by Anonymous on 6/05/2007 03:44:00 PM

Tuesday, June 05, 2007

Builders Forgive Illegal Second Liens

From the Charlotte Observer:

Three Charlotte-area builders will forgive almost $2 million in mortgage loans they made as part of a scheme to sell homes that the buyers couldn't afford, state regulators announced Monday.

These were unusual mortgage loans, according to a complaint filed by regulators. They were set up without the knowledge of the borrowers. The amounts were small. And there was no attempt to collect monthly payments.

But in the strange world of mortgage lending, these loans ranging from $24,000 to $37,000 allowed the recipients to qualify for larger loans from other companies. With that money, they paid for homes.

The settlement with Dixie Homes LLC of Gastonia and MCE Properties Inc. and Evans-Davis Inc. of Kings Mountain resolves allegations that the companies violated state mortgage and consumer protection laws.

Dixie and its owners, Brian Bragg, Donna Bragg and Mark Penegar, will pay a civil penalty of $7,000, and MCE will pay a penalty of $18,000, according to the office of N.C. Attorney General Roy Cooper.

All three builders also will cooperate in the state's investigation of the company that arranged the large and small loans, Hall Financial Services of Matthews. . . .

Hall's customers mostly lacked the savings for a down payment, and could not qualify to borrow 100 percent of the sales price.

On paper, the builders made mortgage loans to the buyers that covered 20 percent of the sales price. Hall then arranged a loan for 80 percent of the sales price from a mortgage company, generally New Century Financial Corp. These 80 percent loans were easier to get because lenders are comfortable that the home can be sold to cover the loan.

But borrowers were generally unaware of the 20 percent loans until closing. Some were originally quoted a lower price, but at closing were given papers listing a price 20 percent higher, and offering a second loan.

The builder loans typically required interest payments each month, with the full amount due after three years. The loan also had to be paid if a buyer tried to sell the home or refinance the larger loan. Most buyers, lacking the savings for a down payment, had no hope of paying the loan when it came due.

Wonder if this will come up when NAHB defends subprime lending on Capitol Hill tomorrow . . .

ISM Services Index Rises

by Calculated Risk on 6/05/2007 01:48:00 PM

From Rex Nutting at MarketWatch: Services growing at best pace in a year

The nonmanufacturing side of the U.S. economy grew at the best pace in a year in May, the Institute for Supply Management reported Tuesday.This follows an improvement in manufacturing: Factories see higher orders, production and prices

The ISM nonmanufacturing index rose to 59.7% from 56% in April. It's the highest since April 2006.

More U.S. manufacturers were expanding their businesses in May than at any time in the past year, the Institute of Supply Management reported Friday.These reports probably mean Q2 will look much better than Q1.

The ISM index rose to 55% from 54.7% in April. It's the highest since April 2006.

Homebuilder: "sudden and dramatic" decline in business

by Calculated Risk on 6/05/2007 11:56:00 AM

From the AP: Ga. home builder files for Chapter 11 (hat tip Dave)

Georgia builder Meyer-Sutton Homes Inc. filed for protection from creditors Monday in the U.S. Bankruptcy Court in Newnan, the result of a "sudden and dramatic" decline in business.

...

"The housing market has suffered a dramatic decline in demand, with the result problems of excess inventory and compressed profit margins," Buchanan said in court papers.

According to its bankruptcy filing, the company has cut new construction starts to two per month from 25 per month.

Bernanke: The Housing Market and Subprime Lending

by Calculated Risk on 6/05/2007 10:42:00 AM

Chairman Bernanke spoke today: The Housing Market and Subprime Lending. This is basically the same speech Bernanke gave back in November 2006. Back then, Bernanke said:

"Over the next year or so, the economy appears likely to expand at a moderate rate, close to or modestly below the economy's long-run sustainable pace."Now Bernanke says:

On average, over coming quarters, we expect the economy to advance at a moderate pace, close to or slightly below the economy’s trend rate of expansion.Same thing. But the differences are interesting. Back in November, Bernanke talked about "stabilization" in the housing market. And as recently as April, the Fed's Mishkin saw "minimal" spillover from housing:

"... spillovers to other segments of the mortgage market or to financial markets in general appear to have been minimal."Now Bernanke talks about further weakness in housing and no "major spillovers".

"... the adjustment in the housing sector is still ongoing, and the slowdown in residential construction now appears likely to remain a drag on economic growth for somewhat longer than previously expected.I do have a problem with Bernanke's "fundamentals":

... we have not seen major spillovers from housing onto other sectors of the economy."

"... fundamental factors--including solid growth in incomes and relatively low mortgage rates--should ultimately support the demand for housing."In the short term, the key fundamentals for housing are supply and demand. Income growth is important for the long term. Perhaps Bernanke should read my recent post: Housing Update, June 2007. The outlook for housing is dismal.

And finally, I wish Bernanke would stop talking like a NAR economist when he talks about interest rates. In the near future I'll discuss interest rates and the impact on housing.

Homebuilder X: By Any Means Necessary

by Anonymous on 6/05/2007 08:21:00 AM

From Forbes, "Homebuilders Hit the Hill":

Washington, D.C. - On Wednesday, 1,300 home builders will call on Capitol Hill as part of a legislative conference organized by their trade group, the National Association of Home Builders. They'll do so against a grim industry backdrop.

"For the first summer in many summers, we're not helping to keep unemployment numbers down," says Jerry M. Howard, 51, the NAHB's chief executive. "For the first time in six years, we are a drag on the economy rather than a plus." . . .

"Our strategy is to remind policymakers of our importance in economic and societal terms," he says, "and to convince them to take no action that would exacerbate this downturn in the housing industry."

One area of potential exacerbation: immigration. The NAHB has come out strongly against the proposed immigration overhaul now being considered by the U.S. Senate, particularly its portions cracking down on employers that hire illegal workers, directly or through subcontractors. . . .

Naturally, maintaining government support for home finance is also an area of interest. Another talking point the NAHB reps will take with them to Capitol Hill Wednesday is to defend subprime lending . . . "If we only lent to people with prime credit ratings," counters Howard, "the homeownership rate in this country would be incredibly low."

I see. If we have to have illegal employment practices and predatory lending in order to achieve the American Dream, well, then, dream on . . .

Monday, June 04, 2007

Fitch Report on Loan Modifications

by Anonymous on 6/04/2007 06:22:00 PM

Fitch Ratings has a new Special Report out today, "Changing Loss Mitigation Strategies for U.S. RMBS." (You will have to register if you want to see the full document.) See below for the text of the press release.

My reading of the document is that Fitch's servicing analysts are, like the servicers themselves, not exactly thrilled to be dealing with what could be construed as mistakes that were made somewhat earlier in the process:

The volume of defaulted loans in subprime portfolios has exceeded the expected levels for this product, and with the number of adjustable-rate mortgage (ARM) loans still moving into the reset phase, this number will increase unless an aggressive stance to work out these cases is adopted. This report does not delve specifically into the reasons for these increased defaults, except as they affect the timing and/or opportunities available to the servicer to develop workable solutions.

Quite honestly, if I were Fitch, I wouldn't want to "delve specifically into" that either. As I am not Fitch, I wonder how long they'll be allowed to get away with that. If a rating agency is supposed to do anything, it is supposed to be good at predicting "expected defaults." That these subprime pools have fallen apart so far, so fast, is a problem the servicers have inherited. That some of these servicers have fallen apart so far, so fast, is a problem the bondholders are inheriting in bankruptcy court. One needs to read this report with that context in mind.

Each of the items discussed below have a direct impact on the servicer’s cost to service by requiring additional staff or technology expenditures, increased costs of vendor services, carrying cost of advances, and development and performance of initiatives outside the normal expected scope of activities for a residential servicer. The servicers of subprime loans closely monitor and manage their cost to service and have indicated that, for the most part, they expect the current servicing fees in transactions to cover their increased costs. However, Fitch believes this is an area of concern for certain servicers who either do not have a diversified portfolio or who are not continuing to take in new production, which would improve the ratio of performing to nonperforming loans. This concern could also arise upon the need to transfer a subprime portfolio that contained high default levels, as the number of servicers willing to take on this servicing at current fee structure levels could be limited.

If that doesn't mean "Look, bondholders, you'll either approve some modifications or your servicer will fold beneath you and any substitute servicer will be able to name its price because you need them waaay more than they need you," well, then Tanta's never read a ransom note.

Servicers have also noted that they believe there will be longer foreclosure timelines on the horizon due to the increased volume of filings and repeat actions required after multiple efforts with borrowers. In addition, increased foreclosures are causing delays with county recorders, broker price opinion (BPO) providers, property inspection and preservation vendors and REO networks. Some servicers have indicated that vendors and, particularly, attorney networks may be adversely affected by increased foreclosures, property preservation and inspection orders, and REO listings, noting that vendors must also increase their ranks with experienced staff. In addition, local jurisdictions and courts are becoming backlogged and overloaded with foreclosure cases, which have negatively affected foreclosure timelines and translated into higher costs to carry.

Most Fitch-rated servicers have strict timeline adherence policies and clearly delineated options. However, ultimately, servicers have agreed that current measurements for foreclosure and REO liquidation timeline management will need to be closely monitored and reset as the market reacts to the pressure of quickly changing volumes.

The worse it gets, the worse it gets. I honestly don't know how Fitch expects us to read the two paragraphs above. Are there those for whom this is news? Are they, um, investors in Fitch-rated securities?

Let us be clear. Foreclosure waves create additional losses just by being foreclosure waves. You can try to rush for the exits all you want; it takes too long to get out of this door if there are too many people in line. This has always been true. I read things like the above and wonder whether Fitch's loss models ever considered that when declining home values (a key element in the loss severity calculation) get to a certain point, the foreclosure volume gets to a point such that the operational risk explodes, which drives those loss severities even deeper. The beginning of that paragraph, "servicers have also noted that they believe," quite honestly makes me wonder whether this is news to Fitch.

This report raises the question of the authority given servicers under the RMBS documents, including the limitations of REMIC law and FASB 140 accounting rules. Curiously, it doesn't actually really answer those questions. It simply states:

For the purpose of this report, Fitch is taking the view that modifications within RMBS transactions are permitted and, as such, the focus is more on the processes and controls around the strategy than offering an opinion on the legality of the strategy itself. As stated, Fitch expects each servicer, with the counsel of their legal staff and accountants, to make an independent assessment and determination of the use and type of loss mitigation strategies allowed within their portfolio. However, based on projections from servicers, Fitch believes that over the next 12–18 months, modifications could be used on as many as 5%–10% of the loans, based on the original outstanding balance of the deal, and could be the only viable loss mitigation strategy for as much as 40%–50% of the loans in default or determined to be a reasonably foreseeable default scenario.

Uh, the original outstanding balance of all subprime securitizations in just 2006 was in the neighborhood of $450 billion. $45 billion in mulligans in the second year of the whole thing?

Oh well, at least this time nobody's pretending we have any real idea whether all these do-overs are going to work:

There is no adequate historical data on which to base projections of the redefault rate for loans that have been modified or the effect these will ultimately have on the losses within the RMBS pools. Therefore, it is very important that servicers accept and endorse the request for this information from the various parties. The industry is being asked to accept the belief that the servicers can and will adequately manage and affect procedures that will impact not only the lives of the homeowners but also the return on investments for many investors.

I can hear it now. We bondholders are being asked to just take the servicer's word for it? Whose word did you take for it when you bought this stuff?

To summarize: Fitch does not know how bad this could get. Fitch does not know if all of these servicers can afford it to get bad as it could get. Fitch does not know how legal all these loss-mit options are. Fitch does not know if these loss-mit options will work. Fitch knows that its servicers believe that there are no other good choices. Fitch is working on getting some better trustee reports for y'all. You will be kept posted, otherwise: just watch for the downgrades and step-down failures.

Fitch: New U.S. RMBS Criteria Reflects Greater Use of Loan Modifications

by Calculated Risk on 6/04/2007 03:45:00 PM

04 Jun 2007 12:46 PM (EDT)Emphasis Added.

Fitch Ratings-New York-04 June 2007: Increased use of loan modifications as a loss mitigation tool may cause larger numbers of poorly performing subprime loans to be reported as performing well. This could allow for early overcollateralization (OC) release in securitizations, according to Fitch Ratings, which has amended its rating criteria for U.S. subprime RMBS/HEL ABS to better reflect this trend in its rating opinions. The changes will be effective for transactions closing in August 2007.

As U.S. home price growth has slowed and begun to fall, mortgage delinquency rates, particularly subprime mortgage delinquencies, have risen. The concomitant rise in mortgage foreclosures has resulted in a focus by policy makers, regulators, community groups and mortgage/securitization industry participants on ways to assist homeowners in avoiding foreclosure. One approach that is gaining increasing favor is loan modification, which means changing the terms of the mortgage in order to make the payments more affordable to the borrower. Successful loan modifications can preserve homeownership and reduce loss to securitizations. However, when loan terms are changed, common servicing industry practice is to report borrowers payment performance under the new terms, so that the high risk of such loans is not apparent. This has implications for securitization structures that are addressed in Fitch's revised criteria.

Fitch's new rating criteria will reflect the risk of early OC release followed by high levels of borrower re-default, where such risk is deemed to be substantial. Analysis of various loss timing and cash flow scenarios will be incorporated into Fitch's rating opinions. Fitch's criteria will also consider any structural features within a securitization that may reduce the risk of OC release as a function of modification practices.

Fitch has long been of the opinion that loan modifications are an important part of a mortgage servicer's loss mitigation strategy for limiting loss on defaulted mortgages. Successful loan modification programs can benefit investors in RMBS through maximizing cash flow and reducing loss. Fitch has discussed the challenges facing servicers in its report 'U.S. RMBS Servicer Workshop' May 18, 2007. Today Fitch has also released a new report analyzing loan modifications and other loss mitigation tools ('U.S. RMBS Loss Mitigation Strategies').

While Fitch recognizes the value of loan modification programs, the extensive levels of modifications that some servicers are contemplating, and that others have already initiated, presents new challenges in analyzing the credit risk of securitizations. Varying practices with respect to capturing and reporting data on loan modifications can make it difficult to track the quantity and characteristics of modified loans. Moreover, the performance of mortgages post-modification may vary widely and the timing and amount of re-default and loss is uncertain.

Loan modifications and subsequent loan performance is also of concern when considering the effectiveness of trigger events designed to prevent OC step-down. These trigger events are based on performance tests which compare delinquency rates to available credit enhancement. In a trigger event, the securitization fails the performance test and enhancement is not released as it would be if the test was passed. While there has been much discussion of the effectiveness of the standard trigger language in use today, extensive use of modifications, coupled with the reporting of modified loans as contractually current, presents a new situation. It is quite conceivable that securitizations with high levels of mortgage defaults will not fail delinquency trigger tests, thus allowing OC to step down. Fitch believes that recognition of this risk requires a change in rating criteria for subprime RMBS/HEL ABS.

Fitch announces the following change to its criteria: When analyzing new securitizations, if a trigger event's performance test definition effectively counts modified loans as part of the '60+ day' delinquency calculation, Fitch will continue to assume for modeling purposes that trigger events will be in effect in its rating stress scenarios. Effective inclusion of modified loans in performance tests could be achieved through reporting mortgage delinquency status on an original contractual basis, or adding new terms to trigger definitions. For example, recent transactions from one issuer have featured the following amendment to the definition of 60+ day delinquency: 'each Mortgage Loan modified within 12 months of the related Distribution Date'. Fitch sees this amended definition as having two benefits: First, it addresses the risk described above by including modified loans in the trigger definition. Second, by limiting the inclusion to a 12-month period, transactions containing performing modified loans are not unduly penalized under the performance test.

When analyzing proposed securitizations that allow for extensive modification without reporting original contractual delinquency status, Fitch will consider the likelihood of OC stepping down, potentially followed by subsequent high defaults. In some instances Fitch's credit ratings may be lower on securitization classes which Fitch views as having heightened risk of substantial loss relative to post step-down credit enhancement. Analysis of various loss timing and cash flow scenarios will be incorporated into Fitch's rating opinions. Fitch's approach will be further elaborated in an update to the U.S. RMBS cash flow modeling criteria, currently described in the report 'U.S. RMBS Cash Flow Modeling Criteria: Updated' February 6, 2007. Fitch's updated criteria will be effective for deals closing in August 2007. The August effective date allows for sufficient time for Fitch to describe its revised methodology in detail and consider any market commentary.

Fitch's rating opinions on new securitizations will reflect the potential impact of the extensive use of loan modifications. However, Fitch recognizes that many existing securitizations may release OC despite high levels of mortgage default, if large numbers of modified loans are reported as current. This may in turn result in downgrades, depending on analysis of available credit enhancement and forecasted levels of re-default. However it must be stressed that more severe rating actions could result if modifications were not made. Outstanding transactions that allow for original contractual delinquency reporting may exhibit greater rating stability reflecting trigger events and higher subordination levels, particularly if data on the amount of cash flow being generated by modified loans is provided. Additionally, while changes to the documents of existing deals is difficult, servicers may find that they have some discretion under the documents as to when and if to report a modified borrower as current, thus achieving similar results as that for new deals outlined above. Fitch will be in on-going discussions with servicers to determine what reporting practices are being put in place alongside modification programs.

Appraiser: Housing Prices to Fall 25% to 50%

by Calculated Risk on 6/04/2007 01:58:00 PM

From the Modesto Bee: Realty Red Flags (hat tip Brian)

“This year, we’re going to see prices drop in every market across the country for the first time since the Great Depression,” said Steven Smith, a property appraiser and consultant from San Bernardino.This seems like an excessive price decline to me. I think prices might fall 20% in some bubble areas, in nominal terms, over several years. In real terms (adjusted for inflation), prices might fall 30% to 40% in some areas - but not "throughout the country".

Smith predicted that home values throughout the country will fall 25 percent to 50 percent below what they were at their peak, which was in 2005 or 2006, depending on the region.

LoanPerformance: Delinquency Rates Keep Rising

by Calculated Risk on 6/04/2007 10:25:00 AM

Mathew Padilla at the OC Register reports delinquency numbers from LoanPerformance: Delinquencies keep rising for subprime and Alt-A loans

In March, subprime loan delinquencies rose to 14.83%. Alt-A, the catch-all category above subprime, increased to 3.05%.Of course, remember these numbers do not include foreclosures. According to the MBA:

... our latest subprime numbers are 14.4% delinquent by at least one payment, plus another 4.5% in foreclosure, for a total of 18.9% either delinquent or in foreclosure. For just subprime ARMs that number is 21.1%...And it is probably going to get much worse, from Bloomberg:

"The 2006 vintage is the weakest in terms of underwriting standards," [Sheila Bair, chairman of the Federal Deposit Insurance Corp.] said. "We are expecting 2008 and early 2009 to be somewhat nasty." Next year the delinquency rate on such loans may hit 30 percent, she said.

The New Piggybacking: Lipstick on a FICO

by Anonymous on 6/04/2007 09:38:00 AM

Yes, well, read the whole thing if you want the important information. I'm here to lose myself in those minor details that provide verisimilitude:

Only a low credit score stood between Alipio Estruch and a mortgage to buy a $449,000 Spanish-style house in Weston, Fla., a few miles west of Fort Lauderdale.

Instead of spending several years repairing his credit rating, which he said was marred by two forgotten cell phone bills and identity theft, the 37-year-old real estate agent paid $1,800 to an Internet-based company to bump up his score almost overnight.

"Two forgotten cell phone bills and identity theft." Let us imagine the person ahead of us in line at the CVS busted for trying to pass a forged prescription for Oxycontin: "Well, I had a couple of hang nails a few months ago, plus I was beaten savagely by a gang of street thugs." It makes perfect sense that this person couldn't get a real doctor to help.

Now, you know I do have real sympathy for victims of identity theft. The very first thing I expect them to do is depend on the kindness of strangers.

The pitch to those who are essentially renting their credit history for pay is seductive: You don't need to worry about users of this service receiving duplicate copies of your credit cards, account numbers or any of your personal information. It's essentially free money, they are told.

Brian Kinney, 44, a retired Army officer in Glendale, Calif., pulls in more than $2,500 a month by lending out 19 credit card spots on two old Citibank cards with strong payment histories. Kinney, whose FICO score is above 800 on the scale of 300 to 850, quit his job working at a Farmers Insurance agency and uses the ICB income to tide him over until he starts his own insurance agency. . . .

Kinney, the retired Army officer in California, said those borrowing his good credit history don't get his personal information, full credit card number or credit card expiration dates. Any sensitive data is handled through ICB, and Kinney adds the users himself by calling his credit card company. ICB also destroys any duplicate cards that are issued to the credit renter, according to its contract.

Instead of being worried about risks he may be assuming, Kinney said borrowers are the ones vulnerable to scammers posing as do-gooders. Those seeking a credit hike give the cardholder their names and Social Security numbers, which, in the wrong hands, could lead to identity theft. Kinney said he also receives credit card offers in the mail for the credit borrowers on his accounts, opening up another possibility for fraud, but he throws them away.

"I know the whole thing sounds kind of odd and not very legitimate, but it is for now," Kinney said. "I don't know how long before someone will decide it's illegal. But I'm not counting on this for the long-term."

You cannot but admire Mr. Kinney's approach to advertising for his soon-to-be launched insurance agency. Don't ask me what kinds of policies Mr. Kinney intends to write; I limit myself to mortgage fraud.

You cannot also but admire Mr. Estruch, who helpfully provides the name of his mortgage lender to the reporter. I have made many representations and warranties over the years; I have never personally had one falsified in an AP story picked up by the New York Times, nor have I discovered this falsification while sitting in my bathrobe drinking coffee on a rainy Sunday morning at home. What, do you wonder, is American Home Mortgage going to do now? Hope whoever bought that loan doesn't read the papers?

There are people who tell me that I should lighten up on brokers and lenders, you know, because really anyone can get taken advantage of by unscrupulous borrowers. Am I the only one who wondered just how carefully concealed this sort of fraudulent behavior might have been at the time the loan was made, given an environment in which the happy participants, Mr. Estruch and Mr. Kinney, are so cheerfully willing to spill the beans to an AP reporter? Is there a plainer sight in which one might hide? Mortgage lenders, do you have that odd sensation that you are being laughed at behind your back? If so, you really ought to seek psychiatric assistance. No one is waiting until your back is turned.

Sunday, June 03, 2007

Housing Update, June 2007

by Calculated Risk on 6/03/2007 07:32:00 PM

Here are a few simple facts:

• Housing inventories are at record levels, in both absolute terms, and as a percent of owner occupied units.

• Households are already dedicating a record percentage of their income to mortgage obligations.

• Banks are tightening mortgage-lending standards.

So what will happen to the housing market? For normal markets, these facts - excess supply, falling demand - would foreshadow falling prices. But, for housing, prices are sticky because sellers tend to want a price close to recent sales in their neighborhood, and buyers, sensing prices are declining, will wait for even lower prices.

But sticky doesn't mean stuck. Prices are now falling by most measures, and will probably continue to fall. However, in a typical housing bust, prices tend to fall slowly over several years - so buyers wait, and transaction volumes also decline.

Writing in the NY Times, Floyd Norris does an excellent job of discussing the dynamics of a housing bust: The Long Life Span of a Housing Downturn (See article for more graphics).

If the current bust follows the '89 pattern, prices will decline in the index cities for another 3 years. However, the recent boom was far greater than the late '80s boom, and this bust might also be worse. Some of the hardest hit markets following the '89 bust were Los Angeles and Hartford; prices declined in both markets for more than 6 years, and the total price declines were 21% and 15% respectively in nominal terms.

One thing that was very different at the 1989 peak from the one in 2006 was the trend in the number of homes being offered for sale. When prices peaked in 1989, the number of homes for sale was already declining, and it continued to fall for some months, perhaps reflecting decisions by homeowners to hold on and wait for prices to come back.

Click on graph for larger image.

Click on graph for larger image.This graph shows sales and inventory normalized by the number of owner occupied units. As Norris noted, inventory was flat or falling in '89, but inventory is increasing rapidly and is at an all time high.

Note: all data is year-end except 2007. For 2007, the April sales rate and inventory are used. For owner occupied units, Q1 2007 data from the Census Bureau housing survey was used for April 2007.

NOTE: In the article, Norris mentions that inventories are at record levels, but his numbers are incorrect. He wrote:

... the latest report shows that more than 4.1 million homes were for sale at the end of April, the largest number ever. That included almost 3.6 million existing homes, also a record high.Actually the total is 4.7 million with 4.2 million existing homes for sale. From the NAR:

Total housing inventory rose 10.4 percent at the end of April to 4.20 million existing homes available for sale ...Another stark difference between '89 and today is that transaction volumes are still near record highs as a percent of owner occupied units. In '89, sales had already fallen below the normal turnover level - meaning sales probably wouldn't fall much more. In the near future, it is very likely that the turnover rate for existing homes will fall back to more normal levels, putting even more pressure on prices.

In '91, the months of supply peaked at 8.1 months (end of '91, some months were higher), and currently the months of supply is already at 8.4 months. If turnover falls back to normal levels, there might be a full year or more of supply on the market.

On to the homebuilders:

Existing homes are a competing product for new homes, so for the homebuilders, all this inventory spells P-A-I-N. There is a substantial amount of excess inventory on the market - my estimate was 1.1 to 1.4 million units - Gary Shilling's estimate was over 2 million units.

So far the homebuilders have only cut starts back to about 1.5 million units (Seasonally Adjusted Annual Rate, SAAR).

So far the homebuilders have only cut starts back to about 1.5 million units (Seasonally Adjusted Annual Rate, SAAR).Back in January, Fannie Mae chief economist David Berson wrote:

We have argued for some time that the surge in housing demand in recent years ... was unsustainable. Understandably, builders responded to this pickup in overall housing demand by significantly increasing house construction. As a result, too many housing units were built in recent years relative to the underlying pace of housing demand-- bringing unsold inventories up to record highs. But how large is this overhang relative to long-term housing demand?Berson calculated the overhang at 600K (this appears to be far too low based on Census Bureau vacancy rates). Berson used 1.8 Million units per year as a steady state demand; I used 1.7 million units. This number is important, because if the builders are still starting 1.5 million units per year, and the overhang is say 1 million units (just an example, probably too low), then it will take 5 years to work off the excess inventory.

To work off the excess inventory in just a couple of years, housing starts need to fall much further - perhaps to about 1.1 million SAAR. However the builders find themselves with serious cash flow problems. They have too much land (remember the ludicrous "land bank" comments from a couple of years ago?), but they can't sell the land. Hovanian just noted:

[Land sales have] "just really slowed to a complete trickle with very few buyers of any type out there"So the builders have to build spec houses, and then discount the prices to get any money for their land. This keeps the inventory levels high and prolongs the housing slump.

In conclusion, the outlook for housing remains dismal.

Economics: The Stories We Tell Ourselves

by Anonymous on 6/03/2007 06:04:00 AM

Being a former Lit Major with an occupational interest in Economics, I was fascinated by this interview with Robert Frank, Professor of Economics at Cornell and a co-author of our Ben Bernanke's. Professor Frank is a fan of throttling back on all those graphs and equations in the teaching of introductory economics, in favor of a bit of storytelling:

The narrative theory of learning now tells us that information gets into the brain a lot more easily in some forms than others. You can get information into the student’s brain in the form of equations and graphs, yes, but it’s a lot of work to do that. If you can wrap the same ideas around stories, around narratives, they seem to slide into the brain without any effort at all. After all, we evolved as storytellers; that’s what we’re good at. That’s how we always exchanged ideas and information. And if a narrative has an actor, a plot, if it makes sense, then the brain stores it quite easily; you can pull it up for further processing without any effort; you can repeat the story to others. Those seem to be the steps that really make for active learning in the brain. [Emphasis added]

One gathers that the good professor has never read The Sound and the Fury. Or any given day's edition of the New York Times or the Washington Post or the Podunk Startlegram, wherein easily-grasped storylines--Evil Bank Forecloses On Piteous Family, Stupid Borrower Fails to Read Fine Print, Young Family Achieves Wealth Through Homeownership, Sinister Accountants Re-enact Enron Saga--do have a tendency to substitute for those graphs and equations, but not everyone is convinced we're the wiser for it. In fact, it seems as if Dr. Frank is entirely innocent of the role narratives play in ideology and propaganda, something the Lit crowd has been aware of for some time and that surely one of Dr. Frank's colleagues at Cornell's English Department might have warned him about.

I am not trying to make the tedious point about anecdotes and data, nor am I suggesting that Frank makes that mistake. I'm wondering how anyone as sophisticated as Frank can miss the distinction between plot and point of view, which, forgive me, is covered in Lit 101 as often as "opportunity cost" is covered in Econ 101. Here's an example of Frank's "economic naturalist" theory of storytelling in action:

So, for example, Bill Tjoa, one of my students in 1997, asked, Why do the keypads in the drive-up ATM machines have Braille dots on them? It’s a good question. Drivers obviously can see; why do they need Braille dots on the drive-up cash machines? Mr. Tjoa made use of the cost-benefit principle. That’s probably the simplest and most important of all of the ideas we try to stress in the course. It says that if the benefit exceeds the cost, then it’s a good idea. What he argued was that you’re going to make the machines with Braille dots on the keypads anyway for the walk-up machines, so you’ve got to incur the expense of designing and manufacturing the keypads with the Braille dots. Once you’ve done that, it’s just cheaper to make all of the machines the same way, rather than keep two separate inventories and make sure that the right machines go out to the right destinations. So: Cost lower, benefit the same, it doesn’t inconvenience drivers any to use the machines with the Braille dots, so it would be foolish to do it any other way. So the real question isn’t why should there be Braille dots on the keypads — why shouldn’t there be? There’s no reason not to put them there.

Now, I have worked for banks, so I've gotten that question a lot over the years. It never arises, at least in my experience, as the sort of thoughtful, normal-human-mind-struggles-with-economic-concepts question like "Why couldn't we just print more money? What is money, anyway?" No, it comes out in a rather different tone, more the "gotcha" thing, not a question that is hard to answer but a rhetorical question that is designed to answer itself: "boy are those banks dumb" being the approximate burden of wisdom of the exercise.

I confess it has always floored me. "Well," I say, looking as kindly and thoughtful as I can manage, "you are assuming that no one uses the drive-up lanes except drivers." Well, yeah, har, har, who else uses the drive-up lane, hikers? "Well," I say, "there are passengers, you see." Silence. "And we always counsel our blind customers not to give their PIN to the cabbie." Silence. "Of course, we could force them to make the cab wait--meter running--while they walk in to use the teller window, but it seems so unfair to do that when you can put Braille plates on the ATMs and the cannister console." Silence.

But I am not an economist, and so it never occurred to me to accept the hidden assumption that the drive-up is only for drivers. Of course it's hard to argue with Frank's assertion that "there's no reason not to put them there." So it's an extremely inexpensive way of allowing the drive-up to be useful to blind passengers in a car, apparently, because per Frank the purpose was merely to save costs on machine production while not inconveniencing drivers.

The thing is that it does seem to "inconvenience" them. It just bugs people that those Braille dots are there. It bugs them so much that the question finally got the attention of an economist, who immediately understood the question in the way that drives me nuts about economists, they never having read The Sound and the Fury, and hence never showing a lot of willingness to imagine that there is an alternative point of view that can wreak havoc with our comfortable storylines if we are willing to let it. Not everyone is behind the wheel. Sometimes it is worth the effort to challenge the stories everyone repeats. It appears that in certain contexts this is a revolutionary thought. Oh, my.

We Lit types may very well be soft-hearted and fanciful, but you Econ types are still dismal.

Saturday, June 02, 2007

Saturday Rock Blogging: In Your Pension, Your Peaceful Pension . . .

by Anonymous on 6/02/2007 12:47:00 PM

Might as well laugh . . .

Reelin' In the Suckers

by Anonymous on 6/02/2007 10:26:00 AM

In case you missed it in the comments, there were many discussions of this (excellent) Bloomberg piece yesterday, "Banks Sell 'Toxic Waste' CDOs to Calpers, Texas Teachers Fund." Please read the whole thing if you have not done so already. Some highlights:

June 1 (Bloomberg) -- Bear Stearns Cos., the fifth-largest U.S. securities firm, is hawking the riskiest portions of collateralized debt obligations to public pension funds.

At a sales presentation of the bank's CDOs to 50 public pension fund managers in a Las Vegas hotel ballroom, Jean Fleischhacker, Bear Stearns senior managing director, tells fund managers they can get a 20 percent annual return from the bottom level of a CDO. . . .

The California Public Employees' Retirement System, the nation's largest public pension fund, has invested $140 million in such unrated CDO portions, according to data Calpers provided in response to a public records request. Citigroup Inc., the largest U.S. bank, sold the tranches to Calpers.

``I have trouble understanding public pension funds' delving into equity tranches, unless they know something the market doesn't know,'' says Edward Altman, director of the Fixed Income and Credit Markets program at New York University's Salomon Center for the Study of Financial Institutions.

``That's obviously a very risky play,'' he says. ``If there's a meltdown, which I expect, it will hit those tranches first.''

Calpers spokesman Clark McKinley declined to comment. . . .

Chriss Street, treasurer of Orange County, California, the fifth-most-populous county in the U.S., says no public fund should invest in equity tranches. He says fund managers are ignoring their fiduciary responsibilities by placing even 1 percent of pension assets into the riskiest portion of a CDO.

``It's grossly inappropriate to take this level of risk,'' he says. ``Fund managers wanted the high yield, so Wall Street sold it to them. The beauty of Wall Street is they put lipstick on a pig.'' . . .

The General Retirement System of Detroit holds three equity tranches it bought for $38.8 million. The Teachers Retirement System of Texas owns $62.8 million of them. The Missouri State Employees' Retirement System owns a $25 million equity tranche.

Ronald Zajac, spokesman for the Detroit pension fund, declined to comment on the fund's equity tranche investments.

Kay Chippeaux, fixed-income portfolio manager of the New Mexico council, says it decided to buy equity tranches after listening to pitches from Merrill Lynch & Co., Wachovia Corp. and Bear Stearns.

``We got very interested in them just because a broker brought them to our attention,'' Chippeaux, 50, says. She says the investment is worth the risk because the fund may be able to get higher returns than it can from bonds. The council has purchased equity tranches from Bear Stearns, Citigroup, Merrill Lynch and Morgan Stanley.

The council is relying on advice from bankers who are selling the CDOs, Chippeaux says. ``We manage risk through who we invest with,'' she says. ``I don't have a lot of control over individual pieces of the subprime.'' . . .

Pension fund managers face the same hurdle as all CDO investors: The market has almost no transparency, with both current prices and contents of CDOs almost impossible to find, says Frank Partnoy, a former debt trader who's now a law professor at the University of San Diego.

The murky nature of the CDO market presents danger for the unwary investor, and it's particularly unsuitable for public pension money, Partnoy says.

``I think `smoke and mirrors' in some sense understates the problem,'' he says. ``You can see through smoke. You can see something reflected in a mirror. But when you look at the CDO market, you really can't see enough information to enable you to make a rational investment decision.''

That hasn't stopped pension funds from taking high risks with the retirement plans of teachers, firefighters and police. [boldface added, only because I don't have an html tag for flashing red lights]

Your pension fund managers are buying "high yield" bonds that put you in first loss position on a bunch of junk bonds, and they are doing so on the risk-management "advice" of the people who are making a commission from selling those bonds.

Look, CDOs are complicated, and one of these days I'll manage to do a long UberNerd post on them. Here's the short version, with a nice picture (vandalized by Tanta) courtesy of Pershing Capital Management:

You take a bunch of subprime loans, and make a pool with them. Then you tranche that pool up and create a security (this chart calls it ABS or asset-backed security; it's the same thing as MBS or REMIC for present purposes). Then you take those low-rated subordinate tranches and put them into a pool with a bunch of other stuff (commercial security tranches, corporate debt, junk bonds, heaven knows what), and then you tranche that up into a new thing called a Collateralized Debt Obligation, the "beauty" of which is that it's an actively traded, not static pool, so that while you might know what's in it the day you bought part of it, you may never know what's in it after that. Then you take the lowest possible tranche of the CDO--the "equity" portion or the very first part to take any losses, which is so high-risk it is referred to as "toxic waste," the stuff that is unrated by the rating agencies because it has no "credit support" whatsoever--and you put it in a pension plan managed by some goofball who thinks that it must be a good deal because a party who owns some of the higher rated tranches--the ones you "support" with your equity piece--tells you that if the planets align and the Messiah returns and everybody rolls a lucky seven, you'll make 20%!

I'm still not sure everyone is getting the picture here, so let's try this: the subordinate tranche of a subprime ABS/MBS is a "pig." With or without lipstick. The equity tranche of a CDO made up of subordinate tranches of a subprime ABS/MBS, mixed up with some other junk you do not understand, is a pig of a pig, distilled essence of pig, ur-pig, Total Ultimate X-Treme Mega Pig. Buying a B tranche of a subprime ABS is playing with matches. Buying the equity tranche of a CDO is playing with a blowtorch in the parking lot of the Exxon station while wearing a St. Lucia wreath on your head.

There is, you know, a reason they call these "equity" tranches. "Equity" in this context means "skin in the game." In what we might laughingly refer to as a "normal market," the party who issues the security keeps the "equity" piece, giving it some "skin in the game" and thus some incentive to make sure that underlying pool isn't total stinking piles of sewage. In what we no-longer-laughingly call the market we're in, the investment banks are "selling" their "skin" to your pension fund. Unless that IB has zero interest whatsoever in the rest of the CDO, they just pulled one on you. And the only party who could tell you who owns what--and could "appraise" the thing for you--is the IB, who will make a fee from selling it to you regardless.

Have I mentioned that there is such a thing as a "CDO Squared"? I bet you can guess what that is. Do I know whether there are pension funds buying pieces of a CDO2? No. Do you?

Teachers, firefighters, and police officers: you are not just the sucker at the table here. You are the sucker at the table of the suckers in the big casino of suckers. Your "managers" of your pension money just took the "opportunity" to assume the risk that Wall Street does not want to keep because it doesn't think a "20% return" is worth it.

Go. Call. Your. Benefit. Manager. Now.

Friday, June 01, 2007

WSJ: CRE Lenders, Investors may be Turning Cautious

by Calculated Risk on 6/01/2007 09:56:00 PM

From the WSJ: Skyscraper Prices Might Start Returning to Earth

... lenders have become worried that prices have gotten so high that buyers wouldn't be able to raise rents high enough to pay off their loans. In response, the interest rates that buyers have to pay have risen, and banks have demanded that buyers put up bigger portions of the purchase price.The following sounds familiar ...

At the root of the buying frenzy was a change in the way investors viewed real estate. In the past, buying a building was like buying a bond -- you were purchasing a stream of income for years to come. ... More recently, investors started treating buildings like stocks, betting that they could sell them later at significantly higher prices. Loans were being underwritten based on predictions of future cash flow.

"It used to be people bought for the current rents, and the upside was a surprise," said Cedric Philipp Jr., managing director of Commercial Mortgage-Backed Securities Structured Finance Group for Moody's Investors Service. "Now, they are banking on the upside."

Whatever

by Anonymous on 6/01/2007 04:53:00 PM

Via Reuters:

NEW YORK, May 31 (Reuters) - JPMorgan Chase & Co. is downplaying its role in subprime lending even as spectacular flameouts in that sector have turned the Wall Street bank into one of the biggest originators of risky mortgages.The King Is Dead. Long Live the King!.

"We don't do much in the subprime business -- at all," JPMorgan Chief Executive Jamie Dimon told investors earlier this month at the company's annual meeting. "It will be a good business, by the way."

In other banking news, via the Boston Globe:

ASHLAND -- In a scene reminiscent of the Cartoon Network bomb scare that paralyzed the Boston area in January, police shut down a strip mall yesterday in this small western suburb after employees at a Bank of America branch mistook a botched fax for a bomb threat.

Frustrated shop owners said the branch overreacted to the strange fax, which turned out to be an in-house marketing document sent by the bank's corporate office.

Frankly, that's the first I've ever heard of anyone actually reading a fax from corporate marketing. Guess it wasn't such a hot idea.

And via the Associated Press:

ATLANTA - On an episode of A&E's popular reality series "Flip This House," Atlanta businessman Sam Leccima sits in front of a run-down house and calls buying and selling real estate his passion.

Now authorities and legal filings claim that Leccima's true passion was a series of scams that included faking the home renovations shown on the cable TV show and claiming to have sold houses he never owned.

You mean this whole flippin' thing was just some kind of made-up teevee ripoff? I wonder if the bondholders are going to sue A&E . . .

Happy Friday afternoon, all.

Many Builders Building Spec Homes to Liquidate Land

by Calculated Risk on 6/01/2007 02:42:00 PM

According to Hovanian (via Briefing.com hat tip Brian)

[Land sales have] "just really slowed to a complete trickle with very few buyers of any type out there"So homebuilders are building spec homes to liquidate land:

"that's part of the reason why you do see many home builders resorting to selling spec homes because there's really a way of liquidating the land portfolio."Can't sell it? Build on it. With too much inventory already on the market, I wonder how this will work out for the homebuilders ...

Wal-Mart Cuts Capital Spending

by Calculated Risk on 6/01/2007 11:27:00 AM

A press release from Wal-Mart states that Wal-Mart plans to build "190 and 200 new U.S. supercenters during this fiscal year". This is a significant reduction from the announced plans just six months ago:

In October 2006, the Company had announced that its fiscal year 2008 growth plans included between 265 and 270 supercenters in the United States.This will result in approximately a 10% reduction in capital spending for Wal-Mart:

[The] strategy is expected to reduce capital expenditures for fiscal year 2008 to approximately $15.5 billion, down from the previously projected $17 billion ...This reduction in spending by Wal-Mart is a sign that the commercial real estate boom might be ending. And, as I keep pointing out, continued strong non-residential investment is one of the keys for keeping the U.S. economy out of recession.

May Employment Report

by Calculated Risk on 6/01/2007 09:10:00 AM

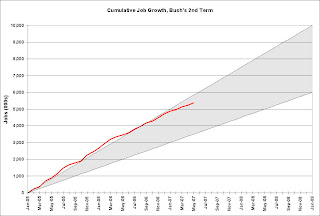

The BLS reports: U.S. nonfarm payrolls rose by 157,000 in May, after a downward revised 80,000 gain in April. The unemployment rate was steady at 4.5% in May.  Click on graph for larger image.

Click on graph for larger image.

Here is the cumulative nonfarm job growth for Bush's 2nd term. The gray area represents the expected job growth (from 6 million to 10 million jobs over the four year term). Job growth has been solid for the last 2 1/4 years and is near the top of the expected range.

The following two graphs are the areas I've been watching closely: residential construction and retail employment.

Residential construction employment decreased by 1,300 jobs in May, and including downward revisions to previous months, is down 137.9 thousand, or about 4.0%, from the peak in March 2006. This is probably just the beginning of the loss of hundreds of thousands of residential construction jobs over the next year or so.

Note the scale doesn't start from zero: this is to better show the change in employment.

Retail employment lost 4,900 jobs in May. As the graph shows, retail employment has turned positive in recent months. YoY retail employment has also turned positive.

The expected reported job losses in residential construction employment still haven't happened, and any spillover to retail isn't apparent yet. With housing starts off over 30%, it's a puzzle why residential construction employment is only off about 4%. It is possible this puzzle has been solved (see: Residential Construction Employment Conundrum Solved?), but we will not know until the yearly revisions are announced.

Subprime Update: We Built This City on Rock and Roll

by Anonymous on 6/01/2007 09:05:00 AM

This is important data to contemplate, since credible claims have been made that a lot of new home purchase volume over the period in question was running on the fumes of the most marginal borrowers--stated income high-CLTV subprimes--and that any cutback in that kind of lending spells disaster for the home builders. And we have seen some "voluntary" tightening of this exact kind of subprime credit; we have also just heard the OCC hinting loudly at a regulatory "involuntary" tightening here.

So take some white-out to all the red and yellow parts of the bars on this chart, and then do the math. Ick.

Note: "Verbal verification" means "oral" (phone) verification of employment, but not of income. (You call up Calculated Risk and ask, "Does Tanta really work for you? OK, thanks.") It is, in other words, what you all think of as "stated income." The "none" category includes loans that do not even state income. They probably don't even "state" employment; if the borrower does fill out the box on the application for "employer," no one verifies that on the "none" loans. So on the "verbal" loans you know the borrower is employed but you don't know how much they actually make; on the "none" loans you don't know nuthin' 'bout nuthin'.