by Anonymous on 8/11/2008 09:56:00 AM

Monday, August 11, 2008

Trouble at Corporate Credit Unions

From the Wall Street Journal:

Five of the nation's largest credit unions are reporting big paper losses on mortgage-related securities, a sign that housing-market distress is spreading even to the most risk-averse financial sectors.This is a detailed article and I suggest you read the entire thing. It is important to bear in mind that the five big credit unions mentioned in the article are "corporate" CUs, not regular old CUs used by consumer-members.

The federal regulator overseeing credit unions says the losses are likely to be reversed when mortgage markets stabilize, and that the institutions are sound and adequately capitalized. But some outside observers are concerned that the credit unions are underestimating the depth of their mortgage-market problems.

Corporate credit unions were founded to serve regular credit unions, many of which are too small to engage directly in sophisticated investing. Regular credit unions park a portion of their funds with one or more of the corporates, which in turn invest the money. In total, the 28 corporates, which are owned by their member credit unions, have about $90 billion in assets. (U.S. Central serves as a credit union for corporates, providing them with similar investment services.) . . .Reporter Mark Maremont is quickly moving to the top of Tanta's Approved Reporter list, following his excellent piece a while back on the FDIC's trouble with Superior Bank loans. Thank you, Mr. Maremont. This is what we are asking for: context. Elaboration of unfamiliar terms or concepts. Maintaining distinctions when distinctions are very relevant. Real reporting, in other words.

As with banks, credit unions are federally insured up to $100,000 per account and $250,000 per retirement account. So far this year, nine regular credit unions have failed, including at least two due to mortgage-related problems. Seven failed in 2007.

In theory, the failure of a corporate credit union could lead to losses for any regular credit union that has deposited money with the corporate, and ripple down to individual depositors. The last time a corporate credit union failed was in 1995. Ultimately, the regular credit unions that were involved recovered their money.

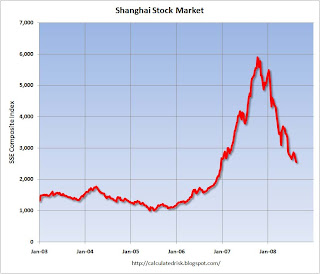

Shanghai Cliff Diving

by Calculated Risk on 8/11/2008 12:03:00 AM

Sunday, August 10, 2008

WSJ: Euro Banks Tighten Lending Standards

by Calculated Risk on 8/10/2008 09:38:00 PM

From the WSJ: Banks in Euro Zone Tighten Lending Again

Banks in the euro zone continued to tighten lending standards during the second quarter amid a deteriorating economic outlook, and criteria could become even tighter, according to the European Central Bank's July Bank Lending Survey.The Fed's July Senior Loan Officer survey should be released soon - and will probably show banks tightened lending standards in the U.S. too.

...

"The ongoing tightening of bank credit standards and the further weakening in demand for bank loans strengthens our belief that the euro-zone credit cycle is turning sharply lower," said Martin van Vliet, an economist at ING Bank.

The Credit Crunch continues. And the 2nd half recovery - projected by many economists - has been cancelled. From Kelly Evans at the WSJ: Economists Expect 2008's Second Half to Be Worse Than First. Here is a video of the WSJ's Evans summarizing the article:

Off Topic: Hiking Trip

by Calculated Risk on 8/10/2008 06:56:00 PM

It seems every time I leave town, banks fail, huge write-downs are announced or some major new Fed facility is unveiled ... so just to let everyone know, I'll be in the Sierra again next Friday and Saturday (Aug 15th and 16th), and I'll be hiking the John Muir Trail from August 31st through September 8th (from Yosemite Valley to Mt Whitney). I suspect some major news stories will break!

While I'm gone, Tanta will be posting more frequently - and to help her out, Paul Jackson of Housing Wire will be posting news stories. And there will be a surprise post or two too.

Yes, I've been training several hours a day, and this has limited my analysis posts. I apologize. Oh well, the extra training has been great for my weight.

Best to all, CR

Paulson Interview: No Plans to Insert Money in Fannie and Freddie

by Calculated Risk on 8/10/2008 04:10:00 PM

Paulson interview starts at about 1 min 30 secs and runs to about 28 minutes. Brokaw ask him what happened to "containment" and about President Bush's comment about Wall Street getting drunk.

UK: House Repossessions Hit 12-year-high

by Calculated Risk on 8/10/2008 10:41:00 AM

From the Independent: House repossessions soar to 12-year-high

The number of UK house repossessions jumped by 48 per cent in the first half of the year to its highest level for 12 years, figures showed today. ... The [Council of Mortgage Lenders] said the rate of repossession, at 0.16 per cent, was now the highest seen for 10 years.Part of the problem (in addition to the house price bubble bursting in the UK) is that mortgage rates have increased, from The Times: Bank customers hit for £3.8 billion

But it stressed this was still low in the context of the entire mortgage market and less than half that experienced amid the housing market crash of the early 1990s.

Today's figures also reveal that the number of mortgages three months or more in arrears has risen ... to 1.33 per cent of all home loans, although the number of mortgages more than six months in arrears was 0.58 per cent of all loans.

Over the past 12 months HSBC has increased the cost of its two-year fix for borrowers with 25% equity in their home by half a percentage point, from 6.34% in July 2007 to 6.84% last month, according to figures from the data firm Defaqto.

...

A year ago, [Cheltenham & Gloucester] was charging an average interest rate of 6.28% on a two-year fixed-rate deal for those with a 25% deposit compared with an average 6.61% in July this year

Saturday, August 09, 2008

ARS Mess: Banks Agree to Buyout Investors

by Calculated Risk on 8/09/2008 05:55:00 PM

In February the Auction Rate Securities (ARS) market froze. Auction-rate securities are a borrow short, lend long (or invest long) strategy used by cities and student-loan organizations to lower their borrowing costs.

It has been alleged that many banks marketed ARS to investors as "safe as money markets". Since the markets froze, many investors have been unable to withdraw their funds. Now the banks, to avoid legal action, are having to buyout those investors.

From the WSJ: UBS to Pay $19 Billion As Auction Mess Hits Wall Street

On Friday, facing allegations of wrongdoing over its sales of so-called auction-rate securities, UBS AG agreed to buy back from investors nearly $19 billion of the investments as part of a settlement with federal and a group of state regulators. It will start buying from individuals and charities in October and from institutional clients in mid-2010.This isn't a loss for the banks - although there may be some losses in the future - because the Auction Rate Securities are still paying interest. However this does tie up the banks' capital and contributes to the credit crunch.

UBS was the third major firm this week to vow to buy back the securities, which allegedly were improperly sold as higher-rate equivalents for super-safe money-market funds.

UBS, Merrill Lynch & Co. and Citigroup Inc. have committed to taking back a total of more than $36 billion of the instruments. Other financial firms are expected to follow suit.

...

Wall Street sold more than $330 billion of these securities to more than 100,000 individuals and other investors.

Lansner: Tax Twists in Housing Bill

by Calculated Risk on 8/09/2008 01:17:00 PM

From Jon Lansner at the O.C. Register: Insider Q&A hears tax twists in housing bailout bill. Lansner interviews Leonard Wright, a San Diego-based CPA and chair of CalCPAs state personal financial planning committee:

Us: The new law has some downside for vacation or rental home owners who subsequently make the property their primary residence. Let’s say a couple buys a rental property in 2008 for $500,000. After 10 years, they move in making it their primary residence. Fifteen years later they sell it for $1.2 million, a $700,000 profit. How much could they exclude from capital gains under the new law?This is the issue we discussed earlier. Lansner and Wright have more.

Wright: Basically this affects the capital gains tax exclusion — normally $250,000 for a single filer, $500,000 for a couple — from the sale of your primary residence. The new law for the sale of a principal residence introduces the concept of non-qualified use. Essentially, non-qualified use is any period of time that the property is not occupied as the principal residence. The law now requires us to look back at the cumulative use of the property. In this case, 10 years of rental use was non-qualified use and 15 years use as a principal residence was qualified use. Since it was a principal residence 60 percent of the time (15 years/25 years), you can exclude from income $300,000 of the $700,000 profit rather than $500,000. Depreciation is also recaptured and is included in income.

For some taxpayers, there may be a break on non-qualified use. If the taxpayer was away from the residence due to official extended duty for up to a total of 10 years, or a temporary absence up to two years occurred because of an employment or health condition change, those years are excluded from non-qualified use.

Friday, August 08, 2008

Bank United: Non-Performing Assets Increase Sharply

by Calculated Risk on 8/08/2008 06:24:00 PM

Press Release: BankUnited Announces Fiscal 2008 Third-Quarter Results

The ratio of non-performing assets as a percentage of total assets increased to 7.73% at June 30, 2008, from 4.75% at March 31, 2008, and 0.86% at June 30, 2007.Fiscal 2009 will be interesting with so many more Option ARMs reaching the 115% limit. Fiscal 2010 will probably be even worse (based on industry data, not BankUnited data).

...

Net charge-offs for the quarter ended June 30, 2008, were $22.7 million, or an annualized rate of 0.73% of average total loans. This compares to $13.3 million, or an annualized rate of 0.42% of average total loans, for the quarter ended March 31, 2008, and $1.1 million, or an annualized rate of 0.04% of average total loans, for the quarter ended June 30, 2007.

...

BankUnited’s option ARM loans are re-amortized over the remaining term at the earlier of five years from inception of the loan or upon reaching 115% of the original principal balance. As of June 30, 2008, a total of 128 loans had reached the maximum 115% of the original loan amount. These 128 loans had an aggregate balance of $42.9 million, or 0.41% of the total residential loan balance as of June 30, 2008. ...

The company estimates that approximately $48 million of option ARM loans will reach the 115% limit during the remaining quarter of fiscal 2008, and that $686 million will reach the 115% limit during fiscal year 2009.

emphasis added

ACA: Cram-Down

by Calculated Risk on 8/08/2008 05:45:00 PM

From Bloomberg: ACA Terminates $65 Billion of Credit-Default Swaps (hat tips Sam & Brian)

ACA Capital Holdings Inc. ... terminated $65 billion in credit-default swap contracts and turned over most of the company to creditors.

Counterparties now own a 95 percent residual interest in New York-based ACA Capital's insurance unit through surplus notes, the company said in a statement today.

Ford to Reduce Leasing

by Calculated Risk on 8/08/2008 04:28:00 PM

From the WSJ: Ford Credit to Cut Back On Leasing, Citing Risks

The lending arm for Ford Motor Co. told investors it is substantially scaling back the number of vehicles it expects to lease and warned that if market conditions continue to deteriorate, further losses could place Ford Credit's lending plan at further risk.From the SEC filing:

The recent, rapid decline in auction values for used full-size trucks and traditional SUVs, together with difficult credit market conditions, has made leasing vehicles less economical than in the past. Accordingly, Ford Credit is planning to reduce lease originations, while still offering leasing to consumers who prefer this product.

...

Consistent with the overall market, Ford Credit has been impacted by volatility in the asset-backed securities markets that began in August 2007. Since then, Ford Credit has experienced higher credit spreads and, in certain circumstances, shorter maturities in its public and private securitization issuances. In addition, committed liquidity program renewals have come at a higher cost. Given present market conditions, Ford Credit expects that its credit spreads and the cost of renewing its committed liquidity programs will continue to be higher in 2008 than prior to August 2007. About 25% of Ford Credit's committed capacity is up for renewal during the remainder of 2008. Given the nature of its asset-backed committed facilities, Ford Credit has the ability to obtain term funding up to the time that the facilities mature. Any outstanding debt at the maturity of the facilities remains outstanding through the term of the underlying assets.

Ford Credit's funding plan is subject to risks and uncertainties, many of which are beyond its control. If auction values for used vehicles continue to weaken or further reductions occur in the market capacity for the types of asset-backed securities used in Ford Credit's asset-backed funding, there could be increased risk to Ford Credit's funding plan. As a result, Ford Credit may need to reduce the amount of receivables and operating leases it purchases or originates. A significant reduction in Ford Credit's managed receivables would reduce its ongoing profits, and could adversely affect its ability to support the sale of Ford vehicles.

emphasis added

Fannie Mae: 41% of HomeSaver Advance Loans Still Delinquent

by Calculated Risk on 8/08/2008 03:01:00 PM

From Bloomberg: Fannie Mae Unsecured Second Loans Often Don't Fix Delinquencies

Fannie Mae's initial attempts to restore delinquent homeowners to on-time payments with unsecured second loans failed 41 percent of the time.

The company purchased 17,901, or $121 million, of ``HomeSaver Advance'' loans through June 30 after it started five months ago to offer the debt to cover borrowers' missed payments ... Of the loans made through May 30, only 59 percent resulted in the associated mortgages being current on June 30 ...

Oil and the Dollar

by Calculated Risk on 8/08/2008 01:09:00 PM

Oil continues to sell off, and is now below $114 per barrel (Brent Crude Oil nearest futures)

Meanwhile the dollar is rallying.

These are two important stories.

As I noted late last year, the dollar had fallen enough to make a significant dent in the ex-petroleum trade deficit. Unfortunately for the trade deficit, oil prices were surging. Click on table for larger image in new window.

Click on table for larger image in new window.

This graph shows the U.S. trade deficit through May. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. The current probable recession is marked on the graph.

The oil deficits in June, July and probably August will be ugly, but it now looks like the oil deficit will decline sharply later this year. Although there are other factors that impact exchange rates, this decline in oil prices will have a significant impact on the overall deficit, and might mean the dollar has finally bottomed (heresy to some I know!).

Note: import oil prices are calculated when oil is delivered, so there is a lag between future prices and import prices.

Fannie Mae: Q2 Ended in June, but July was Worse

by Calculated Risk on 8/08/2008 11:04:00 AM

Opening comments from the conference call (hat tip Brian):

“You will recall, by way of background, that even though our second quarter books closed on June 30, subsequent events factor in, and in fact, heavily weight our outlook and our expectations going forward. And those events in July loom significantly in that calculus. That week of July 7 was one of the worst Fannie Mae has experienced in the debt and equity markets. The Treasury-fed backstop plan that was announced on July 13 calmed the market somewhat, and the passage of the Housing bill on the 26th of July added more certainty. But on the downside, July was a tough month for our credit performance. We experienced higher defaults and higher loan loss severities in the markets that were experiencing the steepest home price declines. And that gave us higher charge-offs than we had experienced in any month in the second quarter, and higher than we had expected. We also saw a higher proportion of foreclosures coming from states and products with higher loan balances, which increases the absolute dollar losses. In terms of severity, the loss that we experienced when a loan defaults also increased from 19 basis points in the first quarter to 23 basis points in the second quarter. And that rose again in July to 27 basis points. We are now seeing average initial charge off severities of 40% for loans in California. Home prices have cratered in certain markets since the peak -- Cape Coral, Florida, down 50%; Las Vegas, down 35%; northern Virginia, down 30%; and in California, Modesto, and Stockton, down 50%; Riverside, down 40%. The list goes on. Alt-A foreclosures have doubled in southern California. Our average serious delinquency rate in Florida increased in June to over 3% -- four times the average on our total book of business last year. Almost 2% of the loans in our Florida book are now referred to foreclosure. So, the housing market has returned to earth fast and hard. Some signs do offer rays of positive light. Foreclosures actually fell in Michigan . Same-period home sales were up in California . And as the GSEs provide most of the liquidity to the primary market, that market is functioning, and a safe center of credit risk pricing and product is being restored. All told however, that story all put together led us to again revise our credit loss estimate upward from the year, from 13 to 17 basis points to 23 to 26 basis points. And that, as you will note, commensurately drives our addition to loss reserves of almost $4 billion."See the previous post from Tanta on Fannie Mae Push Backs. Alt-A lenders are probably pretty nervous.

emphasis added

Fannie Mae Push-Back

by Anonymous on 8/08/2008 10:49:00 AM

Aside from the announcement today that Fannie Mae will end Alt-A lending by the end of the year, there was this little nugget in the press release:

[Fannie will be] ramping up defaulted loan reviews to pursue recoveries from lenders, focusing especially on our Alt-A book. The objective is to expand loan reviews where the company incurred a loss or could incur a loss due to fraud or improper lending practices. To achieve this, we are increasing post-foreclosure loan reviews from 900 a month in January to 4,000 a month by the end of the year, expanding our quality-control reviews for targeted products and practices, and are on track to double our anti-fraud investigations this year. We expect this effort to increase our credit loss recoveries in 2008 and 2009.More great news for BOA.

Fannie Mae: Books $5.35 billion in credit-costs, to Halt Alt-A

by Calculated Risk on 8/08/2008 09:42:00 AM

From the WSJ: Fannie Posts Deep Loss, Slashes Dividend Payment

Fannie Mae swung to a second-quarter loss as the largest buyer of home loans booked $5.35 billion in credit-costs from boosting loss provisions and charge-offs. ... eliminating higher-risk loans -- namely newly originated Alt-A acquisitions ... As of June 30, Alt-A mortgage loans represented 11% of Fannie's total mortgage book of business and 50% of its second-quarter credit losses.And from Bloomberg: Fannie Mae, Battling Losses, to Stop Accepting Alt-A Mortgages

Fannie Mae, the largest U.S. mortgage- finance company, will stop buying or guaranteeing Alt-A home loans, such as those that require little or no documentation of borrower incomes or assets, by yearend.

...

``Over 60 percent of our losses have come from a small number of products, but especially Alt-A loans,'' ... the Washington-based company said in a statement.

Why We Have a Foreclosure Crisis in the First Place

by Anonymous on 8/08/2008 08:34:00 AM

The Washington Post reports on tenants caught up in the "foreclosure crisis":

Thousands of unsuspecting renters who have been paying their rent on time are getting enmeshed in the foreclosure crisis that is plaguing the housing market.This isn't the first story we've seen, by any means, about the plight of tenants in foreclosure. As far as it goes, there's nothing particularly wrong with the focus of the article--on the effects on the tenants themselves.

In many cases, their landlords, often individual real estate investors, bought properties during the boom days, rented them out, then failed to keep up with their mortgages. The homes went into foreclosure, often unbeknownst to the tenants, who face disrupted lives and even homelessness. . . .

The Mortgage Bankers Association, which tracks foreclosures, does not know how many tenants have been uprooted this way. But one in five foreclosures initiated in the third quarter last year were not occupied by the properties' owners, the group said. Some of those nearly 70,000 properties may have been vacation homes. Others may have been vacant. But a large chunk were probably rentals, and as the foreclosure rate has climbed this year, those numbers have probably climbed.

But I am as usual struck by the apparent lack of curiosity displayed here about how you can have so many foreclosures of cash-flowing rental properties. It makes perfect sense that vacant "investment" properties get foreclosed a lot: the owner has to carry the mortgage payment without any income from the property. But a foreclosure of a property with a paying tenant is, historically speaking, rather unusual. It means one of several things:

1. The purchase price of the property was simply nonsensical for an investment property, given market rents. Even though the tenants are paying, the rental payment is significantly less than the carrying costs of the property and the owner's other income is in no way adequate to make up the difference. This was a dumb loan for the owner to take and a dumb loan for the lender to make. The odds that it involved appraisal fraud--either an inflated value of the property based on the comparable approach or inflated market rents used to inflate the value on an income approach--are excellent.

2. The property was never intended to be a rental property in the first place. This would be the old "If I can't keep making the payment on this expensive house, I'll just move into mom's basement and rent it out" thing that some people told themselves during the boom. This loan wasn't made with inflated market rents in mind only because no one actually gave a moment's worth of serious thought to what market rents--and normal vacancy rates and so on--actually were likely to be.

3. The tenant is paying rent, but nowhere near what the market would support. This may be a "non-arm's-length" deal between landlord and tenant, or a desperate amateur landlord, or a naive tenant who doesn't recognize "too good to be true" or some combination thereof.

4. The owner is simply skimming rents. That is, the cash flow from tenants could cover all or nearly all of the mortgage payment, but the owner is either a classic fraudster or an idiot trying to juggle a "real estate empire" who simply never intended to apply rental payments to the mortgage.

If there are "thousands" of loans like this, then I posit that it might be more helpful to see these tenants as caught up not in a "foreclosure crisis," but in either a real estate swindle or an insane lending boom that finally had to end. That may not mean much to the tenants involved, but it would help for public policy reasons to stop thinking of foreclosure as the "cause" of these disruptions rather than the inevitable result of such "malinvestment."

Thursday, August 07, 2008

2007 Vintage Mortgages

by Calculated Risk on 8/07/2008 05:21:00 PM

Update: Tanta comments:

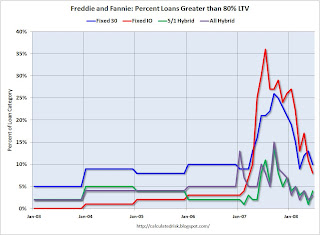

I think the chart would be more helpful if it also included CLTV over this period.Original post:

(I'm sure CR didn't do that because UBS didn't report that data.)

My sense is that those spikes in 2007 in high LTV are telling you the Day the Second Lien Lenders Died. (And the drop-off in high LTVs is telling you the Day the MIs Backed Off.)

In other words, my theory is that Freddie was mostly buying 80% LTV loans in 2003-2006 because that's what people were making. Nobody wanted a high LTV loan with MI when they could get these piggyback deals. If you looked at CLTV over this same period, I think it would show that.

So everybody's share of high LTV loans increased in 2007, because the supply of subordinate financing dried up.

End of the day, it doesn't explain the early DQ of the 2007 vintage for me because I suspect the CLTVs on the 2006 vintage were just as high.

Click on table for larger image in new window.

Click on table for larger image in new window.This is a graph of the percent of Freddie Mac and Fannie Mae loans with a LTV greater than 80% (by loan category). The data is annual through 2006, and monthly starting in January 2007.

The graphs for low FICO loans, and greater than 90% LTV loans, are of similar shape, although the percentages are not as high.

This suggests that lending standards at Fannie and Freddie were relaxed in 2007, and have been tightened in 2008.

For the complete table, see: Fannie and Freddie: High LTV, Low FICO by Year

The WSJ's article on 2007 delinquencies: Mortgages Made in 2007 Go Bad at Rapid Clip

For Tanta's take on the WSJ article: 2007 Vintage: Nowhere to Go?

Tanta is suggesting 2007 vintage borrowers had nowhere to go - they couldn't refi, they couldn't sell, they couldn't access their HELOC - and this might be causing the higher delinquencies in 2007. The graph above suggests that the looser lending standards at Fannie and Freddie might have contributed too.

LA Times: Vineyard National Bank Ordered to Stop Accepting Brokered Deposits

by Calculated Risk on 8/07/2008 04:01:00 PM

From the LA Times: Regulators try to stabilize Vineyard National Bank

[F]ederal regulators have ordered Vineyard National Bank of Corona to stop accepting so-called hot-money deposits ...The amount of uninsured deposits is pretty amazing - and I'd expect some withdrawals after this story in the LA Times.

Vineyard has nearly $2 billion in deposits, with branches in Orange, Los Angeles, Marin, Riverside, San Bernardino and San Diego counties. ... Vineyard had nearly $2 billion in loans as of June 30, of which 48% were to home builders and developers.

In its filing with regulators Monday, Vineyard estimated that about $660 million of its nearly $2 billion in deposits are above those standard insured limits.

Not to suggest Vineyard will fail, but IndyMac disclosed they were ordered to stop accepting brokered deposits on July 7th, and IndyMac was closed by the FDIC on July 11th.

Deutsche Bank to Foreclose on Casino

by Calculated Risk on 8/07/2008 03:18:00 PM

From Bloomberg: Deutsche Bank to Foreclose on $3.5 Billion Casino

Deutsche Bank AG will foreclose on the $3.5 billion Cosmopolitan Resort & Casino in Las Vegas after developer Ian Bruce Eichner defaulted on a $760 million loan ... Deutsche Bank ... is talking with companies including MGM Mirage and Hilton Hotels Corp. to help run its 80,000-square-foot casino ...This seems like one of those 'from the frying pan into the fire' stories - from gambling on CRE loans to running a gambling joint.

Sagging commercial real estate prices ... forced banks to hold projects until prices rise or sell at a loss. The Frankfurt-based bank would oversee an 8.5-acre development with two high-rise towers, three wedding chapels, a sandy beach overlooking the Las Vegas Strip and a deck featuring ``European-style bathing.''

And I'm always amazed by the "waiting for a better market" argument. That is what many residential lenders did during the last couple of years, only to discover their losses kept growing.