by Calculated Risk on 8/16/2007 03:23:00 PM

Thursday, August 16, 2007

Fitch Places $12.1B of U.S. Second-Lien RMBS on Rating Watch Negative

Fitch Places $12.1B of U.S. Second-Lien RMBS on Rating Watch Negative (hat tip James Bednar)

Fitch Ratings has placed all classes of 58 U.S. RMBS subprime transactions backed by pools of closed-end second-liens (CES) on Rating Watch Negative. This action includes all classes from these transactions previously placed on Rating Watch Negative. The 58 transactions have an aggregate outstanding balance of approximately $12.1 billion. 35 of the transactions were originated in 2005, 22 were originated in 2006, and one this year. These transactions comprise the entirety of Fitch's rated portfolio of CES RMBS from those vintages.Too much news, not enough time!

"Pre and Post Turmoil" Data

by Calculated Risk on 8/16/2007 12:58:00 PM

We need better phrases than "pre turmoil" and "post turmoil" to describe incoming data. This story on the Philly Fed today describes most of the data as before the "changes in the financial markets".

From Reuters: Philly Fed factory activity stagnates in August

Factory activity in the Mid-Atlantic region stagnated in August, with a measure of growth falling to its weakest level this year, a survey showed on Thursday.We need to be aware, when looking at incoming data, whether the sample was taken before or after (during?) the changes in the financial market. For example, the recent Fed Senior Officer Loan survey was pre-turmoil, even though the data was ugly. And this Philly Fed report is mostly pre-turmoil too, and ugly too.

The Philadelphia Federal Reserve Bank said its business activity index was at 0.0 in August, its weakest in since December 2006, versus 9.2 in July. Economists polled by Reuters had forecast a reading of 9.0.

...

A Philadelphia Fed spokesman said the index may not fully take into account recent turmoil in the financial markets caused by tighter credit conditions.

"We had a limited number of firms that were reporting since the changes in the financial markets," said Michael Trebing, senior economic analyst at the Philadelphia Fed.

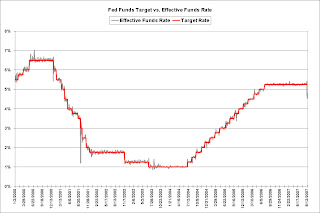

Fed Funds Target vs. Effective Funds Rate

by Calculated Risk on 8/16/2007 12:30:00 PM

UPDATE: From the WSJ: Has the Fed Secretly Cut U.S. Interest Rates?

Speculation intensified that the U.S. Federal Reserve is going to cut interest rates soon -- or even has already done so secretly -- without any clear signal from the Fed to encourage it.Maybe the Fed will cut soon, but they haven't cut rates in secret. As noted below, it is not that unusual for the Fed to let the Fed Funds effective rate drift away from the target rate for a few days. Besides, with the Fed's emphasis on transparency, they simply would not cut rates in secret. Right now, it's best to assume the Fed's intention is to bring the Fed funds rate back to 5.25%.

Original post: For the last few days, the Effective Fed Funds rate has been well below the target rate.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Fed Funds target rate vs. the effective funds rate. There have been other short periods when the Fed didn't defend their target rate, like after 9/11. This was true for short periods in the '90s too.

This morning the Fed did a repo at 5.1% (for MBS), suggesting that the effective rate is already back above 5%.

As of yesterday, the probabilities for a rate cut in September had increased sharply (see the Cleveland Fed). However this was before Fed President William Poole spoke:

Barring a "calamity," there is no need to consider an emergency rate cut, Poole said.With the effective rate rising back above 5%, I expect that the odds of a rate cut in September have diminished, barring a "calamity" of course. But I do expect a rate cut later this year as the economy weakens further.

Fannie Mae Reports on Credit Quality

by Anonymous on 8/16/2007 10:43:00 AM

There is a great deal of information in this Fannie Mae report on its outstanding mortgage book.

On Alt-A:

As of June 30, 2007, we have purchased or guaranteed approximately $310 billion of Alt-A loans, or 12 percent of our single-family mortgage credit book of business, where Alt-A loans are defined as loans that lenders, when delivering mortgage loans to us, have classified as Alt-A based on the reduced documentation requirements or other product features of these loans. We usually guarantee Alt-A loans from our traditional lenders that generally specialize in originating prime mortgage loans. Alt-A loans originated by these lenders typically follow an origination path similar to that used for their prime origination process. In addition, Alt-A loans we guaranty must comply with our guidelines and the terms of our seller-servicer agreements. Accordingly, we believe that our guaranteed Alt-A loans have more favorable credit characteristics than the overall market of Alt-A loans, based on the following data for Alt-A loans in our single-family mortgage credit book of business (as of June 30, 2007):On total book:

• Average loan amount is $172,545.

• Adjustable rate loans represent 33% of the book.

• High FICO scores – 720 weighted average; 1 percent has a FICO score of less than 620.

• Approximately 39 percent of the loans have credit enhancement.

• Low exposure to loans with high LTV ratios – 5 percent of our Alt-A loans have original LTV ratios greater than 90 percent.

• Estimated weighted average mark-to-market LTV is 64 percent.

• Approximately 1.01 percent of the Alt-A book is seriously delinquent.

• Guaranty fees on Alt-A loans are generally higher than our average guaranty fee to compensate us for the increased risk associated with this product. Our Alt-A loans are currently performing consistent with expectations used in establishing our guaranty pricing.

We believe our conventional single-family mortgage credit book has characteristics that reflect our historically disciplined approach to risk management. Our book is highly diversified based on date of origination, geography and product type. Some salient data (as of June 30, 2007) include:

• Total conventional single-family mortgage credit book of business is $2,338 billion.

• Average loan amount is $138,736.

• Geographically diverse, with no region representing greater than 25% of the single-family mortgage credit book of business.

• Approximately 0.64 percent of the book is seriously delinquent.

• Weighted average original loan-to-value (LTV) ratio is 71 percent, with 9 percent above 90 percent.

• Estimated weighted average mark-to-market LTV ratio is 57 percent, with 4 percent above 90 percent. Less than 1 percent of our book has a mark-to-market LTV ratio greater than 100 percent. Mark-to-market LTV reflects changes in the value of the property and amortization of the principal balance subsequent to origination.

• Weighted average FICO score of borrowers is 722, with 5 percent below 620 FICO score.

• Fixed rate loans total 88 percent of the book; adjustable rate loans total 12 percent.

• Loans to owner-occupants make up 90 percent of our book; the balance is investor and second home properties.

• Second lien mortgages are 0.1 percent of the book.

• Credit enhancement exists on 20 percent of the book.

Fannie Mae Files Delayed 2006 Annual Report

by Calculated Risk on 8/16/2007 09:51:00 AM

From the WSJ: Fannie Mae Profit Fell in 2006, Expects Higher Delinquencies

Fannie Mae ... said it expects higher delinquencies and credit losses this year amid the ongoing credit market turmoil.

...

Fannie said negative-amortizing adjustable rate mortgages -- loans on which homeowners don't even have to pay the full monthly interest payments -- made up close to 3% of its single-family business volume in 2005 and 2006, while interest-only ARMs were roughly 9% of volume and about 7% as of June 30. Combined, Fannie said both loans represented roughly 6% of its credit book of business at the end of 2005 and 2006 and June 30.

Fannie's mortgage credit book of business, which includes mortgage assets in its investment portfolio, the firm's mortgage-backed securities held by third parties and credit enhancements provided on mortgage assets, was $2.6 trillion as of Mar. 31, or approximately 23% of total U.S. residential mortgage debt outstanding.

Fannie said as of June 30, about 12% of the single-family mortgage book of business was Alt-A, or near-prime, mortgages or structured Fannie mortgage-backed securities backed by Alt-A loans. That is up from 11% as of Dec. 31.

Subprime loans made up 2.2% of the single-family book of business as of June 30 and the end of 2006, with most of that in private-label mortgage-backed securities.

Looking ahead, Fannie expects higher delinquencies and credit losses this year compared with 2006, "and the increase in our exposure to credit risk resulting from our purchase or securitization of loans with higher credit risk may cause a further increase in the delinquencies and credit losses we experience." Such an increase "is likely to reduce our earnings ... and also could adversely affect our financial condition."

Housing Starts and Completions for July

by Calculated Risk on 8/16/2007 08:33:00 AM

The Census Bureau reports on housing Permits, Starts and Completions. Seasonally adjusted permits decreased:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,373,000. This is 2.8 percent below the revised June rate of 1,413,000 and is 22.6 percent below the revised July 2006 estimate of 1,774,000.Starts declined:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,381,000. This is 6.1 percent below the revised June estimate of 1,470,000 and is 20.9 percent below the revised July 2006 rate of 1,746,000.And Completions declined slightly:

Privately-owned housing completions in July were at a seasonally adjusted annual rate of 1,512,000. This is 0.1 percent below the revised June estimate of 1,513,000 and is 22.2 percent below the revised July 2006 rate of 1,944,000.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Starts vs. Completions.

As expected, Completions have followed Starts "off the cliff".

My forecast is for starts to fall to around the 1.1 million units per year level; a substantial decline from the current level. The decline in Starts for July appears to be the beginning of this next down leg for starts and completions.

This graph shows starts, completions and residential construction employment. (starts are shifted 6 months into the future). Completions and residential construction employment were highly correlated, and Completions used to lag Starts by about 6 months.

Why residential construction employment hasn't fallen further is a puzzle. See The Residential Construction Employment Puzzle for an overview of several explanations of why employment hasn't fallen.

Even with the declines in permits and starts, this report shows builders are still starting too many projects, and that residential construction employment is still too high.

Countrywide Goes Thrifty

by Anonymous on 8/16/2007 07:46:00 AM

CALABASAS, Calif., Aug 16, 2007 /PRNewswire-FirstCall via COMTEX News Network/ -- Countrywide Financial Corporation (NYSE: CFC) announced today that it has supplemented its funding liquidity position by drawing on an $11.5 billion credit facility. In addition, the Company has accelerated its plans to migrate its mortgage production operations into Countrywide Bank, FSB.

"As we have previously discussed, secondary market demand for non-agency mortgage-backed securities has been disrupted in recent weeks," said David Sambol, President and Chief Operating Officer. "Along with reduced liquidity in the secondary market, funding liquidity for the mortgage industry has also become constrained.

"For many years, Countrywide's liquidity management framework has focused on maintaining a diverse, multi-layered assortment of financing alternatives," said Sambol. "A primary component of this framework is a committed, unsecured credit facility of $11.5 billion provided by a syndicate of 40 of the world's largest banks. In response to widely-reported market conditions, Countrywide has elected to draw upon this entire facility to supplement its funding liquidity position. Over 70 percent of this facility has an existing term greater than four years and the remainder has a term of at least 364 days.

"Countrywide has taken decisive steps which we believe will address the challenges arising in this environment and enable the Company to meet its funding needs and continue growing its franchise. Importantly, in addition to the significant liquidity which we have accessed from our bank lines, the Company's primary strategy going forward is to fund its production through Countrywide Bank, FSB. We are already originating in excess of 70 percent of our total origination volume through the Bank, and expect to accelerate our strategy so that nearly all of our volume will be originated in our Bank by the end of September.

"Furthermore, as a result of lessened liquidity for loans which are not eligible for delivery to the GSEs, Countrywide has materially tightened its underwriting standards for such loans, and, we now expect that 90 percent of the loans we originate will be GSE-eligible or will meet our Bank's investment criteria.

"Our objective is to navigate the difficult conditions in today's market as we complete the transition of our Bank business and funding strategy," Sambol concluded. "With these changes, we believe we are well-positioned to leverage opportunities presented by a consolidating industry."

Quote of the Day

by Anonymous on 8/16/2007 07:21:00 AM

From the Washington Post, "Approved Home Loans No Longer Done Deals":

"What I'm telling people is that they should not shop around for the lowest rate necessarily," Binstock said. "Go with the lender who you think is going to be there in the end."That's right, folks. No more of that "stated lender" folderol. Make 'em show you their balance sheet before you agree to accept whatever interest rate they're willing to quote.

GMMI: And We All Know What a "Final Residing Place" Is

by Anonymous on 8/16/2007 07:06:00 AM

Reuters, "Asian central banks patrol as credit fears rise":

SINGAPORE/HONG KONG (Reuters) - Asia Pacific central banks and financial chiefs kept a tight watch on money markets and attempted to reassure investors on Thursday as fears of a worsening global credit storm gripped the region.

There's a degree of panic over the uncertainty induced by the subprime sector in the United States," said P.K. Basu, Singapore-based chief economist for Asia ex-Japan at Daiwa.

"The economic fundamentals in Asia are very sound. However, the final residing place of these CDOs (collateralized debt obligations) and the derivatives issued on the subprime mortgages is difficult to predict."

Paulson: Turmoil to Slow Growth

by Calculated Risk on 8/16/2007 01:07:00 AM

From the WSJ: Paulson Expects Markets to Slow, Not Stall, Growth

Treasury Secretary Henry Paulson, in his first public comments since the sharp downturn in financial markets, said the turmoil "will extract a penalty on the growth rate" of the U.S. economy. But he expressed confidence that "the economy and the markets are strong enough to absorb the losses" without provoking a U.S. recession.What happened to "containment"? And what happened to calling the housing bottom?

...

[Paulson] said that, beyond the steps already taken to encourage more transparency among hedge funds and the like, the ability of the Bush administration to react constructively is limited. It has largely relied on the Federal Reserve and other central banks to fight the financial fire by pumping large amounts of liquidity into parched money markets.

"There is nothing, in my judgment, that we should be doing in terms of guaranteeing market participants against losses or in terms of restraining risk taking," Mr. Paulson said. "One of the natural consequences of the excesses is that some entities will cease to exist."

He hesitated to specify areas where he and regulators will focus in coming months as they draw lessons from recent weeks. "Clearly, there really needs to be a focus on mortgages and how the product is originated and sold," he said. A major source of today's problems was deterioration of the standards used to issue mortgages, particularly in the subprime market, and the ripple effects when delinquency rates on those loans began to rise.

Wednesday, August 15, 2007

Fed's Poole: No Need for Emergency Rate Cut

by Calculated Risk on 8/15/2007 07:27:00 PM

From Bloomberg: Poole Says No Subprime Impact Yet on `Real Economy'

Federal Reserve Bank of St. Louis President William Poole said there's no sign that the subprime- mortgage rout is harming the broader economy and an interest-rate cut isn't yet needed.Prediction: Cramer's head will explode.

"It's premature to say that this upset in the market is changing the course of the economy in any fundamental way," he said in an interview in the bank's boardroom. "Obviously, there could be an impact, but we have to rely on some real evidence."

Barring a "calamity," there is no need to consider an emergency rate cut, Poole said. ...

Poole, 70, said businesses have maintained their hiring and investment plans and banks have sufficient capital to weather the credit-market turmoil. The St. Louis Fed chief stressed that the best course is for policy makers to assess the latest economic data when they next meet Sept. 18. The comments contrast with the certainty that traders put on a rate cut next month.

"If the data confirm the market's view that the economy is sagging, we'll have to decide whether to share that view," said Poole, who votes on the rate-setting Federal Open Market Committee this year. He cited the monthly jobs, retail sales and industrial production reports as key gauges he'll be watching.

...

Poole rebutted comments from some Fed watchers that the central bank may be out of touch with market developments. The criticism followed comments the St. Louis Fed chief made to reporters on July 31 that the slump in stocks was ``a typical market upset.''

"No one has called up and said the sky is falling," Poole said today. "As I talk to companies, their capital spending plans are intact."

...

Poole said he didn't regret that the Aug. 7 statement retained a bias against inflation. He also said that while consumer price gains are "moving in the right direction," the "job is not done."

Freddie Mac and Alt-A Purchases

by Anonymous on 8/15/2007 04:33:00 PM

This Reuters article has everyone very concerned, since it seems to be saying that Freddie is now going to buy more Alt-A loans. Its description of the actual announcement from Freddie is pretty garbled, but we get a lot of that.

I have not yet found this Freddie Mac Media Advisory on Freddie's website, but I do have a copy of it and this is exactly what it says:

McLean, VA . . . Paul E. Mullings, senior vice president for single family sourcing at Freddie Mac (NYSE:FRE) today released the following statement regarding the Alternative-A market:Here's what it means:

“Freddie Mac continues to be an active force in the Alt-A market and is taking steps to increase liquidity in the Alt-A market while maintaining its commitment to prudently and responsibly manage mortgage credit risk.

“Specifically, Freddie Mac is providing 90-day forward commitment capability on a negotiated basis to experienced lenders with credit terms that will accommodate a majority of the fixed and adjustable rate Alt-A product, including many of the reduced documentation mortgages underwritten with appropriate credit risk offsets that Freddie Mac now purchases on a bulk basis through structured transactions.

“Available credit terms specifically include reduced documentation mortgages under-written with appropriate credit risk offsets. This will give more Alt-A borrowers the security of being able to lock in their rate for up to three months.

“At the same time, we are committed to continuing our current bulk purchases of a wide range of Alt-A products on a spot bid basis.

“Going forward, based on our continual assessment of credit performance and market conditions we may determine to restrict credit terms available for certain higher risk mortgage products, including no-documentation and high LTV Alt-A mortgages.

“By taking these steps, Freddie Mac continues to fulfill its mission to provide stability, liquidity, and affordability to the US housing finance system and put more people in homes they can afford and keep.”

1. Freddie may or may not be increasing the total dollar amount of Alt-A loans it buys. This document doesn't say, one way or the other.

2. Freddie is now buying Alt-A loans in two ways, where it used to buy them only one way. The old way was through "bulk purchases" of loans the lenders had already closed. These bulk purchase transactions have always competed with the private "non-agency" securitization market, and over the last several years Freddie has lost most of those auctions: like the MIs, the GSEs have often refused to lower their risk-based pricing for this stuff. But now that the private securitization market has had a pall cast upon it, Freddie is making some purchases in the bulk side.

3. But bulk purchases only take closed loans off an originator's warehouse line. They don't provide "liquidity" to current originations. So what Freddie is doing is offering a "forward commitment" version of this to selected lenders, where Freddie will agree in advance to buy a bulk package of loans (at guidelines negotiated between Freddie and the lender) at a specified guarantee fee. This allows these lenders to start originating the product again, because now they have a price to put on their rate sheets. Remember that in the last few weeks, we've seen lenders with "no bid" or "this product not priced" showing up on their rate sheets.

4. This announcement doesn't say what kind of a price Freddie is offering on these forward deals, just that it is willing to put out a forward price. I would bet a fair pile of change that nobody is really going to like this price. But if it's a choice between using a forward commitment with Freddie to keep one's operation going until the private market "unfreezes" or just throwing in the towel today, I suspect a number of lenders will put Freddie's price on the rate sheet.

5. Notice that Freddie is also saying they might change their guidelines so they no longer buy Alt-A at the same standards they used to. I doubt this is an idle threat.

6. This has nothing to do with raising the portfolio caps or the conforming loan limit.

7. Remember back in June when Freddie announced it would commit $20 billion over 4-5 years to help with the subprime problem? The press went on and on about a bailout, but clearly Freddie's $20 billion wasn't quite enough to cover that bar tab. This won't be, either. But something is being done and is being seen to be done.

I'll keep you posted if I get any more real information regarding the dollar amounts in play here.

California Bay Area: Home Sales Slowest Since '95

by Calculated Risk on 8/15/2007 02:44:00 PM

From DataQuick: Bay Area home prices steady, slow sales

Bay Area homes continued to sell at their slowest pace since 1995 last month ... median prices remain stable at near-record highs...The more expensive areas will probably start seeing price declines soon with rising rates on jumbo prime loans. The sales decline in California is stunning, with sales running at about half the rate of a few years ago.

A total of 7,423 new and resale houses and condos were sold in the nine-county Bay Area in July. That was down 6.8 percent from 7,964 in June, and down 12.4 percent from 8,476 for July a year ago, according to DataQuick Information Systems.

Sales have decreased on a year-over-year basis the last 30 months. Last month's sales count was the lowest for any July since 6,666 homes were sold in 1995. The strongest July in DataQuick's statistics, which go back to 1988, was in 2004 when 14,258 homes were sold. The July average is 9,800.

"The trend we're seeing statewide is that more expensive neighborhoods are doing better than less expensive neighborhoods. The Bay Area has always been a high-cost market, and we're not seeing the declines in prices or sales volume that we're seeing elsewhere in California. There certainly is a lull in sales, but it appears that both buyers and sellers are taking a wait-and-see stance," said Marshall Prentice, DataQuick president.

...

Foreclosure resales accounted for 4.5 percent of July's sales activity, up from 4.1 percent in June, and up from 1.5 percent in July of last year. Foreclosure resales do not yet have a regional effect on prices.

NAHB: Builder Confidence Falls in August

by Calculated Risk on 8/15/2007 01:00:00 PM

Click on graph for larger image.

Click on graph for larger image.

The NAHB reports that builder confidence fell to 22 in August, from 24 in July. The record low was 20 in January 1991.

NAHB Press Release: Credit Tightening Weighing On Builder Confidence In August

Highly visible problems in the housing finance system are contributing to a wait-and-see attitude among prospective home buyers and reducing builder confidence in the single-family housing market, according to the latest National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today. The HMI declined two points to 22 in August, its lowest level since January 1991.

“Builders realize that issues related to mortgage credit cost and availability have become more acute, filtering some prospective buyers out of the market and prompting others to delay their decision to purchase a new home,” said NAHB President Brian Catalde, a home builder from El Segundo, Calif. “Builders are responding by trimming prices and stepping up non-price incentives to bolster sales and limit cancellations, although we’re dealing in a difficult market environment.”

“There is no question that problems in the subprime mortgage sector have spilled over to other components of housing finance, including the Alt.-A and jumbo markets, delaying a revival of the single-family housing market,” added NAHB Chief Economist David Seiders. “However, the government-related parts of the mortgage market still are functioning well and the underlying economic fundamentals promise to remain solid for some time – providing support to the longer-run housing outlook. We now expect to see home sales return to an upward path by early next year and we expect housing starts to begin a gradual recovery process by mid-2008. From there, the market will have plenty of room to grow in 2009 and beyond.”

Derived from a monthly survey that NAHB has been conducting for more than 20 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as either “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as either “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view sales conditions as good than poor.

All three component indexes declined in August. The index gauging current single-family home sales fell a single point, to 23, while the index gauging sales expectations for the next six months declined two points to 32 and the index gauging traffic of prospective buyers declined three points to 16.

Three out of four regions of the country posted declines in the August HMI. While the South’s HMI reading remained unchanged at 25, the West recorded a one-point decline to 23, the Northeast posted a two-point decline to 30 and the Midwest posted a five-point decline to 14.

Storms and Oil

by Calculated Risk on 8/15/2007 11:48:00 AM

From MarketWatch: Crude oil rallies on storm worries, supply drop

Crude-oil futures extended their strong gains Wednesday, after the Energy Department reported a higher-than-expected drop in petroleum supplies in the latest week, as other energy futures also rallied, continuing to draw support from worries over the potential impact of a tropical storm on oil installations in the Gulf of Mexico.There are two tropical storms right now in the Atlantic: Tropical Storm Erin in the Gulf of Mexico (GOM), and Tropical Storm Dean in the Atlantic bearing down on the windward islands.

Dean is the concern for oil interests in the GOM. From the NHC:

Just like with money market stories, fears about hurricanes are usually much worse than the actual damage - however Katrina and Rita were both exceptions in 2005.

Sentinel "Money Market" Update

by Anonymous on 8/15/2007 08:27:00 AM

The news that a "money market fund" was halting redemptions yesterday certainly caused a fair-sized anxiety-attack yesterday. I'm the last person to suggest that what's happening with Sentinel Mangement Group is good news, but it doesn't appear to be the kind of bad news a lot of us assumed at first glance. This is, obviously, a common problem with "hot news": we're all over it before we've had time to stop and really examine it.

I should have known better, myself, because my immediate response was "who the hell is Sentinel?" It's not like I'm an expert in money market funds or anything, but I read the papers and I have a money market fund account myself--with Vanguard--so at least once in my life I did some comparisons of prospectuses. My second response was "how can you have a redemption problem with a money market fund?" The money market is supposed to be the shortest durations available; that is, the most liquid investment there is short of an interest-bearing checking account. I'm sure everyone else thought the same things I did, and so we all got pretty freaked out. The liquidity freeze has hit the money market? Head for the Bankerdome!

Well, but. First of all, it appears that a prudent elderly risk-averse retail customer like me has never heard of this Sentinel fund because it is not a retail investor fund. Second, it doesn't appear to be a true short-duration credit-risk free high-liquidity fund like your usual retail fund. Third, it appears to have, um, made a certain misrepresentation about having asked its regulator for permission to halt redemptions yesterday. Bloomberg:

Sentinel, based in the Chicago suburb of Northbrook, said it contacted the Commodity Futures Trading Commission for approval to halt redemptions ``until we can honor them in an orderly fashion,'' according to an Aug. 13 client letter posted on TheStreet.com Web site. Regulators said the firm never made such a request.That Horizon fund is probably the kind of thing most of us think of when we hear "retail brokerage money market fund." Sentinel's fund sounds like another classic case of the high-rollers chasing yield in an "innovation" of the classic money market concept.

``They're not honoring withdrawal requests, and the plan is over time to get out of positions,'' Jeff Barclay, a lawyer with Chicago-based Schuyler, Roche & Zwirner who represents Sentinel clients, said in an interview today. ``Their intent is to return money to clients, which is an admirable position, but it's a breach of contract and bad for a client that needs the money tomorrow for a margin call,'' Barclay said after speaking with members of the firm's legal staff today.

``Investor fear has overtaken reason and has induced a period in which most securities have simply ceased to trade,'' Sentinel said in its letter, which didn't specify which funds were affected. ``We are concerned that we cannot meet any significant redemption requests without selling securities at deep discounts to their fair value and therefore causing unnecessary losses to our clients.''

Eric Bloom, Sentinel's president and chief executive officer, didn't return phone calls seeking comment. . . .

The CFTC talked with Sentinel about its status but wasn't asked to approve a freeze, a commission official said. Such a decision isn't up to the Washington-based regulator, added the official, who asked not to be identified because the discussions were private.

``We are aware of the situation and we are monitoring it,'' CFTC spokesman Dennis Holden said. . . .

Sentinel invests for clients such as managed-futures funds, high-net-worth individuals and hedge funds that want to be able to withdraw their cash quickly. Investments include short-term commercial paper, foreign currency, investment-grade bonds and Treasury notes, according to the Web site.

The firm's Prime Portfolio pooled account had 82 percent of its assets in floaters, or debt that pays floating-rate interest, as of June 30, according to the Web site. The weighted-average maturity of securities in the fund was 33 years, mostly in corporate securities. Only about 6 percent of assets were in overnight loans.

In contrast, Horizon Cash Management LLC, a $3.2 billion cash-management firm based in Chicago, has an average maturity across its separately managed accounts of 254 days.

The Prime Portfolio is designed to give clients ``a short- term investment alternative that combines safety of principal, liquidity and competitive yields through a portfolio of investment-grade securities,'' Sentinel said on the Web site. It also said that the firm follows ``concentration limits'' on investment holdings in order to reduce risk.

I do not give investment or cash management advice to other people. I will simply note that I didn't run right out and close my Vanguard account yesterday, nor do I intend to do it today. Furthermore, I want to ask everyone to bear in mind why it is that this blog is what it is. We aren't here to provide "tradeable news," or to swap investment strategies with each other. What we're trying to do is take some of this "news" and subject it to the collective analytical talents of a group of people--fuddy duddies, for sure--who want to slow down and take a look at these things from a rather wider perspective.

Yesterday, some of those excellent commenters of ours who do that kind of thing got drowned out by a lot of panicked people demanding to know if they should yank their money out of the money market and buy T-bills or gold or ammo or what have you. This morning, we learn that the folks getting burned, at least in this story, are those "qualified investors" who should have known better but didn't. This isn't Brookstreet, where you had small-time retail investors being sold inverse floaters. This is a money market hedge fund learning the lesson that you can't have credit-risk free supershort-duration investments with a NAV = $1.00 and get a higher yield than the unwashed masses get.

In other words, this is part of a pattern that we've been seeing lately. In that respect, it's not really "hot news."

Martin Wolf Supports William Poole

by Calculated Risk on 8/15/2007 12:52:00 AM

A little background (as if everyone doesn't know the story). On July 20th, St. Louis Fed President William Poole gave a speech: Reputation and the Non-Prime Mortgage Market.

As I noted at the time - just two days after Fed Chairman Bernanke told Congress the mortgage problems were contained to subprime ARMs - Poole correctly expanded the discussion beyond subprime to include Alt-A. But what really got people's attention was this comment by Poole:

"Financial markets have dealt harshly, but on the whole appropriately, with banks, hedge funds and certain other investors who were heavily exposed to the riskiest segments of the non-prime securitized mortgage market."Jim Cramer responded by calling Poole "shameful". (here is the video of Cramer)

Now Martin Wolf writes in the Financial Times: Fear makes a welcome return

Panic follows mania as night follows day. The great 19th-century economist and journalist, Walter Bagehot, knew this better than anybody. Lombard Street, his masterpiece, is dedicated to the phenomenon. It is devoted, too, to how central banks should deal with its results.And Martin Wolf on Poole and Cramer:

...

This is not new. It is as old as financial capitalism itself. The late Hyman Minsky, who taught at the University of California, Berkeley, laid down the canonical model. The process starts with “displacement”, some event that changes people’s perceptions of the future. Then come rising prices in the affected sector. The third stage is easy credit and its handmaiden, financial innovation.

The fourth stage is over-trading, when markets depend on a fresh supply of “greater fools”. The fifth stage is euphoria, when the ignorant hope to enjoy the wealth gained by those who came before them. The warnings of those who cry “bubble” are ridiculed, because these Cassandras have been wrong for so long. In the sixth stage comes insider profit-taking. Finally, comes revulsion.

When William Poole, chairman of the St Louis Federal Reserve, said that “the Fed should respond to market upsets only when it has become clear that they threaten to undermine achievement of fundamental objectives of price stability and high employment or when financial market developments threaten market processes themselves”, I gave a cheer.I recommend reading all of Wolf's piece.

Not so Jim Cramer, hedge fund manager and television pundit, who declared last Friday that chairman of the Federal Reserve, Ben Bernanke, “is being an academic!...My people have been in this game for 25 years. And they are losing their jobs and these firms are going to go out of business, and he’s nuts! They’re nuts! They know nothing! . . . The Fed is asleep.”

So capitalism is for poor people and socialism is for capitalists. This view is not just offensive. It is catastrophic.

Tuesday, August 14, 2007

Growing Criticism of Rating Firms

by Calculated Risk on 8/14/2007 11:13:00 PM

A few short excerpts from the WSJ: How Rating Firms' Calls Fueled Subprime Mess

In 2000, Standard & Poor's made a decision about an arcane corner of the mortgage market. It said a type of mortgage that involves a "piggyback," where borrowers simultaneously take out a second loan for the down payment, was no more likely to default than a standard mortgage.The Alt-A mortgage and LBO debt markets are also a mess, but this articles focuses on subprime.

...

Six years later, S&P reversed its view of loans with piggybacks. It said they actually were far more likely to default. By then, however, they and other newfangled loans were key parts of a massive $1.1 trillion subprime-mortgage market.

Today that market is a mess.

It was lenders that made the lenient loans, it was home buyers who sought out easy mortgages, and it was Wall Street underwriters that turned them into securities. But credit-rating firms also played a role in the subprime-mortgage boom that is now troubling financial markets. S&P, Moody's Investors Service and Fitch Ratings gave top ratings to many securities built on the questionable loans, making the securities seem as safe as a Treasury bond.Also from Bloomberg: Moody's, S&P Lose Credibility on CPDOs They Rated

Also helping spur the boom was a less-recognized role of the rating companies: their collaboration, behind the scenes, with the underwriters that were putting those securities together. Underwriters don't just assemble a security out of home loans and ship it off to the credit raters to see what grade it gets. Instead, they work with rating companies while designing a mortgage bond or other security, making sure it gets high-enough ratings to be marketable.

The result of the rating firms' collaboration and generally benign ratings of securities based on subprime mortgages was that more got marketed. And that meant additional leeway for lenient lenders making these loans to offer more of them.

...

The subprime market has been lucrative for the credit-rating firms. Compared with their traditional business of rating corporate bonds, the firms get fees about twice as high when they rate a security backed by a pool of home loans. The task is more complicated. Moreover, through their collaboration with underwriters, the rating companies can actually influence how many such securities get created.

Moody's Investors Service and Standard & Poor's, the arbiters of creditworthiness, are losing their credibility in the fastest growing part of the bond market.

The New York-based ratings firms last month gave a new breed of credit derivatives triple-A ratings, indicating they were as safe as U.S. Treasuries. Now, investors are being offered as little as 70 cents on the dollar for the constant proportion debt obligations, securities that use credit-default swaps to speculate that companies with investment-grade ratings will be able to repay their debt.

``The rating doesn't tell me anything,'' said Bas Kragten, who helps manage the equivalent of about $380 billion as head of asset-backed securities at ING Investment Management in The Hague. ``The chance that a CPDO won't be triple-A tomorrow is a lot greater than it is for the government of Germany.''

The legacy built by John Moody and Henry Varnum Poor a century or more ago is being tarnished by losses on securities linked to everything from subprime mortgages that the firms failed to downgrade before it was too late to high-yield, high- risk loans.

Impac Suspends Alt-A Loans

by Calculated Risk on 8/14/2007 04:33:00 PM

Press Release: Impac Mortgage Holdings, Inc. Announces Results of Second Quarter 2007

During the second quarter, the secondary and securitization mortgage markets have deteriorated, become more unpredictable and volatile, making it more difficult to sell loans and securities to investors. In addition, because housing prices have declined, default and credit losses have increased; investors are requiring higher returns, reducing the prices of mortgage loans. As a result, the loans have not performed up to expectations and the fair value of mortgage loans has deteriorated. The underlying reason for the deterioration of industry conditions appears to be initially based on the relatively poor performance of loans originated in 2006. This decline in performance has led to a lack of confidence by bond investors and lenders and their reluctance to invest/lend as aggressively. These market conditions have also increased the Company's loss severities during the second quarter.emphasis added

Recently these market conditions required us to focus on preserving liquidity. We have received a significant amount of margin calls from our lenders, and have satisfied all the margin calls to date. As we continue to receive margin calls from our lenders in the current market environment, we intend to satisfy these margin calls, however, we cannot make any assurances we will satisfy all margin calls in the future. In addition, we are operating under waivers provided by certain lenders as certain lenders have waived certain covenants that require us to maintain positive net income and certain leverage ratios. There can be no assurance that we will be able to obtain future waivers or new waivers if covenants are not met, or that we will be offered to obtain waivers on favorable terms. Further, we have negotiated sales of approximately $1.0 billion of our $1.6 billion of loans held on financed facilities.

In light of the continued and widely publicized volatility in the secondary and securitization markets, we have suspended funding on loans previously referred to as Alt-A loans and currently do not have any plans to originate these types of loans in the near future. At this point, the Company is only funding loans that are eligible to be sold to government sponsored agencies. In addition to the suspension of Alt-A loans, the Company has taken steps to significantly reduce operating expenses which include staff reductions and closure of selected facilities. Should the market conditions continue to deteriorate, we may take further steps including significantly limiting our operations to the Long Term Investment Operations.

During the quarter ended June 30, 2007 the residential mortgage market continued to be affected by increasing interest rates, a weakening housing market and increasing delinquencies and defaults, regulators and legislators increased their focus on tightening underwriting standards for new mortgage loans. Many non-prime mortgage lenders were impacted by reduced liquidity and as a result were required to scale back or cease operations. Most market participants responded to changes in the marketplace with changes in product offering and tightening of underwriting guidelines.

SoCal home sales slowest since 1995

by Calculated Risk on 8/14/2007 03:42:00 PM

From DataQuick: Southland home sales slowest since 1995

Southern California home sales remained at their lowest level since the mid 1990s last month ... The median price paid for a home inched back up to a peak first reached in March, tugged up by sales in high-end markets, ...

A total of 17,867 new and resale homes sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was down 11.4 percent from 20,166 for the previous month, and down 27.4 percent from 24,614 for July last year, according to DataQuick Information Systems.

Last month's sales were the slowest for any July since 1995, when 16,225 homes sold, the lowest for any July in DataQuick's statistics, which go back to 1988. The strongest July was in 2003, when 38,996 homes sold. The July sales average is 26,829.

...

When adjusted for shifts in market mix (i.e. fewer lower-cost homes selling now), year-over-year price changes went negative in January and are now roughly three percent below year-ago levels. The declines are in the lower half of the market, while prices are flat or even increasing in the upper half of the market.

...

Foreclosure resales accounted for 8.3 percent of July's sales activity, up from 7.7 percent in June, and up from 2.0 percent in July of last year. Foreclosure resales do not yet have a marketwide effect on prices, although pockets of foreclosure discounts appear to be emerging in some local Inland Empire and High Desert markets.