by Calculated Risk on 8/23/2019 10:25:00 AM

Friday, August 23, 2019

Fed Chair Powell: "Challenges for Monetary Policy"

From Fed Chair Powell: Challenges for Monetary Policy A few excerpts:

Through the FOMC's setting of the federal funds rate target range and our communications about the likely path forward for policy and the economy, we seek to influence broader financial conditions to promote maximum employment and price stability. In forming judgments about the appropriate stance of policy, the Committee digests a broad range of data and other information to assess the current state of the economy, the most likely outlook for the future, and meaningful risks to that outlook. Because the most important effects of monetary policy are felt with uncertain lags of a year or more, the Committee must attempt to look through what may be passing developments and focus on things that seem likely to affect the outlook over time or that pose a material risk of doing so. Risk management enters our decision making because of both the uncertainty about the effects of recent developments and the uncertainty we face regarding structural aspects of the economy, including the natural rate of unemployment and the neutral rate of interest. It will at times be appropriate for us to tilt policy one way or the other because of prominent risks. Finally, we have a responsibility to explain what we are doing and why we are doing it so the American people and their elected representatives in Congress can provide oversight and hold us accountable.

We have much experience in addressing typical macroeconomic developments under this framework. But fitting trade policy uncertainty into this framework is a new challenge. Setting trade policy is the business of Congress and the Administration, not that of the Fed. Our assignment is to use monetary policy to foster our statutory goals. In principle, anything that affects the outlook for employment and inflation could also affect the appropriate stance of monetary policy, and that could include uncertainty about trade policy. There are, however, no recent precedents to guide any policy response to the current situation. Moreover, while monetary policy is a powerful tool that works to support consumer spending, business investment, and public confidence, it cannot provide a settled rulebook for international trade. We can, however, try to look through what may be passing events, focus on how trade developments are affecting the outlook, and adjust policy to promote our objectives.

This approach is illustrated by the way incoming data have shaped the likely path of policy this year. The outlook for the U.S. economy since the start of the year has continued to be a favorable one. Business investment and manufacturing have weakened, but solid job growth and rising wages have been driving robust consumption and supporting moderate growth overall.

As the year has progressed, we have been monitoring three factors that are weighing on this favorable outlook: slowing global growth, trade policy uncertainty, and muted inflation. The global growth outlook has been deteriorating since the middle of last year. Trade policy uncertainty seems to be playing a role in the global slowdown and in weak manufacturing and capital spending in the United States. Inflation fell below our objective at the start of the year. It appears to be moving back up closer to our symmetric 2 percent objective, but there are concerns about a more prolonged shortfall.

Committee participants have generally reacted to these developments and the risks they pose by shifting down their projections of the appropriate federal funds rate path. Along with July's rate cut, the shifts in the anticipated path of policy have eased financial conditions and help explain why the outlook for inflation and employment remains largely favorable.

Turning to the current context, we are carefully watching developments as we assess their implications for the U.S. outlook and the path of monetary policy. The three weeks since our July FOMC meeting have been eventful, beginning with the announcement of new tariffs on imports from China. We have seen further evidence of a global slowdown, notably in Germany and China. Geopolitical events have been much in the news, including the growing possibility of a hard Brexit, rising tensions in Hong Kong, and the dissolution of the Italian government. Financial markets have reacted strongly to this complex, turbulent picture. Equity markets have been volatile. Long-term bond rates around the world have moved down sharply to near post-crisis lows. Meanwhile, the U.S. economy has continued to perform well overall, driven by consumer spending. Job creation has slowed from last year's pace but is still above overall labor force growth. Inflation seems to be moving up closer to 2 percent. Based on our assessment of the implications of these developments, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

emphasis added

New Home Sales decreased to 635,000 Annual Rate in July, Sales in June revised up to New Cycle High

by Calculated Risk on 8/23/2019 10:15:00 AM

The Census Bureau reports New Home Sales in July were at a seasonally adjusted annual rate (SAAR) of 635 thousand.

The previous three months were revised up combined. June was revised up to a new cycle high.

"Sales of new single‐family houses in July 2019 were at a seasonally adjusted annual rate of 635,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.8 percent below the revised June rate of 728,000, but is 4.3 percent above the July 2018 estimate of 609,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in July to 6.4 months from 5.5 months in June.

The months of supply increased in July to 6.4 months from 5.5 months in June. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of July was 337,000. This represents a supply of 6.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

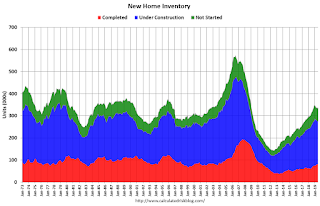

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is close to normal.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In July 2019 (red column), 53 thousand new homes were sold (NSA). Last year, 52 thousand homes were sold in July.

The all time high for July was 117 thousand in 2005, and the all time low for July was 26 thousand in 2010.

This was slightly below expectations of 645 thousand sales SAAR, however sales in the three previous months were revised up, combined. I'll have more later today.

Thursday, August 22, 2019

Friday: New Home Sales, Fed Chair Powell

by Calculated Risk on 8/22/2019 06:18:00 PM

Friday:

• At 10:00 AM ET, New Home Sales for July from the Census Bureau. The consensus is for 645 thousand SAAR, down from 646 thousand in June.

• Also at 10:00 AM, Speech, Fed Chair Jerome Powell, Challenges for Monetary Policy, At the Jackson Hole Economic Policy Symposium: Challenges for Monetary Policy, Jackson Hole, Wyo.

Philly Fed: State Coincident Indexes increased in 37 states in July

by Calculated Risk on 8/22/2019 02:36:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for July 2019. Over the past three months, the indexes increased in 44 states, decreased in four states, and remained stable in two, for a three-month diffusion index of 80. In the past month, the indexes increased in 37 states, decreased in nine states, and remained stable in four, for a one-month diffusion index of 56.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

The map is mostly green on a three month basis, but there are some grey and red states.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In July, 37 states had increasing activity (graph includes minor increases).

Kansas City Fed: "Tenth District Manufacturing Declined in August"

by Calculated Risk on 8/22/2019 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Declined in August

The Federal Reserve Bank of Kansas City released the August Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity declined in August, while expectations for future activity edged higher.Another weak report.

“Regional factory activity had its largest monthly drop in over three years, and over 55 percent of firms expect negative impacts from the latest round of U.S. tariffs on Chinese goods,” said Wilkerson. “However, even though many firms expect trade tensions to persist, expectations for future shipments and exports expanded slightly.”

...

The month-over-month composite index was -6 in August, down from -1 in July and 0 in June, and the lowest reading since March 2016. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. The drop in manufacturing activity was driven by declines at both durable and nondurable plants, but especially from decreases in primary metal, electrical equipment, appliances, paper, printing, and chemical manufacturing. Most month-over-month indexes decreased in August, and the shipments and supplier delivery time indexes also turned negative. All of the year-over-year factory indexes decreased in August, and the composite index fell from 11 to -1. On the other hand, the future composite index edged higher from 9 to 11, as expectations for shipments, order backlog, employment, and new orders for exports grew slightly.

emphasis added

Black Knight: "Mortgage Delinquencies See Strong Recovery from June Spike"

by Calculated Risk on 8/22/2019 09:30:00 AM

From Black Knight: Black Knight’s First Look: July Prepayment Activity Hits Highest Level Since 2016; Mortgage Delinquencies See Strong Recovery from June Spike

• Prepayment activity jumped 26% from June to its highest level in nearly three years and 58% above this time last year as falling interest rates continue to fuel refinance incentiveAccording to Black Knight's First Look report for July, the percent of loans delinquent decreased 7.3% in July compared to June, and decreased 4.3% year-over-year.

• The national delinquency rate fell by 7% in July, offsetting the bulk of June’s calendar-related spike

• At 3.46%, July 2019’s delinquency rate is the lowest of any July on record (dating back to 2000)

• Both serious delinquencies (-11,000) and active foreclosure inventory (-1,000) fell as well

• Serious delinquencies (all loans 90 or more days delinquent but not in active foreclosure) fell below 445,000 for the first time since June 2006

The percent of loans in the foreclosure process decreased 0.5% in July and were down 13.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.46% in July, down from 3.73% in June.

The percent of loans in the foreclosure process decreased in July to 0.49% from 0.50% in June.

The number of delinquent properties, but not in foreclosure, is down 54,000 properties year-over-year, and the number of properties in the foreclosure process is down 35,000 properties year-over-year.

Note: The "spike" in delinquencies in June was due to timing and seasonal factors. No worries.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jul 2019 | Jun 2019 | Jul 2018 | Jul 2017 | |

| Delinquent | 3.46% | 3.73% | 3.61% | 3.90% |

| In Foreclosure | 0.49% | 0.50% | 0.57% | 0.87% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,807,000 | 1,950,000 | 1,861,000 | 1,986,000 |

| Number of properties in foreclosure pre-sale inventory: | 258,000 | 259,000 | 293,000 | 398,000 |

| Total Properties | 2,065,000 | 2,209,000 | 2,154,000 | 2,384,000 |

Weekly Initial Unemployment Claims decreased to 209,000

by Calculated Risk on 8/22/2019 08:34:00 AM

The DOL reported:

In the week ending August 17, the advance figure for seasonally adjusted initial claims was 209,000, a decrease of 12,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 220,000 to 221,000. The 4-week moving average was 214,500, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 250 from 213,750 to 214,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 214,500.

This was lower than the consensus forecast.

Wednesday, August 21, 2019

Thursday: Unemployment Claims

by Calculated Risk on 8/21/2019 07:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Pop Higher

Mortgage rates moved higher today, and it had nothing to do with any of the day's events or news headlines. Quite simply put, the bond market (which dictates the rates that can offered by lenders) had already begun to weaken as of yesterday afternoon. Weakness continued overnight as global financial markets dialed back their demand for safe havens. … Safe haven demand has been waxing and waning as the broader market settles in to a new range following the big shake-up in early August. Today was just another minor fluctuation in that regard, but the timing issue (bond market weakness yesterday afternoon followed by more this morning) made for a noticeable adjustment from mortgage lenders. [Most Prevalent Rates 30YR FIXED - 3.5% - 3.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, down from 220 thousand last week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for August.

FOMC Minutes: A Wide Range of Views

by Calculated Risk on 8/21/2019 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, July 30–31, 2019. A few excerpts:

In their discussion of monetary policy decisions at this meeting, those participants who favored a reduction in the target range for the federal funds rate pointed to three broad categories of reasons for supporting that action.

• First, while the overall outlook remained favorable, there had been signs of deceleration in economic activity in recent quarters, particularly in business fixed investment and manufacturing. A pronounced slowing in economic growth in overseas economies—perhaps related in part to developments in, and uncertainties surrounding, international trade—appeared to be an important factor in this deceleration. More generally, such developments were among those that had led most participants over recent quarters to revise down their estimates of the policy rate path that would be appropriate to promote maximum employment and stable prices.A couple of participants indicated that they would have preferred a 50 basis point cut in the federal funds rate at this meeting rather than a 25 basis point reduction. They favored a stronger action to better address the stubbornly low inflation rates of the past several years, recognizing that the apparent low sensitivity of inflation to levels of resource utilization meant that a notably stronger real economy might be required to speed the return of inflation to the Committee's inflation objective.

• Second, a policy easing at this meeting would be a prudent step from a risk-management perspective. Despite some encouraging signs over the intermeeting period, many of the risks and uncertainties surrounding the economic outlook that had been a source of concern in June had remained elevated, particularly those associated with the global economic outlook and international trade. On this point, a number of participants observed that policy authorities in many foreign countries had only limited policy space to support aggregate demand should the downside risks to global economic growth be realized.

• Third, there were concerns about the outlook for inflation. A number of participants observed that overall inflation had continued to run below the Committee's 2 percent objective, as had inflation for items other than food and energy. Several of these participants commented that the fact that wage pressures had remained only moderate despite the low unemployment rate could be a sign that the longer-run normal level of the unemployment rate is appreciably lower than often assumed. Participants discussed indicators for longer-term inflation expectations and inflation compensation. A number of them concluded that the modest increase in market-based measures of inflation compensation over the intermeeting period likely reflected market participants' expectation of more accommodative monetary policy in the near future; others observed that, while survey measures of inflation expectations were little changed from June, the level of expectations by at least some measures was low. Most participants judged that long-term inflation expectations either were already below the Committee's 2 percent goal or could decline below the level consistent with that goal should there be a continuation of the pattern of inflation coming in persistently below 2 percent.

Several participants favored maintaining the same target range at this meeting, judging that the real economy continued to be in a good place, bolstered by confident consumers, a strong job market, and a low rate of unemployment. These participants acknowledged that there were lingering risks and uncertainties about the global economy in general, and about international trade in particular, but they viewed those risks as having diminished over the intermeeting period. In addition, they viewed the news on inflation over the intermeeting period as consistent with their forecasts that inflation would move up to the Committee's 2 percent objective at an acceptable pace without an adjustment in policy at this meeting. Finally, a few participants expressed concerns that further monetary accommodation presented a risk to financial stability in certain sectors of the economy or that a reduction in the target range for the federal funds rate at this meeting could be misinterpreted as a negative signal about the state of the economy.

In their discussion of the outlook for monetary policy beyond this meeting, participants generally favored an approach in which policy would be guided by incoming information and its implications for the economic outlook and that avoided any appearance of following a preset course. Most participants viewed a proposed quarter-point policy easing at this meeting as part of a recalibration of the stance of policy, or mid-cycle adjustment, in response to the evolution of the economic outlook over recent months. A number of participants suggested that the nature of many of the risks they judged to be weighing on the economy, and the absence of clarity regarding when those risks might be resolved, highlighted the need for policymakers to remain flexible and focused on the implications of incoming data for the outlook.

emphasis added

AIA: "Architecture Billings Index Continues Its Streak of Soft Readings"

by Calculated Risk on 8/21/2019 01:19:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Continues Its Streak of Soft Readings

Demand for design services in July remained essentially flat in comparison to the previous month, according to a new report released today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 50.1 in July showed a small increase in design services since June, which was a score of 49.1. Any score above 50 indicates an increase in billings. In July, the design contracts score dipped into negative territory for the first time in almost a year. Additionally, July billings softened in all regions except the West, and at firms of all specializations except multifamily residential.

“The data is not the same as what we saw leading up to the last economic downturn but the continued, slowing across the board will undoubtedly impact architecture firms and the broader construction industry in the coming months,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “A growing number of architecture firms are reporting that the ongoing volatility in the trade situation, the stock market, and interest rates are causing some of their clients to proceed more cautiously on current projects.”

...

• Regional averages: West (51.2); Midwest (48.9); South (48.3); Northeast (48.3)

• Sector index breakdown: multi-family residential (50.6); institutional (49.8); commercial/industrial (49.2); mixed practice (48.9)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.1 in July, up from 49.1 in June. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 10 of the previous 12 months, suggesting some further increase in CRE investment in 2019 - but this is the weakest five month stretch since 2012.