by Calculated Risk on 7/08/2021 04:32:00 PM

Thursday, July 08, 2021

July 8th COVID-19 New Cases, Vaccinations, Hospitalizations

According to the CDC, on Vaccinations.

Total doses administered: 332,345,797, as of a week ago 328,152,304. Average doses last week: 0.60 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 67.3% | 67.2% | 66.7% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 158.3 | 157.9 | 155.9 | ≥1601 |

| New Cases per Day3🚩 | 14,884 | 14,341 | 12,832 | ≤5,0002 |

| Hospitalized3🚩 | 12,419 | 11,418 | 11,948 | ≤3,0002 |

| Deaths per Day3 | 153 | 127 | 205 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing week-over-week for Cases, Hospitalized, and Deaths | ||||

KUDOS to the residents of the 20 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, Maryland, California, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Colorado, Oregon and D.C. are all over 70%.

Next up are Wisconsin at 65.8%, Nebraska at 65.6%, Florida at 65.3%, Utah at 64.8%, South Dakota at 64.5%, and Iowa at 64.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

New Hampshire Real Estate in June: Sales Up 6% YoY, Inventory Down 31% YoY

by Calculated Risk on 7/08/2021 03:46:00 PM

Note: Remember sales were weak in April and May 2020 due to the pandemic. I'm tracking data for many local markets around the U.S. I think it is especially important to watch inventory this year.

From the New Hampshire Realtors for the entire state:

Inventory in June was up 27.9% from last month.

NMHC: Rent Payment Tracker Shows Households Paying Rent Decreased Slightly YoY in Early July

by Calculated Risk on 7/08/2021 12:52:00 PM

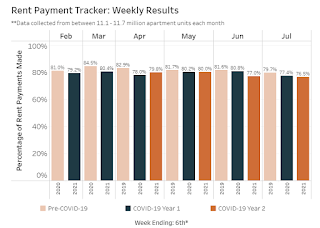

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 76.5 percent of apartment households made a full or partial rent payment by July 6 in its survey of 11.7 million units of professionally managed apartment units across the country.

This is a 0.9 percentage point decrease from the share who paid rent through July 6, 2020 and compares to 79.7 percent that had been paid by July 6, 2019. This data encompasses a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the NMHC Rent Payment Tracker shows the percent of household making full or partial rent payments by the 6th of the month compared to 2019 and to the first COVID year.

This is mostly for large, professionally managed properties.

The second graph shows full month payments through June compared to the same month the prior year.

Leading Index for Commercial Real Estate "Loses Steam In June"

by Calculated Risk on 7/08/2021 11:24:00 AM

From Dodge Data Analytics: Dodge Momentum Index Loses Steam In June

Following six months of consecutive gains, the Dodge Momentum Index fell to 165.8 (2000=100) in June, down 5% from the revised May reading of 175.1. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year.

The decline in June was the result of losses in both institutional planning, which fell 7%, and commercial planning, which lost 4%.

Uncertain demand for some building types (such as retail and hotels), higher material prices, and continued labor shortages are weighing down new project planning. Even with June’s decline, however, the Momentum Index remains near a 13-year high and well above last year. Compared to a year earlier, both commercial and institutional planning were significantly higher than in June 2020 (39% and 46% respectively). Overall, the Momentum Index was 41% higher.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 165.8 in June, down from 175.1 in May.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This index suggests a decline in Commercial Real Estate construction through most of 2021, but a pickup towards the end of the year, and growth in 2022 (even with the decline in the June index).

Weekly Initial Unemployment Claims increase to 373,000

by Calculated Risk on 7/08/2021 08:35:00 AM

The DOL reported:

In the week ending July 3, the advance figure for seasonally adjusted initial claims was 373,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 364,000 to 371,000. The 4-week moving average was 394,500, a decrease of 250 from the previous week's revised average. This is the lowest level for this average since March 14, 2020 when it was 225,500. The previous week's average was revised up by 2,000 from 392,750 to 394,750This does not include the 99,001 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 114,186 the previous week.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 392,750.

The previous week was revised up.

Regular state continued claims decreased to 3,339,000 (SA) from 3,484,000 (SA) the previous week.

Note: There are an additional 5,824,831 receiving Pandemic Unemployment Assistance (PUA) that decreased from 5,935,630 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And an additional 4,908,107 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 5,261,991.

Weekly claims were higher than the consensus forecast.

Wednesday, July 07, 2021

Northwest Real Estate in June: Sales up 31% YoY, Inventory down 34% YoY

by Calculated Risk on 7/07/2021 05:27:00 PM

The Northwest Multiple Listing Service reported Market offers hope for homebuyers, but Northwest MLS brokers say it may be temporary

Homebuyers may find some good news in the latest report from Northwest Multiple Listing Service (NWMLS). The number of active listings at the end of June, 6,358, reached the highest level since November when buyers could choose from 6,505 properties. The volume of new listings added last month was the highest number in 17 months (13,111 last month versus 14,689 at the end of November 2019).The press release is for the Northwest MLS area. There were 10,923 closed sales in June 2021, up 31.4% from 8,312 sales in June 2020. Active inventory for the Northwest is down 34.3%.

"Homebuyers will be happy to hear that between May and June the number of listings in King, Pierce, and Snohomish counties rose, giving them more homes to choose from and possibly easing the pressure just a little," remarked Matthew Gardner, chief economist at Windermere Real Estate.

For the tri-county area, total active listings of single family homes and condominiums increased 14.5% from May. System-wide, the report covering all 26 counties served by Northwest MLS shows month-to-month inventory improved 14.9%.

...

The latest report from Northwest MLS shows a year-over-year (YOY) drop in active listings of more than 34%, with only about two weeks (0.58 months) of supply available areawide. Last month marked the first time since July 2020 that the year-over-year decline fell below 40%.

...

Brokers reported 10,923 completed transactions during June, a 31.4% increase from twelve months ago, and up 16.5% from May's total of 9,374. Prices on last month's sales, which includes single family homes and condominiums, rose nearly 27% from a year ago, from $465,000 to $589,000.

emphasis added

In King County, sales were up 45.6% year-over-year, and active inventory was down 35.0% year-over-year.

In Seattle, sales were up 58.3% year-over-year, and inventory was down 14.9% year-over-year. (inventory in Seattle was extremely low before the pandemic). This puts the months-of-supply in Seattle at just 0.86 months.

FOMC Minutes: "Inflation Risks tilted to upside", Begin reducing asset purchases "somewhat earlier"

by Calculated Risk on 7/07/2021 03:53:00 PM

From the Fed: Minutes of the Federal Open Market Committee, June 15-16, 2021. A few excerpts:

In discussing the uncertainty and risks associated with the economic outlook, participants commented that the process of reopening the economy was unprecedented and likely to be uneven across sectors. Some participants judged that supply chain disruptions and labor shortages complicated the task of assessing progress toward the Committee's goals and that the speed at which these factors would dissipate was uncertain. Accordingly, participants judged that uncertainty around their economic projections was elevated. Although they generally saw the risks to the outlook for economic activity as broadly balanced, a substantial majority of participants judged that the risks to their inflation projections were tilted to the upside because of concerns that supply disruptions and labor shortages might linger for longer and might have larger or more persistent effects on prices and wages than they currently assumed. Several participants expressed concern that longer-term inflation expectations might rise to inappropriate levels if elevated inflation readings persisted. Several other participants cautioned that downside risks to inflation remained because temporary price pressures might unwind faster than currently anticipated and because the forces that held down inflation and inflation expectations during the previous economic expansion had not gone away or might reinforce the effect of the unwinding of temporary price pressures.

...

Participants discussed the Federal Reserve's asset purchases and progress toward the Committee's goals since last December when the Committee adopted its guidance for asset purchases. The Committee's standard of "substantial further progress" was generally seen as not having yet been met, though participants expected progress to continue. Various participants mentioned that they expected the conditions for beginning to reduce the pace of asset purchases to be met somewhat earlier than they had anticipated at previous meetings in light of incoming data. ...

Various participants offered their views on the Committee's agency MBS purchases. Several participants saw benefits to reducing the pace of these purchases more quickly or earlier than Treasury purchases in light of valuation pressures in housing markets. Several other participants, however, commented that reducing the pace of Treasury and MBS purchases commensurately was preferable because this approach would be well aligned with the Committee's previous communications or because purchases of Treasury securities and MBS both provide accommodation through their influence on broader financial conditions. In coming meetings, participants agreed to continue assessing the economy's progress toward the Committee's goals and to begin to discuss their plans for adjusting the path and composition of asset purchases. In addition, participants reiterated their intention to provide notice well in advance of an announcement to reduce the pace of purchases.

emphasis added

July 7th COVID-19 New Cases, Vaccinations, Hospitalizations

by Calculated Risk on 7/07/2021 03:44:00 PM

According to the CDC, on Vaccinations.

Total doses administered: 331,651,464, as of a week ago 326,521,526. Average doses last week: 0.73 million per day.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Yesterday | Week Ago | Goal | |

| Percent over 18, One Dose | 67.2% | 67.1% | 66.5% | ≥70.0%1,2 |

| Fully Vaccinated (millions) | 157.9 | 157.6 | 154.9 | ≥1601 |

| New Cases per Day3🚩 | 13,859 | 13,982 | 12,305 | ≤5,0002 |

| Hospitalized3🚩 | 12,419 | 11,418 | 11,948 | ≤3,0002 |

| Deaths per Day3 | 183 | 189 | 211 | ≤502 |

| 1 America's Short Term Goals, 2my goals to stop daily posts, 37 day average for Cases, Hospitalized, and Deaths 🚩 Increasing week-over-week for Cases, Hospitalized, and Deaths | ||||

KUDOS to the residents of the 20 states and D.C. that have already achieved the 70% goal: Vermont, Hawaii and Massachusetts are at 80%+, and Connecticut, Maine, New Jersey, Rhode Island, Pennsylvania, New Mexico, Maryland, California, Washington, New Hampshire, New York, Illinois, Virginia, Delaware, Minnesota, Colorado, Oregon and D.C. are all over 70%.

Next up are Wisconsin at 65.7%, Nebraska at 65.5%, Florida at 65.2%, Utah at 64.7%, South Dakota at 64.5%, and Iowa at 64.1%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

This data is from the CDC.

Las Vegas Real Estate in June: Sales up 53% YoY, Inventory down 46% YoY

by Calculated Risk on 7/07/2021 11:25:00 AM

Note: Sales slumped in April and May 2020 everywhere due to the pandemic, and were still low in June 2020 in Las Vegas - although sales picked up in July last year.

The Las Vegas Realtors reported Southern Nevada home prices inch closer to $400,000 mark; LVR housing statistics for June 2021

A report released Wednesday by Las Vegas REALTORS® (LVR) shows local home prices continuing to set records while sales rise and the local housing supply remains tight.1) Overall sales (single family and condos) were up 52.8% year-over-year from 2,934 in June 2020 to 4,486 in June 2021.

...

LVR reported a total of 4,486 existing local homes, condos and townhomes sold during June. Compared to one year ago, June sales were up 43.8% for homes and up 100.6% for condos and townhomes. So far this year, local home sales are on pace to exceed last year’s total.

…

By the end of June, LVR reported 2,454 single-family homes listed for sale without any sort of offer. Although down 51.7% from the same time last year, Martinez noted the number of homes listed without offers actually increased for the fourth straight month. For condos and townhomes, the 575 properties listed without offers in June were more than were listed during the previous month, though that inventory is still down 64.4% from the same time last year.

...

With eviction and foreclosure bans still in place, the number of so-called distressed sales remains near historically low levels. LVR reported that short sales and foreclosures combined accounted for just 0.7% of all existing local property sales in June. That compares to 2.2% of all sales one year ago, 2.2% of all sales two years ago, 2.6% three years ago and 6.3% four years ago. Martinez added that these percentages may increase once government moratoriums are lifted.

emphasis added

2) Active inventory (single-family and condos) is down 45.7% from a year ago, from a total of 6,695 in June 2020 to 3,029 in June 2021. And months of inventory is extremely low.

3) Active inventory is up 18.3% from the previous month (May 2021).

BLS: Job Openings "Little Changed" at 9.2 Million in May

by Calculated Risk on 7/07/2021 10:06:00 AM

From the BLS: Job Openings and Labor Turnover Summary

The number of job openings was little changed at 9.2 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Hires were little changed at 5.9 million. Total separations decreased to 5.3 million. Within separations, the quits rate decreased to 2.5 percent. The layoffs and discharges rate, while little changed over the month, hit a series low of 0.9 percent.The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are usually pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

The huge spikes in layoffs and discharges in March and April 2020 are labeled, but off the chart to better show the usual data.

Jobs openings increased in May to 9.209 million from 9.193 million in April. This is a new record high for this series.

The number of job openings (yellow) were up 69% year-over-year.

Quits were up 63% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").