by Calculated Risk on 2/13/2009 06:31:00 PM

Friday, February 13, 2009

Bank Failure #11 in 2009: Riverside Bank of the Gulf Coast &

From the FDIC: TIB Bank, Naples, Florida, Assumes All of the Deposits of Riverside Bank of the Gulf Coast, Cape Coral, Florida

Riverside Bank of the Gulf Coast, Cape Coral, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with TIB Bank, Naples, Florida, to assume all of the deposits of Riverside Bank.That makes 2 today.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $201.5 million. TIB Bank's acquisition of all of the deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Riverside Bank is the eleventh bank to fail in the nation this year. The last bank to fail in Florida was Ocala National Bank on January 30, 2009.

Bank Failure #10 in 2009: Sherman County Bank, Loup City, Nebraska

by Calculated Risk on 2/13/2009 05:44:00 PM

From the FDIC: Heritage Bank, Wood River, Nebraska, Assumes All the Deposits of Sherman County Bank, Loup City, Nebraska

Sherman County Bank, Loup City, Nebraska, was closed today by the Nebraska Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Heritage Bank, Wood River, Nebraska, to assume all of the deposits of Sherman County Bank.It is Friday!

...

As of February 12, 2009, Sherman County Bank had total assets of approximately $129.8 million and total deposits of $85.1 million. Heritage Bank will pay the FDIC a premium of six percent. In addition to assuming all of the deposits of Sherman County Bank, Heritage Bank agreed to purchase approximately $21.8 million in assets, comprised mainly of cash, cash equivalents and marketable securities. The FDIC will retain the remaining assets for later disposition.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $28.0 million. Heritage Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Sherman County Bank is the tenth bank to fail in the nation this year. The last institution to fail in Nebraska was Equitable Savings and Loan, Columbus, on February 16, 1990.

Freddie, Fannie Suspend Foreclosure Sales

by Calculated Risk on 2/13/2009 05:18:00 PM

From Freddie Mac: FREDDIE MAC EXTENDS MORATORIUM ON FORECLOSURE SALES

Freddie Mac (NYSE: FRE) today announced it is immediately suspending all foreclosure sales involving occupied single family and 2-4 unit properties with Freddie Mac-owned mortgages through March 6, 2009. The suspension does not apply to vacant properties.From Fannie Mae: Fannie Mae Suspends Foreclosure Sales Pending Administration Announcement

The extension will provide servicers with more time to help troubled borrowers find an alternative to foreclosure.

Freddie Mac gives lenders servicing its mortgages broad authority to provide forbearance to borrowers facing financial difficulties, and permanent rate reductions, mortgage term extensions, forbearance of principal or other modifications to borrowers who are already delinquent.

Fannie Mae (FNM/NYSE) today announced it is suspending all foreclosure sales and evictions of occupied properties through March 6 in anticipation of the Administration's national foreclosure prevention and loan modification program.

The company had previously put in place a suspension of foreclosure sales through January and had previously suspended all evictions through the end of February. In addition, the company adopted a national Real Estate Owned (REO) Rental Policy that allows renters in Fannie Mae-owned foreclosed properties to remain in their homes or receive transitional financial assistance should they choose to seek new housing.

Hotels: Wyndham says RevPAR to decline 6% to 10% in 2009

by Calculated Risk on 2/13/2009 04:16:00 PM

Note: RevPAR is revenue per available room.

From Bloomberg: Wyndham Plunges After Announcing New Stock Sale, Quarterly Loss

Revpar, a measure of hotel room rates and occupancy, will drop 6 percent to 10 percent this year, more than 3 percent to 6 percent decline Wyndham forecast in December, [Chief Executive Officer Stephen] Holmes said. The company franchises Super 8, Travelodge and Days Inn hotels.Look at these key points:

...

“People trade down to a value purchase as times get tougher,” said Holmes, 52. “Hotel owners need our brands during difficult times even more than they do during good times.”

Hotel revenue fell 3 percent to $170 million in the fourth quarter as Revpar tumbled 9.2 percent. Excluding currency changes, Revpar declined 9.3 percent in the U.S. and 1.6 percent internationally.

“We do not have a heavy concentration of luxury or upper- scale properties in large urban markets where you’re seeing a lot of the more dramatic, double-digit declines in Revpar,” Holmes said.

Back in November PricewaterhouseCoopers forecast a significant decline in RevPAR in 2009 (see: Forecast: 2009 Hotel Occupancy Rate to be Lowest Since 1971) and based on the Wyndman numbers that was probably too optimistic.

JPMorgan, Citi, Morgan Stanley Temporarily Halt Foreclosures

by Calculated Risk on 2/13/2009 01:14:00 PM

"We believe three weeks is adequate time for the Treasury to announce – and for us to implement – a new plan."From CNBC: Three Big Banks Are Halting Foreclosures for Now

Jamie Dimon, CEO JPMorgan in letter to Congress

Citigroup, JPMorgan Chase and Morgan Stanley said they had placed a moratorium on foreclosing on some home loans to give the government time to launch a $50 billion mortgage relief program.Another "evolving plan". I think they will discover that there is no easy method for successful loan modifications (as FDIC Chairwoman Sheila Bair discovered when they took over IndyMac). I guess the plan is to buy down loans with the $50 billion - or pay a portion of the monthly payment.

...

The Obama plan under consideration would seek to help homeowners before they fall into arrears on their loans. ... Under the evolving plan, homes would undergo a standardized reappraisal and homeowners would face a uniform eligibility test ...

The details will be interesting. I'm curious - how do you measure success when the borrowers aren't already in default?

S&P: "First quarter ever of negative earnings"

by Calculated Risk on 2/13/2009 12:52:00 PM

"This ... will be the first quarter ever of negative earnings"From MarketWatch: S&P heads to first quarter ever of negative earnings

Howard Silverblatt, senior index analyst, at Standard & Poor's.

[N]early 400 of the S&P's 500 companies have weighed in and reported a collective loss -- even excluding financials.What is the P/E for that?

...

A sixth quarter of negative growth ties the prior record set when Harry Truman was president, and ran from the first quarter of 1951 to the second quarter of 1952.

"And next quarter we're expected a new record of seven quarters of negative growth," Silverblatt said.

As of the close of business Thursday, Silverblatt calculates S&P earnings-per-share, on a reported basis, at a loss of $10.44 for the quarter. If financials were taken out of the equation, that EPS deficit would drop to $2.35.

Lloyds: More HBOS Losses

by Calculated Risk on 2/13/2009 11:13:00 AM

From The Times: Lloyds dives on HBOS £10bn black hole

Lloyds Banking Group shares plunged 40 per cent this afternoon after it revealed a £10 billion black hole at HBOS, the struggling bank that it rescued last year.A billion pounds here, a billion pounds there ...

Lloyds Banking Group ... [made] a surprise announcement ... that trading at HBOS had worsened in December, driving its losses up by a further £1.6 billion to £10 billion.

...

"It is no secret that the UK economy continued to decline in December, and this was reflected in today's numbers.” [Lloyds said in a statement]

...

Lloyds Banking Group said that the huge losses at HBOS owe to a £4 billion "impact of market dislocation" and about £7 billion of impairments in the HBOS corporate division.

Tough Times for Restaurants

by Calculated Risk on 2/13/2009 08:53:00 AM

From Jerry Hirsch at the LA Times: Cost-conscious customers wreaking havoc on ailing restaurants

From the corner diner to elegant Westside eateries, restaurants in Southern California are shrinking portions, slashing wine prices, cutting employee hours and reducing staff. Some chain restaurants and fast-food purveyors are shutting unprofitable branches, and experts say some may not survive.Dining out is a discretionary expense, and it no suprise that many restaurants are getting hit hard. We can see this in the Restaurant Performance Index from the National Restaurant Association (NRA). Low end chains however might do OK as consumers move to inferior goods; McDonald's same-store sales rose 7.1% in January!

Many large dinner-house chains are reporting some of the largest drops in same-store sales -- an important measure of a retailer's financial health -- in recent history.

After the stock market closed Thursday, Southern California chains Cheesecake Factory Inc. and California Pizza Kitchen Inc. both reported plunging same-store sales and profits.

"It is a very tough environment out there," said Richard Rosenfield, co-chief executive of CPK

...

Cheesecake Factory said ... Same-store sales decreased 7.1% ... CPK said ... Same-store sales slid 7.2%.

The WSJ has an article too: Consumers Cut Food Spending Sharply

Consumers have cut back sharply on food spending, shunning restaurants, opting for generic products over brand names, trading in lattes for home-brewed coffee and shopping for bargains. That is hurting sales and profits at many food processors, grocery chains and restaurants.More cliff diving.

...

In 2008's fourth quarter, consumer spending on food fell at an inflation-adjusted 3.7% from the third quarter, according to data from the Commerce Department's Bureau of Economic Analysis. That is the steepest decline in the 62 years the government has compiled the figure.

The News Hour Economists panel - Krugman, Rogoff, Marron, Rivlin

by Calculated Risk on 2/13/2009 01:30:00 AM

Thursday, February 12, 2009

Attorney Layoffs: "Unprecedented Bloodbath"

by Calculated Risk on 2/12/2009 10:59:00 PM

Reader Hoopajoops writes:

[A] huge number of law firms laid off attorneys today. This is an unprecedented bloodbath. DLA Piper laid off 140 people in the UK on Tuesday and today cut another 80 lawyers and 100 staff in the US, Holland & Knight laid off 243, including 70 lawyers, Epstein Becker lays off 23 attorneys and 30 staff, Bryan Cave cut 58 attorneys and 76 staffers, Luce Forward laid off 27 attorneys on Monday and today cancelled their entire 2009 summer program, Faegre & Benson cuts 29 attorneys, Cadwalader laid off 3 attorneys in london, a small count but Cad is one of the big names, Cozen O'Connor laid off 55 secretaries and 6 paralegals, all in all an incredible day.I've been hearing rumors of legal layoffs ...

Abovethelaw.com, a legal gossip rag, is keeping track of the layoffs ...

The WSJ Law Blog: The Darkest Day Ever for Big Law Firms?

from Hoopajoops (Author unknown):

On a windy Manhattan winter day

With the economy tanking under skies of gray

Associates and staff met an unkind end

As PPP's continued to descend

Dechert released nineteen by noon

And greater losses would be announced soon

Next came news from Bryan Cave

Where fifty-eight young careers went to the grave

Goodwin Proctor continued the act

Wheen seventy-four employees were promptly sacked

Then fell the ax at Holland & Knight

The steady paychecks of hundreds vanished from sight

An industry leader in expanding too fast

DLA Piper added scores more to the unemployed caste

Then a large cull from the North Star state

As twenty-nine associates met a cruel fate

Cadwalader sent sixteen Londoners to redundancy consultation

But a week without Cadwalader layoffs would be quite the aberration

The final cut of the day came at a mid-size shop

Where more than fifty felt the ax drop

Our sorrow is deep for our colleagues fired en masse

But do keep in mind that this too shall pass

We share in your pain, your shame, your dismay

On this darkest of dark, this Black Thursday

OTS Chairman Reich Steps Down

by Calculated Risk on 2/12/2009 07:28:00 PM

From MarketWatch: Office of Thrift Supervision chairman steps down

Office of Thrift Supervision Chairman John Reich on Thursday announced his resignation from the agency.This is too kind. Remember this photo?

...

Reich's resignation also changes the make up of the FDIC board, which has five members. In addition to Reich, Bair, Office of Comptroller of the Currency chairman John Dugan and two others sit on the division's board.

| This photo from 2003 shows two regulators: John Reich (2nd from right, then Vice Chairman of the FDIC and later at the OTS) and James Gilleran of the Office of Thrift Supervision (with the chainsaw) and representatives of three banker trade associations: James McLaughlin of the American Bankers Association, Harry Doherty of America's Community Bankers, and Ken Guenther of the Independent Community Bankers of America. |

The WaPo had an excellent article on the OTS last year: Banking Regulator Played Advocate Over Enforcer. The article discussed how the OTS dragged their feet when new lending guidelines were proposed by the Office of the Comptroller of the Currency in 2005 and 2006:

In 2006, at the peak of the boom, lenders made $255 billion in option ARMs ... Most option ARMs were originated by OTS-regulated banks.John Dugan at the OCC was trying hard to reign in the excessive lending (he started in 2005 too), but Reich was resisting those efforts.

Concerns about the product were first raised in late 2005 by another federal regulator, the Office of the Comptroller of the Currency. The agency pushed other regulators to issue a joint proposal that lenders should make sure borrowers could afford their full monthly payments. "Too many consumers have been attracted to products by the seductive prospect of low minimum payments that delay the day of reckoning," Comptroller of the Currency John C. Dugan said in a speech advocating the proposal.

OTS was hesitant to sign on ... [John] Reich, the new director of OTS, warned against excessive intervention. He cautioned that the government should not interfere with lending by thrifts "who have demonstrated that they have the know-how to manage these products through all kinds of economic cycles."

Back in 2005 I posted frequently on the progress of the proposed new guidance. I spoke with a number of regulators in 2005 and 2006 who were involved in the process, and a number of them expressed frustration with both the Fed and the OTS.

Setser on Trade and the Current Account Deficit

by Calculated Risk on 2/12/2009 05:42:00 PM

Brad Setser asks: Can the improvement in the US trade balance continue?

The US trade deficit — which is a good proxy for the current account balance (the income surplus offsets a transfers deficit) — is now around $40b a month. At its peak it was more like around $60b a month. That implies, if nothing changes, the 2009 current account deficit would be around $500b, down from a peak of $700b.That is an important point, but I'd like to focus on another comment from Brad:

In fact, if nothing changes the trade balance balance might improve a bit more. ...

Remember this the next time someone argues that the US will be borrowing more from the rest of the world to finance its fiscal deficit: the total amount the US borrows from the world is defined by the current account deficit and the current account deficit clearly went down in the fourth quarter even as the US fiscal deficit (and the Treasury’s borrowing need) soared. That is because the rise in government borrowing offset a contraction in private investment and a rise in private savings.

Forecasts that the US deficit will fall to 2.5% to 3% of GDP strike me as optimistic.Back in 2005, I argued that the trade deficit would start to decline as a percent of GDP - but I haven't forecast how much further the deficit would decline.

The net result: I expect a slowing global economy to take a toll on US exports and do not expect much additional improvement in the US current account balance. I’ll be watching closely to see if the markets are willing to finance a growing deficit …. and, for that matter, if China is willing to finance a growing US deficit and add to its already considerable exposure.

Click on graph for larger image.

Click on graph for larger image.This graph shows the U.S. trade deficit / surplus as a percent of GDP since 1960 through Q4 2008.

The trade deficit as a percent of GDP started declining in 2006, even with the rapid increase in oil prices. Now, with oil prices declining sharply, the trade deficit has plunged to 3.7% of GDP in Q4.

The oil deficit will fall further in January, and if all else stays the same, the trade deficit might fall close to $30 billion per month in Q1 2009. At that pace, the deficit as a percent of GDP would be in the 2.5% to 3.0% range.

So although I agree with Brad that I'd prefer the rebalancing was because of "strong growth abroad not a collapse in private US demand", I think the deficit will fall to 3% of GDP sometime in 2009.

U.S. Considers Mortgage Subsidies for Some Homeowners

by Calculated Risk on 2/12/2009 03:27:00 PM

From Reuters: Obama eyes home loan subsidies in rescue plan: sources

The Obama administration is hammering out a program to subsidize mortgage payments for troubled homeowners who have gone through a standardized re-appraisal and affordability test ... Under the plan being mulled, homeowners would have to make a case of hardship to qualify for new loan terms.I need more details on the subsidies, but at least the dumb idea of buying down mortgage rates has apparently been shelved.

...

Housing policymakers weighed but have for now shelved one plan that would have seen the government stand behind low-cost mortgages of between 4 and 4.5 percent, sources said.

NY AG Cuomo Letter to Barney Frank on Merrill Bonuses

by Calculated Risk on 2/12/2009 01:31:00 PM

For those who haven't seen it, here is the letter Re: Merrill Lynch 2008 Bonuses (pdf)

The letter breaks down the timing and amounts of the bonuses.

"One disturbing question that must be answered is whether Merrill Lynch and Bank of America timed the bonuses in such a way as to force taxpayers to pay for them through the deal funding. We plan to require top officials at both Merrill Lynch and Bank of America to answer this question and to provide justifications for the massive bonuses they paid ahead of their massive losses....New York Attorney General Andrew Cuomo, Feb 10, 2009

What my Office has learned thus far concerning the allocation of the nearly $4 billion in Merrill Lynch bonuses is nothing short of staggering. Some analysts have wrongly claimed that individual bonuses were actually quite modest and thus legitimate because dividing the $3.6 billion over thousands upon thousands of employees results in relatively small amounts estimated at approximately $91,000 per employee. In fact, Merrill chose to do the opposite. While more than 39 thousand Merrill employees received bonuses from the pool, the vast majority of these funds were disproportionately distributed to a small number of individuals.

...

[T]hese payments and their curious timing raise serious questions as to whether the Merrill Lynch and Bank of America Boards of Directors were derelict in their duties and violated their fiduciary obligations. We will also continue to examine whether senior officials at both companies violated their own fiduciary obligations to shareholders. If they did, this raises additional serious issues with regard to the inappropriate use of taxpayer funds."

Fed Paper: Effective Practices in Crisis Resolution

by Calculated Risk on 2/12/2009 11:16:00 AM

Here is an interesting economic commentary from Cleveland Fed researchers O. Emre Ergungor and Kent Cherny: Effective Practices in Crisis Resolution and the Case of Sweden A few excerpt:

We maintain that the goal of any resolution strategy should be to transfer assets from failed financial institutions to institutions that can put the assets to their most efficient use, and at the least possible short and long-term costs to the taxpayer. As in most things, this is easier said than done. When faced with financial markets and institutions that appear to be spiraling out of control, regulators and policymakers often resort to blanket guarantees of uninsured deposits and other liabilities by providing unlimited liquidity to financial markets until the crisis dissipates.This is why the stress test must be completed quickly (30 days is probably sufficient), and the results should be made public. Last night I listed the three probable categories for the banks: 1) no assistance needed, 2) additional capital needed, and 3) Nationalization needed. I believe this should be fully disclosed and announced publicly in mid-March.

While blanket guarantees might be policymakers’ best choice given the urgency of bringing some calm to markets, history shows that such guarantees have their dangers: they bail out investors who should have done a better job at evaluating and managing their risks and disciplining financial institutions that were mismanaging their money.

...

Most important, according to Ergungor and Thomson, is that successful crisis resolutions have been characterized by transparency. When officials move to contain a financial crisis, their primary task is to identify which institutions are viable and which assets are good, and conversely which institutions are insolvent and which assets are bad. This triage and full disclosure of associated losses clears the uncertainty surrounding the financial institutions and makes it possible for the viable institutions to raise new funds from private investors or from the government if private sources are not available. Failing to acknowledge the true value of assets or the condition of troubled banks early on makes it easy for them to live on as propped up “zombies” (as happened in Japan during the 1990s)—healthy on paper but economically insolvent. Initial full disclosure avoids these situations, and improves efficiency during industry restructuring.

emphasis added

There is much more in the paper.

One of the questions is how big was the Swedish bubble?

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph (from the Cleveland Fed paper) shows that real estate prices more than doubled in the 1980s and then declined sharply in the bust. The price-to-rent ratio increased by about 40% before returning to normal.

And how does this compare to the U.S. housing bubble?

This graph shows the Case-Shiller National price index through Q3 2008 (most recent data, Q4 to be released later this month). This shows that prices double in the U.S. during the recent housing bubble.

This graph shows the Case-Shiller National price index through Q3 2008 (most recent data, Q4 to be released later this month). This shows that prices double in the U.S. during the recent housing bubble.This graph is in nominal terms as is the Swedish graph (not inflation adjusted). Note that prices in Sweden declined, but didn't fall to earlier levels.

Real prices, price-to-rent and price-to-income measures all probably provide better estimates of how far prices will fall.

On price-to-rent, here is a similar graph through Q3 2008 using the Case-Shiller National Home Price Index:

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.

This graph shows the price to rent ratio (Q1 1997 = 1.0) for the Case-Shiller national Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used.Looking at the price-to-rent ratio based on the Case-Shiller index, the price-to-rent increased more in the U.S. than in Sweden, and the ratio still has to decline further (although we don't have the data yet, this ratio definitely declined further in Q4 2008).

Just to repeat, the key lesson in crisis resolution is transparency. I hope the results of the bank stress test will be made public, and the zombie banks clearly identified.

NAR: Distressed Sales Accounted for 45% of Q4 Activity

by Calculated Risk on 2/12/2009 10:44:00 AM

From the National Association of Realtors (NAR): 4th Quarter Metro Area Home Prices Down as Buyers Purchase Distressed Property

Distressed sales – foreclosures and short sales – accounted for 45 percent of transactions in the fourth quarter, dragging down the national median existing single-family price to $180,100, which is 12.4 percent below the fourth quarter of 2007 when conditions were more balanced; the median is where half sold for more and half sold for less.Median home prices are a poor measure of house price changes, especially right now since the mix of homes has shifted significantly to the low end. Repeat sales indexes are better measures of price changes.

The largest sales gain in the fourth quarter from a year earlier was in Nevada, up 133.7 percent, followed by California which rose 84.7 percent, Arizona, up 42.6 percent, and Florida with a 12.5 percent increase.Distressed sales are the market in many areas of California, Florida, Nevada and other bubble states.

“Once again, we see a pattern of strong sales gains, particularly in lower price homes, in areas with price declines resulting from foreclosures,” Yun said. “... in California and Florida ... distressed sales accounted for roughly two-third of all sales ...”

Unemployment Claims: 4 Week Average above 600 Thousand

by Calculated Risk on 2/12/2009 08:31:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Feb. 7, the advance figure for seasonally adjusted initial claims was 623,000, a decrease of 8,000 from the previous week's revised figure of 631,000. The 4-week moving average was 607,500, an increase of 24,000 from the previous week's revised average of 583,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending Jan. 31 was 4,810,000, an increase of 11,000 from the preceding week's revised level of 4,799,000. The 4-week moving average was 4,745,250, an increase of 73,750 from the preceding week's revised average of 4,671,500.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims and continued claims since 1971.

The four week moving average is at 607,500, the highest since 1982.

Continued claims are now at 4.81 million - another new record - above the previous all time peak of 4.71 million in 1982.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.

The second graph shows the 4-week average of initial weekly unemployment claims (blue, right scale), and total insured unemployed (red, left scale), both as a percent of covered employment.This normalizes the data for changes in insured employment.

Another weak unemployment claims report ...

Retail Sales Increase Slightly in January

by Calculated Risk on 2/12/2009 08:30:00 AM

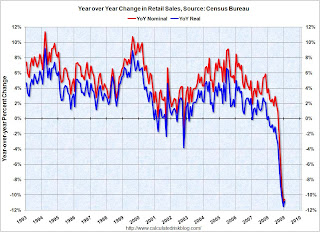

On a monthly basis, retail sales increased slightly from December to January (seasonally adjusted), but sales are off 10.6% from January 2008 (retail and food services decreased 9.7%).

The following graph shows the year-over-year change in nominal and real retail sales since 1993. Click on graph for larger image in new window.

Click on graph for larger image in new window.

To calculate the real change, the monthly PCE price index from the BEA was used (January PCE prices were estimated as the same as December).

Although the Census Bureau reported that nominal retail sales decreased 10.6% year-over-year (retail and food services decreased 9.7%), real retail sales declined by 10.9% (on a YoY basis). The YoY change decreased slightly from last month.

There is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $344.6 billion, an increase of 1.0 percent (±0.5%) from the previous month, but 9.7 percent (±0.7%) below January 2008. Total sales for the November 2008 through January 2009 period were down 9.5 percent (±0.5%) from the same period a year ago. The November to December 2008 percent change was revised from –2.7 percent (±0.5%) to –3.0 percent (±0.2%).One month does not make a trend change, and January retail sales are still over 2% below sales in Q4 - suggesting a further decline in Q1 PCE.

Stress Test: Almost 100 Regulators at Citigroup

by Calculated Risk on 2/12/2009 12:01:00 AM

From Eric Dash at the NY Times: Bank Test May Expand U.S. Regulators’ Role

Nearly 100 federal banking regulators descended on Citigroup in New York on Wednesday morning. Dozens more fanned out through Bank of America, JPMorgan Chase and other big banks across the nation.It sounds like the stress tests could be completed within "weeks" at some banks, and I think 30 days is sufficient for all 18 or so banks with $100 billion in assets.

...

[E]xams for 18 or so of the biggest banks are set to begin immediately, and the first results could arrive within weeks. They are not expected to be made public for every institution.

...

Regulators plan to assess the potential losses a bank could face over the next two years, rather than the typical one year ... They are also expected to look at banks’ exposure to derivatives and other assets normally carried off their balance sheets ... Their assumptions will be guided on a “worst case” basis.

The banks will probably fall into one of three categories:

1) No additional assistance required. These banks will definitely want this publicized!

2) The banks in between that will need additional capital. This is where the Capital Assistance Program comes in:

Capital Assistance Program: While banks will be encouraged to access private markets to raise any additional capital needed to establish this buffer, a financial institution that has undergone a comprehensive “stress test” will have access to a Treasury provided “capital buffer” to help absorb losses and serve as a bridge to receiving increased private capital. ... Firms will receive a preferred security investment from Treasury in convertible securities that they can convert into common equity if needed to preserve lending in a worse-than-expected economic environment. This convertible preferred security will carry a dividend to be specified later and a conversion price set at a modest discount from the prevailing level of the institution’s stock price as of February 9, 2009.3) Banks that will need to be nationalized or sold.

emphasis added

The NY Times article suggests that the results will not be made public for every institution, but that will just lead to rumors and speculation. It would be better to announce the category of all 18+ banks at the same time (in 30 days or so). At that time announce the capital infusions for the category 2 banks, and the nationalization of the category 3 banks.

The sooner the better, although March 12th works for me (30 days from Geithner's speech)! (update: I was just making up a date for fun - this isn't an announced date)

Wednesday, February 11, 2009

Viewing Problems Today and Congressional Video

by Calculated Risk on 2/11/2009 08:24:00 PM

I know a number of readers couldn't access the blog today. Please accept my apology for the inconvenience. This happened for anyone who was using the old blogspot address as a bookmark or an older link from another site.

Google is supposed to redirect that address to the new URL www.calculatedriskblog.com. The RSS feed also wasn't updating. That should all be fixed now too.

We had another display of pettifogging Congressmen today, but at least they provided some entertainment! Here is Congressman Mike Capuano venting (hat tip Nemo):