Holding has $1.8 billion due for repayment next year.