by Calculated Risk on 5/04/2009 02:07:00 PM

Monday, May 04, 2009

Fed: Banks Tighten Lending Standards Further

From the Fed: The April 2009 Senior Loan Officer Opinion Survey

on Bank Lending Practices

In the April survey, the net percentages of respondents that reported having tightened their business lending policies over the previous three months, although continuing to be very elevated, edged down for the second consecutive survey. In contrast, somewhat larger net percentages of domestic banks than in the January survey reported having tightened credit standards on residential mortgages. The net percentage of domestic respondents that reported having tightened their lending policies on credit card loans remained about unchanged from the January survey, whereas the net percentage that reported having tightened their policies on other consumer loans fell. Respondents indicated that demand for loans from both businesses and households continued to weaken for nearly all types of loans over the survey period, an exception being demand for prime mortgages, a category of loans that registered an increase in demand for the first time since the survey began to track prime mortgages separately in April 2007.Charts here for CRE, residential mortgage, consumer loans and C&I.

In response to the special questions on the outlook for loan quality, a significant majority of banks reported that credit quality for all types of loans is likely to deteriorate over the year if the economy progresses according to consensus forecasts.

Report: Wells Fargo Asked to Raise Capital

by Calculated Risk on 5/04/2009 12:55:00 PM

From CNBC: Wells Fargo Is Asked to Raise More Capital After Stress Test

Regulators have told Wells Fargo to shore up its finances after government "stress tests" showed the bank would have trouble surviving a deeper recession.The leaks continue ... Citi, BofA, and Wells need to raise capital ... more to come.

Kansas Fed President Hoenig: Let Troubled Banks Fail

by Calculated Risk on 5/04/2009 11:51:00 AM

Dr. Thomas Hoenig, President of Federal Reserve of Kansas City speaks today in New York at Demos: A Better Way To Restore The Banking System

Yesterday Hoenig wrote in the Financial Times: Troubled banks must be allowed a way to fail. Excerpts below the video.

Here is a live webcast of Hoenig's speech (starts at 12:30PM ET):

Excerpts from Hoenig's opinion piece:

... I believe there is an alternative method for addressing this crisis that deals more effectively with the issues we currently face while also considering the long-run consequences of those actions: the implementation of a systematic plan to resolve large, problem financial institutions.

... Boiled down to its simplest elements, the plan would require those firms seeking government assistance to make the taxpayer senior to all shareholders, with the government determining the circumstances for managers and directors. ...

Non-viable institutions would be allowed to fail and be placed into a negotiated conservatorship or a bridge institution, with the bad assets liquidated while the remainder of the firm is operated under new management and re-privatised as soon as is feasible. This plan is similar to what was done in Sweden in the 1990s and in the US with the failure of Continental Illinois in the 1980s.

This plan has many advantages, including that management and shareholders bear the costs for their actions before taxpayer funds are committed. This process also is equitable across all firms; is similar to what is currently done with smaller banks; and provides a definitive process that should reduce market uncertainty. These are important reasons to implement this kind of resolution process.

....

Certainly, the approach I suggest for resolving these large firms also is not without substantial cost, but it looks to both the short and long run.

A systematic approach would reduce the uncertainty that has paralysed financial markets; the cost is more measurable and therefre manageable; and there will be fewer adverse consequences compared to the path we are on now.

Because we still have far to go in this crisis, there remains time to define a clear process for resolving large institutional failure. Without one, the consequences will involve a series of short-term events and far more uncertainty for the global economy in the long run.

While I agree that central banks must sometimes take actions affecting the short run, they must keep the long run in focus or risk failing their mission.

Private Construction Spending Declines Slightly in March

by Calculated Risk on 5/04/2009 10:01:00 AM

Private residential construction spending is 61.8% below the peak of early 2006.

Private non-residential construction spending is 5.7% below the peak of last September. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is essentially flat on a year-over-year basis, and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

As I've noted before, these will probably be two key stories for 2009: the collapse in private non-residential construction, and the probable bottom for residential construction spending. Both stories are just developing ...

From the Census Bureau: February 2009 Construction at $967.5 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $661.0 billion, 0.1 percent (±1.4%) below the revised February estimate of $661.6 billion. Residential construction was at a seasonally adjusted annual rate of $258.4 billion in March, 4.2 percent (±1.3%) below the revised February estimate of $269.6 billion. Nonresidential construction was at a seasonally adjusted annual rate of $402.6 billion in March, 2.7 percent (±1.4%) above the revised February estimate of $392.0 billion.

Pending Home Sales Up Slightly in March

by Calculated Risk on 5/04/2009 10:00:00 AM

From MarketWatch: U.S. March pending home sales index up 3.2%

The housing market improved in March, a trade group said Monday. The pending home sales index rose 3.2% compared with February and was up 1.1% compared with a year earlier, the National Association of Realtors reported.Note: Existing home sales are reported at the close of escrow, pending home sales are reported when contracts are signed. The Pending Home Sales index leads existing home sales by about 45 days, so the March pending report suggests existing home sales will increase slightly from April to May. (March is the most recent existing home sales report).

Financial Times: BofA plans to raise more than $10 Billion in Capital

by Calculated Risk on 5/04/2009 12:48:00 AM

From the Financial Times: BofA and Citi in last push on stress tests

Citigroup and Bank of America are working on plans to raise more than $10bn each in fresh capital ... Citi, BofA and at least two other lenders will on Monday attempt to convince the Treasury and the Federal Reserve that the findings of “stress tests” into their financial health were too pessimistic.This will be an interesting week.

... the government will present the final test results to 19 banks tomorrow with an announcement scheduled for Thursday ...

emphasis added

David Leonhardt reports the NY Times: Tests of Banks May Bring Hope More Than Fear

The results of the bank stress tests to be released by the Obama administration this week are expected to include more detailed information about individual banks — assessing specific parts of their loan portfolios ...It sounds like regulators will release loss projections by the 12 loan categories included in the Fed White Paper: The Supervisory Capital Assessment Program: Design and Implementation

Sunday, May 03, 2009

Krugman: Falling Wage Syndrome

by Calculated Risk on 5/03/2009 11:24:00 PM

Paul Krugman writes in the NY Times: Falling Wage Syndrome

Wages are falling all across America.It sure seems many analysts suffer from a bipolar disorder. A few months ago it was depression, now it is "green shoots". As Krugman notes, it appears the pace of deterioration has slowed, and perhaps the economy will bottom sometime this year - but that is different from new growth. Stagnation is a real concern.

...

[A]ccording to the Bureau of Labor Statistics, the average cost of employing workers in the private sector rose only two-tenths of a percent in the first quarter of this year — the lowest increase on record. Since the job market is still getting worse, it wouldn’t be at all surprising if overall wages started falling later this year.

...

Suppose that workers at the XYZ Corporation accept a pay cut. That lets XYZ management cut prices, making its products more competitive. Sales rise, and more workers can keep their jobs. So you might think that wage cuts raise employment — which they do at the level of the individual employer.

But if everyone takes a pay cut, nobody gains a competitive advantage. So there’s no benefit to the economy from lower wages. Meanwhile, the fall in wages can worsen the economy’s problems on other fronts.

In particular, falling wages, and hence falling incomes, worsen the problem of excessive debt ...

There has been a lot of talk lately about green shoots and all that, and there are indeed indications that the economic plunge that began last fall may be leveling off. ... the risk that America will ... face years of deflation and stagnation — seems, if anything, to be rising.

WSJ: Banks Tighten Corporate Credit Lines

by Calculated Risk on 5/03/2009 08:26:00 PM

From the WSJ: Banks Get Tougher on Credit Line Conditions

Banks are shortening the terms on lines of credit ... They are charging significantly higher fees for the lines of credit, known as revolvers. And instead of promising an interest rate determined mainly by the company's credit rating, banks will now charge more if the cost of insuring the company's debt against default is higher.There are two key changes: the duration has been shortened, and the interest rate is based on the price of default insurance (as opposed to credit rating). Another snub of the ratings agencies!

...

About 72% of the revolving credit facilities obtained by investment-grade companies in the first quarter of 2009 had 364-day maturities, or tenors, and no companies received five-year lines ... In the same period a year ago, 30% of the facilities were for 364 days and 41% had five-year maturities.

Also on lending standards, the Fed's April Senior Loan Officer Survey on bank lending practices will probably be released this week.

Credit Crisis Indicators

by Calculated Risk on 5/03/2009 03:53:00 PM

It has been some time, so here is a look at few credit indicators:

First, the British Bankers' Association reported Friday that the three-month dollar Libor rates were fixed at 1.007%. The LIBOR was at 1.30% a few weeks ago, and peaked at 4.81875% on Oct 10, 2008. The dollar LIBOR might break below 1.0% this week. Click on graph for larger image in new window.

Click on graph for larger image in new window.

There has been improvement in the A2P2 spread. This has declined to 0.56. This is far below the record (for this cycle) of 5.86 after Thanksgiving, but still above the normal spread.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

| Meanwhile the TED spread has decreased further over the last week, and is now at 86.39. This is the difference between the interbank rate for three month loans and the three month Treasury. The peak was 463 on Oct 10th and a normal spread is around 50 bps. |

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.

The third graph shows the spread between 30 year Moody's Aaa and Baa rated bonds and the 30 year treasury.The spread has decreased sharply over the last couple of weeks. The spreads are still very high, especially for lower rated paper.

The Moody's data is from the St. Louis Fed:

Moody's tries to include bonds with remaining maturities as close as possible to 30 years. Moody's drops bonds if the remaining life falls below 20 years, if the bond is susceptible to redemption, or if the rating changes.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.

This graph shows the at the Merrill Lynch Corporate Master Index OAS (Option adjusted spread) for the last 2 years.This is a broad index of investment grade corporate debt:

The Merrill Lynch US Corporate Index tracks the performance of US dollar denominated investment grade corporate debt publicly issued in the US domestic market.Back in early March, Warren Buffett mentioned that credit conditions were tightening again - and this was probably one of the indexes he was looking at. Since March, the index has declined.

All of these indicators are still too high, but there has been progress.

Blight Laws and Foreclosed Properties

by Calculated Risk on 5/03/2009 11:49:00 AM

Here are a few stories on cities fighting foreclosure related blight ...

From the San Francisco Chronicle: Vacant foreclosed homes spawn blight, crime

Next door to Jeffrey Cash's tidy East Oakland bungalow sits a boarded-up foreclosed house that has been vacant for months, attracting locals who shoot dice in the driveway, smoke crack on the porch and dump debris in the yard, he said.From the Boston Herald: City liens on lenders

...

His situation is emblematic of a larger problem. The droves of vacant foreclosures nationwide and locally, many of them clustered in low-income areas, act as magnets for crime and create neighborhood blight, according to residents and civic leaders.

...

Many [cities] turn to anti-blight ordinances to try to force the banks that own the foreclosures to take care of them - mow the lawns, board up windows and doors - or face stiff fines if they don't. A California bill enacted in September (SB1137) allows municipalities to charge lenders $1,000 a day for failing to maintain foreclosed properties; some cities already have similar anti-blight provisions in place.

City inspectors have slapped thousands of dollars in liens on 43 vacant or foreclosed properties blighting Hub neighborhoods to halt the national housing crisis from spreading more urban decay.From the WSJ: Banker: 'What'd I Do Wrong, Officer?' Cop: 'You've Got Algae in the Pool, Sir'

Among those being targeted are big banks, including Deutsche Bank and Wells Fargo, who have ignored their responsibility to maintain the seized homes. ...

Officials at a Citigroup Inc. office in St. Louis placed a call to this desert town recently. The bank had caught word that Indio was coming after the lending giant with fines and threats of criminal charges. The offense: an algae-infested swimming pool at 79760 Eagle Bend Court.These fines will push the lenders to sell the properties quicker - or demolish them - or possibly not even foreclose on some properties.

...

[L]ast year, Indio passed a law that allowed it to charge banks with a criminal misdemeanor if they allowed a home to fall into disrepair.

"If I need to do it, I'll say, 'Mr. Bank President, if you don't come and take care of your property, we're going to come arrest you and take you to court in California,'" says Brad Ramos, Indio's long-serving police chief.

...

After the letters from Indio, Citigroup paid a $3,450 fine to Indio and sent a cleaning crew to fix the pool at Eagle Bend Court where Citigroup had managed the foreclosure process.

Jim the Realtor: "Selling like hotcakes"

by Calculated Risk on 5/03/2009 09:02:00 AM

This video might surprise some people ...

Jim takes us on a tour of a new home site in Carmel Valley, San Diego (Video on May 2nd). Jim said these homes are "selling like hotcakes".

Just a reminder, new home sales are counted by the Census Bureau when the contract is signed (even before the homes are built).

Note: Carmel Valley is in a newer area of San Diego (east of Del Mar).

Saturday, May 02, 2009

Shiller on Depression Scares

by Calculated Risk on 5/02/2009 07:59:00 PM

Professor Shiller writes in the New York Times: Depression Scares Are Hardly New

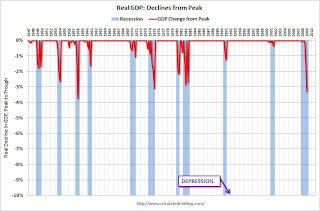

WHAT is the chance that the current downturn will morph into another Great Depression? That question has been preoccupying people for months.Here is a graph comparing the decline in real GDP for the current recession with other recessions since 1947. Depression is marked on the graph as -10%.

The popular mood has a huge impact on the economy, so it’s worth noting what many people seem to forget: Depression scares come and go. And by one authoritative measure, the current outbreak of concern has been surprisingly mild.

The University of Michigan Surveys of Consumers have included in their regular measurements this specific question about fear of a prolonged depression:

“Looking ahead, which would you say is more likely — that in the country as a whole we’ll have continuous good times during the next five years or so, or that we will have periods of widespread unemployment or depression, or what?”

... A high score on the question means that the answers tilted toward continuous good times, with a low score tilting toward unemployment or depression. Since 1960, the average score has been 94.

If we define a depression scare as any time the score is below 65, there have been four such scares since 1951. They were in the periods from 1974 to 1975, during which 47 was the lowest score; from 1978 to 1982, with a low of 41; from 1990 to 1992, with a low of 54; and from 2008 to 2009, with a low (to date) of 59. Note that so far, at least, the worst reading in the current scare has not been as bad as those of the previous episodes.

In each case, the scare’s significance is further confirmed by electronically counting in news databases the number of articles containing the word pair “great depression.” There were huge peaks in the count during these periods.

Click on table for larger image in new window.

Click on table for larger image in new window.After the 6.1% SAAR decline in Q1 2009 GDP, the cumulative real decline is now 3.3% from the peak.

NOTE: GDP is reported on a real (inflation adjusted) Seasonally Adjusted Annual Rate (SAAR) basis. Real GDP declined about 1.5% in Q1.

Even though the current recession is already one of the worst since 1947, it is only about 1/3 of the way to a depression (commonly defined as a 10% decline in real GDP).

Stated another way, to reach a depression, the economy would have to decline at about the same annual rate as the last two quarters for the next four quarters.

Just to put this in perspective, during the Great Depression, real GDP declined 26.5% from the peak to the trough.

I believe the odds of the current recession becoming a depression are very low (much less another Great Depression), but I think the current period has far greater risks than those earlier periods because of the severe financial crisis.

Buffett on Housing and Consumer Spending

by Calculated Risk on 5/02/2009 01:59:00 PM

From MarketWatch: Buffett sees some housing market stabilization

"In the last few months you've seen a real pickup in activity although at much lower prices," Buffett said, citing data from Berkshire's real estate brokerage business, which is one of the largest in the U.S.Also from MarketWatch: Buffett: Consumer spending slump not over

...

"We see something close to stability at these much-reduced prices in the medium to lower part of the market," Buffett said.

The recent drop in consumer spending and the resulting pressure on retailing, manufacturing and services industries could last "quite a long time," Berkshire Hathaway Chairman Warren Buffett said Saturday.

"I think our retail businesses will not do well for some time" as U.S. consumers save more, Buffett told investors at the company's annual shareholders meeting. "I would not look for any quick rebound in retail, manufacturing and services businesses."

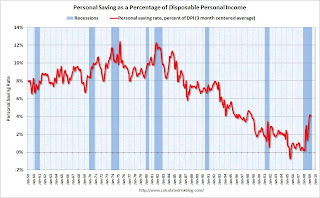

Click on graph for large image.

Click on graph for large image.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing) through the March Personal Income report released yesterday. The saving rate was 4.1% in March.

This suggest households are saving substantially more than during the last few years (when the saving rate was close to zero). The saving rate will probably continue to rise (an aging population usually pushes the saving rate higher) and a rising saving rate will repair household balance sheets, but, as Buffett notes, this will also keep pressure on personal consumption.

Foreclosures: Banks Setting Opening Auction Bid Below Amount Owed

by Calculated Risk on 5/02/2009 09:02:00 AM

From Jillayne Schlicke at Rain City Guide: Why are Banks Setting the Opening Auction Bid Below The Principal Balance?

I attended a foreclosure auction in Bellevue, WA last week to discover if the rumor was true that banks are opening their bids below the amount owed. I received confirmation from three professional investors that yes, the banks have been doing that, it’s no secret, and there seems to be no discernable pattern. It’s not one particular bank or lender, it’s not particular types of property or in any specific area. It appears to be random.Jillayne offers some possible explanations why the banks are bidding below the amount they are owed. I've been hearing similar stories in California.

... Only a few of the trustee sales attracted bidders, and the rest were deeded back to the bank. Out of the 92 active sales, 25 had opening bids below the amount owed to the bank.

Also, here is the monthly post: April Economic Summary in Graphs.

Friday, May 01, 2009

Summary Post

by Calculated Risk on 5/01/2009 10:27:00 PM

[Silverton Bank's failure] will ripple through the banking industry, which some industry experts said will have catastrophic consequences for banks across the Sun Belt as it impacts potentially hundreds of bank balance sheets.Many small banks invested in Silverton, or Silverton sold them loan participation in mostly Construction & Development loans. The losses could lead to other bank failures.

Bank Failure 32: America West Bank, Layton, Utah

by Calculated Risk on 5/01/2009 08:13:00 PM

Whom do they remind you of?

Moe, Curly, Larry.

by Soylent Green is People

From the FDIC: Cache Valley Bank, Logan, Utah, Assumes All of the Deposits of America West Bank, Layton, Utah

America West Bank, Layton, Utah, was closed today by the Utah Department of Financial Institutions, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Cache Valley Bank, Logan, Utah, to assume all of the deposits of America West.

...

As of December 31, 2008, America West Bank had total assets of approximately $299.4 million and total deposits of $284.1 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $119.4 million. Cache Valley Bank's acquisition of all of the deposits of America West Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

America West Bank is the 32nd bank to fail in the nation this year and the second in Utah. The last FDIC-insured institution to fail in the state was MagnetBank, Salt Lake City, on January 30, 2009.

WSJ: Citi Needs "Up to $10 Billion" in Capital

by Calculated Risk on 5/01/2009 07:54:00 PM

From the WSJ: Citi Said to Need Up to $10 Billion

Citigroup Inc. may need to raise as much as $10 billion in new capital, according to people familiar with the matter ...If Citi isn't required to raise capital, I doubt there will be much confidence in the stress test results. I was expecting a much higher number than $10 billion.

The bank ... is negotiating with the Federal Reserve and may need less if regulators accept the bank's arguments about its financial health ... In a best-case scenario, Citigroup could wind up having a roughly $500 million cushion above what the government is requiring.

Also, from the NY Times: Citigroup to Sell Japanese Units for $5.56 Billion

Citigroup said Friday that it would sell its Japanese brokerage and investment banking units for $5.56 billion, securing much-needed capital before results due this coming week from a U.S. government “stress test” of its financial health.

...

Citigroup said it would realize a loss of $200 million on the transaction, which would generate $2.5 billion in tangible common equity, a measure of financial health.

Bank Failure 31: Citizens Community Bank, Ridgewood, New Jersey

by Calculated Risk on 5/01/2009 05:05:00 PM

Mixing money aroma...

Two Jersey banks merge.

by Soylent Green is People

From the FDIC: North Jersey Community Bank, Englewood Cliffs, New Jersey, Assumes All of the Deposits of Citizens Community Bank, Ridgewood, New Jersey

Citizens Community Bank, Ridgewood, New Jersey, was closed today by the New Jersey Department of Banking and Insurance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with North Jersey Community Bank, Englewood Cliffs, New Jersey, to assume all of the deposits of Citizens Community Bank.

...

As of December 31, 2008, Citizens Community Bank had total assets of approximately $45.1 million and total deposits of $43.7 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $18.1 million. North Jersey Community Bank's acquisition of the deposits of Citizens Community Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives.

Citizens Community Bank is the 31st bank to fail in the nation this year and the first in New Jersey. The last FDIC-insured institution to fail in the state was Dollar Savings Bank, Newark, on February 14, 2004.

Bank Failure 30: Silverton Bank, National Association, Atlanta, Georgia

by Calculated Risk on 5/01/2009 04:14:00 PM

Silverton Bank, crash and burn.

May might be hectic

by Soylent Green is People

From the FDIC: FDIC Creates Bridge Bank to Take Over Operations of Silverton Bank, National Association, Atlanta, Georgia

The Federal Deposit Insurance Corporation (FDIC) created a bridge bank to take over the operations of Silverton Bank, National Association, Atlanta, Georgia, after the bank was closed today by the Office of the Comptroller of the Currency (OCC). ...

Silverton Bank did not take deposits directly from the general public nor did it make loans to consumers. It was a commercial bank that provided correspondent banking services to its client banks.

Silverton Bank had approximately 1,400 client banks in 44 states, and operated six regional offices. It provided a variety of services for its clients, including credit card operations, clearing accounts, investments, consulting, purchasing loans, and selling loan participations. Since the FDIC created a new bank to take over the operations of Silverton Bank, there is not expected to be any meaningful impact on the bank's clients.

...

At the time of its closing, Silverton Bank had approximately $4.1 billion in assets and $3.3 billion in deposits, all of which are expected to be within the FDIC's insurance limits.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $1.3 billion. Silverton Bank is the 30th bank to fail in the nation this year and the sixth in Georgia. The last FDIC-insured institution to fail in the state was American Southern Bank, Kennesaw, on April 24