by Calculated Risk on 1/26/2009 12:53:00 PM

Monday, January 26, 2009

TARP: Free Ice Cream!

Click on photo for larger image in new window.

Click on photo for larger image in new window.

Photo Credit: Otishertz

Otishertz spotted this Ice Cream truck in Portland yesterday. Thanks for sharing!

Umpqua Bank received $214 million from TARP in mid-November.

They cut their dividend recently according to the Portland Business Journal:

Umpqua Bank parent Umpqua Holdings Inc., based in Portland, cut its quarterly dividend in December to 5 cents from prior payments of 19 cents per share.At least we know what they are using the TARP money for: Free ice cream!

Existing Home Sales (NSA)

by Calculated Risk on 1/26/2009 11:26:00 AM

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were slightly higher in December 2008 than in December 2007.

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were slightly higher in December 2008 than in December 2007.

For three of the last four months, sales in 2008 were close to, or slightly higher, than the level of 2007.

However a much larger percentage of the sales in 2008, compared to 2007, were foreclosure resales, and although these are real sales, I think existing home sales will fall further when foreclosure resales start to decline. The second graph shows inventory by month starting in 2002.

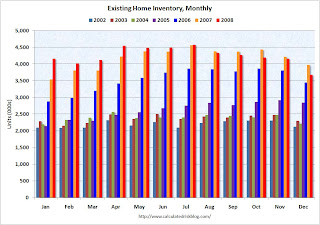

The second graph shows inventory by month starting in 2002.

Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle. Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some ghost inventory (REOs being held off the market).

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that might take some time - especially if sales continue to fall in 2009 as I expect.

Existing Home Sales Increase in December

by Calculated Risk on 1/26/2009 10:00:00 AM

From the NAR: Existing-Home Sales Show Strong Gain In December

ExistingExisting-home sales rose unexpectedly while inventory declined, led by a surge of sales in the West, according to the National Association of Realtors®.

Existing-home sales – including single-family, townhomes, condominiums and co-ops – jumped 6.5 percent to a seasonally adjusted annual rate1 of 4.74 million units in December from a downwardly revised pace of 4.45 million units in November, but are 3.5 percent below the 4.91 million-unit pace in December 2007.

For all of 2008 there were 4,912,000 existing-home sales, which was 13.1 percent below the 5,652,000 transactions recorded in 2007. This is the lowest volume since 1997 when there were 4,371,000 sales.

...

Total housing inventory at the end of December fell 11.7 percent to 3.68 million existing homes available for sale, which represents a 9.3-month supply2 at the current sales pace, down from a 11.2-month supply in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2008 (4.74 million SAAR) were 6.5% higher than last month, and were 3.5% lower than December 2007 (4.91 million SAAR).

Not exactly a "strong gain" looking at a long term graph!

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested said a couple of months ago that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 3.67 million in December, from an all time record of 4.57 million homes for sale in July 2008. Usually inventory peaks in mid-Summer, and then declines slowly through November - and then declines sharply in December as families take their homes of the market for the holidays. This decrease was especially large, but this is the usual pattern.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 3.67 million in December, from an all time record of 4.57 million homes for sale in July 2008. Usually inventory peaks in mid-Summer, and then declines slowly through November - and then declines sharply in December as families take their homes of the market for the holidays. This decrease was especially large, but this is the usual pattern. Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.UPDATE: Important note: The NAR uses Seasonally Adjusted sales, and Not Seasonally adjusted inventory to calculate the Months of Supply. Since inventory always declines in December, the Months of Supply always declines too.

Months of supply decreased to 9.3 months.

I still expect sales to fall further in 2009. It will be interesting in 2009 to see if existing home inventory has peaked for this cycle. I'll have more on existing home sales ...

Job Cuts: Caterpillar 20,000, Sprint 8,000, Home Depot 7,000

by Calculated Risk on 1/26/2009 08:21:00 AM

Update: Home Depot to cut 7,000 jobs. Press Release: The Home Depot Exits EXPO Business

The Home Depot®, the world's largest home improvement retailer, today announced it will exit its EXPO business. The Company is also taking steps to streamline its support functions. These decisions will impact 7,000 associates, or approximately two percent of the Company's total workforce.From MarketWatch Caterpillar profit falls 32% in fourth quarter

Caterpillar Inc. on Monday posted a 32% drop in fourth-quarter profit ...From MarketWatch: Sprint to eliminate 8,000 jobs

More dismal was the bellwether company's 2009 outlook, which predicted a 25% decline in sales due to tighter credit markets and the recession. In response, Caterpillar said it would cut costs, including the elimination of some 20,000 jobs -- nearly 18% of its workforce.

"We expect 2009 will be the weakest year for economic growth in the postwar period," the company said in a statement.

Sprint Nextel Corp. said Monday it will eliminate 8,000 jobs in the first three months of 2009 as part of an effort to reduce costs in the face of a deepening U.S. recession.

Nationalization

by Calculated Risk on 1/26/2009 01:30:00 AM

From the NY Times: Nationalization Gets a New, Serious Look

[M]ost members of the Obama economic team concede that the rapid deterioration of the country’s biggest banks, notably Bank of America and Citigroup, is bound to require far larger investments of taxpayer money, atop the more than $300 billion of taxpayer money already poured into those two financial institutions and hundreds of others.Does this mean "Nationalization"?

But if hundreds of billions of dollars of new investment is needed ... what do taxpayers get in return?

So far, President Obama’s top aides have steered clear of the word entirely, and they are still actively discussing other alternatives, including creating a “bad bank” that would nationalize the worst nonperforming loans by taking them off the hands of financial institutions without actually taking ownership of the banks. Others talk of de facto nationalization, in which the government owns a sizeable chunk of the banks but not a majority...I say to-may-to, you say to-mah-to.

That has already happened ...

Sunday, January 25, 2009

Slow Day, Busy Week

by Calculated Risk on 1/25/2009 08:02:00 PM

For a few months it seemed Sunday had become the new Monday for news. I'm happy for a slow news day!

But this week will be busy: existing home sales on Monday, Case-Shiller house price index on Tuesday, the FOMC meeting on Wednesday, New Home sales on Thursday, and Q4 GDP (the big news) on Friday ... and much more.

The consensus is for a real GDP decline of 5.5% annualized in Q4. Should be interesting ...

Best to all.

Summers: "Next few months are going to be very, very difficult"

by Calculated Risk on 1/25/2009 03:35:00 PM

From Bloomberg: Summers Says Economy Entering a ‘Difficult’ Time

“The next few months are, no question, going to be very, very difficult and it may be longer than that,” said Summers, appearing on NBC’s “Meet the Press.”"Very different" doesn't tell us much.

...

Summers said Obama plans to overhaul the $700 billion Troubled Asset Relief Program enacted in October. Obama’s bank rescue plan, using the remaining $350 billion in TARP, will be “very different” than it was under George W. Bush’s administration, Summers said.

...

“Secretary-designate Geithner ... will be laying out the plans and principles behind our approach,” said Summers ...

CRE: When the Reserve Runs Dry

by Calculated Risk on 1/25/2009 10:30:00 AM

Bloomberg has an update on Manhattan’s largest apartment complex: Tishman’s Stuyvesant Town Fund May Run Dry This Year (hat tip Brian)

Tishman Speyer Properties LP and BlackRock Realty ... are relying on a reserve fund to pay debt on the property and have only six months of money left before it runs out, Fitch Ratings said in a report. ... The fund for the Stuyvesant Town and Peter Cooper Village apartments has declined to $127.7 million as of Jan. 15, from $400 million when it was established.This property was purchased in 2006 and has obviously not met income projections. When the reserve fund runs dry, the owner will need to put in more cash or possibly default on the loan.

This is a common problem for office, retail and apartment properties that were purchased in 2005 or 2006, at prices that were based on overly optimistic pro forma income projections. A reserve fund was used to pay interest until the rents increased, a scenario that is now unlikely with a recession and declining rents. Many of these deals will blow up when the interest reserve is depleted - probably this year or in 2010.

Saturday, January 24, 2009

Obama to Make Changes to Financial Regulatory System

by Calculated Risk on 1/24/2009 10:07:00 PM

From the NY Times: Obama Plans Fast Action to Tighten Financial Rules

Officials say they will make wide-ranging changes, including stricter federal rules for hedge funds, credit rating agencies and mortgage brokers, and greater oversight of the complex financial instruments that contributed to the economic crisis.It sounds like the Obama administration will propose the stimulus plan, the new bank bailout, and significant regulatory changes for financial system all in short order.

...

Officials said they want rules to eliminate conflicts of interest at credit rating agencies ...

Aides said they would propose new federal standards for mortgage brokers ... They are considering proposals to have the S.E.C. become more involved in supervising the underwriting standards of securities that are backed by mortgages.

...

The administration is also preparing to require that derivatives like credit default swaps ... be traded through a central clearinghouse and possibly on one or more exchanges.

U.S. Trade Deficit Graphs

by Calculated Risk on 1/24/2009 08:06:00 PM

“President Obama — backed by the conclusions of a broad range of economists — believes that China is manipulating its currency.”I'm just thinking about some trades issues, and here a few graphs that might be helpful:

Treasury Secretary nominee Tim Geithner, Jan 22, 2009

Click on graph for larger image.

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through November 2008 (most recent data). The recent rapid decline in foreign trade is clear. Note that a large portion of the decline in imports is related to the fall in oil prices.

Looking at port traffic data, exports and imports collapsed further in December.

The second graph shows the U.S. trade deficit / surplus as a percent of GDP since 1960 through Q3 2008.

The second graph shows the U.S. trade deficit / surplus as a percent of GDP since 1960 through Q3 2008.The trade deficit as a percent of GDP started declining in 2006, even with the rapid increase in oil prices. Now, with oil prices falling rapidly, the trade deficit as a percent of GDP will decline sharply in Q4 2008 and Q1 2009.

The third graph shows the U.S. trade deficit, both with and without petroleum through November.

The third graph shows the U.S. trade deficit, both with and without petroleum through November. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

So, excluding petroleum, the trade deficit has been falling since early 2006.

This graph compares monthly U.S. spot oil prices from the Energy Information Administration (EIA) with import oil prices from the Census Bureau trade report.

This graph compares monthly U.S. spot oil prices from the Energy Information Administration (EIA) with import oil prices from the Census Bureau trade report.Obviously the two price series track very well. This implies that import oil prices will drop sharply in the December and January reports, from $67 per barrel in November to around $37 per barrel in January.

Based on this decline in oil prices, and looking back at the third graph, the oil deficit will probably fall from around $19 billion in November to close to $10 billion in January (the actual decline depends on volumes in addition to price). All else being equal, this would push the trade deficit down to $30 billion in January.

And this brings us back to the quote at the top from Geithner. The trade deficit with China was $23 billion in November alone, and even with declining imports from China, the deficit with China will probably account for well over half of the U.S. trade deficit in January.

Just some thoughts ... For some excellent discussion of trade issues (especially with China) see Brad Setser's blog: Follow the Money

Report: U.K. Government to Insure up to £100 billion in RBS Loans

by Calculated Risk on 1/24/2009 06:42:00 PM

From The Times: RBS to purge directors in big shake-up

The Sunday Times can reveal RBS is preparing to place £50 billion to £100 billion of loans into the government’s new bank-insurance scheme ... designed to protect RBS from significant further losses and allow it to restart lending to British companies.This is similar to the insurance plan the U.S. provided for Citigroup and Bank of America. RBS will take the first 10% of losses on the loans and the U.K. taxpayers are on the hook for any additional losses.

The move comes as [new chief executive Stephen] Hester puts the finishing touches to a radical restructuring. As many as 30,000 jobs, out of 170,000, could go in the next three to five years ...

RBS, which has more than £2 trillion of assets, is being used as a guinea pig for the government’s loss insurance rescue scheme.

Report: More Layoffs at Starbucks

by Calculated Risk on 1/24/2009 04:19:00 PM

From the Seattle Times: More layoffs expected at Starbucks

Another big round of layoffs is expected at Starbucks, possibly 1,000 people — a third of its headquarters employees — and some district managers and field employees, according to an e-mail sent to a stock brokerage's customers Friday.The story doesn't mention any more store closings - although apparently no "barista jobs are in jeopardy".

"The cuts might be next week or in February," wrote Diane Daggatt, a managing director at McAdams Wright Ragen in Seattle.

Roubini: The U.K. is NOT Iceland

by Calculated Risk on 1/24/2009 09:24:00 AM

From Professor Roubini: Is the U.K. an Iceland 2? No but there are serious financing risks ahead. Also: BBC News TV and Radio Interviews.

... [I]s the risk that the UK will be Iceland 2? Let us discuss next this issue in more detail:I agree with Roubini that the U.K. will probably not be the next Iceland, but the U.K. clearly has some serious problems.

In many ways the UK looks more like the US than Iceland: a housing and mortgage boom that got out of control; excessive borrowing (mortgage debt, credit cards, auto loans, etc.) and low savings by households; a large and rising current account deficit driven by the consumption boom (and private savings fall) and the real estate investment boom; an overvalued exchange rate; an over-bloated financial system that took excessive risks; a light-touch regulation and supervision system that failed to control the financial excesses; and now an ugly financial and economic crisis as the housing and credit boom turns into a bust. This will be the worst financial crisis and recession in the UK in the last few decades.

Iceland had the same macro and financial imbalances as the US and the UK but the Icelandic banks were both too big to fail and too big to be saved as their losses were much larger than the government capacity to bail them out. Thus, in Iceland you have a solvency crisis for the banks, for the government and for the country too leading to a currency crisis, systemic banking crisis and near sovereign debt crisis.

The US has also a busted banking system and an insolvent household sector (or part of it) but so far the sovereign has the willingness and ability to socialize such private losses via a vast increase in public debt.

This week in the UK investors started to worry that the UK government looks more like the Iceland one than the US: having banks that are too big to be saved given the fiscal/financial resources of the country.

But in principle the UK looks more like the US: the public debt to GDP is relatively low (in the 40s % range) and thus the sovereign should be able to absorb fiscal bailout costs and additional fiscal stimulus costs that may eventually increase that debt ratio by as high as 20% of GDP. Note that during WWII the UK public debt to GDP ratio peaked well above 150% and the UK government remained solvent.

... at best, the UK faces an economic and financial crisis that will be as bad as the US one: a severe and protracted recession that could last two years with very weak growth recovery once it is over; a near insolvent financial system, most of which will be formally or informally nationalized; a large fiscal costs of budget deficits surging because of the recession and the bailout of financial institutions; a weakening currency that may risk a hard landing if the crisis is not properly managed. A more dramatic run on the cross-border liabilities of banks, a run on the government debt and a hard landing of the pound can be prevented by coherent and forceful policy action.

More on Intrade Depression Odds

by Calculated Risk on 1/24/2009 12:24:00 AM

Earlier this week I noted that the Intrade method of calculating a depression was flawed.

I found out today that James Kwak at RGEMonitor noticed it before me: Betting on a “Depression” Kudos to James!

Now Intrade has added some more depression bets, including a 10% decline in nomimal GDP by the end of 2009. Jay Hancock, who blogs at the Baltimore Sun, points out these are flawed too: Intrade modifies depression bet, messes up again

[T]here are new depression bets, which Intrade couches in terms of absolute change in GDP dollar value rather than the rates that tripped it up before. ... But the rules are still problematic. In the new bet, Intrade will trace changes in nominal GDP instead of real, inflation-adjusted GDP. Nobody measures business cycles this way.I guess they can't figure out how to explain a 10% real decline in GDP, so the bet is based on nominal GDP instead. Interesting - at least to nerds like me - is that the GDP price deflator could be negative in 2009, and therefore a 10% nominal decline in GDP could actually be less likely than a 10% decline in real GDP!

Friday, January 23, 2009

2009 Bank Failure #3: 1st Centennial Bank, Redlands, CA

by Calculated Risk on 1/23/2009 09:21:00 PM

1st Centennial Bank, Redlands, California, was closed today by the California Department of Financial Institutions, which then appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with First California Bank, Westlake Village, California, to assume the insured deposits of 1st Centennial.It is officially Friday.

...

As of January 9, 2009, 1st Centennial had total assets of $803.3 million and total deposits of $676.9 million, of which there were approximately $12.8 million that exceeded the insurance limits. ...

1st Centennial also had approximately $362 million in brokered deposits that are not part of today's transaction. ...

First California agreed to assume the insured deposits for a 5.29% premium. It will also purchase approximately $293 million of the failed bank's assets. The assets are comprised mainly of cash, cash equivalents and marketable securities. The FDIC will retain the remaining assets for later disposition.

The cost to the FDIC's Deposit Insurance Fund is estimated to be $227 million. 1st Centennial is the third bank to fail this year, and the first in California since Downey Savings and Loan, F.A., Newport Beach, was closed on November 21, 2008.

It's Never Enough: Citigroup $12 Billion, Freddie Mac $35 Billion

by Calculated Risk on 1/23/2009 05:35:00 PM

From Bloomberg: Citigroup Raises $12 Billion in Largest FDIC-Backed Bond Sale (hat tip stockdog42)

Citigroup Inc. sold $12 billion of notes guaranteed by the Federal Deposit Insurance Corp. ... The sale is the biggest offering of debt backed by the FDIC since banks began using the government’s Temporary Liquidity Guarantee Program on Nov. 25From Freddie Mac 8-K SEC filing (hat tip Comrade Byzantine_Ruins):

Freddie Mac (formally known as the Federal Home Loan Mortgage Corporation) is in the process of preparing its financial statements for the fourth quarter of 2008 and the year ended December 31, 2008. Based on preliminary unaudited information concerning its results for these periods, management currently estimates that the Federal Housing Finance Agency, in its capacity as conservator of Freddie Mac (Conservator), will submit a request to the U.S. Department of the Treasury (Treasury) to draw an additional amount of approximately $30 billion to $35 billion under the $100 billion Senior Preferred Stock Purchase Agreement (Purchase Agreement) between Freddie Mac and Treasury. The actual amount of the draw may differ materially from this estimate as Freddie Mac goes through its internal and external process for preparing and finalizing its financial statements.See previous post for some comedy relief: "I Want some TARP".

The Accidental Landlord

by Calculated Risk on 1/23/2009 04:20:00 PM

I've joked about "accidental landlords" before, and how these owners are just more shadow housing inventory.

Here is a UK story from the Financial Times: ‘Accidental landlords’ face shrinking rents

Letting agents saw a rush of so-called “accidental landlords” into the market last year, as falling house prices convinced property vendors to delay their sales. But the sheer volume of properties that have become available to potential tenants in recent months has brought stiff competition for landlords and put pressure on rents.Ouch.

...

Many landlords have had to slash rents by around 20 per cent, according to agents. In the most oversupplied parts of London, falls in rental income have been as sharp as 30 per cent.

In the U.S. if an owner decides to rent, the mortgage rate doesn't change (although many areas have a property tax exemption for homeowners that no longer applies). But in the UK:

Homeowners who let their property are obliged to tell their lender and may have to move on to a more expensive buy-to-let mortgage.Falling rents, more vacancies, and a higher mortgage payment - and falling property values - the joys of the accidental landlord. They probably would have been better off just selling at a loss.

Housing and "Ghost Inventory"

by Calculated Risk on 1/23/2009 02:57:00 PM

From CNNMoney: Flood of foreclosures: It's worse than you think (hat tip Larry)

There is probably even more excess housing inventory gumming up the market than current statistics indicate, thanks to a wave of foreclosures that has yet to hit the market.Usually most REOs (lender Real Estate Owned) are listed pretty quickly, although lenders typically clean up the properties and sometimes do minor repairs before listing the property, so there is some lag between foreclosure and the property being listed. The size of this "ghost inventory" is unknown.

...

The problem: Many foreclosed homes and other distressed properties that are now owned by banks have yet to be listed for sale.

...

RealtyTrac looked at listings in four states, California, Maryland, Florida and Wisconsin, and found that they contained only a third of the foreclosures it has in its database.

I've also heard a number stories of lenders delaying foreclosures, probably because they are overwhelmed right now. This is another type of potential "ghost inventory", although many of these properties might already be listed as short sales by the owner.

There is also a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so for all these reasons, existing home inventory levels will probably stay elevated for some time.

Britain Officially in Recession

by Calculated Risk on 1/23/2009 11:17:00 AM

From The Times: It's official - Britain is in recession

Britain is in the grip of its sharpest recession for three decades, grim official figures confirmed today ... The economy suffered a brutal 1.5 per cent drop in Gross Domestic Product (GDP) during the past three months, shrinking at its fastest quarterly pace since 1980.This brings up a couple of interesting points:

Coming on the heels of an already steep 0.6 per cent plunge in GDP in the third quarter of last year, the news means that the widely accepted definition of recession as two consecutive quarters of falling output has finally been met.

A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators.

China reports the year-over-year change in real GDP for the quarter, so the 6.8% GDP for Q4 recently reported includes the changes in Q1 through Q3 too. As Roubini noted:

The Chinese came out today with their 6.8% estimate of Q4 2008 growth. China publishes its quarterly GDP figure on a year over year basis, differently from the U.S. and most other countries that publish their GDP growth figure on a quarter on quarter annualized seasonally adjusted (SAAR) basis.Here is the Britain report: UK output decreased by 1.5% in Q4 2008

When growth is slowing down sharply the Chinese way to measure GDP is highly misleading as quarter on quarter growth may be negative while the year over year figure is positive and high because of the momentum of the previous quarters’ positive growth.

Indeed if one were to convert the 6.8% y-o-y figure in the more standard quarter over quarter annualized figure Chinese growth in Q4 would be close to zero if not negative.

Gross Domestic Product (GDP) contracted by 1.5 per cent in the fourth quarter of 2008, compared with a decrease of 0.6 per cent in the third quarter. The increased rate of decline in output was due to weaker services and production industries output.

Construction output decreased by 1.1 per cent, compared with a decrease of 0.2 per cent in the previous quarter.