by Calculated Risk on 5/07/2025 07:59:00 PM

Wednesday, May 07, 2025

Thursday: Unemployment Claims

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for initial claims of 223 thousand, down from 241 thousand last week.

Leading Index for Commercial Real Estate Increased 1% in April

by Calculated Risk on 5/07/2025 04:01:00 PM

From Dodge Data Analytics: Dodge Momentum Index Increases 1% in April

The Dodge Momentum Index (DMI), issued by Dodge Construction Network, grew 0.9% in April to 205.1 (2000=100) from the downwardly revised March reading of 203.1. Over the month, commercial planning grew 3.3% while institutional planning fell 4.2%.

“Despite an uptick in April, the bulk of the DMI’s growth was driven by a surge in data center planning, while momentum in other nonresidential sectors lagged behind,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Owners and developers are navigating heightened economic and policy uncertainty, which likely bogged down much of this month’s planning activity.”

A wave of data center projects entering planning played a key role in boosting commercial growth. Without data centers, commercial planning would have receded 2.3% in April and the entire DMI would have receded 3.0%. Office and hotel planning saw a sharp retreat this month, while warehouse and retail planning modestly ticked up. On the institutional side, planning momentum waned for education, healthcare, and government buildings. This was slightly offset by an uptick in recreational projects.

...

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 205.1 in April, up from 220.9 the previous month.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a pickup in mid-2025, however, uncertainty might impact these projects.

FOMC Statement: No Change to Fed Funds Rate

by Calculated Risk on 5/07/2025 02:00:00 PM

Fed Chair Powell press conference video here or on YouTube here, starting at 2:30 PM ET.

FOMC Statement:

Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty about the economic outlook has increased further. The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Susan M. Collins; Lisa D. Cook; Austan D. Goolsbee; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Alberto G. Musalem; and Christopher J. Waller. Neel Kashkari voted as an alternate member at this meeting.

emphasis added

1st Look at Local Housing Markets in April

by Calculated Risk on 5/07/2025 11:11:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 1st Look at Local Housing Markets in April

A brief excerpt:

This is the first look at several early reporting local markets in April. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.There is much more in the article.

Closed sales in April were mostly for contracts signed in February and March when 30-year mortgage rates averaged 6.84% and 6.65%, respectively (Freddie Mac PMMS). This was a decrease from the average rate for homes that closed in March. Any negative economic impacts from policy mostly happened in April, and that will probably not impact existing home sales until the May or June reports.

...

In April, sales in these markets were down 0.9% YoY. Last month, in March, these same markets were down 1.3% year-over-year Not Seasonally Adjusted (NSA).

Note that most of these early reporting markets have shown stronger year-over-year sales than most other markets for the last several months.

Important: There were the same number of working days in April 2025 (22) as in April 2024 (22). So, the year-over-year change in the headline SA data will be close to the change in the NSA data (there are other seasonal factors).

...

Many more local markets to come!

Wholesale Used Car Prices Increased in April; Up 4.9% Year-over-year

by Calculated Risk on 5/07/2025 09:32:00 AM

From Manheim Consulting today: Wholesale Used-Vehicle Prices Increased in April

Wholesale used-vehicle prices (on a mix, mileage, and seasonally adjusted basis) were much higher in April compared to March. The Manheim Used Vehicle Value Index (MUVVI) increased to 208.2, an increase of 4.9% from a year ago and also higher than March levels by 2.7%. This is the highest reading for the index since October 2023. The seasonal adjustment dampened the rise seen in the month, as non-seasonally adjusted values increased sharply on the back of the tariff announcement in early April. The non-adjusted price in April increased by 3.3% compared to March, moving the unadjusted average price up 4.3% year over year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This index from Manheim Consulting is based on all completed sales transactions at Manheim’s U.S. auctions.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 5/07/2025 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 11.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 2, 2025.

The Market Composite Index, a measure of mortgage loan application volume, increased 11.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 12 percent compared with the previous week. The Refinance Index increased 11 percent from the previous week and was 51 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 11 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 13 percent higher than the same week one year ago.

“The economic news last week included a negative reading for first-quarter GDP growth and further signs of contraction in the manufacturing sector, mixed with a solid employment report for April. The net impact on mortgage rates was mostly downward but just back to levels from early April. The 30-year fixed rate declined to 6.84 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Conventional purchase application volume increased 13 percent and was up 9 percent from year-ago levels, a surprisingly strong move given lingering economic uncertainty. Borrowers of conventional loans tend to have larger loan sizes and more apt to be move-up buyers. Government purchase loans were also up 6 percent for the week, led by a 9 percent growth in FHA purchase applications.”

Added Fratantoni, “With rates moving lower, refinance volume increased 11 percent, led by VA refinance applications, which were up 26 percent.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.84 percent from 6.89 percent, with points increasing to 0.68 from 0.67 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

emphasis added

Click on graph for larger image.

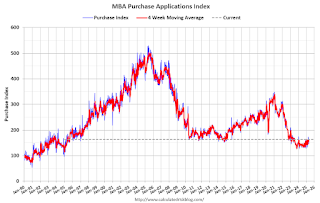

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 13% year-over-year unadjusted.

Tuesday, May 06, 2025

Wednesday: FOMC Meeting

by Calculated Risk on 5/06/2025 07:46:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM, FOMC Meeting Announcement. No change to to the Fed funds rate is expected at this meeting.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

TSA: Airline Travel Unchanged YoY

by Calculated Risk on 5/06/2025 02:01:00 PM

Anecdotally, I've heard that airlines ticket prices are falling. That suggests less travel. Also, the Real ID restrictions go in place tomorrow, and that might impact domestic airline travel.

This is also something to watch with less international travel.

This data is as of May 5, 2025.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA (Blue).

The red line is the percent of 2019 for the seven-day average. Air travel - as a percent of 2019 - is up about 4% from pre-pandemic levels.

Asking Rents Mostly Unchanged Year-over-year

by Calculated Risk on 5/06/2025 10:29:00 AM

Today, in the Real Estate Newsletter: Asking Rents Mostly Unchanged Year-over-year

Brief excerpt:

Another monthly update on rents.This is much more in the article.

Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure.

More recently, immigration policy has become a negative for rentals.

Apartment List: Asking Rent Growth -0.3% Year-over-year ...

On the supply side of the rental market, our national vacancy index ticked up to 7 percent, setting a new record high in the history of that monthly data series, which goes back to the start of 2017. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over three years amid an influx of new inventory. 2024 saw the most new apartment completions since the mid-1980s, and although we’re past the peak of new multifamily construction, this year is still expected to bring a robust level of new supply.Realtor.com: 20th Consecutive Month with Year-over-year Decline in RentsIn March 2025, the U.S. median rent recorded its 20th consecutive year-over-year decline, dropping 1.2% for 0-2 bedroom properties across the 50 largest metropolitan areas.

Trade Deficit increased to $140.5 Billion in March

by Calculated Risk on 5/06/2025 08:30:00 AM

The Census Bureau and the Bureau of Economic Analysis reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $140.5 billion in March, up $17.3 billion from $123.2 billion in February, revised.

March exports were $278.5 billion, $0.5 billion more than February exports. March imports were $419.0 billion, $17.8 billion more than February imports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Exports and imports increased in March.

Exports were up 6.7% year-over-year; imports were up 27.1% year-over-year.

Exports have generally increased recently, and imports increased sharply as importers rushed to beat tariffs.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Note that net, exports of petroleum products are positive and have been increasing.

The trade deficit with China increased to $17.9 billion from $17.2 billion a year ago.