by Calculated Risk on 8/26/2008 09:24:00 AM

Tuesday, August 26, 2008

Case-Shiller: House Prices Decline in June

S&P/Case-Shiller released their monthly Home Price Indices for June this morning. This includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national house price index - I'll have more on that later. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index was off 7.0% annual rate in June (from May), and is off 20.3% from the peak.

The Composite 20 index was off 5.9% annual rate in June (from May), and is off 18.8% from the peak.

Prices are still falling, but the rate of monthly price declines has slowed a little. Some of this may be seasonal, and prices will probably continue to decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 17.0% over the last year.

The Composite 20 is off 15.9% over the last year.

More on prices later ... including Q2 data, selected cities, and real prices.

Monday, August 25, 2008

WSJ: Regulators Step Up Bank Actions

by Calculated Risk on 8/25/2008 10:07:00 PM

From the WSJ: Regulators Step Up Bank Actions

The Federal Reserve and the Office of the Comptroller of the Currency, two of the nation's primary bank regulators, have issued more ... memorandums of understanding so far this year than they did for all of 2007 ...It will be interesting to see how many banks are on double secret probation!

The depth of problems in the banking sector will become clearer Tuesday when the Federal Deposit Insurance Corp. updates its list of "problem" institutions. ...

Take A Load Off Fannie

by Calculated Risk on 8/25/2008 06:05:00 PM

"The story of Fannie Mae, as narrated by The Band"

WaMu Offering 5% 12 Month CDs

by Calculated Risk on 8/25/2008 03:50:00 PM

From WaMu: a 5% 12 month FDIC insured CD. (hat tip Anthony)

Just saying ... WaMu is paying 5% in an environment when few banks are paying over 4.25% and most banks are under 4% for one year CD.

JPMorgan: Fannie & Freddie Investments Decline by Half

by Calculated Risk on 8/25/2008 02:55:00 PM

From the JPMorgan SEC 8-K filing today:

JPMorgan Chase & Co. disclosed today that it held approximately $1.2 billion par value of Fannie Mae and Freddie Mac perpetual preferred stock. Such securities are held in the Firm's investment portfolio and are marked to market through the Firm's earnings. The Firm estimates that such preferred stocks have declined in value by approximately an aggregate $600 million in the third quarter to date, based on current market values. The precise amount of losses that may be incurred on these securities for the third quarter is difficult to determine, given the significant volatility being experienced in the market values of these securities.Many banks hold preferred shares in Fannie and Freddie, and the impact could be widespread.

OTS Expresses Concerns about BankUnited Financial

by Calculated Risk on 8/25/2008 12:22:00 PM

From the BankUnited Financial Corporation 10-Q filed with the SEC today (see page 22 for more):

BankUnited has been advised by the OTS of certain concerns that BankUnited has agreed to address. ... These measures include efforts to seek to raise at least $400 million of capital and to submit an alternative capital plan to be applicable if the Company is unable to raise the $400 million; termination of the option ARM loan program (other than in the wealth management area and, in certain limited circumstances, for loan modifications); termination of reduced and no documentation loan programs; reduction of the portfolio of negative amortization loans; and enhanced monitoring and internal reporting, as well as reporting to regulators on option ARM loan reduction efforts, preservation and enhancement of capital, mortgage insurance and liquidity strength. The Bank also agreed to enhance its policies and procedures regarding the Bank’s allowance for loan losses, including increasing the allowance to a level which has already been attained. The Bank has also agreed to maintain capital ratios substantially in excess of the minimum required ratios to be deemed well-capitalized upon raising the agreed upon amount of capital. The OTS has advised that the Bank must limit its asset growth and notify it prior to: adding directors or senior executive officers; making certain kinds of severance and other forms of payments; entering into, renewing, extending, or revising any compensatory or benefits arrangements with any director or officer; entering into any third-party contracts out of the normal course of business; and issuing any capital distribution, such as dividends. Based on a recent notification, BankUnited believes that, unless it raises significant capital, the OTS will reclassify the Bank to adequately capitalized primarily due to the deterioration in the Bank’s non-traditional mortgage loan portfolio, the concentration of risk associated with that portfolio, and a resultant need for significant additional capital. The Company has continued its efforts to raise capital. Management believes that the Bank will maintain its well-capitalized status if the Company’s capital raising efforts are successful. There can be no guarantee that any of the measures already taken or in progress will be successful or satisfy the concerns of the OTS, and additional restrictions may be imposed on BankUnited’s activities in the future that could have a material adverse effect on BankUnited’s financial position and operations.

Subsequent to June 30, 2008, the FHLB commenced a review of our borrowing capacity, which is ongoing. The FHLB has advised us that it has changed its position regarding collateral held by affiliates, and that $736 million of pledged collateral from our affiliated REIT may not be fully eligible to support borrowings. Management is assessing alternatives for addressing this issue. Additionally, during the quarter ended June 30, 2008, we instituted the use of brokered deposits. The Bank had $268 million of brokered deposits at June 30, 2008 and $774 million as of August 15, 2008. OTS and FDIC regulations limit the use of brokered deposits in certain situations, including requiring a prior waiver from the FDIC if the Bank were reclassified as adequately capitalized.

emphasis added

July Existing Home Sales: Record Inventory

by Calculated Risk on 8/25/2008 10:00:00 AM

From NAR: July Existing-Home Sales Show Gain

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 3.1 percent to a seasonally adjusted annual rate¹ of 5.00 million units in July from a downwardly revised level of 4.85 million in June, but are 13.2 percent lower than the 5.76 million-unit pace in July 2007.

...

Total housing inventory at the end of July rose 3.9 percent to 4.67 million existing homes available for sale, which represents an 11.2.-month supply at the current sales pace, up from a 11.1-month supply in June.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in July 2008 (5.00 million SAAR) were the weakest July since 2000 (4.82 million SAAR).

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). The NAR suggested last month that "short sales and foreclosures [account] for approximately one-third of transactions". Although these are real transactions, this means that normal activity (ex-foreclosures) is running around 3.3 million SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September).

The second graph shows nationwide inventory for existing homes. According to NAR, inventory increased to an all time record 4.67 million homes for sale in July. Usually inventory peaks in mid-Summer, so this could be the peak for inventory this year (although it might happen in August or September). Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

But there is some evidence lenders are holding off foreclosing, perhaps trying for workouts, or maybe the lenders are just overwhelmed - and many of these units are probably not included in inventory. And there are definitely homeowners waiting for a "better market" - and those homeowners will probably keep the supply high for a few years.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply increased to 11.2 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels have peaked for the year, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year.

My forecast was for Months of Supply to peak at about 12 months this year and this metric is pretty close.

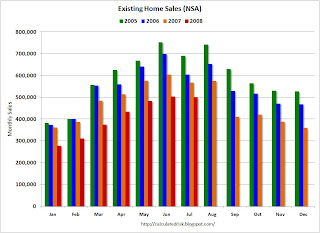

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.

The fourth graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are lower in July 2008 compared to the previous three years.NSA sales were reported at 501 thousand in July, however about one-third of those were foreclosure resales. This means regular sales are less than half the level of July 2005 and 2006.

NYT: The GSEs Invent the Risk Premium

by Anonymous on 8/25/2008 09:59:00 AM

Either I've finally lost what passes for my mind, or business press's increased fixation on blaming every problem in the mortgage market on Fannie Mae and Freddie Mac has just about jumped the shark. I don't know how else to explain this, from the NYT:

MORTGAGE rates are typically driven by the financial market’s outlook for long-term interest rates, but not always. Policy changes at Fannie Mae and Freddie Mac, the two government-sponsored companies that buy most mortgages issued by United States lenders, recently helped drive that point home.Um, what kind of profound mental confusion could make someone write those first two sentences? Mortgage rates have always been driven by the market "outlook for long-term interest rates," they still are, and they always will be. So have Treasury rates and the yield the local bank offers you on your certificate of deposit. That yield curve thingy. You've heard of it, maybe.

This month, Fannie and Freddie increased the fees they charge lenders for many loans, effectively bumping up interest rates for many borrowers who have marginal credit. The companies also tightened their policies on refinance loans that enable an owner to take cash out of a home.

But mortgage rates have never been "purely" about the bond market's outlook for benchmark yields, since the benchmarks, like U.S. Treasuries, are credit risk-free investments. Treasuries are backed by the full faith and credit of the U.S. Government, which has financial resources that Joe Blow the homebuyer doesn't have. Mortgage loans, like corporate bonds, have credit risk: the borrower might default and you might not get all your money back.

This is why interest rates on home mortgages are always higher than the rate on risk-free bonds of equivalent duration, like Treasury notes. If they weren't, nobody would invest in mortgages, they'd just buy the risk-free bonds. Are you still with me, everyone?

So there are always two main ingredients of mortgage rates, comparable-duration bond yields and the credit risk premium. And the credit risk premium, theoretically as well as practically, can fluctuate pretty widely, depending on, well, one's "outlook" for credit risk.

Fannie and Freddie have always guaranteed the credit risk of the mortgage-backed securities they issue. That is what they do and why they're here. In the "required yields" they establish for the loans they securitize, there has always been this little extra bit that they do not pass through to investors; it's the part they keep for themselves to cover credit losses, because they do not pass credit losses on to investors. You can call it a guarantee fee or a loan-level pricing adjustment or a post-settlement fee, if you want to be technical, or you can just call it a "credit risk premium."

One possibility here is that the GSEs are increasing their credit risk premium--which, in the absence of marked changes in required net yield to the end investor, will appear to make mortgage rates rise "independently" of other long-term interest rates--because, well, current conditions in the housing and mortgage market suggest that mortgages are pretty risky right now, credit-wise. One thing that indicates the extent of this risk, of course, is that by and large nobody but the GSEs are buying mortgage loans right now. Perhaps this is what is confusing the Times reporter: if Fannie and Freddie had any competition right now--if there were anyone else out there buying loans--it might be more obvious that everyone increases risk premiums when perceived credit risk rises. But really, you know. When nobody else but the government-chartered investors are in the market, that can be understood to mean that risk is so high that nobody else is even feeling strong enough to be willing put a price on it. The absence of competitors in a market often suggests that risk has risen in that market. If you've ever tried to get flood insurance, you may have noticed this phenomenon.

Of course, there's another way to look at this, which is that in the last five to seven years it did not "appear" that there was much of a risk premium in mortgage rates because, well, there wasn't much of one. Since we cannot actually open a newspaper or get on the internet without another story of horrible losses taken by investors in mortgages whose "cushion" for defaults--their credit risk premium--was ludicrously low given the riskiness of the mortgages they were investing in, we might have concluded by now that things like the increased risk premiums that the GSEs are now charging are something along the lines of a return to "normal" interest rates. Normal rates being ones that have a realistic risk premium in them.

These two issues do, actually, converge: if the GSEs are the only ones buying loans right now, then they are likely to be buying more of the kinds of loans that private investors used to buy before they quit buying anything. Unless they want to go the same way their private competitors have gone, they have to either tighten standards or raise risk premiums or a combination of both, since it's pretty obvious that the private investor loans of the last few years--mostly subprime, Alt-A, and jumbo--were pretty seriously underpriced. Mortgage markets really aren't that weirder than any other market: you can't make up a negative margin on volume.

This Times piece strikes me as just a somewhat subtler version of the "GSEs Refuse to Save the Day" rhetoric we've seen expressed somewhat more stridently before. What else can we make of this:

Those buying homes will have little choice but to absorb the cost. But the new policies will be felt more by those thinking of refinancing mortgages.Ohhh-kaaay. If you have to buy--apparently people do "have to" buy--you just have to pay a higher interest rate than buyers did until recently. But if you already have a mortgage and refinancing doesn't look promising right now because the rate you have is lower than the rate on a new loan--you're really suffering? Well, OK, what we seem to mean is that if you "have to" refinance--to get cash or to get out of some crazy high-risk ARM--then you will feel some pain. Because apparently Fannie and Freddie aren't willing to take borrowers who "have to" supplement their income with cash-outs or bail out of loans that let them buy too much house without charging extra for it.

Strangely enough, the Times piece makes pretty clear that this "charging extra" doesn't really amount to all that much, relatively speaking. Another eighth of a percent on the annual interest rate isn't exactly going to hit the usury ceiling any time soon. It also provides a nifty little chart showing that one-year ARM rates are still out there with a pretty decent discount. If you don't like paying 6.93% (in New York) for a 30-year fixed, you can always get an ARM for 6.01%. What? You don't want an ARM because you're afraid rates will rise in the future? And we thought rates no longer had anything to do with such expectations . . .

LA Times: FBI Saw Mortgage Fraud Threat in 2004

by Calculated Risk on 8/25/2008 09:11:00 AM

From the LA Times: FBI saw threat of mortgage crisis

Long before the mortgage crisis began rocking Main Street and Wall Street, a top FBI official made a chilling, if little-noticed, prediction: The booming mortgage business, fueled by low interest rates and soaring home values, was starting to attract shady operators and billions in losses were possible.As the article notes, the FBI had other priorities, and they didn't really have the resources to investigate the growing epidemic of mortgage fraud, and most of the mortgage lenders didn't seem to care:

"It has the potential to be an epidemic," Chris Swecker, the FBI official in charge of criminal investigations, told reporters in September 2004. But, he added reassuringly, the FBI was on the case. "We think we can prevent a problem that could have as much impact as the S&L crisis," he said.

Officials said they began approaching mortgage companies and others in an attempt to raise awareness about the growing fraud problem. But the lenders had little incentive to cooperate because they were continuing to make money.More warnings that were ignored.

Sunday, August 24, 2008

Hamilton on Recession Indicators

by Calculated Risk on 8/24/2008 04:13:00 PM

From Professor Hamilton at Econbrowser: Recession indicators

Many people may not care whether our current situation meets the formal definition of a recession, but as I've explained previously, you should. ...See Jim Hamilton's graphs.

I do think there's a pretty strong case, based on the employment and unemployment numbers, that we are currently in a recession. ... the whole reason I'm interested in this question of whether our current difficulties should be classified as a recession, is that if we are in a true recession, the process is going to feed on itself, and more bad things are ahead of us. If it's a real recession, it should be evident in the 2008:H2 GDP numbers.

I believe the economy is in recession and the negative feedback loops have started to kick-in. Good examples are less business investment and less local government spending - both impacting employment. These will be classic symptoms of a recession.

"Loan Participation" Hitting Rural Banks

by Calculated Risk on 8/24/2008 02:18:00 PM

From Joe Rauch at the Atlanta Business Chronicle: Bank flu spreads to rural areas (hat tip Edward)

The housing market’s collapse is reaching banks beyond the [Atlanta] metro area, through a process largely hidden from public view.Just more containment.

Banks in more rural areas of Georgia reported rising levels of loan losses for the second quarter of 2008.

Industry experts attribute many of those problems to the purchase and sale of loans between banks, a practice called “loan participations.”

The loan pieces are for projects often geographically distant from the home markets and familiar territory of the purchasing banks ...

The process was dubbed by one local banker as “a poor man’s securitization” ...

While parceling out portions of the loans distributes risk through the financial system, critics argue bankers relaxed their credit analysis on the loans during the building boom, enticed by the prospect of rapid growth by buying into others’ deals.

... “The same sloppiness that crept into regular lending crept into participations,” said bank analyst Chris Marinac of FIG Partners LLC. “It was a convenient means to an end. It was really easy to get lazy with these things.”

Saturday, August 23, 2008

Merced: Another Foreclosure, Right Here, Right Now

by Calculated Risk on 8/23/2008 06:49:00 PM

David Streitfeld at the NY Times writes about Merced, CA: In the Ruins of the Housing Bust

On a recent Sunday evening, an extended family of a dozen children, teenagers and adults is unloading a U-Haul into a house in a two-year-old subdivision called Summer Creek. The patriarch takes a break from wrestling with a refrigerator to explain he has abandoned his house a few miles away and is now renting this nearly-new five-bedroom."Somewhere a lender is recording yet another foreclosure."

The result, he says happily, is a drop in his monthly housing bill to $1,200 from $3,400. Somewhere a lender is recording yet another foreclosure.

In Merced, it is "Right here, right now!"

"Boom Years Over" in UK and Decoupling

by Calculated Risk on 8/23/2008 05:24:00 PM

From The Times: Recession: boom years are over as economy slows to halt

After 16 years, or 63 consecutive quarters, of continuous growth it is likely that Britain is already in recession, City analysts say. Another downgrade in a month’s time could confirm that the economy has shrunk.And from Peter Goodman at the NY Times: U.S. and Global Economies Slipping in Unison

The latest data, from the Office for National Statistics, showed a slump in every part of the economy as the credit crunch and the rising cost of living took their toll.

Only a few months ago, some economists still offered hope that robust expansion could continue in much of the world even as the United States slowed. Foreign investment was expected to keep replenishing American banks still bleeding from their disastrous bets on real estate and to provide money for companies looking to expand. Overseas demand for American goods and services was supposed to continue compensating for waning demand in the States.Decoupling never made much sense, although Professor Krugman has a small issue with the NY Times article concerning international linkages: Synchronized sinking

Now, high energy prices, financial systems crippled by fear, and the decline of trading partners have combined to choke growth in many major economies.

There should be a post title contest - I think Krugman and Tanta (I'm biased) would be the winners!

Bank and Thrift Failures

by Calculated Risk on 8/23/2008 03:42:00 PM

The FDIC announced the ninth bank failure of 2008 last night; Columbian Bank and Trust Company, of Topeka, KS. To put that into context, here is a graph of bank and thrift failures since the FDIC was created in 1934: Click on graph for larger image in new window.

Click on graph for larger image in new window.

The huge spike in the '80s was due to the S&L crisis. The nine bank failures so far in 2008 barely show up.

It's interesting to note that even with the failure of almost 3,000 banks and thrifts during the S&L crisis, the overall economy stayed fairly healthy with only a mild-to-moderate recession starting in July 1990.

During the Roaring '20s, 500 bank failures per year was common with depositors typically losing 30% to 40% of their bank deposits in the failed institutions. The number of bank failures soared to 4000 (estimated) in 1933.

It's important to note that the housing bust hasn't hurt most small banks and institutions, because the banks didn't hold many of the residential mortgages they originated. Instead the small to mid-sized institutions focused on commercial real estate (CRE), and construction and development (C&D) loans.

And it appears that bad C&D loans took down Columbian Bank and Trust Company. From iStockAnalyst on August 2nd: Columbian Bank Aims to Boost Capital, Overcome Loan Troubles

[Jim Helvey, former CEO] said many of the bank's loans financed real-estate developers' purchases of land. He said Columbian's loans typically were paid off as developers sought and gained construction lending from other banks.Although Columbian is small, and the losses to the FDIC will pale in comparison to IndyMac, Columbian is probably more representative than IndyMac of the type of institutions that will fail in this cycle.

"The problem started creeping in when commercial real-estate loans fell out of favor and there was no 'Bank B' to take us out of our acquisition loan," Helvey said.

The crunch in real-estate lending has left Columbian with $92 million in problem loans, which includes some construction and residential loans.

More Fannie and Freddie

by Calculated Risk on 8/23/2008 10:13:00 AM

A quote from Bloomberg: Freddie, Fannie Failure Could Be World `Catastrophe,' Yu Says

``If the U.S. government allows Fannie and Freddie to fail and international investors are not compensated adequately, the consequences will be catastrophic,'' [Yu Yongding, a former adviser to China's central bank] said in e-mailed answers to questions yesterday. ``If it is not the end of the world, it is the end of the current international financial system.'And from the WaPo: Treasury's Vigil On Fannie, Freddie

A top concern of Treasury Secretary Henry M. Paulson Jr. as he ponders whether to pull the trigger on a rescue plan for mortgage financiers Fannie Mae and Freddie Mac is the fate of its "preferred" shareholders, which include regional and community banks across the nation and central banks around the world, according to private analysts who closely follow the department.And from the NY Times: Uncertainty Over Fannie and Freddie

...

Treasury officials are worried that a sell-off of these [preferred] shares poses serious risks to the broader financial system, the analysts said.

“We’re in a Catch 22,” said an executive with one of the mortgage firms who was not authorized to speak to the media. “As long as there is uncertainty over Treasury’s plan, we can’t raise money, and as long as we can’t raise money, there’s going to be more and more speculation about Treasury’s plan.”It seems like just a matter of when - not if - Paulson's hand will be forced and the Treasury will rescue Fannie and Freddie.

...

“You would have to be insane to invest in these companies right now, and we’ve basically told them that,” said an investment professional with one firm that was approached by Freddie Mac, but who is not authorized to speak to the media. “When Treasury comes in, they are guaranteed to get a better deal than us, which would push down the value of our investment. So why would we ever invest before we know what Treasury is going to do?”

Friday, August 22, 2008

Fed: Delinquency Rates Increased Sharply in Q2

by Calculated Risk on 8/22/2008 08:27:00 PM

The Federal Reserve reports that delinquency rates rose in Q2 in all categories. (hat tip Rick) Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the delinquency rates at the commercial banks for three key categories: residential real estate, commercial real estate, and consumer credit cards.

Credit card delinquency rates are at 4.9%, about the same level as the peak of the '01 recession. Credit card delinquencies peaked at 5.45% during the '91 recession.

Commercial real estate delinquencies are rising rapidly, and are at the highest rate since Q1 '95 (as delinquency rates declined following the S&L crisis).

Residential real estate delinquencies are at the highest level since the Fed started tracking the data (since Q1 '91).

Although there is credit deterioration everywhere, the rise in CRE delinquencies is especially significant. The Fed defines commercial as "construction and land development loans, loans secured by multifamily residences, and loans secured by nonfarm, nonresidential real estate", and many of the problems are probably in the C&D loans.

My guess is commercial real estate delinquencies will be higher than residential in Q3, even though residential delinquencies are still increasing rapidly.

FDIC Closes Columbian Bank and Trust Company, Topeka, KS

by Calculated Risk on 8/22/2008 07:12:00 PM

From the FDIC: Citizens Bank and Trust, Chillicothe, MO, Acquires the Insured Deposits of the Columbian Bank and Trust Company, Topeka, KS

The Columbian Bank and Trust Company, Topeka, Kansas, was closed today by the Kansas Bank Commissioner J. Thomas Thull, and the Federal Deposit Insurance Corporation (FDIC) was named receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Citizens Bank and Trust, Chillicothe, Missouri, to assume the insured deposits of The Columbian Bank and Trust Company.

The nine branches of The Columbian Bank and Trust Company will reopen on Monday as branches of Citizens Bank and Trust. Depositors of the failed bank will automatically become depositors of Citizens Bank and Trust. Deposits will continue to be insured by the FDIC, so there is no need for customers to change their banking relationship to retain their deposit insurance coverage.

Over the weekend, customers of The Columbian Bank and Trust Company Bank can access their money by writing checks or using ATM or debit cards. Checks drawn on the bank will continue to be processed. Loan customers should continue to make their payments as usual.

As of June 30, 2008, The Columbian Bank and Trust Company had total assets of $752 million and total deposits of $622 million, of which there were approximately $46 million in uninsured deposits held in approximately 610 accounts that potentially exceeded the insurance limits. This amount is an estimate that is likely to change once the FDIC obtains additional information from these customers.

The Columbian Bank and Trust Company also had approximately $268 million in brokered deposits that are not part of today's transaction. The FDIC will pay the brokers directly for the amount of their insured funds.

...

Citizens Bank and Trust agreed to assume the insured deposits for a 1.125% premium. It will also purchase $85.5 million of the failed bank's assets. The assets are comprised mainly of cash, cash equivalents and securities. The FDIC will retain the remaining assets for later disposition.

The cost to the FDIC's Deposit Insurance Fund is estimated to be $60 million. The Columbian Bank and Trust Company is the first bank to fail in Kansas since Midland Bank of Kansas, Mission, Kansas, on April 2, 1993. This year, a total of nine FDIC-insured institutions have been closed.

Bank Failure Friday?

by Calculated Risk on 8/22/2008 04:46:00 PM

It's Friday afternoon. Time to check with the FDIC.

Here is the FDIC Failed Bank List.

It's been three weeks since the last failure.

Bernanke Urges Haircuts for Creditors When Investment Banks Fail

by Calculated Risk on 8/22/2008 02:56:00 PM

Fed Chairman Bernanke's urged changes in the financial structure in his speech this morning.

First, Bernanke pointed out the moral hazard in bailing out Bear Stearns:

As you know, in March the Federal Reserve acted to prevent the default of the investment bank Bear Stearns. ... [T]hose events also have consequences that must be addressed. In particular, if no countervailing actions are taken, what would be perceived as an implicit expansion of the safety net could exacerbate the problem of "too big to fail," possibly resulting in excessive risk-taking and yet greater systemic risk in the future. Mitigating that problem is one of the design challenges that we face as we consider the future evolution of our system.Bernanke suggested that regulatory and statutory changes need to be made so that the Fed can wipe out the equity holders and give haircuts to some creditors when critical nonbanks fail:

A statutory resolution regime for nonbanks, besides reducing uncertainty, would also limit moral hazard by allowing the government to resolve failing firms in a way that is orderly but also wipes out equity holders and haircuts some creditors, analogous to what happens when a commercial bank fails.

emphasis added

MTI: WaPo Hears Mortgage Voices

by Anonymous on 8/22/2008 01:05:00 PM

Long-time readers will remember the MMI, or Muddled Metaphor Index, which was basically a long-running gag at the media's expense. Now I've been provoked again, and so I introduce the MTI, or Mortgage Telephone Index. I'm sort of hoping this will be the only entrant into the series, but you never know. The MTI features reporters and editors who apparently spend all their day on bad cell phone connections and do not actually read much about mortgages. This produces an effect like the old game of "Telephone," with equally hilarious results.

Today's Washington Post brings us "Bad Begets Worse," which is actually the title of this article and did I not make that up.

Freddie Mac, for instance, no longer finances no-money-down mortgages, nor does it continue to buy or guarantee mortgages given to people who have failed to document their finances. Fannie Mae has withdrawn from the market for all-day loans, which are considered risky because they require less documentation than traditional prime loans.No, Fannie Mae has not suddenly decided that mortgage loans need to have terms of more than 24 hours to be eligible for purchase. It appears that someone said "Alt-A" and someone else heard "all-day."

Presumably we will be able to tell if we have any readers at the Washington Post by how long it takes for that to go away . . . .

(Hat tip, Michael!)