by Calculated Risk on 7/18/2025 02:44:00 PM

Friday, July 18, 2025

Q2 GDP Tracking: Mid-2s

From BofA:

Since our last weekly publication, our 2Q GDP tracking is down one-tenth to 2.2% q/q saar. [July 18th estimate]From Goldman:

emphasis added

June single-family housing starts were weaker than our previous GDP tracking assumptions. We lowered our Q2 GDP tracking estimate by 0.1pp to +2.8% (quarter-over-quarter annualized). Our Q2 domestic final sales estimate stands at +0.9%. [July 18th estimate]And from the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.4 percent on July 18, unchanged from July 17 after rounding. After this morning’s housing starts release from the US Census Bureau, the nowcast of second-quarter real residential investment growth decreased from -6.4 percent to -7.0 percent. [July 18th estimate]

Lawler: Early Read on Existing Home Sales in June

by Calculated Risk on 7/18/2025 12:10:00 PM

From housing economist Tom Lawler:

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.92 million in June, down 2.7% from May’s preliminary pace and down 0.3% from last June’s seasonally adjusted pace. Unadjusted sales should show a modest YOY increase, with the SA/NSA difference reflecting the higher business day count this June compared to last June.

Local realtor/MLS reports suggest that the median existing single-family home sales price last month was up by about 1.9% from a year earlier.

CR Note: The NAR is scheduled to release June Existing Home sales on Wednesday, July 23rd at 10:00 AM. The consensus is for 4.00 million SAAR, down from 4.03 million last month. Last year, the NAR reported sales in June 2024 at 3.93 million SAAR.

Newsletter: Housing Starts Increased to 1.321 million Annual Rate in June

by Calculated Risk on 7/18/2025 09:11:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Housing Starts Increased to 1.321 million Annual Rate in June

A brief excerpt:

Total housing starts in June were above expectations (due to volatile multi-family sector) and starts in April and May were revised up.There is much more in the article.

The third graph shows the month-to-month comparison for total starts between 2024 (blue) and 2025 (red).

Total starts were down 0.5% in June compared to June 2024. Year-to-date (YTD) starts are down 1.0% compared to the same period in 2024. Single family starts are down 6.9% YTD and multi-family up 15.7% YTD.

Housing Starts Increased to 1.321 million Annual Rate in June

by Calculated Risk on 7/18/2025 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in June were at a seasonally adjusted annual rate of 1,321,000. This is 4.6 percent above the revised May estimate of 1,263,000, but is 0.5 percent below the June 2024 rate of 1,327,000. Single-family housing starts in June were at a rate of 883,000; this is 4.6 percent below the revised May figure of 926,000. The June rate for units in buildings with five units or more was 414,000.

Building Permits:

Privately-owned housing units authorized by building permits in June were at a seasonally adjusted annual rate of 1,397,000. This is 0.2 percent above the revised May rate of 1,394,000, but is 4.4 percent below the June 2024 rate of 1,461,000. Single-family authorizations in June were at a rate of 866,000; this is 3.7 percent below the revised May figure of 899,000. Authorizations of units in buildings with five units or more were at a rate of 478,000 in June.

emphasis added

Click on graph for larger image.

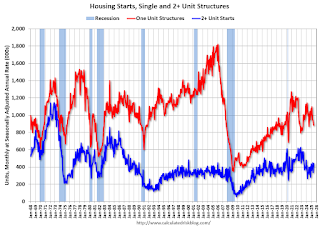

Click on graph for larger image.The first graph shows single and multi-family housing starts since 2000.

Multi-family starts (blue, 2+ units) increased sharply month-over-month in June. Multi-family starts were up 26.6% year-over-year.

Single-family starts (red) decreased in June and were down 10.0% year-over-year.

The second graph shows single and multi-family housing starts since 1968.

The second graph shows single and multi-family housing starts since 1968. Total housing starts in June were above expectations and starts in April and May were revised up.

I'll have more later …

Thursday, July 17, 2025

Friday: Housing Starts

by Calculated Risk on 7/17/2025 07:57:00 PM

Friday:

• At 8:30 AM ET, Housing Starts for June. The consensus is for 1.300 million SAAR, up from 1.256 million SAAR in May.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for July).

• Also at 10:00 AM, State Employment and Unemployment (Monthly) for June 2025

LA Ports: Traffic Down 3% YoY in June

by Calculated Risk on 7/17/2025 03:16:00 PM

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Click on graph for larger image.

Click on graph for larger image.Usually imports peak in the July to October period as retailers import goods for the Christmas holiday and then decline sharply and bottom in the Winter depending on the timing of the Chinese New Year.

To remove the strong seasonal component for inbound traffic, the second graph shows the rolling 12-month average.

On a rolling 12-month basis, inbound traffic decreased 0.3% in June compared to the rolling 12 months ending the previous month. Outbound traffic decreased 0.3% compared to the rolling 12 months ending the previous month.

On a rolling 12-month basis, inbound traffic decreased 0.3% in June compared to the rolling 12 months ending the previous month. Outbound traffic decreased 0.3% compared to the rolling 12 months ending the previous month.Hotels: Occupancy Rate Decreased 3.2% Year-over-year

by Calculated Risk on 7/17/2025 01:11:00 PM

The U.S. hotel industry reported negative year-over-year comparisons, according to CoStar’s latest data through 12 July. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

6-12 July 2025 (percentage change from comparable week in 2024):

• Occupancy: 67.2% (-3.2%)

• Average daily rate (ADR): US$158.42 (-0.5%)

• Revenue per available room (RevPAR): US$106.39 (-3.7%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.

NAHB: "Builder Confidence Edges Up in July"'; "Negative territory for 15 consecutive months"

by Calculated Risk on 7/17/2025 10:00:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 33, up from 33 last month. Any number below 50 indicates that more builders view sales conditions as poor than good.

From the NAHB: Builder Confidence Edges Up in July

Builder confidence for future sales expectations received a slight boost in July with the passage of the One Big Beautiful Bill Act but elevated interest rates and economic and policy uncertainty continue to act as headwinds for the housing sector.

Builder confidence in the market for newly built single-family homes was 33 in July, up one point from June, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today. Builder sentiment has now been in negative territory for 15 consecutive months.

“The passage of the One Big Beautiful Bill Act provided a number of important wins for households, home builders and small businesses,” said NAHB Chairman Buddy Hughes, a home builder and developer from Lexington, N.C. “While this new law should provide economic momentum after a disappointing spring, the housing sector has weakened in 2025 due to poor affordability conditions, particularly from elevated interest rates.”

Indeed, the latest HMI survey also revealed that 38% of builders reported cutting prices in July, the highest percentage since NAHB began tracking this figure on a monthly basis in 2022. This compares with 37% of builders who reported cutting prices in June, 34% in May and 29% in April. Meanwhile, the average price reduction was 5% in July, the same as it’s been every month since last November. The use of sales incentives was 62% in July, unchanged from June.

“Single-family housing starts will post a decline in 2025 due to ongoing housing affordability challenges,” said NAHB Chief Economist Robert Dietz. “Single-family permits are down 6% on a year-to-date basis and builder traffic in the HMI is at a more than two-year low.”

...

The HMI index gauging current sales conditions rose one point in July to a level of 36 while the component measuring sales expectations in the next six months increased three points to 43. The gauge charting traffic of prospective buyers posted a one-point decline to 20, the lowest reading since end of 2022.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 45, the Midwest held steady at 41, the South dropped three points to 30 and the West declined three points to 25.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB index since Jan 1985.

This was at the consensus forecast.

Retail Sales Increased 0.6% in June

by Calculated Risk on 7/17/2025 08:35:00 AM

On a monthly basis, retail sales increased 0.6% from May to June (seasonally adjusted), and sales were up 3.9 percent from June 2024.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for June 2025, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $720.1 billion, up 0.6 percent from the previous month, and up 3.9 percent from June 2024. ... The April 2025 to May 2025 percent change was unrevised from down 0.9 percent (±0.2 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline was up 0.7% in June.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.9% on a YoY basis.

The change in sales in June were above expectations and the previous two months were revised down slightly, combined.

The change in sales in June were above expectations and the previous two months were revised down slightly, combined.

Weekly Initial Unemployment Claims Decrease to 221,000

by Calculated Risk on 7/17/2025 08:30:00 AM

The DOL reported:

In the week ending July 12, the advance figure for seasonally adjusted initial claims was 221,000, a decrease of 7,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 227,000 to 228,000. The 4-week moving average was 229,500, a decrease of 6,250 from the previous week's revised average. The previous week's average was revised up by 250 from 235,500 to 235,750.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 229,500.

The previous week was revised up.

Weekly claims were lower than the consensus forecast.