by Calculated Risk on 11/16/2007 10:40:00 AM

Friday, November 16, 2007

Goldman: Credit Losses Pose Significant Risk

From Bloomberg: Goldman Sees Subprime Cutting $2 Trillion in Lending

The slump in global credit markets may force banks, brokerages and hedge funds to cut lending by $2 trillion and trigger a ``substantial recession'' in the U.S. ...Hatzius also wrote (not in article) that Goldman Sachs' working assumption is home prices will "fall 15% peak to trough ... if the economy stays out of a full-blown recession".

``The likely mortgage credit losses pose a significantly bigger macroeconomic risk than generally recognized,'' [Jan Hatzius, chief U.S. economist at Goldman] wrote. ``It is easy to see how such a shock could produce a substantial recession'' or ``a long period of very sluggish growth,'' he wrote.

NAR: Repeat Buyers With No Down

by Anonymous on 11/16/2007 10:05:00 AM

From National Mortgage News, via Clyde:

Nearly one in three buyers between June 2006 and June 2007 had no skin in their deals, according to new research that represents further evidence of the poor quality of loans that helped fuel the rising tide of delinquencies and foreclosures. Though the study of nearly 10,000 transactions by the National Association of Realtors did not note whether the loans were prime or subprime, it found that 29% of all buyers -- and 45% of all first-timers -- financed the entire purchase price. Somewhat surprisingly, considering that they usually have money from the sale of their previous residence to put into the transaction, 18% of repeat buyers also put up none of their own money.The NAR press release is here.

I note that in the Greenspan-Kennedy method of calculating MEW, those transactions where a repeat buyer receives sales proceeds for an existing home in excess of the existing mortgage amount, but does not use those proceeds to reduce the mortgage amount on the next home purchase, will end up counting as MEW. It is, after all, equity extraction: the equity from the previous home is "extracted" in the sale, but does not become equity in the new home. This means that the loss of 100% financing for purchases will lower net MEW, just as the loss of some cash-out refinancing options will.

GSEs Tighten Up Loan Pricing

by Anonymous on 11/16/2007 08:16:00 AM

Bloomberg reports (hat tip to Bob_in_MA) that the GSEs are adding additional Loan Level Pricing Adjustments (in Fannie-speak) and Postsettlement Delivery Fees (in Freddie-speak) for loans delivered on or after March 1, 2008. What's new and different about these new fees is that they apply to "standard" loans; there are already pretty serious fees being charged for the ones made under the special A Minus/Expanded Approval/"Flexible" programs.

Specifically, they apply to any mortgage with an LTV greater than 70% and FICO less than 680. They range from 75 bps for loans in the 660-679 FICO bucket to 200 bps for loans with FICOs less than 620. These new fees are also cumulative, so they apply on top of the existing fees the GSEs charge for things like high-LTV cash-outs (50 bps for LTVs between 70% and 80% and 75 bps between 80% and 90%). So today, a borrower with a low-average FICO of 675 can get a cash-out up to 90% LTV with a 75 bps fee; that will turn into a 150 bps fee next March.

As most borrowers, especially refinancing borrowers, don't pay points in cash, these fees will either end up as points that are rolled into the loan balance or as higher interest rates. Assuming a rough price:rate ratio of 3:1, that means a note rate 0.25% higher for our hypothetical "average" cash-out borrower.

The Bloomberg article also indicates that Freddie is lowering its maximum LTV for properties in a declining-value market. Actually, the rule in question (reduce maximum LTV by five points in declining markets) has been around since Hector was a pup for Fannie and Freddie and lots of other investors; Freddie is dusting it off and reminding everyone that it exists. For those of you who have become appraisal-issue addicts, here's what Freddie's Bulletin says:

We use http://www.ofheo.gov/hpi_download.aspx to help identify declining markets. This is an example of a tool you may use to help in determining whether a Mortgage is subject to our maximum financing limits.That's not new; old underwriting hands can recite these rules at cocktail parties if you are silly enough to encourage them. This bit, though, is new:

Underwriting expectations – maximum financing in declining markets

With respect to underwriting requirements, when the property securing a Mortgage is located in a declining market, Sellers must:

Determine whether any contributions are interested-party contributions as described in Section 25.3, if any contributions are offered.

Determine the maximum interested-party contribution limits based on the lower of the appraised value or the sale price, if applicable

Adjust the sale price of the property by deducting the total dollar amount of any sales concessions from the sale price of the property. Sales concessions are defined in Section 25.3.

Calculate the LTV/TLTV ratio based on the lower of the appraised value or the adjusted sale price.

Restrict the maximum LTV ratio to at least five percent less than the maximum ratio allowed for the transaction. If there is layering of risk, the Seller should consider higher restrictions to the maximum allowable ratio to address market conditions and the risk in the transaction.

Interested party contributions in the form of financing and sales concessions are becoming more common due to market conditions. Currently, we require that maximum financing concessions be determined based on the LTV ratio of a Mortgage. Because maximum financing concessions and lower Borrower contributions are particularly prevalent in transactions with secondary financing, we are changing our guidelines to require that maximum financing concessions be based on TLTV ratio when secondary financing is present, and LTV ratio when there is no secondary financing.Translation: no more getting around financing concession rules by structuring the loan with a low LTV and a high CLTV (TLTV in Freddie-speak). Whether this will be a big deal or not depends on how many subordinate-financing lenders are still standing in March 2008, of course.

It is fairly typical for the GSEs to make major changes to their rules with a fair amount of lead time: they try not to reprice loans that were already approved or committed to a customer or in the lender's MBS pipeline. Still, these March deadlines are for loans delivered to the GSEs on that date, not loans made on that date. Therefore, these pricing adjustments will be made to lender rate sheets signficantly before March. Merry Christmas.

Thursday, November 15, 2007

Recession and Decoupling

by Calculated Risk on 11/15/2007 11:54:00 PM

The cover story in The Economist: America's vulnerable economy

IN 1929, days after the stockmarket crash, the Harvard Economic Society reassured its subscribers: “A severe depression is outside the range of probability”. In a survey in March 2001, 95% of American economists said there would not be a recession, even though one had already started. Today, most economists do not forecast a recession in America, but the profession's pitiful forecasting record offers little comfort. Our latest assessment (see article) suggests that the United States may well be heading for recession.Does the cover curse apply to The Economist? In this case, I think a U.S. recession is likely (I agree with The Economist), but I'm not so sure about the decoupling theory.

From the Financial Times: China fears impact of US slowdown

China’s commerce ministry warned on Thursday that a slowing US economy would trigger a drop in Chinese exports that would mark a “turning point” for China’s rapid economic growth.That doesn't sound like decoupling to me.

A global economic slowdown ... “will be the biggest challenge to China’s economy next year”, a report from the ministry’s policy research department said.

The report is Beijing’s first public comment on what repercussions it expects from the global credit crisis and a sign that the government does not support the view that Asian growth has “decoupled” from the US. “If demand in the US drops further, Chinese exporters will be devastated by a rapid and continuous fall in orders,” the report said.

Downey Financial Non-Performing Assets

by Calculated Risk on 11/15/2007 06:29:00 PM

From the Downey Financial 8-K released today. (hat tip Greg and others)  Click on graph for larger image.

Click on graph for larger image.

This would be a nice looking chart, except those are the percent non-performing assets by month.

Yes, by month!

Note: So much news today ... Starbucks, J.C. Penny, Alltel Banks Cut Loan Sale Size a Second Time and much more. Clearly the economy is slowing sharply.

DataQuick: California Bay Area Home Sales Slump Continues

by Calculated Risk on 11/15/2007 02:58:00 PM

From DataQuick: Bay Area home sales drag along bottom

Bay Area home sales remained at their lowest level in decades last month, the result of mortgage market turbulence and hesitant buyers. Prices continued to hold up best in core markets, while declines steepened in some inland areas, a real estate information service reported.

A total of 5,486 new and resale houses and condos were sold in the nine-county Bay Area in October. That was up 9.4 percent from 5,014 in September, and down 35.7 percent from 8,532 for October a year ago, DataQuick Information Systems reported.

Sales have decreased on a year-over-year basis the last 33 months. Last month was the slowest October in DataQuick's statistics, which go back to 1988. Until last month, the slowest October was in 1990 when 6,443 homes were sold. The strongest October was in 2003 when sales totaled 13,392. The average for the month is 8,930.

...

The median price paid for a Bay Area home was $631,000 last month, up 1.0 percent from $625,000 in September, and up 2.4 percent from $616,000 for October last year. The median peaked at $665,000 last June and July.

...

Foreclosure activity is at record levels ...

How Much Cash is Left in the Home ATM?

by Calculated Risk on 11/15/2007 01:11:00 PM

This post is a followup to: Bloomberg's Berry: No Recession (Hat tip NJ_Bob for graph ideas)

One of the questions raised by the Bloomberg article is how much more equity can be borrowed on U.S. household real estate. Based on the Fed's flow of funds report, the percent of homeowner equity was at a record low of 51.7% at the end of Q2 2007.

However, according to the Census Bureau, 31.8% of all U.S. owner occupied homes have no mortgage. You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 68%. But we can construct a model based on data from the 2006 American Community Survey (see table here). Click on graph for larger image.

Click on graph for larger image.

This graph shows the distribution of U.S. households by the value of their home, with and without a mortgage. This data is for 2006.

By using the mid-points of each range, and solving for the price of the highest range (to match the Fed's estimate of household real estate assets at the end of 2006: $20.6 Trillion), we can estimate the total dollar value of houses with and without mortgages.

Using this method, the total value of U.S. houses, at the end of 2006, with mortgages was $15.27 Trillion or 74.2% of the total. The value of houses without mortgages was $5.32 Trillion or 25.8% of the total U.S. household real estate.

Since all of the mortgage debt is from the houses with mortgages, these homes have an average of 36% equity. It's important to remember this includes some homes with 90% equity, and some homes with negative equity.

The following graph shows the impact of falling house prices on the percent aggregate equity. At the end of 2006, aggregate equity for mortgage holders was 36%.

At the end of 2006, aggregate equity for mortgage holders was 36%.

If household assets fall 10%, and liabilities stay the same, the percent equity will fall to 28.9%. If household assets fall 20%, the percent equity will fall to 20%.

If assets fall 35%, there will be no equity in the aggregate - households with positive equity will be offset by households with negative equity. Although I don't expect prices to fall anywhere near 35%, even a decline of 10% will probably severely limit the ability of marginal homeowners to borrow from their home equity.

This is based on 2006 data. Mortgage equity borrowing was still strong through the first three quarters of 2007 (Q3 estimated), and the situation is even worse now.

Corporations Taking Hits to Marketable Securities

by Calculated Risk on 11/15/2007 12:44:00 PM

Here is an interesting development, from an 8-K filed today by ADC Telecommunications (hat tip BR)

We hold a variety of highly rated interest bearing auction rate securities that most often represent interests in pools of either interest bearing loans or dividend yielding preferred shares. These auction rate securities provide liquidity via an auction process that resets the applicable interest rate at predetermined calendar intervals, usually every 7, 28, 35 or 90 days. This mechanism allows existing investors either to rollover their holdings, whereby they would continue to own their respective interest in the auction rate security, or to gain immediate liquidity by selling such interests at par. For several months, certain of these auctions have not had sufficient bidders to allow investors to complete a sale, indicating that immediate liquidity at par is unavailable.This is probably not significant for ADC, but these investments were pitched to many other corporations were the losses might be more significant. As BR noted:

At the end of our third quarter for fiscal 2007, we identified approximately $149.0 million of auction rate securities for which there were insufficient bidders at the scheduled rollover dates and another approximately $21.3 million which we believed were at risk of having this occur. As of November 15, 2007 we hold investments subject to auction processes with insufficient bidders with a par value of $169.8 million. These investments represent all of our investments held in auction rate securities.

We are continuing to monitor and analyze our auction rate securities investments. Recently one of these investments with a par value of approximately $17 million was downgraded from a Aaa rating to a A2 rating by Moodys Investor Services. We are not aware of any other of our auction rate securities investments that have been downgraded to date. In light of developing circumstances, we are analyzing the extent to which the estimated market value of this investment may no longer approximate its par value. We have not finalized this analysis. Further, it is possible we will determine other of these investments no longer approximate their par value. If we determine one or more investments no longer approximates its par value, it is possible we will have to record (a) an unrealized loss in the other comprehensive income section of shareowners' investment in our balance sheet as of October 31, 2007, and/or (b) an other-than-temporary impairment charge. An unrealized loss would be recorded in other comprehensive income to the extent we determined the loss on an investment was only temporary in nature and determined that we have the ability to continue to hold the investment until a recovery in market values occurs. In such an event, an unrealized loss would not reduce our net income for the quarter and year ended October 31, 2007, because the loss would not be viewed as permanent. An other-than-temporary impairment charge would be recorded against net income to the extent we determine the loss in fair value of any of these investments is other than temporary.

Several contacts of mine tell me that the money center banks pitched this ... to money funds and corporations over the past 2 years as a little spice on the stew but still AAA. They bought it like candy.

CRE Loan Volumes Fall in Q3

by Calculated Risk on 11/15/2007 10:59:00 AM

It's been some time since I made my prediction in March: Commercial Real Estate Bust?

This might be a story later this year: the start of a commercial real estate bust.Now from Mathew Padilla at the O.C. Register: Commercial real estate loans dipped in Q3

The Mortgage Bankers Association said today commercial real estate loans nationwide fell 4% for all types of real estate in the third quarter vs. a year ago and 30% vs. the second quarter of this year.See Matt's post for more details.

Also from Nouriel Roubini: The Next Shoe to Drop in the Credit Meltdown: Commercial Real Estate and Its Massive Forthcoming Losses

This is chart is a repeat from earlier this week: From Countrywide's 8-K SEC filing on Tuesday, here is a table that included the company's commercial real estate loan pipeline (hat tip idoc).

Click on graph for larger image.

Click on graph for larger image.In October, Countrywide had $752 Million commercial real estate loans in their pipeline, compared to $1,824 million last October and $1,323 million in September.

So Q3 was off 30% from Q2 (according to the MBA) and Q4 is off to a very weak start based on the Countywide October numbers. It looks like the CRE slowdown has started.

Barclays $2.7 Billion Writedown

by Calculated Risk on 11/15/2007 10:13:00 AM

Apparently this was better than expected. From the WSJ: Barclays Ends Speculation Over Subprime Exposure

Barclays PLC Thursday disclosed net charges and write-downs totaling £1.3 billion ($2.67 billion) ... in a move to end speculation over the size of its exposure to the subprime mortgage crisis.Another visit to the confessional.

...

The figure was lower than expected ...

GM Watch: The Flap Continues

by Anonymous on 11/15/2007 08:24:00 AM

So there was a pretty breathlessly hyped story on a blog about how the dismissal of a foreclosure filing meant that the entire MBS market is more or less toast. Then there was a tedious attempt by Tanta to sort through it and figure out what the real issue was and perhaps cool down some of the rhetoric. You know what had to happen next. Gretchen Morgenson got ahold of it.

Do read the whole piece. Perhaps I have gone temporarily blind, and there is somewhere in this article an acknowledgement that this story was "broken" on a blog. (Not mine, by the way: I Am Facing Foreclosure.com "broke" the story. I ignored it as long as I thought I could.) Query: is this where GM has been getting a lot of story juice lately? Could that be why some of her recent reporting, especially on Countrywide, is such a noxious mixture of fact and hype, information and innuendo?

All I know about journalistic practice tells me that if this story had originally been reported in the Podunk Inquirer, GM would have credited the ol' PI in her story. But you can fish in the blogs, it appears, without having to admit it. And without identifying the blog-source of your stories, you avoid having to confront the evaluation problem. There are great blogs and terrible blogs out there. There is carefully gleaned and analyzed information, and there is rumor, garbled gossip, and speculation masquerading as fact. There are people whose agenda and biases are perfectly clearly spelled out, and there are those who are talkin' a book or just shilling. If you want to seine the blogs for NYT material, you have to deal with this problem for yourself and for your readers. Identifying your sources is not simply professional courtesy, it's the beginning of the process of evaluating the source. Yes, I am not a professional reporter and this is a blog and I am lecturing the NYT on Journalism 101. I'm afraid to open the fridge to get milk in case there's a trout in there.

I said most of what I want to say about the issue yesterday. Let me just pause over this one tidbit in GM's article this morning:

When a loan goes into a securitization, the mortgage note is not sent to the trust. Instead it shows up as a data transfer with the physical note being kept at a separate document repository company. Such practices keep the process fast and cheap.I rail endlessly about mortgage industry practices that are "fast and cheap" and that sacrifice risk management. You all have never heard me complaining about the practice of third-party document custody because it is one of the very few old-fashioned slow expensive risk management processes that the New Paradigm people have not yet managed to do away with. Document custodians are the Nerdiest Nerds there are, and their nerditude is in so many cases the only thing separating the current secondary market from a Wild West clown show. They are the thin red-tape line between us and chaos. I have never met anyone having anything to do with mortgage loans who has not at least once indulged in a major bitch-fest about dealing with some Iron-Fisted Custodian who won't just certify pools or mail notes around or change reports because some punk says to. They want appropriately-signed authorizations. They want Trust Receipts. They want originals, not copies; they want letters, not phone calls. They are, personally and institutionally, the kind of people who count the teaspoons after the dinner party guests leave.

And it costs money to use document custodians, who are, if you want to know, required to be financial institutions with a trust department that has direct authorization from its regulator to offer trust services. That does not make them perfect, but to call them "document repository companies" may give you all the impression that we're dealing with some fly-by-night Docs R Us outfit. I don't have exact numbers handy, but I would guess off the top of my head that after Fannie and Freddie, who are the custodians of most but not all of their own notes and mortgages, the single largest concentration of custody docs in this country is probably Wells Fargo. (I invite correction if I'm wrong about that.) Like anyone else who has ever certified pools, I've visited Wells's custodial operations center. I don't remember having to take my shoes off and put them in a basket before they let me in, but then again it was several years ago. At the time, Well's security was better than most airports'.

It has to be. Not only do they hold the documents collateralizing trillions of dollars of debt that belongs to someone else, but they do, in fact, hold those notes I was talking about yesterday that are endorsed in blank. Such a thing is rather more secure than a simple bearer bond, but not by much.

In the case of the DB foreclosure suit dismissal we looked at yesterday, there should have been a set of original notes and original recordable-form (but possibly not actually recorded) assignments of mortgage in the physical custody of a document custodian when DB went to file its FC action. It should therefore have been a matter of DB requesting the pertinent docs from the custodian, who would send them to DB's legal people in order to prepare the filing. Either this did not happen, or the custodian lost the docs, or DB lost the docs, or the docs were never there in the first place. If that last part is true, I want to know how a custodian certified those pools at issuance. If the custodian certified the pools on condition that some missing assignments get turned in later, then when and how did the custodian follow up on that? This is Deal, Big.

It is, mind you, possible that DB is acting as its own custodian. It's a bank, it has a trust department, it qualifies as a custodian. And if DB is acting as its own custodian, and certifying pools without having its hot little hands on the docs first, or it is misplacing those docs it had when it certified the pool to start with, then that, my friends, is a Story. It is a story that Deutsche Bank's regulators might be really really interested in. I know I am.

But this story will not get written by anyone who misunderstands what custodians are, how much they cost (real fee dollars), and how they are supposed to act like the Gatekeepers and SuperNerds of the whole process. In other words, they are supposed to be a check against "fast and cheap," not part of "fast and cheap."

Wednesday, November 14, 2007

GE Bond Fund Breaks the Buck

by Calculated Risk on 11/14/2007 06:15:00 PM

UPDATE: from Reuters: GE says outside investors quit bond fund

All outside investors ... withdrew their money after the company offered them the chance to redeem their holdings at 96 cents on the dollar ...From Andrew Bary at Barron's: Mortgage Woes Damage a GE Bond Fund. (hat tip barely)

Barron's reports that a short-term institutional bond fund managed by GE Asset management has offered investors 96 cents on the dollar.

The GE fund, totaling $5 billion, is an "enhanced" cash fund, meaning it seeks to provide a slightly higher yield than a money-market fund while preserving principal and maintaining an asset value of $1 per share.The one year return of 5.49% (through June 30th) probably seemed pretty attractive for short term money - until now!

...

In a Nov. 8 e-mail to institutional holders of the fund, GE Asset Management cited "extreme conditions in the credit markets" and told investors that "it will soon begin to sell certain securities held in the Fund which will result in realized losses and likely bring the Fund's yield to zero."

In the e-mail, GE Asset Management said the fund has "sufficient liquidity to redeem all non-GE subscribers at the current net asset value (.96) ..."

Cerberus LBO of United Rentals Appears Off

by Calculated Risk on 11/14/2007 04:05:00 PM

From MarketWatch: United Rentals says Cerberus not to proceed with purchase

United Rentals Inc. said Wednesday Cerberus Capital Management LP informed the company that Cerberus is not prepared to proceed with the purchase of United Rentals on the terms agreed on July 22.And from Bloomberg: Cerberus Seeks to Renegotiate United Rentals LBO (hat tip Brian)

Cerberus Capital Management LP is seeking to cut the price on its $4 billion agreement to buy United Rentals Inc., the largest U.S. construction-equipment rental company, people familiar with the transaction said.The banks still can't sell the debt for these LBOs, and they can't afford anymore pier loans (bridge loans that go nowhere and stay on the IBs balance sheet).

...

The United Rentals deal marks the second time in less than a month that Cerberus has sought to get out of a leveraged buyout as investors balk at buying an estimated $300 billion in debt committed to LBOs. ...

``This deal was expected to close sometime this week,'' wrote Stephen Volkmann, an analyst with J.P. Morgan Securities Inc. in New York. ``The banks were struggling with selling the associated debt offering.''

And here is a great quote from Bloomberg (no link yet): Hands Says LBO Bankers Whimpering `in Their Baskets'

``Bankers are like dogs,'' said Hands, the chief executive officer of London-based Terra Firma Capital Partners Ltd., at the industry's SuperInvestor conference in Paris today. ``They hunt in a pack and go into a feeding frenzy. When hit, they whimper, and hide in their baskets. The bankers have been hit very hard, and they're not going to come out of their baskets.''

CNBC: partial FASB 157 Delayed One Year

by Calculated Risk on 11/14/2007 02:37:00 PM

Update from LaSalle Street in the comments:

I e-mailed the FASB today about the implementation of Rule 157. (There was a news story on CNBC about delaying Rule 157)Here is their reply:I did not see this report, but several people have confirmed seeing it on CNBC (hat tip Tim, gamma and others). Perhaps a portion of FASB 157 has been delayed, so we need to wait for more news.On Oct 17, the FASB agreed not to defer the effective date of FASB Statement 157, Fair Value Measurement, in its entirety. At today's meeting, the staff reviewed various deferral alternatives. The Board voted on Alternative "B" - to defer the effective date of Statement 157 for one year for all nonfinancial assets and nonfinancial liabilities, except for those items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually).

More information about Alternative "B" is available in the Board meeting handouts, a link to which is provided at www.fasb.org. More details about what was decided today will also be posted shortly on www.fasb.org.

Communications Manager

Financial Accounting Foundation

FASB 157 was scheduled for implementation tomorrow.

Just one month ago, the WSJ reported: FASB Won't Delay Market-Value Rule

Accounting rule makers decided against deferring a new rule that lays out for companies how to apply market values to financial instruments, as well as some nonfinancial assets, and that mandates disclosures breaking down differences in easy-to-value versus hard-to-price securities.emphasis added.

But a divided Financial Accounting Standards Board left the door open to deferring the rule as it applied to nonfinancial assets on corporate balance sheets, or perhaps to private companies who follow generally accepted accounting principles. Groups such as Financial Executives International, an industry group, had lobbied the board to defer in its entirety the rule, known as FAS 157, for a year.

The seven-member FASB rejected such a proposal by a four-to-three vote.

FAS 157 takes effect for companies with fiscal years beginning after Nov. 15, 2007. This means that most companies will have to begin using the standard from the start of next year. However, many large investment houses and banks chose to adopt the standard early and its disclosures have proven crucial during the recent unrest in debt markets.

Perhaps this is a delay for nonfinancial assets on corporate balance sheets.

DataQuick: Record Low SoCal Home Sales

by Calculated Risk on 11/14/2007 01:32:00 PM

From DataQuick: Southland home sales plummet

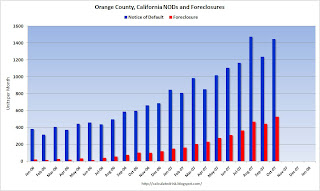

Southern California home sales remained at their lowest level in more than 20 years last month ... Prices have dropped back to spring 2005 levels, a real estate information service reported.Also, from Mathew Padilla at the O.C. Register: O.C foreclosures highest in decade

A total of 12,999 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in October. That was up 4.4 percent from 12,455 for the previous month, and down 45.3 percent from 23,745 for October last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any October in DataQuick's statistics, which go back to 1988. The previous low was in October 1992 when 16,887 homes sold. The October sales average over the past 20 years is 24,725.

...

The median price paid for a Southland home was $444,000 last month, down 3.9 percent from $462,000 in September, and down 8.0 percent from $482,750 for October last year. The year-over-year decline reflects depreciation as well as the recent change in market mix - fewer mid-to-high-priced homes selling with jumbo mortgages. When adjusted for shifts in mix, home values dropped 6.7 percent compared with a year ago. Last month's median sales price was the lowest since $440,000 in April 2005.

Foreclosure activity is at record levels ...

Amid a slumping housing market and a shortage of available loans, banks foreclosed on 530 homes in Orange County last month, the highest monthly total in more than a decade ...

Click on graph for larger image.

Click on graph for larger image.This graph shows the Notice of Default (NOD) and foreclosure data from Padilla's story. Orange County was supposed to be one of those areas immune to a housing bust. I don't think so.

In Re Foreclosure Cases

by Anonymous on 11/14/2007 12:00:00 PM

First of all, thanks to Anne and NYT Junkie and Lyndal who immediately sent me the Opinion and Order. You guys rock.

Second of all, sorry that it took a while to get this updated post written. I'm still convulsing in helpless laughter over one of the footnotes. If you don't know how to have a good time over footnotes to a court order, I can't help you. If you do, you'll love this.

If you don't know what this is about, read this post from earlier today first.

Here's what Judge Boyko (my new personal Snark Hero) had to say on October 31, 2007 regarding some Deutsche Bank FC filings:

On October 10, 2007, this Court issued an Order requiring Plaintiff-Lenders in a number of pending foreclosure cases to file a copy of the executed Assignment demonstrating Plaintiff was the holder and owner of the Note and Mortgage as of the date the Complaint was filed, or the Court would enter a dismissal. After considering the submissions, along with all the documents filed of record, the Court dismisses the captioned cases without prejudice.Yes, the bold italic underscoring is in the original. This means that the judge wanted Deutsche Bank to show it had standing to foreclose on the day the foreclosure suit was initiated, which seems reasonable. Further, this suit was dismissed "without prejudice," meaning that DB can refile if and when it gets its ducks in a row. So right off the bat, we are not dealing with a case in which there is no hope of this foreclosure ever getting completed.

So what happened here?

In each of the above-captioned Complaints, the named Plaintiff alleges it is the holder and owner of the Note and Mortgage. However, the attached Note and Mortgage identify the mortgagee and promisee as the original lending institution — one other than the named Plaintiff. Further, the Preliminary Judicial Report attached as an exhibit to the Complaint makes no reference to the named Plaintiff in the recorded chain of title/interest. The Court’s Amended General Order No. 2006-16 requires Plaintiff to submit an affidavit along with the Complaint, which identifies Plaintiff either as the original mortgage holder, or as an assignee, trustee or successor-in interest. Once again, the affidavits submitted in all these cases recite the averment that Plaintiff is the owner of the Note and Mortgage, without any mention of an assignment or trust or successor interest. Consequently, the very filings and submissions of the Plaintiff create a conflict. In every instance, then, Plaintiff has not satisfied its burden of demonstrating standing at the time of the filing of the Complaint.Okay, before we get to footnote three, here's the plain English version: DB was ordered to produce evidence of standing, but the copies of notes and mortgages it included with its filings don't show ultimate endorsement/assignment to DB. Judge ordered DB to fix this. DB did so by having its attorneys draft after-the-fact assignments, undoubtedly because nobody could find the original assignments. This pissed Judge Boyko off, and rightly so. From His Honor's response to the oral arguments, one has the impression that somebody from DB said, basically, "hey! The dog ate our homework!" There was never really any question that the loans weren't legally sold or assigned to DB; there seems to be a question about the arrogance and audacity of a lender telling a judge to ignore its sloppy paperwork and just get on with a foreclosure.

Understandably, the Court requested clarification by requiring each Plaintiff to submit a copy of the Assignment of the Note and Mortgage, executed as of the date of the Foreclosure Complaint. In the above-captioned cases, none of the Assignments show the named Plaintiff to be the owner of the rights, title and interest under the Mortgage at issue as of the date of the Foreclosure Complaint. The Assignments, in every instance, express a present intent to convey all rights, title and interest in the Mortgage and the accompanying Note to the Plaintiff named in the caption of the Foreclosure Complaint upon receipt of sufficient consideration on the date the Assignment was signed and notarized. Further, the Assignment documents are all prepared by counsel for the named Plaintiffs. These proffered documents belie Plaintiffs’ assertion they own the Note and Mortgage by means of a purchase which pre-dated the Complaint by days, months or years. . . .

Despite Plaintiffs’ counsel’s belief that “there appears to be some level of disagreement and/or misunderstanding amongst professionals, borrowers, attorneys and members of the judiciary,” the Court does not require instruction and is not operating under any misapprehension. The “real party in interest” rule, to which the Plaintiff-Lenders continually refer in their responses or motions, is clearly comprehended by the Court and is not intended to assist banks in avoiding traditional federal diversity requirements.2 Unlike Ohio State law and procedure, as Plaintiffs perceive it, the federal judicial system need not, and will not, be “forgiving in this regard.”3

So here's footnote three:

3 Plaintiff’s, “Judge, you just don’t understand how things work,” argument reveals a condescending mindset and quasi-monopolistic system where financial institutions have traditionally controlled, and still control, the foreclosure process. Typically, the homeowner who finds himself/herself in financial straits, fails to make the required mortgage payments and faces a foreclosure suit, is not interested in testing state or federal jurisdictional requirements, either pro se or through counsel. Their focus is either, “how do I save my home,” or “if I have to give it up, I’ll simply leave and find somewhere else to live.”I say, Judge Boyko For President! I couldn't be any snarkier than that if you gave me a two-week head start.

In the meantime, the financial institutions or successors/assignees rush to foreclose, obtain a default judgment and then sit on the deed, avoiding responsibility for maintaining the property while reaping the financial benefits of interest running on a judgment. The financial institutions know the law charges the one with title (still the homeowner) with maintaining the property.

There is no doubt every decision made by a financial institution in the foreclosure process is driven by money. And the legal work which flows from winning the financial institution’s favor is highly lucrative. There is nothing improper or wrong with financial institutions or law firms making a profit — to the contrary , they should be rewarded for sound business and legal practices. However, unchallenged by underfinanced opponents, the institutions worry less about jurisdictional requirements and more about maximizing returns. Unlike the focus of financial institutions, the federal courts must act as gatekeepers, assuring that only those who meet diversity and standing requirements are allowed to pass through.

Counsel for the institutions are not without legal argument to support their position, but their arguments fall woefully short of justifying their premature filings, and utterly fail to satisfy their standing and jurisdictional burdens. The institutions seem to adopt the attitude that since they have been doing this for so long, unchallenged, this practice equates with legal compliance. Finally put to the test, their weak legal arguments compel the Court to stop them at the gate.

The Court will illustrate in simple terms its decision: “Fluidity of the market” — “X” dollars, “contractual arrangements between institutions and counsel” — “X” dollars, “purchasing mortgages in bulk and securitizing” — “X” dollars, “rush to file, slow to record after judgment” — “X” dollars, “the jurisdictional integrity of United States District Court” —“Priceless.”

To summarize: there were dollars on the table encouraging secondary market participants to get real sloppy. Judge Boyko is making them pay now for what they didn't pay then. So the big news here is not that securitized loans cannot be foreclosed. The big news here is that the true cost of doing business is belatedly showing up. I happen to think that's a more important story than was originally reported.

Retail Sales Slowed in October

by Calculated Risk on 11/14/2007 11:16:00 AM

A couple of quotes ...

From the WSJ: Consumers ‘Hanging on for Dear Life’

The report was weaker than anticipated due to a significant downward revision to August ... The retail sales report often contains some sizeable revisions, but a 0.4 percentage point adjustment to the two months back reading is unusually large. In this case, the revision was not concentrated in any single category — it was scattered across almost every component… The consumer is facing the twin headwinds associated with high energy costs and a negative wealth effect tied to lower housing prices. One of the keys going forward will be whether the labor market continues to provide sufficient income support to prevent too much of a slide in consumer demand. –Morgan Stanley ResearchFrom the National Retail Federation: Consumer Spending Continues to Show Restraint

“Gas prices and other economic issues are beginning to have an effect on consumer spending,” said NRF Chief Economist Rosalind Wells. “While spending did increase in many important areas such as apparel and electronics, the consumer is showing caution while spending.”Here is the Census Bureau report for October.

Deutsche Bank FC Problems and Revenge of the Nerd

by Anonymous on 11/14/2007 09:30:00 AM

I have been asked literally dozens of times in comments of this blog, in emails, and even in posts on other blogs, to comment on this post on I am Facing Foreclosure.Com regarding the dismissal of a foreclosure suit filed by Deutsche Bank. I will tell you right now that it's just too hard to know where to begin: that blog post is so badly written that I don't even know exactly what facts are being alleged to be in evidence. Sorry, but these folks let their outrage run ahead of their reportage, and the result is chaos. So I'm not going to opine on the subject of whether this is an "important" court ruling unless and until one of our kind readers with PACER access emails me a copy of the Order in question. If someone does that, I promise I will make every possible effort to understand it and report back to you all.

Until then, I intend to amuse you (or perhaps just myself) with a story. The first point of this little exercise is to convince you that sometimes things happen because somebody screwed up a bit of paperwork; it is not always a case of things happening because of Organized Predatory Conspiracy to Defraud mortgagors. The second point is to indulge myself in a few minutes of childish vindication of my years spent as Detail Obssessed Literal-Minded Small Picture Pain in the Ass Who Doesn't Play Ball. To everyone who has ever jumped my personal case in the last 20 years about my habit of making a big deal over "technicalities," I have a message to send. Via Deutsche Bank's foreclosure department.

Several years ago I represented a large bank in the process of securitizing a big chunk of its seasoned portfolio loans. Among other things that meant I reviewed several thousand notes. Now, when a loan changes hands, this is effected on the note by an endorsement. It's very much like a check endorsement: you slap a stamp on the back of the note that says "pay to the order of [endorsee] without recourse [endorsor] by [person] its [officer title]," under which is "signature." Each subsequent time a loan changes hands, a new endorsement is made from the prior endorsee to the new endorsee. When loans are securitized, the last endorsement is often "in blank," meaning that the new endorsee is not named. The entire original note goes into the physical custody of the new endorsee or its legal custodian with that blank endorsement, that can be subsequently completed if necessary by the security sponsor. This is a very common and uncontroversial practice.

So I had a couple thousand notes to look at, and about a third of them had an endorsement chain that looked like this: first endorsement from Bank of the County, the original lender, to Bank of the State. Second endorsement from Bank of the State to Bank of the Region. Third endorsement from Bank of the Country to Bank of the Nation. My job was supposed to be to endorse these things on my client's behalf (from Bank of the Nation to blank).

Well, there's a big problem. There was no endorsement from Bank of the Region to Bank of the Country. (The same problem occurred with the chain of assignments of the mortgage.) With a missing link in the chain, there are grounds to question the current owner's rights to endorse this note over to someone else.

Aha! You say. That Tanta: she single-handedly brought down a major banking fraud ring! She blew the whistle on a big name bank who tried to pass off millions of dollars worth of someone else's loans as its own, for ill-gotten gains! How exciting! Will Julia Roberts play Tanta in the movie version?

Hardly. As a matter of fact I knew perfectly well, as did everyone else involved, that Bank of the Country had merged with Bank of the Region, and was legally its successor in interest to these mortgage loans. That wasn't a secret; it had been in the newspapers. The problem was that some dweeb had failed to write the endorsement correctly (it should have been Bank of the Country, successor in interest to Bank of the Region, to Bank of the Nation. Or perhaps someone should have used one of Bank of the Region's old stamps to endorse the note from Region to Country on the same day that it endorsed it from Country to Nation).

There are ways you can fix stuff like that. In this particular case, it ended up involving getting my hands on copies of board resolutions (with an original seal, thank you) showing the successorship, plus a copy of another board resolution (and another original seal!) showing that the officer of Country was also an officer of Region, plus an original board resolution (and seal) giving one Tanta a power of attorney that allowed her legally to void an incorrect endorsement and execute a new one on original notes that didn't actually belong to Tanta. All this had to be done in less than 48 hours, because somebody had already made a commitment to settle tens of millions of dollars and there were some Extremely Unhappy People on both sides of that trade who really really wished that this Tanta person punk had just ignored this problem and certified the pool. One vice president of my client who had had to drag the secretary of the board off the golf course on a sunny Saturday afternoon was good enough to tell me just exactly how unlikely I was to ever get work in this town again.

If I recall correctly the whole episode, which included flying Tanta half-way across the country on a few hours' notice to visit the vault where these original notes were kept, cost the seller about $20,000. It would have cost somebody about $20 to have had a new endorsement stamp made after the merger that included the "successor in interest" verbiage. Throughout the whole thing, Tanta kept explaining that one can spend a whole lot more than $20,000 if one of these puppies goes to foreclosure and some sharp-eyed attorney notices a bad endorsement/assignment chain.

The seller didn't want to spend that money, but the seller's counsel told its executives that once this problem had been brought to the notice of the buyer of the loans, which it had, there was no real choice. After all the dust settled, Tanta managed to re-establish a decent relationship with her client, and so it ended well enough.

However, Tanta knows plenty of people in this business for whom it did not end well. Plenty of insitutions who won't pay the $20,000 to fix their own error because "it's just a technicality," which of course it is. Just a technicality. Tell it to Deutsche Bank.

Allow me to drive home the point, please: before everyone gets all fired up about OMG! Securitized loans can't be foreclosed! Fraud!, please back up a few steps. As I said, I don't have a copy of the court documents, and I'm not going to rely on an amateur paraphrase thereof to make claims about what, specifically, happened in the DB case. But all my years of experience tell me that somebody somewhere used a bad endorsement stamp, pulled the wrong boilerplate verbiage for an affidavit, recorded a lis pendens and an assignment of mortgage in the wrong order, failed to provide a schedule attachment to a blanket assignment showing which loans were covered by it, or something like that. Or perhaps there was a copy board resolution without an original seal, if you can imagine such nefariousness. These kinds of screwups go on all the time in this business.

On the one hand, mistakes just do get made, in any business. On the other hand, the mortgage industry's back room got incredibly sloppy during the boom. You had experienced closing and post-closing staff laid off and replaced by temps who don't know an endorsement from a box of Wheaties, you had loans being sold by brand-new entrants into the business with no experience in these legal transactions, you had gigantic pressures to move loans through the pipeline into a security as fast as possible and paperwork be damned, you had a business too comfortable working on reps and warranties and indemnifications--on a promise to make it good if it ever blows up rather than fixing it now. You had regulators of big depositories that were sound asleep when it came to such operational "trivia."

And this kind of thing with Deutsche Bank and the foreclosure mess is the result. And when Wall Street analysts stand up and demand that companies beef up back rooms, pay veteran employees rather than outsourcing, and slow the hell down so that things are done right the first time, I'll eat every promissory note I've ever endorsed. For every little Tanta with her hands on her hips demanding competent but expensive operations, there's some Chainsaw Al out there "streamlining" the company.

So here's my message to my fellow bloggers: sensationalist stories about LEGAL HANKY PANKY are fun to write and get you a lot of attention. No doubt you have frightened (or pleased) a whole bunch of people with the idea that foreclosures will all grind to a halt nationwide because one fouled-up filing by one Master Servicer of one security in one state means that "They Own Nothing!" Of course they own plenty, and they'll end up establishing it. It might cost them an additional $20,000 or so, but that's the punishment meted out to cost-cutters.

The difficult story to write is the one about how this happens, and what it really means, and who are the hidden victims (all those laid-off employees or non-working consultants whose bad news isn't welcome, plus some shareholders) and hidden villains (like everyone who applauded every time some big bank announced more operational cutting and expertise-dumping). Even if you don't want to write that story, I'd suggest not hyping a story with a hysterical headline based on one email from one interested party. As far as I can tell, the writers of that blog post never even saw the court order itself; the entire post seems to be based on the hyperbolic burbling of a lawyer whose job is to delay foreclosure filings.

I have no particular beef with lawyers who represent homeowners in a foreclosure trying every trick in the book, including exploiting the lender's paperwork errors, in an attempt to stave off the foreclosure or force the lender to work out the loan. That's how the court system works, and frankly, when lenders know this can happen to them, they get smarter about doing their homework correctly.

I do, however, have some problem with lawyers who take their own smoke-blowing tactics too seriously. It's one thing to get a case dismissed because the plaintiff's affidavit is in error; why shouldn't you do that if it's in your client's best interest? It's another thing entirely to smoke your own dope and call this "rampant foreclosure fraud," and for a blogger to claim that this will single-handedly bring down the securitization market. That's fighting bongwater with bongwater. I did a quick Google search this morning to look for any follow-ups to this post, and found the following: "It appears that the holders of CDO's do not have legal title to the properties that have been defaulted on, so they cannot foreclose, so they get a big fat NOTHING." That this is not about CDOs, not about title to real estate, and not about anyone getting NOTHING isn't stopping the internet-chain of conclusion-leaping that make my client's endorsement-chain problems look like a careful business practice. Now a bunch of vocal people "know" something that they do in fact not know. And people like me will be trying to swat this fly forever in the interest of having a useful conversation.

As I said, I might be wrong about the specifics of the DB case, because I haven't seen the actual court order. If someone sends me a copy and it turns out that I'm wrong and this is a Big Deal instead of a Little Deal, I'll be the first to post a mea culpa. Until then I will ask everyone to develop the habit of reading past the hype and evaluating the credibility of a source. Me included.

Bear Stearns: $1.2 Billion Writedown

by Calculated Risk on 11/14/2007 09:00:00 AM

Click on photo for larger image.

Click on photo for larger image.

Headlines on Bear Stearns (hat tip Brian).

"Goal is to keep the franchise intact", Bear Stearns, Nov, 14, 2007

From AP: Bear Stearns to Take $1.2 Billion Credit Writedown, Post Loss in the Fourth Quarter

Investment bank Bear Stearns Cos. will take a $1.2 billion writedown in the fourth quarter related to its credit portfolios, Chief Financial Officer Samuel Molinaro Jr. said Wednesday..

Molinaro said the writedown will lead the company to post a loss during its fiscal fourth quarter, which ends Nov. 30.

Molinaro, presenting at the Merrill Lynch Banking and Finance Conference in New York, said Bear Stearns latest round of writedowns should "suffice" in accurately valuing products such as subprime mortgages and collateralized debt obligations