by Calculated Risk on 4/05/2009 07:48:00 PM

Sunday, April 05, 2009

Introducing Hoocoodanode Comments

I've switched the comments over to Ken's Hoocoodanode system. This should work well with an iPhone, Blackberry and other handheld devices. Also "comments" provides a link for those who want to open the comments in a new tab.

Currently the "comments" indicator on the blog doesn't indicate the number of comments. This should be added soon.

Also Ken will be adding the number of visitors online and an indicator that new comments are pending - plus much much more!

There is a nice preview, and you can also edit your comments. Please try it out. If you see any glitches, please post a comment. Enjoy. CR

Stress Test Update: Regulator Meeting Planned

by Calculated Risk on 4/05/2009 05:02:00 PM

UPDATE: A reader notes:

One more point worth making - Results of the stress tests, especially if they show potential capital shortage, surely constitute a reportable material event and therefore must be publicly disclosed to the SEC to protect the shareholders, who are likely to be diluted.The WSJ has an update: Bank Stress Test Meeting Planned. A few points:

It is not just the matter of public trust and fairness, it is the SEC law.

Top federal bank regulators plan to meet early this week to discuss how to analyze the results of stress tests being conducted on the country's 19 largest banks ... The Federal Reserve is overseeing the stress-test analysis process. People familiar with the matter said the final analysis isn't likely to be completed until at least the end of the month.The end of April was the original schedule, FAQ:

Q10: When will the process be completed?A suggestion for regulators: Ignore the "baseline case" - it is inoperative.

A: The Federal supervisory agencies will conclude their work as soon as possible, but no later than the end of April.

On the differences between assets with the same characteristics:

"[All loan portfolios, even with the same surface characteristics, don't perform the same at all." [said Eugene Ludwig, chief executive of Promontory Financial Group, which advises financial firms]This is an understatement. Last April, Ambac discussed a Bear Stearns deal:

"Ambac originally projected that losses on the underlying collateral of the Bear Stearns transaction would be between 10% and 12%, but now expects losses at 81.8% of underlying collateral ..."This is part of the problem in valuing assets - assets with identical characteristics may have significantly different losses. If it was securitized by Bear Stearns, or the loans were originated by New Century (and others), I'd be especially careful.

And on transparency:

"I think serious efforts will be made to respect the confidential nature of the test and its results," [Ludwig] said, but added that "there is a real danger that the results of the stress test are uncovered and this roils the markets."The results of the stress test should be made public - at least for any bank taking TARP money. This would build confidence in the process, otherwise serious doubts will remain.

CBS Face the Nation: Geithner on PPIP

by Calculated Risk on 4/05/2009 12:15:00 PM

Here is a CQ Transcript: Treasury Secretary Geithner on CBS’s ‘Face the Nation’. Here is a brief excerpt:

SCHIEFFER: Let me ask you about this plan you have put together to create these public-private partnerships to buy these toxic assets that these banks owned to get them off these bank books so they -- the idea is that, if they can do that, then they can start lending again.Three comments (addressing text in bold):

But last week the government did change the accounting rules. So the banks can, in essence, put a different value on those assets. Some people are now saying that, with this in place, the banks may no longer want to sell those toxic assets.

So I guess the question is, can you get the banks to participate in this program?

And do you feel you have the power to force them to sell those toxic assets?

GEITHNER: Bob, banks have a large incentive, now, to clean up their balance sheets, to make it easier for them to go raise equity from the markets, from private investors. So they’re going to have significant incentives to clean up their balance sheets. This gives them a way to do that that did not exist before that.

Just as an example, you know, if you had to sell your home tomorrow, in a world where nobody could get a mortgage to buy your home, you’d have to sell at an enormously low price.

You’d reluctant to sell. You might end up keeping your home longer than you want, not moving to some -- to take a new job, where you can earn more money, going forward.

That’s part of what’s happening to our financial system today.

GEITHNER: So what we try to do is lay out a proposal for how to create a market for these loans, bring in private investors to help protect the government from not overpaying for these assets.

This is just part, though, of a broad set of programs to help address the housing crisis, make sure banks have enough capital to lend even in a deeper recession, make sure we’re providing direct lending to help get small business lending going again. It’s an important part of this -- part of this (inaudible) program.

Mortgage Reform Bill Moving Ahead

by Calculated Risk on 4/05/2009 10:26:00 AM

From the LA Times: Bill would fundamentally reform home mortgage industry.

The Mortgage Reform and Anti-Predatory Lending Act of 2009 (H.R. 1728) was introduced March 26 by coauthors Rep. Brad Miller (D-N.C.), Rep. Melvin Watt (D-N.C.) and Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee ...We need to see the details. If lenders are required to take a 5% stake in all but 30-year fixed-rate loans, many of the non-traditional loans will go away (especially from smaller lenders).

Here's what the legislation would do:

* Ban all fees paid to loan officers that are tied to the interest rate of the mortgage or the type of the loan. ...

* Create mandatory minimum national quality standards for all mortgages. The rules would encourage lenders to make fully documented 30-year, fixed-rate loans with prevailing market rates, as opposed to loans with higher-risk features such as adjustable payments and negative amortization. The bill would also impose a federal "duty of care" standard requiring loan officers to offer applicants terms and rates that are "appropriate" to their income and ability to repay. ...

* Allow borrowers who are put into mortgages that violate the new law to seek legal redress through cancellation of the loan contract, refund of all payments and fees and compensation for legal costs.

Borrowers who lied or committed fraud on their loan applications would have no such recourse. The bill would also extend liability for rule violations to third-party securitizers who buy loans for repackaging into mortgage bonds. Originators of all but fully documented 30-year, fixed-rate loans would be required to retain at least a 5% stake in the loan until it's finally paid off. If the loan goes into default, they would retain some economic stake in the losses.

I also hope Mr. Frank will not try to bring back DAPs again. The data is conclusive - DAPs are bad for housing, the economy and America.

Update: Here is the text of the bill.

Saturday, April 04, 2009

Bankrupt Brits

by Calculated Risk on 4/04/2009 09:59:00 PM

From The Times: Bankrupt Britain: 340 people go bust every day

Begbies Traynor, the insolvency and restructuring group, reckons more than 35,000 firms could go under this year – equivalent to more than 95 a day. The figure would be 18% higher than during the previous peak in the 1990s crash. Nick Hood at Begbies said he would not be surprised if the number rose to 40,000 by the end of the year.The Q1 bankruptcy stats for the U.S. will be very ugly. There was a spike in bankruptcy filings in the U.S. in 2005 prior to the new bankruptcy law taking effect - the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA). Over 2 million bankruptcies were filed in 2005 - and that is a tough record to beat, but I wouldn't be surprised if 2009 is the 2nd worst year ever in the U.S.

Begbies forecasts that as many as 125,000 people will go bust this year – well above the 107,000 peak in 2006 – equivalent to 342 people a day.

...

In America an average 5,945 bankruptcies were filed each day last month by troubled consumers – the highest level since October 2005.

| Click on cartoon for larger image in new window. Repeat of a great cartoon from Eric G. Lewis, a freelance cartoonist living in Orange County, CA. |

Krugman on Crisis

by Calculated Risk on 4/04/2009 07:36:00 PM

“I never imagined that these days I'd get to the epicenter, the place, the heart of the problem, by a commuter train on New Jersey Transit. But here it is. It's the crisis of our lifetime.”From the Desert Sun: Nobel Prize winner Krugman shares harsh view on economic woes (ht Jonathan)

Paul Krugman, April 3, 2009

... "This is terrifying,” [Paul Krugman] said. “I did not imagine in my worst expectations that this would be this hard. I thought that we could sit down and sketch out the kinds of things, in principle, you could do to offset this type of global slump. But I never thought it would be this hard, in practice, to implement.”Jon Lansner at the O.C. Register has more: Krugman: ‘Maybe we need a new bubble to invest in!’ (excerpts from a Twitter transcript)

...

Krugman said, the lesson from Japan is that countries facing a similar fate should be “very aggressive and cut interest rates early.”

And though the United States did - “unfortunately, it didn't turn out to be enough,” he said.

“Once you're in a world where there's just not enough demand out there and you're cutting interest rates down to zero, then you're in a world where the rules of economics go into reverse - much like ‘Alice in Wonderland,'” he said.

How did this happen? We forgot the Great Depression! We exposed ourselves 2 a repeat. May not be a repeat BUT close. Debt levels before this crash approached pre-Depression levels. And we had “the mother of all housing bubbles.” By one professor’s math interest rates should be at minus-8% based on the economy’s plight Big banks are in trouble. Some insolvent. “Socialist” bank seizures in US every week. But giant holding companies? Are we doing enough? If you think this ends soon, then “Yes!” But if this runs on then “No!” This looks inadequate. Stock rally on good news? Not good news just things not getting much worse! We are not clueless. We have not done enough. I am terrified. Hope we find the audacity to fix it.

The DAP Legacy: FHA Delinquencies Rise Sharply in 2008

by Calculated Risk on 4/04/2009 04:47:00 PM

Note: Working on comments today - sorry for any inconvenience.

For years I've complained about FHA related seller-funded Down payment Assistance Programs (DAPs). These programs circumvented the FHA down payment requirements by having the seller funnel the "down payment" to the buyer through a "charity" (for a small fee of course). In 2008, low end buyers with no money for a down payment, flocked to these programs with predictable results ...

From Zach Fox at the NC Times: Delinquencies for FHA surpassed those of subprime loans last year

Once considered among the safest loans available, government-insured mortgages issued last year have performed worse than the subprime loans that kicked off the collapse of the nation's housing market, according to data from a research firm.For more on DAPs, see Tanta's DAP for UberNerds

...

huge level of defaults on loans insured by the Federal Housing Administration, which analysts called "stunning," raise the specter of further market turmoil and more taxpayer funds sent toward fixing the mortgage crisis.

"Frankly, I wouldn't be surprised if you called me up in a year from now and asked, 'What do you think about the FHA bailout?' " said Norm Miller, a professor at University of San Diego's Burnham-Moores Center for Real Estate.

First American CoreLogic ... reported this week that 20.7 percent of all FHA loans issued in 2008 were at least 60 days late by 10 months after the origination date. By the same metric, 14.1 percent of subprime loans issued in 2007 were 60 days delinquent.

The main problem with the delinquent FHA loans was low down-payment requirements, said Sam Khater, senior economist for First American CoreLogic.

...

By definition, FHA loans carry little equity. But the risk of failure was increased by the implementation of "down payment assistance" programs implemented by home builders, said Ramsey Su, a San Diego housing analyst.

...

The government has since discontinued the programs.

Journalists: A story that follows the history of DAPs, profiles the "charities" involved, shows the rising defaults associated with DAPs, examines the efforts of the FHA, HUD and the IRS to eliminate DAPs, and investigates the rent seeking activities of the "charities" (contribution to politicians, etc.) would be very interesting. Follow the money - as they say.

Fannie, Freddie Lift Foreclosure Moratorium

by Calculated Risk on 4/04/2009 01:52:00 PM

Something I should have mentioned earlier this week ...

From the Washington Independent: Fannie, Freddie Quietly Lift Moratorium on Foreclosures (ht many!)

A ban on foreclosure sales and evictions from houses owned by mortgage giants Fannie Mae and Freddie Mac ... is over.This was just the scheduled end of the moratorium - and this will probably lead to an increase in foreclosures for April.

Spokesmen for Fannie Mae and Freddie Mac confirmed the ban ended March 31 ...

Bailout: The Potomac Two-Step

by Calculated Risk on 4/04/2009 08:52:00 AM

From the WaPo: Administration Seeks an Out On Bailout Rules for Firms

The Obama administration is engineering its new bailout initiatives in a way that it believes will allow firms benefiting from the programs to avoid restrictions imposed by Congress, including limits on lavish executive pay, according to government officials.

Administration officials have concluded that this approach is vital for persuading firms to participate in programs funded by the $700 billion financial rescue package.

The administration believes it can sidestep the rules because, in many cases, it has decided not to provide federal aid directly to financial companies, the sources said. Instead, the government has set up special entities that act as middlemen, channeling the bailout funds to the firms and, via this two-step process, stripping away the requirement that the restrictions be imposed ...

Friday, April 03, 2009

Summary Post

by Calculated Risk on 4/03/2009 11:04:00 PM

Note: We are testing a new comment system from Ken (CR Companion). You can try it here http://www.Hoocoodanode.org/welcome

Today was mostly about the (Un)Employment report. Here are three posts:

Best to all.

Inflation vs. Deflation

by Calculated Risk on 4/03/2009 09:43:00 PM

It looks like the FDIC cancelled Friday ...

From Simon Johnson and James Kwak of Baseline Scenario writing in the WaPo: The Radicalization of Ben Bernanke

... Shortly after joining the Fed in 2002, Bernanke gave a speech describing how the Fed could prevent deflation, i.e., a general decline in prices. The key theme was that, in a pinch, the Fed could simply print more dollars -- for example, by buying long-term bonds on the market -- which reduces the value of each dollar in circulation and therefore raises the dollar price of goods and services. "Under a paper-money system," Bernanke explained, "a determined government can always generate higher spending and hence positive inflation." In a time of economic overconfidence, the discussion seemed largely academic. But it is now clear that Bernanke intends to follow through on it.Tim Duy at Economist's View responds: Johnson and Kwak vs. Bernanke

The implicit assumption is that the Fed is expanding the money supply via a policy of quantitative easing with the explicit goal of raising inflation expectations. First off, as Bernanke said once again today, he does not describe policy as quantitative easing:It would seem the bigger concern in the short term is deflation, and I've been assuming the Fed was trying to raise inflation expectations - and I've been calling the Fed's policy "quantitative easing".In pursuing our strategy, which I have called "credit easing," we have also taken care to design our programs so that they can be unwound as markets and the economy revive. In particular, these activities must not constrain the exercise of monetary policy as needed to meet our congressional mandate to foster maximum sustainable employment and stable prices.Pay close attention to Bernanke's insistence that the Fed's liquidity programs are intended to be unwound. If policymakers truly intend a policy of quantitative easing to boost inflation expectations, these are exactly the wrong words to say. Any successful policy of quantitative easing would depend upon a credible commitment to a permanent increase in the money supply. Bernanke is making the opposite commitment - a commitment to contract the money supply in the future. Is this any way to boost inflation expectations? See also Paul Krugman:In that case monetary policy can’t get you there: once the interest rate hits zero, people will just hoard any additional cash – we’re in the liquidity trap. The only way to make monetary policy effective once you’re in such a trap, at least in this framework, is to credibly commit to raising future as well as current money supplies.If Bernanke really intends to raise inflation expectations, he is making an elementary error by reiterating his intention to shrink the Fed's balance sheet in the future. The current increase in money supply is thus transitory and should not affect future expectations of inflation. I can't see him making such an elementary error, which suggests that Bernanke's word should be taken at face value; he intends policy to be "credit easing," not the oft-cited "quantitative easing."

Dr. Duy writes:

Bottom line: I reiterate my concerns that the media and market participants are using the term "quantitative easing" too loosely. I understand that this complaint falls on largely deaf ears. If Bernanke is using quantitative easing to boost inflation expectations, then I think we need to seriously address the likely ineffectiveness of any such policy when Fed officials repeatedly promise to shrink the balance sheet in the future.Mark Thoma at Economist's View has more: Inflation and the Fed

This is, in essence, a question about whether inflation expectations are anchored or not, and that is also the key question is this discussion of the odds of deflation by John Williams of the SF Fed. He argues that the previous decades can be broken into a recent time period in which expectations appear to be well-anchored, the time period 1993 through 2008 is cited in the linked discussion, and a time period in the late 1960s and the 1970s when inflation expectations do not appear to be anchored (based upon Orphanides and Williams 2005). The paper also notes that recent surveys of professional forecasters are consistent with anchored expectations.I recommend the paper Professor Thoma linked to: The Risk of Deflation by John C. Williams, San Francisco Fed Director of Research

But past history shows us that expectations can move from one state to the other, from untethered to tethered, and there's no reason that cannot happen again, but in the other direction. So here I agree with Martin Wolf, it's dependent upon the credibility of policymakers. So long as people believe that the Fed is committed to preventing an outburst of inflation, and that they are capable of carrying through on that commitment, expectations will remain well-anchored. But if people believe that that Fed's hands are tied because of the harm reducing inflation would bring to the real economy, an out of control deficit, or due to political considerations that force them to accept inflation they could and would battle otherwise, then we have a different situation and long-run inflation expectations will change accordingly.

The evidence indicates that a substantial increase in slack can lead to deflation, but the depth and duration of the deflation depends on how well anchored inflation expectations are. Two policy implications can be drawn from this and other research on deflation. First, a central bank should take appropriate actions to stem the emergence of substantial slack in the economy and thereby reduce the risk of deflation. Second, it should clearly communicate its commitment to low positive rates of inflation. An example of such communication is the Federal Open Market Committee's recently released long-run inflation forecasts. Such words, backed by appropriate actions, reinforce the anchoring of inflation expectations and reduce the chances of a deflationary spiral.I need to think about this.

Hoocoodanode? New Comment System Beta Test

by Calculated Risk on 4/03/2009 06:54:00 PM

Ken (CR Companion) has developed a comment system tailored for the CR community.

The system has a dedicated server and is now available for beta testing.

The site is up and running and has been tested against IE 6, Firefox, Safari, and iPhone.

Ken wants to make it clear that we’re in test mode.

Here’s a welcome link to try out the comments (and a description from Ken): http://www.hoocoodanode.org/welcome.

Please feel free to go to the site, and provide Ken feedback.

If all goes well, and once any bugs get fixed, we will integrate the system in Calculated Risk - perhaps sometime next week.

A special thanks to Ken and everyone involved. CR

Waiting for the FDIC

by Calculated Risk on 4/03/2009 05:20:00 PM

If you missed this, here is a story about the FDIC takeover of Bank of Clark County: Anatomy Of A Bank Takeover in January.

Here is the audio from NPR. Click on graph for larger image in new window.

The first graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

The rally has taken the S&P up almost 25% from the low - but the market is still off 46% from the high.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500. The second graph compares four significant bear markets: the Dow during the Great Depression, the NASDAQ, the Nikkei, and the current S&P 500.

See Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries".

The second graph is Updated! about a week old<, but it still tells the tale.

Now back to waiting for the FDIC ...

Chrysler Pier Loans Still Haunting Banks

by Calculated Risk on 4/03/2009 03:51:00 PM

UPDATE: From the WSJ: Banks Balk at Obama Demand to Cut Chrysler Debt

Banks that loaned Chrysler LLC $6.8 billion are resisting government pressure to swap $5 billion of that for stock to slash the car maker's debt, according to several people familiar with the matter ...The banks still holding Chrysler pier loans are facing even more write-downs. (Pier loans are bridge loans that couldn't be sold and have been stuck on the bank's balance sheet). This was obvious before the Cerberus deal even closed: Chrysler's Bankers: Long Walk, Short Pier?

The lenders, which include J.P. Morgan Chase & Co., Goldman Sachs, Citigroup and Morgan Stanley ... own the rights to take control of Chrysler plants and assets, which were pledged as collateral for the loans, if the company files for bankruptcy protection.

...the Obama administration is demanding that these lenders cut their debt by $5 billion of its face value, or about 75%, said people familiar with the talks.

I'm sure Goldman is happy to have sold some of their loans at 80 cents on the dollar in early 2008.

OCC: More Seriously Delinquent Prime Loans than Subprime

by Calculated Risk on 4/03/2009 12:37:00 PM

From the Office of the Comptroller of the Currency and the Office of Thrift Supervision: OCC and OTS Release Mortgage Metrics Report for Fourth Quarter 2008

The Office of the Comptroller of the Currency and the Office of Thrift Supervision today jointly released their quarterly report on first lien mortgage performance for the fourth quarter of 2008. The report covers mortgages serviced by nine large banks and four thrifts, constituting approximately two-thirds of all outstanding mortgages in the United States.Much of the report focuses on modifications and recidivism (see Housing Wire). But this report also shows - for the first time - more seriously delinquent prime loans than subprime loans (by number, not percentage).

The report showed that credit quality continued to decline in the fourth quarter of 2008. At the end of the year, just under 90 percent of mortgages were performing, compared with 93 percent at the end of September 2008. This decline in credit quality was evident in all loan risk categories, with subprime mortgages showing the highest level of serious delinquencies. However, the biggest percentage jump was in prime mortgages, the lowest loan risk category and one that accounts for nearly two-thirds of all mortgages serviced by the reporting institutions. At the end of the fourth quarter, 2.4 percent of prime mortgages were seriously delinquent, more than double the 1.1 percent recorded at the end of March 2008.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Note: "Approximately 14 percent of loans in the data were not accompanied by credit scores and are classified as “other.” This group includes a mix of prime, Alt-A, and subprime. In large part, the loans were result of acquisitions of loan portfolios from third parties where borrower credit scores at the origination of the loans were not available."

This report covers about two-thirds of all mortgages. There are far more prime loans than subprime loans - and the percentage of delinquent prime loans is much lower than for subprime loans. However, there are now more prime loans than subprime loans seriously delinquent. And prime loans tend to be larger than subprime loans, so the losses from each prime loan will probably be higher.

We're all subprime now!

Bernanke on Fed's Balance Sheet

by Calculated Risk on 4/03/2009 12:08:00 PM

From Federal Reserve Chairman Ben Bernanke: The Federal Reserve's Balance Sheet. In this speech Bernanke discusses the recent Fed initiatives in terms of the impact on the balance sheet.

One key question is how all of this will be unwound. Here are some excerpts from Bernanke's speech:

In pursuing our strategy, which I have called "credit easing," we have also taken care to design our programs so that they can be unwound as markets and the economy revive. In particular, these activities must not constrain the exercise of monetary policy as needed to meet our congressional mandate to foster maximum sustainable employment and stable prices.Not that we have to worry about unwinding any time soon.

...

The large volume of reserve balances outstanding must be monitored carefully, as--if not carefully managed--they could complicate the Fed's task of raising short-term interest rates when the economy begins to recover or if inflation expectations were to begin to move higher. We have a number of tools we can use to reduce bank reserves or increase short-term interest rates when that becomes necessary. First, many of our lending programs extend credit primarily on a short-term basis and thus could be wound down relatively quickly. In addition, since the lending rates in these programs are typically set above the rates that prevail in normal market conditions, borrower demand for these facilities should wane as conditions improve. Second, the Federal Reserve can conduct reverse repurchase agreements against its long-term securities holdings to drain bank reserves or, if necessary, it could choose to sell some of its securities. Of course, for any given level of the federal funds rate, an unwinding of lending facilities or a sale of securities would constitute a de facto tightening of policy, and so would have to be carefully considered in that light by the FOMC. Third, some reserves can be soaked up by the Treasury's Supplementary Financing Program. Fourth, in October of last year, the Federal Reserve received long-sought authority to pay interest on the reserve balances of depository institutions. Raising the interest rate paid on reserves will encourage depository institutions to hold reserves with the Fed, rather than lending them into the federal funds market at a rate below the rate paid on reserves. Thus, the interest rate paid on reserves will tend to set a floor on the federal funds rate.

Report: Banks Considering Gaming PPIP

by Calculated Risk on 4/03/2009 10:42:00 AM

The Financial Times reports: Bailed-out banks eye toxic asset buys (ht Scot)

US banks that have received government aid, including Citigroup, Goldman Sachs, Morgan Stanley and JPMorgan Chase, are considering buying toxic assets to be sold by rivals under the Treasury’s $1,000bn (£680bn) plan to revive the financial system.This is just a report, and it would appear to be inappropriate for any bank receiving TARP funds to buy "legacy assets" using the PPIP. My suggestion is to explicitly ban this activity to help build confidence in the PPIP.

The plans proved controversial, with critics charging that the government’s public-private partnership - which provide generous loans to investors - are intended to help banks sell, rather than acquire, troubled securities and loans.

...

The government plan does not allow banks to buy their own assets, but there is no ban on the purchase of securities and loans sold by others.

“It’s an open programme designed to get markets going,” a Treasury official said. But he added: “It is between a bank and their supervisor whether they are healthy enough to acquire assets,” raising the possibility regulators may prevent weak banks from becoming buyers.

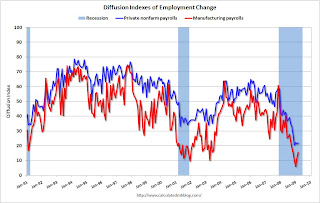

Employment: Comparing Recessions and Diffusion Index

by Calculated Risk on 4/03/2009 09:36:00 AM

Note: earlier Employment post: Employment Report: 663K Jobs Lost, 8.5% Unemployment Rate and Part Time for Economic Reasons Hits 9 Million Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

For the current recession, employment peaked in December 2007, and this recession was a slow starter (in terms of job losses and declines in GDP).

However job losses have really picked up in recent months (red line cliff diving on the graph), and the current recession is now the worst recession in percentage terms since the 1950s - although not in terms of the unemployment rate.

In the early post-war recessions (1948, 1953, 1958), there were huge swings in manufacturing employment and that lead to larger percentage losses. For the current recession, the job losses are more widespread.

In March, job losses were large and widespread across the major industry sectorsHere is a look at how "widespread" the job losses are using the employment diffusion index from the BLS.

BLS, March Employment Report

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.So it is possible for the diffusion index to increase (like manufacturing increased from 11.4 to 15.7) not because industries are hiring, but because fewer industries are losing jobs.

Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Before September, the all industries employment diffusion index was close to 40, suggesting that job losses were limited to a few industries. However starting in September the diffusion index plummeted. In December, the index hit 20.5, suggesting job losses were very widespread. The index has only recovered slightly since then (22 in March).

The manufacturing diffusion index has fallen even further, from 40 in May 2008 to just 6 in January 2009. The manufacturing index recovered slightly to 15.7 in March.

Part Time for Economic Reasons Hits 9 Million

by Calculated Risk on 4/03/2009 09:11:00 AM

From the BLS report:

In March, the number of persons working part time for economic reasons (some-times referred to as involuntary part-time workers) climbed by 423,000 to 9.0 million.

Click on graph for larger image in new window.

Click on graph for larger image in new window.Not only has the unemployment rate risen sharply to 8.5%, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now at a record 9.0 million.

Of course the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this isn't quite a record - yet - but it is getting close.

And the rapid increase is stunning ...

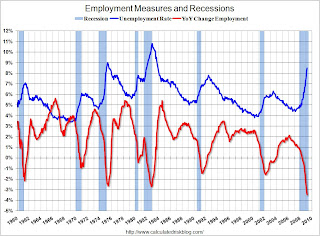

Employment Report: 663K Jobs Lost, 8.5% Unemployment Rate

by Calculated Risk on 4/03/2009 08:30:00 AM

From the BLS:

Nonfarm payroll employment continued to decline sharply in March (-663,000), and the unemployment rate rose from 8.1 to 8.5 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Since the recession began in December 2007, 5.1 million jobs have been lost, with almost two-thirds (3.3 million) of the decrease occurring in the last 5 months. In March, job losses were large and widespread across the major industry sectors.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 663,000 in March. January job losses were revised to

741,000. The economy has lost almost 3.3 million jobs over the last 5 months, and over 5 million jobs during the 15 consecutive months of job losses.

The unemployment rate rose to 8.5 percent; the highest level since 1983.

Year over year employment is strongly negative (there were 4.8 million fewer Americans employed in Mar 2009 than in Mar 2008). This is another extremely weak employment report ... more soon.