by Calculated Risk on 12/30/2022 08:46:00 PM

Friday, December 30, 2022

COVID Dec 30, 2022: Update on Cases, Hospitalizations and Deaths

| COVID Metrics | ||||

|---|---|---|---|---|

| Now | Week Ago | Goal | ||

| New Cases per Week2 | 402,525 | 486,627 | ≤35,0001 | |

| Hospitalized2🚩 | 34,116 | 33,788 | ≤3,0001 | |

| Deaths per Week2 | 2,530 | 2,932 | ≤3501 | |

| 1my goals to stop weekly posts, 2Weekly for Cases, Currently Hospitalized, and Deaths 🚩 Increasing number weekly for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly (columns) number of deaths reported.

Realtor.com Reports Weekly Active Inventory Up 63% YoY; New Listings Down 6% YoY

by Calculated Risk on 12/30/2022 03:06:00 PM

Realtor.com has monthly and weekly data on the existing home market.

For the week ending December 24th, active inventory was up 63.1% year-over-year (YoY), up from 58.1% YoY last week.

New listings were down 5.7% YoY, the smallest YoY decrease since July. This small YoY decrease in new listings might be related to the holidays.

Last year, inventory was at record lows during the Winter. So, it is no surprise that YoY inventory measures are still increasing.

Question #10 for 2023: Will inventory increase further in 2023?

by Calculated Risk on 12/30/2022 09:35:00 AM

Today, in the Real Estate Newsletter: Question #10 for 2023: Will inventory increase further in 2023?

Brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2023. Some of these questions concern real estate (inventory, house prices, housing starts, new home sales), and I’ll post thoughts on those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

10) Housing Inventory: Housing inventory decreased sharply during the pandemic to record lows in early 2022. Since then, inventory has increased, but is still well below pre-pandemic levels. Will inventory increase further in 2023?

...

First, a brief history. Here are a few times when watching existing home inventory helped my analysis.

Starting in January 2005, I was very bearish on housing, but I wasn’t sure when the market would turn. Speculative bubbles can go on and on. However, the increase in inventory in late 2005 (see red arrow on graph) helped me call the top for house prices in 2006.Several years later, in early 2012, when many people were still bearish on housing, the plunge in inventory in 2011 (blue arrow on graph below) helped me call the bottom for house prices in early 2012 (see The Housing Bottom is Here).

...

It seems likely that mortgage rates will remain well above the pandemic lows, and therefore new listings will be depressed again in 2023.

The bottom line is inventory will probably increase year-over-year in 2023. However, with the dearth of new listings, it still seems unlikely - but not impossible - that inventory will be back up to the 2017 - 2019 levels. Inventory is always something to watch!

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 12/30/2022 08:18:00 AM

Two key points:

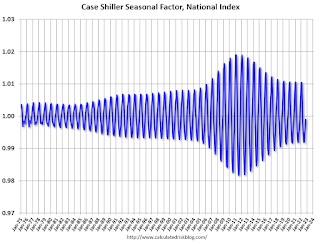

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

For in depth description of these issues, see Jed Kolko's article from 2014 "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through October 2022). The seasonal pattern was smaller back in the '90s and early '00s and increased once the bubble burst.

The seasonal swings declined following the bust, however the recent price surge changed the month-over-month pattern.

The swings in the seasonal factors have decreased, and the seasonal factors had been moving back towards more normal levels.

Thursday, December 29, 2022

Hotels: Occupancy Rate Down 9.7% Compared to Same Week in 2019

by Calculated Risk on 12/29/2022 08:44:00 PM

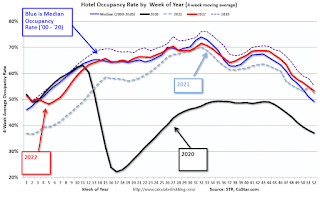

U.S. hotel performance came in lower than the previous week and showed weakened comparisons to 2019 on the unfavorable side of a holiday calendar shift, according to STR‘s latest data through Dec. 24. At the same time, occupancy on the 24th was the highest for any Christmas Eve on record.The following graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

Dec. 18-24, 2022 (percentage change from comparable week in 2019*):

• Occupancy: 43.9% (-9.7%)

• Average daily rate (ADR): $132.29 (+2.3%)

• Revenue per available room (RevPAR): $58.04 (-7.6%)

*Due to the pandemic impact, STR is measuring recovery against comparable time periods from 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021. Dashed purple is 2019 (STR is comparing to a strong year for hotels).

Las Vegas November 2022: Visitor Traffic Down 7.0% Compared to 2019; Convention Traffic Down 3.4%

by Calculated Risk on 12/29/2022 02:00:00 PM

Note: I like using Las Vegas as a measure of recovery for both leisure (visitors) and business (conventions).

From the Las Vegas Visitor Authority: November 2022 Las Vegas Visitor Statistics

Even with typical late fall/early winter seasonal volume decreases kicking in after a stellar October, November 2022 saw visitation of approx. 3.27M, about 5% ahead of last November and ‐7% shy of November 2019 tallies, supported by a variety of events including the Automotive After Market Week and the Raiders vs. Colts home game.

Overall hotel occupancy reached 81.2% (+3.6 pts YoY and down ‐7.0 pts vs. Nov 2019). Weekend occupancy came in at 89.6% (‐1.1 pts of last November and ‐4.5 pts below November 2019), while Midweek occupancy reached 77.5%, up 5.6 pts vs. last November but down ‐7.3 pts vs. November 2019's tally.

The trend of strong room rates continued during the month as ADR approached $187, up roughly 20% YoY and +38% ahead of November 2019 while RevPAR surpassed $151 for the month, +25% YoY and +27% over November 2019.

Click on graph for larger image.

Click on graph for larger image. The first graph shows visitor traffic for 2019 (dark blue), 2020 (light blue), 2021 (yellow) and 2022 (red)

Visitor traffic was down 7.0% compared to the same month in 2019.

Note: There was almost no convention traffic from April 2020 through May 2021.

Philly Fed: State Coincident Indexes Increased in 30 States in November

by Calculated Risk on 12/29/2022 12:54:00 PM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for November 2022. Over the past three months, the indexes increased in 35 states, decreased in 11 states, and remained stable in four, for a three-month diffusion index of 48. Additionally, in the past month, the indexes increased in 30 states, decreased in 13 states, and remained stable in seven, for a one-month diffusion index of 34.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three-month change in the Philly Fed state coincident indicators. This map was all red during the worst of the Pandemic and also at the worst of the Great Recession.

The map is mostly positive on a three-month basis.

Source: Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. In November, 34 states had increasing activity including minor increases.

Inflation Adjusted House Prices 3.8% Below Peak

by Calculated Risk on 12/29/2022 10:14:00 AM

Today, in the Calculated Risk Real Estate Newsletter: Inflation Adjusted House Prices 3.8% Below Peak; Houses are the least “affordable” since 1982 when 30-year mortgage rates were over 14%

Excerpt:

It has been over 16 years since the bubble peak. In the October Case-Shiller released Tuesday, the seasonally adjusted National Index (SA), was reported as being 62% above the bubble peak in 2006. However, in real terms, the National index (SA) is about 12% above the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is about 2% above the bubble peak.

Both indexes have declined for five consecutive months in real terms (inflation adjusted).

People usually graph nominal house prices, but it is also important to look at prices in real terms. As an example, if a house price was $200,000 in January 2000, the price would be almost $339,000 today adjusted for inflation (69.5% increase). That is why the second graph below is important - this shows "real" prices. ...

The second graph shows the same two indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices. In real terms, the National index is 3.8% below the recent peak, and the Composite 20 index is 5.1% below the recent peak in 2022.

In real terms, house prices are still above the bubble peak levels. There is an upward slope to real house prices, and it has been over 16 years since the previous peak, but real prices are historically high.

Weekly Initial Unemployment Claims increase to 225,000

by Calculated Risk on 12/29/2022 08:34:00 AM

The DOL reported:

In the week ending December 24, the advance figure for seasonally adjusted initial claims was 225,000, an increase of 9,000 from the previous week's unrevised level of 216,000. The 4-week moving average was 221,000, a decrease of 250 from the previous week's revised average. The previous week's average was revised down by 500 from 221,750 to 221,250.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 221,000.

The previous week was unrevised.

Weekly claims were close to the consensus forecast.

Wednesday, December 28, 2022

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in November

by Calculated Risk on 12/28/2022 04:41:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.64% in November from 0.67% in October. The serious delinquency rate is down from 1.33% in November 2021. This is slightly below the pre-pandemic lows.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.15% are seriously delinquent (down from 2.34% in October).

Mortgages in forbearance were counted as delinquent in this monthly report, but they were not reported to the credit bureaus.

Freddie Mac reported earlier.