by Calculated Risk on 4/17/2009 12:38:00 PM

Friday, April 17, 2009

Bernanke on Financial Innovation

From Fed Chairman Ben Bernanke: Financial Innovation and Consumer Protection (ht Rex)

The concept of financial innovation, it seems, has fallen on hard times. Subprime mortgage loans, credit default swaps, structured investment vehicles, and other more-recently developed financial products have become emblematic of our present financial crisis. Indeed, innovation, once held up as the solution, is now more often than not perceived as the problem. I think that perception goes too far, and innovation, at its best, has been and will continue to be a tool for making our financial system more efficient and more inclusive. But, as we have seen only too clearly during the past two years, innovation that is inappropriately implemented can be positively harmful. In short, it would be unwise to try to stop financial innovation, but we must be more alert to its risks and the need to manage those risks properly.With hindsight? Hoocoodanode?

...

[W]ith hindsight, we can see that something went wrong in recent years, as evidenced by the currently high rates of mortgage delinquency and foreclosure ... And the damage from this turn in the credit cycle--in terms of lost wealth, lost homes, and blemished credit histories--is likely to be long-lasting. One would be forgiven for concluding that the assumed benefits of financial innovation are not all they were cracked up to be.

...

Where does all this leave us? It seems clear that the difficulty of managing financial innovation in the period leading up to the crisis was underestimated ...

Record Unemployment Rates in California and North Carolina

by Calculated Risk on 4/17/2009 11:26:00 AM

From the BLS: Regional and State Employment and Unemployment: March 2009

Regional and state unemployment rates were nearly all higher in March. Forty-six states recorded over-the-month unemployment rate increases, North Dakota and the District of Columbia registered rate decreases, and 3 states had no change in their rate ...Probably more records coming ...

In March, Michigan again reported the highest jobless rate, 12.6 percent. The states with the next highest rates were Oregon, 12.1 percent; South Carolina, 11.4 percent; California, 11.2 percent; North Carolina, 10.8 percent; Rhode Island, 10.5 percent; Nevada, 10.4 percent; and Indiana, 10.0 percent. Nine additional states and the District of Columbia recorded unemployment rates of at least 9.0 percent. The California and North Carolina rates were the highest on record for those states.

emphasis added, records started in 1976.

Citi: Net Credit Losses Rising Rapidly

by Calculated Risk on 4/17/2009 09:47:00 AM

First, Citi has committed to "tell the market exactly" the results of the stress tests:

[I]t made sense to delay the launch of the exchange offer until we could tell the market exactly what the results of the stress test are.

Citigroup, April 17, 2009

And from the investor presentation:

And from the investor presentation:Click on graph for larger image in new window.

Note the rapid rise in card NCLs. NCLs jumped from 8.04% in Q4 to 10.18% in Q1 2009.

Mortgage NCLs are rising sharply too.

The second graph shows the 90+ Days Past Due (DPD) trend for 1st and 2nd mortgages, and the Net Credit Losses.

The second graph shows the 90+ Days Past Due (DPD) trend for 1st and 2nd mortgages, and the Net Credit Losses. The 90+ DPD is increasing rapidly for 1st mortgages - jumping from 5.71% in Q4, to 7.15% in Q1 2009.

Credit losses are still rising rapidly at Citi.

Citi Announces a Profit

by Calculated Risk on 4/17/2009 08:32:00 AM

From Bloomberg: Citigroup Profit Exceeds Estimates on Trading, Accounting Rule

Citigroup Inc. [reported] a $1.6 billion profit on trading gains and an accounting benefit for companies in distress.So when do they pay back the TARP money?

...

While the bank cut compensation costs and took fewer writedowns, it couldn’t halt rising delinquencies on home and credit-card loans. Citigroup benefited from higher fixed-income trading revenue ...

Citigroup posted a $2.5 billion gain because of an accounting change adopted in 2007. Under the rule, companies are allowed to record any declines in the market value of their own debt as an unrealized gain.

Report: One-Third of REOs Seriously Damaged

by Calculated Risk on 4/17/2009 12:31:00 AM

From CNN: Experts: Some foreclosed homes too damaged to sell

"About a third of all of the foreclosed properties nationwide have been so damaged, either by the previous owners or by criminal gangs coming in after the foreclosure, that they no longer qualify for standard mortgage financing," [researcher] Thomas Popik told CNN. "So there is going to be all kinds of government programs to help, but if they don't qualify for standard mortgage financing, there's no one to buy these properties."This probably explains some of the "shadow" inventory.

Popik says responses from thousands of real estate agents nationwide to the questionnaires he sends out quarterly indicate that badly damaged foreclosed homes ... are a much bigger element of the national housing picture than officials in Washington have acknowledged.

"In many cases, it costs so much to rehabilitate these houses, it's just not cost-effective," he told CNN. "And the properties are eventually going to be bulldozed."

Thursday, April 16, 2009

Bank Stress Test Release Date: May 4th

by Calculated Risk on 4/16/2009 10:25:00 PM

From Bloomberg: U.S. Aims to Release Bank Stress-Test Results May 4 (ht jb)

The Federal Reserve and other regulators aim to release the results of stress tests on 19 of the biggest U.S. banks on May 4, a central bank official said.A potential capital shortage is a reportable material event and therefore all results must be released for banks requiring additional investment.

Regulators also plan to publish a paper on their methods on April 24, according to the official. The May 4 results will include any plans for boosting capital to weather a deeper economic downturn, the person said.

Procedures for releasing information on specific firms, including whether the banks themselves or the supervisors will release the results, are still under discussion. The Securities and Exchange Commission, which sets rules for what publicly traded companies must disclose to investors about their financial condition, is involved in the talks, the person said.

The goal of publishing the stress-test methods is to bolster credibility of the assessments, which will expose weaker banks and may boost confidence in stronger ones.

May 4th is a Monday ... I wonder if the results will be released pre-market (or even leaked Sunday night).

Fed's Yellen: A Minsky Meltdown: Lessons for Central Bankers

by Calculated Risk on 4/16/2009 08:06:00 PM

From San Francisco Fed President Janet Yellen: A Minsky Meltdown: Lessons for Central Bankers

... with the financial world in turmoil, Minsky’s work has become required reading. It is getting the recognition it richly deserves. The dramatic events of the past year and a half are a classic case of the kind of systemic breakdown that he—and relatively few others—envisioned.Much of the speech is about Minsky, but here are some excerpts on bubbles and monetary policy:

Central to Minsky’s view of how financial meltdowns occur, of course, are “asset price bubbles.” This evening I will revisit the ongoing debate over whether central banks should act to counter such bubbles and discuss “lessons learned.” This issue seems especially compelling now that it’s evident that episodes of exuberance, like the ones that led to our bond and house price bubbles, can be time bombs that cause catastrophic damage to the economy when they explode.

[T]his evening I want to address another question that has been the subject of much debate for many years: Should central banks attempt to deflate asset price bubbles before they get big enough to cause big problems? Until recently, most central bankers would have said no. They would have argued that policy should focus solely on inflation, employment, and output goals—even in the midst of an apparent asset-price bubble. That was the view that prevailed during the tech stock bubble and I myself have supported this approach in the past. However, now that we face the tangible and tragic consequences of the bursting of the house price bubble, I think it is time to take another look.This is an interesting topic. I agree with Yellen's emphasis on regulation and oversight. I think it was easy to identify the surge in credit (especially home borrowing) and that lending standards had become very lax. That should have set off the alarm bells for regulators.

Let me briefly review the arguments for and against policies aimed at counteracting bubbles. The conventional wisdom generally followed by the Fed and central banks in most inflation-targeting countries is that monetary policy should respond to an asset price only to the extent that it will affect the future path of output and inflation, which are the proper concerns of monetary policy. ... policy would not respond to the stock market boom itself, but only to the consequences of the boom on the macroeconomy.

However, other observers argue that monetary authorities must consider responding directly to an asset price bubble when one is detected. This is because—as we are witnessing—bursting bubbles can seriously harm economic performance, and monetary policy is hard-pressed to respond effectively after the fact. ...

What are the issues that separate the anti-bubble monetary policy activists from the skeptics? First, some of those who oppose such policy question whether bubbles even exist. ...

Second, even if bubbles do occur, it’s an open question whether policymakers can identify them in time to act effectively. Bubbles are not easy to detect because estimates of the underlying fundamentals are imprecise. ...

Now, even if we accept that we can identify bubbles as they happen, another question arises: Is the threat so serious that a monetary response is imperative? It would make sense for monetary policy makers to intervene only if the fallout were likely to be quite severe and difficult to deal with after the fact. ...

Still, just like infections, some bursting asset price bubbles are more virulent than others. The current recession is a case in point. As house prices have plunged, the turmoil has been transmitted to the economy much more quickly and violently than interest rate policy has been able to offset.

You’ll recognize right away that the assets at risk in the tech stock bubble were equities, while the volatile assets in the current crisis involve debt instruments held widely by global financial institutions. It may be that credit booms, such as the one that spurred house price and bond price increases, hold more dangerous systemic risks than other asset bubbles. By their nature, credit booms are especially prone to generating powerful adverse feedback loops between financial markets and real economic activity. It follows then, that if all asset bubbles are not created equal, policymakers could decide to intervene only in those cases that seem especially dangerous.

That brings up a fourth point: even if a dangerous asset price bubble is detected and action to rein it in is warranted, conventional monetary policy may not be the best approach. It’s true that moderate increases in the policy interest rate might constrain the bubble and reduce the risk of severe macroeconomic dislocation. In the current episode, higher short-term interest rates probably would have restrained the demand for housing by raising mortgage interest rates, and this might have slowed the pace of house price increases. In addition, as Hyun Song Shin and his coauthors have noted in important work related to Minsky’s, tighter monetary policy may be associated with reduced leverage and slower credit growth, especially in securitized markets. Thus, monetary policy that leans against bubble expansion may also enhance financial stability by slowing credit booms and lowering overall leverage.

Nonetheless, these linkages remain controversial and bubbles may not be predictably susceptible to interest rate policy actions. And there’s a question of collateral damage. Even if higher interest rates take some air out of a bubble, such a strategy may have an unacceptably depressing effect on the economy as a whole. There is also the harm that can result from “type 2 errors,” when policymakers respond to asset price developments that, with the benefit of hindsight, turn out not to have been bubbles at all. For both of these reasons, central bankers may be better off avoiding monetary strategies and instead relying on more targeted and lower-cost alternative approaches to manage bubbles, such as financial regulatory and supervisory tools. I will turn to that topic in just a minute.

In summary, when it comes to using monetary policy to deflate asset bubbles, we must acknowledge the difficulty of identifying bubbles, and uncertainties in the relationship between monetary policy and financial stability. At the same time though, policymakers often must act on the basis of incomplete knowledge. What has become patently obvious is that not dealing with certain kinds of bubbles before they get big can have grave consequences. This lends more weight to arguments in favor of attempting to mitigate bubbles, especially when a credit boom is the driving factor. I would not advocate making it a regular practice to use monetary policy to lean against asset price bubbles. However recent experience has made me more open to action. I can now imagine circumstances that would justify leaning against a bubble with tighter monetary policy. Clearly further research may help clarify these issues.

Another important tool for financial stability

Regardless of one’s views on using monetary policy to reduce bubbles, it seems plain that supervisory and regulatory policies could help prevent the kinds of problems we now face. Indeed, this was one of Minsky’s major prescriptions for mitigating financial instability. I am heartened that there is now widespread agreement among policymakers and in Congress on the need to overhaul our supervisory and regulatory system, and broad agreement on the basic elements of reform.

emphasis added

Jim the Realtor on Nightline

by Calculated Risk on 4/16/2009 06:03:00 PM

Jim will be on Nightline tonight. Here is the story: Truth in Advertising: One Realtor's Strategy to Sell Foreclosed Homes

And here some highlights from various Jim videos. Check out Jim comparing a photo in the MLS, taken with a wide angle lens. with the actual yard (at about 2:50). Good stuff ...

TARP COP Elizabeth Warren on the Daily Show

by Calculated Risk on 4/16/2009 04:08:00 PM

Elizabeth Warren on the Daily Show talking about the TARP.

"That is the first time in probably six months to a year that I felt better. Something - I don't know what it is you just did right there - but for a second that was like financial chicken soup for me."For Canadians

Jon Stewart

Part 1:

Part 2:

Regulators Give BankUnited 20 Days to Deal or Die

by Calculated Risk on 4/16/2009 02:54:00 PM

From South Florida Business Journal: BankUnited given 20 days to strike deal (ht FFF)

In a prompt corrective action directive, posted on the Office of Thrift Supervision’s Web site Thursday and issued two days earlier, Florida’s largest bank was ordered to submit a binding merger or acquisition agreement to the OTS within 15 days ...Here is the corrective action: PROMPT CORRECTIVE ACTION DIRECTIVE

BankUnited’s $5.89 billion in option ARMs accounted for 51 percent of its loan portfolio on Dec. 31.

The bank ended 2008 with $13.95 billion in assets, 1,098 employees, $8.61 billion in deposits in 86 branches, and 11 percent of its loans noncurrent.

Just a tease for BFF (Bank Failure Friday).

DataQuick: California Bay Area Home Sales Increase

by Calculated Risk on 4/16/2009 02:04:00 PM

From DataQuick: Bay Area home sales continue climb, median still below $300K

The number of homes sold in the Bay Area rose for the seventh month in a row in March, the result of continued bargain hunting in the East Bay and other foreclosure-discounted communities. ...Once again, ignore the median price - it is distorted by the mix.

A total of 6,325 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was up 25.7 percent from 5,032 in February and up 29.1 percent from 4,898 in March 2008, according to MDA DataQuick of San Diego.

Last year's March was the slowest in DataQuick's statistics, which go back to 1988. Last month was the third-slowest March of all time, ahead of last year and 6,210 sales in March 1995. March sales have averaged 9,025 and peaked in March 2004 at 12,645 sales.

...

"For now, the extent to which prices have fallen in the upscale markets is more difficult to gauge," he added, "because many of those areas are essentially in hibernation, with scant sales."

...

The use of government-insured FHA loans - a common choice among first-time buyers - represented a record 25.4 percent of all Bay Area purchase loans in March, up from 1.5 percent a year ago.

...

Last month 51.2 percent of all Bay Area resale homes had been foreclosed on at some point in the prior 12 months, down from 52.0 percent in February and up from 23.2 percent a year ago. By county it ranged from 11.5 percent in San Francisco to 70.0 in Solano.

...

Foreclosure activity is nearing its 2008 peak ...

This is the same story as SoCal - the sales activity is mostly in foreclosure ravaged areas, and the high end areas are in "hibernation".

Hotel Occupancy: RevPAR Off 28.1 Percent

by Calculated Risk on 4/16/2009 01:05:00 PM

More bad news for CRE today. General Growth (2nd largest mall owner) filed bankruptcy this morning. And Cushman & Wakefield reported the downtown office vacancy rate increased sharply in Q1.

And for lodging, occupancy and RevPAR (Revenue per available room), are off sharply year-over-year.

From HotelNewsNow.com: STR reports U.S. data for week ending 11 April 2009

In year-over-year measurements, the industry’s occupancy fell 17.9 percent to end the week at 52.6 percent (64.1 percent in the comparable week in 2008). Average daily rate dropped 12.5 percent to finish the week at US$96.60 (US$110.36 in the comparable week in 2008). Revenue per available room for the week decreased 28.1 percent to finish at US$50.85 (US$70.76 in the comparable week in 2008).

emphasis added

Click on graph for larger image in new window.

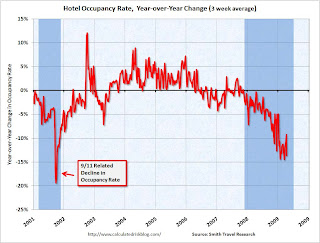

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 13.7% from the same period in 2008.

The average daily rate is down 12.5%, so RevPAR is off 28.1% from the same week last year.

Report: Downtown Office Vacancy Rate Rises to 12.5%

by Calculated Risk on 4/16/2009 11:22:00 AM

Note: This report just covers downtown areas. The REIS report covers more area and shows the nationwide U.S. office vacancy rate at 15.2% in Q1.

From Bloomberg: U.S. Office Vacancies Rise to Three-Year High, Cushman Says

Office vacancies in U.S. downtowns increased to 12.5 percent in the first quarter, the highest in three years, as companies cut jobs and new buildings came onto the market, Cushman & Wakefield said.You think?

The national [downtown] office vacancy rate climbed from 11.2 percent in the fourth quarter and 9.9 percent a year earlier ...

“This will be a very difficult year for commercial real estate and for office markets in particular,” said Maria Sicola, executive managing director and head of Americas Research for Cushman & Wakefield ...

On falling rents:

Downtown office landlords cut their asking rents by an average of 2.2 percent in the first quarter ... “We are just entering into what will be a very strong market for the tenant. We can see rents come down 10 or 15 percent or even 20 percent before this is over.” [Sicola said]CRE is getting crushed.

Philly Fed: Manufacturing "contracted less severely" this Month

by Calculated Risk on 4/16/2009 10:05:00 AM

Here is the Philadelphia Fed Index released today: Business Outlook Survey.

The region's manufacturing sector contracted less severely this month ... Indexes for general activity, new orders, and employment remained negative but improved somewhat from March. ... Most of the survey's broad indicators of future activity improved notably this month, suggesting that the region's manufacturing executives expect declines to bottom out over the next six months.

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, increased from -35.0 in March to -24.4 this month. Although clearly indicating continued overall decline, this reading is the highest since January. The index has been negative for 16 of the past 17 months, a span that corresponds to the current recession ...

Employment losses remained widespread this month, with over 45 percent of the firms reporting declines. The current employment index, though still negative at -44.9, increased seven points from its record low reading last month.

...

Broad indicators of future activity showed significant improvement this month. The future general activity index remained positive for the fourth consecutive month and increased markedly from 14.5 in March to 36.2, its highest reading in 18 months (Note:click here for Philly Fed chart of future activity index).

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Philly index for the last 40 years.

"The index has been negative for 16 of the past 17 months, a period that corresponds to the current recession ."

Unemployment Insurance: Continued Claims above 6 Million

by Calculated Risk on 4/16/2009 08:47:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending April 11, the advance figure for seasonally adjusted initial claims was 610,000, a decrease of 53,000 from the previous week's revised figure of 663,000. The 4-week moving average was 651,000, a decrease of 8,500 from the previous week's revised average of 659,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 4 was 6,022,000, an increase of 172,000 from the preceding week's revised level of 5,850,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows weekly claims and continued claims since 1971. This is not adjusted for changes in population (I'll add that graph next week).

The four week moving average is at 651,000.

Continued claims are now at 6.02 million - the all time record.

The decline to 610,000 initial claims this week is potentially good news, but this is just one week of data, and this series is very volatile. As I mentioned in End of Recessions and Unemployment Claims, the four-week average of initial weekly unemployment claims is a closely watched indicator of the possible end of a recession. However, we need to see the four-week average decline by 20,000 to 40,000 or more from the peak before we get excited - and so far the four-week average is only off 8,500 from the peak of 659,500 last week.

Housing Starts: Near Record Low

by Calculated Risk on 4/16/2009 08:30:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 510 thousand (SAAR) in March, just above the revised record low of 488 thousand in January (the lowest level since the Census Bureau began tracking housing starts in 1959).

Single-family starts were at 358 thousand in March; just above the revised record low in January (356 thousand).

Permits for single-family units were 361 thousand in March, suggesting single-family starts will remain at about the same level in April.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Note that single-family completions of 550 thousand are still significantly higher than single-family starts (358 thousand). This is important because residential construction employment tends to follow completions, and completions will probably decline further.

Total starts and single family starts declined in March (compared to February), and are both just above the record low set in January. This is the second month in a row with starts slightly above the record low - this is just a slight increase in total starts and single family starts are essentially flat with the record low.

It is still too early to call the bottom in January, however I do expect housing starts to bottom sometime in 2009.

General Growth Properties Files Bankruptcy

by Calculated Risk on 4/16/2009 08:13:00 AM

From the WSJ: Mall Titan Enters Chapter 11

Mall owner General Growth Properties Inc. sought bankruptcy protection early Thursday in one of the largest real-estate failures in U.S. history ...The Mall is Flattened ...

The bankruptcy will have far-reaching implications for the mall industry, including putting pressure on already declining property values of U.S. malls ...

China GDP increases 6.1% from Q1 2008

by Calculated Risk on 4/16/2009 12:58:00 AM

From MarketWatch: China's economy expands 6.1% in first quarter

Gross domestic product expanded 6.1% in the first quarter from a year earlier, after expanding 6.8% in the fourth quarter, government data showed Thursday.China reports GDP growth on a year-over-year basis, so this is the growth from Q1 2008 (as opposed to quarterly growth annualized like in the U.S.). Since growth was fairly robust early last year, this suggest GDP is probably slightly positive in the most recent quarter.

...

The Chinese government said Thursday that recent economic data showed "positive changes with better performance than expected."

A spokesman for the National Bureau of Statistics in a statement Thursday cited improvement in agriculture and a steady increase in industrial production, despite falling profits.

However, the bureau also warned that problems remain, including a fall in demand for Chinese exports, reduced government revenue and increased difficulties on employment.

"The national economy is confronted with the pressure of slowdown," the spokesman said.

Wednesday, April 15, 2009

Six Banks to Receive up to $9.9 Billion for Mortgage Modifications

by Calculated Risk on 4/15/2009 09:43:00 PM

From CNNMoney: Obama launches mortgage rescue plan

The Treasury Department announced Wednesday the first six participants to sign up for President Obama's plan. They include three of the nation's largest banks: JPMorgan Chase (JPM, Fortune 500), which will get up to $3.6 billion in subsidy and incentive payments; Wells Fargo (WFC, Fortune 500), $2.9 billion; and Citigroup (C, Fortune 500), $2 billion. The others are GMAC Mortgage, $633 million; Saxon Mortgage Services, $407 million; and Select Portfolio Servicing, $376 million.This is the Making Home Affordable plan.

...

The modification plan calls for the servicer to reduce interest rates so that the monthly obligation is no more than 38% of a borrower's pre-tax income, and then the government would kick in money to bring payments down to 31% of income. Servicers can also reduce the loan balance to achieve these affordability levels. The government will share in the cost, up to the amount the servicer would have received if it had reduced the interest rates.

Only loans where the cost of the foreclosure would be higher than the cost of modification would qualify. Also, Treasury will not provide subsidies to reduce rates to levels below 2%.

Mortgage Defaults Spreading to Higher Priced Areas

by Calculated Risk on 4/15/2009 05:46:00 PM

From Zach Fox at the North County Times: Mortgage defaults hit new high, spread to upscale neighborhoods

Mortgage delinquencies hit a new high in March ... according to a report released Tuesday.Defaults: Movin' on up!

The report also showed that notices of default, the first step in the foreclosure process, have spiked in the region's tonier neighborhoods ---- places that, until now, have avoided the mass foreclosures elsewhere ---- while appearing to have reached a plateau in lower-end regions, which have already been hammered.

In fact, areas such as Valley Center and Rancho Bernardo shot up to be among the leaders in North County for most foreclosure notices per 1,000 houses.

...

Default notices shot to new highs in areas of Carlsbad, Rancho Bernardo and Rancho Penasquitos. On the other hand, notices in foreclosure-prone neighborhoods such as Oceanside and Escondido were below peaks reached earlier.

In fact, one region of Rancho Bernardo saw more default notices in March per 1,000 homes than Oceanside's 92057 ZIP code ---- the most foreclosure-prone neighborhood in North County over the last two years.