by Calculated Risk on 9/11/2008 03:59:00 PM

Thursday, September 11, 2008

Hatzius: An Estimate of Mortgage Credit Losses

From Jan Hatzius, Goldman Sachs chief economist presented at the Brookings conference today: Beyond Leveraged Losses: The Balance Sheet Effects of the Home Price Downturn. Here is a short excerpt on estimating mortgage credit losses (note that Goldman is now forecasting prices to decline another 10%):

If nominal home prices remain at their 2008 Q2 level until mid-2009, before reverting to a +3% annualized trend, our model implies that mortgage credit losses realized in the 2007-2012 period will total $473 billion. If nominal home prices fall another 10% through the middle of 2009, the model projects losses of $636 billion. Finally, if prices drop another 20%, predicted losses increase to $868 billion. Moreover, the table suggests that losses peak in the third quarter of 2008 if home prices are flat going forward; in the fourth quarter of 2008 if prices drop another 10%; and in the second quarter of 2009 if prices drop another 20%.

Bloomberg: Senators Ask Fannie / Freddie to Freeze Foreclosures

by Calculated Risk on 9/11/2008 03:04:00 PM

From Bloomberg: Senators Ask Fannie, Freddie to Freeze Foreclosures

U.S. Senate Banking Committee members urged Fannie Mae and Freddie Mac, the mortgage lenders placed under federal control this week, to freeze foreclosures on loans in their portfolios for at least 90 days.I suppose the goal is work out more modifications ... nothing else will change in 90 days.

Lower Mortgage Rates, But More Lenders Require 15% Down Payment

by Calculated Risk on 9/11/2008 01:12:00 PM

Update: Here are the new guidelines from Fannie Mae (hat tip MaxedOutMama)

NOTE THAT THE 85% LTV applies to cash out refis. Purchase Money Mortgage (new purchase) is still 95% LTV (or 5% down payment).

From Peter Viles at L.A. Land: 10% down? Forget it, it's now 15%

Good news from the government takeover of Fannie and Freddie: Mortgage rates are falling. Bad news for borrowers short on cash: You need more cash to get a mortgage.Peter excerpts from an L.A. Times story by Scott Reckard: Mortgage rates are plunging -- for those who qualify

[L]enders spooked by free-falling home prices and surging foreclosures have imposed tougher lending standards. ... most banks this week immediately adopted new guidelines that Fannie Mae said it would implement next year.Here is the current mortgage product info from Fannie Mae. Does someone have a link to the guidelines for next year?

Among them: Home purchasers must put down at least 15% of the purchase price, up from 10%.

Bloomberg: Lehman Said to be in Talks with Potential Buyers

by Calculated Risk on 9/11/2008 12:38:00 PM

UPDATE: From Reuters: Goldman Sachs is not buying Lehman - sources

From Bloomberg: Lehman Said to Be in Talks With Potential Buyers as Shares Drop

Lehman Brothers Holdings Inc. entered into talks with potential buyers of the securities firm after Moody's Investors Service said the company must find a ``stronger financial partner'' and the shares plummeted.Yves Smith at Naked Capitalism broke this earlier: Lehman End Imminent

Bankers from other firms are reviewing Lehman's books today, people with knowledge of the situation said ...

I heard this rumor from two sources, that Lehman is in its final day or two and Goldman is willing to buy the firm, and the second source, who volunteered the information, is sufficiently well plugged in that I trust the reading. This came from a former senior employee:A couple friends of mine from LEH trading desk called me this a.m. to say that mgmt has taken employees aside to let them know that the end should come in next 24-48 hours. Ratings agencies apparently told them that the steps were not sufficient to prevent a d/g, and LEH mgmt asked them to hold off for a day or so to give them a chance to resolve situation (with sale of company).

Apparently GS is willing buyer, but is buyer of last resort from LEH's perspective, b/c they would keep very few LEH employees.

Lehman: Cliff Diving

by Calculated Risk on 9/11/2008 09:44:00 AM

Lehman is off 40% in early trading.

From the WSJ: Lehman Struggles To Shore Up Confidence

As Lehman Brothers Holdings Inc. stock teetered in recent weeks, Chairman and Chief Executive Richard Fuld Jr. called Wall Street executives to make sure they were still trading with his embattled firm and offering it credit. Rumors about the firm's health kept popping up, he groused to other executives.Probably more whack-a-mole today.

"I feel like I'm playing whack-a-mole every day," Mr. Fuld said, according to people familiar with the calls.

BTW, WaMu is off another 20%.

Unemployment: Continued Claims Over 3.5 Million

by Calculated Risk on 9/11/2008 09:05:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Sept. 6, the advance figure for seasonally adjusted initial claims was 445,000, a decrease of 6,000 from the previous week's revised figure of 451,000. The 4-week moving average was 440,000, an increase of 250 from the previous week's revised average of 439,750.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows weekly claims. The four moving average is at 440,000.

This is a very high level, and indicates continued weakness in the labor market.

Continued claims are now above 3.5 million for the first time since 2003.

The advance number for seasonally adjusted insured unemployment during the week ending Aug. 30 was 3,525,000, an increase of 122,000 from the preceding week's revised level of 3,403,000. The 4-week moving average was 3,429,000, an increase of 36,750 from the preceding week's revised average of 3,392,250.By these measures, the economy is clearly in recession.

Wednesday, September 10, 2008

Investment: Residential vs. Non-Residential

by Calculated Risk on 9/10/2008 09:55:00 PM

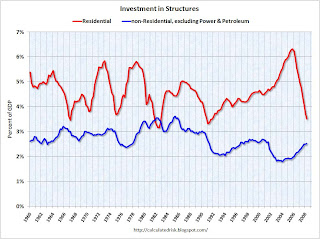

Since investment in non-residential structures is about to slow (especially malls, hotels, and offices), a key question is how did the commercial real estate (CRE) investment boom compare to the residential housing bubble?

The following graph shows residential investment compared to investment in non-residential structures (excluding Power and Petroleum exploration) as a percent of GDP since 1960. All data from the BEA.

Note: Residential investment is primarily single family structures, multi-family structures, commissions, and home improvement. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The recent housing boom and bust is very clear (in red). But this shows that the recent boom in non-residential investment (ex power and petro) was not as excessive as the housing bubble.

Also, the recent boom for CRE was much less than the S&L related boom in the '80s, and even less than the late '90s office boom.

Some areas of non-residential investment have been overbuilt (especially hotels and malls, and offices somewhat). But those looking for a collapse in CRE investment of the same size as the current residential investment bust are wrong.

The CRE Bust: Quick Overview

by Calculated Risk on 9/10/2008 04:55:00 PM

This morning the WSJ and the NY Times had articles on Mall troubles. See WSJ: Mall Glut to Clog Market for Years and NY Times: A Squeeze on Retailers Leaves Holes at Malls

This should come as no surprise. Historically investment in non-residential structures lagged investment in residential by 5 to 8 quarters. The reasons are pretty clear - the commercial builders (for malls, offices, lodging, etc.) don't build until the residential is in place, and the commercial build cycles are usually longer than residential.

It appears we are now at the end of a Commercial Real Estate (CRE) boom based on the following:

"[W]e’ve seen a dramatic contraction in design activity in recent months. ... This weakness in design activity can be expected to produce a contraction in [commercial and multifamily] construction sectors later this year and into 2009.”

AIA Chief Economist Kermit Baker, June 18, 2008

Click on graph for larger image in new window.

Click on graph for larger image in new window.From the American Institute of Architects: Architecture Billings Index Continues in Negative Territory

As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment in the second half of 2008 and throughout 2009.

From the Fed: The July 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for three key categories: residential real estate, commercial real estate, and consumer credit cards.

This graph based on data from the Federal Reserve shows the delinquency rates at the commercial banks for three key categories: residential real estate, commercial real estate, and consumer credit cards.Commercial real estate delinquencies are rising rapidly, and are at the highest rate since Q1 '95 (as delinquency rates declined following the S&L crisis).

It should be no surprise that investment in CRE will decline in the 2nd half of 2008 and in 2009.

Lehman on House Prices

by Calculated Risk on 9/10/2008 02:29:00 PM

From the Lehman conference call:

"[The Lehman] base case assumes national home prices drop 32% peak to trough, vs. 18% to date, with California down 50% vs 27% to date."The 18% corresponds to the reported decline in the S&P Case-Shiller U.S. National Home Price Index through Q2 (so I believe Lehman is using the Case-Shiller index or something very similar).

Ian T. Lowitt, Lehman CFO

In other words, Lehman's base case assumes that house prices have fallen just more than half way from the peak.

It was just last December that Ben Stein argued Goldman's projection of a 15% peak-to-trough decline in national home prices was implausible (Goldman is projecting another 10% decline now). And Professor Krugman responded to Ben Stein:

For what it’s worth, Goldman’s forecast of a 15 percent decline in home prices seems implausible to me, too — but on the low side. A 15 percent decline would bring prices back to their level in early 2005 — when the bubble was already well inflated. If prices fall back to their level in early 2003, that’s a 30 percent decline.Price declines still have a ways to go (see here for a discussion of real prices, price-to-rent ratio and price-to-income ratio).

BofA: Builder Portfolio "Not Pretty"

by Calculated Risk on 9/10/2008 12:40:00 PM

BofA Presentation material is here.

Webcast here.

BofA just concluded a presentation. No story yet, but here are some headlines (hat tip Joshua and Brian):

BofA sees some softening on Commercial Asset Quality

Q3 to be "a little choppy" in capital markets.

BofA sees higher loss rates.

BofA's $13B home builder portfolio "not pretty"

BofA home builder losses grew faster than expected.

BofA see elevated credit costs, no "major pain"

BofA other commercial / industrial loans show weakness.

WaMu Cliff Diving

by Calculated Risk on 9/10/2008 11:31:00 AM

WaMu off another 28%. From Reuters: WaMu's CDS spreads surge to record high-Phoenix

Five-year credit default swaps on Washington Mutual traded at 40 percent upfront, plus 500 basis points annually, up from 32 percent upfront plus 500 basis points a year on Tuesday, according to data from Phoenix Partners Group.Wow.

Tracking REOs in Huntington Beach, CA

by Calculated Risk on 9/10/2008 11:16:00 AM

Mathew Padilla at the Mortgage Insider and the O.C. Register is tracking 10 REOs in Huntingon Beach, CA. to determine pricing and how quickly they sell. See: Time to buy a foreclosure in Surf City?

Although this is a small sample, it will be interesting to follow. There is also a slide show of the properties.

My initial reaction is that these prices are still too high. The following 3 BR / 2BA, 1,123 sq. ft. REO is being offered at $449,900. The house was built in 1960, and last sold for $610,000 in Sept 2006.

As houses sell, I'll include an update ...

Ding Dong! The DAP is ... Alive?

by Calculated Risk on 9/10/2008 09:39:00 AM

Downpayment Assistance Programs (DAPs) are a symbol of the excesses and lack of oversight during the housing bubble. Basically DAPs allow the seller to provide the buyer with the 3% downpayment as a "gift". The FHA has been trying to eliminate these programs for several years - the IRS has called them a "scam" - and one of the provisions in the recent housing bill was to eliminate DAPs for FHA loans.

Some in Congress will not give up. Inman News reports: Congress weighs reprieve for seller-funded gifts (hat tip Jim Klinge)

A last-ditch effort to head off an Oct. 1 ban on the use of seller-funded down-payment assistance with FHA-backed loans is picking up steam as a compromise bill, that would mend rather than end the practice, gains momentum.DAPs encourage appraisal fraud, and lead to higher default rates for FHA loans.

HR 6694, which would allow home builders to continue funneling down-payment assistance through nonprofit groups to home buyers using FHA loans, is certain to pass the House of Representatives and has the blessing of the Department of Housing and Urban Development, Rep. Barney Frank, D-Mass., said at a hearing on foreclosures this weekend.

HUD has sought to end the use of seller-funded down-payment assistance with FHA loans outright, claiming the practice artificially inflates home prices and that borrowers who relied on the gifts are more likely to default.Perhaps this is part of the reason the foreclosure rate is so high in Merced. And what is this comment about a 20% downpayment? The FHA only requires 3.5% as of Oct 1st, and any potential home buyer that can't save (or borrow from friends and family) a small downpayment probably isn't ready to be a homeowner.

Although FHA loan guarantee programs have always been self-sustaining -- they are funded by premiums paid by borrowers, and not taxpayers -- HUD said the enormous growth in the use of seller-funded gifts and the poor performance of the loans threatens to put the insurance fund in the red.

...

At Saturday's hearing, Merced Mayor Ellie Wooten [a local Realtor] said the down-payment assistance program offered by Nehemiah Corp. of America was "heavily used" in Merced County.

"We are an agricultural community, and (farmworkers) are solid people, but many people don't have bank accounts with the 20 percent down payment," Wooten said. The minimum down payment for FHA guaranteed loans is now 3 percent, and is being raised to 3.5 percent on Oct. 1.

Oxley: Ideologues hurt Fannie and Freddie

by Calculated Risk on 9/10/2008 09:12:00 AM

“We missed a golden opportunity that would have avoided a lot of the problems we’re facing now, if we hadn’t had such a firm ideological position at the White House and the Treasury and the Fed [in 2005].From the Financial Times: Oxley hits back at ideologues (hat tip Paul Krugman)

...

All the handwringing and bedwetting is going on without remembering how the House stepped up on this. What did we get from the White House? We got a one-finger salute.”

former Congressman Mike Oxley (R-Ohio), Sept 9, 2008

Note: Greenspan was at the Fed. John Snow was the Treasury Secretary.

Actually, They Hate You Too

by Anonymous on 9/10/2008 08:24:00 AM

This headline in the WSJ caught my eye this morning. "Retailers Reprogram Workers In Efficiency Push." Do tell:

LANGHORNE, Pa. -- Retailers have a new tool to turn up the heat on their salespeople: computer programs that dictate which employees should work when, and for how long. . . .But maybe Mr. Knaul should worry a bit more about what those other 95 switches and knobs do:

AnnTaylor calls its system the Ann Taylor Labor Allocation System -- Atlas for short. It was developed by RedPrairie Corp., a retail-operations software firm based in Waukesha, Wisc. "We liken the system to an airplane dashboard with 100 different switches and levers and knobs," said AnnTaylor's Mr. Knaul. "When we launched that, we messed with five of them." Giving the system a nickname, Atlas, he said, "was important because it gave a personality to the system, so [employees] hate the system and not us."

Mr. Knaul said the new system exceeded the company's targets for converting more browsers into buyers. He said that AnnTaylor hopes to refine the system, possibly with features that rank employees based on skills other than their sales proficiency, such as how well they operate cash registers.I haven't been in an Ann Taylor store in several years. Last time I wandered into one, about 75% of the clothing was one of three shades of the same bright pink that every other retailer was loading up on, all slacks and trousers had the same super-low-rise waists that I don't wear, and anything I might have worn to work, like simple linen skirts or blouses, were dry-clean-only, which isn't my idea of what "business casual" dressing is all about. Either that, or the only sizes on the rack were fours or twelves. I didn't notice anyone having problems operating the cash registers, but then again I didn't get that far, given that if I want badly-fitting clothes in a ubiquitous color and style I can get them cheaper than Ann Taylor's prices. But I can certainly see why that chain needs aggressive salespeople to push the merchandise.

Another option, Mr. Knaul added, was to begin using the system to more efficiently schedule managers.

Lehman Conference Call at 8 AM

by Calculated Risk on 9/10/2008 07:53:00 AM

Here is the Lehman Press Release.

The conference call number is 800-369-1721 (domestic) or 517-308-9232 (international) at least ten minutes prior to the start of the conference call. The pass code for all callers is 7561430.

The conference call will also be accessible through the “Shareholders” section of the Firm’s Web site under the subcategory “Events and Presentations.” See here.

I'll post some remarks (plus see the comments).

Fuld: "significant deterioration" in 2nd quarter in credit markets.

Fuld: "final stages" of selling majority interest in IMD.

Fuld: "remain committed" to all alternatives.

Project 34% price drop on houses (stress case), compared to 18% decline in house prices so far (pretty quick, I think this is correct).

Reader Brian comments: "Alt-A is real mess. 18% DQ rate at this point, bound to get worse, is a horror show....Of course they are financing the REI spinoff, so there is no risk reduction unless REI can attract external funding"

Lehman: $3.9 Billion Loss, Spin Off Commercial Real Estate Assets

by Calculated Risk on 9/10/2008 07:30:00 AM

Lehman cuts dividend, to sell majority stake in Neuberger, Spin-off CRE assets, report $3.9 Billion loss.

From Lehman: LEHMAN BROTHERS ANNOUNCES PRELIMINARY THIRD QUARTER RESULTS AND STRATEGIC RESTRUCTURING Excerpts:

Spin-off to Lehman Brothers’ Shareholders of Vast Majority of the Firm’s Commercial Real Estate Assets into a New, Separate Public Company

o Leaves Firm with Limited Commercial Real Estate Exposure

o Shareholders Retain Upside in Commercial Real Estate Portfolio

o Expected to be Completed in First Quarter of Fiscal 2009

Intention to Sell a Majority Interest in Investment Management DivisionMuch more in press release.

o Auction Process Highlights Value of Investment Management Business

o Expected to Result in Tangible Book Value Benefit of More Than $3.0 Billion

o Lehman Brothers Expects to Maintain the Majority of the Pre-Tax Income of the Investment Management Division

o Ongoing Strategic Relationship Maintained with Lehman Brothers

Tuesday, September 09, 2008

CRE: More on the Mall Glut

by Calculated Risk on 9/09/2008 11:38:00 PM

The WSJ has some updated statistics on malls in this article: Mall Glut to Clog Market for Years

Developers have built one billion square feet of retail space in the 54 largest U.S. markets since the start of 2000, 25% more than what they built during the same period of the 1990s, according to Property & Portfolio Research Inc. of Boston. U.S. retail space now amounts to 38 square feet for every person in those 54 markets, up from 29 square feet in 1983, the firm says.Update: The NY Times has a mall article too: A Squeeze on Retailers Leaves Holes at Malls

...

David Simon, chairman and chief executive of Simon Property Group Inc., the largest U.S. mall owner with 323 malls, sees "a decade of little new development" and a shakeout. "There were a lot of projects that shouldn't have been built" in recent years, he said.

Some 6,500 chain stores are expected to close this year, the largest number since 2001, according to the International Council of Shopping Centers, a trade group.Not only are there too many new projects being built, but vacancy rates are rising. Reuters reported for Q2: US retail property 2nd-qtr worst in 30 yrs - report

Strip malls ... saw average vacancies spike 0.5 percentage points to 8.2 percent, a level unseen since 1995 ...

Click on image for larger graph in new window.

Click on image for larger graph in new window.This graph shows the strip mall vacancy rate since Q2 2007. Note that the graph doesn't start at zero to better show the change.

Too many new projects and rising vacancies rates suggests new mall construction will decline sharply. This is one of the three areas of new construction of Commercial Real Estate (CRE) were I expect a significant decline in investment over the next several quarters; there are investment in Malls, Hotels, and Office space.

Lehman Press Release; Bloggin' the Conference Call

by Calculated Risk on 9/09/2008 10:45:00 PM

Here is the Lehman Press Release.

The news will be released at 7:30 AM, the conference call is at 8 AM ET. You can listen to the call on the web here. I'll be awake (hopefully!) and blogging:

Lehman Brothers Holdings Inc. (NYSE: LEH) will announce its expected third quarter fiscal 2008 results as well as key strategic initiatives for the Firm on Wednesday, September 10, 2008 in a press release that will be issued at approximately 7:30 a.m. The press release will also be available on the Firm’s Web site, http://www.lehman.com.

A conference call to discuss the Firm’s expected financial results, outlook and strategy will be held at 8:00 a.m. ET that day. The call will be open to the public.

Members of the public who would like to access the conference call should dial 800-369-1721 (domestic) or 517-308-9232 (international) at least ten minutes prior to the start of the conference call. The pass code for all callers is 7561430. The conference call will also be accessible through the “Shareholders” section of the Firm’s Web site under the subcategory “Events and Presentations.” For those unable to listen to the live broadcast, a replay will be available on the Firm’s Web site or by dialing 800-337-5613 (domestic) or 402-220-9646 (international). The replay will be available approximately one hour after the event and will remain available on the Lehman Brothers Web site and by phone until 11:59 p.m. ET on September 17, 2008.

emphasis added

Lehman to Announce Expected Results, Strategic Initiatives

by Calculated Risk on 9/09/2008 07:01:00 PM

From MarketWatch: Lehman to report expected results Wednesday 7:30 am ET

Update: From TheStreet.com: Lehman in Free Fall as Default Fears Mount(hat tip JP)

Richard Bove, an analyst at Ladenburg Thalmann, predicted that the government would broker a private investment in or takeover of Lehman or one of its businesses overnight before the market opened on Wednesday.Darn, I have to get to bed early tonight!