by Calculated Risk on 8/06/2021 02:08:00 PM

Friday, August 06, 2021

AAR: July Rail Carloads down, Intermodal Down Compared to 2019

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

U.S. rail traffic in July 2021 was up over July 2020, but for most commodity categories the percentage increase was significantly lower than in other recent months, both because of more difficult comparisons and because various external factors have led to a recent deceleration in rail volumes. In July, total U.S. carloads were up 6.6% over July 2020 and down 13.3% from July 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2019, 2020 and 2021:

U.S. railroads originated 904,670 total carloads in July 2021, up 6.6% over July 2020 and down 13.3% from July 2019. The 6.6% is the smallest year-over-year gain for total carloads in four months. Total carloads averaged 226,168 per week in July 2021, which is the smallest weekly average for any month since February 2021 and the smallest weekly average for July — other than July 2020 — since our records begin in 1988.

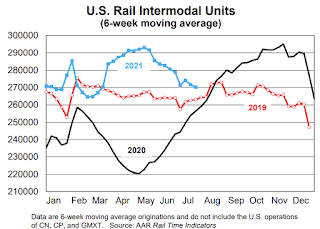

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):U.S. intermodal originations were up 1.5% in July 2021 over July 2020 but were down 1.9% from July 2019. ...

The carload categories that caused the biggest problems for U.S. rail volumes in July 2021 were motor vehicles and grain.

Homebuilder Comments in July: “The frenzy is over, but things are still strong"

by Calculated Risk on 8/06/2021 12:08:00 PM

Some twitter comments from Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting:

Analyzing July new home trends from our just published monthly builder survey. Top 3 themes: 1) Frenzy phase for housing is over, but still solid demand. 2) Fewer builders restricting sales. 3) Hitting price ceilings in more markets. Commentary from across the country to follow.

#Austin builder: “Builders are starting to offer incentives again to drive traffic and sales.”

#Dallas builder: “We have hit price ceilings in the majority of our submarkets.”

#Denver builder: “Already seeing prices flatten. Little buyer urgency in the market right now. Some is seasonal but feeling like the market is tapped out in pricing. Market is still very healthy but has lost its frenetic pace. Feels healthier and a bit more balanced.”

#SanDiego builder: “The frenzy is over, but things are still strong. However, you can feel the difference.”

#RiversideSanBernardino builder: “It doesn't feel like we're done with price appreciation. It feels more like a decline in the rate of increases. Prices have now reached a point where it is getting harder to qualify people.”

#Atlanta builder: “Major pause in the market w/on-line activity, which is 1/4 normal, w/leads way down & sales significantly down. Very little inventory to sell, mixed w/first 'seasonality' in almost 2 years. White hot frenzy from January to May of this year is clearly over."

#Charlotte builder: “No sales in June because we did not allow any and we had maximum that could be sold in July. Need to give production and design time to catch up on our backlog.”

#RaleighDurham builder: “The market can’t maintain its trajectory. If it does, local and long-term residents will be completely priced out of the market.”

#Greensboro builder: “We continue to experience delays in construction that stop our cycle build time, which limits our inventory and frustrates buyers, sellers, and trades.”

#Wilmington builder: “Just starting to put specs on the market again but trickling out based on stage of construction. Not preselling. Getting some price resistance now, but not backing off our price.”

#Nashville builder: “Starting to feel price hesitation, especially from first-time homebuyers and in outer shoulder markets.”

#Chicago builder: “We have seen a slowdown in overall activity in the last few weeks. Pace of sales is still good but not what it was, and seeing more price reductions than we have in the past.”

#Jacksonville builder: “Sales have definitely slowed down which is expected in July. The sales we are seeing are mostly from out-of-town buyers who don't have the sticker shock like the "locals" do. I do believe we've peaked as far as pricing is concerned."

#Naples builder: “We continue to have a sales moratorium in Southwest Florida. This most likely will last another 60 days before we can release any new homes. We need to spend this time to catch up on our backlog.”

#WashingtonDC builder: “There is a pronounced slowdown due to communities selling out faster than expected, limitations on sales, particularly townhomes and condominiums, and the lack of affordable first time buyer products.”

#Harrisburg builder: “Sales have decreased due to not having enough available lots ready in this market.”

#Provo builder: “Cancellations aren’t a concern - see some buyers' remorse after quick contracts. We are able to rewrite cancelled homes with another new buyer quickly.”

#Reno builder: “Sales are tapering due to reduced starts, driven in part by labor & material shortages. Seeing traffic slowing (seasonal slowdown, people traveling, taking vacations & school starts in a few weeks) which contributes to tapering sales.”

#Oakland builder: “We continue to be temporarily sold out at all of our communities and have long waiting lists.”

#Seattle builder: “Seeing a small correction as more inventory becomes available. Suspect we'll find the market & pricing remain flat with some incentives on move-in ready homes.”

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 8/06/2021 11:26:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of August 3rd.

From Andy Walden at Black Knight: 71K Decline in Forbearance Plans to Start the Month

After last week’s not unexpected increase, our McDash Flash daily mortgage performance dataset shows the number of active forbearance plans has declined by 71,000 since last Tuesday, continuing a trend of strong early month declines.

As of August 3, 1.82 million homeowners remain in COVID-19-related forbearance plans, representing 3.4% of all active mortgages, including 2.0% of GSE, 6.0% of FHA/VA and 4.2% of loans held in bank portfolio and private securitizations.

Improvement was seen across the board. FHA/VA saw the greatest reduction with a 36,000 (-4.8%) decline in active plans. The number of GSE loans in forbearance fell by 18,000 (-3.2%) from the week prior and portfolio/PLS saw a 17,000 (-3%) decline.

That puts the number of active plans down 131,000 (-6.7%) from the same time last month, a slightly slower rate of improvement than in recent weeks. It’s less a slowdown in improvement than an indication of the stronger than average declines we saw last month as the initial wave of forbearance entrants went through their 15-month review process.

Click on graph for larger image.

Indeed, the 121,000 plan exits since last Tuesday – up from just over 40,000 the prior week – made up only about half of what we saw in the first week of last month due to July’s much larger volumes of reviews.

Plan starts, including both new plans and restarts, pulled back this week, hitting their lowest weekly mark since early July. Of the plans reviewed over the past week, just under 60% were exits, with the other 40% being extended. That’s down from a 65-35 exit/extension ratio at the same time last

More than 340,000 plans are currently slated for review for extension/removal throughout August. An estimated one-third of those are set to reach their final expiration based on current allowable forbearance term lengths. Volumes of final expirations will increase significantly in September and October.

emphasis added

Comments on July Employment Report

by Calculated Risk on 8/06/2021 09:16:00 AM

The headline jobs number in the July employment report was slightly above expectations, and employment for the previous two months was revised up significantly. The participation rate increased slightly and the unemployment rate decreased sharply to 5.4%.

Earlier: July Employment Report: 943 Thousand Jobs, 5.4% Unemployment Rate

In July, the year-over-year employment change was 7.255 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In July, the number of permanent job losers decreased to 2.930 million from 3.187 million in June.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate increased in July to 81.8% from 81.7% in June, and the 25 to 54 employment population ratio increased to 77.8% from 77.2% in June.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"In July, the number of persons employed part time for economic reasons, at 4.5 million, was about unchanged. There were 4.4 million persons in this category in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in July to 4.483 million from 4.627 million in June. This is back close to pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 9.2% from 9.8% in June. This is down from the record high in April 22.9% for this measure since 1994. This measure was at 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.425 million workers who have been unemployed for more than 26 weeks and still want a job, down from 3.985 million in June.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was slightly above expectations, and the previous two months were revised up by 119,000 combined. And the headline unemployment rate decreased to 5.4%.

July Employment Report: 943 Thousand Jobs, 5.4% Unemployment Rate

by Calculated Risk on 8/06/2021 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 943,000 in July, and the unemployment rate declined by 0.5 percentage point to 5.4 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in leisure and hospitality, in local government education, and in professional and business services.

...

The change in total nonfarm payroll employment for May was revised up by 31,000, from +583,000 to +614,000, and the change for June was revised up by 88,000, from +850,000 to +938,000. With these revisions, employment in May and June combined is 119,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In July, the year-over-year change was 7.255 million jobs. This was up significantly year-over-year.

Total payrolls increased by 943 thousand in July. Private payrolls increased by 703 thousand.

Payrolls for May and June were revised up 119 thousand, combined.

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate increased to 61.7% in June, from 61.6% in June. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate increased to 61.7% in June, from 61.6% in June. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 58.4% from 58.0% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in July to 5.4% from 5.9% in June.

This was slightly above consensus expectations, and May and June were revised up by 119,000 combined.

Thursday, August 05, 2021

Friday: Employment Report

by Calculated Risk on 8/05/2021 09:00:00 PM

My July Employment Preview

Goldman July Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for July. The consensus is for 900,000 jobs added, and for the unemployment rate to decrease to 5.7%.

Goldman July Payrolls Preview

by Calculated Risk on 8/05/2021 04:21:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 1,150k in July ... Labor supply constraints eased further due to the wind-down of federal unemployment top-ups in some states and the addition of over 2 million youth job seekers in June and July. ... We estimate a 0.4pp drop in the unemployment rate to 5.5% (vs. consensus 5.7%), reflecting a strong household employment gain offset by a sizable rise in the participation rate.CR Note: The consensus is for 900 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

emphasis added

Northwest Real Estate in July: Sales up 11% YoY, Inventory down 23% YoY

by Calculated Risk on 8/05/2021 04:06:00 PM

The Northwest Multiple Listing Service reported Home buyers are finding some relief, but Northwest MLS brokers say it is temporary

Competition for homes eased slightly in July across much of Washington state, but brokers from Northwest Multiple Listing Service expect the respite to be short-lived, with inventory still tight and prices still climbing.The press release is for the Northwest MLS area. There were 10,919 closed sales in July 2021, up 11.0% from 9,840 sales in July 2020. Active inventory for the Northwest is down 22.5%.

"Although the local market is intense, buyers can find some relief because there aren't as many offers to compete with compared to earlier this year," observed J. Lennox Scott, chairman and CEO of John L. Scott Real Estate. He noted the number of listings brokers added last month outgained the number of homes going under contract by a small margin in most areas in the report.

...

At month end, there were 7,948 total listings offered for sale, down 22.5% from the year-ago total of 10,259. That was the highest level since October when inventory totaled 8,623 properties, including single family homes and condominiums.

emphasis added

In King County, sales were up 18.4% year-over-year, and active inventory was down 30.9% year-over-year.

In Seattle, sales were up 27.8% year-over-year, and inventory was down 22.7% year-over-year. This puts the months-of-supply in Seattle at just 0.93 months.

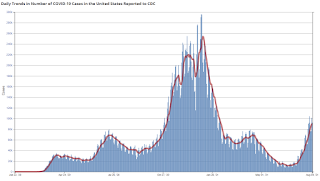

August 5th COVID-19

by Calculated Risk on 8/05/2021 03:46:00 PM

Congratulations to the residents of Maine and New Jersey on joining the 80% club! Well done. Go for 90%!!!

The 7-day average deaths is the highest since June 8th.

According to the CDC, on Vaccinations.

Total doses administered: 348,966,419, as of a week ago 344,071,595. Average doses last week: 0.70 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose✅ | 70.4% | 70.1% | 69.4% | ≥70.0%1,2 |

| Fully Vaccinated✅ (millions) | 165.6 | 165.3 | 163.9 | ≥1601 |

| New Cases per Day3🚩 | 89,976 | 89,663 | 67,273 | ≤5,0002 |

| Hospitalized3🚩 | 44,865 | 43,037 | 31,331 | ≤3,0002 |

| Deaths per Day3🚩 | 377 | 355 | 279 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Short term goal met (even if late). | ||||

KUDOS to the residents of the 20 states and D.C. that have achieved the 70% goal (percent over 18 with at least one dose): Vermont, Hawaii, Massachusetts, Connecticut, Maine and New Jersey are at 80%+, and New Mexico, Rhode Island, Pennsylvania, California, Maryland, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Oregon, Colorado and D.C. are all over 70%.

Next up are Florida at 69.9%, Utah at 68.5%, Nebraska at 68.1%, Wisconsin at 67.7%, Kansas at 67.0%, South Dakota at 66.8%, Nevada at 66.4%, and Iowa at 66.2%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

July Employment Preview

by Calculated Risk on 8/05/2021 11:45:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for 900 thousand jobs added, and for the unemployment rate to decrease to 5.7%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 6.8 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 330,000 private sector jobs, well below the consensus estimate of 675,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in July to 52.9%, up from 49.9% last month. This would suggest little change in manufacturing employment in July. ADP showed 8,000 manufacturing jobs added.

The ISM® Services employment index increased in July to 53.8%, from 49.3% last month. This would suggest about 175,000 service jobs added in April. ADP showed 318,000 service jobs added.

In general, the ISM indexes suggest employment growth below expectations.

• Unemployment Claims: The weekly claims report showed a small increase in the number of initial unemployment claims during the reference week (include the 12th of the month) from 418,000 in June to 424,000 in July. This would usually suggest about the same turnover in July as in June, although this might not be very useful right now. In general, weekly claims have been close to expectations in July.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers had been flat over the last several months.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

This data is only available back to 1994, so there is only data for three recessions. In June, the number of permanent job losers decreased to 3.187 million from 3.234 million in May. These jobs will likely be the hardest to recover.

• IMPORTANT: The employment report will probably show a large increase in state and local government education hiring. This is because of a quirk in the seasonal adjustment due to fewer educators hired this year due to the pandemic, so fewer educators will be let go in July.

• Conclusion: The data suggests a weaker than expected report in July. There are some seasonal factors that will boost the BLS report (especially related to education).