by Calculated Risk on 5/14/2025 10:36:00 AM

Wednesday, May 14, 2025

Q1 NY Fed Report: Mortgage Originations by Credit Score, Delinquencies Increase, Foreclosures Increase

Today, in the Calculated Risk Real Estate Newsletter: Q1 NY Fed Report: Mortgage Originations by Credit Score, Delinquencies Increase, Foreclosures Increase

A brief excerpt:

The transition rate to serious delinquent is generally increasing and foreclosures are close to pre-pandemic levels. The Q1 increase is likely due to the end of the VA foreclosure moratorium.There is much more in the article.

...

There is much more in the report.

MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

by Calculated Risk on 5/14/2025 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 9, 2025.

The Market Composite Index, a measure of mortgage loan application volume, increased 1.1 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1 percent compared with the previous week. The Refinance Index decreased 0.4 percent from the previous week and was 44 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 18 percent higher than the same week one year ago.

“Last week saw steadier mortgage rates, as the FOMC meeting played as predicted, and market movements led to a small two-basis point increase in the 30-year conforming rate to 6.86 percent,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Refinance volume was little changed for the week, with a small increase in government refinances, and a decrease in conventional refinances. The news for the week was the growth in purchase applications, up 2.3 percent and almost 18 percent higher than last year’s pace. Despite the economic uncertainty, the increase in home inventory means there are additional properties to buy, unlike the last two years, and this supply is supporting more transactions.”

Added Fratantoni, “There was a notable gain in government purchase applications, up almost 5 percent for the week and 40 percent on an annual basis.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) increased to 6.86 percent from 6.84 percent, with points remaining unchanged at 0.68 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

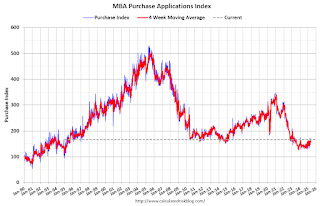

Click on graph for larger image.The first graph shows the MBA mortgage purchase index.

According to the MBA, purchase activity is up 18% year-over-year unadjusted.

Tuesday, May 13, 2025

Wednesday: Mortgage Applications

by Calculated Risk on 5/13/2025 07:56:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Cleveland Fed: Median CPI increased 0.3% and Trimmed-mean CPI increased 0.2% in April

by Calculated Risk on 5/13/2025 12:39:00 PM

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.3% in April. The 16% trimmed-mean Consumer Price Index increased 0.2%. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation.

NY Fed Q1 Report: Change in Household Debt Balances Mixed; Student Loan Delinquencies Rise Sharply

by Calculated Risk on 5/13/2025 11:14:00 AM

From the NY Fed: Change in Household Debt Balances Mixed; Student Loan Delinquencies Rise Sharply

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit. The report shows total household debt increased by $167 billion (0.9%) in Q1 2025, to $18.20 trillion. The report is based on data from the New York Fed’s nationally representative Consumer Credit Panel. It includes a one-page summary of key takeaways and their supporting data points.

The New York Fed also issued an accompanying Liberty Street Economics blog post examining student loan delinquency, including which borrowers were past due in the first quarter and implications for their access to other credit.

“Transition rates into serious delinquency have leveled off for credit card and auto loans over the past year,” said Daniel Mangrum, Research Economist at the New York Fed. “However, the first batch of past due student loans were reported in the first quarter of 2025, resulting in a large jump in seriously delinquent borrowers.”

Credit card balances fell by $29 billion from the previous quarter and stood at $1.18 trillion at the end of March 2025. Auto loan balances also declined by $13 billion, representing the second drop from one subsequent quarter since 2011, and totaled $1.64 trillion. Mortgage balances grew by $199 billion and stood at $12.80 trillion. HELOC balances rose by $6 billion to $402 billion, representing the twelfth consecutive quarterly increase. Student loan balances grew by $16 billion and now stand at $1.63 trillion. Other balances, which include retail cards and other consumer loans, fell by $12 billion.

The pace of mortgage originations increased slightly, with $426 billion newly originated mortgages in Q1 2025. Aggregate limits on credit card accounts increased moderately by $77 billion, representing a 1.5% increase from the previous quarter.

Aggregate delinquency rates increased from the previous quarter, with 4.3% of outstanding debt in some stage of delinquency. Transition into early delinquency held steady for nearly all debt types, with the exception of student loans. Student loans saw a large uptick in the rate at which balances went from current to delinquent due to the resumption of reporting of delinquent student loans on credit reports after a nearly five-year pause due to the pandemic. Transition into serious delinquency remained stable for auto loans, credit cards, and other debt.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are three graphs from the report:

The first graph shows household debt increased in Q1. Household debt previously peaked in 2008 and bottomed in Q3 2013. Unlike following the great recession, there wasn't a decline in debt during the pandemic.

From the NY Fed:

Aggregate nominal household debt balances increased by $167 billion in the first quarter of 2025, a 0.9% rise from 2024Q4. Balances now stand at $18.20 trillion and have increased by $4.06 trillion since the end of 2019, just before the pandemic recession.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate increased in Q1. From the NY Fed:

Aggregate delinquency rates increased in the first quarter of 2025. As of the end of March, 4.3 percent of outstanding debt was in some stage of delinquency, up from 3.6 percent in the fourth quarter. Transition into early delinquency held steady for nearly all debt types; the exception was for student loans, which saw a large uptick in the rate at which balances went from current to delinquent due to the resumption of reporting of delinquent student loans on credit reports after a nearly 5-year pause due to the pandemic. Transition rates into serious delinquency, defined as 90 or more days past due, remained stable for auto loans and credit cards, and saw increases for mortgages, HELOCs, and student loans.

The third graph shows Mortgage Originations by Credit Score.

The third graph shows Mortgage Originations by Credit Score.From the NY Fed:

The volume of mortgage originations, measured as appearances of new mortgages on consumer credit reports and including both refinance and purchase originations, increased slightly with $426 billion newly originated in 2025Q1. ... Home equity lines of credit (HELOC) limits continued to rise and saw a $3 billion increase.There is much more in the report.

YoY Measures of Inflation: Services, Goods and Shelter

by Calculated Risk on 5/13/2025 08:46:00 AM

Here are a few measures of inflation:

The first graph is the one Fed Chair Powell had mentioned two years ago when services less rent of shelter was up around 8% year-over-year. This declined and is now up 3.3% YoY.

This graph shows the YoY price change for Services and Services less rent of shelter through April 2025.

Services less rent of shelter was up 3.3% YoY in April, unchanged from 3.3% YoY in March.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.

The second graph shows that goods prices started to increase year-over-year (YoY) in 2020 and accelerated in 2021 due to both strong demand and supply chain disruptions.Commodities less food and energy commodities were at 0.2% YoY in April, up from 0.0% YoY in March.

Here is a graph of the year-over-year change in shelter from the CPI report (through April) and housing from the PCE report (through March)

Here is a graph of the year-over-year change in shelter from the CPI report (through April) and housing from the PCE report (through March)Shelter was up 4.0% year-over-year in April, unchanged from 4.0% in March. Housing (PCE) was up 4.3% YoY in March, unchanged from 4.3% in February.

Core CPI ex-shelter was up 1.8% YoY in April. This key measure has been at or below the Fed's target for 8 of the last 12 months.

BLS: CPI Increased 0.2% in April; Core CPI increased 0.2%

by Calculated Risk on 5/13/2025 08:30:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent on a seasonally adjusted basis in April, after falling 0.1 percent in March, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.3 percent before seasonal adjustment.The change in CPI was below expectations. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

The index for shelter rose 0.3 percent in April, accounting for more than half of the all items monthly increase. The energy index also increased over the month, rising 0.7 percent as increases in the natural gas index and the electricity index more than offset a decline in the gasoline index. The index for food, in contrast, fell 0.1 percent in April as the food at home index decreased 0.4 percent and the food away from home index rose 0.4 percent over the month.

The index for all items less food and energy rose 0.2 percent in April, following a 0.1-percent increase in March. Indexes that increased over the month include household furnishings and operations, medical care, motor vehicle insurance, education, and personal care. The indexes for airline fares, used cars and trucks, communication, and apparel were among the major indexes that decreased in April.

The all items index rose 2.3 percent for the 12 months ending April, after rising 2.4 percent over the 12 months ending March. The April change was the smallest 12-month increase in the all items index since February 2021. The all items less food and energy index rose 2.8 percent over the last 12 months. The energy index decreased 3.7 percent for the 12 months ending April. The food index increased 2.8 percent over the last year.

emphasis added

Monday, May 12, 2025

Tuesday: CPI, Q1 Household Debt and Credit

by Calculated Risk on 5/12/2025 07:13:00 PM

Tariffs and trade policy have been a new and important consideration for the bond market for just over a month now. That matters to mortgage rates because mortgage pricing is primarily determined by bond prices.Tuesday:

...

Over the weekend, the US and China agreed on a 90 day pause on the more extreme tariff brinksmanship. While levels remain elevated enough to cause some inflation concern (remember: bad for rates), they've come down enough to alleviate some concern about the global economy (also bad for rates). [30 year fixed 6.92%]

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for April.

• At 8:30 AM, The Consumer Price Index for April from the BLS. The consensus is for 0.3% increase in CPI (up 2.4% YoY), and a 0.3% increase in core CPI (up 2.8% YoY).

• At 11:00 AM, NY Fed: Q1 Quarterly Report on Household Debt and Credit

Fed April SLOOS Survey: Banks reported Weaker Demand for Residential Real Estate

by Calculated Risk on 5/12/2025 02:00:00 PM

From the Federal Reserve: The April 2025 Senior Loan Officer Opinion Survey on Bank Lending Practices

The April 2025 Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) addressed changes in the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which generally correspond to the first quarter of 2025.

Regarding loans to businesses over the first quarter, survey respondents reported, on balance, tighter lending standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes. Furthermore, banks reported tighter or basically unchanged lending standards, and weaker or basically unchanged demand for commercial real estate (CRE) loans.

Banks also responded to a set of special questions about changes in lending policies and demand for CRE loans over the past year. For all CRE loan categories, banks reported having tightened policies related to loan-to-value ratios and debt service coverage ratios. For some CRE loan categories, banks also tightened policies related to market areas served and the length of interest-only payment periods. For office loans, banks reported having tightened all queried policies on such loans over the past year.

For loans to households, banks reported basically unchanged lending standards and weaker demand for most categories of residential real estate (RRE) loans, on balance. Banks similarly reported basically unchanged lending standards but stronger demand for home equity lines of credit (HELOCs). In addition, banks reported having tightened standards for credit card loans, while standards remained basically unchanged for auto and other consumer loans. Meanwhile, demand reportedly weakened for credit card and other consumer loans and remained basically unchanged for auto loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph on Residential Real Estate demand is from the Senior Loan Officer Survey Charts.

This graph is for demand and shows that demand has been weak since late 2021.

2nd Look at Local Housing Markets in April

by Calculated Risk on 5/12/2025 10:31:00 AM

Today, in the Calculated Risk Real Estate Newsletter: 2nd Look at Local Housing Markets in April

A brief excerpt:

It appears sales will be down year-over-year for the 3rd consecutive month, and sales-to-date in 2025 are trailing sales in 2024 - and 2024 was the lowest sales year since 1995! And sales in April might have a 3 handle (be under 4 million).There is much more in the article.

...

Here is a look at months-of-supply using NSA sales. Since this is NSA data, it is likely months-of-supply will increase into the Summer.

Months in red are areas that are seeing 5 months of supply now and might see price pressures later this summer.

...

Many more local markets to come!