by Calculated Risk on 6/24/2013 06:29:00 PM

Monday, June 24, 2013

Existing Home Inventory is up 16.9% year-to-date on June 24th

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for May). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 16.9%, and I expect further increases over the next few months.

Inventory is well above the peak percentage increases for 2011 and 2012 and this suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year.

It is important to remember that inventory is still very low, and is down 14.3% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), I expect price increases to slow.

Market Update

by Calculated Risk on 6/24/2013 04:56:00 PM

Click on graph for larger image.

By request - following the recent sell-off - here are a couple of stock market graphs. The first graph shows the S&P 500 since 1990 (this excludes dividends).

The dashed line is the closing price today. The market is only up 10.3% year-to-date.

The second graph (click on graph for larger image) is from Doug Short and shows the S&P 500 since the 2007 high ...

LPS: House Price Index increased 1.5% in April, Up 8.1% year-over-year

by Calculated Risk on 6/24/2013 12:30:00 PM

Notes: I follow several house price indexes (Case-Shiller, CoreLogic, LPS, Zillow, FHFA, FNC and more). The timing of different house prices indexes can be a little confusing. LPS uses April closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From LPS: LPS' April HPI Report: Home Prices Up 1.5 Percent from March, 8.1 Percent Year-Over-Year

Lender Processing Services ... today released its latest LPS Home Price Index (HPI) report, based on April 2013 residential real estate transactions. The LPS HPI combines the company’s extensive property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 15,500 U.S. ZIP codes. The LPS HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.The LPS HPI is off 18.2% from the peak in June 2006. Note: The press release has data for the 20 largest states, and 40 MSAs. LPS shows prices off 47.7% from the peak in Las Vegas, 39.6% off from the peak in Riverside-San Bernardino, CA (Inland Empire), and at a new peak in Austin, Dallas and Denver! (Also, on the state level, new peaks for the Colorado and Texas).

Note: Case-Shiller for April will be released tomorrow.

Dallas Fed: Regional Manufacturing Activity "surges" in June

by Calculated Risk on 6/24/2013 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Surges and Outlook Improves

Texas factory activity increased sharply in June, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose six points to 17.1, posting its highest reading in more than two years.This was above expectations of a reading of 0.0 for the general business activity index. This is the 3rd regional Fed report for June and all were above expectations and indicated expansion.

Notably stronger manufacturing activity was reflected in other survey measures as well. The new orders index climbed to 13 in June, a level not seen since July 2011. The capacity utilization index rose to a two-year high, jumping from 6.4 to 15.3. The shipments index advanced 12 points to 15.4.

Perceptions of broader business conditions rebounded strongly in June. The general business activity index rose to 6.5 after posting negative readings in April and May. The company outlook index soared 20 points to 13.3, reaching its highest level in 16 months.

Labor market indicators reflected steady labor demand and longer workweeks. The employment index was zero in June, suggesting no change in employment levels. The hours worked index moved up to 4.8 after four months in negative territory.

emphasis added

Chicago Fed: "Economic Activity slightly improved in May"

by Calculated Risk on 6/24/2013 08:38:00 AM

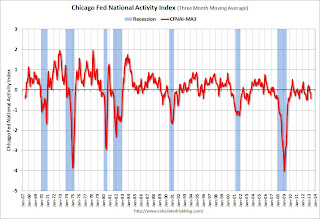

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic activity slightly improved in May

Led by improvements in production-related indicators, the Chicago Fed National Activity Index (CFNAI) increased to –0.30 in May from –0.52 in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, decreased to –0.43 in May from –0.13 in April, marking its third consecutive reading below zero and its lowest level since October 2012. May’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in May (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, June 23, 2013

Monday: Dallas Fed Mfg Survey, Chicago Fed National Activity Index

by Calculated Risk on 6/23/2013 10:04:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for May. This is a composite index of other data.

• At 10:30 AM ET, the Dallas Fed Manufacturing Survey for June. The consensus is a reading of 0, up from minus 10.5 in May (below zero is expansion).

Weekend:

• Schedule for Week of June 23rd

The Asian markets are red tonight with the Nikkei down 0.1%, and Shanghai Composite down 1.1%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 5 and DOW futures are down 40 (fair value).

Oil prices have moved down recently with WTI futures at $93.59 per barrel and Brent at $100.59 per barrel.

Real Estate: Pocket Listings in a Tight Market

by Calculated Risk on 6/23/2013 06:10:00 PM

From Alejandro Lazo at the LA Times: Motivated home buyers skip the bidding wars

[A]gents like Mathys are resorting to reconnaissance and back-channel networks to find homes that haven't yet hit the market. They're cold-calling homeowners with offers and targeting specific neighborhoods with direct mail. Some come bearing bizarre gifts in return for a listing. One agent offered a seller the use of his exotic car; one of his clients offered free dogs.Pocket listings (kept in the agent's "pocket") are always popular with agents in a tight market. This way the agent can get both sides of the commission (or share with someone in their office - or an agent they know who will return the favor). Other agents and buyers hate pocket listings because they never get a chance at buying the property - and it is usually best for the seller to actually have the property listed and see other offers.

And they're chasing so-called pocket listings, homes privately marketed among those in the know. The low-profile nature of the listings makes them hard to quantify. But agents and other real estate experts say they've become common in the booming Southland market, where the median home price shot up nearly 25% in the last year.

Mathys — a 10-year veteran who, with his partner Tracie Kersten, specializes in high-end San Diego properties — said he'd never before seen the market this tight or felt the need to get this creative.

emphasis added

A few comments on dumb policy

by Calculated Risk on 6/23/2013 01:45:00 PM

Please excuse my frustration ... there are frequently honest disagreements on policy, but occasionally there are policies that are almost universally panned.

An example of a recent dumb policy was the seller-financed Downpayment Assistance Programs (DAPs) for FHA insured loans. Basically DAPs allowed the seller to provide the buyer - through a 3rd party "charity" - with the 3% downpayment as a "gift". This allowed the buyer to put no money down. The FHA tried to eliminate these programs for several years - the IRS even called them a "scam" - but certain Congressmen fought to keep the DAPs alive. (The FHA's financial position would be much stronger today if seller-financed DAPs never existed). Finally DAPs were eliminated in 2008, after causing serious damage, but some Congressmen like Barney Frank (D-MA) kept fighting for them.

Another example of a dumb policy was the Homebuyer Tax Credit sponsored by Senators Johnny Isakson (R-GA) and Joe Lieberman (I-CT). This was part of the 2009 stimulus package and was a complete mistake. (I wrote numerous posts opposing the tax credit - and talked to a number of Senate staffers - and it passed any way). One of the problems in 2009 was there was an excess supply of housing units, and part of the tax credit provided an incentive to build more! Dumb and dumber.

An example of a recent dumb proposal was Senator Elizabeth Warren's (D-MA) suggestion that FHA short sales not require arms-length transaction (The arms-length requirement is a key protection against short sale fraud, and is a major reason short sale activity increased sharply a couple of years ago).

I could go on ... but now we have the sequestration budget cuts that are considered a blunder by most economists and analysts (at least the ones I respect). These are mindless across the board budget cuts that are hurting the economy - and probably not helping with deficit reduction in the long run. If they are hurting the economy, and not helping with deficit reduction, why can't we get rid of the cuts?

Some people say the "PAYGO" rules require an offset. But Congress could exempt this from "PAYGO" (PAYGO expired in 2002, so the 2003 tax cuts didn't require an offset). Some people point fingers on sequestration blaming one party of the other. That is silly. We all know who is to blame.

If the House passed a bill ending the sequestration budget cuts today, the Senate (barring a filibuster) would pass it tomorrow, and the President would sign the bill the second it landed on his desk. So the problem is the House - and since I'm naming names - the problem is with the House leadership of John Boehner (R- OH), Eric Cantor (R- VA), and Paul Ryan (R-WI). Unfortunately none of these men are even arguing to end the sequestration cuts; they aren't even talking about them.

This is frustrating and embarrassing for the U.S. - and this also impacts the Fed. If we ended the sequestration budget cuts, then there would be a better chance that the Fed could taper and end QE3 sooner rather than later. Dumb policy is hurting the country right now ... and if I was a reporter, I'd ask these three Congressmen about ending the cuts at every opportunity.

Gasoline Prices down slightly Nationally, Higher in California due to Refinery Issues

by Calculated Risk on 6/23/2013 10:17:00 AM

The refineries in the Midwest are back online, and gasoline prices are falling. From the StarTribune: Gas prices trend down, easing road trips

Average gas prices in the Twin Cities peaked at $4.35 on May 18. By late last week, though, the average price had dropped to $3.52, lower than the national average ...However in California: Gas prices up 5 cents overnight

Less gasoline was available in the Upper Midwest that month, when two oil refineries in the region underwent maintenance. ... For the time being, anyway, the refineries that had stopped operations are back online, and the gasoline is flowing.

Southern California gasoline prices are on the rise in response to a partial shutdown of a major refinery outside of Los Angeles. ... ExxonMobil confirmed the shutdown Wednesday of crude distillation units at its Torrance refinery, which has reduced production significantly from the 150,000-barrel-a-day capacity.Oil prices were down this week, with WTI down to $93.69 per barrel, and Brent at $100.91.

Using the calculator from Professor Hamilton, and the current price of Brent crude oil, the national average should be under $3.40 per gallon. That is almost 20 cents below the current level according to Gasbuddy.com. There are probably some seasonal factors not included in the calculator, but if crude oil prices stay at the current level - and the refinery issues are resolved - we should expect national gasoline prices to fall below $3.40 per gallon.

Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, June 22, 2013

Schedule for Week of June 23rd

by Calculated Risk on 6/22/2013 11:23:00 AM

There are two key housing reports to be released this week: New Home sales for May and Case-Shiller house prices for April. Other key reports are the third estimate of Q1 GDP on Wednesday, and the May Personal Income and Outlays report on Thursday.

For manufacturing, the Dallas, Richmond, and Kansas City regional manufacturing surveys for June will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for May. This is a composite index of other data.

10:30 AM: Dallas Fed Manufacturing Survey for June. The consensus is a reading of 0, up from minus 10.5 in May (below zero is expansion).

8:30 AM: Durable Goods Orders for May from the Census Bureau. The consensus is for a 3.3% increase in durable goods orders.

9:00 AM: FHFA House Price Index for April 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 1.2% increase.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April.

9:00 AM: S&P/Case-Shiller House Price Index for April. Although this is the April report, it is really a 3 month average of February, March and April. This graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indexes through March 2012 (the Composite 20 was started in January 2000).

The consensus is for a 10.9% year-over-year increase in the Composite 20 index (NSA) for December. The Zillow forecast is for the Composite 20 to increase 12.1% year-over-year, and for prices to increase 1.7% month-to-month seasonally adjusted.

10:00 AM: New Home Sales for May from the Census Bureau.

10:00 AM: New Home Sales for May from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the April sales rate.

The consensus is for an increase in sales to 460 thousand Seasonally Adjusted Annual Rate (SAAR) in May from 454 thousand in April.

10:00 AM: Conference Board's consumer confidence index for June. The consensus is for the index to decrease to 75.0 from 76.2.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for June. The consensus is for a reading of 2 for this survey, up from minus 2 in May (Below zero is contraction).

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Q1 GDP (third estimate). This is the third estimate of Q1 GDP from the BEA. The consensus is that real GDP increased 2.4% annualized in Q1, unrevised from the 2nd estimate.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an decrease to 345 thousand from 354 thousand last week.

8:30 AM ET: Personal Income and Outlays for May. The consensus is for a 0.2% increase in personal income in April, and for a 0.4% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM ET: Pending Home Sales Index for May. The consensus is for a 1.0% increase in the index.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for June. This is the last of the regional manufacturing surveys for June. The consensus is for a reading of 4 for this survey, up from 2 in May (Above zero is expansion).

9:45 AM: Chicago Purchasing Managers Index for June. The consensus is for a decrease to 55.0, down from 58.7 in May.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for June). The consensus is for a reading of 83.0.