by Calculated Risk on 7/26/2007 02:06:00 PM

Thursday, July 26, 2007

Predict Existing Home Sales Contest

If anyone missed the post yesterday, we are having a contest to predict Existing Home sales for 2007 (to be announced in January '08). Please post your predictions in the comments to the contest post: Contest: Forecast 2007 Existing Home Sales

As food for thought, here is an excerpt from a Goldman Sachs piece yesterday: How Much More Downside for Housing Activity?

Today’s comment assesses how far the US housing downturn has progressed, relative to historically “typical” trough levels for both housing starts and existing home sales. If we are on our way to such a “typical” trough, both indicators would have significantly further to fall, from a current 1.47 million to 1.1 million in the case of housing starts and—more dramatically—from 5.75 million to 3.6 million in the case of existing home sales.

Even though our housing views have long been on the bearish side, these figures are well below our baseline forecasts, especially in the case of existing home sales. We do believe these “typical trough” results are probably too pessimistic, mainly because of structural improvements in the workings of the housing and mortgage markets compared with the 1970s and 1980s. However, the recent upheavals in the mortgage finance industry have made us less confident on this score.

Excerpted with permission.

Wells Fargo to Close Non-Prime Wholesale Lending Business

by Calculated Risk on 7/26/2007 12:40:00 PM

Click on photo for larger image.

Wells Fargo Closes Nonprime Wholesale Lending Business

Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A., said today that it will close its nonprime wholesale lending business, which processes and funds nonprime loans for third-party mortgage brokers. In 2006, this business represented 1.6 percent of Wells Fargo's total residential mortgage loan volume of $397.6 billionJPMorgan also tightened mortgage lending standards today too. From JPMorgan:

Will require an initial fixed rate for at least five years on adjustable-rate mortgages for non-prime borrowers to reduce payment shock risk

Will employ underwriting guidelines that require borrowers to demonstrate their ability to handle increases in interest rates on non-traditional mortgages

Has tightened credit standards, including making adjustments to acknowledge declining home values in certain markets and reducing the use of high loan-to-value ratios and stated-income products

Will continue to consider borrowers’ required property tax and homeowners’ insurance payments in determining affordability. Chase offers all its borrowers an option to escrow those payments with Chase

Will continue its practice of not offering option ARMs, which can expose borrowers to negative amortization when their monthly payment does not cover interest costs

More on June New Home Sales

by Calculated Risk on 7/26/2007 11:07:00 AM

For more graphs, please see my earlier post: June New Home Sales Click on graph for larger image.

Click on graph for larger image.

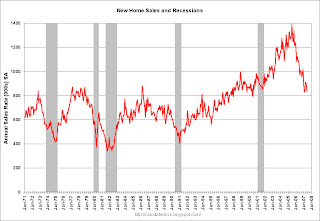

The first graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001. This should raise concerns about a possible consumer led recession in the months ahead.

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through June.

Typically, for an average year, about 52% of all new home sales happen before the end of June. Therefore the scale on the right is set to 52% of the left scale.

At the current pace, new home sales for 2007 will probably be in the high 800 thousands - about the same level as in 1998 through 2000. This is significantly below the forecasts of even many bearish forecasters.

If sales slow in the 2nd half of 2007 - as I expect - New Home sales might be in the low 800s - the lowest level since 1997.

June New Home Sales

by Calculated Risk on 7/26/2007 10:00:00 AM

According to the Census Bureau report, New Home Sales in June were at a seasonally adjusted annual rate of 834 thousand. Sales for May were revised down significantly to 893 thousand, from 930 thousand. Numbers for April were also revised down.

Click on Graph for larger image.

Sales of new one-family houses in June 2007 were at a seasonally adjusted annual rate of 834,000 ... This is 6.6 percent below the revised May rate of 893,000 and is 22.3 percent below the June 2006 estimate of 1,073,000..

The Not Seasonally Adjusted monthly rate was 77,000 New Homes sold. There were 98,000 New Homes sold in June 2006.

June '07 sales were the lowest June since 2000 (71,000).

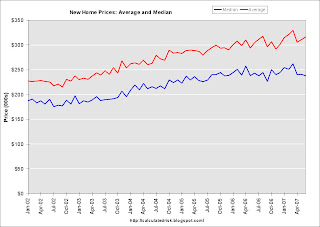

The median and average sales prices were mixed. Caution should be used when analyzing monthly price changes since prices are heavily revised and do not include builder incentives.

The median sales price of new houses sold in June 2007 was $237,900; the average sales price was $316,200.

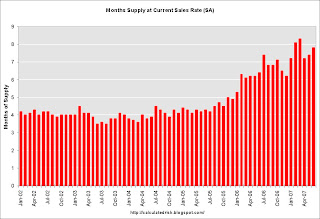

The seasonally adjusted estimate of new houses for sale at the end of June was 537,000.

The 537,000 units of inventory is slightly below the levels of the last year. Inventory for the previous months were revised up slightly.

Inventory numbers from the Census Bureau do not include cancellations - and cancellations are once again at record levels. Actual New Home inventories are probably much higher than reported - some estimate are about 20% higher.

This represents a supply of 7.8 months at the current sales rate.

It appears we are back to were sales are being revised down every month. As I noted last month, this probably indicates another downturn in the market. More later today on New Home Sales.

Wednesday, July 25, 2007

Citigroup Loves Piers

by Calculated Risk on 7/25/2007 08:17:00 PM

NOTE: Haloscan comments are acting up again. Please try refreshing the page if the posts do not display completely. Please accept my apologies for the poor performance of Haloscan.

We've been joking about short term bridge loans turning into "pier loans", and it appears Citigroup is the proud owner of many of these shiny new piers.

From the WSJ: Chrysler Throws Salt in Citigroup’s Wounds (hat tip Brian)

Citigroup is one of the banks that will ... be left holding the bag after investors took a pass on the sale of $10 billion of loans at Chrysler’s auto unit for the company’s leveraged buyout. ... It isn’t good news for either the banks or the buyout firms. There will come a point, if we aren’t there already, when banks refuse to make new loan commitments.That is a lot of piers.

...

Chatter among investment bankers lately has focused on Citigroup, which is said to be clamping down especially hard on making new loans. ... Citi has the misfortune of having been involved in a lot of the buyout loans that have soured lately, including Allison Transmission, U.S. Foodservice, Dollar General and ServiceMaster. It also has a role in three of the coming megadeals that still need to be financed: First Data, TXU and Clear Channel Communications.

NAHB Economist Cuts Forecast

by Calculated Risk on 7/25/2007 05:43:00 PM

John Spence as MarketWatch reports: Economist cuts housing forecasts

The chief economist for the National Association of Home Builders on Wednesday ... lowered his forecasts for new construction as the market has weakened further ...This means Seiders expects starts to average about 1.38 million per month, at a seasonally adjusted annual rate, for the 2nd half of '07. That is too much production, and I expect starts to fall even further.

"It's fair to say the performance of the housing market during the first half [of 2007] and the outlook for the second half and next year are a lot weaker than six months ago," said David Seiders ...

His outlook for 2007 single-family housing starts is now 9% lower than it was at the beginning of the year, while his 2008 forecast has been slashed by 15%, Seiders said on a conference call. His forecast is for housing starts of 1.42 million this year and 1.45 million in 2008.

Contest: Forecast 2007 Existing Home Sales

by Calculated Risk on 7/25/2007 01:33:00 PM

Existing home sales through June were 2.929 million units. In a typical year, sales through June are about half the sales for the year. So at the current pace, sales will be around 5.86 million.

Here are a few forecasts (made at the end of '06):

David Lereah (as NAR economist): 6.34 million

Fannie Mae Chief Economist David Berson: 5.925 million

Calculated Risk (me): 5.7 million (center of range, 5.6 to 5.8 million).

And a few more forecasts from the comments:

Banker: 5.5 million

Barely: 5.35 million

central_scrutinizer: 5.9 million

Please feel free to add your prediction to the comments section of this post. We will announce a winner in January - and the prize will be ... uh, your name announced as the winner and the admiration of others.

More on June Existing Home Sales

by Calculated Risk on 7/25/2007 12:05:00 PM

For more existing home sales graphs, please see the previous post: June Existing Home Sales

To put the NAR numbers into perspective, here are the year-end sales, inventory and months of supply numbers, since 1969. Click on graph for larger image.

Click on graph for larger image.

This graph shows the actual annual sales, year end inventory and months of supply, since 1982 (sales since 1969). For 2007, the June inventory and Seasonally Adjusted Annual Rate (SAAR) for sales were used.

The current inventory of 4.196 million is below the all time record 4.431 million units set last month. However, since sales have continued to fall, the "months of supply" metric remained at the same level: 8.8 months. The "months of supply" is now above the level of the previous housing slump in the early '90s, but still below the levels of the housing bust in the early '80s.

The "months of supply" is calculated by dividing the total inventory by the seasonally adjusted annual rate (SAAR) of sales, and multiplying by 12. Currently inventory is 4.196 million, SAAR sales are 5.75 million giving 8.8 months of supply.

Both the numerator and the denominator are generally moving in the wrong direction (although inventory declined in June). Not only is inventory near record levels, but sales - though falling - are still significantly above the normal range as a percent of owner occupied units.

Forecasts

The followings shows the actual cumulative existing home sales (through June) vs. three annual forecasts for 2007 (NAR's Lereah, Fannie Mae's Berson, and me). Note: Several people have asked me to add their forecasts to this graph, instead I think I'll have a contest to predict the total existing home sales for 2007. My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

My forecast was for sales to be between 5.6 and 5.8 million units (shown as 5.7 million).

NSA sales are 2.929 million units through June. In a typical year, sales through June are about half the sales for the year. So at the current pace, sales will be around 5.86 million. It appears that sales will slow, perhaps significantly, in the second half of 2007, so the risk to my forecast is most likely on the downside.

To reach the NAR forecast, revised downward on July 11 to 6.11 million units, sales would have to be above the 2006 levels for the remainder of the year. Given tighter lending standards, we can probably already say the July NAR forecast was too optimistic.

KKR Debt Deal Fails For Alliance Boots

by Calculated Risk on 7/25/2007 11:36:00 AM

From Bloomberg: KKR's Banks Fail to Sell $10 Billion of Alliance Boots LBO Debt

Kohlberg Kravis Roberts & Co.'s banks, led by Deutsche Bank AG, failed to sell 5 billion pounds ($10 billion) of senior loans to fund the leveraged buyout of Alliance Boots Plc, two people with direct knowledge of the deal said.And from the WSJ: Bankers Postpone Chrysler Debt Sale

Bankers raising $20 billion in loans for Chrysler Group have postponed a sale of $12 billion in debt for the auto company and are planning to fund the bulk of that debt from their own pockets for the time being, according to a person familiar with the matter.

June Existing Home Sales

by Calculated Risk on 7/25/2007 09:56:00 AM

The National Association of Realtors (NAR) reports Prices Rise, Existing-Home Sales Decline in June

Total existing-home sales – including single-family, townhomes, condominiums and co-ops – declined 3.8 percent to a seasonally adjusted annual rate1 of 5.75 million units in June from a downwardly revised level of 5.98 million in May, and are 11.4 percent below the 6.49 million-unit pace in June 2006.

...

The national median existing-home price2 for all housing types was $230,100 in June, up 0.3 percent from June 2006 when the median was $229,300. The median is a typical market price where half of the homes sold for more and half sold for less.

Click on graph for larger image.

Click on graph for larger image.The first graph shows the NSA sales per month for the last 3 years.

The pattern of YoY declines in sales is continuing. For New home sales, March is usually the strongest sales month of the year. For existing homes, the Summer months are more critical.

The second graph shows the months of supply. With the months of supply now over 8 months, we should expect falling prices nationwide.

However, the NAR reports that YoY prices were up slightly in June.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory declined from the record in May to a 4.196 million units in June.

The third graph shows nationwide inventory for existing homes. According to NAR, inventory declined from the record in May to a 4.196 million units in June.Total housing inventory fell 4.2 percent at the end of June to 4.20 million existing homes available for sale, which represents an 8.8-month supply at the current sales pace, the same as a downwardly revised 8.8-month supply in MayOther sources have reported that inventory levels have increased, and I expect inventories to continue to rise through the summer. More on existing home sales later today.

Alt-A Update: CDR Goes Mainstream

by Anonymous on 7/25/2007 09:05:00 AM

I would have posted this yesterday, but I got caught up in reading the actual Citi report on which it is based (and that's 58 pages of hard-core Nerdalytics). I am going to try to have something more to say about this today. Until then, Bloomberg:

July 24 (Bloomberg) -- Defaults on some so-called Alt A mortgages packaged into bonds last year are now outpacing those from subprime loans, according to Citigroup Inc.

The three-month constant default rate for 2006 Alt A hybrid adjustable-rate mortgages is 2.3 percent, compared with 2.2 percent for subprime ARMs, New York-based Citigroup analysts led by Rahul Parulekar wrote in a July 20 report. The figures represent the percentage of balances in a mortgage-bond pool expected to default in the next year based on 90-day trends.

The speed at which Alt A hybrid ARMs are being paid off due to home sales or refinancing has also fallen to about the same level as for subprime ARMs, which typically prepay more slowly, the analysts said. Slower prepayments can make the same rates of defaults more damaging by leaving more of the initial balances outstanding to eat into bond-investor protections.

The combination of challenges mean 2006 bonds backed by Alt A mortgages, a credit grade above subprime loans, may need ``lower loss severities to still come out with lower cumulative losses than subprimes,'' the Citigroup analysts wrote.

Life Is Like A Box of Subprime Loans

by Anonymous on 7/25/2007 08:01:00 AM

Some of you may have noticed that LEND took quite a beating yesterday. Apparently there is some question of the viability of the Lone Star deal:

On June 29, Jean Wan filed an amended stockholder class action lawsuit against Accredited, Lone Star and several executives and directors involved in the deal.Stupid is as stupid does.

Wan claimed Accredited would be better off remaining independent because many of the company's subprime mortgage rivals had already gone bankrupt. Once the market recovers, Accredited could thrive as one of the few remaining subprime specialists and shareholders shouldn't miss out on this opportunity, the suit argued.

The complaint is being called the "Forrest Gump" suit because it compares Accredited's situation with that of the two main characters in the 1994 film.

Forrest and Lieutenant Dan buy a shrimp boat and start the Bubba Gump shrimp company. But they struggle early on because there are so many other boats catching all the shrimp. Then a hurricane hits, destroying many boats and leaving Bubba Gump owning the last shrimp boat in the area. From then on, Forrest and Dan become rich, the suit explained.

Accredited, like Forrest and Dan, was able to weather the subprime mortgage storm that destroyed rivals like New Century Financial.

"Effectively, Accredited is now the 'Bubba Gump' of the subprime lending market," the suit said. "Currently, Accredited stands in the enviable position of being able to grab up the market share left by New Century and the other subprime lenders that have declared bankruptcy or left the market."

"This position will allow the holders of Accredited's equity to reap the lion's share of profits available in the subprime lending market," the complaint added. "The Individual Defendants, however, wish to keep these profits for themselves and freeze out Accredited's current shareholders."

Chrysler's Bankers: Long Walk, Short Pier?

by Calculated Risk on 7/25/2007 01:50:00 AM

From the WSJ: Chrysler's Bankers May Take On Debt

Chrysler's attempt to tap debt markets for $20 billion hit a critical juncture as bankers began discussing the likelihood that they will have to step up with a large part of the money because investor demand hasn't been strong enough.

...

The struggle to raise money from investors was the latest sign of how inhospitable debt markets have become recently. ... Chrysler's bankers -- including J.P. Morgan Chase & Co., Goldman Sachs Group Inc., Citigroup Inc., Bear Stearns Cos. and Morgan Stanley ... were yesterday discussing plans to take a half or more of a $10 billion piece of the Chrysler auto loan, people familiar with the matter said.

The debt to be held by the banks would bear the first losses if Chrysler has problems repaying. ... The $8 billion loan sale for Chrysler Financial, meanwhile, is still on track to be completed this week, though the company has had to increase the amount of interest it would pay on the debt.

It also needs to raise $42 billion, much of it to compensate Daimler for existing Chrysler debt it still holds. That sale isn't expected to be as difficult, because much of it will be backed by healthy Chrysler auto loans.

Tuesday, July 24, 2007

Fed's Plosser: No Signs Of Subprime Woes Spreading

by Calculated Risk on 7/24/2007 07:41:00 PM

From the WSJ: Fed Official Sees No Signs Of Subprime Woes Spreading

A Fed policy maker said rising delinquencies on prime mortgages would be one reason to worry that problems in subprime mortgages are affecting the broader economy, but there's no sign of that yet.I guess Plosser will be "more nervous" tonight when he reads the CFC press release and the summary of their conference call.

"If I started to see some of the spillovers occur in some of the prime mortgages, I'd get more nervous," Federal Reserve Bank of Philadelphia president Charles Plosser said in an interview with The Wall Street Journal Tuesday. Worrisome signals, he said, would be "things like serious, substantial falls in consumer spending, or employment really begin to tail off" or signs that the negative impact on consumer wealth of falling housing prices is "showing up in consumption in one form or another, or employment. And we don't see that much."

Housing: Demand Shifts

by Calculated Risk on 7/24/2007 05:03:00 PM

Later this week I'll post an update on my 2007 housing forecast. I've been waiting for the foreclosure data for Q2, and the existing and new home sales data for June, scheduled to be released tomorrow and Thursday respectively.

On Friday I pulled out the old Supply and Demand drawings to compare the housing market to an efficient market. In this post I'd like to discuss two recent shifts in demand for housing, and how I expect them to unwind.

First, here are the new and existing home sales, since 1969, normalized by the number of owner occupied units (OOU). Click on graph for larger image.

Click on graph for larger image.

For the recent housing boom (in sales, not price), I marked three periods on the graph. There may be some disagreement on the dates and the causes of the boom for each period, but a simply explanation is:

Period 1: This was mostly due to fundamentals of real wage growth, employment growth and demographics.

Period 2: This was primarily due to an interest rate shock (lower rates) that moved renters to home ownership.

Period 3: This was primarily due to speculation, especially home buyers using excessive leverage for speculation.

NOTE: The following models of demand shifts assume an efficient market and no shifts in supply.

Period 2: Interest Rate Shock This diagram depicts how I'd expect an interest rate shock to impact housing demand. After interest rates decrease sharply, there would be a temporary increase in demand - perhaps for a couple of years - as renters migrate to home ownership.

This diagram depicts how I'd expect an interest rate shock to impact housing demand. After interest rates decrease sharply, there would be a temporary increase in demand - perhaps for a couple of years - as renters migrate to home ownership.

According to the Census Bureau, the number of American households renting decreased by 1.4 million from 2001 to early 2004. These households probably migrated to home ownership because the "rent or buy" decision favored buying due to lower interest rates.

This increase in demand was temporary, and according to the Census Bureau, the migration from renting to buying ended by early 2004. Looking at a Supply and Demand diagram, the interest rate shock temporarily shifted demand from D0 to D1.

Looking at a Supply and Demand diagram, the interest rate shock temporarily shifted demand from D0 to D1.

This moved the quantity demanded from Q0 to Q1, and the price from P0 to P1.

When the demand shifts back (above model of temporary demand shift), the quantity demanded falls back to Q0 - but housing suffers from sticky prices, so price only declines slowly to P0.

However, we can look at the graph of actual sales (first graph), and we can see that sales didn't decline in 2004 and 2005; instead sales increased.

Period 3: Excessive Leverage as Speculation Speculation frequently chases appreciation, and the earlier price increases, based at least somewhat on fundamentals and an interest rate shock, probably spurred many buyers to only considered their monthly costs when buying a home (during period 3). Many of these buyers used excessive leverage, speculating that the price would continue to increase into the future.

Speculation frequently chases appreciation, and the earlier price increases, based at least somewhat on fundamentals and an interest rate shock, probably spurred many buyers to only considered their monthly costs when buying a home (during period 3). Many of these buyers used excessive leverage, speculating that the price would continue to increase into the future.

This type of leveraged activity pulls demand from future periods as shown in this diagram. The rampant speculation (with innovative mortgage products) pushed demand from D1 to D2, with associated increases in price and the quantity demanded. However, when the speculation ends, demand will eventually fall back to D3; below the level of demand (D1) when the speculation started.

These models are just a guide, and are intended for efficient markets. But this suggests to me that sales, especially of existing homes, will eventually decline to below the levels of 1998 to 2001.

Flippers and Supply Shifts

Some people may be thinking about the impact of investors (or flippers) on the demand curve. Note: This type of speculation was probably only rampant in the coastal regions. Instead of viewing investor activity as a demand shift, it might be better way to view this type of speculation is as storage - or a supply shift; when the investor buys, they remove the asset from the supply. This means that investor speculation shifted the supply curve (not shown) to the left during the period of speculative activity. When the speculator sells, the supply curve shifts to the right, as the stored units come back on the market. So the news is bad for housing: not only is the demand curve shifting left, but the supply curve is shifting right (especially in some coastal regions).

Credit: template for diagram was from Wikipedia.

PIMCO's Gross: Enough is Enough

by Calculated Risk on 7/24/2007 01:15:00 PM

From Bill Gross at PIMCO: Enough is Enough

Over the past few weeks much ... has changed. The mistrust of rating service ratings, the constipation of the new issue market and the liquidity to hedge the obvious in CDX markets has led to current high yield CDX spreads of 400 basis points or more and bank loan spreads of nearly 300. The market in the U.S. seems to be looking towards this week’s large and significant placing/pricing of the Chrysler Finance and Chrysler auto deals to determine what the new level for debt should be. In the U.K., a similarly large deal for BOOTS promises to be the bell cow for European buyers. But the tide appears to be going out for levered equity financiers and in for the passive owl money managers of the debt market. And because it has been a Nova Scotia tide, rising in increments of ten in a matter of hours, it promises to have severe ramifications for those caught in its wake. No longer will double-digit LBO returns be supported by cheap financing and shameless covenants. No longer therefore will stocks be supported so effortlessly by the double-barreled impact of LBOs and company buybacks. The U.S. economy in turn will not benefit from this tidal shift and increasing cost of financing. The Fed tightens credit by raising short-term rates but rarely, if ever, have they raised yields by 150 basis points in a month and a half’s time as has occurred in the high yield market. Those that assert that this is merely an isolated subprime crisis should observe very closely the price and terms that lenders are willing to accept with Chrysler finance this week. That more than anything else may wake them, shake them, and tell them that their world has suddenly changed.The Chrysler deal will be interesting, and Chrysler finance is probably the best part of the deal (and most easily financed). Back in '89, the failure of the UAL LBO marked the peak of the LBO cycle, however that deal was very different from today since UAL was contingent on obtaining debt financing (if I remember correctly). Now very few deals have contingencies, and we are seeing more and more bridge loans become "pier loans" that end up on the investment banks' balance sheets. See Citi May Be Stuck With Bridge Loans and JPMorgan Marks Down "Hung" Bridge Loan. This probably means the consequences of a failed major deal could be much uglier than in '89.

emphasis added

Record Foreclosures in California

by Calculated Risk on 7/24/2007 11:34:00 AM

From Mathew Padilla at the O.C. Register reporting on DataQuick numbers:

There were 17,408 foreclosures in the Golden State in the second quarter — that’s the highest quarterly total since DataQuick began tracking them in 1988. It surpassed the previous high point of 15,418 foreclosures in the third quarter of 1996.DataQuick reported 46,670 Notice of Defaults (NODs) in Q1.

...

Notices of default, the first stage of foreclosure, totaled 53,943 in the second quarter, the highest since late 1996.

Click on graph for larger image.

Click on graph for larger image.This graph shows the NODs filed in California since 1988. For 2007, the number is estimated at twice the NODs for the first half of 2007. This estimate is probably low, since the housing market appears to be deteriorating rapidly in California.

UPDATE: Here is the DataQuick press release: California Foreclosure Activity Continues to Rise

CFC Reports A Little Prime Problem

by Anonymous on 7/24/2007 08:28:00 AM

This ought to calm the markets:

Management anticipates that the second half of 2007 will be increasingly challenging for the industry and Countrywide. Absent a reduction in mortgage interest rates, production volumes are expected to fall and competitive pricing pressures are expected to increase. In addition, volatility in the secondary markets has increased significantly early in the third quarter and liquidity for mortgage securities has been reduced as a result. These conditions are expected to adversely impact secondary market execution and further pressure gain on sale margins. Furthermore, additional deterioration in the housing market may further impact credit costs.Guidance hereby reduced to $2.70 to $3.30/diluted EPS from April's $3.50 to $4.30.

Management has taken, and is continuing to take, a number of actions in response to changing market conditions. These include tightening of credit guidelines, particularly related to subprime and prime home equity loans; further curtailment of subprime product offerings, including the recent elimination of certain adjustable-rate products; risk-based pricing adjustments; use of mortgage insurance for credit enhancement; and expense reduction initiatives. . . .

Credit-related costs in the second quarter included:

-- Impairment on credit-sensitive retained interests. Impairment charges of $417 million were taken during the quarter on the Company's investments in credit-sensitive retained interests. This included $388 million, or approximately $0.40 in earnings per diluted share based on a normalized tax rate, of impairment on residual securities collateralized by prime home equity loans. The impairment charges on these residuals were attributable to accelerated increases in delinquency levels and increases in the estimates of future defaults and loss severities on the underlying loans.

-- Held-for-investment (HFI) portfolio. The provision for losses on HFI loans incurred in the second quarter was $293 million, driven primarily by a loan loss provision of $181 million on prime home equity HFI loans in the Banking segment.

I could be snarky about this, but since it's the first thing I've read today that didn't blame the rating agencies for all the problems, I'm giving extra credit.

It Takes One To Know One

by Anonymous on 7/24/2007 08:11:00 AM

Continuing today's utter childishness:

Headline: "Basis Hires Blackstone to Limit Losses on Hedge Funds"

Funny Money Quote:

``The fallout from subprime is likely to impact most asset classes and investment strategies over the next couple of years because the ratings agencies completely goofed up,'' said Peter Douglas, the principal and founder of Singapore-based hedge fund research firm GFIA Pte. ``Basis Capital is viewed as a bellwether.''Maybe Blackstone will help out by explaining what "basis risk" is.

Wall Street Heads For the Diaper Aisle

by Anonymous on 7/24/2007 07:35:00 AM

CR has been drawing our attention to what happens when "bridge loans" become "pier loans." There's another kind of what is supposed to be temporary financing on the Street known as "warehouse" lending. Mortgage bankers use warehouse lines of credit to fund loans as they are originated, carrying them in the warehouse until they can be sold to a whole-loan investor or securitized. What happens if the bottom falls out of the whole-loan or security market and nothing moves out of the warehouse? Long walk. Short pier.

CDO issuers also use warehouse funding to buy tranches of ABS and other securities to create the CDOs with. There are many different kinds of warehousing agreements, but I will note that one kind is known as a "gestational" facility. A better term might be "day care" facility, since the idea, like the bridge loan, is that somebody's going to show up at 5:30 and take the grubby little ankle-biters off your hands.

That's all in aid of extracting the utmost enjoyment out of the following, from Bloomberg, which I must say carries a headline we could only have dreamed of last year, "KKR, Homeowners Face Funding Drain as CDO Machine Shuts Down":

July 24 (Bloomberg) -- The Wall Street money-machine known as collateralized debt obligations is grinding to a halt, imperiling $8.6 billion in annual underwriting fees and reducing credit for everyone from buyout king Henry Kravis to homeowners."We don't want to get too far along." Uh huh. Today you're a little bit pregnant, tomorrow you're loading up the cart with Pampers.

Sales of the securities -- used to pool bonds, loans and their derivatives into new debt -- dwindled to $3.7 billion in the U.S. this month from $42 billion in June, analysts at New York-based JPMorgan Chase & Co. said yesterday. The market is ``virtually shut,'' the bank said in a July 13 report. . . .

``We're walking on thin ice,'' said Alexander Baskov, a fund manager who helps oversee $25 billion of high-yield debt for Pictet Asset Management SA in Geneva. ``People are trying to find value and the right price and right now nobody knows what it is. Pretty much everyone is in the dark.'' [Insert Patsy Cline chorus here] . . .

The shakeout is leading firms from Maxim Capital Management in New York to Paris-based Axa Investment Managers to delay or scrap planned CDO sales.

Maxim began buying mortgage bonds for a new CDO after completing its second deal in March. Chief Investment Officer Doug Jones in New York said he slowed the purchases, having acquired only a third of the assets planned, partly because the bank underwriting the deal grew concerned it could lose money as volatility increased. He declined to name the underwriter.

``We don't want to get too far along and create something that's not sellable,'' said Jones, who manages $4 billion of CDOs.

Banks are becoming more skittish about providing credit lines, called warehouse financing, managers use to buy assets that go into CDOs in the months before the securities are issued, said James Finkel, chief executive officer of Dynamic Credit Partners. The New York-based company manages $7 billion in 10 CDOs and a hedge fund.

``There are just very few, if any, bankers opening new warehouses,'' said Finkel.