by Calculated Risk on 6/05/2008 12:00:00 AM

Thursday, June 05, 2008

Video of "Buy One, Get One Free" Real Estate Offer

Here is a video from TheStreet.com concerning that buy one house, get a second one free offer in Escondido, California. The video features Paul Kedrosky of Infectious Greed.

I've driven by the row homes, and they are on the corner of two busy streets - "Conveniently located on the corner of Midway Drive and Grand Avenue in Escondido" according to the builder - and not in the best neighborhood.

This is obviously just a gimmick to generate interest ... and it accomplished that goal.

Wednesday, June 04, 2008

The Residential Construction Employment Puzzle

by Calculated Risk on 6/04/2008 08:00:00 PM

An article in the WSJ today reminded me of the residential construction employment conundrum. From the WSJ: Housing Slump Hits Hispanic Workers, But Most Immigrants Remain in U.S.

The housing slump has disproportionately hurt Hispanic workers, provoking a jump in unemployment that has hit the immigrants among them the hardest, according to a new study.Here is the report: Latino Labor Report, 2008: Construction Reverses Job Growth for Latinos

...

Many undocumented workers don't appear on employment rosters because they work as independent contractors or are hired indirectly by big developers through subcontractors or labor brokers who don't officially hire every worker. "They were ghosts to begin with," says Rose Quint, an economist at the National Association of Homebuilders. Thus, she says, "the decline in employment is probably bigger than numbers are showing."

This graph shows the construction employment conundrum: why have starts and completions declined about 50% from the peak in 2006, and yet residential construction employment is off only 14%?

Click on graph for larger image in new window.

Click on graph for larger image in new window.Note that starts are shifted 6 months into the future since it takes a little over 6 months to complete a typical residential unit.

Last year Greg Ip at the WSJ reviewed an analysis from Deutsche Bank economists suggesting that the illegal immigrant explanation accounts for most of the missing job losses:

[E]conomists at Deutsche Bank estimate construction employment should have fallen about 900,000 since early 2006 when in fact it’s only down 150,000. They conclude 500,000 of the unexplained gap is attributable to layoffs of illegal Hispanic workers.To update the numbers, residential construction employment is off 477,000 from the peak, but there are still close to 1 million too many jobs based on starts and completions.

The uncounted illegal immigrant argument is important for the impact on the economy, but it doesn't seem to explain why the BLS employment numbers haven't fallen more. Although the BLS is missing the job losses for illegal workers on the way down, they also didn't count them on the way up either.

Although miscounted illegal workers probably explains some of the fewer than expected BLS reported job losses, there are two other explanations that make sense:

The answer is probably a combination of all of the above.

Merced Foreclosure Video

by Calculated Risk on 6/04/2008 06:43:00 PM

From the LA Times:

Merced provides a great contrast to Oceanside. Both areas have been inundated with foreclosures, and REOs are driving prices sharply lower.

In Oceanside (at least some areas), the prices have reached levels attractive to some investors. The rental market is tight in coastal north county San Diego, and these investors will provide somewhat of a floor on prices.

However in Merced, it appears there are simply more homes than households. This is farm land, and is definitely not a 2nd home location.

Accredited Home Lenders Closes Offices

by Calculated Risk on 6/04/2008 05:36:00 PM

Here is an email from Accredited:

| ||||||||||||||||||

Bernanke on Energy and Inflation: 1970s vs. Today

by Calculated Risk on 6/04/2008 03:50:00 PM

From Fed Chairman Ben Bernanke: Remarks on Class Day 2008

The oil price shock of the 1970s began in October 1973 when, in response to the Yom Kippur War, Arab oil producers imposed an embargo on exports. Before the embargo, in 1972, the price of imported oil was about $3.20 per barrel; by 1975, the average price was nearly $14 per barrel, more than four times greater. President Nixon had imposed economy-wide controls on wages and prices in 1971, including prices of petroleum products; in November 1973, in the wake of the embargo, the President placed additional controls on petroleum prices.It was a crazy time. I wasted both gas and time driving around looking for open gas stations, and then waiting in long lines.

As basic economics predicts, when a scarce resource cannot be allocated by market-determined prices, it will be allocated some other way--in this case, in what was to become an iconic symbol of the times, by long lines at gasoline stations. In 1974, in an attempt to overcome the unintended consequences of price controls, drivers in many places were permitted to buy gasoline only on odd or even days of the month, depending on the last digit of their license plate number. Moreover, with the controlled price of U.S. crude oil well below world prices, growth in domestic exploration slowed and production was curtailed--which, of course, only made things worse.

In addition to creating long lines at gasoline stations, the oil price shock exacerbated what was already an intensifying buildup of inflation and inflation expectations. In another echo of today, the inflationary situation was further worsened by rapidly rising prices of agricultural products and other commodities.It is worth reading Bernanke's views because that is the general consensus of the Fed. His comments on the Fed fighting inflation in the "medium term" further suggests the rate cuts are over for now - even if the economy weakens further. Inflation, and inflation expectations are just too high.

Economists generally agree that monetary policy performed poorly during this period. In part, this was because policymakers, in choosing what they believed to be the appropriate setting for monetary policy, overestimated the productive capacity of the economy. I'll have more to say about this shortly. Federal Reserve policymakers also underestimated both their own contributions to the inflationary problems of the time and their ability to curb that inflation. For example, on occasion they blamed inflation on so-called cost-push factors such as union wage pressures and price increases by large, market-dominating firms; however, the abilities of unions and firms to push through inflationary wage and price increases were symptoms of the problem, not the underlying cause. Several years passed before the Federal Reserve gained a new leadership that better understood the central bank's role in the inflation process and that sustained anti-inflationary monetary policies would actually work. Beginning in 1979, such policies were implemented successfully--although not without significant cost in terms of lost output and employment--under Fed Chairman Paul Volcker. For the Federal Reserve, two crucial lessons from this experience were, first, that high inflation can seriously destabilize the economy and, second, that the central bank must take responsibility for achieving price stability over the medium term.

emphasis added

Fast-forward now to 2003. In that year, crude oil cost a little more than $30 per barrel. Since then, crude oil prices have increased more than fourfold, proportionally about as much as in the 1970s. Now, as in 1975, adjusting to such high prices for crude oil has been painful. Gas prices around $4 a gallon are a huge burden for many households, as well as for truckers, manufacturers, farmers, and others. But, in many other ways, the economic consequences have been quite different from those of the 1970s. One obvious difference is what you don't see: drivers lining up on odd or even days to buy gasoline because of price controls or signs at gas stations that say "No gas." And until the recent slowdown--which is more the result of conditions in the residential housing market and in financial markets than of higher oil prices--economic growth was solid and unemployment remained low, unlike what we saw following oil price increases in the '70s.

For a central banker, a particularly critical difference between then and now is what has happened to inflation and inflation expectations. The overall inflation rate has averaged about 3-1/2 percent over the past four quarters, significantly higher than we would like but much less than the double-digit rates that inflation reached in the mid-1970s and then again in 1980. Moreover, the increase in inflation has been milder this time--on the order of 1 percentage point over the past year as compared with the 6 percentage point jump that followed the 1973 oil price shock. From the perspective of monetary policy, just as important as the behavior of actual inflation is what households and businesses expect to happen to inflation in the future, particularly over the longer term. If people expect an increase in inflation to be temporary and do not build it into their longer-term plans for setting wages and prices, then the inflation created by a shock to oil prices will tend to fade relatively quickly. Some indicators of longer-term inflation expectations have risen in recent months, which is a significant concern for the Federal Reserve. We will need to monitor that situation closely. However, changes in long-term inflation expectations have been measured in tenths of a percentage point this time around rather than in whole percentage points, as appeared to be the case in the mid-1970s. Importantly, we see little indication today of the beginnings of a 1970s-style wage-price spiral, in which wages and prices chased each other ever upward.

A good deal of economic research has looked at the question of why the inflation response to the oil shock has been relatively muted in the current instance. One factor, which illustrates my point about the adaptability and flexibility of the U.S. economy, is the pronounced decline in the energy intensity of the economy since the 1970s. Since 1975, the energy required to produce a given amount of output in the United States has fallen by about half. This great improvement in energy efficiency was less the result of government programs than of steps taken by households and businesses in response to higher energy prices, including substantial investments in more energy-efficient equipment and means of transportation. This improvement in energy efficiency is one of the reasons why a given increase in crude oil prices does less damage to the U.S. economy today than it did in the 1970s.

Another reason is the performance of monetary policy. The Federal Reserve and other central banks have learned the lessons of the 1970s. Because monetary policy works with a lag, the short-term inflationary effects of a sharp increase in oil prices can generally not be fully offset. However, since Paul Volcker's time, the Federal Reserve has been firmly committed to maintaining a low and stable rate of inflation over the longer term. And we recognize that keeping longer-term inflation expectations well anchored is essential to achieving the goal of low and stable inflation. Maintaining confidence in the Fed's commitment to price stability remains a top priority as the central bank navigates the current complex situation.

Although our economy has thus far dealt with the current oil price shock comparatively well, the United States and the rest of the world still face significant challenges in dealing with the rising global demand for energy, especially if continued demand growth and constrained supplies maintain intense pressure on prices. The silver lining of high energy prices is that they provide a powerful incentive for action--for conservation, including investment in energy-saving technologies; for the investment needed to bring new oil supplies to market; and for the development of alternative conventional and nonconventional energy sources. The government, in addition to the market, can usefully address energy concerns, for example, by supporting basic research and adopting well-designed regulatory policies to promote important social objectives such as protecting the environment. As we saw after the oil price shock of the 1970s, given some time, the economy can become much more energy-efficient even as it continues to grow and living standards improve.

Bernanke also spoke about productivity.

Moody's may Downgrade Ambac, MBIA

by Calculated Risk on 6/04/2008 12:57:00 PM

From AP: Moody's may downgrade Ambac, MBIA ratings (hat tip Nemo, Juan)

Haven't we been here before?

Cancellations, Yet Again

by Calculated Risk on 6/04/2008 12:04:00 PM

First, the outlook for housing is negative. Just because I mention a few minor shreds of good news for housing, doesn't mean my view has changed. It hasn't, especially for existing home sales and prices.

OK, for those hoping to buy at lower prices, the outlook is rosy. Now that we’ve gotten the semantics out of the way, the overall outlook remains negative for house sales and prices. With tighter lending standards, demand will remain weak, and supply is already at record levels and still rising - especially the supply of distressed homes. This record supply, combined with continuing weak demand, will put pressure on house prices, probably for several years, in real terms, in many areas.

Now let’s return to cancellations. The cancellation issue can be confusing.

When looking at new home sales, we are interested in net sales, but the Census Bureau reports gross new sales. A simple equation would be:

Sales (net) = Sales (gross) – Cancellations + Sales of earlier cancellations.In the long run, the cancellation terms balance out, and the Census Bureau numbers are what we want. In other words, Sales(net) = sales(gross). But in the short run, with cancellations increasing, the Census Bureau probably overestimates sales; and with cancellations decreasing, the Census Bureau underestimates sales.

We don’t have the raw data for cancellations and sales of earlier cancellations. However the public builders typically report net sales and cancellation rates. Using the public data, we can estimate net vs. gross sales for the industry, and adjust the Census Bureau estimates accordingly. Luckily the analysis isn’t too difficult: when cancellations rates are rising, net sales are typically below gross sales, and when the cancellation rates are falling, net sales are usually above gross sales. Right now cancellation rates are falling and the builders are reporting they are reducing their inventory of “unintended spec homes”, and net sales are above gross sales.

Currently cancellation rates are still significantly above normal for the home builders. As an example, Toll Brothers just announced a cancellation rate of 24.9%, far above their historical rate of 7%. But the key for adjusting the Census Bureau numbers is that the cancellation rate has declined from 38.9% two quarters ago. What matters for this calculation is the change in cancellation rate over the previous six months since that is the time it typically takes to build a home.

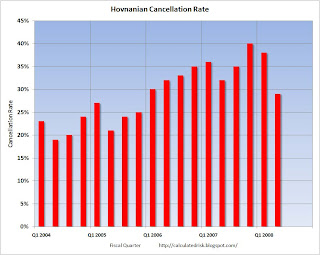

The same is true for other builders. Another example is Hovnanian: they reported a cancellation rate of 29%, down from 40% two quarters ago. Hovanian averaged 23% cancellation rate in 2004 and 2005 (cancellation rates are builder specific because of their downpayment and pre-qualification requirements).

Since cancellations rates are now falling, this suggests that the Census Bureau is currently underestimating sales for new homes. This is not a positive comment about these individual builders, but this helps analyze the entire market.

Possible Casual Dining Bankruptcy

by Calculated Risk on 6/04/2008 09:25:00 AM

From the WSJ: Bennigan's Owner In Crucial Credit Talks (hat tip Geoffrey)

The owner of national casual-dining chains Bennigan's, Ponderosa and Steak and Ale is in talks with its major lender GE Capital Solutions in an effort to stave off a possible bankruptcy filing ...Casual dining is a discretionary expense and is frequently one of the first expenses that consumers reduce during hard times.

The problems at Metromedia show just how difficult life has become for casual-dining chains. Consumers are cutting back on discretionary spending. That comes as food prices for everything from corn to steak are on the rise. Many of the companies are also highly leveraged, which is pushing them to seek protection from creditors.

Earlier this year, the parent companies of the Bakers Square, Village Inn and Old Country Buffet filed for Chapter 11 bankruptcy protection, citing fall sales and rising food costs. A host of other chains -- from Outback Steakhouse to Ruby Tuesday's -- are also struggling.

MBA: Purchase Applications Decline

by Calculated Risk on 6/04/2008 09:05:00 AM

It appears the MBA Purchase Index might be useful again. Note: the index wasn't useful when lenders were going out of business because of the method used to calculated the index.

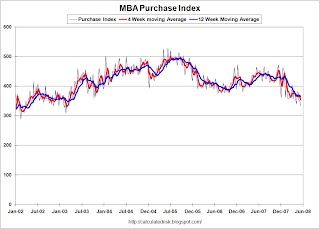

The MBA reports that the Purchase Index fell to 333.6, the lowest level since early 2003. Because of the changes to the index, we can't compare directly to 2003. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the MBA Purchase Index, and four week and twelve week moving averages.

Although we can't compare directly to earlier periods because of the changes in the index, this does suggest that sales of homes are continuing to decline.

Ed McMahon Receives Notice of Default

by Calculated Risk on 6/04/2008 12:15:00 AM

From the WSJ: Ed McMahon May Lose Beverly Hills Home

ReconTrust, a unit of mortgage lender Countrywide Financial, on Feb. 28 filed a notice of default on a $4.8 million Countrywide loan backed by Mr. McMahon's home. ... According to the filing, Mr. McMahon was then about $644,000 in arrears on the loan. It isn't clear whether Countrywide still owns the loan or is acting on behalf of investors who acquired it.We are all subprime now.

Mr. McMahon broke his neck in a fall about 18 months ago and hasn't been able to work, [Howard Bragman, a spokesman for Mr. McMahon] said. That health problem, along with the weak housing market and economy, has forced Mr. McMahon into foreclosure proceedings ...

Tuesday, June 03, 2008

Hovnanian Reports Huge Loss

by Calculated Risk on 6/03/2008 10:01:00 PM

Here are some words that shareholders hate:

"We expect to persevere ..."Expect? Oh yeah, that inspires confidence.

CEO Ara K. Hovnanian, June 3, 2008

From Reuters: Hovnanian reports 2Q loss grows tenfold (hat tip barely)

[T]he company reported a net loss of $340.7 million, or $5.29 per share, for the quarter that ended April 30. This compared with a loss of $30.7 million, or 49 cents per share, for the same period a year ago.Ouch. That is much worse than expected.

And the little bit of good news:

Hovnanian's contract cancellation rate, excluding the joint ventures, improved to 29 percent from 38 percent last quarter and 32 percent in last year's second quarter.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the Hovnanian cancellation rate by quarter since 2004 (note that Hovnanian just finished fiscal Q2 2008).

The cancellation rate is now declining after peaking last year at 40%. One of the key reasons to track cancellation rates is to estimate the error in the Census Bureau numbers. Since it takes about 6 months to build a home, the usual comparison is current quarter vs. 6 months ago. The cancellation rate is declining (from 40% to 29%) and that suggests that the Census Bureau is currently underestimating sales.

Note that Hovnanian's cancellation rate was in the 20% range during the boom years (Toll Brothers' cancellation rate was running around 4.5% in 2004). The cancellation rate tends to be builder specific because of different down payment and pre-qualification requirements.

Northern Ireland: Bursting the Bubble

by Calculated Risk on 6/03/2008 06:22:00 PM

Here is an update on the Ireland housing market from UTV Insight:

Part I: (8 minutes)

Part II: (8 minutes)

Part III: (8 minutes):

A "Tsunami of REOs"

by Calculated Risk on 6/03/2008 04:11:00 PM

From Peter Tong at the LA Times: Foreclosures lead a town's downturn

It wasn't long ago that Andy Krotik was selling houses to out-of-town investors who would sometimes buy two at a time.For some of these fairly isolated communities, it will probably take years to absorb all the excess inventory built during the boom.

Now, Krotik spends his days warily entering abandoned houses, checking for angry holdouts or startled squatters. He wants to make sure the properties are empty and secure so he can sell them for the banks that have repossessed them.

"We're experiencing a tsunami of bank-owned properties," said Krotik, who has been selling real estate in this Central Valley town since 1989.

Few places in California flew as high in the real estate boom and crashed as hard as Merced.

The lead in this story reminds me of commercials on TV (circa 2005) urging homeowners to take equity out of their homes and "build an empire". I can just imagine these equity rich homeowners as "out-of-town investors", driving to Yosemite, and stopping at Merced to buy "two at a time". Ouch.

Ford, Toyota Report Lower Sales

by Calculated Risk on 6/03/2008 02:35:00 PM

This is a followup to the post this morning about GM significantly cutting production.

From the WSJ: GM, Ford Sales Plunge As Truck Demand Wanes

In May, GM sales of cars and light trucks totaled 268,892, down from 371,056 a year earlier. There were 27 selling days in May, compared with 26 a year ago. ...There is some good news: people are buying more fuel efficient cars - and the roads are noticeably less crowded where I live in SoCal.

Toyota sold 257,404 vehicles in May, compared with 269,023 a year earlier. Toyota's passenger car sales inched up 0.4% to 168,942 while light-truck sales slid 12% to 88,462. ...

Ford reported May sales of 217,268 light vehicles, compared with 258,123 a year earlier. Sales of Ford trucks and sport-utility vehicles were down 26% to 126,364, with F-series truck sales tumbling 31%.

Soros Warns on "commodity bubble"

by Calculated Risk on 6/03/2008 01:12:00 PM

From MarketWatch: Soros says commodity bubble echoes '87 climate

The investment flood into commodity indexes bears eerie similarities to the craze for portfolio insurance which led to the stock market crash of 1987, said hedge fund investor George Soros, who warned the rush into commodities has created a "bubble."

"In both cases, the institutions are piling in on one side of the market and they have sufficient weight to unbalance it," said Soros in testimony prepared for a Senate panel on energy manipulation.

"If the trend were reversed and the institutions as a group headed for the exit as they did in 1987, there would be a crash," he said.

Bernanke Concerned about Weak Dollar, Inflation

by Calculated Risk on 6/03/2008 10:49:00 AM

From Fed Chairman Ben Bernanke: Remarks on the economic outlook

On the sources of the financial turmoil:

Although the severity of the financial stresses became apparent only in August, several longer-term developments served as prologue for the recent turmoil and helped bring us to the current situation.And on the dollar and inflation:

The first of these was the U.S. housing boom, which began in the mid-1990s and picked up steam around 2000. Between 1996 and 2005, house prices nationwide increased about 90 percent. During the years from 2000 to 2005 alone, house prices increased by roughly 60 percent--far outstripping the increases in incomes and general prices--and single-family home construction increased by about 40 percent. But, as you know, starting in 2006, the boom turned to bust. Over the past two years, building activity has fallen by more than half and now is well below where it was in 2000. House prices have shown significant declines in many areas of the country.

A second critical development was an even broader credit boom, in which lenders and investors aggressively sought out new opportunities to take credit risk even as market risk premiums contracted. Aspects of the credit boom included rapid growth in the volumes of private equity deals and leveraged lending and the increased use of complex and often opaque investment vehicles, including structured credit products. The explosive growth of subprime mortgage lending in recent years was yet another facet of the broader credit boom. Expanding access to homeownership is an important social goal, and responsible subprime lending is beneficial for both borrowers and lenders. But, clearly, much of the subprime lending that took place during the latter stages of the credit boom in 2005 and 2006 was done very poorly.

A third longer-term factor contributing to recent financial and economic developments is the unprecedented growth in developing and emerging market economies. From the U.S. perspective, this growth has been a double-edged sword. On the one hand, low-cost imports from emerging markets for many years increased U.S. living standards and made the Fed's job of managing inflation easier. Moreover, currently, the demand for U.S. exports arising from strong global growth has been an important offset to the factors restraining domestic demand, including housing and tight credit. On the other hand, the rapid growth in the emerging markets and the associated sharp rise in their demand for raw materials have been--together with a variety of constraints on supply--a major cause of the escalation in the relative prices of oil and other commodities, which has placed intense economic pressure on many U.S. households and businesses.

...

The current economic and financial situation reflects, in significant part, the unwinding of two of these longer-term developments--the housing boom and the credit boom--and the continuation of the pressure of global demand on commodity prices.

The challenges that our economy has faced over the past year or so have generated some downward pressures on the foreign exchange value of the dollar, which have contributed to the unwelcome rise in import prices and consumer price inflation. We are attentive to the implications of changes in the value of the dollar for inflation and inflation expectations and will continue to formulate policy to guard against risks to both parts of our dual mandate, including the risk of an erosion in longer-term inflation expectations.It unusual for a Fed Chairman to comment so directly on the dollar, and this probably means rate cuts are off the table for now - even if the economy weakens further.

GM Reduces Production

by Calculated Risk on 6/03/2008 10:06:00 AM

“Since the first of this year, however, U.S. economic and market conditions have become significantly more difficult. Higher gasoline prices are changing consumer behavior, and they are significantly affecting the U.S. auto industry sales mix.”From the NY Times: G.M. Closing 4 Plants in Shift From Trucks Toward Cars

GM Chairman Rick Wagoner, June 3, 2008

General Motors said Tuesday that it would stop making pickup trucks and big S.U.V.s at four North American assembly plants and would consider selling its Hummer brand.More bad news for the auto industry (although shifting away from large SUVs is probably good news in the long run).

... the company ... will slash 500,000 units from the automaker’s overall production ...

"House of Pain"

by Anonymous on 6/03/2008 08:31:00 AM

Several readers have sent me the link to this Milwaukee Journal Sentinel story about a wretched tale of mortgage fraud. It's worth reading, both for an understanding of how many parties need to be complicit for such a blatantly fraudulent transaction to occur, but also for the way it tracks the hardening of attitudes of the lender over time, from an initial spontaneous recognition that this borrower got fleeced but good to a later tendency to blame the victim. Kudos to the Journal Sentinel for digging into the details of this one.

Monday, June 02, 2008

Home Builder Quote of the Day

by Calculated Risk on 6/02/2008 08:47:00 PM

"We've always said we were a home builder and not a land speculator. We probably got a little bit off our basics because we were being a little greedy."A little greedy?

Larry Seay, COO, Meritage Homes, June 1, 2008

Minneapolis: Price Distribution of Distressed Homes

by Calculated Risk on 6/02/2008 04:51:00 PM

This morning I posted some graphs on the price distribution of distressed homes (short sales, REOs) in Orange County.

Here is some similar data on the Minneapolis area, from a recent report by MAAR Research Manager Jeff Allen and Aaron Dickinson: Foreclosures and short sales in the Twin Cities Housing Market (hat tip Jeff) Click on graph for larger image in new window.

Click on graph for larger image in new window.

Just like for Orange County, there are many more distressed homes for sale at the low end; over 50% of inventory priced below $120,000 is distressed. Many of these distressed homes were probably purchased with subprime loans.

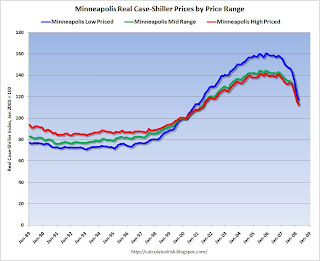

Naturally the areas with a higher percentage of distressed properties have seen faster price declines. Of course - just like for Orange County - those areas also saw the most appreciation because of loose underwriting for subprime lending. Here is a graph showing the real Case-Shiller prices in Minneapolis for three price ranges. This graph show the real Case-Shiller prices for homes in Minneapolis by price range.

This graph show the real Case-Shiller prices for homes in Minneapolis by price range.

The low price range is less than $176,486 (current dollars). Prices in this range have fallen 27.0% from the peak in real terms.

The mid-range is $176,486 to $250,300. Prices have fallen 21.9% in real terms.

The high price range is above $250300. Prices have fallen 20.8% in real terms.

This is the common pattern: the low end saw the most appreciation, the most foreclosures, and now the fastest price declines. This higher distressed property activity at the low end is also distorting some of the median price measures, as Jeff and Aaron report:

[The] higher market share places a heavy downward weight on aggregate sales price figures, giving many the erroneous impression that the housing market in its entirety is seeing massive declines in value. In reality, the lender-mediated market and the traditional seller market are experiencing stark differences.I spoke with Jeff Allen today, and just like for some REOs in Oceanside, the low end REOs in Minneapolis are seeing a significant pickup in buyer interest, possibly from investors, as the lenders have started to price these homes aggressively. This suggests that prices are approaching a bottom in some of these low end areas.

As has been widely reported in recent months (including in our own research products), the median sales prices of Twin Cities homes in the first quarter of 2008 were 10.3 percent below the first quarter of 2007—a sizeable and conspicuous decline. But lost in the hub-bub—and partly because no one had the data until now—is that the traditional sales market that does not include foreclosures and short sales saw only a 3.9 percent decline in median sales price during the same time period.