by Calculated Risk on 6/18/2025 07:00:00 AM

Wednesday, June 18, 2025

MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 13, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 4 percent compared with the previous week. The Refinance Index decreased 2 percent from the previous week and was 25 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 14 percent higher than the same week one year ago.

“Mortgage rates decreased last week, driven by financial market volatility caused by current geopolitical conflict and ongoing tariff uncertainties. The 30-year fixed rate decreased to 6.84 percent, its lowest level since April,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Even with lower average mortgage rates, applications declined over the week as ongoing economic uncertainty weighed on potential homebuyers’ purchase decisions.”

Added Kan, “Refinance activity declined for both conventional and government borrowers. VA applications, however, bucked the trend with a 2 percent increase in purchase applications and a slight increase in refinance applications. Additionally, the overall average loan size at $380,200, was the lowest since January 2025.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.84 percent from 6.93 percent, with points increasing to 0.66 from 0.64 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 14% year-over-year unadjusted.

Tuesday, June 17, 2025

Wednesday: Housing Starts, Unemployment Claims, FOMC Statement

by Calculated Risk on 6/17/2025 07:56:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for initial claims of 250 thousand, up from 248 thousand last week.

• Also at 8:30 AM ET, Housing Starts for May. The consensus is for 1.370 million SAAR, up from 1.361 million SAAR in April.

• During the day, The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Statement. The FOMC is expected to leave the Fed Funds rate unchanged at this meeting.

• Also at 2:00 PM, FOMC Projections This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

LA Ports: Traffic Down Sharply in May

by Calculated Risk on 6/17/2025 05:31:00 PM

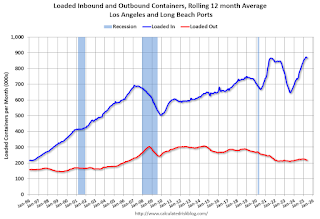

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Click on graph for larger image.

Click on graph for larger image.Usually imports peak in the July to October period as retailers import goods for the Christmas holiday and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

To remove the strong seasonal component for inbound traffic, the second graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 0.8% in May compared to the rolling 12 months ending the previous month. Outbound traffic decreased 0.9% compared to the rolling 12 months ending the previous month.

On a rolling 12-month basis, inbound traffic decreased 0.8% in May compared to the rolling 12 months ending the previous month. Outbound traffic decreased 0.9% compared to the rolling 12 months ending the previous month.Housing Market Index and Single Family Starts

by Calculated Risk on 6/17/2025 12:18:00 PM

Today, in the Calculated Risk Real Estate Newsletter: Housing Market Index and Single Family Starts

A brief excerpt:

This morning, the National Association of Home Builders (NAHB) released their monthly housing market index: Builder Sentiment at Third Lowest Reading Since 2012There is much more in the article.

...

There are several negatives for new home builders now. The NAHB lists the following: rising inventory levels (this is true for both new homes and existing homes that compete with new homes), price declines for existing home sales in a “growing number of markets”, buyer hesitancy due to “elevated mortgage rates and tariff and economic uncertainty”.

In addition, margins are being squeezed by rising costs (both material and labor), and price cuts. This will be a difficult period for homebuilders.

The following graph shows the NAHB HMI and single family starts since 1985.

NAHB: "Builder Sentiment at Third Lowest Reading Since 2012" in June

by Calculated Risk on 6/17/2025 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 32, down from 34 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Sentiment at Third Lowest Reading Since 2012

In a further sign of declining builder sentiment, the use of price incentives increased sharply in June as the housing market continues to soften.

Builder confidence in the market for newly built single-family homes was 32 in June, down two points from May, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. The index has only posted a lower reading twice since 2012 – in December 2022 when it hit 31 and in April 2020 at the start of the pandemic when it plunged more than 40 points to 30.

“Buyers are increasingly moving to the sidelines due to elevated mortgage rates and tariff and economic uncertainty,” said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, N.C. “To help address affordability concerns and bring hesitant buyers off the fence, a growing number of builders are moving to cut prices.”

Indeed, the latest HMI survey also revealed that 37% of builders reported cutting prices in June, the highest percentage since NAHB began tracking this figure on a monthly basis in 2022. This compares with 34% of builders who reported cutting prices in May and 29% in April. Meanwhile, the average price reduction was 5% in June, the same as it’s been every month since last November. The use of sales incentives was 62% in June, up one percentage point from May.

“Rising inventory levels and prospective home buyers who are on hold waiting for affordability conditions to improve are resulting in weakening price growth in most markets and generating price declines for resales in a growing number of markets,” said NAHB Chief Economist Robert Dietz. “Given current market conditions, NAHB is forecasting a decline in single-family starts for 2025.”

...

All three of the major HMI indices posted losses in June. The HMI index gauging current sales conditions fell two points in June to a level of 35, the component measuring sales expectations in the next six months dropped two points lower to 40 while the gauge charting traffic of prospective buyers posted a two-point decline to 21, the lowest reading since November 2023.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell one point to 43, the Midwest moved one point higher to 41, the South dropped three points to 33 and the West declined four points to 28.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was well below the consensus forecast.

Industrial Production Decreased 0.2% in May

by Calculated Risk on 6/17/2025 09:15:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production (IP) fell 0.2 percent in May after increasing 0.1 percent in April. Manufacturing output ticked up 0.1 percent in May, driven by a gain of 4.9 percent in the index for motor vehicles and parts; the index for manufacturing excluding motor vehicles and parts fell 0.3 percent. The index for mining increased 0.1 percent, and the index for utilities decreased 2.9 percent. At 103.6 percent of its 2017 average, total IP in May was 0.6 percent above its year-earlier level. Capacity utilization moved down to 77.4 percent, a rate that is 2.2 percentage points below its long-run (1972–2024) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April 2020, and close to the level in February 2020 (pre-pandemic).

Capacity utilization at 77.4% is 2.2% below the average from 1972 to 2023. This was below consensus expectations.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased to 103.6. This is above the pre-pandemic level.

Industrial production was below consensus expectations and the previous months were revised down.

Retail Sales Decreased 0.9% in May

by Calculated Risk on 6/17/2025 08:30:00 AM

On a monthly basis, retail sales decreased 0.9% from April to May (seasonally adjusted), and sales were up 3.3 percent from May 2024.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for May 2025, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $715.4 billion, down 0.9 percent from the previous month, and up 3.3 percent rom May 2024. ... The March 2025 to April 2025 percent change was revised from up 0.1 percent to down 0.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was down 0.8% in May.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.4% on a YoY basis.

The change in sales in May were below expectations and the previous two months were revised down.

The change in sales in May were below expectations and the previous two months were revised down.Monday, June 16, 2025

Tuesday: Retail Sales, Industrial Production, Homebuilder Survey

by Calculated Risk on 6/16/2025 07:11:00 PM

While there's been no shortage of political and geopolitical headlines over the past 2 business days, there hasn't been much by way of inspiration for the bond market. Bonds (and, thus, rates) have moved nonetheless.Tuesday:

...

Tomorrow's Retail Sales data is capable of causing volatility in either direction, depending on the outcome. Then on Wednesday, we'll hear from the Fed. While they will not be cutting rates at this meeting, they will be updating their rate outlook--something that frequently gets the market's attention. [30 year fixed 6.91%]

emphasis added

• At 8:30 AM ET, Retail sales for May is scheduled to be released. The consensus is for a 0.5% decrease in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for May. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.7%.

• At 10:00 AM, The June NAHB homebuilder survey. The consensus is for a reading of 36, up from 34 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

3rd Look at Local Housing Markets in May

by Calculated Risk on 6/16/2025 10:49:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 3rd Look at Local Housing Markets in May

A brief excerpt:

The NAR is scheduled to release May existing home sales on Monday, June 23rd at 10:00 AM. Housing economist Tom Lawler expects the NAR to report sales at a seasonally adjusted annual rate (SAAR) of 4.03 million for May, up slightly from April and down slightly year-over-year.There is much more in the article.

...

In May, sales in these markets were down 4.3% YoY. Last month, in April, these same markets were down 3.4% year-over-year Not Seasonally Adjusted (NSA).

Important: There were fewer working days in May 2025 (21) as in May 2024 (22). So, the year-over-year change in the headline SA data will be higher than for the NSA data.

...

More local markets to come!

Housing June 16th Weekly Update: Inventory up 2.1% Week-over-week, Up 33.1% Year-over-year

by Calculated Risk on 6/16/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.