by Calculated Risk on 3/02/2009 03:48:00 PM

Monday, March 02, 2009

Market: More Cliff Diving

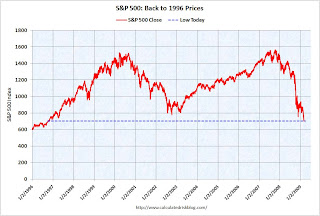

The S&P 500 closed just above 700. We are back to 1996 prices ...

The low in 1997 was 737.01.

The low in 1996 was 598.48. Click on graph for larger image in new window.

Click on graph for larger image in new window.

DOW off about 4.3%

S&P 500 off about 4.7%

NASDAQ off 4.0%

The second graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears". (If not updated right way, Doug should update in a few minutes)

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Vehicle Sales in January

by Calculated Risk on 3/02/2009 02:22:00 PM

The BEA released vehicle sales for January this morning. Total auto and truck sales in the U.S. were below 10 million (SAAR) for the first time since 1982. I've update the sales and turnover graphs below with the January data.

The automakers will release February sales numbers tomorrow, and here is a preview from MarketWatch: No sales bounce in sight for automakers

The total industry decline, according to Edmunds.com, is expected to reach 41.4%. Most forecasts on Wall Street call for a seasonally adjusted annual rate of sales in the low 9-million range, down from 9.6 million last month, which marked a 26-year low.

...

"The crisis in the automotive market continues to worsen, but we believe we are nearing the bottom of this cycle," J.D. Power analyst Jeff Schuster said in a report last week. "Our expectation is for February or March to be the low point, but a high degree of uncertainty and risk remains for the second half of 2009."

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows monthly vehicle sales (autos and trucks) as reported by the BEA at a Seasonally Adjusted Annual Rate (SAAR).

This shows that sales have plunged to just over a 9.75 million annual rate in January - the lowest rate since 1982. If the car analysts are correct, February will be even worse.

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).

This graph shows the total number of registered vehicles in the U.S. divided by the sales rate - and gives a turnover ratio for the U.S. fleet (this doesn't tell you the age of the fleet).Currently this ratio is at 25.5 years, the highest ever. This is an unsustainable level (I doubt most vehicles will last 25 years!), and the ratio will probably decline over the next few years. This could happen with vehicles being removed from the fleet, but more likely because of a sales increase.

This suggests vehicle sales are much nearer the bottom than the top, and there will probably be some sort of modest rebound later this year or in 2010.

January PCE and Personal Saving Rate

by Calculated Risk on 3/02/2009 11:36:00 AM

Amid all the gloom this morning - the AIG bailout and massive losses, the weak manufacturing ISM index, the cliff diving construction spending numbers - there was this Personal Income and Outlays report for January from the BEA.

This report showed that personal income increased in January, however the increase was mostly because of special factors related to government and military wage increases. But this report also showed that PCE was up slightly from October to January (the period that matters for GDP); about 0.7% in real terms annualized. Not much - and this is just one data point and could be revised, and this might be impacted by gift cards (this data uses the January retail numbers) - but perhaps PCE won't fall completely off a cliff in Q1. I still expect PCE to decline sharply in Q1, but maybe not as rapidly as in Q3 2008 (-3.8% SAAR) and Q4 2008 (-4.3% SAAR)

(SAAR: seasonally adjusted annual rate)

Also interesting:

Personal saving -- DPI less personal outlays -- was $545.5 billion in January, compared with $416.8 billion in December. Personal saving as a percentage of disposable personal income was 5.0 percent in January, compared with 3.9 percent in December.This increase in the percent saved is an important part of the rebalancing process and helps repair household balance sheets.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the saving rate starting in 1959 (using a three month centered average for smoothing).

Although this data may be revised significantly, this does suggest households are saving substantially more than during the last few years (when they saving rate was close to zero). This is a necessary but painful step ... and a rising saving rate will repair balance sheets, but also keep downward pressure on personal consumption.

February 2009 Manufacturing ISM: Employment Index at Record Low

by Calculated Risk on 3/02/2009 10:30:00 AM

From the ISM: February 2009 Manufacturing ISM Report On Business®

"Manufacturing continues to decline at a rapid rate in February. While production has slowed its rate of decline, employment continues to fall precipitously. Prices continue to decline, but price advantages are not sufficient to overcome manufacturers' apparent loss of demand. Survey respondents appear generally pessimistic about recovery in 2009."Manufacturing is still contracting, and employment is especially weak with the employment index at a record low (since the index started in 1948).

...

Manufacturing contracted in February as the PMI registered 35.8 percent, which is 0.2 percentage point higher than the 35.6 percent reported in January. This is the 13th consecutive month of contraction in the manufacturing sector. A reading above 50 percent indicates that the manufacturing economy is generally expanding; below 50 percent indicates that it is generally contracting.

...

ISM's Employment Index registered 26.1 percent in February, which is 3.8 percentage points lower than the 29.9 percent reported in January. This is the seventh consecutive month of decline in employment. An Employment Index above 49.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) data on manufacturing employment.

Construction Spending: Non-Residential Cliff Diving

by Calculated Risk on 3/02/2009 10:01:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months to two years. The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

Nonresidential spending is now at the year ago level and will turn strongly negative going forward. Residential construction spending is still declining, although the YoY change will probably be less negative going forward.

These are two key stories for 2009: the collapse in private non-residential construction, and the probably bottom for residential construction spending.

From the Census Bureau: January 2009 Construction at $986.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $682.6 billion, 3.7 percent (±1.1%) below the revised December estimate of $709.0 billion. Residential construction was at a seasonally adjusted annual rate of $291.5 billion in January, 2.9 percent (±1.3%) below the revised December estimate of $300.3 billion. Nonresidential construction was at a seasonally adjusted annual rate of $391.0 billion in January, 4.3 percent (±1.1%) below the revised December estimate of $408.7 billion.

AIG: $61.7 Billion Loss

by Calculated Risk on 3/02/2009 06:21:00 AM

For the Fed and Treasury AIG restructuring announcement, please see the previous post.

From MarketWatch: AIG reports fourth-quarter loss of over $61 billion

[AIG] said its fourth-quarter loss widened to $61.66 billion, or $22.95 a share, from the $5.29 billion loss in the year-earlier period. Continued severe credit market deterioration, particularly in commercial mortgage-backed securities, and charges related to ongoing restructuring-related activities weighed down results.The numbers just keep getting bigger ...

Treasury and Fed: AIG Restructuring Plan

by Calculated Risk on 3/02/2009 06:15:00 AM

From the Fed: U.S. Treasury and Federal Reserve Board Announce Participation in AIG Restructuring Plan

The U.S. Treasury Department and the Federal Reserve Board today announced a restructuring of the government's assistance to AIG in order to stabilize this systemically important company in a manner that best protects the U.S. taxpayer. ...

The company continues to face significant challenges, driven by the rapid deterioration in certain financial markets in the last two months of the year and continued turbulence in the markets generally. ...

As significantly, the restructuring components of the government's assistance begin to separate the major non-core businesses of AIG, as well as strengthen the company's finances. The long-term solution for the company, its customers, the U.S. taxpayer, and the financial system is the orderly restructuring and refocusing of the firm. This will take time and possibly further government support, if markets do not stabilize and improve.

...

Treasury has stated that public ownership of financial institutions is not a policy goal and, to the extent public ownership is an outcome of Treasury actions, as it has been with AIG, it will work to replace government resources with those from the private sector to create a more focused, restructured, and viable economic entity as rapidly as possible. This restructuring is aimed at accelerating this process. Key steps of the restructuring plan include:

Preferred Equity

The U.S. Treasury will exchange its existing $40 billion cumulative perpetual preferred shares for new preferred shares with revised terms that more closely resemble common equity and thus improve the quality of AIG's equity and its financial leverage. The new terms will provide for non-cumulative dividends and limit AIG's ability to redeem the preferred stock except with the proceeds from the issuance of equity capital.

Equity Capital Commitment

The Treasury Department will create a new equity capital facility, which allows AIG to draw down up to $30 billion as needed over time in exchange for non-cumulative preferred stock to the U.S. Treasury. This facility will further strengthen AIG's capital levels and improve its leverage.

Federal Reserve Revolving Credit Facility

The Federal Reserve will take several actions relating to the $60 billion Revolving Credit Facility for AIG established by the Federal Reserve Bank of New York (New York Fed) in September 2008, to further the goals described above.

[see statement for more details]

Sunday, March 01, 2009

AIG: Earnings at 6 AM ET, Webcast at 8:30 AM

by Calculated Risk on 3/01/2009 10:25:00 PM

American International Group, Inc. (AIG) will report its fourth quarter and full year 2008 results on Monday, March 2, 2009 at approximately 6:00 a.m. EST. AIG’s earnings release and financial supplement will be available in the Investor Information section of www.aigcorporate.com following the filing of AIG’s Form 10-K for the year ended December 31, 2008.From the WSJ: U.S. Revamps Bailout of AIG

AIG Chairman and Chief Executive Officer Edward M. Liddy will host a conference call, broadcast live over the Internet, on Monday, March 2, 2009 at 8:30 a.m. EST to discuss AIG’s fourth quarter results.

The audio webcast of the conference call can be accessed at www.aigwebcast.com.

The new deal, the government's fourth for AIG, represents a nearly complete reversal from the one first laid out in mid-September. Back then, federal officials acted as a demanding lender, forcing the insurer to pay a steep interest rate for what was expected to be a short-term loan. Now the government is relaxing loan terms by wiping out interest in hopes of preserving AIG's value over a longer period.AIG: a black hole.

With the latest move, AIG will have the benefit of up to $70 billion from the TARP program; it got a $40 billion TARP investment in November. The total amounts to 10% of the $700 billion financial-sector rescue fund, money that most lawmakers did not expect would go toward propping up a troubled insurer. Officials believed they had little choice but to use the TARP money, particularly because they lack the authority to unwind a troubled firm such as AIG the way the government can do now with failing banks.

Sunday Evening Futures

by Calculated Risk on 3/01/2009 07:50:00 PM

Just an open thread (I'm working on fixing the comments):

For those interested, here are few sources for futures and the foreign markets.

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

Futures from barchart.com

And the Asian markets.

Right now the futures are off a little for the U.S. markets. It appears DOW 7000 is in jeopardy.

Best to all.

HSBC Update

by Calculated Risk on 3/01/2009 03:15:00 PM

As we discussed yesterday, AIG will not be alone in the confessional tomorrow. HSBC is about to announce a £17bn hit on bad loans.

Now the Financial Times reports: HSBC to scale back US lending

HSBC will on Monday announce plans to scale back its US consumer finance operations as the bank launches a £12bn-plus ($17bn) rights issue ... HSBC is expected to say that it is further shrinking HSBC Finance Corporation, its US-based credit card and mortgage lender ...The WSJ has a headline only: HSBC plans to cease U.S. personal loans and mortgages but will continue to provide credit cards.

I'm sure HSBC regrets the Household International acquisition!

NY Times: "When Will the Recession Be Over?"

by Calculated Risk on 3/01/2009 02:32:00 PM

The NY Times asked several economists and forecasters 'When Will the Recession Be Over?'

Here are a few excerpts:

Beware the False Dawn

By STEPHEN S.ROACH (Chairman of Morgan Stanley Asia)

IT would be premature to declare an end to America’s recession at the first sign of a resumption of growth. After the unusually steep declines in the economy late last year and early this year, a statistical rebound in the second half of 2009 would hardly be shocking. ... But any such whiffs of growth are likely to herald a false dawn, because the consumer remains in terrible shape. ...A Long Goodbye

This points to an unusually anemic upturn, at best — not strong enough to keep the unemployment rate from rising to near 10 percent over the next year and a half. Since it’s hard to call that a recovery, it looks to me as if this recession won’t end until late 2010 or early 2011.

By A. MICHAEL SPENCE (Stanford Professor, Nobel prize, economics)

THE short answer is not soon.An Ordinary Crisis

The recession is global: exports, production and consumption are in high-speed descent. The headwinds are powerful because of excessive leverage, damaged balance sheets and the resulting tight credit.

...

Governments and central banks are the only major sources of credit, liquidity and incremental demand ... If governments are quick and clear in their intentions and intervene in a coordinated way in both the real economy and the financial sector, we will probably have an unusually long and deep global recession through 2010. If they don’t, it is likely to be worse than that.

By GEORGE COOPER

TODAY’S financial crisis is the biggest in recent history, when measured by its speed, the scale of its capital losses or its global reach. Yet viewed from another perspective the crisis is surprisingly ordinary, following the same path as dozens of previous bubbles.There are number of other short Op-Eds from Nouriel Roubini, James Grant and others.

...

If we go by the first measure [started in mid'80s] we may see two or more decades of readjustment. If we go by the second [started turn of the millennium], we are still probably in the early stages of the credit correction, meaning that while the technical recession could be over by the end of the year, the broader credit cycle will likely remain a significant drag on economic activity well into the next decade. Either way, we have a long way to go.

More AIG

by Calculated Risk on 3/01/2009 10:50:00 AM

| First a repeat of Eric's great AIG cartoon! Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

From the WSJ: Rating Agencies Endorse Revised AIG Bailout

Major credit rating agencies have signed off on the latest revamp of American International Group Inc.'s $150 billion government rescue package ... Both Standard & Poor's and Moody's Investors Services have quietly endorsed the terms of the revised bailout ...One aspect of the plan is clear - taxpayers will be more exposed.

The agreement clears the way for the insurer's board to give its final approval when it meets on Sunday. AIG's latest restructuring ... is expected to be announced with the insurer's results on Monday.

... Many details of the new plan aren't clear but ... it will result in a complete reconfiguration of AIG. ... The revised plan relies on a series of complicated financial maneuvers that will reduce AIG's interest and debt burdens, while also deepening government involvement and taxpayer exposure.

Report: AIG Deal Near

by Calculated Risk on 3/01/2009 02:08:00 AM

From Reuters: Exclusive: AIG near deal on new terms of bailout (ht Brad)

American International Group Inc is close to a deal with the U.S. government ... The revised AIG agreement is expected to include an additional equity commitment of about $30 billion, more lenient terms on an existing preferred investment, and a lower interest rate on a $60 billion government credit line ...It sounds like the deal will be announced on Monday.

AIG will also give the U.S. Federal Reserve ownership interests in American Life Insurance (Alico), ... [and] American International Assurance Co (AIA) in return for reducing its debt ... The board ... is due to meet on Sunday to vote on the deal ...

Saturday, February 28, 2009

Late Night Comments

by Calculated Risk on 2/28/2009 11:59:00 PM

Just a few comments on comments ...

I'm working with JS-Kit. They have moved all the old comments over to the new database.

Hopefully we can have the default be "flat". And we can add a refresh (that takes the user to the bottom).

JS-Kit will also be adding the following features:

Best to all. And thanks for your patience.

HSBC to take £17bn Bad Loan Provision

by Calculated Risk on 2/28/2009 05:08:00 PM

From The Times: HSBC takes £17bn hit on bad loans

HSBC is to own up to the full horror of its American sub-prime business, Household, when it unveils a £7 billion goodwill write-off in addition to a £17 billion provision against rising bad loans.Oh, the horror! The confessional remains busy, and AIG will be dropping by on Monday.

The provisions will be announced tomorrow alongside a heavily discounted £12 billion rights issue – the biggest ever held in Britain – and a dividend cut ...

The fundraising will make HSBC the strongest bank in the world that has not received a cash injection from the state. Its tier-one ratio, a key measure of financial strength, will rise from 8.5% to 10.5%. Analysts say it will provide a $40 billion (£28 billion) buffer against further bad debts.

February Economic Summary in Graphs

by Calculated Risk on 2/28/2009 09:59:00 AM

Here is a collection of 20 real estate and economic graphs from February ...

New Home Sales in January

New Home Sales in JanuaryThe first graph shows monthly new home sales (NSA - Not Seasonally Adjusted).

Note the Red column for January 2009. This is the lowest sales for January since the Census Bureau started tracking sales in 1963. (NSA, 23 thousand new homes were sold in January 2009).

From: Record Low New Home Sales in January

Housing Starts in January

Housing Starts in JanuaryTotal housing starts were at 464 thousand (SAAR) in January, by far the lowest level since the Census Bureau began tracking housing starts in 1959.

Single-family starts were at 347 thousand in January; also the lowest level ever recorded (since 1959).

From: Housing Starts at Another Record Low

Construction Spending in December

Construction Spending in DecemberThis graph shows private residential and nonresidential construction spending since 1993.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months.

From: Construction Spending: Private Nonresidential has Peaked

January Employment Report

January Employment ReportThis graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls decreased by 598,00 in January, and the annual revision reduced employment by another 311,000 in 2008. The economy has lost almost 2.5 million jobs over the last 5 months!

The unemployment rate rose to 7.6 percent; the highest level since June 1992.

Year over year employment is now strongly negative (there were 3.5 million fewer Americans employed in Jan 2008 than in Jan 2007).

From: January Employment Report: 598,000 Jobs Lost, Unemployment Rate 7.6%

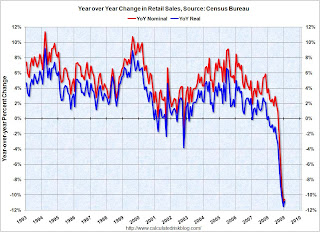

January Retail Sales

January Retail SalesThis graph shows the year-over-year change in nominal and real retail sales since 1993.

Although the Census Bureau reported that nominal retail sales decreased 10.6% year-over-year (retail and food services decreased 9.7%), real retail sales declined by 10.9% (on a YoY basis). The YoY change decreased slightly from last month.

From: Retail Sales Increase Slightly in January

LA Port Traffic in January

LA Port Traffic in JanuaryThis graph shows the combined loaded inbound and outbound traffic at the ports of Long Beach and Los Angeles in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Inbound traffic was 14% below last January. This slowdown in imports (inbound traffic to the U.S.) is hitting Asian countries hard. There was a slight increase from December to January, but that appears to be mostly seasonal (the data is NSA).

For the LA area ports, outbound traffic continued to decline in January, and was 28% below the level of January 2008. Export traffic is now at about the same level as in 2005.

From: LA Area Ports: Exports Decline in January

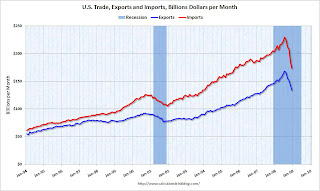

U.S. Imports and Exports Through December

U.S. Imports and Exports Through DecemberThe first graph shows the monthly U.S. exports and imports in dollars through December 2008. The recent rapid decline in foreign trade continued in December. Note that a large portion of the decline in imports is related to the fall in oil prices - but not all.

From: U.S. Trade: Exports and Imports Decline Sharply

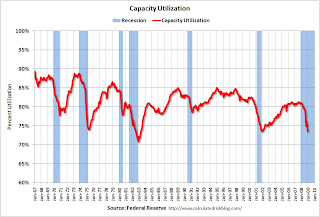

January Capacity Utilization

January Capacity UtilizationThe Federal Reserve reported that industrial production fell 1.8 percent in January, and output in January was 10.0% below January 2008. The capacity utilization rate for total industry fell to 72.0%, the lowest level since 1983.

The significant decline in capacity utilization suggests less investment in non-residential structures for some time.

From: Capacity Utilization and Industrial Production Cliff Diving

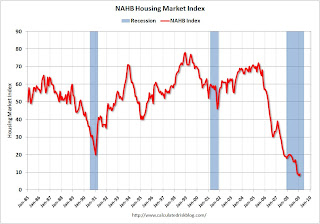

NAHB Builder Confidence Index in February

NAHB Builder Confidence Index in FebruaryThis graph shows the builder confidence index from the National Association of Home Builders (NAHB).

The housing market index (HMI) increased slightly to 9 in February from the record low of 8 set in January.

From: NAHB Housing Market Index Near Record Low

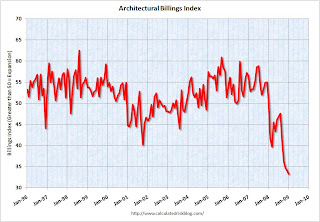

Architecture Billings Index for January

Architecture Billings Index for JanuaryThe American Institute of Architects (AIA) reported the January ABI rating was 33.3, down from the 34.1 mark in December (any score above 50 indicates an increase in billings).

From: Architecture Billings Index Hits Another Record Low

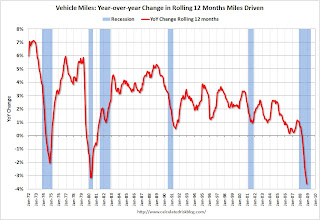

Vehicle Miles driven in December

Vehicle Miles driven in DecemberThis graph shows the annual change in the rolling 12 month average of U.S. vehicles miles driven. Note: the rolling 12 month average is used to remove noise and seasonality.

By this measure, vehicle miles driven are off 3.6% Year-over-year (YoY); the decline in miles driven is worse than during the early '70s and 1979-1980 oil crisis. As the DOT noted, miles driven in December 2008 were 1.6% less than December 2007, so the YoY change in the rolling average may start to increase.

From: U.S. Vehicle Miles Driven Off 3.6% in 2008

Existing Home Sales in January

Existing Home Sales in January This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January 2009 (4.49 million SAAR) were 5.4% lower than last month, and were 8.6% lower than January 2008 (4.91 million SAAR).

From: More on Existing Home Sales (and Graphs)

Existing Home Inventory

Existing Home InventoryThis graph shows inventory by month starting in 2004. Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle.

From: More on Existing Home Sales (and Graphs)

Case Shiller House Prices for December

Case Shiller House Prices for DecemberThis graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 28.3% from the peak.

The Composite 20 index is off 27.0% from the peak.

From: Case-Shiller: House Prices Decline Sharply in December

Price-to-Rent Ratio for Q4

Price-to-Rent Ratio for Q4This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

Looking at the price-to-rent ratio based on the Case-Shiller index, the adjustment in the price-to-rent ratio is probably 75% to 85% complete as of Q4 2008 on a national basis. This ratio will probably continue to decline.

However it now appears rents are falling too (although this is not showing up in the OER measure yet) and this will impact the price-to-rent ratio.

From: House Prices: Real Prices, Price-to-Rent, and Price-to-Income

Unemployment Claims

Unemployment ClaimsThis graph shows weekly claims and continued claims since 1971.

The four week moving average is at 639,000 the highest since 1982.

Continued claims are now at 5.11 million - another new record (not adjusted for population) - above the previous all time peak of 4.71 million in 1982.

From: Weekly Claims: Continued Claims Over 5 Million

Restaurant Performance Index for January

Restaurant Performance Index for January"The Association’s Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry – stood at 97.4 in January, up 1.0 percent from December’s record low level of 96.4."

From: Restaurant Performance Index Rebounds Slightly

New Home Sales

New Home SalesThis graph shows New Home Sales vs. recessions for the last 45 years. New Home sales have fallen off a cliff.

From: Record Low New Home Sales in January

Q4 Homeownership Rate

Q4 Homeownership RateThe homeownership rate decreased slightly to 67.5% and is now back to the levels of late 2000.

Note: graph starts at 60% to better show the change.

From: Q4: Homeownership Rate Declines to 2000 Level

New Home Months of Supply

New Home Months of SupplyThe months of supply is at an all time record 13.3 months in January.

From: Record Low New Home Sales in January

Buffett's Letter to Shareholders

by Calculated Risk on 2/28/2009 08:27:00 AM

Here is Buffett's Letter to Shareholders

There are several interesting sections, but for housing I think the section on Clayton Homes (Buffett's manufactured home division) is especially interesting. Here is a brief excerpt (starts on page 10). First Buffett describes the lending debacle in the manufactured home industry in the 1997 to 2000 period:

Clayton is the largest company in the manufactured home industry, delivering 27,499 units last year. This came to about 34% of the industry’s 81,889 total. Our share will likely grow in 2009, partly because much of the rest of the industry is in acute distress.And now Buffett draws a parallel to the national housing bubble:

...

[In 1998] much of the industry employed sales practices that were atrocious. Writing about the period somewhat later, I described it as involving “borrowers who shouldn’t have borrowed being financed by lenders who shouldn’t have lent.”

To begin with, the need for meaningful down payments was frequently ignored. Sometimes fakery was involved. ... Moreover, impossible-to-meet monthly payments were being agreed to by borrowers who signed up because they had nothing to lose. The resulting mortgages were usually packaged (“securitized”) and sold by Wall Street firms to unsuspecting investors. This chain of folly had to end badly, and it did.

... industry losses were staggering. And the hangover continues to this day. This 1997-2000 fiasco should have served as a canary-in-the-coal-mine warning for the far-larger conventional housing market. But investors, government and rating agencies learned exactly nothing from the manufactured-home debacle.

[I]n an eerie rerun of that disaster, the same mistakes were repeated with conventional homes in the 2004-07 period: Lenders happily made loans that borrowers couldn’t repay out of their incomes, and borrowers just as happily signed up to meet those payments. Both parties counted on “house-price appreciation” to make this otherwise impossible arrangement work. ... The consequences of this behavior are now reverberating through every corner of our economy.

Clayton’s 198,888 borrowers, however, have continued to pay normally throughout the housing crash ... This is not because these borrowers are unusually creditworthy ... Why are our borrowers – characteristically people with modest incomes and far-from-great credit scores – performing so well? The answer is elementary, going right back to Lending 101. Our borrowers simply looked at how full-bore mortgage payments would compare with their actual – not hoped-for – income and then decided whether they could live with that commitment. Simply put, they took out a mortgage with the intention of paying it off, whatever the course of home prices.

Just as important is what our borrowers did not do. They did not count on making their loan payments by means of refinancing. They did not sign up for “teaser” rates that upon reset were outsized relative to their income. And they did not assume that they could always sell their home at a profit if their mortgage payments became onerous. Jimmy Stewart would have loved these folks.

...

Homeowners who have made a meaningful down-payment – derived from savings and not from other borrowing – seldom walk away from a primary residence simply because its value today is less than the mortgage. Instead, they walk when they can’t make the monthly payments.

...

The present housing debacle should teach home buyers, lenders, brokers and government some simple lessons that will ensure stability in the future. Home purchases should involve an honest-to-God down payment of at least 10% and monthly payments that can be comfortably handled by the borrower’s income. That income

should be carefully verified.

Putting people into homes, though a desirable goal, shouldn’t be our country’s primary objective. Keeping them in their homes should be the ambition.

UK: 500,000 Lloyds Borrowers have Negative Equity

by Calculated Risk on 2/28/2009 01:07:00 AM

From The Times: Lloyds counts cost of HBOS takeover and property slump as 500,000 customers slip into negative equity

HBOS, Britain’s biggest mortgage lender, revealed that 381,669 customers, about 16.8 per cent of its mortgage book, owed more than the value of their homes. At Lloyds TSB, 162,000 homeowners, 15 per cent of its mortgage book, were in the same position.Also on comments: Haloscan crashed hard, so I switched to JS-Kit. I'll try to improve the JS-Kit interface, and hopefully Ken (CR Companion) will be able to provide some help. Thanks to everyone for your patience.

These figures compare with only 0.1 per cent of customers of each bank – a total of less than 4,000 households – being in negative equity at the end of 2007.

...

Michael Saunders, chief economist at Citigroup, said last month that the bank estimated homeowners with negative equity was up to about 1.2 million, from 100,000 a year ago, out of a total of between 11 million and 12 million mortgages. “There is no sign that the decline in house prices – and hence the surge in negative equity – is yet close to ending,” he said.

He said in December that about one owner in four could be in negative equity if prices fell by a total of 30 per cent by 2010, as many analysts expect.

Friday, February 27, 2009

High on the Hill

by Calculated Risk on 2/27/2009 09:31:00 PM

Tomorrow morning at 8AM ET, the Buffett letter to investors will be released, and later I'll post a February Economic Summary in Graphs.

The AIG deal might be announced Sunday evening or Monday morning.

Today real GDP growth was revised down to minus 6.2% (annualized), the Citi deal was announced, two banks failed (Heritage Community Bank, Glenwood, Illinois and Security Savings Bank, Henderson, Nevada), and the S&P 500 is back to 1996 prices.

Also, the Restaurant Performance Index for January was released, and here is a look at Investment Contributions to GDP.

If you need a laugh after reading that news, Jim the Realtor showcases an investment opportunity in San Diego - enjoy!