by Calculated Risk on 5/05/2025 02:14:00 PM

Monday, May 05, 2025

Recession Watch Metrics

Early in February, I expressed my "increasing concern" about the negative economic impact of "executive / fiscal policy errors", however, I concluded that post by noting that I was not currently on recession watch.

"We should be looking to trade with the rest of the world, and we should do what we do best, and they should do what they do best ... Trade should not be a weapon.”In the short term, it is mostly trade policy that will negatively impact the economy. However, there are several policies that will negatively impact the economy in the long run, and I'll discuss those later.

This graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average of NSA data) are up 2% year-over-year.

This graph shows the YoY change in New Home Sales from the Census Bureau. Currently new home sales (based on 3-month average of NSA data) are up 2% year-over-year.

And light vehicle sales were strong in April.

And light vehicle sales were strong in April.  Here is a graph of the Sahm rule from FRED since 1959.

Here is a graph of the Sahm rule from FRED since 1959.The Sahm Rule was at 0.27 in March (Last data at FRED) and increased to 0.30 in April.

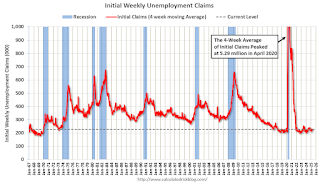

And weekly unemployment claims always rise sharply at the beginning of a recession (other events - like hurricane Katrina - can cause a temporary spike in weekly claims).

And weekly unemployment claims always rise sharply at the beginning of a recession (other events - like hurricane Katrina - can cause a temporary spike in weekly claims).ICE Mortgage Monitor: Home Prices Continue to Cool

by Calculated Risk on 5/05/2025 11:56:00 AM

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: Home Prices Continue to Cool

Brief excerpt:

House Price Growth Continues to SlowThere is much more in the newsletter.

Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. ICE reports the median price change of the repeat sales. The index was up 2.4% year-over-year in March, down from 3.5% YoY in February. The early look at the April HPI shows a 1.9% YoY increase.

• Improved inventory levels are providing more options and a softer price dynamic for homeowners shopping this springThere is much more in the mortgage monitor.

• Annual home price growth cooled to a revised +2.4% in March from +3.5% at the start of the year, with an early look at April data via ICE’s enhanced Home Price Index suggesting price growth has cooled further to +1.9% which would mark the slowest growth rate in nearly two years

• Early April data also shows home prices rose by a modest 0.1% in the month on a seasonally adjusted basis, which would mark the softest single month growth since late 2023 when mortgage rates had climbed above 7.5%

• If recent seasonally adjusted gains persist, the annual home price growth rate would cool further in Q2

• Single family prices were up by +2.1% from the same time last year, with condos down -0.4%, marking the first such annual decline since 2012

• All in, nearly half of major markets are seeing condo prices down from last years levels, with the largest declines in Florida, especially in areas heavily impacted by last year’s hurricanes

ISM® Services Index Increased to 51.6% in April

by Calculated Risk on 5/05/2025 10:00:00 AM

(Posted with permission). The ISM® Services index was at 51.6%, up from 50.8% last month. The employment index increased to 49.0%, from 46.2%. Note: Above 50 indicates expansion, below 50 in contraction.

From the Institute for Supply Management: Services PMI® at 51.6% April 2025 Services ISM® Report On Business®

Economic activity in the services sector expanded for the 10th consecutive month in April, say the nation's purchasing and supply executives in the latest Services ISM® Report On Business®. The Services PMI® registered 51.6 percent, indicating expansion for the 56th time in 59 months since recovery from the coronavirus pandemic-induced recession began in June 2020.This was below consensus expectations.

The report was issued today by Steve Miller, CPSM, CSCP, Chair of the Institute for Supply Management® (ISM®) Services Business Survey Committee: “In April, the Services PMI® registered 51.6 percent, 0.8 percentage point higher than the March figure of 50.8 percent. The Business Activity Index registered 53.7 percent in April, 2.2 percentage points lower than the 55.9 percent recorded in March. This is the index’s 59th consecutive month of expansion. The New Orders Index recorded a reading of 52.3 percent in April, 1.9 percentage points higher than the March figure of 50.4 percent. The Employment Index stayed in contraction territory for the second month in a row; the reading of 49 percent is a 2.8-percentage point increase compared to the 46.2 percent recorded in March.

“The Supplier Deliveries Index registered 51.3 percent, 0.7 percentage point higher than the 50.6 percent recorded in March. This is the fifth consecutive month that the index has been in expansion territory, indicating slower supplier delivery performance. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.)

“The Prices Index registered 65.1 percent in April, a 4.2-percentage point increase from March’s reading of 60.9 percent and a fifth consecutive reading above 60 percent. The Inventories Index registered its third consecutive month in expansion territory in April, registering 53.4 percent, an increase of 3.1 percentage points from March’s figure of 50.3 percent. The Inventory Sentiment Index expanded for the 24th consecutive month, registering 56.1 percent, down 0.5 percentage point from March’s reading of 56.6 percent. The Backlog of Orders Index registered 48 percent in April, a 0.6-percentage point increase from the March figure of 47.4 percent, indicating contraction for the eighth time in the last nine months.

“Eleven industries reported growth in April, a drop of three from the 14 industries reported in January and February. The Services PMI® has expanded in 55 of the last 58 months dating back to June 2020. The April reading of 51.6 percent is 1 percentage point below the 12-month average reading of 52.6 percent.”

Miller continues, “April’s change in indexes was a reversal of March’s direction, with increases in three (New Orders, Employment and Supplier Deliveries) of the four subindexes that directly factor into the Services PMI®. Of those four, only the Business Activity Index had a lower reading compared to March. Employment continues to be the only one of these subindexes in contraction territory, with two straight months of contraction. From December through February, all four subindexes were in expansion. Regarding tariffs, respondents cited actual pricing impacts as concerns, more so than uncertainty and future pressures. Respondents continue to mention federal agency budget cuts as a drag on business, but overall, results are improving.”

emphasis added

Housing May 4th Weekly Update: Inventory up 2.1% Week-over-week, Up 32.9% Year-over-year

by Calculated Risk on 5/05/2025 08:11:00 AM

Click on graph for larger image.

Click on graph for larger image. This second inventory graph is courtesy of Altos Research.

This second inventory graph is courtesy of Altos Research.Sunday, May 04, 2025

Monday: ISM Services

by Calculated Risk on 5/04/2025 06:13:00 PM

Weekend:

• Schedule for Week of May 4, 2025

Monday:

• At 10:00 AM ET, the ISM Services Index for April. The consensus is for a reading of 50.6, down from 50.8.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 12 and DOW futures are down 80 (fair value).

Oil prices were down over the last week with WTI futures at $58.29 per barrel and Brent at $61.29 per barrel. A year ago, WTI was at $80, and Brent was at $84 - so WTI oil prices are down about 27% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $3.14 per gallon. A year ago, prices were at $3.63 per gallon, so gasoline prices are down $0.49 year-over-year.

FOMC Preview: No Change to Fed Funds Rate

by Calculated Risk on 5/04/2025 09:22:00 AM

Most analysts expect no change to FOMC policy at the meeting this week, keeping the target range at 4 1/4 to 4 1/2 percent. Market participants currently expect the FOMC to also be on hold at the June meeting, with the next rate cut in July, and one or two more rate cuts later in the year.

The May FOMC meeting looks like a placeholder: policy rates on hold and no change in Chair Powell’s tone from his recent speeches. He will probably reiterate that the Fed is assessing the total impact of all policy changes by the Trump Administration, not just trade policy in isolation. We think the bar for a June cut is high, but Powell is unlikely to rule it out at this stage.

emphasis added

| GDP projections of Federal Reserve Governors and Reserve Bank presidents, Change in Real GDP1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Mar 2025 | 1.5 to 1.9 | 1.6 to 1.9 | 1.6 to 2.0 | |

| Dec 2024 | 1.8 to 2.2 | 1.9 to 2.1 | 1.8 to 2.0 | |

The unemployment rate was at 4.2% in April and after averaging 4.1% for Q1. The forecast for the Q4 unemployment rate is likely low.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents, Unemployment Rate2 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Mar 2025 | 4.3 to 4.4 | 4.2 to 4.5 | 4.1 to 4.4 | |

| Dec 2024 | 4.2 to 4.5 | 4.1 to 4.4 | 4.0 to 4.4 | |

As of March 2025, PCE inflation increased 2.3 percent year-over-year (YoY). There will likely be some increase in PCE inflation from policy, but this appears to in the forecast range.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents, PCE Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Mar 2025 | 2.6 to 2.9 | 2.1 to 2.3 | 2.0 to 2.1 | |

| Dec 2024 | 2.3 to 2.6 | 2.0-2.2 | 2.0 | |

PCE core inflation increased 2.6 percent YoY in March. This is in the range of FOMC projections for Q4.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents, Core Inflation1 | ||||

|---|---|---|---|---|

| Projection Date | 2025 | 2026 | 2027 | |

| Mar 2025 | 2.7 to 3.0 | 2.1 to 2.4 | 2.0 to 2.1 | |

| Dec 2024 | 2.5 to 2.7 | 2.0-2.3 | 2.0 | |

Saturday, May 03, 2025

Hotels: Occupancy Rate Decreased 1.0% Year-over-year

by Calculated Risk on 5/03/2025 07:04:00 PM

The U.S. hotel industry reported mixed year-over-year comparisons, according to CoStar’s latest data through 26 April. ...The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

20-26 April 2025 (percentage change from comparable week in 2024):

• Occupancy: 65.1% (-1.0%)

• Average daily rate (ADR): US$161.98 (+4.2%)

• Revenue per available room (RevPAR): US$105.40 (+3.2%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2025, blue is the median, and dashed light blue is for 2024. Dashed purple is for 2018, the record year for hotel occupancy.

Real Estate Newsletter Articles this Week: House Price Index Up 3.9% year-over-year in February

by Calculated Risk on 5/03/2025 02:11:00 PM

At the Calculated Risk Real Estate Newsletter this week:

• Case-Shiller: National House Price Index Up 3.9% year-over-year in February

• Freddie Mac House Price Index Mostly Unchanged in March; Up 3.0% Year-over-year

• Fannie and Freddie: Single Family Serious Delinquency Rates Decreased in March

• Inflation Adjusted House Prices 0.8% Below 2022 Peak

• Final Look at Local Housing Markets in March and a Look Ahead to April Sales

This is usually published 4 to 6 times a week and provides more in-depth analysis of the housing market.

Schedule for Week of May 4, 2025

by Calculated Risk on 5/03/2025 08:11:00 AM

The key report scheduled for this week is the March trade balance.

The FOMC meets this week and no change to the Fed funds rate is expected.

10:00 AM: the ISM Services Index for April. The consensus is for a reading of 50.6, down from 50.8.

8:30 AM: Trade Balance report for March from the Census Bureau.

8:30 AM: Trade Balance report for March from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $129.0 billion. The U.S. trade deficit was at $122.7 billion in February as importers rushed to beat the tariffs.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

2:00 PM: FOMC Meeting Announcement. No change to to the Fed funds rate is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for initial claims of 223 thousand, down from 241 thousand last week.

No major economic releases scheduled.

Friday, May 02, 2025

May 2nd COVID Update: COVID Deaths Continue to Decline

by Calculated Risk on 5/02/2025 07:56:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| Deaths per Week | 378 | 461 | ≤3501 | |

| 1my goals to stop weekly posts. 🚩 Increasing number weekly for Deaths. ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported since Jan 2023.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has been moving sideways recently.

This appears to be a leading indicator for COVID hospitalizations and deaths. This has been moving sideways recently.